High Integrity Pressure Protection System Market Report

Published Date: 22 January 2026 | Report Code: high-integrity-pressure-protection-system

High Integrity Pressure Protection System Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the High Integrity Pressure Protection System (HIPPS) market from 2023 to 2033, covering market size, trends, industry analysis, regional dynamics, and insights into key players and future forecasts.

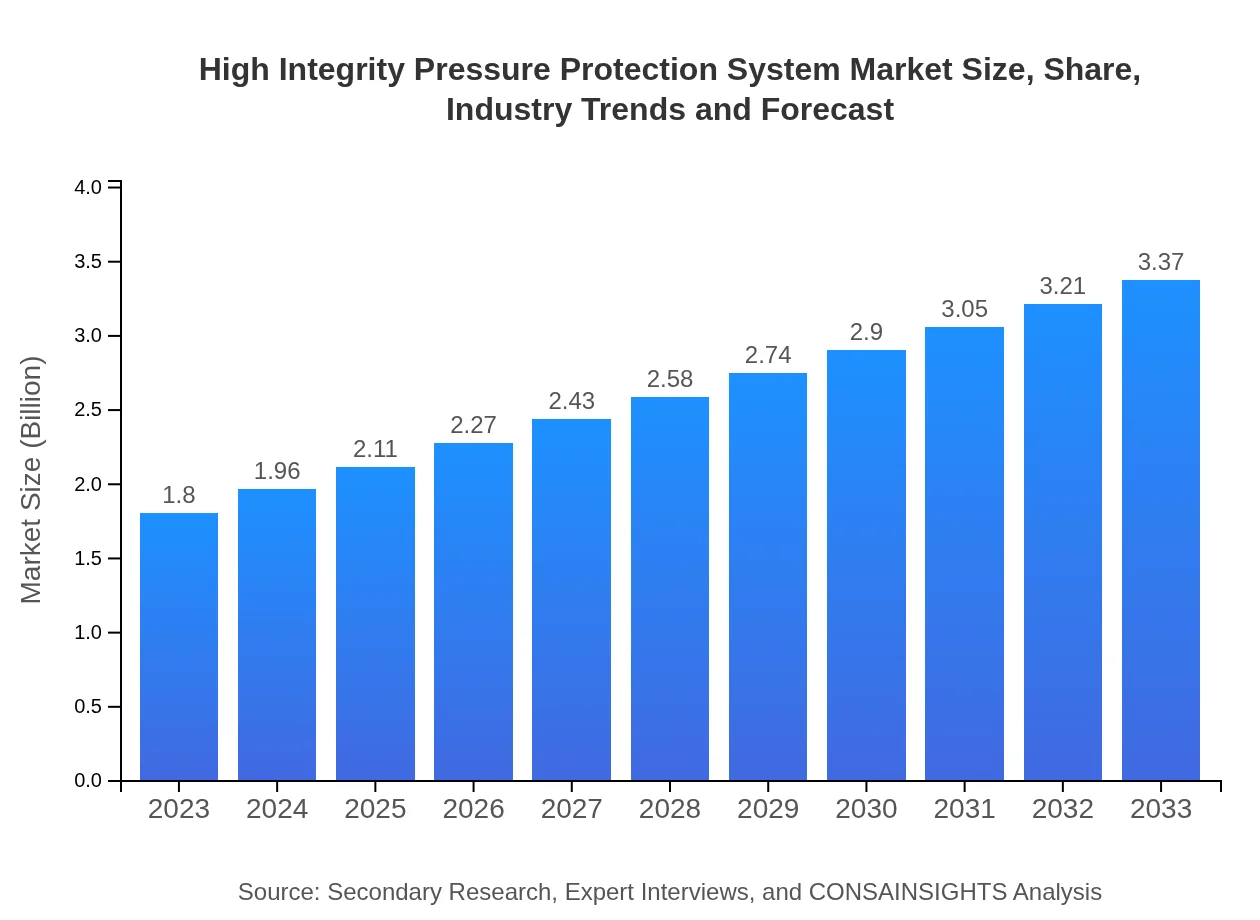

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.80 Billion |

| CAGR (2023-2033) | 6.3% |

| 2033 Market Size | $3.37 Billion |

| Top Companies | Emerson Electric Co., Honeywell International Inc., Siemens AG, Yokogawa Electric Corporation, Rockwell Automation Inc. |

| Last Modified Date | 22 January 2026 |

High Integrity Pressure Protection System Market Overview

Customize High Integrity Pressure Protection System Market Report market research report

- ✔ Get in-depth analysis of High Integrity Pressure Protection System market size, growth, and forecasts.

