High Energy Lasers Market Report

Published Date: 31 January 2026 | Report Code: high-energy-lasers

High Energy Lasers Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the High Energy Lasers market from 2023 to 2033, covering market trends, size, CAGR, segmentation, regional insights, and key players in the industry.

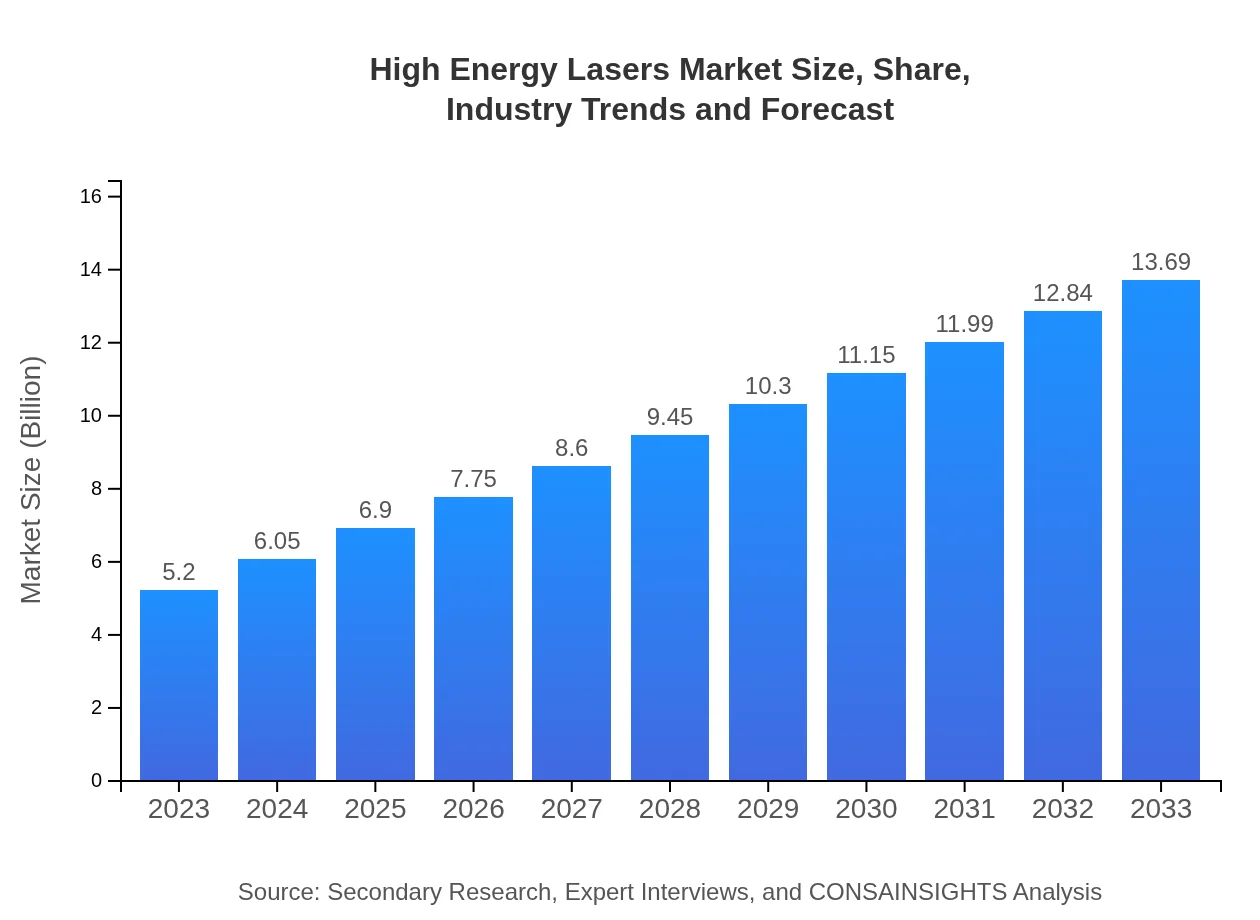

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.20 Billion |

| CAGR (2023-2033) | 9.8% |

| 2033 Market Size | $13.69 Billion |

| Top Companies | Raytheon Technologies, Lockheed Martin, Northrop Grumman, Thales Group, Coherent, Inc. |

| Last Modified Date | 31 January 2026 |

High Energy Lasers Market Overview

Customize High Energy Lasers Market Report market research report

- ✔ Get in-depth analysis of High Energy Lasers market size, growth, and forecasts.

