High Potency Api Hpapi Market Report

Published Date: 31 January 2026 | Report Code: high-potency-api-hpapi

High Potency Api Hpapi Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the High Potency API (HPAPI) market, focusing on market size, trends, and forecasts from 2023 to 2033. Insights include industry dynamics, regional breakdowns, segmentation, and profiles of market leaders.

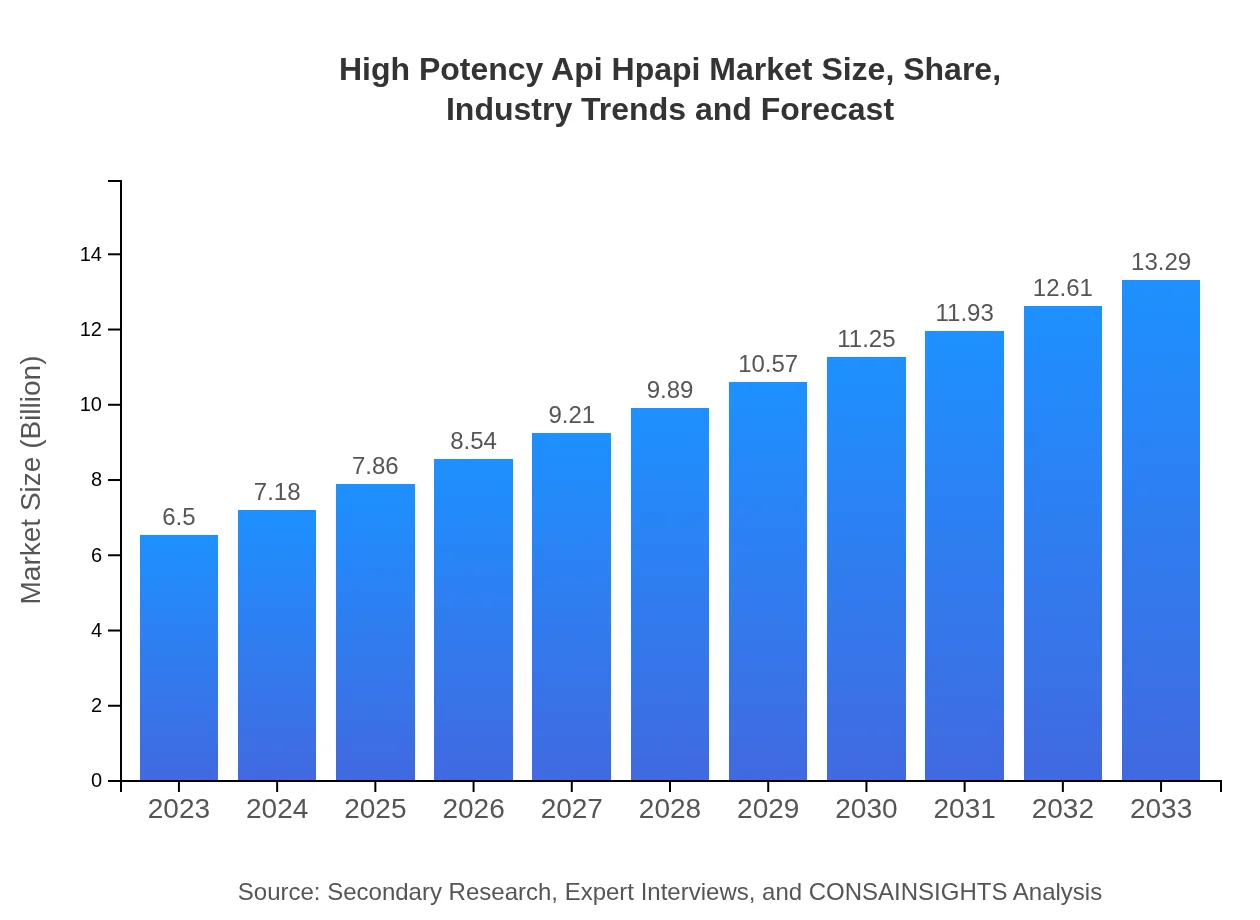

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $6.50 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $13.29 Billion |

| Top Companies | Lonza Group, Boehringer Ingelheim, AstraZeneca, Siegfried AG |

| Last Modified Date | 31 January 2026 |

High Potency Api Hpapi Market Overview

Customize High Potency Api Hpapi Market Report market research report

- ✔ Get in-depth analysis of High Potency Api Hpapi market size, growth, and forecasts.

