High Performance Inertial Measurement Unit Imu Market Report

Published Date: 31 January 2026 | Report Code: high-performance-inertial-measurement-unit-imu

High Performance Inertial Measurement Unit Imu Market Size, Share, Industry Trends and Forecast to 2033

This report analyzes the High Performance Inertial Measurement Unit (IMU) market, offering insights into current trends, growth forecasts, and competitive landscape from 2023 to 2033. It provides detailed market segmentation, regional analysis, and an overview of key players driving the industry.

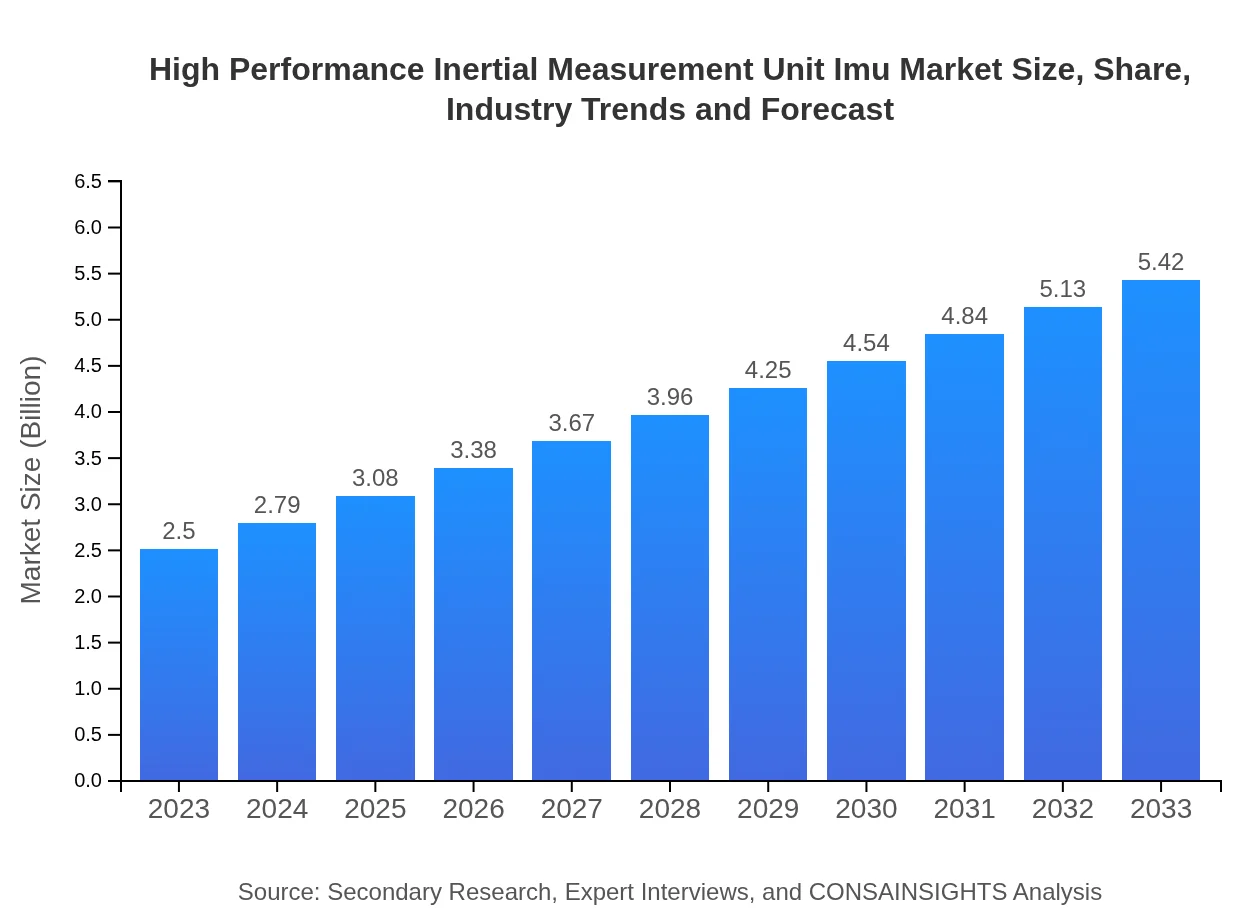

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $5.42 Billion |

| Top Companies | Honeywell International Inc., Northrop Grumman Corporation, STMicroelectronics, Analog Devices, Inc. |

| Last Modified Date | 31 January 2026 |

High Performance Inertial Measurement Unit Imu Market Overview

Customize High Performance Inertial Measurement Unit Imu Market Report market research report

- ✔ Get in-depth analysis of High Performance Inertial Measurement Unit Imu market size, growth, and forecasts.

