High Fructose Corn Syrup Hfcs Market Report

Published Date: 31 January 2026 | Report Code: high-fructose-corn-syrup-hfcs

High Fructose Corn Syrup Hfcs Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the High Fructose Corn Syrup (HFCS) market, outlining current trends, market size, and growth forecasts from 2023 to 2033. Key insights into regional markets and competitive landscapes are also included.

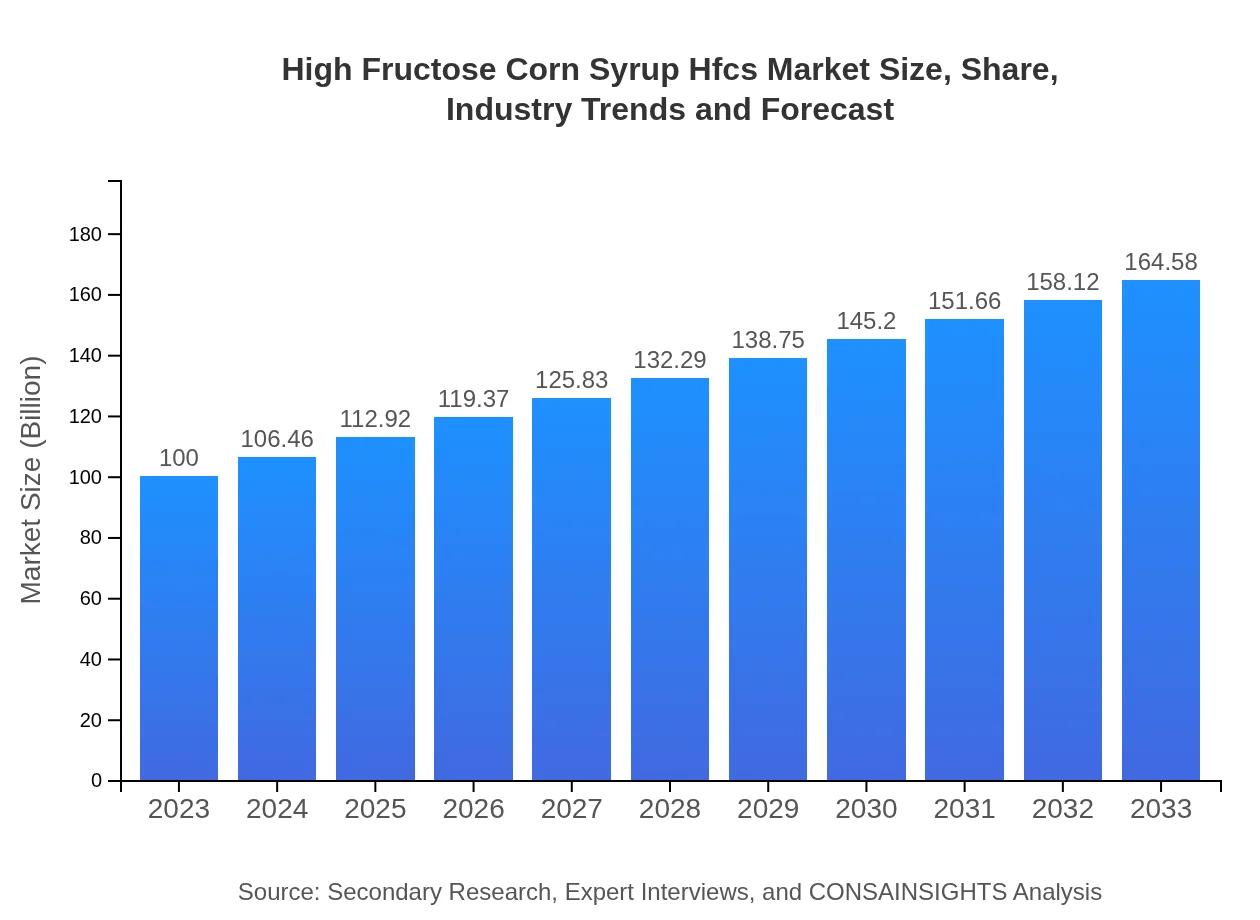

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $100.00 Million |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $164.58 Million |

| Top Companies | Cargill Incorporated, Archer Daniels Midland Company (ADM), Ingredion Incorporated, Tate & Lyle PLC, Sweetener Supply Corporation |

| Last Modified Date | 31 January 2026 |

High Fructose Corn Syrup Hfcs Market Overview

Customize High Fructose Corn Syrup Hfcs Market Report market research report

- ✔ Get in-depth analysis of High Fructose Corn Syrup Hfcs market size, growth, and forecasts.

