High Frequency Trading Server Market Report

Published Date: 31 January 2026 | Report Code: high-frequency-trading-server

High Frequency Trading Server Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the High Frequency Trading Server market, focusing on insights, trends, and forecasts from 2023 to 2033. We examine market size, growth rates, regional dynamics, and technological advancements impacting the industry.

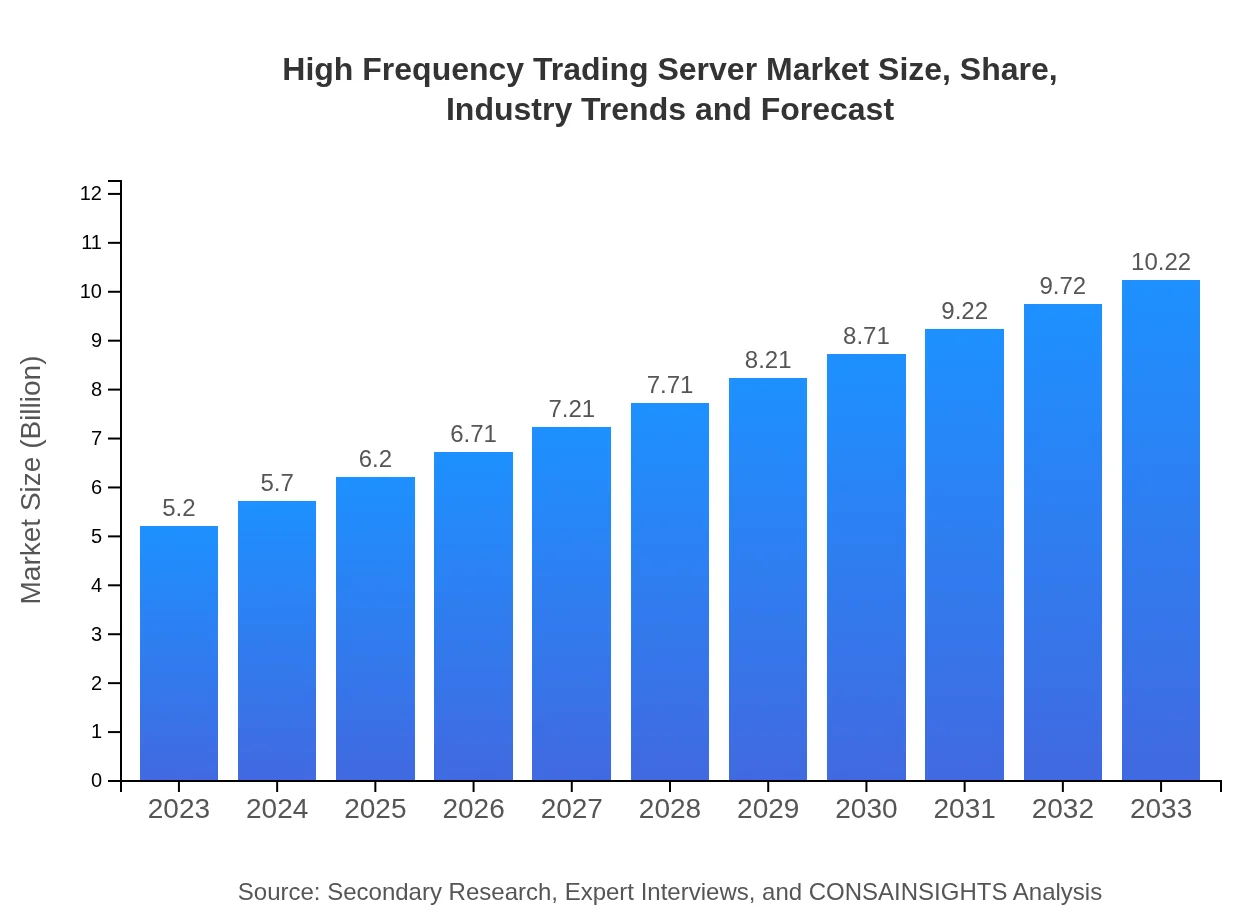

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.20 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $10.22 Billion |

| Top Companies | IBM, Dell Technologies, Cisco Systems, Hewlett Packard Enterprise, Intel Corporation |

| Last Modified Date | 31 January 2026 |

High Frequency Trading Server Market Overview

Customize High Frequency Trading Server Market Report market research report

- ✔ Get in-depth analysis of High Frequency Trading Server market size, growth, and forecasts.