- ✔ Understand High Energy Lasers's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in High Energy Lasers

What is the Market Size & CAGR of High Energy Lasers market in 2023 and 2033?

High Energy Lasers Industry Analysis

High Energy Lasers Market Segmentation and Scope

Tell us your focus area and get a customized research report.

High Energy Lasers Market Analysis Report by Region

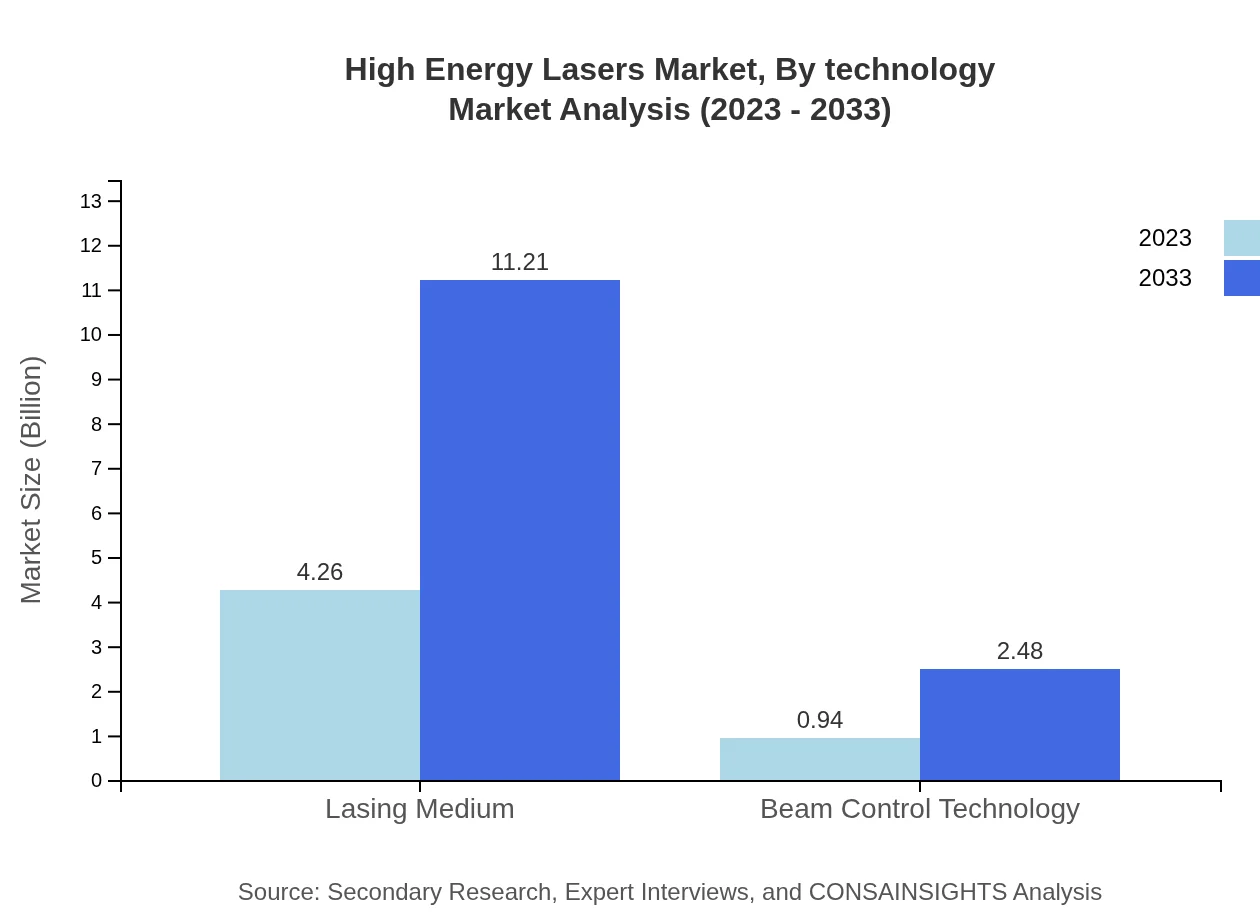

Europe High Energy Lasers Market Report:

