High End Inertial Systems Market Report

Published Date: 31 January 2026 | Report Code: high-end-inertial-systems

High End Inertial Systems Market Size, Share, Industry Trends and Forecast to 2033

This market report provides a comprehensive analysis of the High End Inertial Systems sector, detailing market dynamics, size forecasts, regional insights, segmentation, and industry trends from 2023 to 2033.

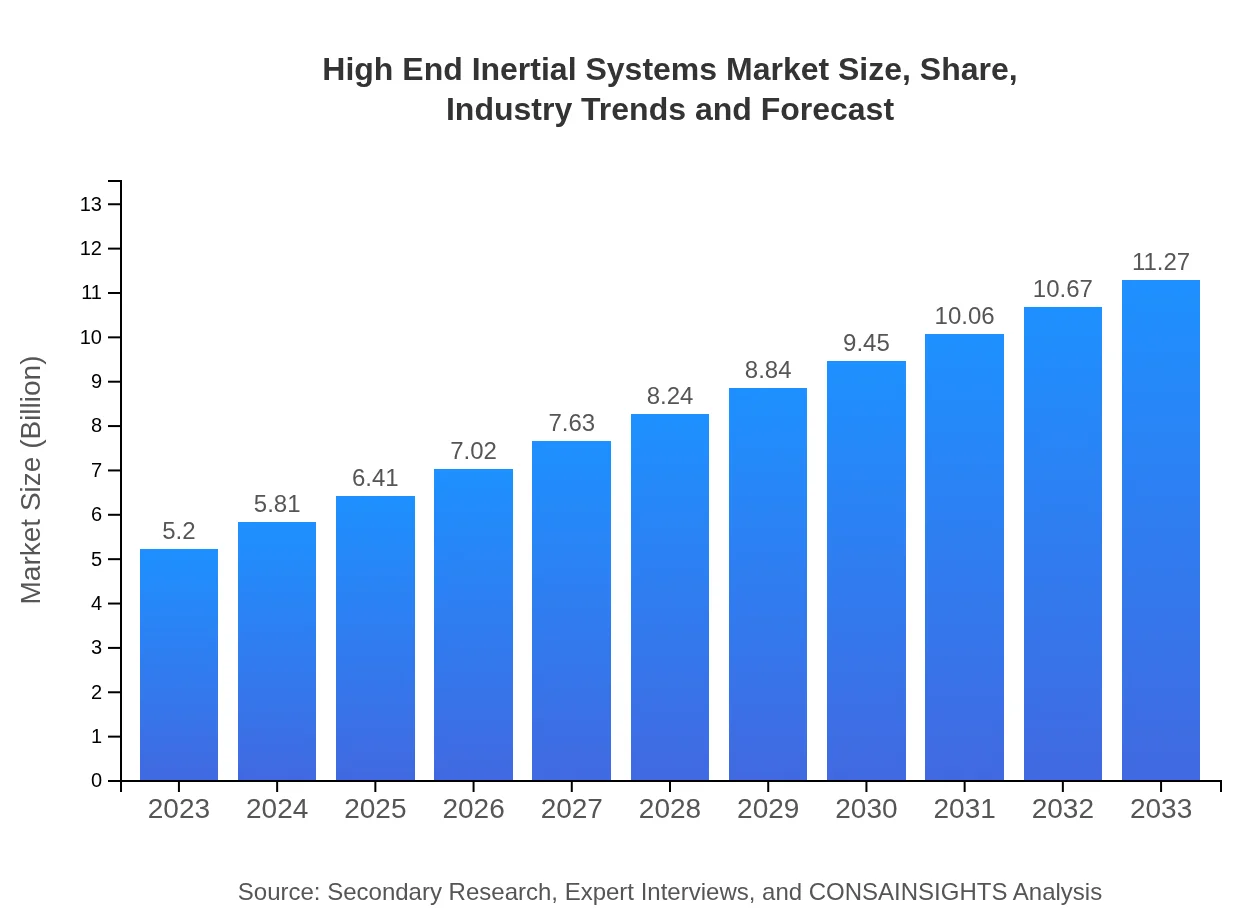

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.20 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $11.27 Billion |

| Top Companies | Honeywell International Inc., Northrop Grumman Corporation, Thales Group, Analog Devices, Inc., STMicroelectronics |

| Last Modified Date | 31 January 2026 |

High End Inertial Systems Market Overview

Customize High End Inertial Systems Market Report market research report

- ✔ Get in-depth analysis of High End Inertial Systems market size, growth, and forecasts.