- ✔ Understand High Fructose Corn Syrup Hfcs's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in High Fructose Corn Syrup Hfcs

What is the Market Size & CAGR of High Fructose Corn Syrup Hfcs market in 2023?

High Fructose Corn Syrup Hfcs Industry Analysis

High Fructose Corn Syrup Hfcs Market Segmentation and Scope

Tell us your focus area and get a customized research report.

High Fructose Corn Syrup Hfcs Market Analysis Report by Region

Europe High Fructose Corn Syrup Hfcs Market Report:

The European HFCS market is forecasted to increase from $29.42 billion in 2023 to $48.42 billion by 2033. Regulatory frameworks promoting natural products are expected to encourage the use of HFCS as a cost-effective alternative to sugar.Asia Pacific High Fructose Corn Syrup Hfcs Market Report:

In the Asia Pacific region, the HFCS market is expected to grow significantly from $17.91 billion in 2023 to $29.48 billion by 2033, reflecting a strong demand in emerging economies as consumer preferences shift towards convenience and sweetness in products.North America High Fructose Corn Syrup Hfcs Market Report:

North America remains the largest market for HFCS, anticipated to grow from $37.85 billion in 2023 to $62.29 billion in 2033. The region’s established agricultural infrastructure and high corn production have solidified its position as a leader in HFCS manufacturing.South America High Fructose Corn Syrup Hfcs Market Report:

The South American HFCS market, although smaller, is projected to rise from $6.31 billion in 2023 to $10.38 billion in 2033. Key players are increasingly entering this market to tap into the growing food processing industry and portfolio diversification.Middle East & Africa High Fructose Corn Syrup Hfcs Market Report:

The Middle East and Africa region’s HFCS market will see growth from $8.51 billion in 2023 to $14.01 billion in 2033. Increasing urbanization and the rise of the processed food sector are driving demand for sweeteners.Tell us your focus area and get a customized research report.

