High Pressure Pumps Market Report

Published Date: 22 January 2026 | Report Code: high-pressure-pumps

High Pressure Pumps Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the High Pressure Pumps market, covering the market size, trends, segments, and regional insights, along with forecasts up to 2033. It aims to deliver valuable insights for stakeholders seeking to understand the dynamics of this industry.

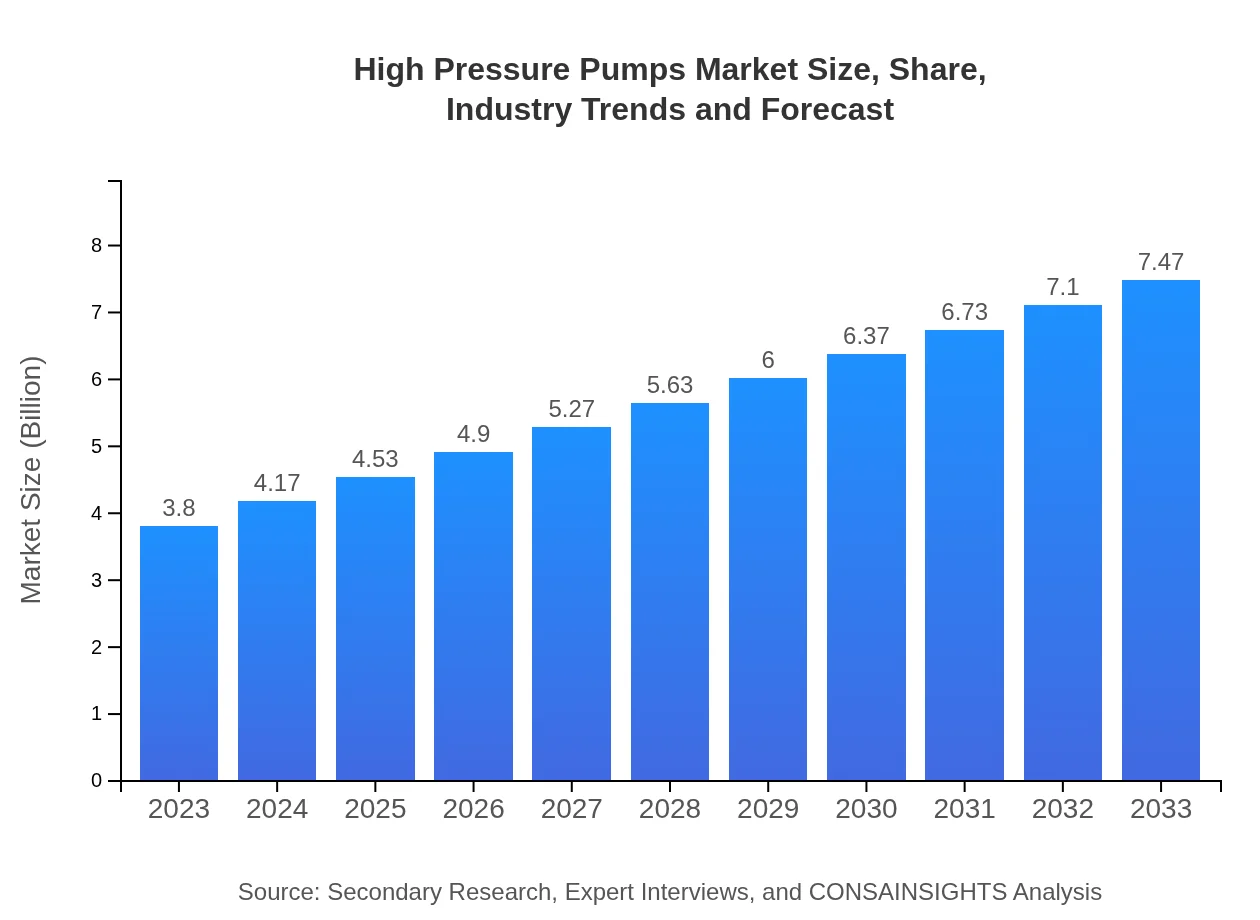

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.80 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $7.47 Billion |

| Top Companies | KSB SE & Co. KGaA, Sulzer AG, Flowserve Corporation, Siemens AG |

| Last Modified Date | 22 January 2026 |

High Pressure Pumps Market Overview

Customize High Pressure Pumps Market Report market research report

- ✔ Get in-depth analysis of High Pressure Pumps market size, growth, and forecasts.