- ✔ Understand High Potency Api Hpapi's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in High Potency Api Hpapi

What is the Market Size & CAGR of High Potency Api Hpapi in 2023 and 2033?

High Potency Api Hpapi Industry Analysis

High Potency Api Hpapi Market Segmentation and Scope

Tell us your focus area and get a customized research report.

High Potency Api Hpapi Market Analysis Report by Region

Europe High Potency Api Hpapi Market Report:

Europe's HPAPI market is predicted to grow significantly, starting at $1.94 billion in 2023 and reaching $3.96 billion by 2033. The robust regulatory framework and increasing collaboration between industry players for drug development are enhancing market growth.Asia Pacific High Potency Api Hpapi Market Report:

The Asia Pacific region is experiencing significant growth, with a market value of $1.29 billion projected to rise to $2.63 billion by 2033. This growth is fueled by expanding pharmaceutical manufacturing capabilities, increasing investment in R&D, and a rising patient population requiring innovative treatments.North America High Potency Api Hpapi Market Report:

North America remains the leading market for HPAPIs with a substantial valuation of $2.24 billion in 2023, anticipated to reach $4.58 billion by 2033. The stronghold of major pharmaceutical companies, advanced research facilities, and a growing emphasis on personalized medicine are key factors driving this expansion.South America High Potency Api Hpapi Market Report:

In South America, the HPAPI market is expected to grow from $0.36 billion in 2023 to $0.73 billion by 2033. The region is gradually enhancing its pharmaceutical supply chain, supported by government initiatives aimed at improving healthcare access and drug affordability.Middle East & Africa High Potency Api Hpapi Market Report:

The Middle East and Africa region, currently valued at $0.68 billion, is projected to grow to $1.38 billion by 2033. Improvements in regulatory policies and increasing foreign investments in local pharmaceutical industries are vital for this growth.Tell us your focus area and get a customized research report.

