High Performance Medical Plastics Market Report

Published Date: 31 January 2026 | Report Code: high-performance-medical-plastics

High Performance Medical Plastics Market Size, Share, Industry Trends and Forecast to 2033

This report analyzes the market for high performance medical plastics from 2023 to 2033, detailing market size, segmentation, regional insights, and trends impacting growth in the medical industry.

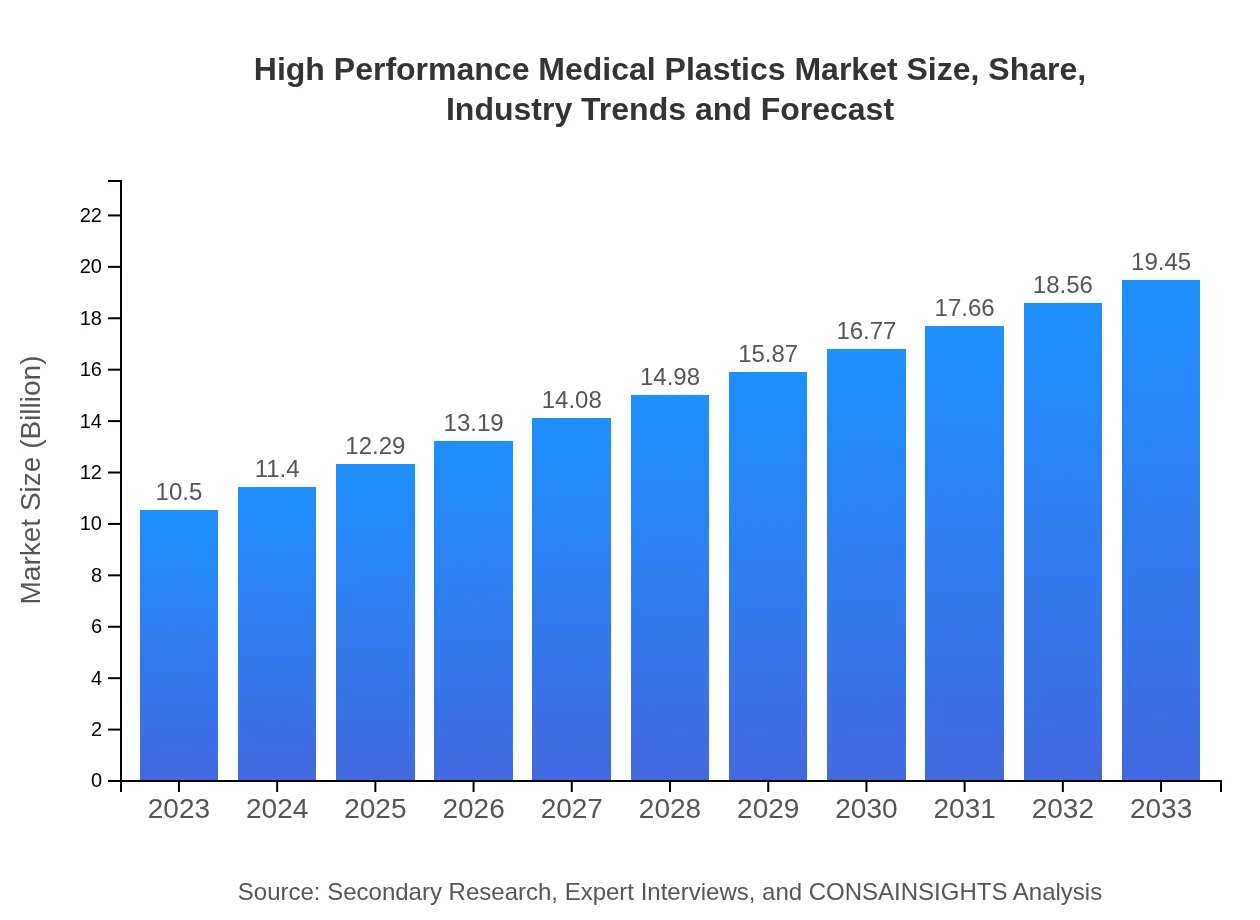

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $19.45 Billion |

| Top Companies | BASF, Covestro, Invista, Eastman Chemical Company, Mitsubishi Chemical Corporation |

| Last Modified Date | 31 January 2026 |

High Performance Medical Plastics Market Overview

Customize High Performance Medical Plastics Market Report market research report

- ✔ Get in-depth analysis of High Performance Medical Plastics market size, growth, and forecasts.