- ✔ Understand High Integrity Pressure Protection System's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in High Integrity Pressure Protection System

What is the Market Size & CAGR of High Integrity Pressure Protection System market in 2023?

High Integrity Pressure Protection System Industry Analysis

High Integrity Pressure Protection System Market Segmentation and Scope

Tell us your focus area and get a customized research report.

High Integrity Pressure Protection System Market Analysis Report by Region

Europe High Integrity Pressure Protection System Market Report:

The European market for High Integrity Pressure Protection Systems is anticipated to grow from $0.51 billion in 2023 to $0.96 billion by 2033. The growth is supported by the push for energy efficiency and the need to comply with the EU’s stringent safety standards.Asia Pacific High Integrity Pressure Protection System Market Report:

The Asia Pacific region is expected to witness significant growth in the High Integrity Pressure Protection System market, reaching approximately $0.62 billion by 2033 from $0.33 billion in 2023. This growth is driven by rapid industrialization, increased investments in the oil and gas sector, and the implementation of stricter safety regulations.North America High Integrity Pressure Protection System Market Report:

North America is poised to dominate the HIPPS market, with expected growth from $0.70 billion in 2023 to $1.31 billion in 2033. Factors such as technological advancements, the expansion of shale gas production, and stringent safety regulations are key contributors to the market expansion.South America High Integrity Pressure Protection System Market Report:

In South America, the HIPPS market is projected to grow from $0.16 billion in 2023 to $0.30 billion by 2033. The growth is primarily driven by increasing exploration and production activities in oil and gas, as well as growing investments in energy infrastructure.Middle East & Africa High Integrity Pressure Protection System Market Report:

The Middle East and Africa region is expected to expand its HIPPS market from $0.10 billion in 2023 to $0.18 billion by 2033. This growth is attributed to the ongoing expansion of oil and gas projects which necessitate high safety standards to mitigate leakage and explosion risks.Tell us your focus area and get a customized research report.