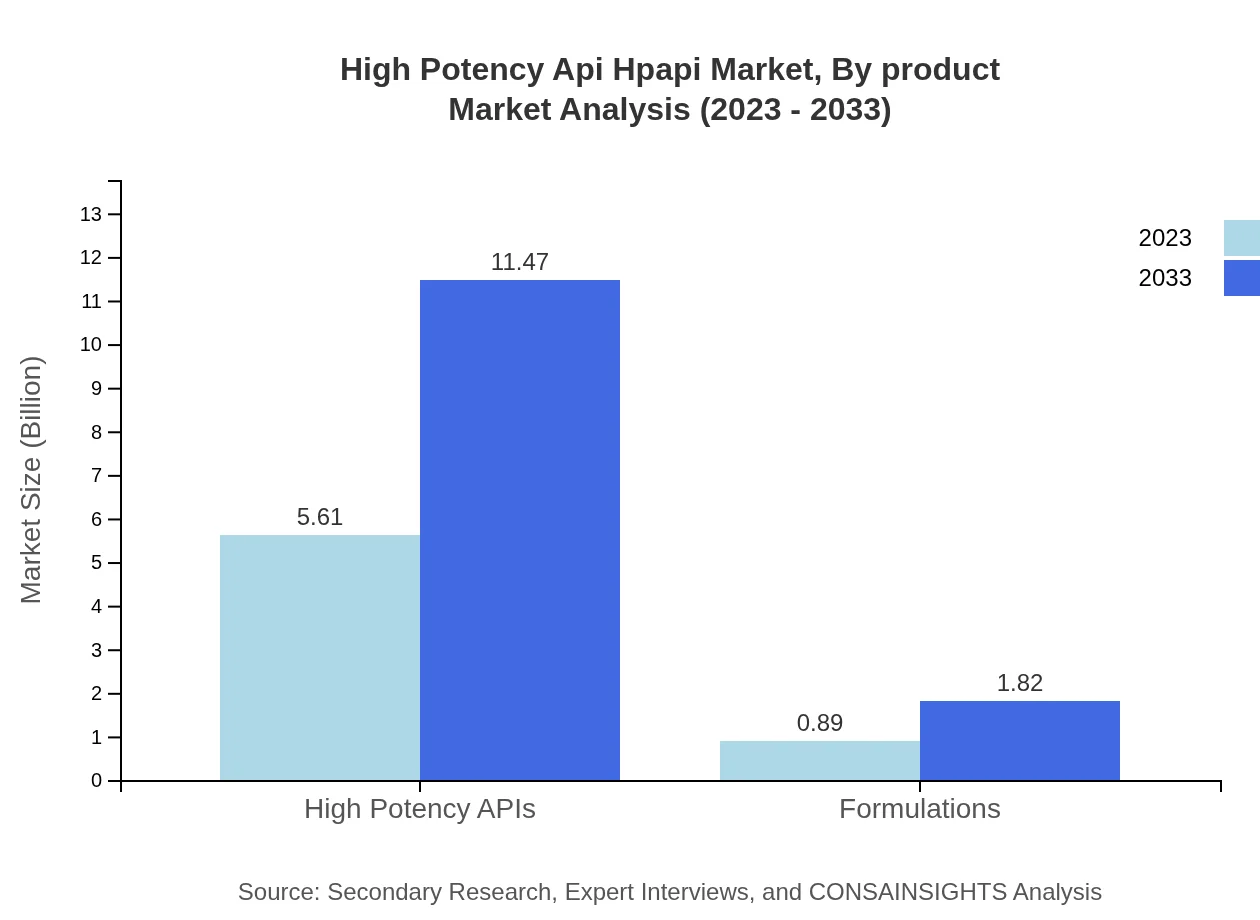

High Potency Api Hpapi Market Analysis By Product

The HPAPI market is predominantly driven by high potency APIs, which account for approximately $5.61 billion in 2023, expanding to around $11.47 billion by 2033. This segment reflects strong market demand for targeted therapies, particularly in oncology.