- ✔ Understand High Performance Medical Plastics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in High Performance Medical Plastics

What is the Market Size & CAGR of High Performance Medical Plastics Market in 2023?

High Performance Medical Plastics Industry Analysis

High Performance Medical Plastics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

High Performance Medical Plastics Market Analysis Report by Region

Europe High Performance Medical Plastics Market Report:

In Europe, the market is poised to grow from $3.42 billion in 2023 to $6.34 billion by 2033. The demand is influenced by stringent regulations on medical products, advances in materials technology, and a push towards sustainable medical solutions.Asia Pacific High Performance Medical Plastics Market Report:

In the Asia Pacific region, the high performance medical plastics market is expected to grow from $1.86 billion in 2023 to approximately $3.44 billion by 2033. This growth is fueled by increasing healthcare expenditures, technological advancements in medical devices, and a focus on innovative healthcare solutions in developing nations.North America High Performance Medical Plastics Market Report:

The North American market will grow from $3.67 billion in 2023 to $6.81 billion in 2033. The region benefits from strong regulatory frameworks, high investments in healthcare technology, and continued innovations, particularly in medical devices and personalized medicine.South America High Performance Medical Plastics Market Report:

The South America market is projected to increase from $0.17 billion in 2023 to $0.31 billion by 2033. Growth factors include an expanding healthcare sector and rising healthcare standards, though challenges remain due to economic fluctuations in the region.Middle East & Africa High Performance Medical Plastics Market Report:

The Middle East and Africa market is expected to rise from $1.38 billion in 2023 to $2.55 billion by 2033. Healthcare improvements, increased access to advanced medical technologies, and rising investments in healthcare infrastructure are driving growth in this region.Tell us your focus area and get a customized research report.