- ✔ Understand High End Inertial Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in High End Inertial Systems

What is the Market Size & CAGR of High End Inertial Systems market in 2023?

High End Inertial Systems Industry Analysis

High End Inertial Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

High End Inertial Systems Market Analysis Report by Region

Europe High End Inertial Systems Market Report:

Europe's market is expected to expand from $1.37 billion in 2023 to $2.96 billion by 2033. Key contributors include high R&D investments and stringent regulations demanding innovative navigational technologies across various industries.Asia Pacific High End Inertial Systems Market Report:

The Asia Pacific region is expected to exhibit significant growth, projected to reach $2.29 billion by 2033 from $1.05 billion in 2023. The growth is fueled by increased manufacturing capabilities, investments in smart technologies, and demand across various industries such as consumer electronics and automotive.North America High End Inertial Systems Market Report:

North America is a leading market, projected to grow from $1.71 billion in 2023 to $3.71 billion in 2033. The region's growth is largely due to federal investments in defense technologies and aerospace exploration initiatives.South America High End Inertial Systems Market Report:

In South America, the market is anticipated to grow from $0.51 billion in 2023 to $1.10 billion by 2033. The growth is driven by the rising adoption of advanced technologies in industrial automation and defense sectors.Middle East & Africa High End Inertial Systems Market Report:

The Middle East and Africa region will see growth from $0.56 billion in 2023 to $1.22 billion by 2033, driven by defense expenditures and the emphasis on advanced technology in defense and security.Tell us your focus area and get a customized research report.