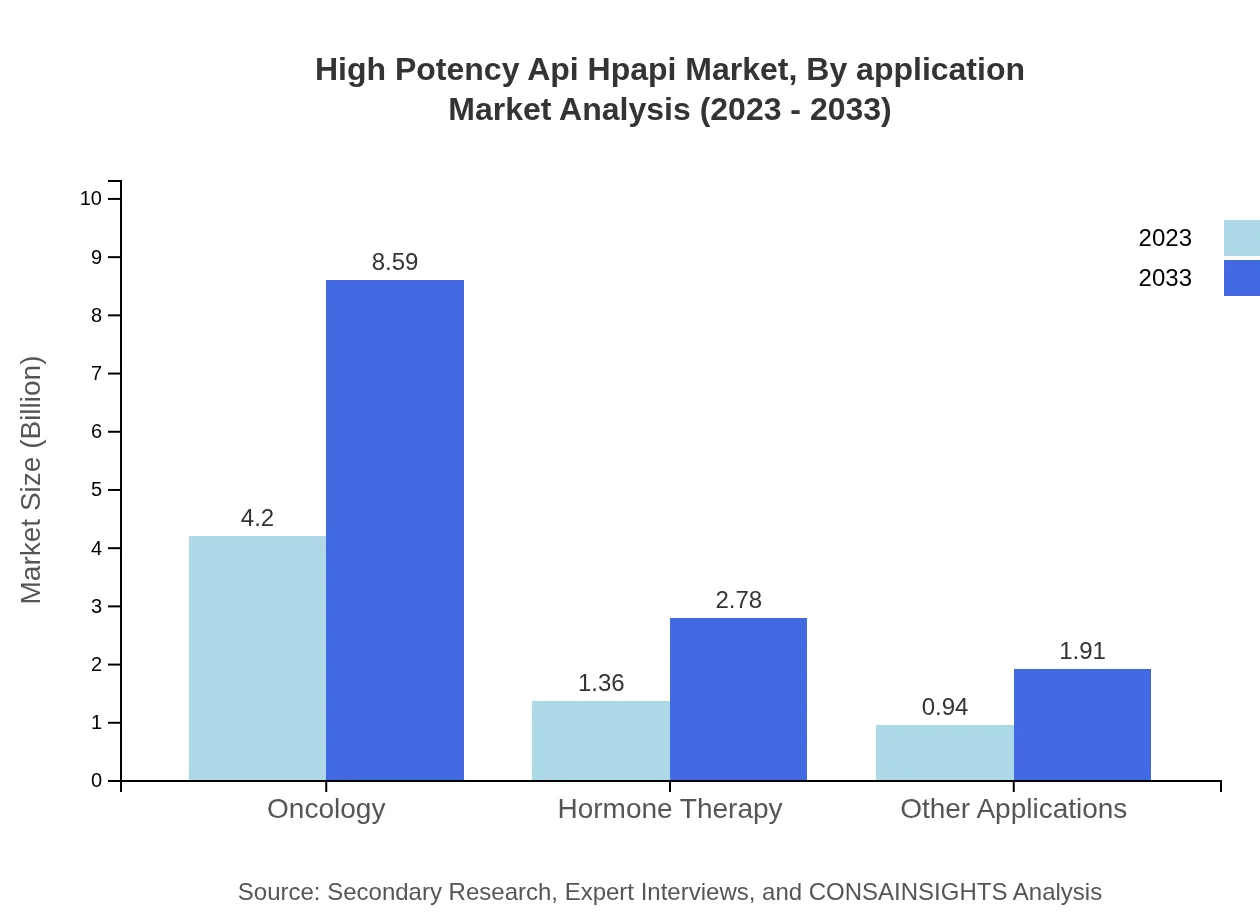

High Potency Api Hpapi Market Analysis By Application

Oncology represents the largest application for HPAPIs, contributing $4.20 billion in 2023 with a forecasted growth to $8.59 billion by 2033. Other applications include hormone therapy and specialized formulations, indicating a diverse usage of high potency APIs.