The European High Energy Lasers market is projected to grow significantly, from $1.51 billion in 2023 to $3.97 billion by 2033. With major players investing in research and development, the market is poised for advancements in laser applications, particularly in defense and healthcare.Asia Pacific High Energy Lasers Market Report:

In the Asia Pacific region, the High Energy Lasers market is anticipated to experience significant growth, reaching $2.48 billion by 2033, up from $0.94 billion in 2023. This growth is primarily driven by increased military expenditure and technological advancements in countries such as China, Japan, and India.North America High Energy Lasers Market Report:

North America currently holds a leading position in the HEL market, valued at $2.02 billion in 2023 and expected to reach $5.31 billion by 2033. The primary drivers include advanced defense initiatives and innovations in laser technology across various industries.South America High Energy Lasers Market Report:

The South American market for High Energy Lasers is expected to grow from $0.28 billion in 2023 to $0.74 billion by 2033. The rising demand for laser technology in industrial applications and healthcare is expected to boost market growth in this region.Middle East & Africa High Energy Lasers Market Report:

The Middle East and Africa are projected to see growth in the High Energy Lasers market from $0.45 billion in 2023 to $1.19 billion by 2033. The focus on military applications and increasing investments in technology drive this growth.Tell us your focus area and get a customized research report.

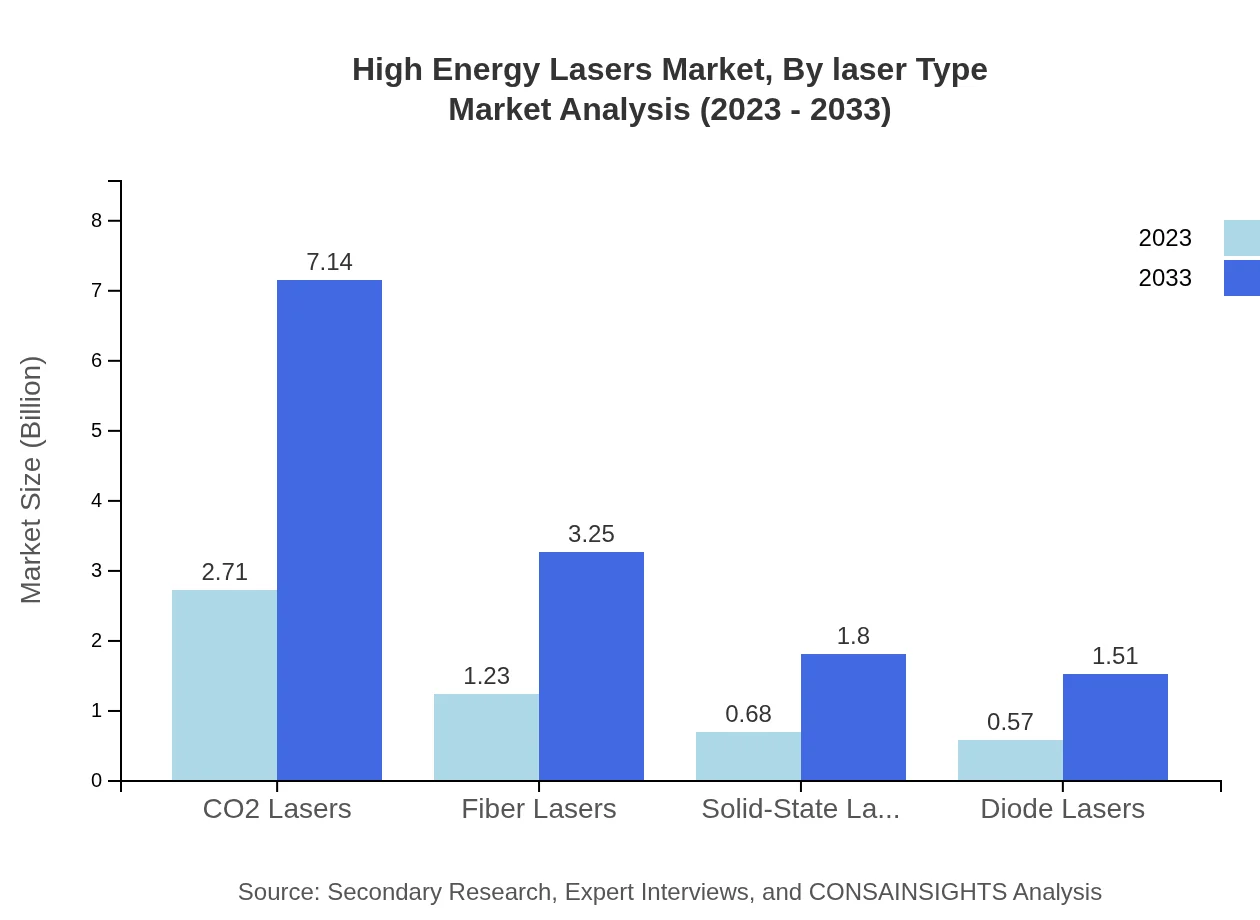

High Energy Lasers Market Analysis By Laser Type

The High Energy Lasers market by laser type includes segmentations for CO2 lasers, fiber lasers, solid-state lasers, diode lasers, and others. CO2 lasers dominate the market, expected to grow from $2.71 billion in 2023 to $7.14 billion in 2033. Other segments such as fiber lasers and solid-state lasers are also witnessing substantial growth, reflecting shifts in technological preference towards more efficient and versatile solutions.

