High Throughput Process Development Market Report

Published Date: 31 January 2026 | Report Code: high-throughput-process-development

High Throughput Process Development Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the High Throughput Process Development market, including key trends, segmentations, and regional insights. The forecast period spans from 2023 to 2033, offering predictions on market growth and technological advancements.

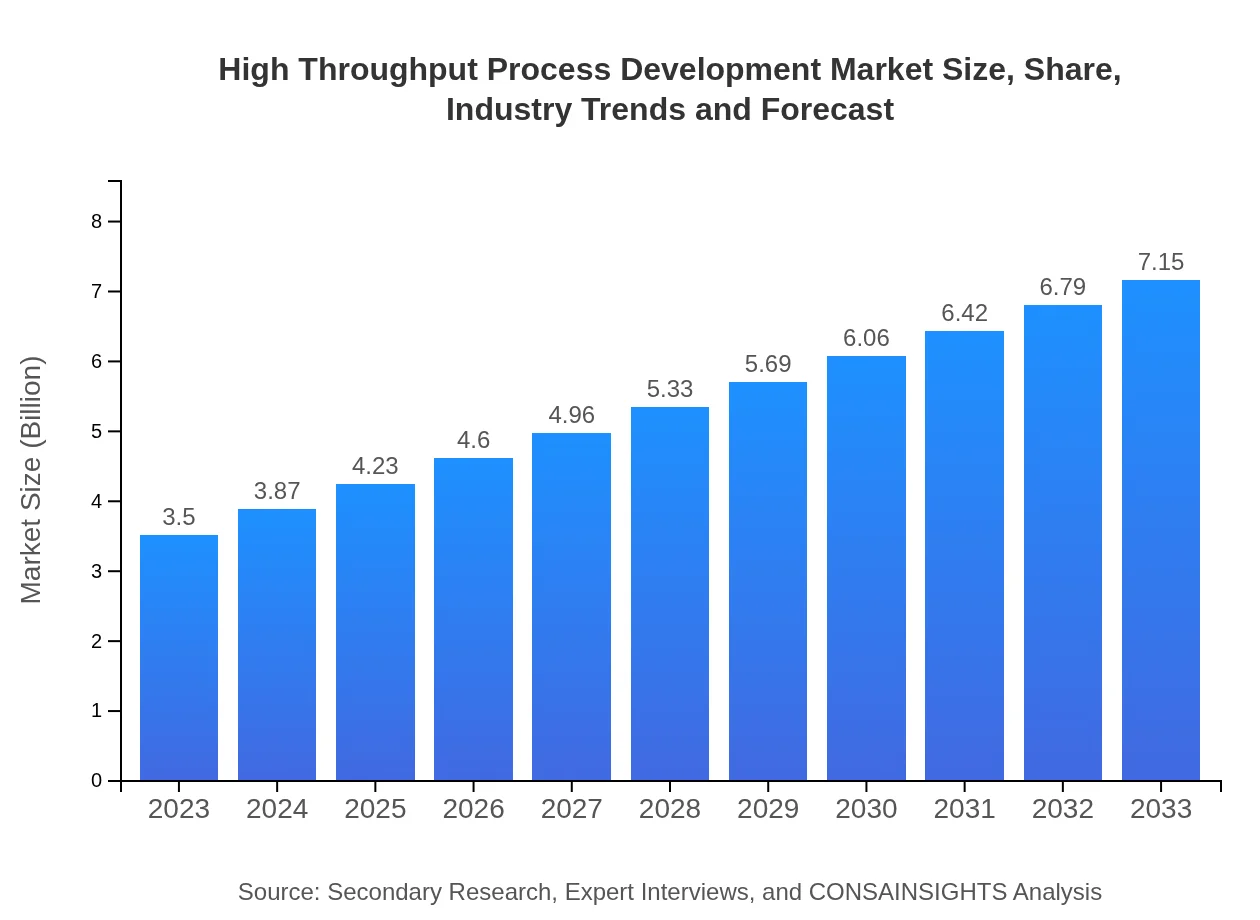

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $7.15 Billion |

| Top Companies | Thermo Fisher Scientific, Waters Corporation, Agilent Technologies, PerkinElmer, Sartorius |

| Last Modified Date | 31 January 2026 |

High Throughput Process Development Market Overview

Customize High Throughput Process Development Market Report market research report

- ✔ Get in-depth analysis of High Throughput Process Development market size, growth, and forecasts.

- ✔ Understand High Throughput Process Development's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in High Throughput Process Development

What is the Market Size & CAGR of High Throughput Process Development market in 2033?

High Throughput Process Development Industry Analysis

High Throughput Process Development Market Segmentation and Scope

Tell us your focus area and get a customized research report.