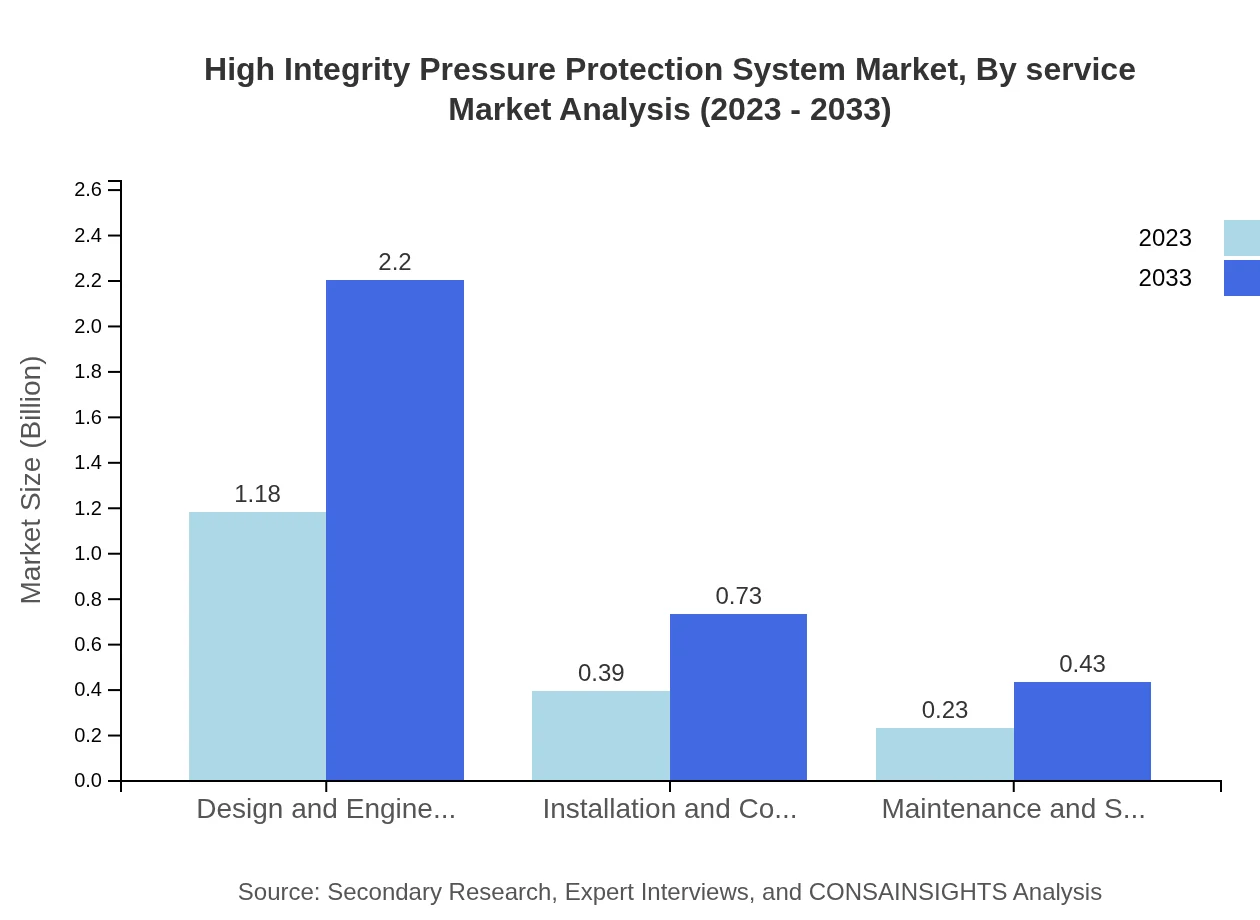

High Integrity Pressure Protection System Market Analysis By Service

The service segment forms a crucial part of the HIPPS market, encompassing design, engineering, installation, and maintenance services. As of 2023, this segment accounts for significant market shares, particularly in design and engineering, valued at $1.18 billion. By 2033, it is anticipated to grow to $2.20 billion, as industries prioritize safety and compliance.