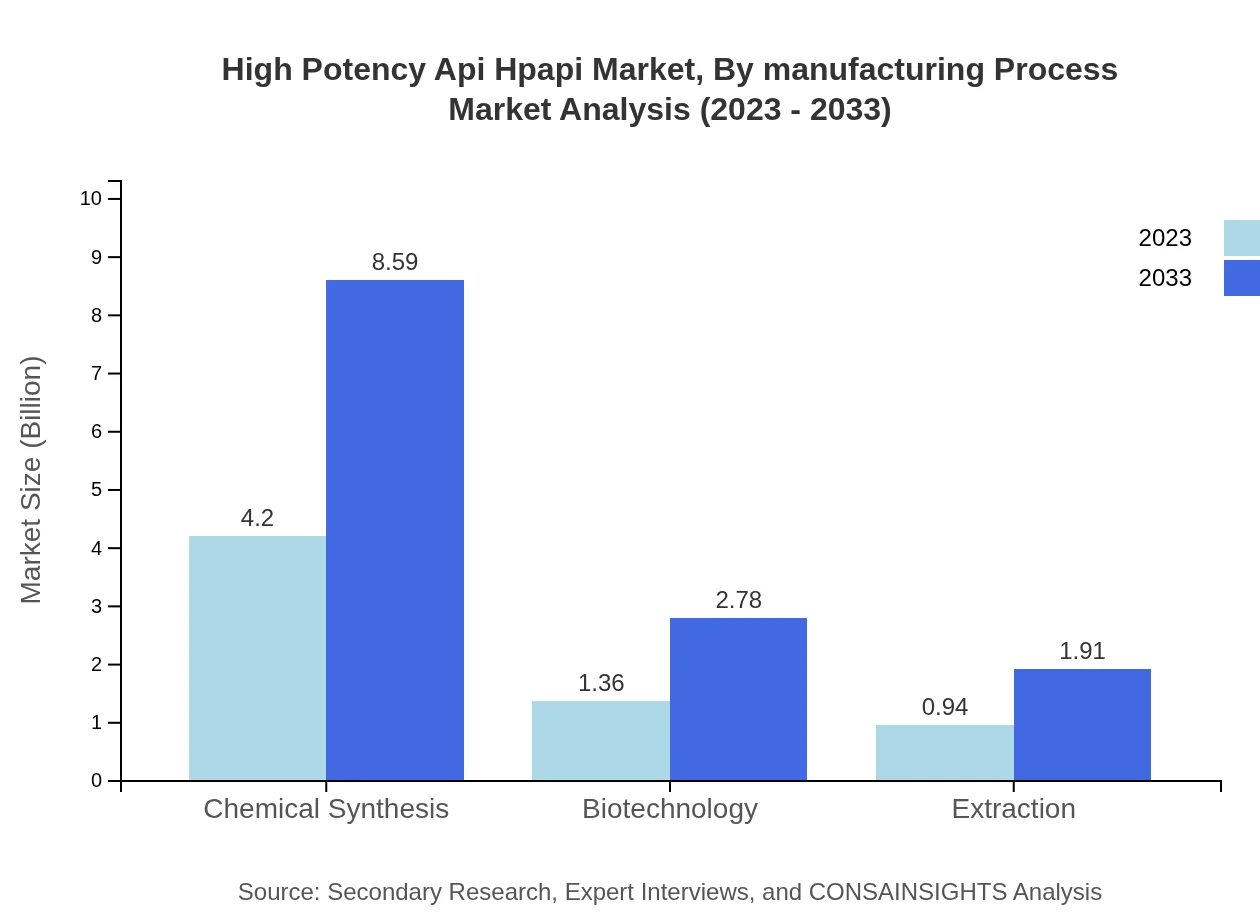

High Potency Api Hpapi Market Analysis By Manufacturing Process

Chemical synthesis plays a critical role in HPAPI production, commanding a market size of $4.20 billion in 2023 and projected to grow similarly towards $8.59 billion by 2033. Meanwhile, biotechnology also presents growth, expected to escalate from $1.36 billion to $2.78 billion over the same period.