- ✔ Understand High Pressure Pumps's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in High Pressure Pumps

What is the Market Size & CAGR of High Pressure Pumps market in 2023?

High Pressure Pumps Industry Analysis

High Pressure Pumps Market Segmentation and Scope

Tell us your focus area and get a customized research report.

High Pressure Pumps Market Analysis Report by Region

Europe High Pressure Pumps Market Report:

With a market size of $0.95 billion in 2023, Europe is expected to grow to $1.86 billion by 2033. The emphasis on clean and sustainable energy solutions, alongside stringent energy efficiency regulations, drives the adoption of advanced high pressure pumps across various industries.Asia Pacific High Pressure Pumps Market Report:

In 2023, the Asia Pacific region held a significant share of the High Pressure Pumps market, valued at $0.81 billion, projected to grow to $1.58 billion by 2033, driven by industrial growth in countries like China and India. The region experiences heightened demand for efficient pumping solutions across construction, mining, and water management sectors.North America High Pressure Pumps Market Report:

North America represents a prominent market, valued at $1.36 billion in 2023 and expected to attain $2.68 billion by 2033. Regulatory standards, coupled with technological advancements, drive innovations in high-pressure pumping systems, particularly within the oil and gas sector.South America High Pressure Pumps Market Report:

The South American market for High Pressure Pumps is valued at $0.36 billion in 2023, anticipated to reach $0.72 billion by 2033. The ongoing investments in infrastructure and mining industries in the region foster this growth, emphasizing the need for reliable pumping solutions.Middle East & Africa High Pressure Pumps Market Report:

The Middle East and Africa market was valued at $0.32 billion in 2023, projected to grow to $0.63 billion by 2033. The increasing demand for pumping solutions in the oil and gas sector, along with ongoing infrastructural projects, underline the potential for market expansion.Tell us your focus area and get a customized research report.