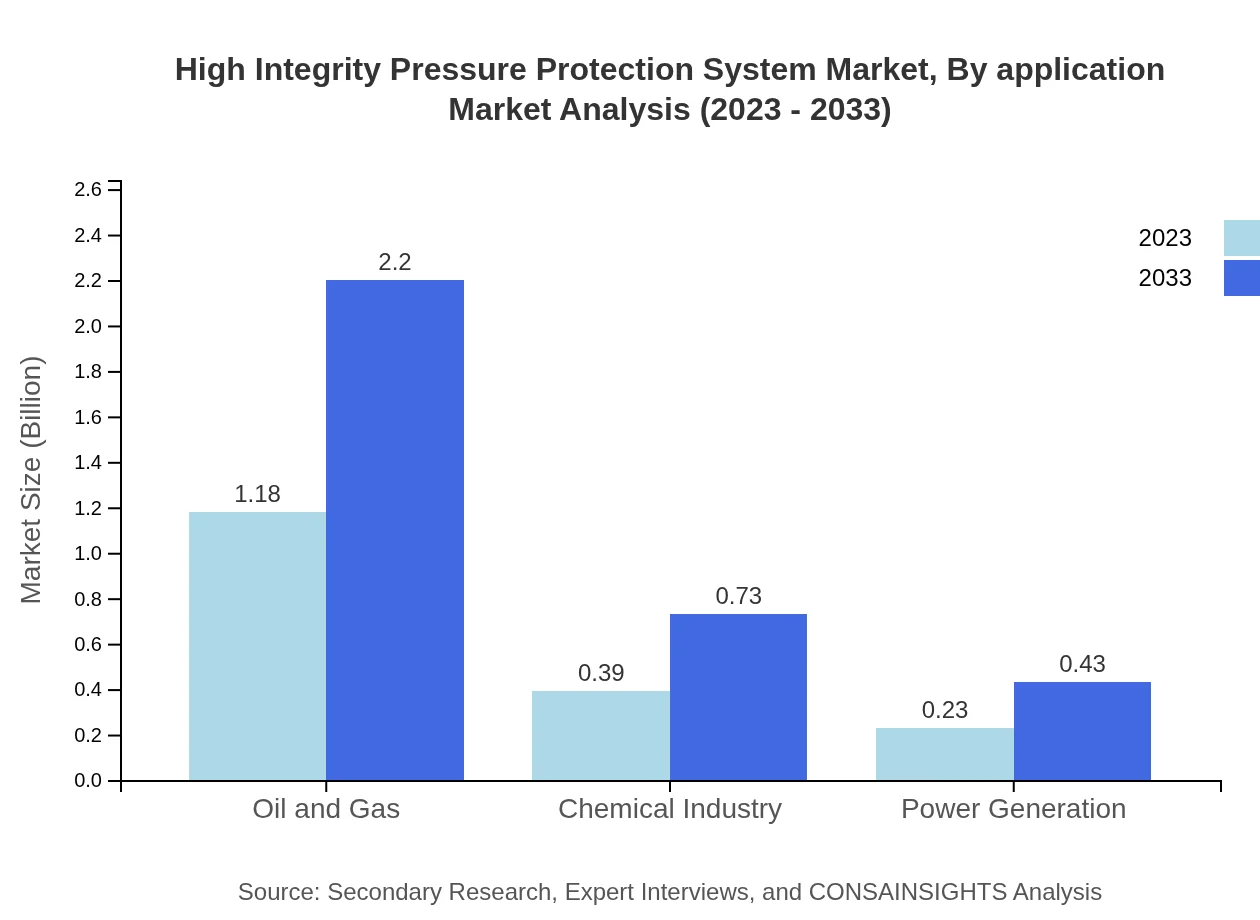

High Integrity Pressure Protection System Market Analysis By Application

Applications across various sectors such as oil and gas, chemicals, and power generation drive the HIPPS market forward. The oil and gas sector dominates with a market size of $1.18 billion in 2023, expected to move to $2.20 billion by 2033. The chemical industry and power generation segments also maintain significant presence.