- ✔ Understand High Frequency Trading Server's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in High Frequency Trading Server

What is the Market Size & CAGR of High Frequency Trading Server market in 2023?

High Frequency Trading Server Industry Analysis

High Frequency Trading Server Market Segmentation and Scope

Tell us your focus area and get a customized research report.

High Frequency Trading Server Market Analysis Report by Region

Europe High Frequency Trading Server Market Report:

The European market, currently valued at $1.47 billion, is expected to grow substantially to $2.89 billion by 2033. Regulatory support and a robust financial market ecosystem are key growth enablers in this region.Asia Pacific High Frequency Trading Server Market Report:

The Asia-Pacific region, with a market worth approximately $1.03 billion in 2023, is expected to reach $2.03 billion by 2033, reflecting a growing interest in high-speed trading among emerging economies. Key factors include advancements in technology and increasing adoption rates among financial institutions.North America High Frequency Trading Server Market Report:

North America is the largest market for High Frequency Trading Servers, valued at $1.85 billion in 2023, projected to grow to $3.63 billion by 2033. This growth is driven by the presence of major financial institutions and technological innovations in trading infrastructure.South America High Frequency Trading Server Market Report:

In South America, the market size for High Frequency Trading Servers stands at $0.38 billion in 2023, anticipated to grow to $0.75 billion by 2033. The region's financial sector is gradually embracing analytics and algorithmic trading, leading to increased investments in HFT technology.Middle East & Africa High Frequency Trading Server Market Report:

The Middle East and Africa market for High Frequency Trading Servers is projected to grow from $0.47 billion in 2023 to $0.91 billion by 2033. Increased trading activities along with digital transformation in financial services are driving this growth in the region.Tell us your focus area and get a customized research report.