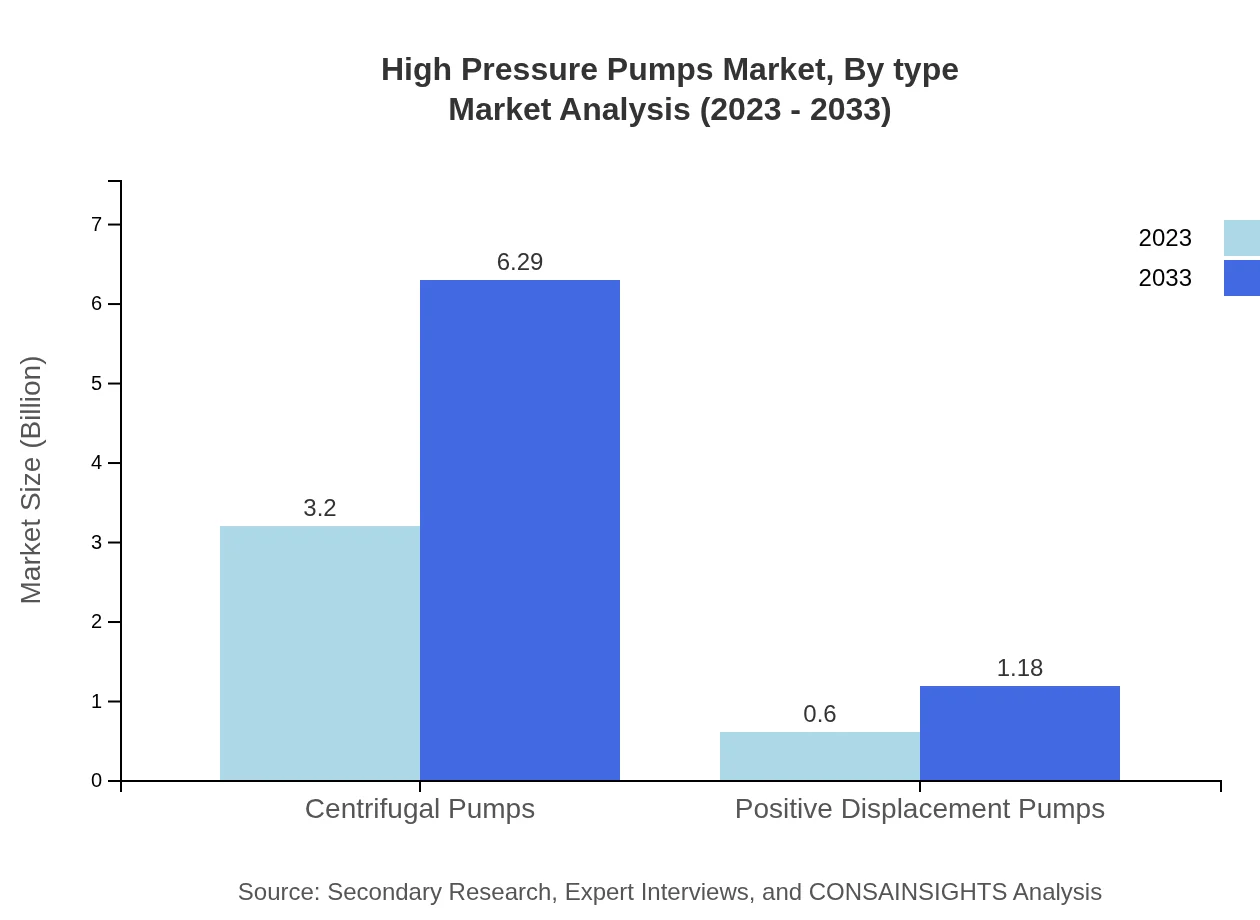

High Pressure Pumps Market Analysis By Type

Centrifugal Pumps dominate the market, with a size of $3.20 billion in 2023 and expected growth to $6.29 billion by 2033. Positive Displacement Pumps also hold a significant market share, valued at $0.60 billion in 2023 and projected to reach $1.18 billion by 2033.