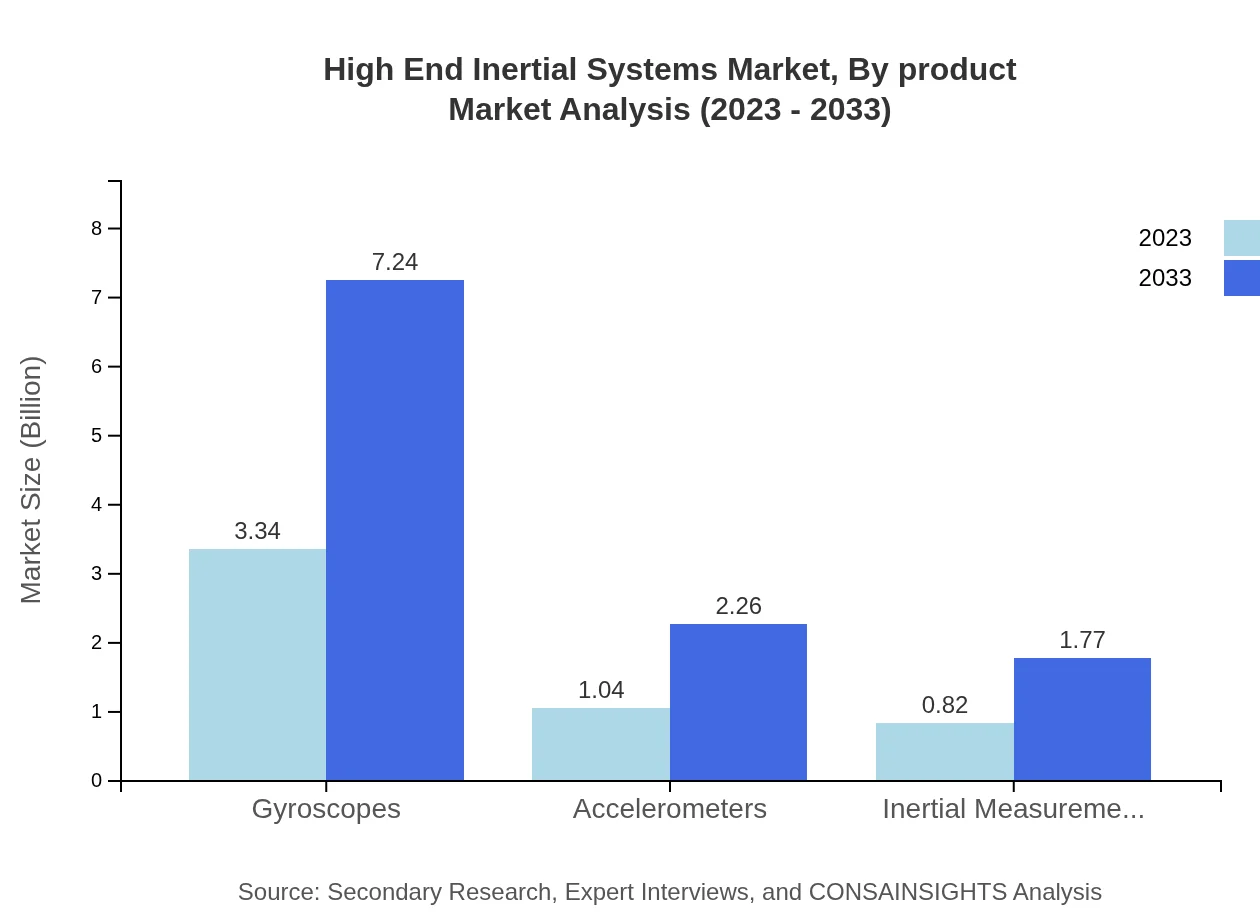

High End Inertial Systems Market Analysis By Product

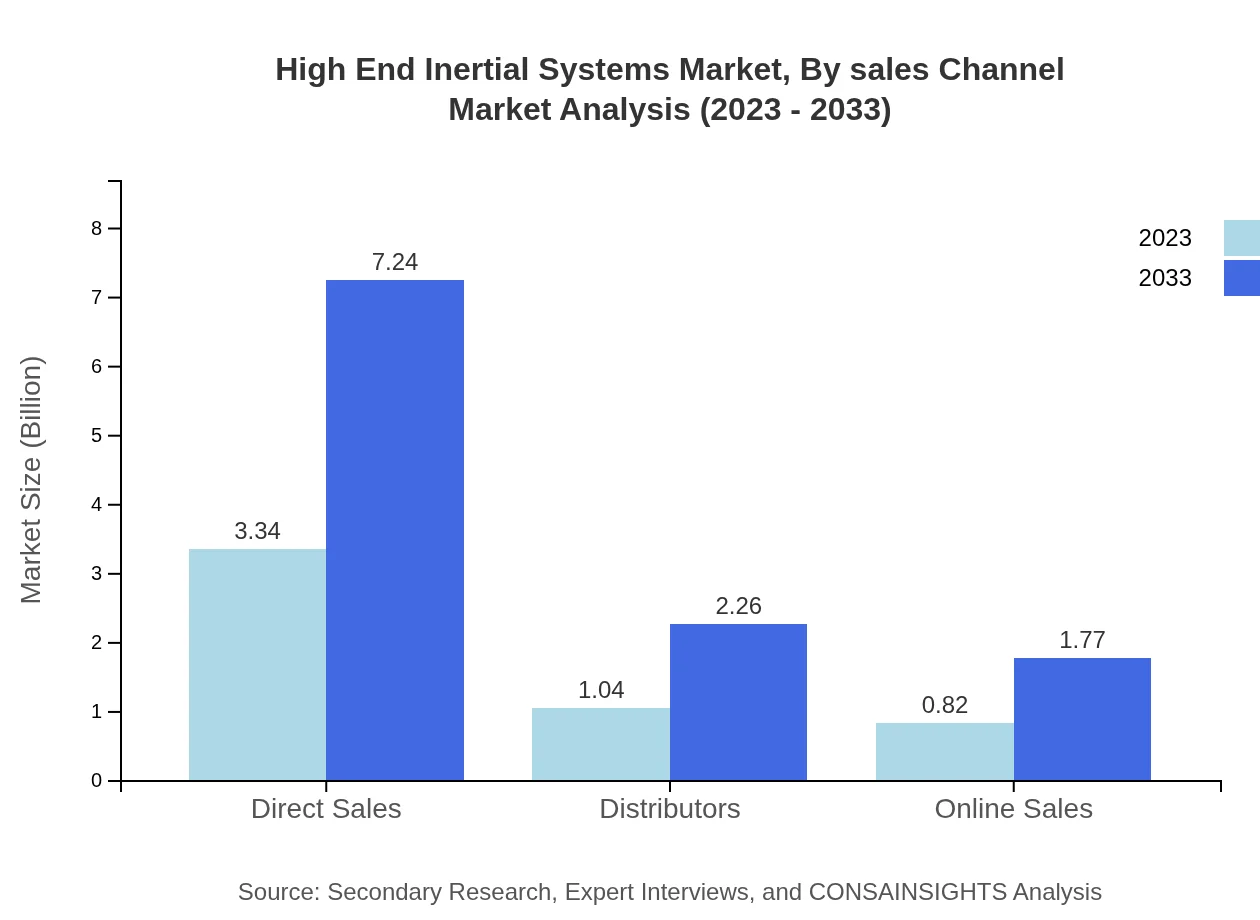

Key products in the High End Inertial Systems market include Gyroscopes, Accelerometers, and Inertial Measurement Units (IMUs). Gyroscopes dominate the market, expected to grow from $3.34 billion in 2023 to $7.24 billion by 2033, representing a 64.2% market share. Accelerometers and IMUs also show promise with respective growth forecasts from $1.04 billion to $2.26 billion (20.06% market share) and from $0.82 billion to $1.77 billion (15.74% market share).