- ✔ Understand High Performance Inertial Measurement Unit Imu's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in High Performance Inertial Measurement Unit Imu

What is the Market Size & CAGR of High Performance Inertial Measurement Unit Imu market in 2023?

High Performance Inertial Measurement Unit Imu Industry Analysis

High Performance Inertial Measurement Unit Imu Market Segmentation and Scope

Tell us your focus area and get a customized research report.

High Performance Inertial Measurement Unit Imu Market Analysis Report by Region

Europe High Performance Inertial Measurement Unit Imu Market Report:

In Europe, the market for High Performance Inertial Measurement Units is estimated at $0.79 billion for 2023, with forecasts suggesting it will grow to $1.72 billion by 2033. The European automotive industry's push towards electric and autonomous vehicles, combined with stringent regulatory norms on safety and navigation, fosters demand for advanced IMUs.Asia Pacific High Performance Inertial Measurement Unit Imu Market Report:

In 2023, the Asia Pacific market size for High Performance Inertial Measurement Units is estimated at $0.42 billion, projected to rise to $0.92 billion by 2033. Growth in this region is driven by increasing industrial automation, aerospace activities, and a booming consumer electronics sector. Emerging economies such as India and China are significantly ramping up their investment in technology, further propelling market expansion.North America High Performance Inertial Measurement Unit Imu Market Report:

North America holds a significant share of the High Performance Inertial Measurement Unit market with a size of $0.91 billion in 2023, projected to reach $1.98 billion by 2033. The presence of leading aerospace and automotive manufacturers, along with robust defense expenditures, underscores this region's dominant market position.South America High Performance Inertial Measurement Unit Imu Market Report:

The South American High Performance Inertial Measurement Unit market was valued at $0.20 billion in 2023, expected to double to $0.44 billion by 2033. The rising demand for navigation systems in the transportation sector and increased defense budgets in countries like Brazil and Argentina contribute to market growth.Middle East & Africa High Performance Inertial Measurement Unit Imu Market Report:

The Middle East and Africa market size for High Performance Inertial Measurement Units stands at $0.16 billion in 2023, with a projected increase to $0.35 billion by 2033. Increased military investments and technological advancements in navigation systems within the defense and aerospace sectors are the key drivers for growth in this region.Tell us your focus area and get a customized research report.