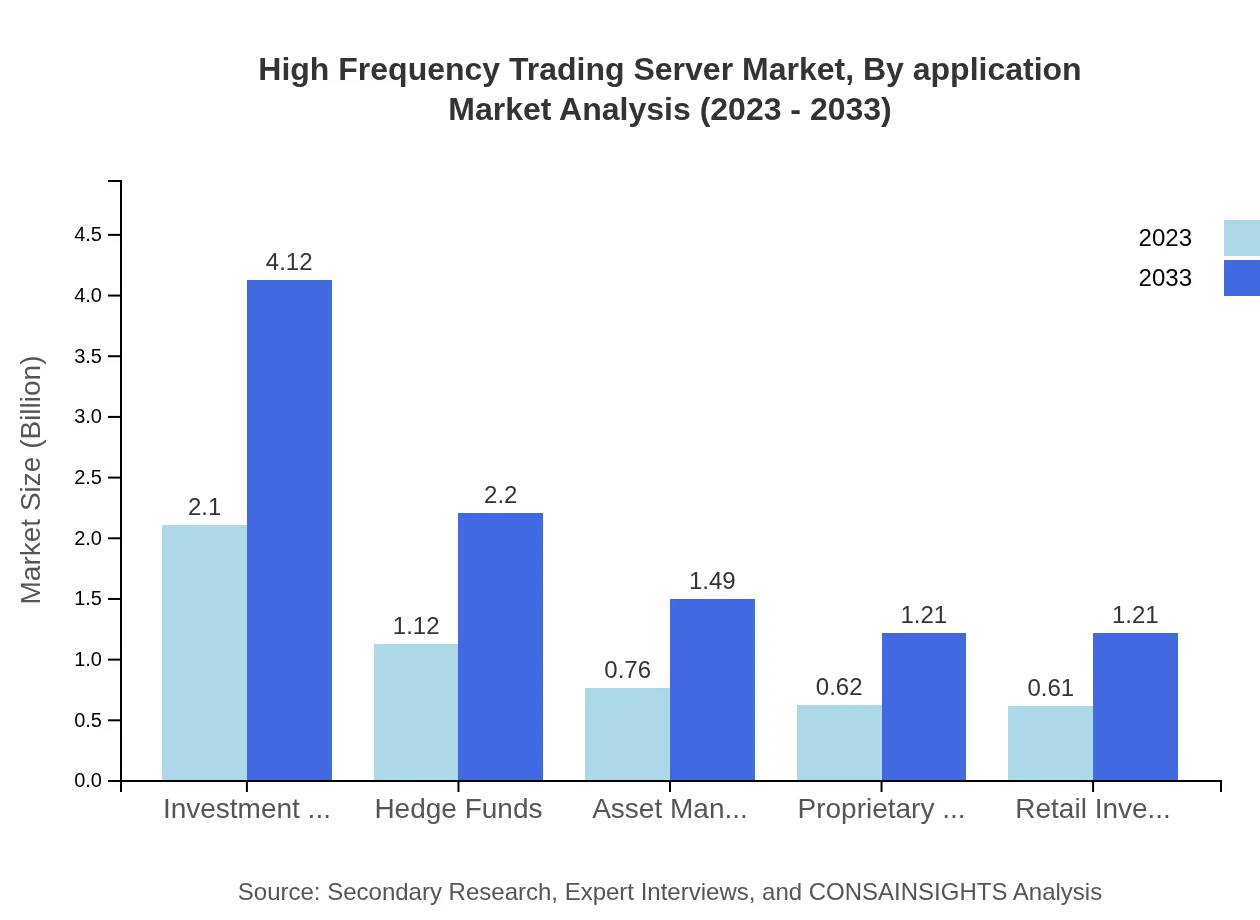

High Frequency Trading Server Market Analysis By Application

Investment Banks in the High Frequency Trading Server segment are anticipated to increase from $2.10 billion in 2023 to $4.12 billion by 2033, maintaining a steady market share of 40.31%. Hedge funds, growing from $1.12 billion to $2.20 billion over the same period, will hold a substantial share of approximately 21.49%. The asset management segment will also experience growth, expanding from $0.76 billion to $1.49 billion, with a consistent share of 14.54%. Proprietary trading firms and retail investors similarly contribute to the market dynamic, with growth prospects extending from $0.62 billion to $1.21 billion and $0.61 billion to $1.21 billion respectively.