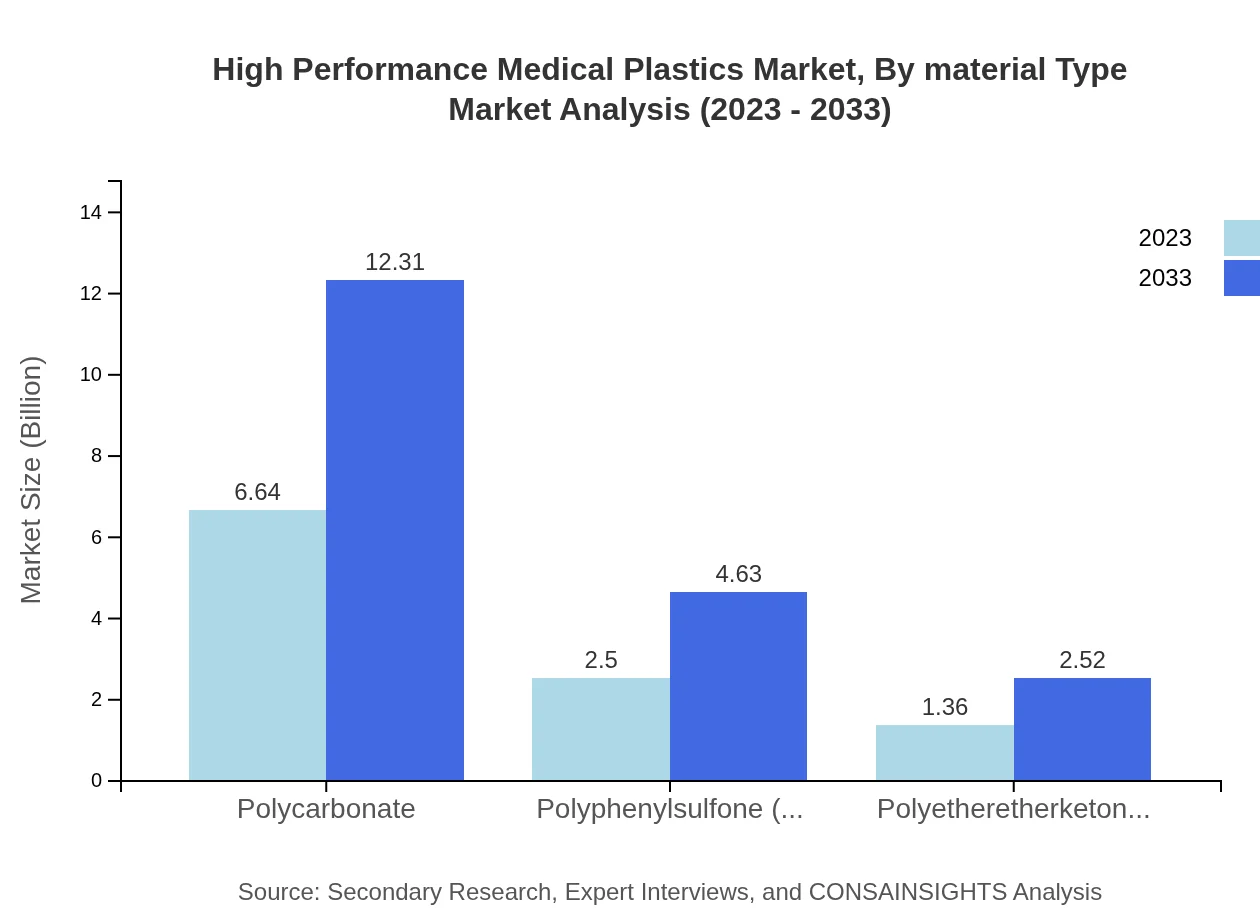

High Performance Medical Plastics Market Analysis By Material Type

Key material types dominating the high performance medical plastics market include polycarbonate, PPSU, and PEEK. Polycarbonate holds a major share due to its impact resistance and optical clarity. PPSU offers excellent chemical resistance and thermal stability, while PEEK is recognized for its exceptional mechanical properties, making them suitable for high-stress applications in medical devices.