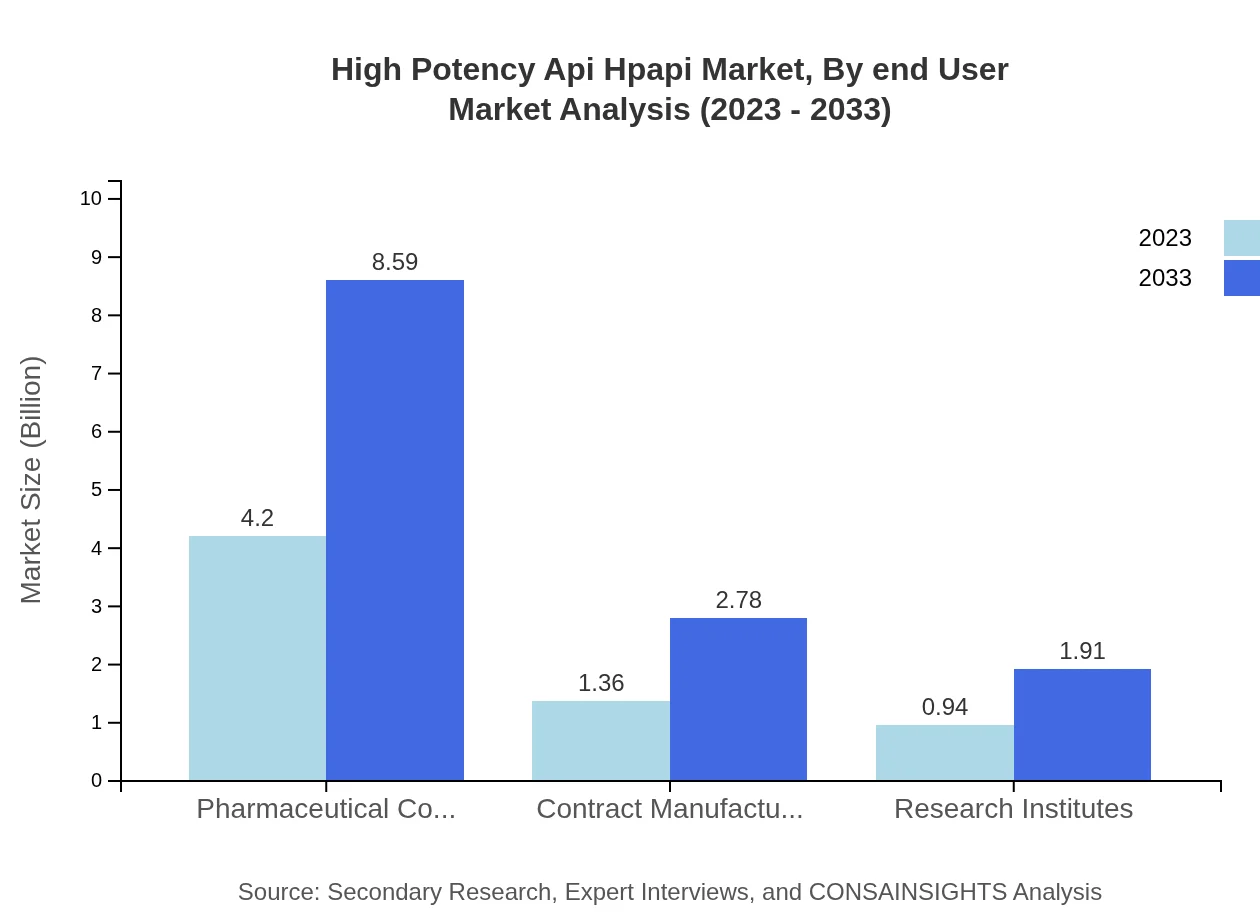

High Potency Api Hpapi Market Analysis By End User

Pharmaceutical companies dominate end-user segmentation, representing $4.20 billion in 2023 and growing substantially to $8.59 billion by 2033. Contract manufacturers and research institutes are also gaining prominence due to the need for specialized production capabilities.