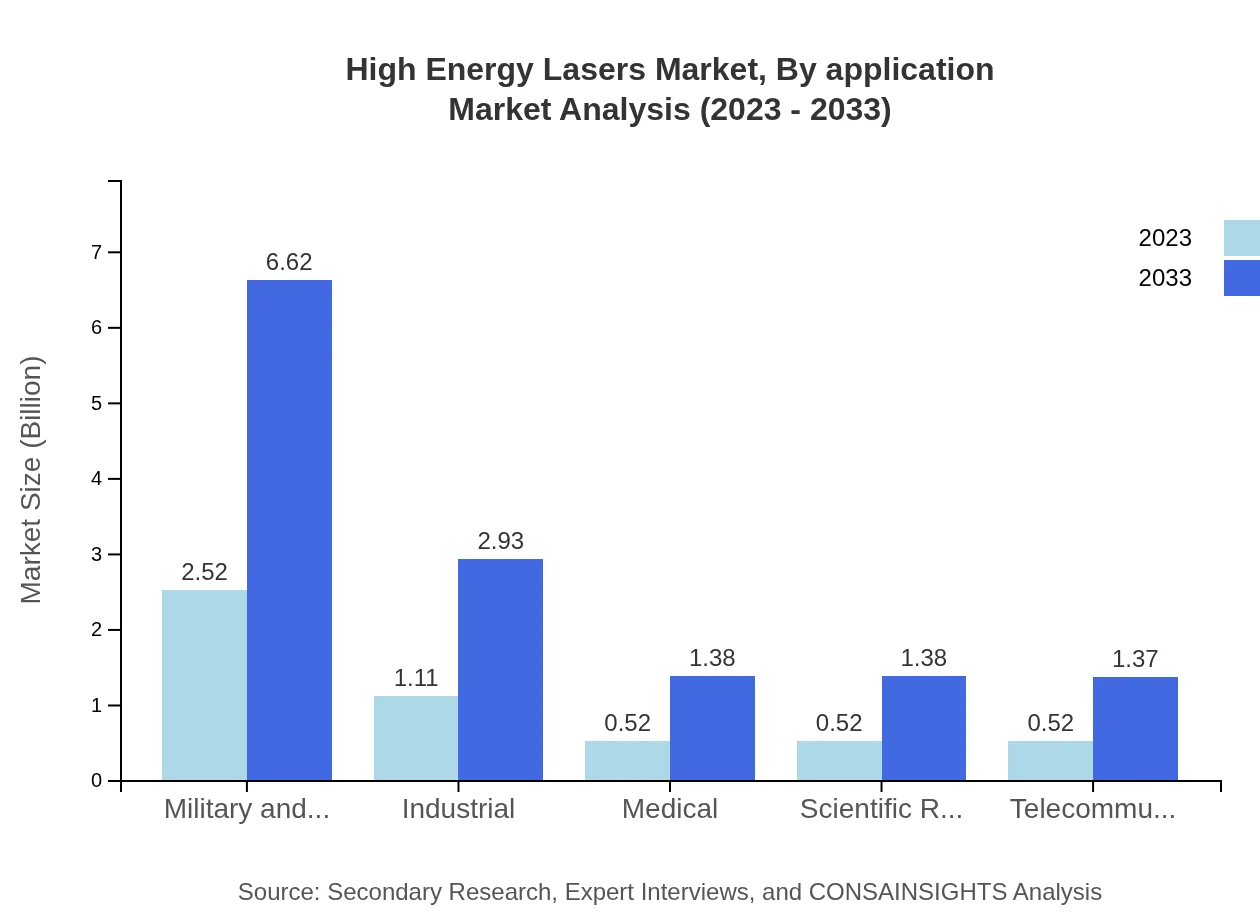

High Energy Lasers Market Analysis By Application

In terms of application, the High Energy Lasers market is divided into military and defense, industrial, medical, telecommunications, and scientific research. Military and defense applications lead the sector, generating substantial revenue due to the growing need for precision weapon systems and directed energy applications.

High Energy Lasers Market Analysis By Technology

The technology segment highlights advancements in CO2 lasers, fiber lasers, and solid-state lasers. Fiber lasers are gaining traction for their efficiency and versatility, expected to grow from $1.23 billion in 2023 to $3.25 billion by 2033, showcasing the technological shift in the market.