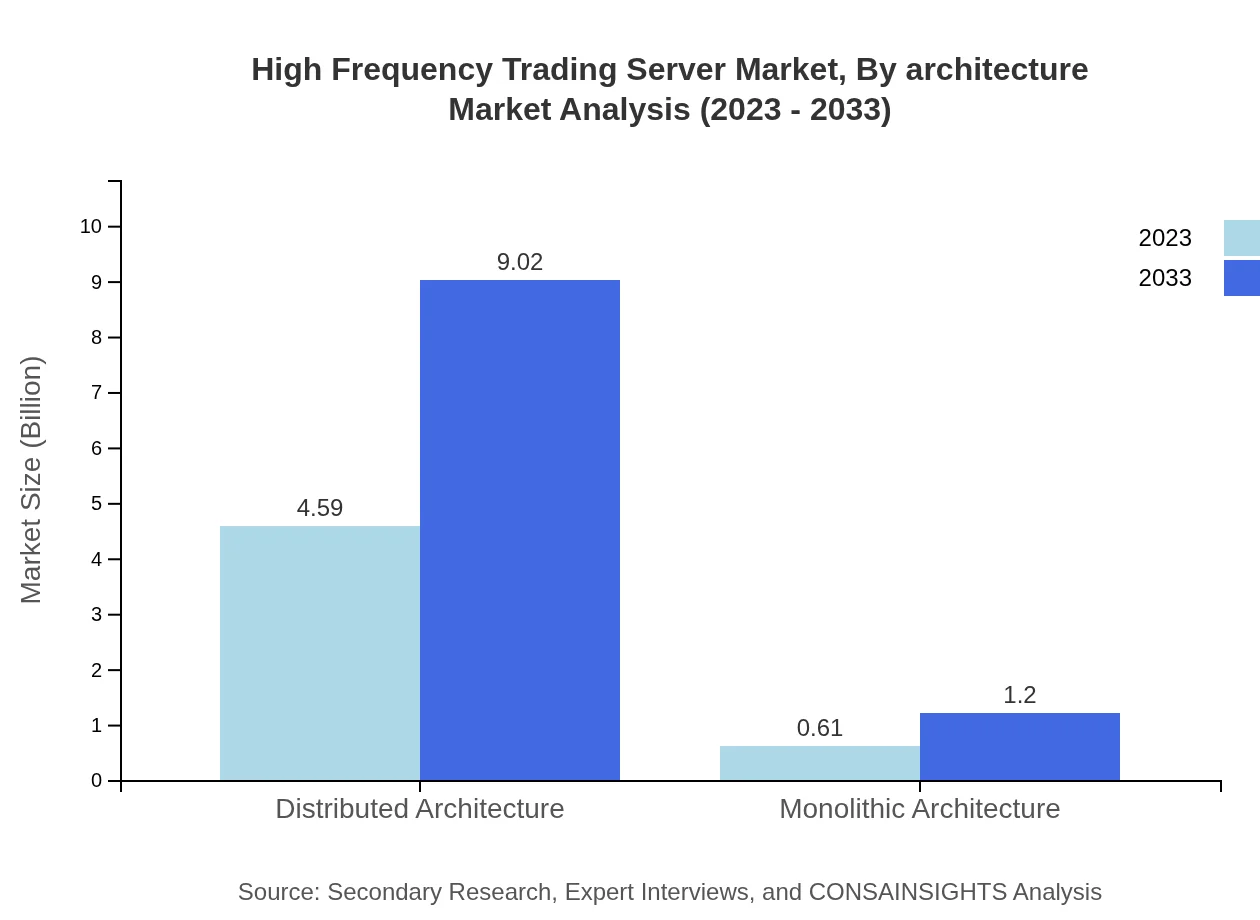

High Frequency Trading Server Market Analysis By Architecture

The market is dominantly held by distributed architecture, capturing 88.3% of market share with a projected growth from $4.59 billion to $9.02 billion between 2023 and 2033. Monolithic architecture, constituting the remaining 11.7%, will grow modestly from $0.61 billion to $1.20 billion, indicating a gradual transition towards more flexible and scalable systems.