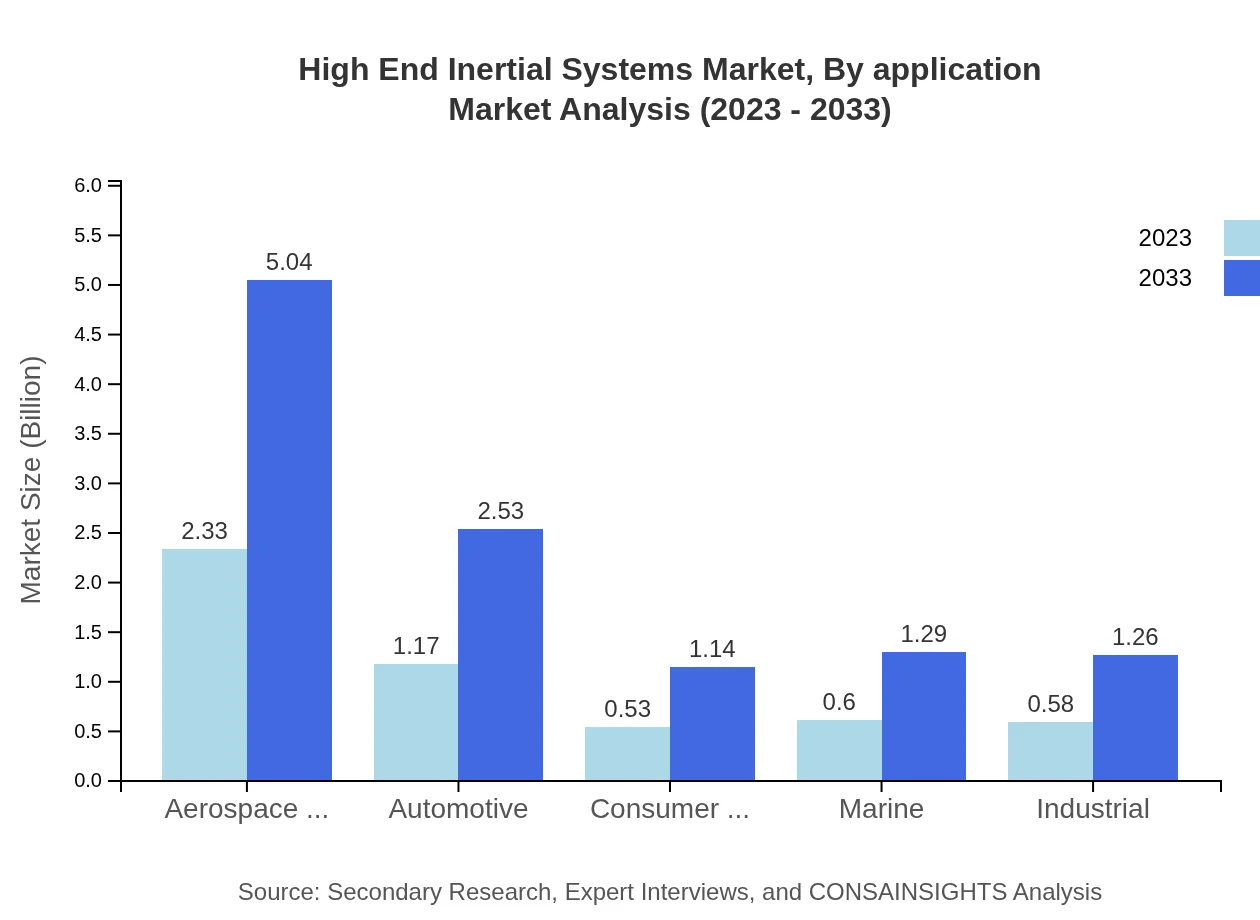

High End Inertial Systems Market Analysis By Application

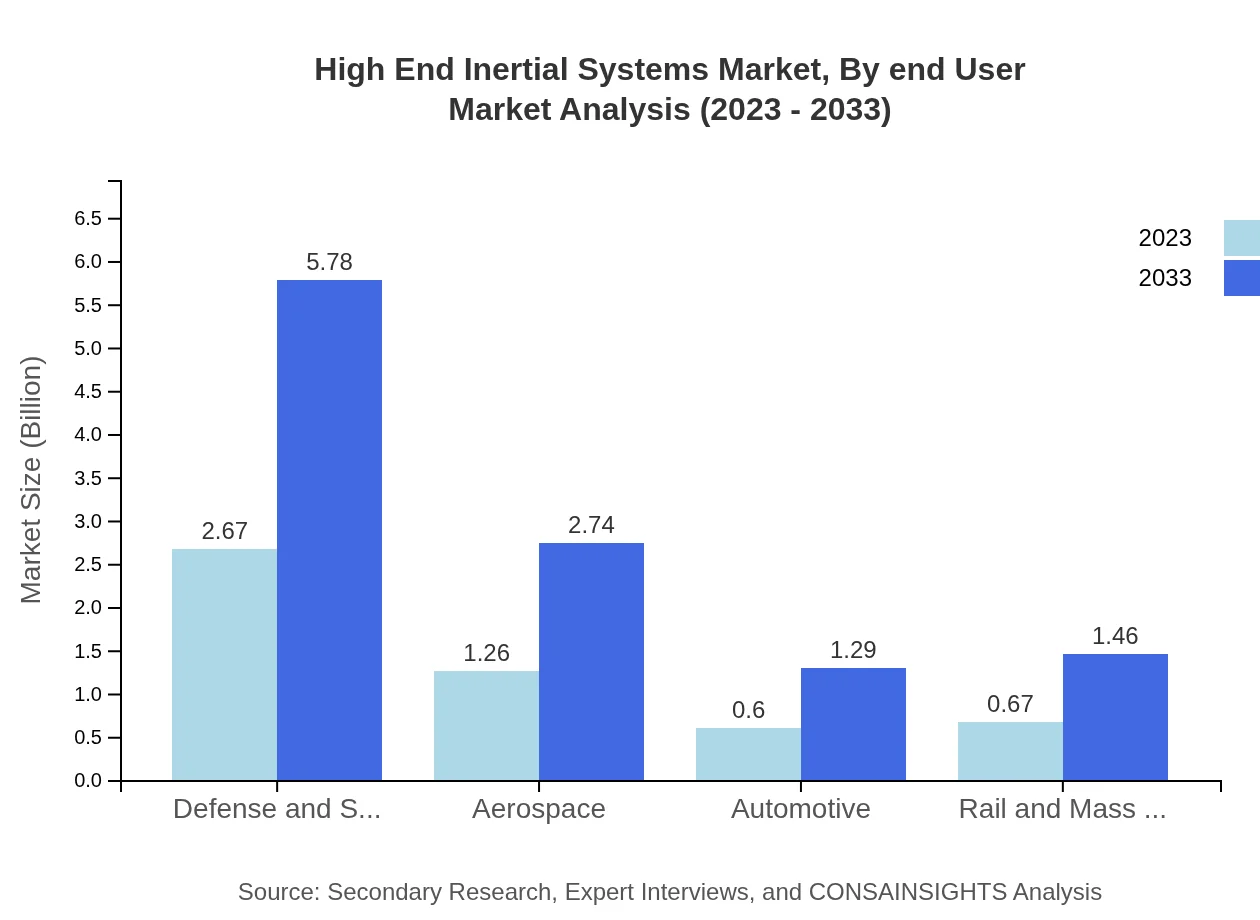

In terms of applications, the defense and security segment accounts for a significant share, expected to grow from $2.67 billion in 2023 to $5.78 billion in 2033, representing 51.26% of the market. Aerospace follows with growth from $1.26 billion to $2.74 billion (24.3% share). Other applications such as automotive, consumer electronics, and industrial also contribute to the diverse application landscape.