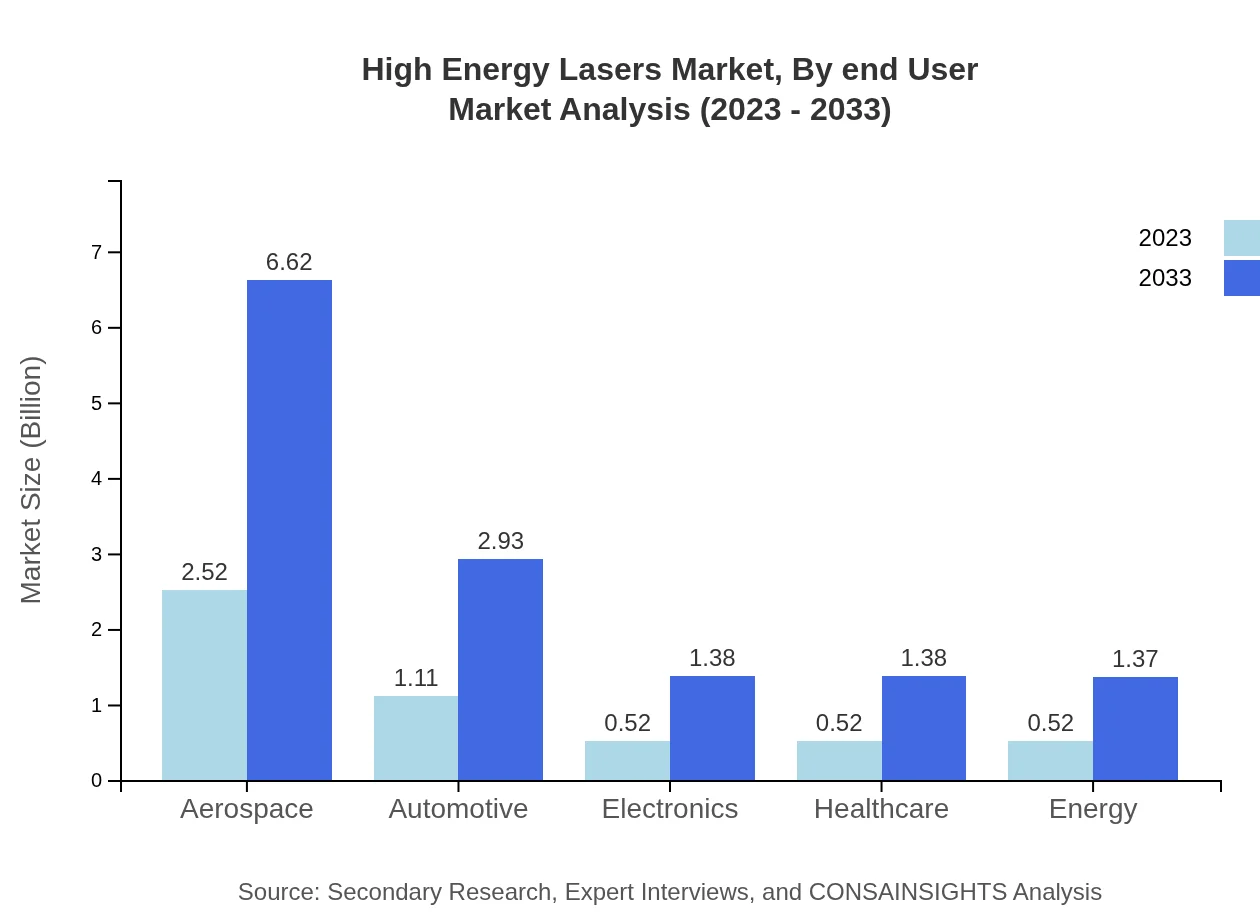

High Energy Lasers Market Analysis By End User

End-user industries encompass aerospace, automotive, electronics, healthcare, and energy. The aerospace sector showcases robust growth, with market shares expected to remain significant due to the increasing application of lasers in aircraft manufacturing and maintenance.

High Energy Lasers Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in High Energy Lasers Industry

Raytheon Technologies:

Raytheon Technologies is a leading defense contractor known for its advanced directed energy solutions and commitment to innovation in HEL systems.Lockheed Martin:

Lockheed Martin is a key player in the HEL market, developing high-performance laser systems for military applications.Northrop Grumman:

Northrop Grumman is recognized for its focus on laser technology and integration into defense systems, providing advanced HEL solutions.Thales Group:

Thales Group is an expert in laser technologies, offering high-energy laser systems for defense and industrial applications.Coherent, Inc.:

Coherent specializes in laser solutions and is a renowned provider of HEL technologies across various applications, including industrial and medical sectors.We're grateful to work with incredible clients.

FAQs

What is the market size of high Energy Lasers?

The high-energy lasers market is valued at $5.2 billion in 2023, with a projected CAGR of 9.8% from 2023 to 2033, indicating significant growth opportunities during this decade.

What are the key market players or companies in this high Energy Lasers industry?