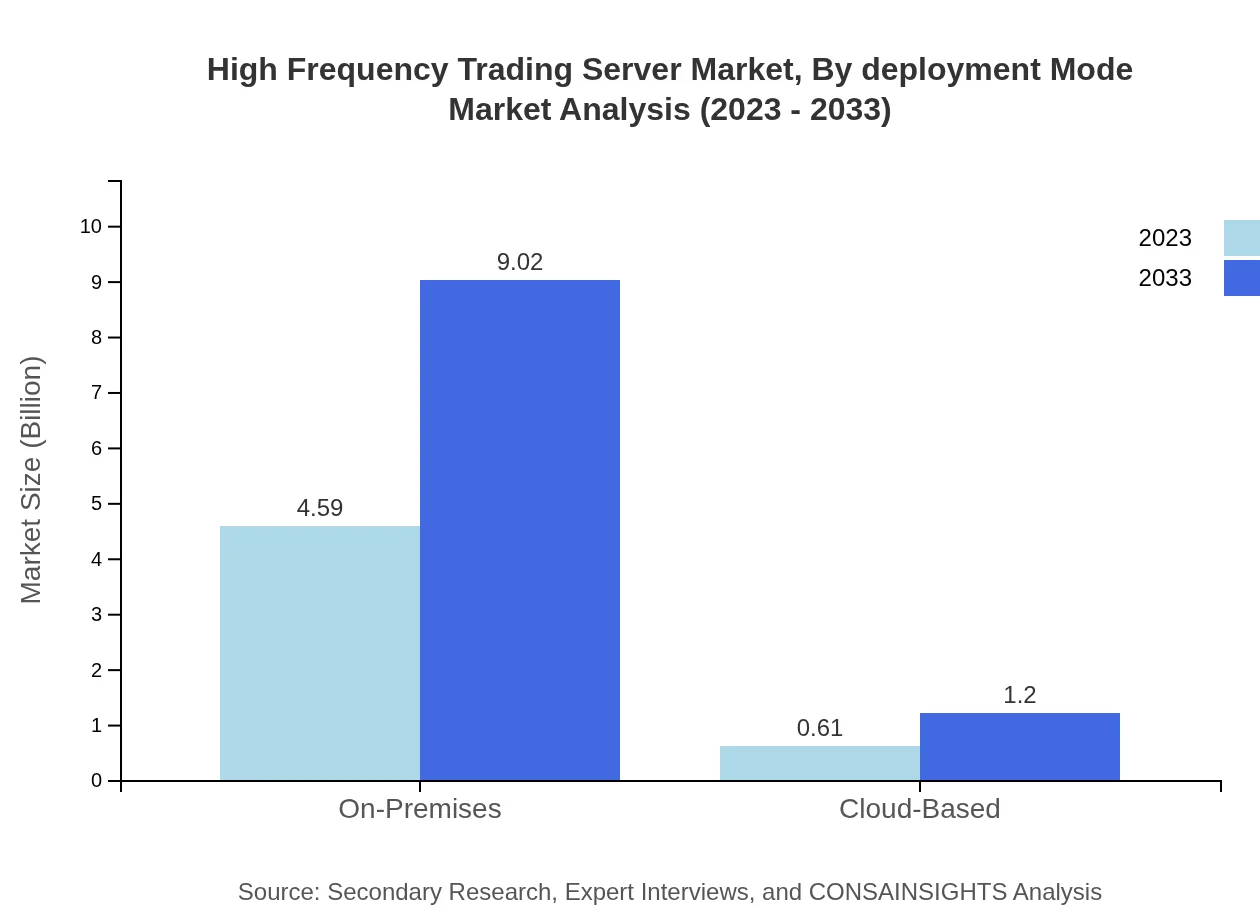

High Frequency Trading Server Market Analysis By Deployment Mode

The on-premises deployment mode remains the preferred choice, holding an 88.3% market share with growth expected from $4.59 billion to $9.02 billion. Meanwhile, cloud-based solutions, though currently less favored, are on the rise, increasing in value from $0.61 billion to $1.20 billion, indicating a shifting trend towards more agile trading solutions by 2033.