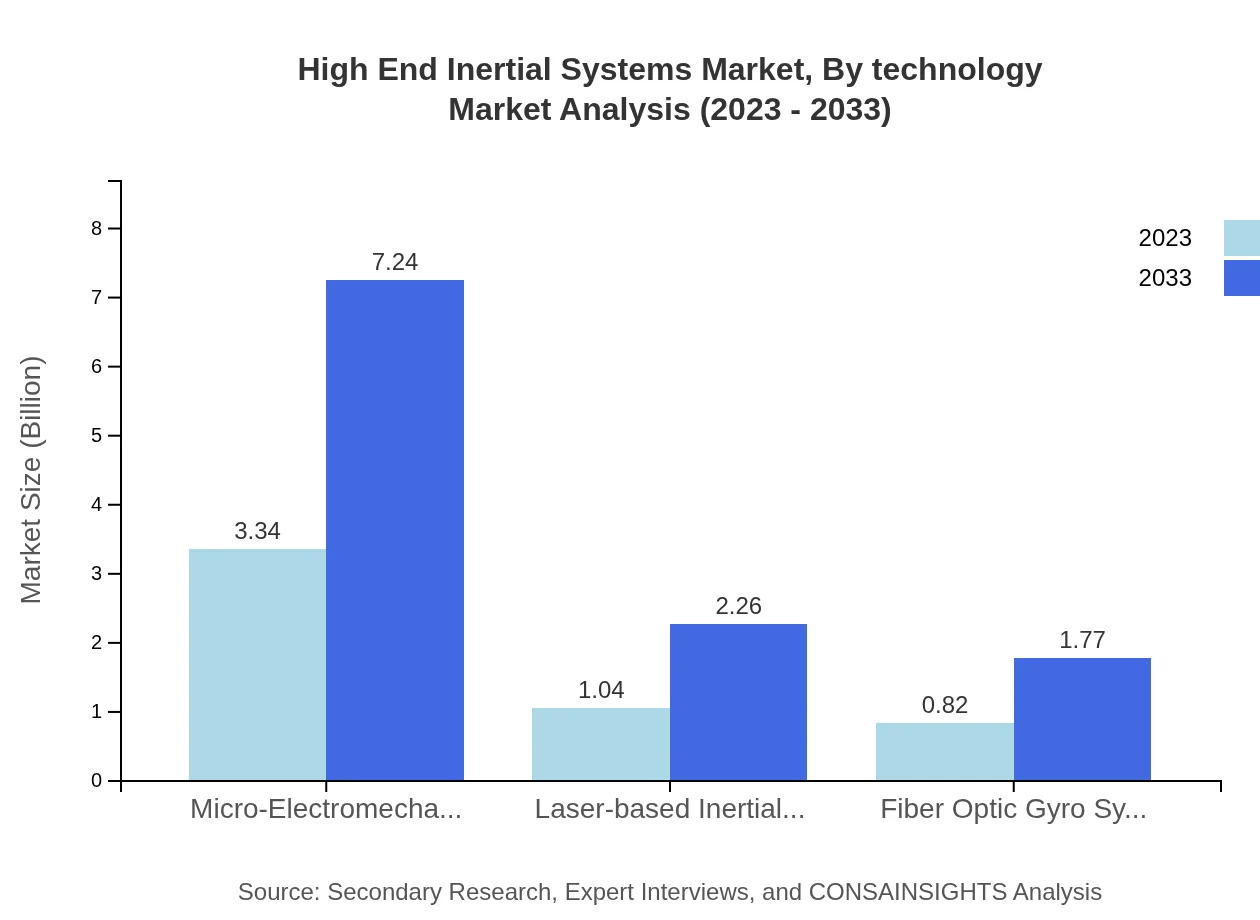

High End Inertial Systems Market Analysis By Technology

Technological advancement drives the market with segments including Micro-Electromechanical Systems (MEMS), Fiber Optic Gyro Systems, and Laser-based Inertial Systems. MEMS dominate, projected to grow from $3.34 billion to $7.24 billion (64.2% market share). Fiber Optic Gyro Systems are also important, forecasted to grow from $0.82 billion to $1.77 billion (15.74% share).

High End Inertial Systems Market Analysis By End User

End-users of High-End Inertial Systems include aerospace and defense, automotive, marine, industrial, and consumer electronics. The aerospace and defense sectors represent the most significant growth potential, driven by technological advancements and increased defense spending, followed by the automotive sector projected to grow steadily.

High End Inertial Systems Market Analysis By Sales Channel

Sales channels include direct sales, distributors, and online sales, with direct sales expected to dominate the market. Direct sales are anticipated to grow from $3.34 billion in 2023 to $7.24 billion in 2033 (64.2% market share). Online sales are also emerging as a strong channel, showing alignment with shifting consumer preferences.

High End Inertial Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in High End Inertial Systems Industry

Honeywell International Inc.:

A leader in providing advanced inertial systems, Honeywell focuses on innovative solutions for aerospace and defense sectors.Northrop Grumman Corporation:

Specializing in defense technology, Northrop Grumman offers high-performance inertial systems utilized in various military applications.Thales Group:

Thales delivers cutting-edge inertial sensors and navigation systems with applications across aerospace, defense, and transportation.Analog Devices, Inc.:

Analog Devices is a major player in MEMS technology for inertial sensing, catering to sectors such as automotive and industrial.STMicroelectronics:

Offering a wide range of MEMS inertial sensors, STMicroelectronics contributes to the consumer electronics and automotive industries.We're grateful to work with incredible clients.

FAQs

What is the market size of high End Inertial Systems?

The high-end inertial systems market is projected to reach a size of approximately $5.2 billion by 2033, growing at a robust CAGR of 7.8% from its current size. This growth reflects increasing demand across various sectors including defense and aerospace.

What are the key market players or companies in this high End Inertial Systems industry?

The key players in the high-end inertial systems market include industry leaders known for innovative solutions. These companies invest significantly in research and development to enhance their product offerings, ensuring competitive advantage and market presence within the aerospace, automotive, and defense industries.

What are the primary factors driving the growth in the high End Inertial Systems industry?

Growth in the high-end inertial systems industry is primarily driven by advancements in technology, increasing military spending on defense systems, and the rising demand for precision navigation in aerospace and automotive sectors. Additionally, the growing adoption of autonomous systems is a significant growth factor.

Which region is the fastest Growing in the high End Inertial Systems?

The fastest-growing region for high-end inertial systems between 2023 and 2033 is North America, with market size projected to grow from $1.71 billion to $3.71 billion. Europe follows closely with significant growth opportunities in both defense and aerospace applications.

Does ConsaInsights provide customized market report data for the high End Inertial Systems industry?

Yes, ConsaInsights offers customized market report data for the high-end inertial systems industry, tailoring insights according to client-specific needs. This includes detailed analysis on market trends, competitive landscape, and regional performance.

What deliverables can I expect from this high End Inertial Systems market research project?

From the high-end inertial systems market research project, clients can expect deliverables including comprehensive market reports, detailed analysis of key segments, competitive landscaping, forecasts, and actionable insights that align with strategic planning and decision-making.

What are the market trends of high End Inertial Systems?

Current trends in the high-end inertial systems market include increasing integration of MEMS technology, a shift towards fiber optic gyroscopes, and the expansion of applications in consumer electronics and automotive sectors, reflecting ongoing technological advancements and market diversification.