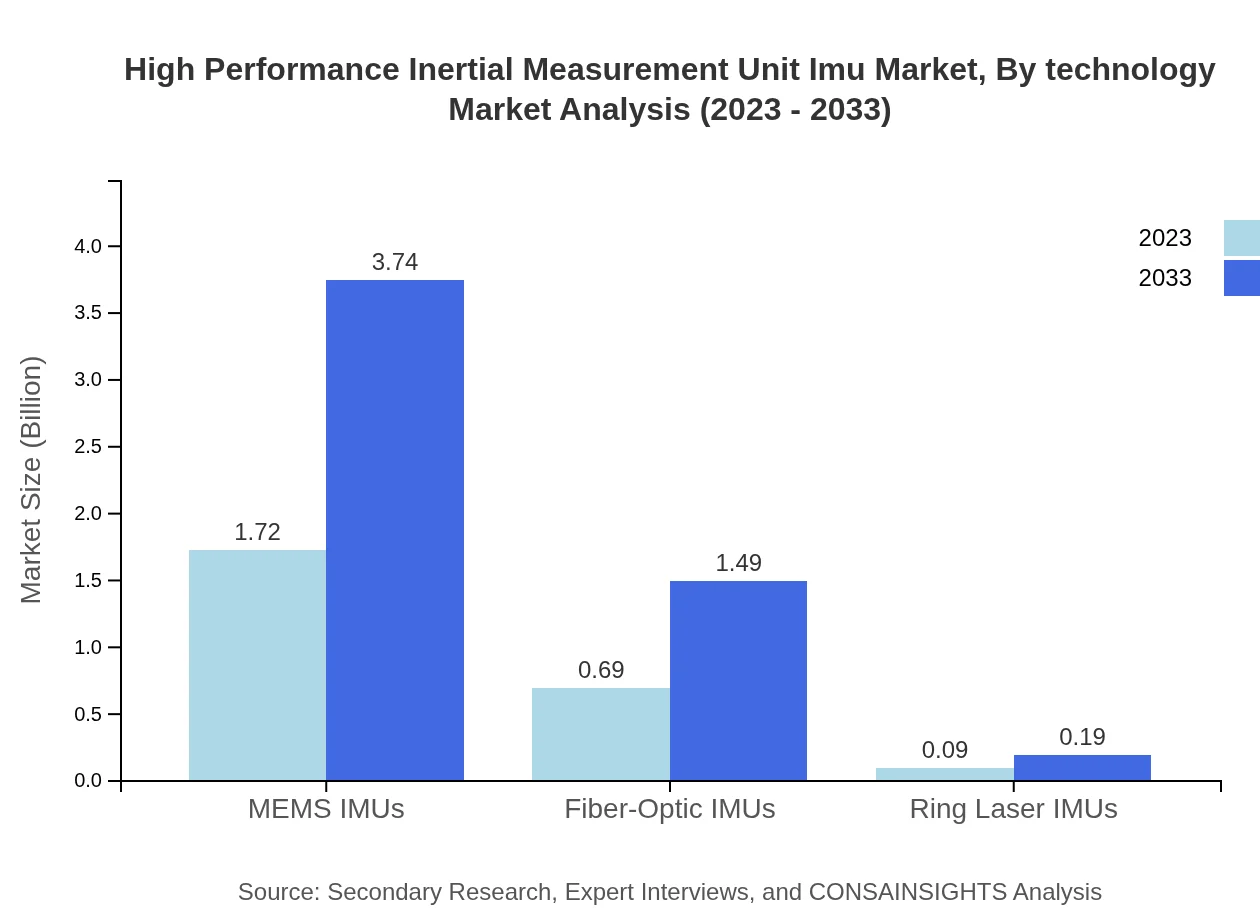

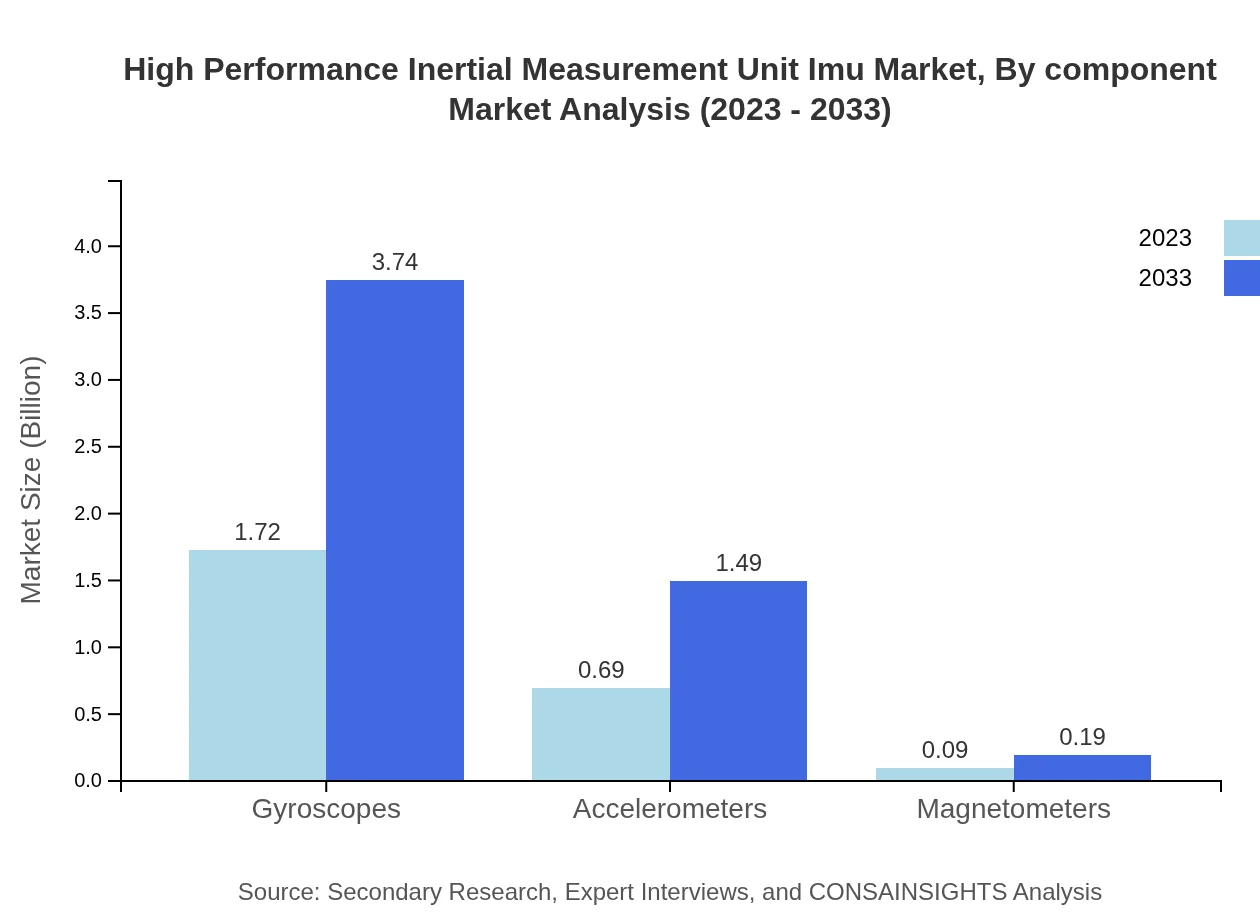

High Performance Inertial Measurement Unit Imu Market Analysis By Technology

The market segmentation by technology includes: Gyroscopes, accounting for a projected size of $1.72 billion in 2023 and growing to $3.74 billion by 2033, dominating the market with a share of 68.93%. Accelerometers are expected to see growth from $0.69 billion to $1.49 billion, maintaining a 27.55% share. Magnetometers represent a smaller segment, with a market size of $0.09 billion in 2023, projected to rise to $0.19 billion, holding a 3.52% share.