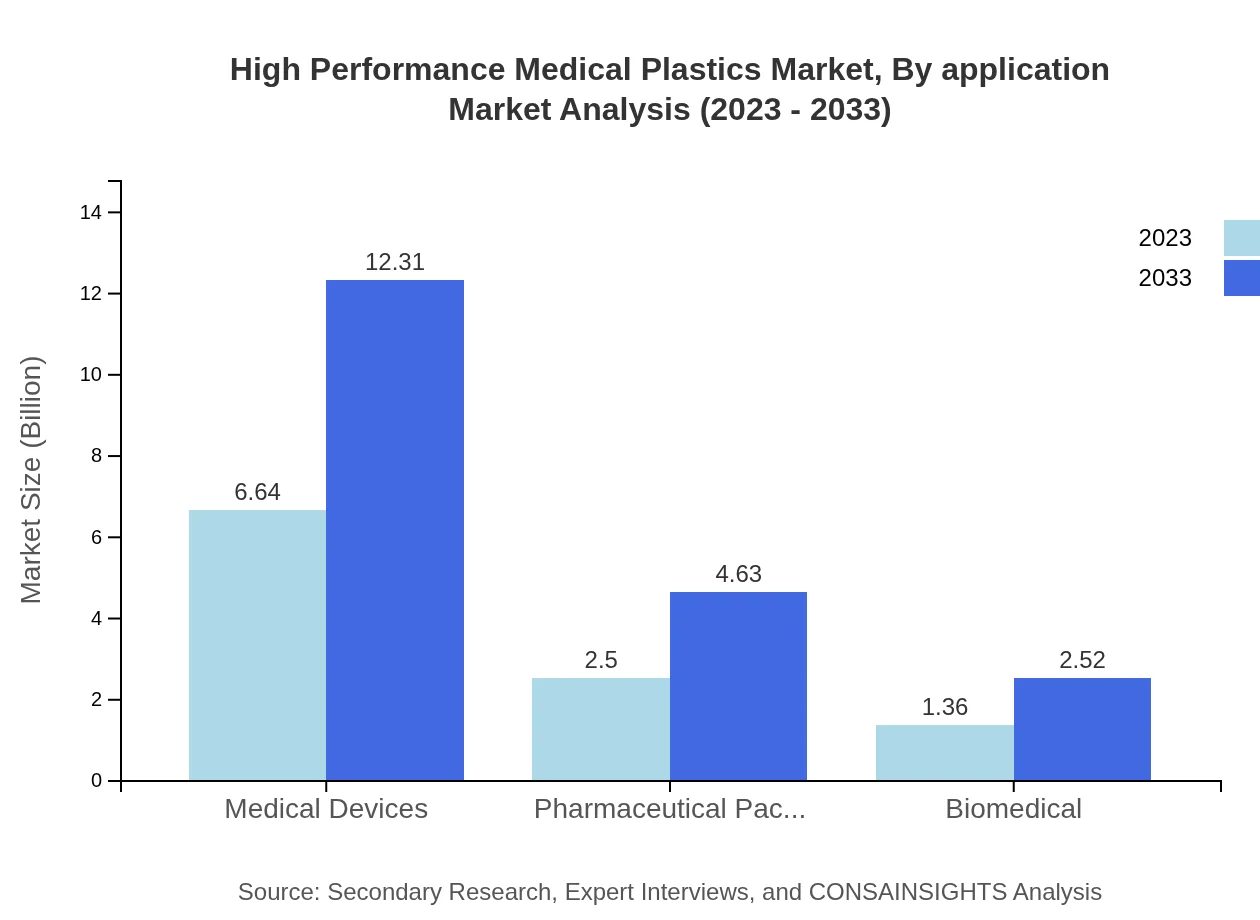

High Performance Medical Plastics Market Analysis By Application

The application segments include medical devices, pharmaceutical packaging, and biomedical applications. Medical devices account for the largest share, representing a significant percentage of the total market. Innovative applications are emerging, including the use of these plastics in drug delivery systems, implantable devices, and diagnostic equipment.