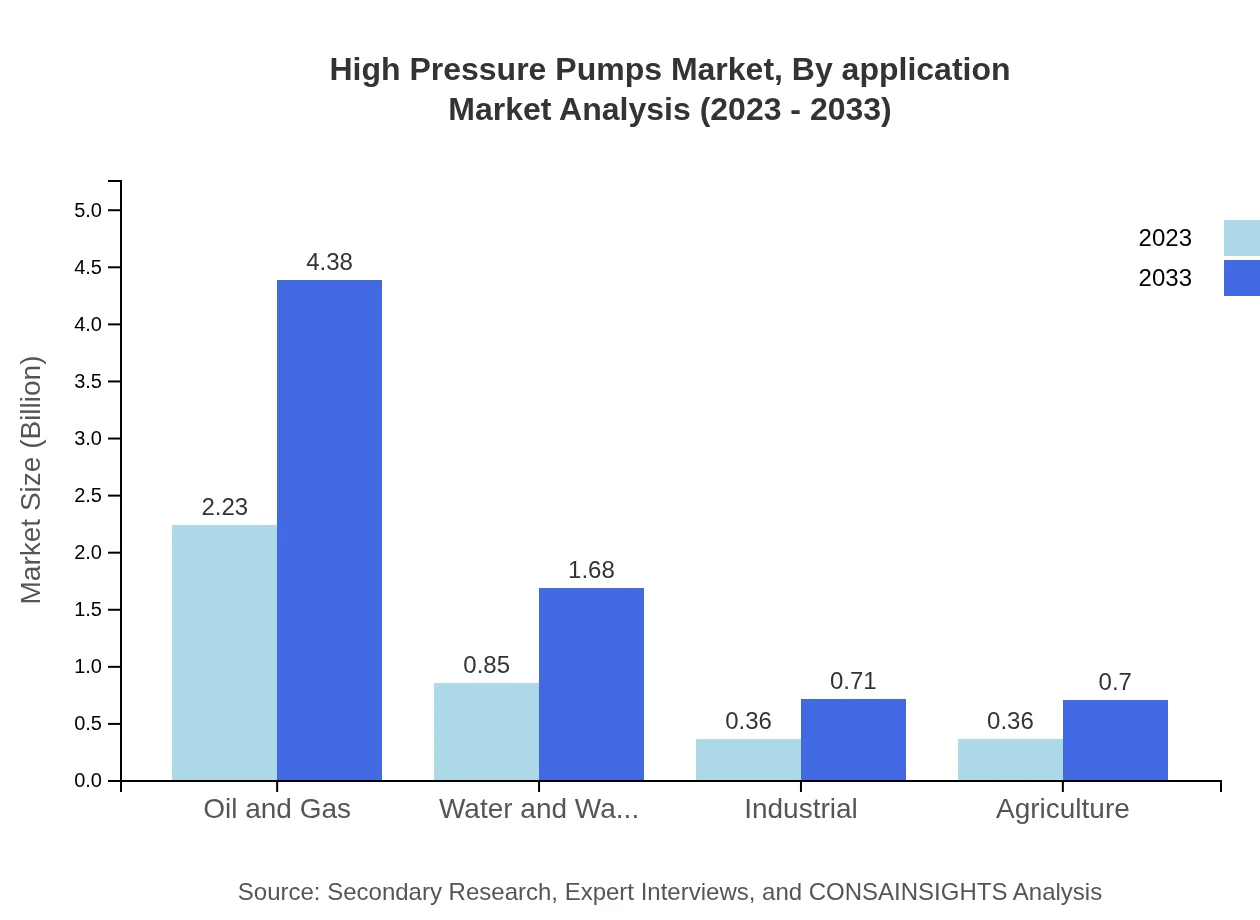

High Pressure Pumps Market Analysis By Application

The Oil and Gas sector represents the largest application segment, valued at $2.23 billion in 2023, anticipated to grow to $4.38 billion by 2033. Other key applications include Manufacturing, Construction, Water and Wastewater management, and Agriculture.