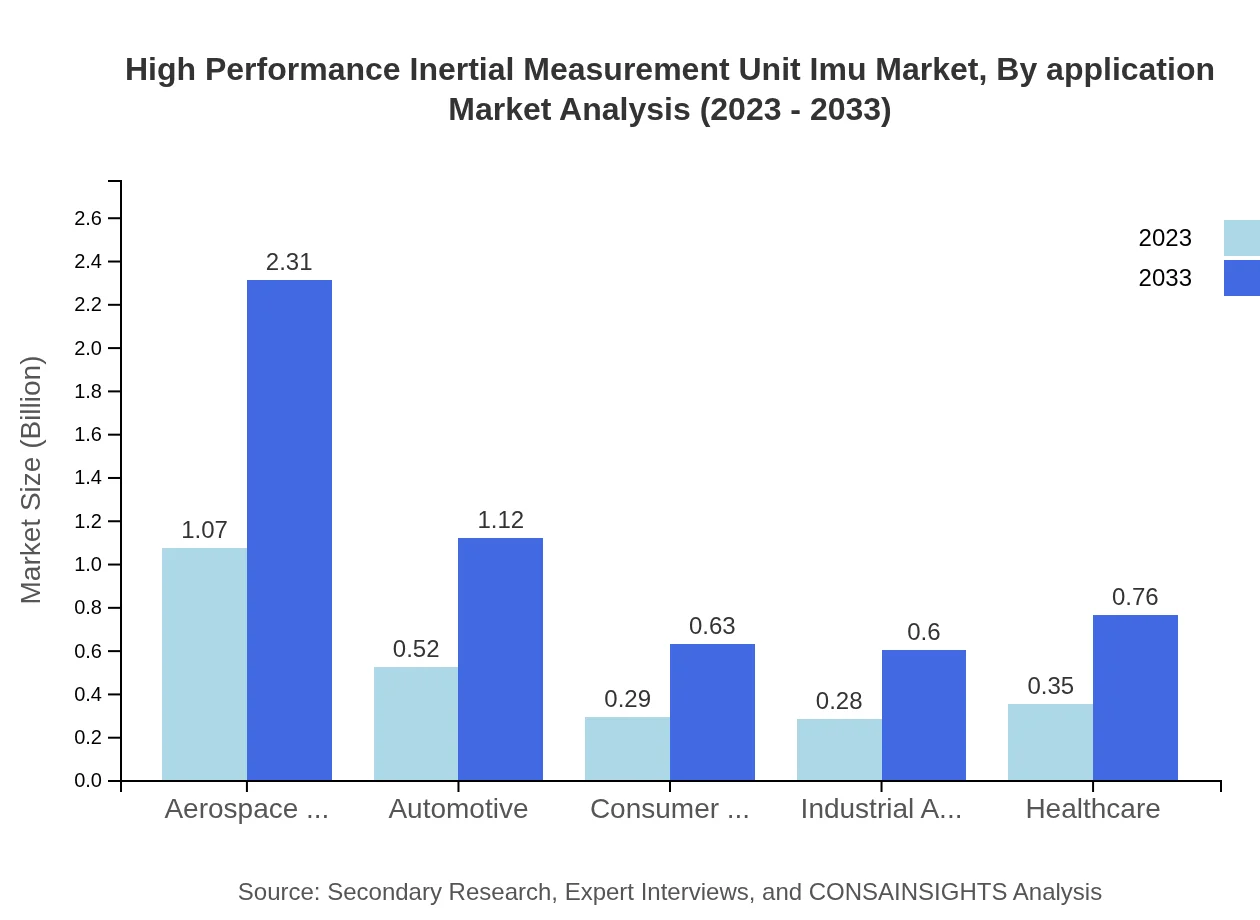

High Performance Inertial Measurement Unit Imu Market Analysis By Application

The primary applications of High-Performance IMUs span: Aerospace and Defense with a market size of $1.07 billion in 2023, expected to increase to $2.31 billion by 2033, capturing 42.64% share. Automotive applications project growth from a size of $0.52 billion to $1.12 billion, retaining a 20.69% share. Other notable applications include healthcare, industrial automation, and consumer electronics, all showing promising growth trends.