Key players in the high-energy lasers market include prominent companies like Northrop Grumman, Raytheon Technologies, Lockheed Martin, and BAE Systems, each contributing to advancements in laser technology for military and industrial applications.

What are the primary factors driving the growth in the high Energy Lasers industry?

Growth in the high-energy lasers industry is driven by increasing military applications, advancements in laser technologies, rising demand for precision in manufacturing, and the growing focus on laser-based medical treatments.

Which region is the fastest Growing in the high Energy Lasers?

North America is the fastest-growing region, with the market projected to grow from $2.02 billion in 2023 to $5.31 billion by 2033, fueled by extensive military funding and technological innovations in laser systems.

Does ConsaInsights provide customized market report data for the high Energy Lasers industry?

Yes, ConsaInsights offers customized market report data for the high-energy lasers industry, providing tailored insights based on specific client requirements for strategic decision-making.

What deliverables can I expect from this high Energy Lasers market research project?

The deliverables from the high-energy lasers market research project include comprehensive reports on market size, trends, growth opportunities, competitive analysis, and forecasts segmented by region and application.

What are the market trends of high Energy Lasers?

Market trends in high-energy lasers include increasing integration in defense systems, a rise in industrial laser applications, and advancements in fiber and solid-state laser technologies driving market growth across various sectors.