High Throughput Process Development Market Analysis Report by Region

Europe High Throughput Process Development Market Report:

Europe’s market is valued at $1.12 billion in 2023, forecasted to reach $2.30 billion by 2033. The focus on drug discovery and regulatory compliance drives the growth in this sophisticated market.Asia Pacific High Throughput Process Development Market Report:

In the Asia Pacific region, the market is valued at $0.67 billion in 2023, significantly increasing to $1.37 billion by 2033. The rise is driven by the region's investments in biotech and pharma technologies, coupled with growing R&D capabilities.North America High Throughput Process Development Market Report:

North America holds a dominant position in the HTPD market with a size of $1.15 billion in 2023, expected to grow to $2.35 billion by 2033. The region's advanced healthcare infrastructure and significant R&D spending contribute to its market leadership.South America High Throughput Process Development Market Report:

The South American market reflects a modest growth, with a value of $0.19 billion in 2023, forecasted to reach $0.38 billion by 2033. Factors such as improving infrastructure and increasing government support for biotechnology are pivotal for growth.Middle East & Africa High Throughput Process Development Market Report:

The Middle East and Africa market starts at $0.37 billion in 2023, with projections of reaching $0.76 billion by 2033. An increase in investments in health technologies and rising public health initiatives support market expansion.Tell us your focus area and get a customized research report.

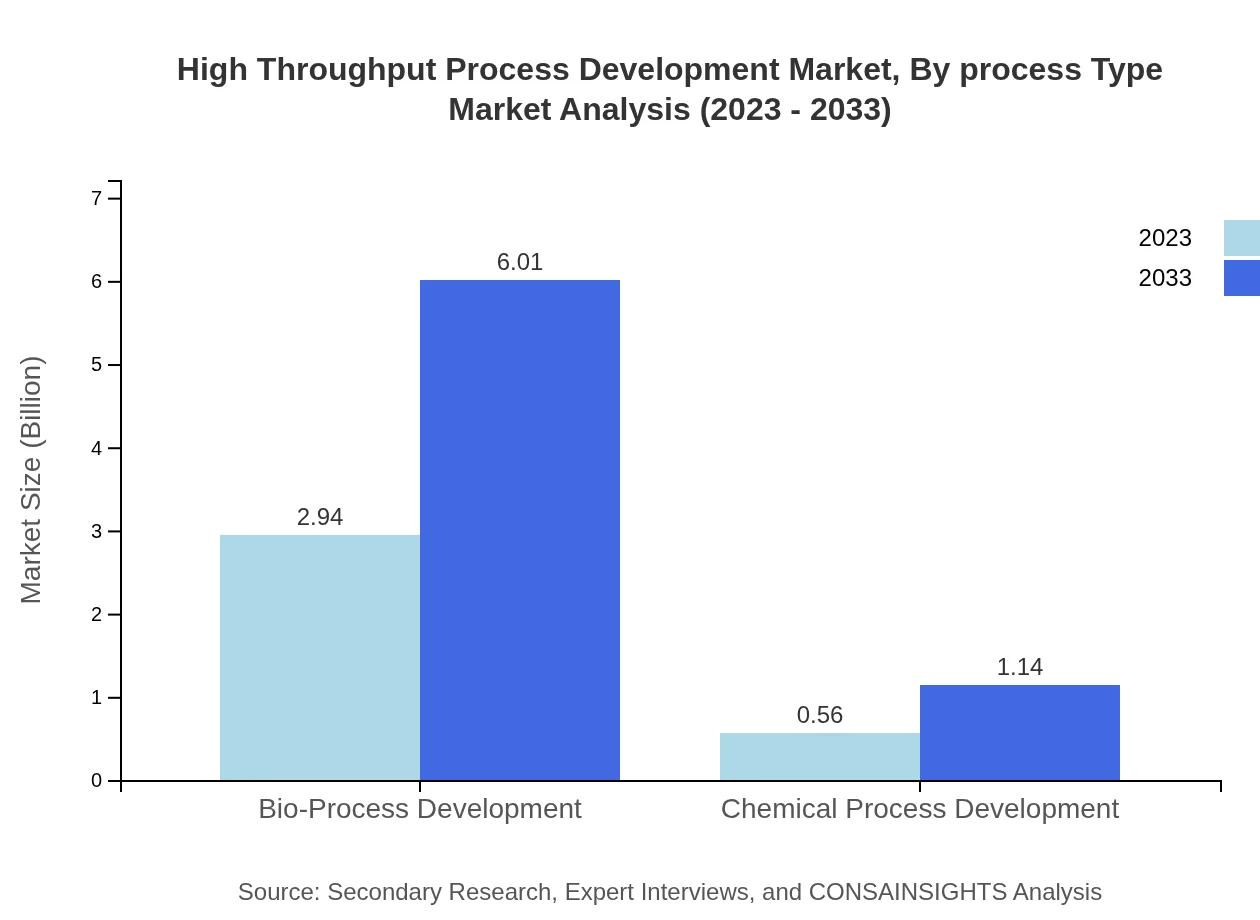

High Throughput Process Development Market Analysis By Process Type

By process type, the market is categorized into bio-process development and chemical process development. In 2023, bio-process development dominates with a market size of $2.94 billion, expected to reach $6.01 billion by 2033, holding a substantial market share due to its relevance in drug development.