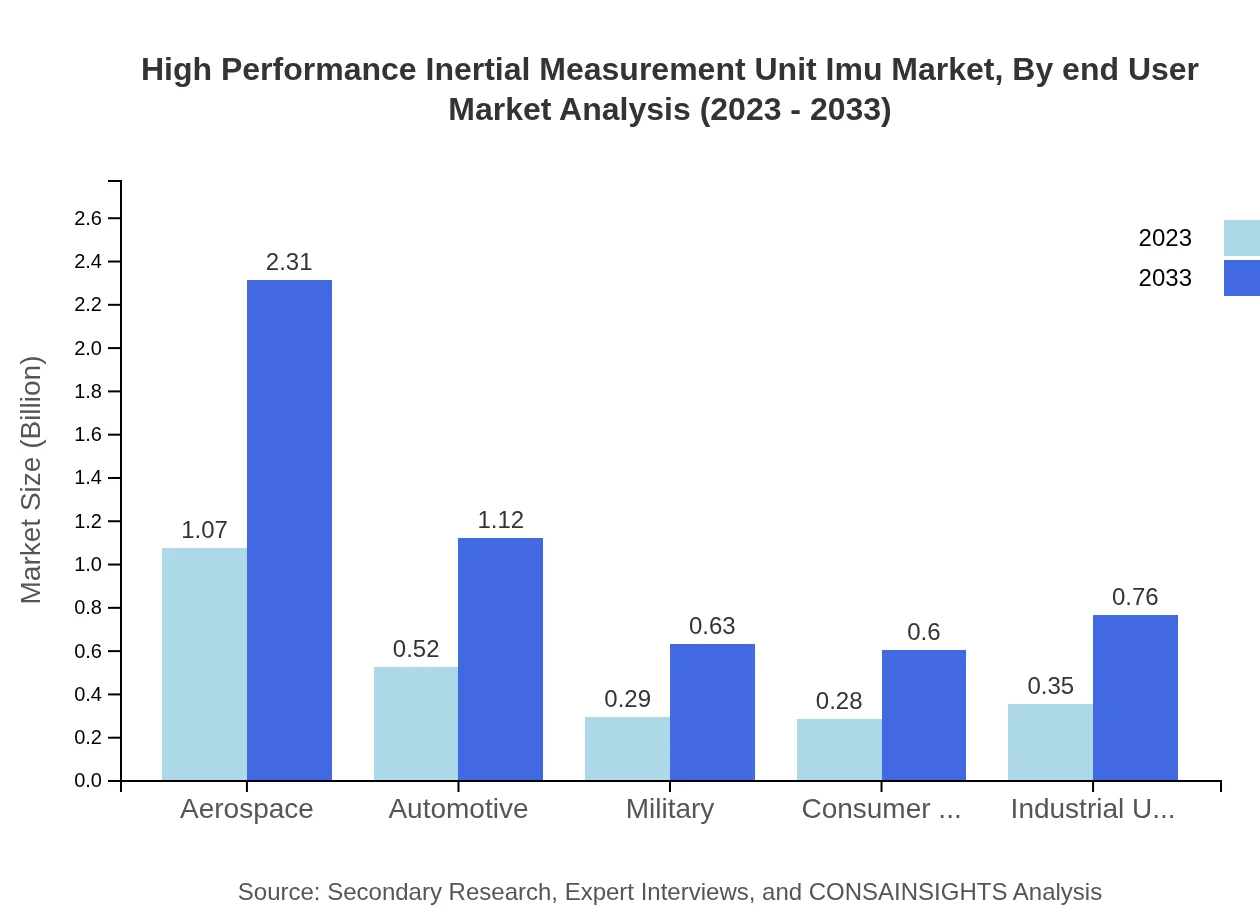

High Performance Inertial Measurement Unit Imu Market Analysis By End User

End-user segmentation reveals diverse uses across industries: Aerospace and Defense holds a significant share, followed by automotive applications characterized by rapid advancements towards automation. Industrial applications expect considerable growth due to increased automation push and smart manufacturing strategies, while healthcare integration presents opportunities for precise diagnostics and monitoring.