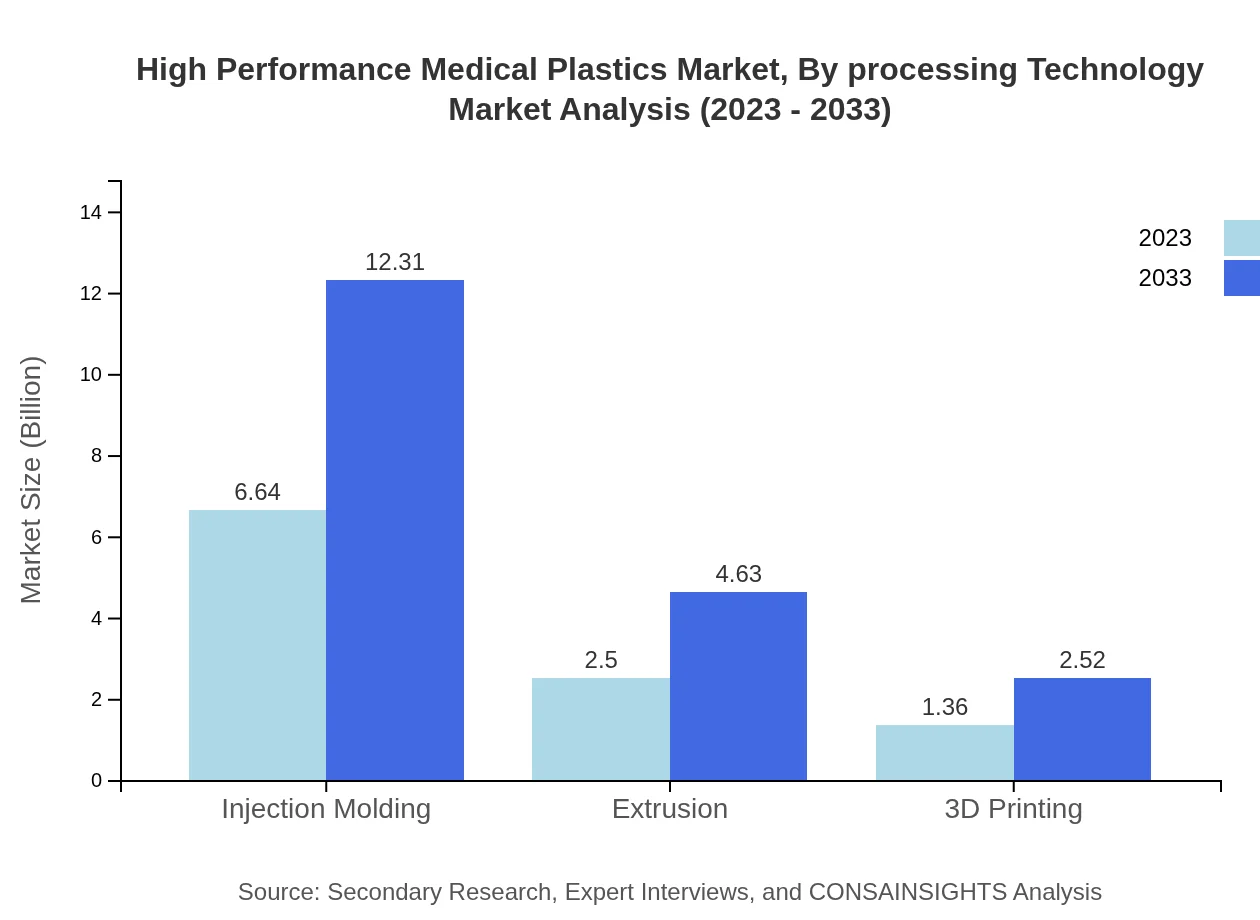

High Performance Medical Plastics Market Analysis By Processing Technology

Processing technologies such as injection molding, extrusion, and 3D printing play crucial roles in shaping high performance medical plastics. Injection molding remains dominant due to its efficiency and versatility, while 3D printing is gaining traction for its ability to produce customized, complex structures that facilitate individualized patient care.