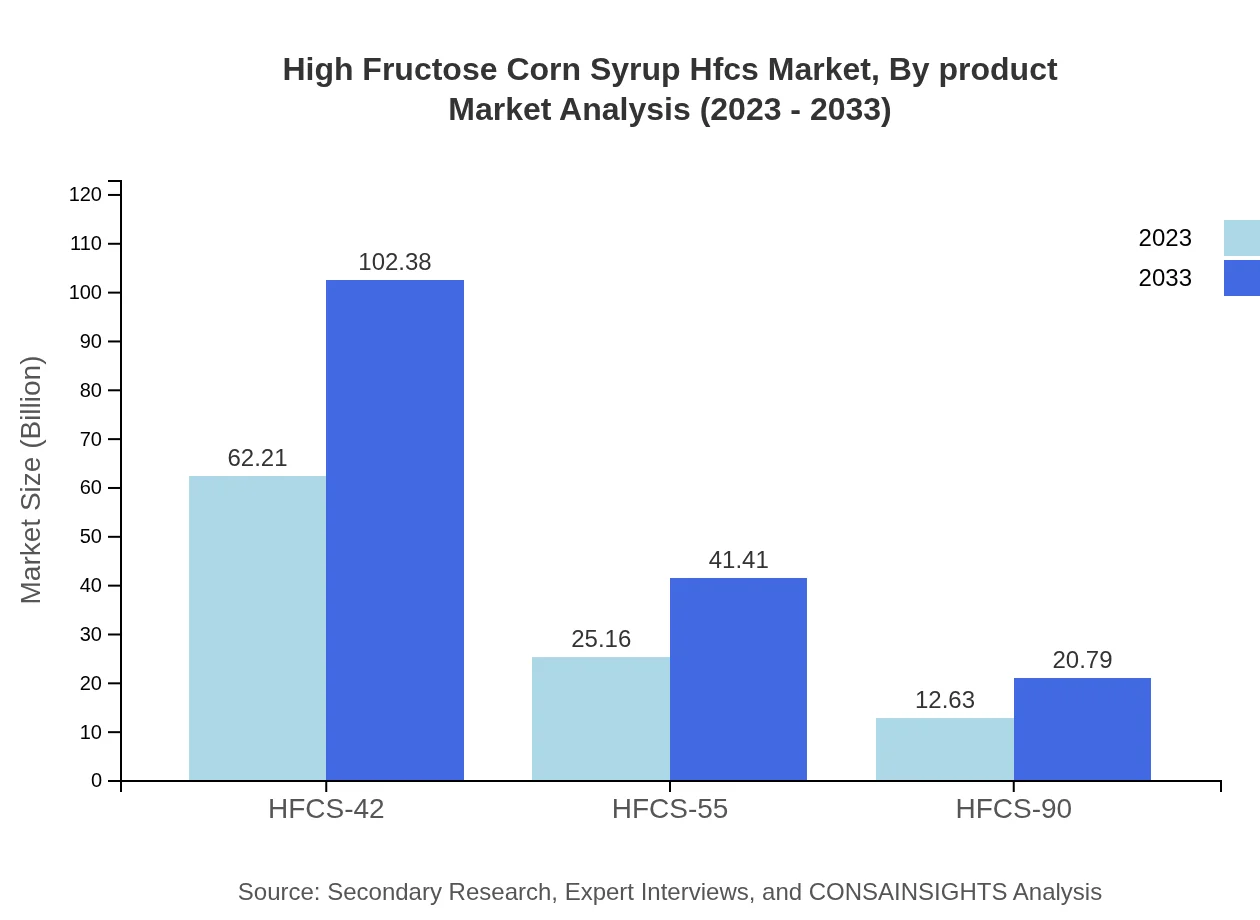

High Fructose Corn Syrup Hfcs Market Analysis By Product

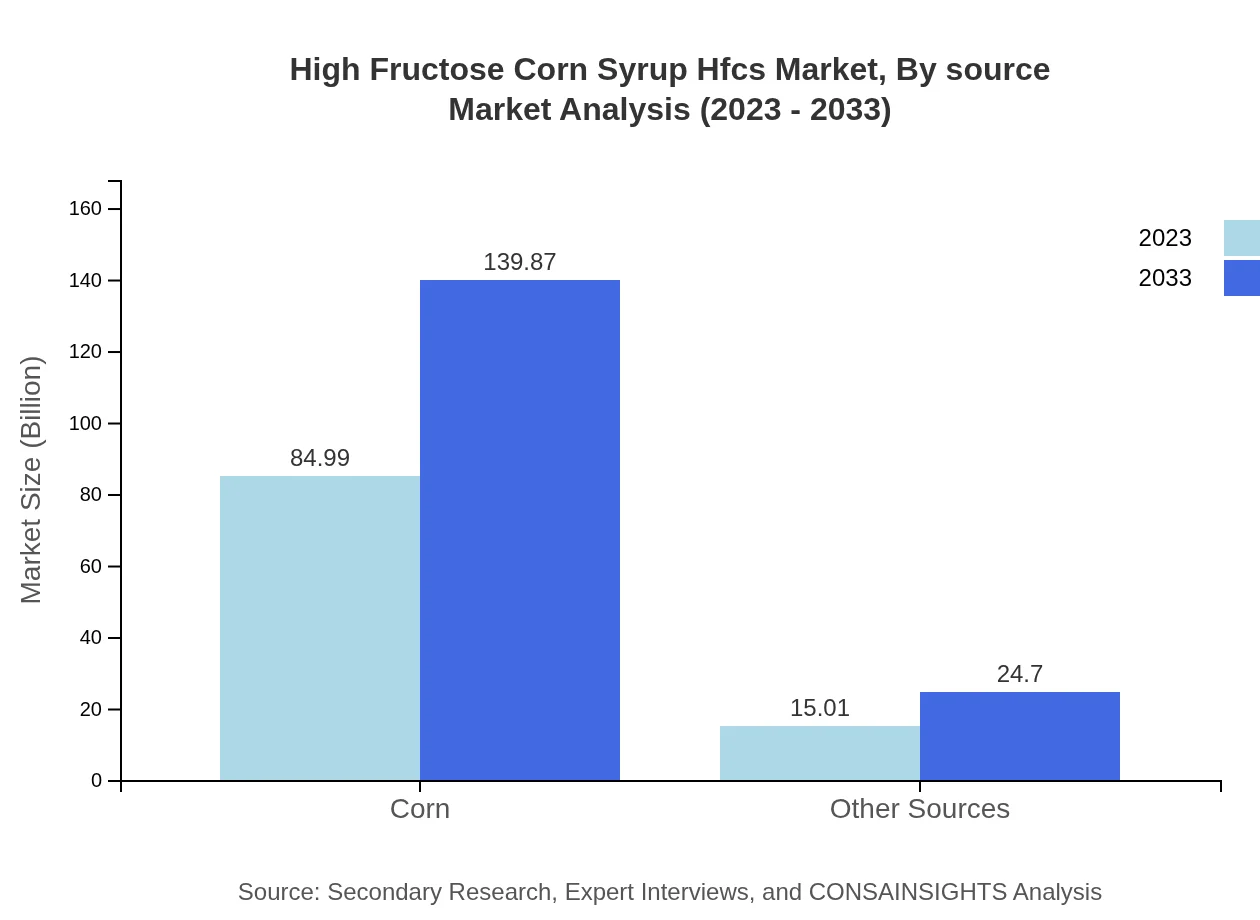

The product segmentation of the HFCS market reveals that Corn-based HFCS dominates the market, expected to grow from $84.99 billion in 2023 to $139.87 billion by 2033, indicating its importance in sweetening formulations across industries.