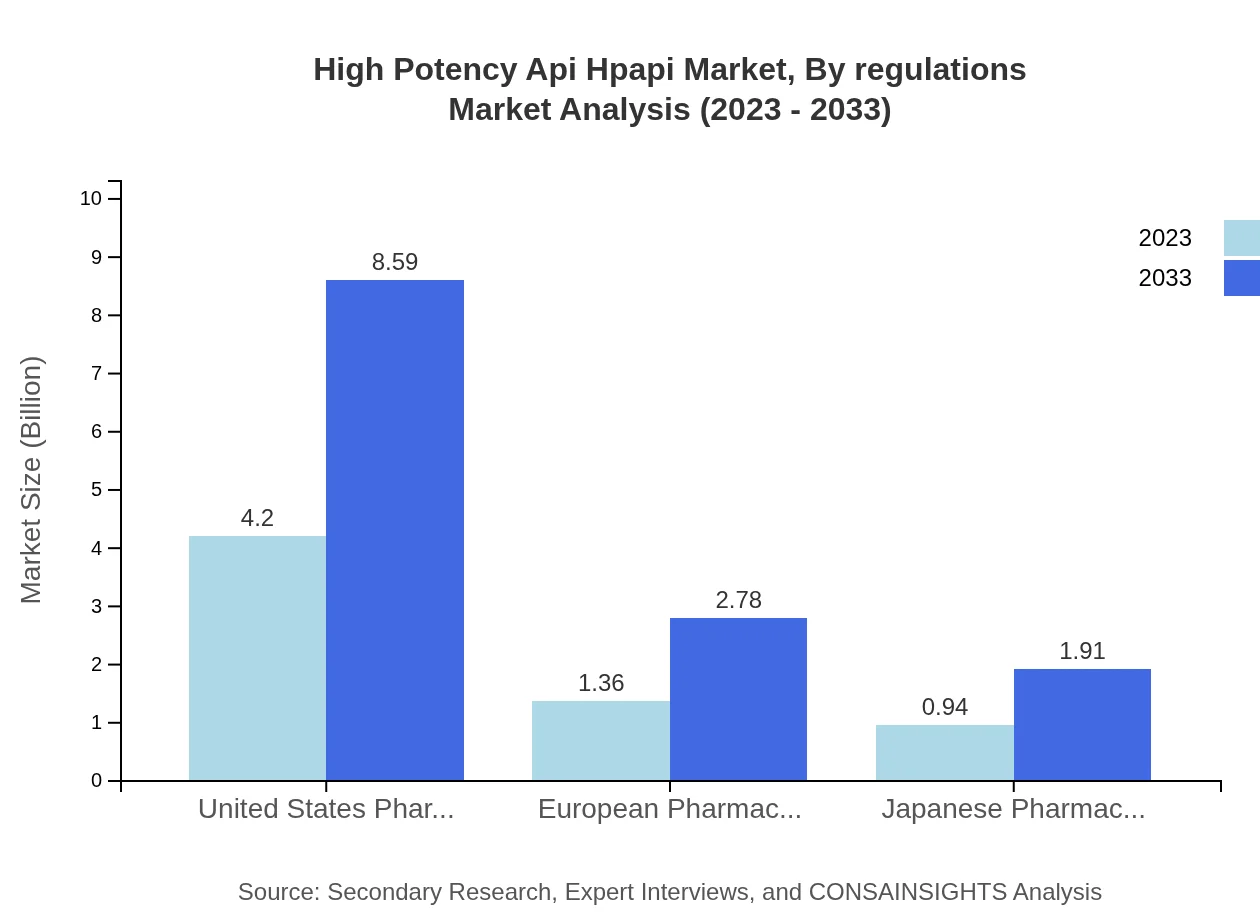

High Potency Api Hpapi Market Analysis By Regulations

Compliance with major regulatory standards such as USP, EP, and JP is essential for market participation. The market segments associated with these standards are expected to reflect robust growth, corresponding with the increased scrutiny and standards for HPAPI production.

High Potency Api Hpapi Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in High Potency Api Hpapi Industry

Lonza Group:

Lonza is a global leader in life sciences, specializing in the development and manufacturing of high-potency APIs, offering services from R&D through to commercial-scale manufacture.Boehringer Ingelheim:

Boehringer Ingelheim focuses on biopharmaceutical contract manufacturing, with a strong portfolio in HPAPIs for oncology and other therapeutic areas, emphasizing quality and safety.AstraZeneca:

AstraZeneca is heavily involved in developing and commercializing high potency drug formulations, contributing to significant advancements in global HPAPI markets.Siegfried AG:

Siegfried AG provides end-to-end solutions in the HPAPI space, focusing on custom manufacturing and high standards of quality assurance.We're grateful to work with incredible clients.

FAQs

What is the market size of high Potency Api Hpapi?

The global high-potency API (HPAPI) market is projected to reach approximately $6.5 billion by 2033, growing at a CAGR of 7.2%. This growth reflects the increasing demand for specialized pharmaceuticals, particularly in oncology and hormone therapy, driving innovation and expansion.

What are the key market players or companies in this high Potency Api Hpapi industry?

Key players in the high-potency API industry include major pharmaceutical companies, contract manufacturers, and research institutes. These entities compete in terms of technology, production capabilities, and regulatory compliance to deliver high-quality potent compounds.

What are the primary factors driving the growth in the high Potency Api Hpapi industry?

Growth in the HPAPI industry is primarily driven by advancements in cancer therapeutics, increasing prevalence of chronic diseases, and growing demand for targeted therapies. Enhanced production capabilities and regulatory support also contribute significantly to market expansion.

Which region is the fastest Growing in the high Potency Api Hpapi?

The fastest-growing region in the high-potency API market is North America, expected to rise from $2.24 billion in 2023 to $4.58 billion by 2033. Europe and Asia Pacific also show robust growth, reflecting regional investments in biotech and pharmaceutical sectors.

Does ConsaInsights provide customized market report data for the high Potency Api Hpapi industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the high-potency API industry. Clients can request insights focusing on particular segments, regions, or trends to facilitate strategic decision-making.

What deliverables can I expect from this high Potency Api Hpapi market research project?

Expect comprehensive deliverables from the HPAPI market research project, including market size data, segment analysis, competitive landscape, regional insights, and forecasts. Detailed reports will help stakeholders create effective growth strategies.

What are the market trends of high Potency Api Hpapi?

Current trends in the high-potency API market include increased investment in oncology drugs, a shift towards personalized medicine, and advancements in manufacturing processes, such as continuous flow technology, enhancing production efficiency and safety.