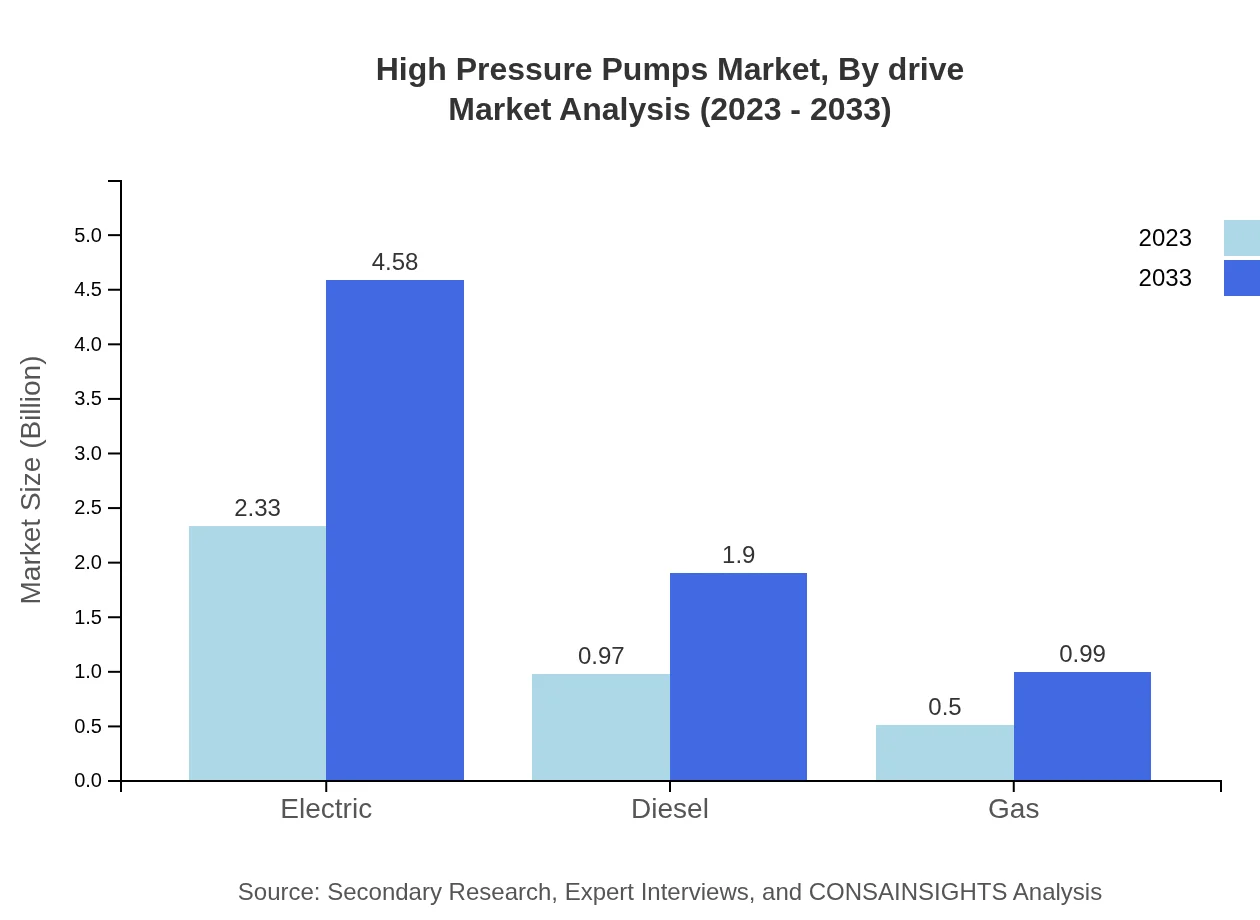

High Pressure Pumps Market Analysis By Drive

Electric pumps are a preferred choice due to their efficiency, accounting for $2.33 billion in 2023 and expected to grow to $4.58 billion by 2033, while diesel and gas-powered pumps are also relevant in remote applications.