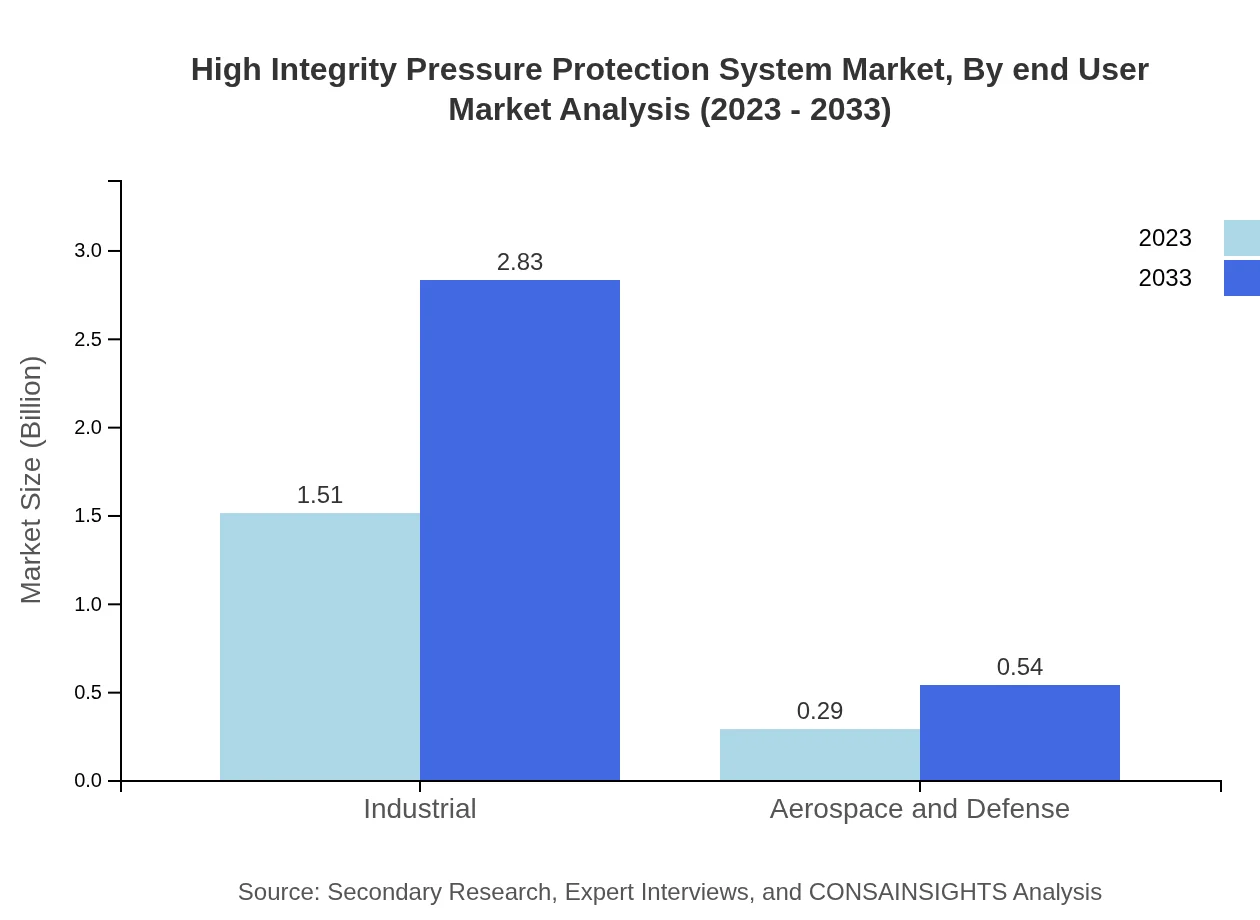

High Integrity Pressure Protection System Market Analysis By End User

End-users include sectors like oil and gas, aerospace, and chemicals with an emphasis on industrial safety. Industrial applications lead with an 84.07% market share of total HIPPS investments as of 2023, maintaining their significance through 2033.