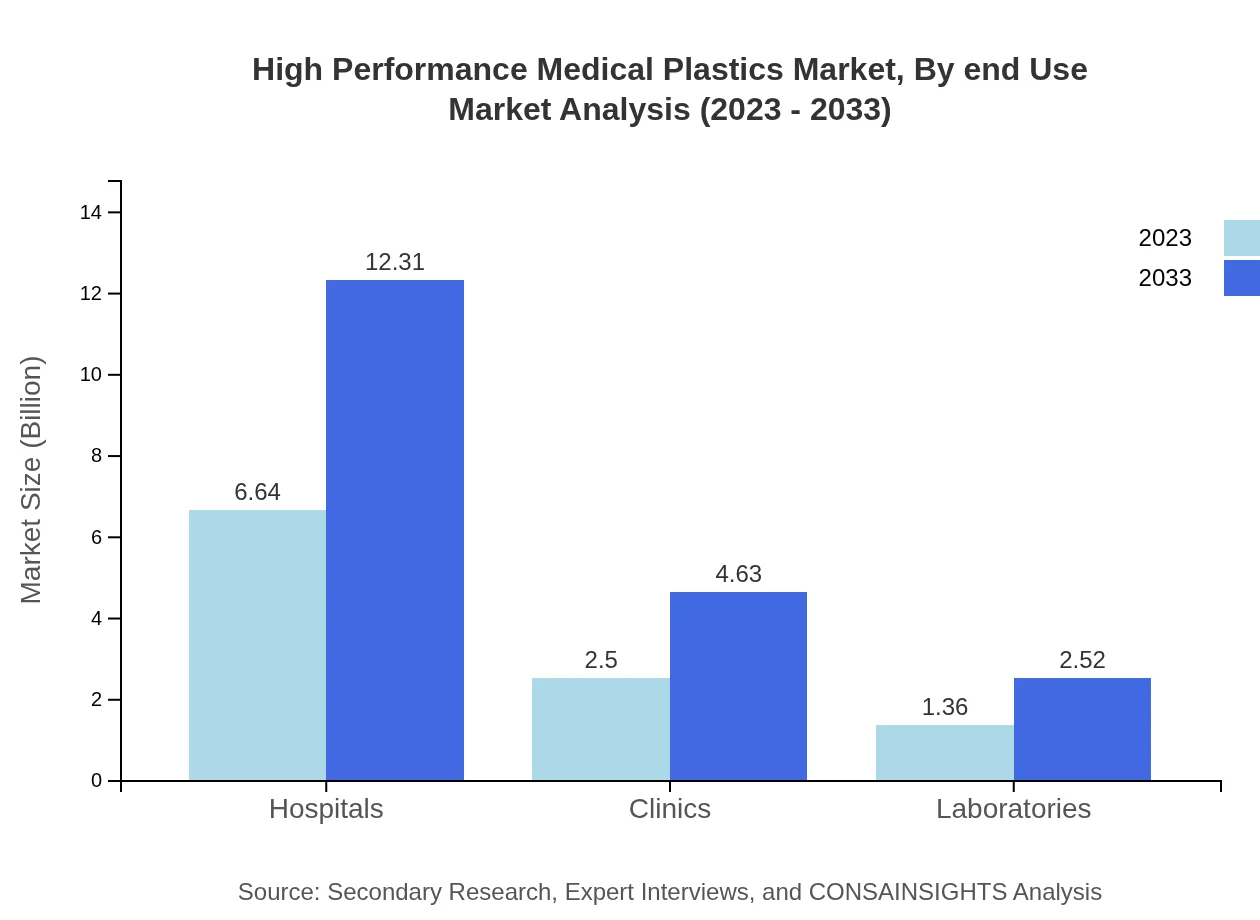

High Performance Medical Plastics Market Analysis By End Use

End-use sectors include hospitals, clinics, laboratories, and medical device manufacturers. Hospitals and medical device manufacturers are the leading adopters of high performance medical plastics, significantly contributing to market share due to the critical nature of equipment and devices used in patient care.