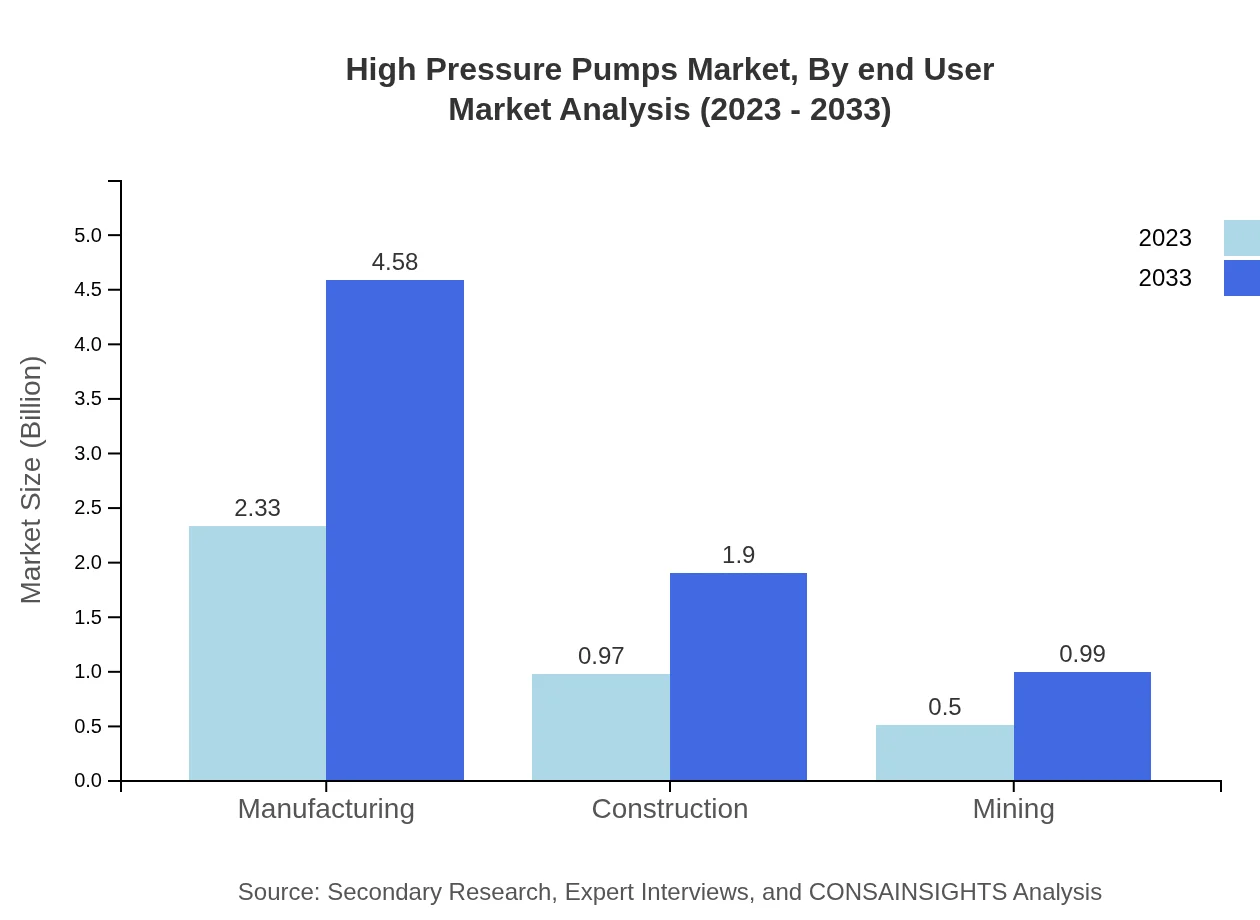

High Pressure Pumps Market Analysis By End User

The Manufacturing sector is the largest end-user, representing a significant share of the market at $2.33 billion in 2023, anticipated to expand to $4.58 billion by 2033. Other end-user industries include Construction, Mining, and Oil and Gas, each driving substantial demand for high pressure pumping solutions.