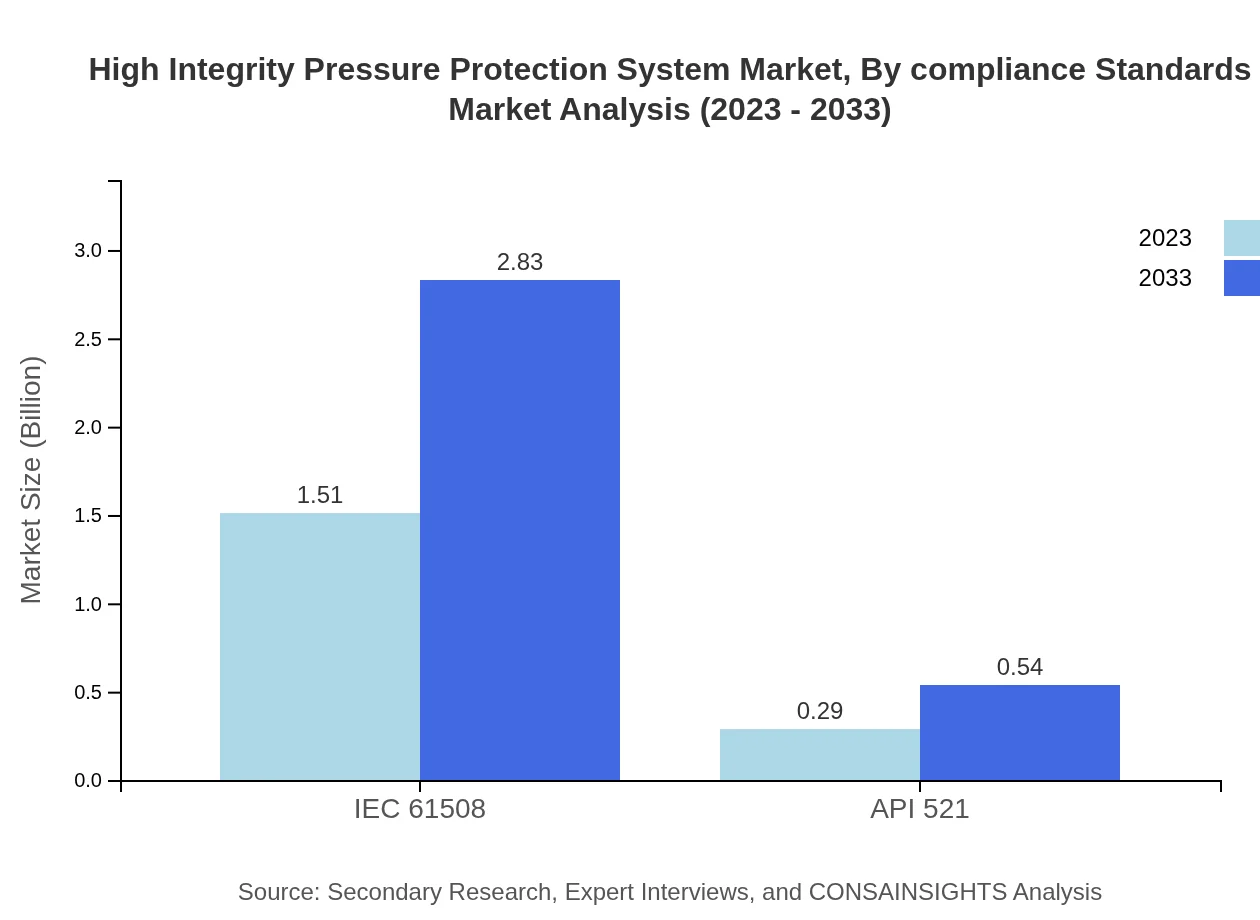

High Integrity Pressure Protection System Market Analysis By Compliance Standards

Compliance with standards such as IEC 61508 is paramount for producers of High Integrity Pressure Protection Systems. The market share of compliant systems is projected to reach 84.07% in 2033, highlighting the industry’s focus on adhering to safety regulations.

High Integrity Pressure Protection System Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in High Integrity Pressure Protection System Industry

Emerson Electric Co.:

A leader in automation and control solutions, Emerson provides innovative technologies for improving safety and efficiency in industrial processes, including HIPPS.Honeywell International Inc.:

Honeywell is a major player in safety systems, offering advanced solutions for pressure protection that integrate seamlessly into existing processes.Siemens AG:

Siemens specializes in industrial automation and digitalization, contributing significantly to HIPPS through its advanced control and monitoring systems.Yokogawa Electric Corporation:

With a focus on process automation and safety, Yokogawa provides cutting-edge HIPPS solutions designed to enhance operational safety.Rockwell Automation Inc.:

Rockwell Automation offers a range of solutions for industrial safety, helping organizations achieve compliance and improve risk management in operations.We're grateful to work with incredible clients.

FAQs

What is the market size of high Integrity Pressure Protection System?

The global market size for High Integrity Pressure Protection Systems is projected to reach $1.8 billion by 2033, growing at a CAGR of 6.3% from 2023. This growth reflects increasing demand for safety in various industries.

What are the key market players or companies in this high Integrity Pressure Protection System industry?

Key players in the High Integrity Pressure Protection System market include major engineering firms and technology providers specializing in safety systems for industrial applications. Their innovations and technological advancements significantly influence market dynamics.

What are the primary factors driving the growth in the high Integrity Pressure Protection System industry?

Growth drivers for the High Integrity Pressure Protection System market include increased safety regulations, rising demand in oil and gas sectors, technological advancements, and the industry's focus on improving operational efficiency and risk management.

Which region is the fastest Growing in the high Integrity Pressure Protection System?

Currently, North America leads the High Integrity Pressure Protection System market and is expected to grow aggressively, reaching $1.31 billion by 2033, propelled by policy enforcement and technological adoption.

Does ConsaInsights provide customized market report data for the high Integrity Pressure Protection System industry?

Yes, ConsaInsights offers tailored market report data for the High Integrity Pressure Protection System industry, accommodating specific client needs for segmented analyses, regional insights, and competitive landscapes.

What deliverables can I expect from this high Integrity Pressure Protection System market research project?

Deliverables include comprehensive reports detailing market size, growth forecasts, competitive analysis, regional breakdowns, and segment-wise insights, equipping stakeholders with actionable intelligence to make informed decisions.

What are the market trends of high Integrity Pressure Protection System?

Trends in the High Integrity Pressure Protection System market include increasing automation, enhanced integration of digital technologies, a growing focus on regulatory compliance, and rising investments in renewable energy sectors.