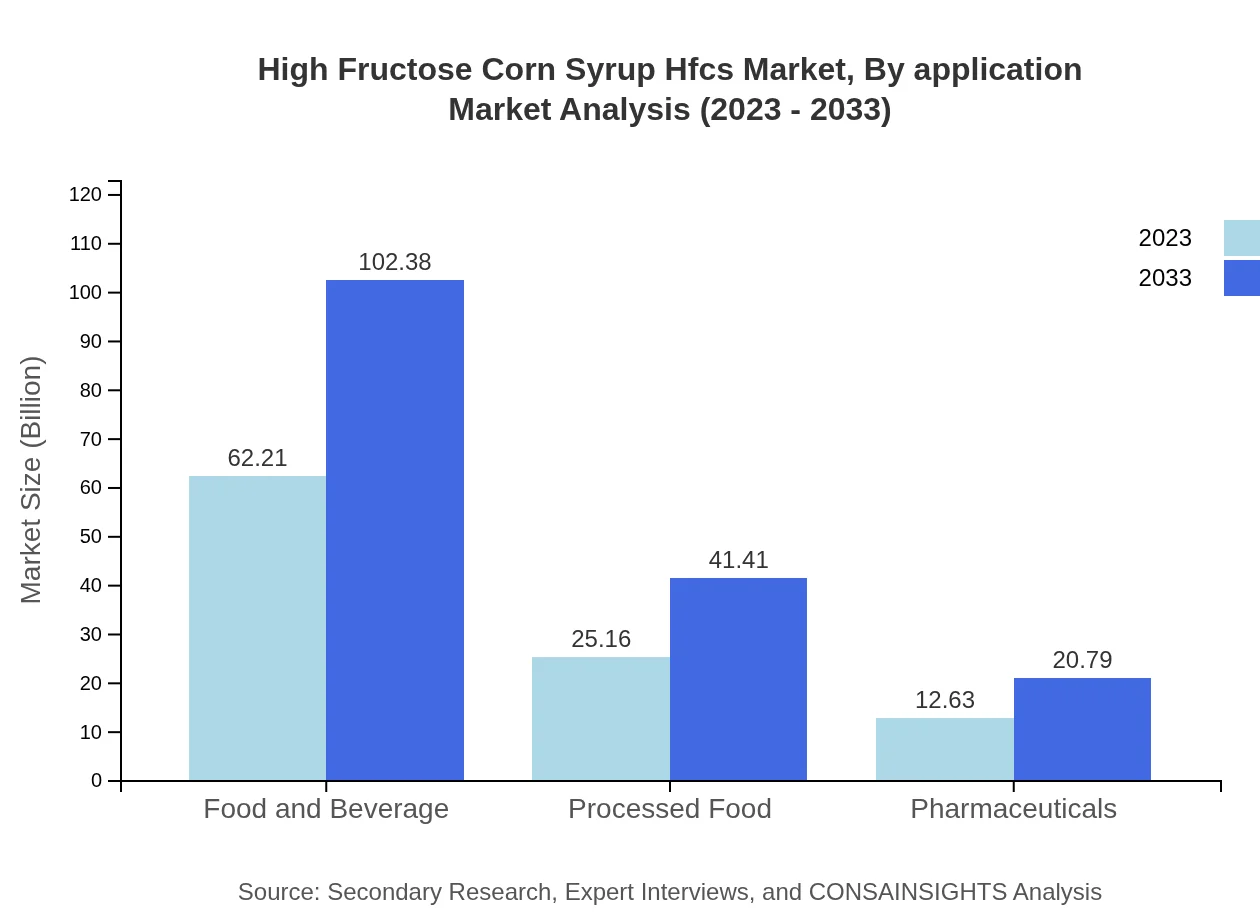

High Fructose Corn Syrup Hfcs Market Analysis By Application

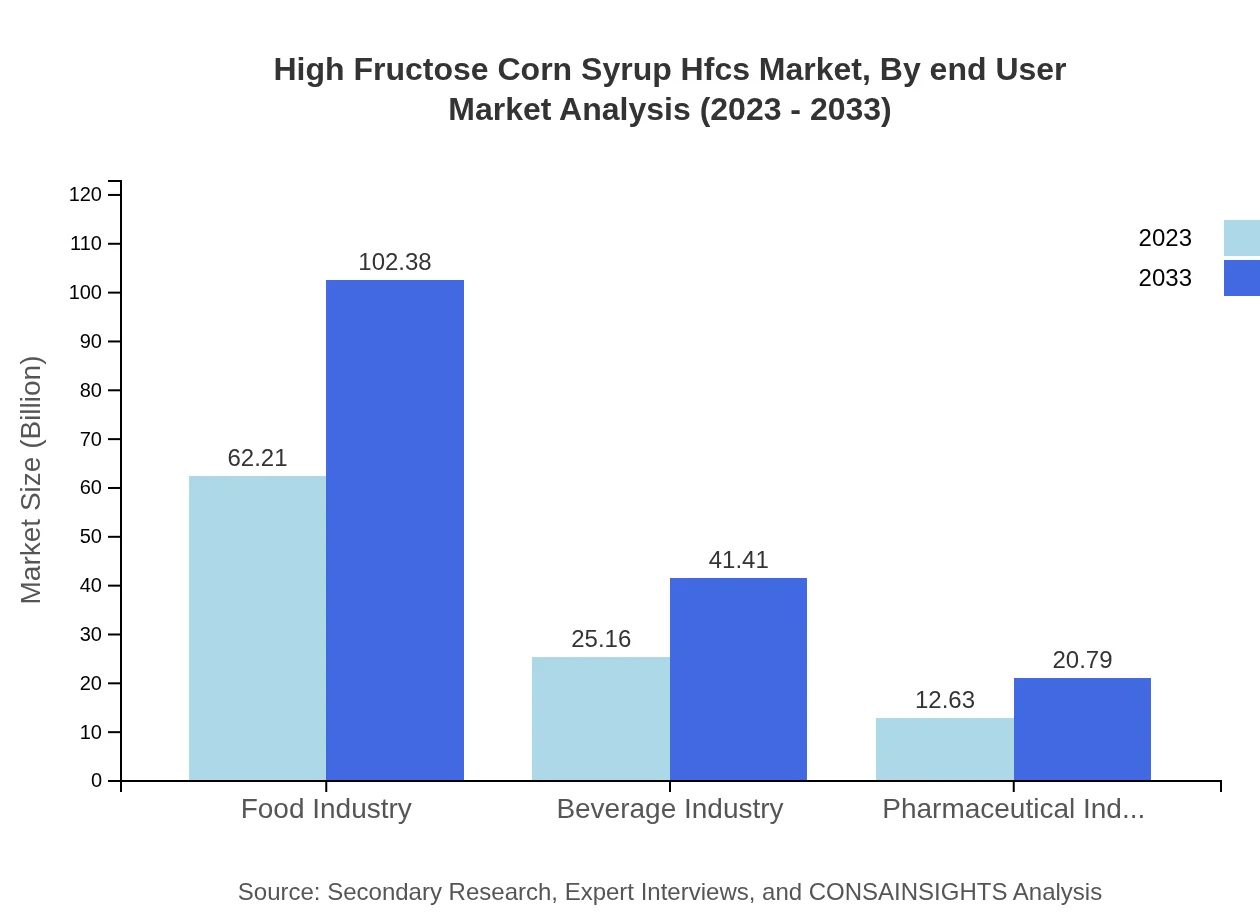

In the application segment, the food industry leads with a market size of $62.21 billion in 2023, projected to reach $102.38 billion by 2033. The beverage industry follows with a significant contribution, reflecting the versatility of HFCS in sweetening beverages.

High Fructose Corn Syrup Hfcs Market Analysis By Source

The source analysis highlights Corn as the chief ingredient in HFCS production, expected to grow from $84.99 billion in 2023 to $139.87 billion by 2033, showcasing its continuous demand in various sectors.

High Fructose Corn Syrup Hfcs Market Analysis By End User

The end-user segment reveals diverse applications in food and beverages, pharmaceuticals, and processed foods, consolidating HFCS's foothold as a preferred sweetening agent across industries, with steady growth expected in all sectors.