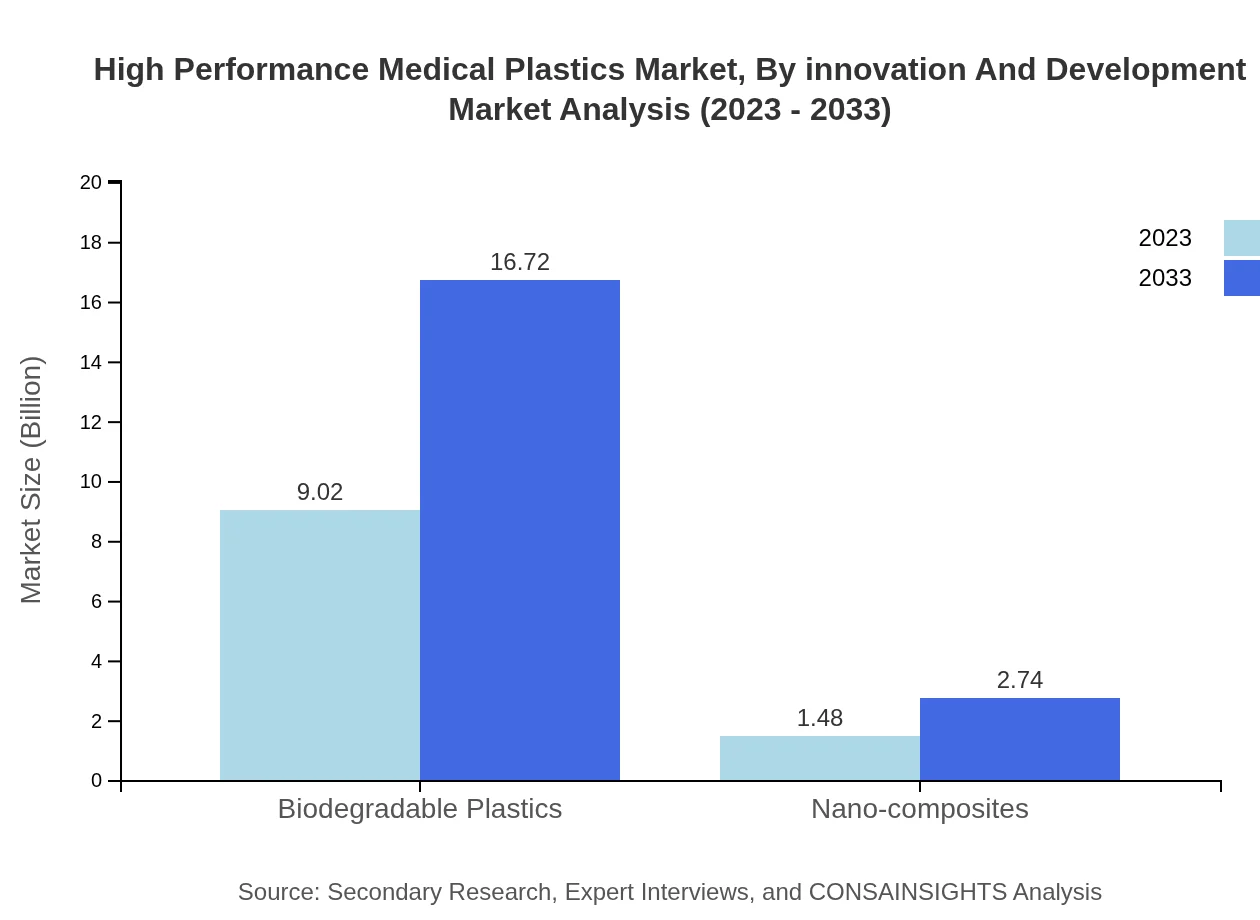

High Performance Medical Plastics Market Analysis By Innovation And Development

Recent innovations in high performance medical plastics revolve around biocompatible materials and eco-friendly production techniques. Initiatives for producing biodegradable variants and exploring nanocomposite materials are emerging trends. Development programs that focus on enhancing material properties to meet regulatory demands while addressing ecological concerns are gaining momentum.

High Performance Medical Plastics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in High Performance Medical Plastics Industry

BASF:

A leading chemical company specializing in innovative plastics solutions for the medical field, offering a diverse range of high performance materials.Covestro:

Known for high-quality polycarbonate and polycarbonate blends, Covestro focuses on producing materials that meet stringent medical requirements.Invista:

A major player in polymer manufacturing, Invista is involved in developing advanced high performance plastics for various medical applications.Eastman Chemical Company:

Eastman is recognized for its innovative medical-grade polymers that are designed for durability and biocompatibility.Mitsubishi Chemical Corporation:

Active in high performance polymer production, Mitsubishi contributes significantly to the medical industry with diverse product offerings.We're grateful to work with incredible clients.

FAQs

What is the market size of high Performance medical plastics?

The high-performance medical plastics market is valued at approximately $10.5 billion in 2023, with an impressive CAGR of 6.2% projected till 2033, indicating significant growth potential within the healthcare sector.

What are the key market players or companies in this high Performance medical plastics industry?

Key players in the high-performance medical plastics market include industry leaders like BASF, DuPont, and Covestro, known for their extensive product portfolios and innovative solutions tailored for medical applications.

What are the primary factors driving the growth in the high Performance medical plastics industry?

Factors driving market growth include increasing demand for advanced medical devices, enhanced healthcare standards, and the rising need for durable and lightweight materials in medical applications.

Which region is the fastest Growing in the high Performance medical plastics market?

The Asia Pacific region is projected to be the fastest-growing market, expanding from $1.86 billion in 2023 to $3.44 billion by 2033, driven by healthcare advancements and increasing medical device demand.

Does ConsaInsights provide customized market report data for the high Performance medical plastics industry?

Yes, ConsaInsights offers customized market report data for high-performance medical plastics, tailoring insights to specific client needs and industry focuses for maximizing strategic benefits.

What deliverables can I expect from this high Performance medical plastics market research project?

Expect detailed market analysis reports, competitive landscaping, growth forecasts, and segment breakdowns, enabling informed decision-making and strategic planning towards market opportunities.

What are the market trends of high Performance medical plastics?

Market trends include increasing adoption of biodegradable plastics, integration of 3D printing technologies, and heightened focus on regulatory compliance and innovation in medical packaging solutions.