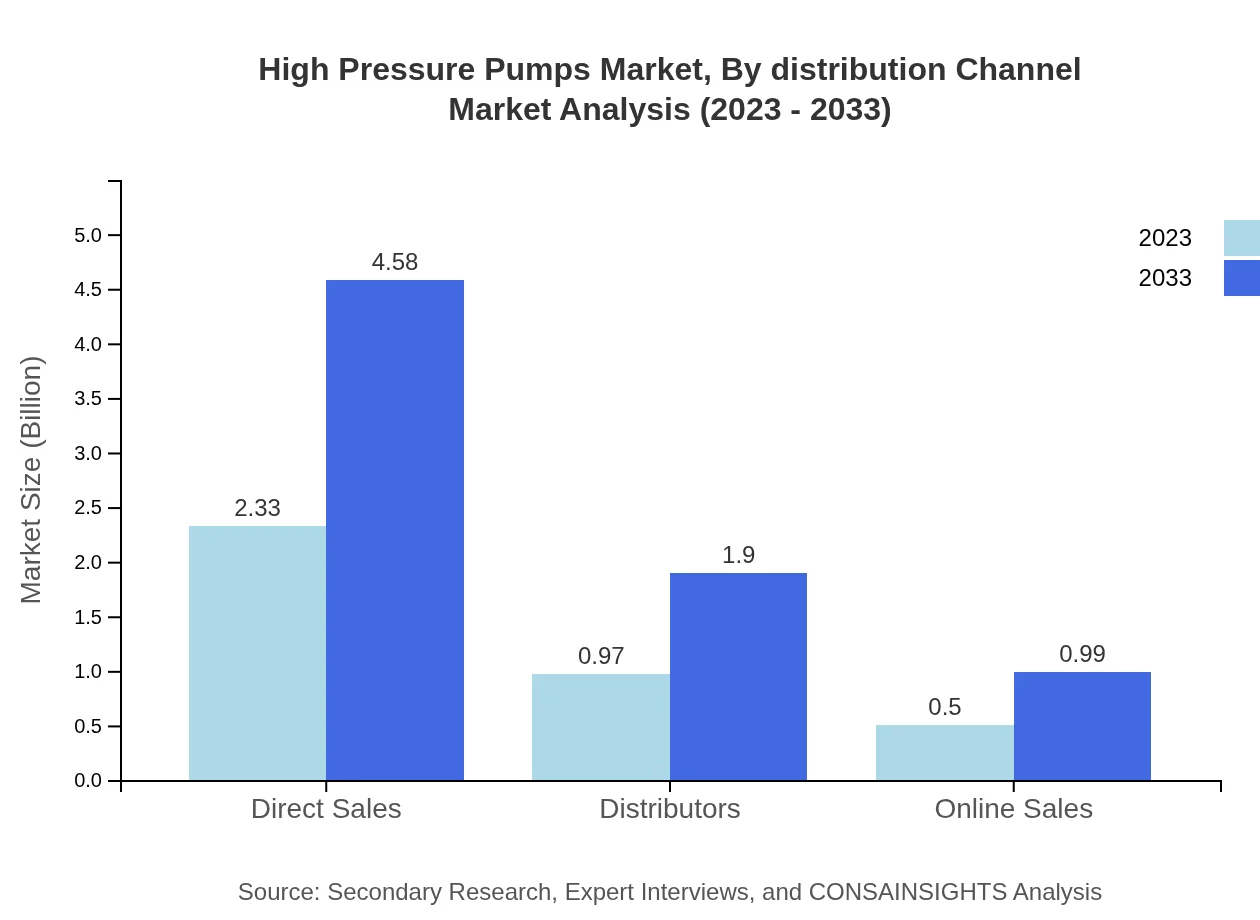

High Pressure Pumps Market Analysis By Distribution Channel

Direct sales account for $2.33 billion in 2023, reflecting a strong reliance on manufacturer relationships, with expected growth to $4.58 billion by 2033. Distribution through Distributors also plays a critical role, valued at $0.97 billion in 2023 and set to rise to $1.90 billion by 2033.

High Pressure Pumps Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in High Pressure Pumps Industry

KSB SE & Co. KGaA:

A leading pump manufacturer headquartered in Germany, KSB offers a wide range of high pressure pumps and solutions tailored for various applications, focusing on energy efficiency and operational reliability.Sulzer AG:

Sulzer is a Swiss industrial engineering and manufacturing company providing pumping solutions for oil and gas, power generation, and water management sectors, emphasizing innovative technologies and sustainable practices.Flowserve Corporation:

Flowserve is a global leader in fluid motion and control products, known for its advanced pumping solutions, including high pressure pumps, catering to diverse industries.Siemens AG:

Siemens is recognized for its contributions to automation and digitalization, with innovative high pressure pumping solutions that integrate IoT for enhanced performance and monitoring.We're grateful to work with incredible clients.

FAQs

What is the market size of high Pressure pumps?

The high-pressure pumps market is valued at $3.8 billion in 2023, with a projected CAGR of 6.8%, indicating strong growth potential through 2033. This growth trajectory reflects increased demand across multiple sectors, including oil and gas, manufacturing, and construction.

What are the key market players or companies in the high Pressure pumps industry?

Key market players include prominent manufacturers and innovators in pump technology, focusing on efficiency and reliability in high-pressure applications. Leading companies continuously evolve their product lines to meet diverse customer needs while maintaining competitive market positioning.

What are the primary factors driving the growth in the high Pressure pumps industry?

The growth of the high-pressure pumps market is primarily driven by rising industrial activities, increased investments in infrastructure, and the need for efficient water management systems. Technological advancements also play a significant role in enhancing pump performance and expanding application areas.

Which region is the fastest Growing in the high Pressure pumps market?

The Asia-Pacific region is anticipated to show significant growth, increasing from a market size of $0.81 billion in 2023 to $1.58 billion by 2033. This rapid growth can be attributed to industrialization and urbanization trends within developing economies.

Does ConsaInsights provide customized market report data for the high Pressure pumps industry?

Yes, ConsaInsights offers tailored market report data for the high-pressure pumps industry. Clients can request specific insights and analyses that cater to their unique business needs, ensuring relevant and actionable market intelligence.

What deliverables can I expect from this high Pressure pumps market research project?

Deliverables from the research project include detailed market analysis, trend forecasts, competitor profiling, and market segmentation insights. These reports will help inform strategic decisions and identify opportunities within the high-pressure pumps market.

What are the market trends of high Pressure pumps?

Market trends for high-pressure pumps indicate a shift towards sustainable technologies, increasing demand for electric over diesel pumps, and a focus on automation in industrial processes. These trends reflect broader changes in energy efficiency and operational reliability across sectors.