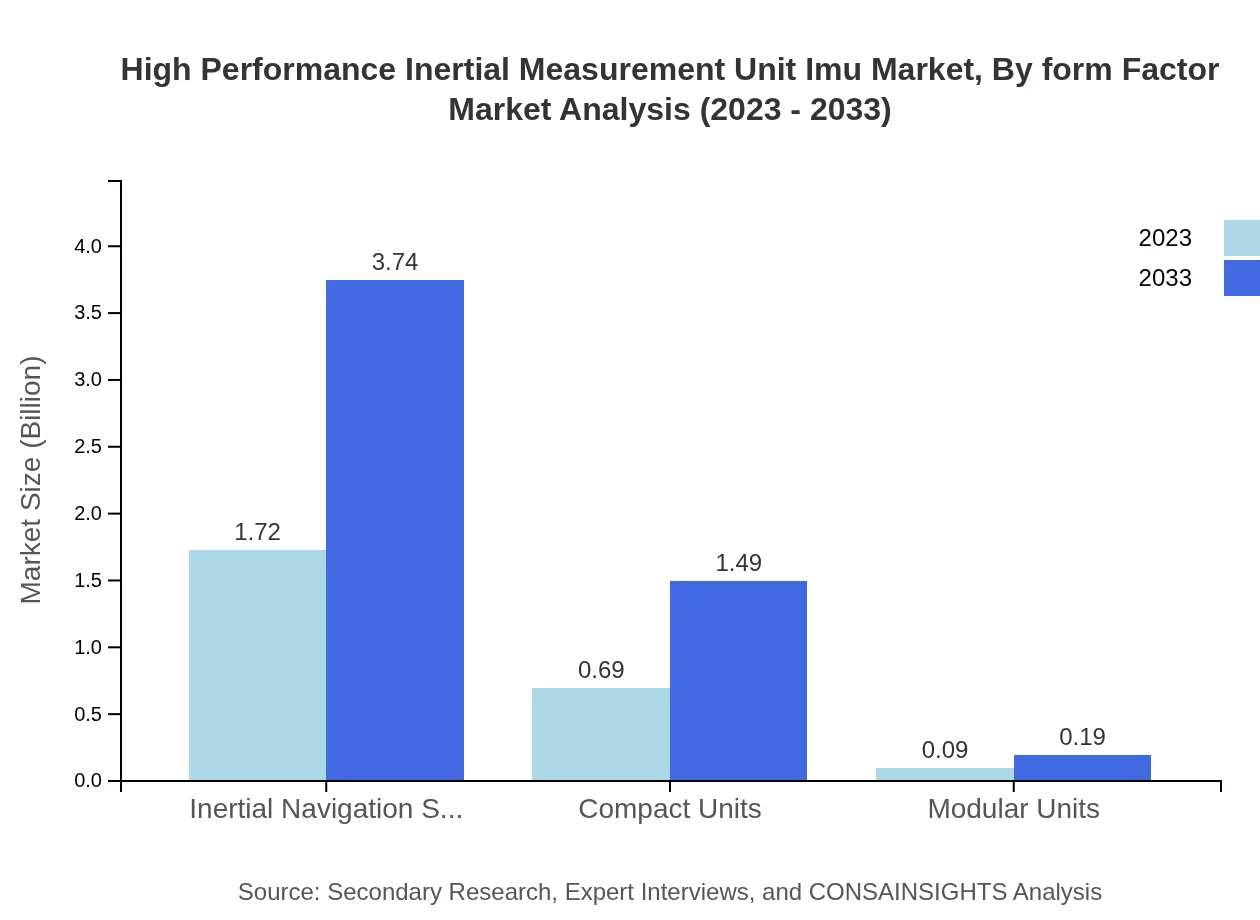

High Performance Inertial Measurement Unit Imu Market Analysis By Form Factor

Form factor segmentation includes compact and modular units, with compact units projected to grow from $0.69 billion to $1.49 billion in size, accounting for 27.55% of the market share. Modular units present a smaller demand, but their versatility in applications retains a consistent relevance in various sectors.

High Performance Inertial Measurement Unit Imu Market Analysis By Component

By component, the market includes significant segments like gyroscopes and accelerometers, essential for achieving the effective performance of IMUs across applications. Each component segment reflects fluctuating trends with respect to technological advancements, impacting overall market supply and dynamics.

High Performance Inertial Measurement Unit Imu Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in High Performance Inertial Measurement Unit Imu Industry

Honeywell International Inc.:

Honeywell is a leader in advanced technologies with a broad portfolio in aerospace products incorporating high-performance IMUs suited for various applications.Northrop Grumman Corporation:

Specializing in defense technology, Northrop Grumman produces robust IMUs designed for precision navigation and guidance systems.STMicroelectronics:

STMicroelectronics provides MEMS-based inertial sensors widely adopted in consumer electronics and automotive applications.Analog Devices, Inc.:

Analog Devices offers a range of sensor technologies and IMUs, focusing on high accuracy for applications in various industries including automotive and aerospace.We're grateful to work with incredible clients.

FAQs

What is the market size of high Performance Inertial Measurement Unit Imu?

The market size of high-performance inertial measurement units (IMUs) is currently estimated at $2.5 billion. The market is projected to grow at a CAGR of 7.8%, indicating significant expansion in demand over the coming years.

What are the key market players or companies in this high Performance Inertial Measurement Unit Imu industry?

Key players in the high-performance IMU market include prominent companies such as Honeywell, Northrop Grumman, and Analog Devices. These companies lead in technological advancements, product offerings, and strategic collaborations to enhance market growth.

What are the primary factors driving the growth in the high Performance Inertial Measurement Unit Imu industry?

Factors driving growth in the IMU industry include advancements in technology, increased demand in aerospace and automotive sectors, and rising adoption of automation in industries. The proliferation of consumer electronics and IoT devices also contributes significantly to market expansion.

Which region is the fastest Growing in the high Performance Inertial Measurement Unit Imu?

The fastest-growing region for high-performance IMUs is Asia Pacific, with market growth expected from $0.42 billion in 2023 to $0.92 billion by 2033. European markets also show robust growth, projected to rise from $0.79 billion to $1.72 billion in the same period.

Does ConsaInsights provide customized market report data for the high Performance Inertial Measurement Unit Imu industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the high-performance IMU industry. This option allows businesses to gain in-depth insights based on unique market conditions and factors relevant to their operations.

What deliverables can I expect from this high Performance Inertial Measurement Unit Imu market research project?

Deliverables from the high-performance IMU market research project include comprehensive market analysis reports, regional insights, competitive landscape evaluations, and segment analysis, providing valuable information for strategic planning and decision-making.

What are the market trends of high Performance Inertial Measurement Unit Imu?

Current market trends in the high-performance IMU sector include increasing miniaturization of devices, rising integration with AI and machine learning technologies, and a growing focus on developing inertial navigation systems for various applications across different industries.