High Fructose Corn Syrup Hfcs Market Analysis By Distribution Channel

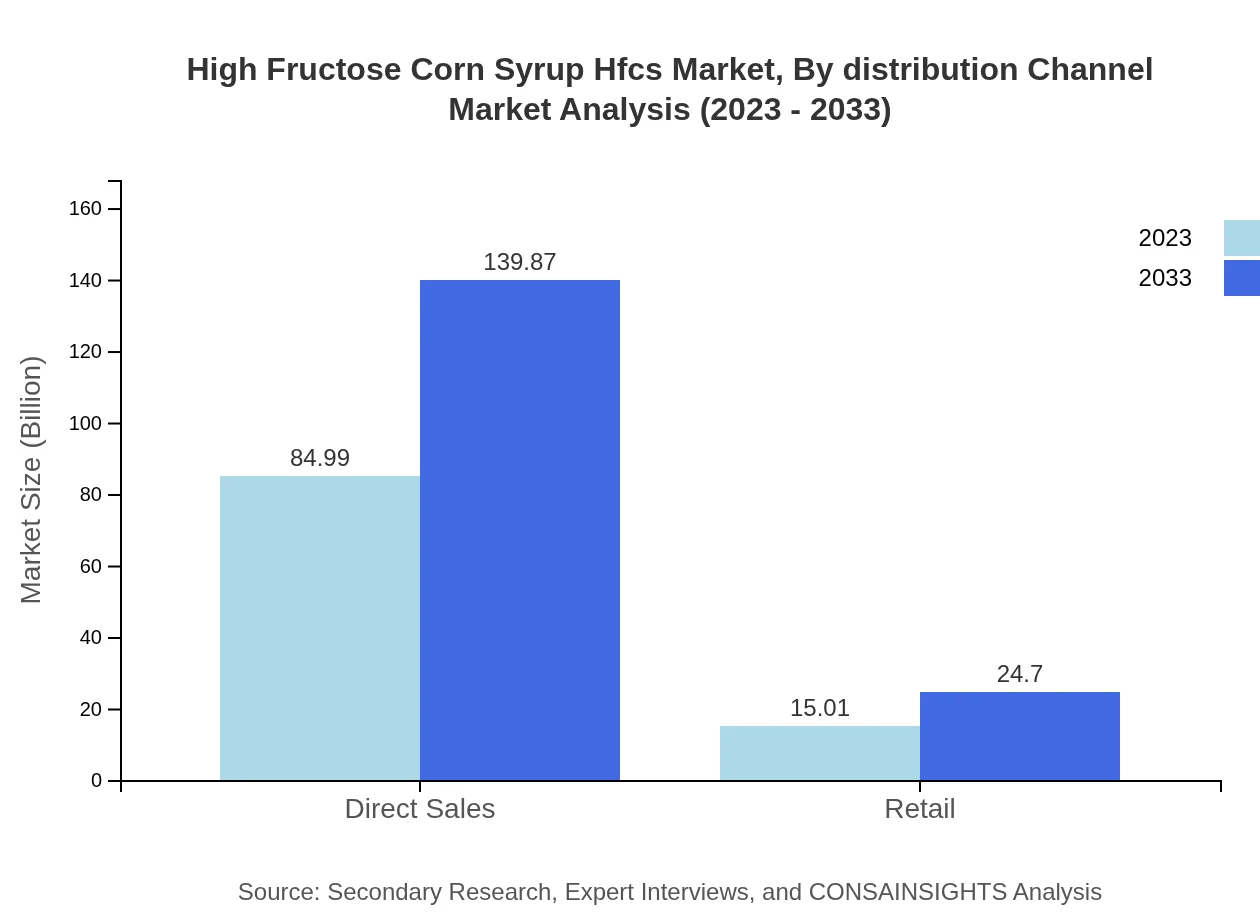

Direct sales channels dominate the distribution of HFCS, projected to steadily grow from $84.99 billion in 2023 to $139.87 billion by 2033, reflecting the increasing penetration of HFCS products in grocery and retail markets.

High Fructose Corn Syrup Hfcs Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in High Fructose Corn Syrup Hfcs Industry

Cargill Incorporated:

Cargill is a leading provider of HFCS, known for its innovations in food science and technology, guiding the industry towards sustainable and efficient production methods.Archer Daniels Midland Company (ADM):

ADM is a significant player in the HFCS market, supplying a variety of sweeteners globally, while advancing sustainable agricultural practices.Ingredion Incorporated:

Ingredion focuses on developing ingredient solutions including HFCS, serving various industries while prioritizing nutrition and health in its product offerings.Tate & Lyle PLC:

Tate & Lyle is a well-established manufacturer of HFCS, recognized for its commitment to sugar reduction and healthier food formulations.Sweetener Supply Corporation:

Sweetener Supply provides a range of HFCS products while supporting food manufacturers with customized solutions for sweetening.We're grateful to work with incredible clients.

FAQs

What is the market size of high Fructose Corn Syrup Hfcs?

The global market size for High Fructose Corn Syrup (HFCS) in 2023 is valued at approximately $100 million, with an expected CAGR of 5% from 2023 to 2033. This reflects a steady growth trajectory in the HFCS market.

What are the key market players or companies in this high Fructose Corn Syrup Hfcs industry?

Key players in the HFCS market include major companies involved in the agricultural and food processing sectors, who contribute significantly to production and distribution capabilities, ensuring a competitive landscape that drives innovation.

What are the primary factors driving the growth in the high Fructose Corn Syrup Hfcs industry?

Factors such as increasing consumer demand for processed foods, the cost-effectiveness of HFCS as a sweetener, and its wide application across various industries, especially food and beverages, are driving growth in the HFCS market.

Which region is the fastest Growing in the high Fructose Corn Syrup Hfcs?

North America is expected to be the fastest-growing region in the HFCS market, with a projected market value growth from $37.85 million in 2023 to $62.29 million by 2033, showcasing a strong demand and production capacity.

Does ConsaInsights provide customized market report data for the high Fructose Corn Syrup Hfcs industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs in the HFCS industry, allowing businesses to access precise and relevant insights for strategic decision-making.

What deliverables can I expect from this high Fructose Corn Syrup Hfcs market research project?

From the HFCS market research project, clients can expect comprehensive reports that include market size analysis, growth forecasts, competitive landscapes, segment data, and regional insights to support informed business strategies.

What are the market trends of high Fructose Corn Syrup Hfcs?

Current trends in the HFCS market include increased use in healthier food options, rising demand from developing regions, and innovation in production technologies, which are enhancing the quality and efficiency of HFCS supply.