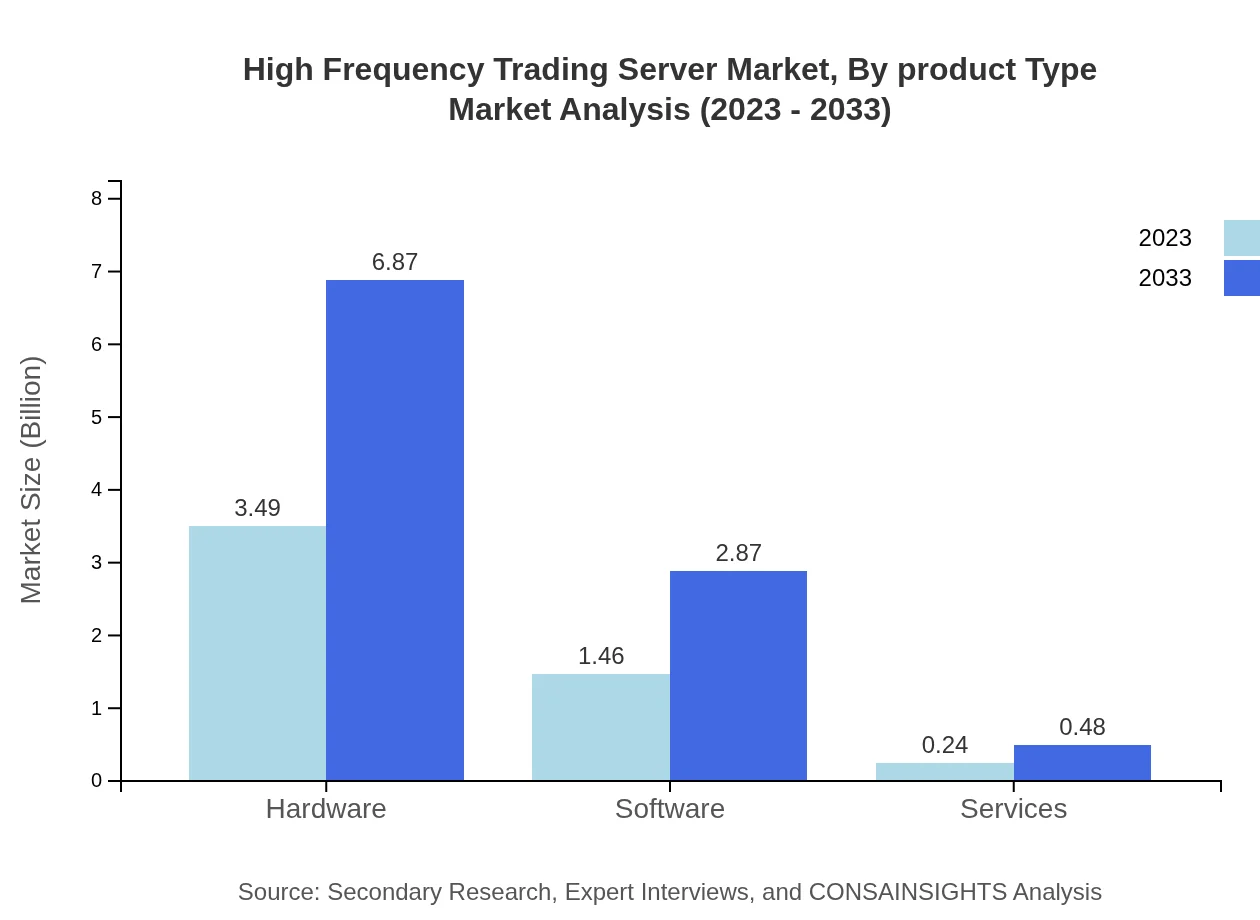

High Frequency Trading Server Market Analysis By Product Type

Analyzing the product types, hardware remains fundamental, growing from $3.49 billion to $6.87 billion, maintaining a 67.19% market share. Software is also critical, expanding from $1.46 billion to $2.87 billion, holding 28.1% of the market. Service components, while smaller at $0.24 billion to $0.48 billion, continue to play a vital role as firms seek operational support and maintenance.

High Frequency Trading Server Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in High Frequency Trading Server Industry

IBM:

IBM provides high-performance computing solutions tailored for financial trading, specializing in HFT servers with low latency and advanced processing capabilities.Dell Technologies:

Dell Technologies offers robust server solutions that cater to the needs of high-frequency trading, focusing on speed and reliability.Cisco Systems:

Cisco Systems delivers network hardware coupled with high-frequency trading solutions enhancing infrastructure efficiency and security.Hewlett Packard Enterprise:

Hewlett Packard Enterprise specializes in high-performance computing solutions that support various financial applications, including HFT operations.Intel Corporation:

Intel offers advanced processors and architectural designs specifically optimized for the demands of high-frequency trading environments.We're grateful to work with incredible clients.

FAQs

What is the market size of High-Frequency-Trading-Server?

The global high-frequency trading server market was valued at approximately $5.2 billion in 2023, with an expected CAGR of 6.8% from 2023 to 2033, reflecting a strong demand for advanced trading technologies.

What are the key market players or companies in the High-Frequency-Trading-Server industry?

Key players in the high-frequency trading server market include major financial technology firms, trading software developers, and server manufacturers that innovate in hardware and algorithm-based trading solutions.

What are the primary factors driving the growth in the High-Frequency-Trading-Server industry?

Factors driving growth include increased trading volumes, advancements in technology, the rise of algorithmic trading, and the need for ultra-low latency solutions to enhance trading strategies, contributing to market expansion.

Which region is the fastest Growing in the High-Frequency-Trading-Server market?

The Asia Pacific region is projected to witness the fastest growth in the high-frequency trading server market, with a market size increasing from $1.03 billion in 2023 to $2.03 billion by 2033, driven by growing investment activities.

Does Consainsights provide customized market report data for the High-Frequency-Trading-Server industry?

Yes, Consainsights offers tailored market report data for the high-frequency trading server industry, allowing clients to receive insights that suit their specific strategic needs and objectives.

What deliverables can I expect from this High-Frequency-Trading-Server market research project?

Clients can expect comprehensive market analysis reports, trend evaluations, competitive landscapes, regional insights, and segment data, ensuring a holistic understanding of the high-frequency trading server market.

What are the market trends of High-Frequency-Trading-Server?

Current trends in the high-frequency trading server market include a shift towards distributed architecture, increasing reliance on cloud-based solutions, and a growing focus on hardware advancements to support intricate trading algorithms.