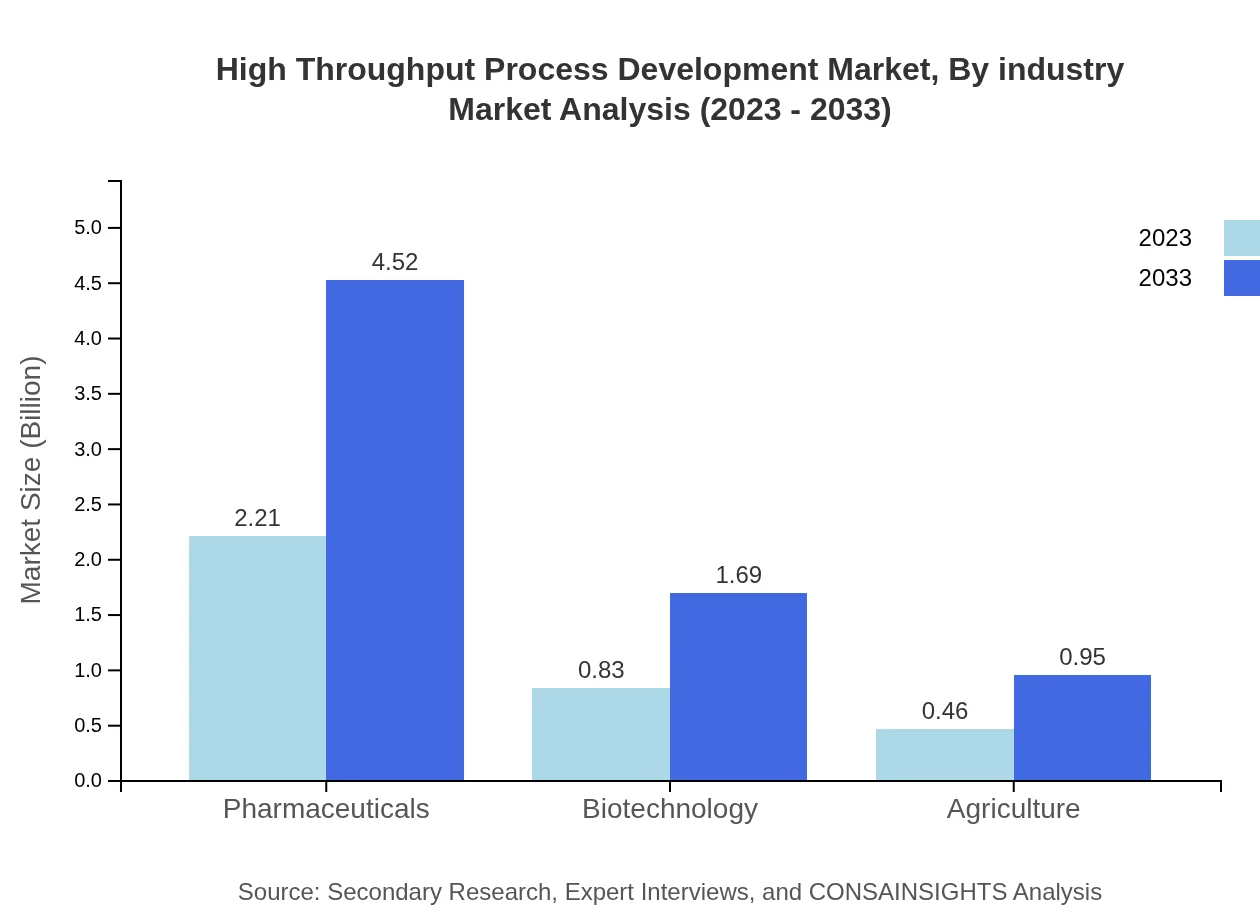

High Throughput Process Development Market Analysis By Industry

Segmentation by industry shows pharmaceuticals leading with $2.21 billion in 2023, estimated to grow to $4.52 billion by 2033. Biotechnology and agriculture segments are also experiencing notable growth, focusing on innovative applications of HTPD.

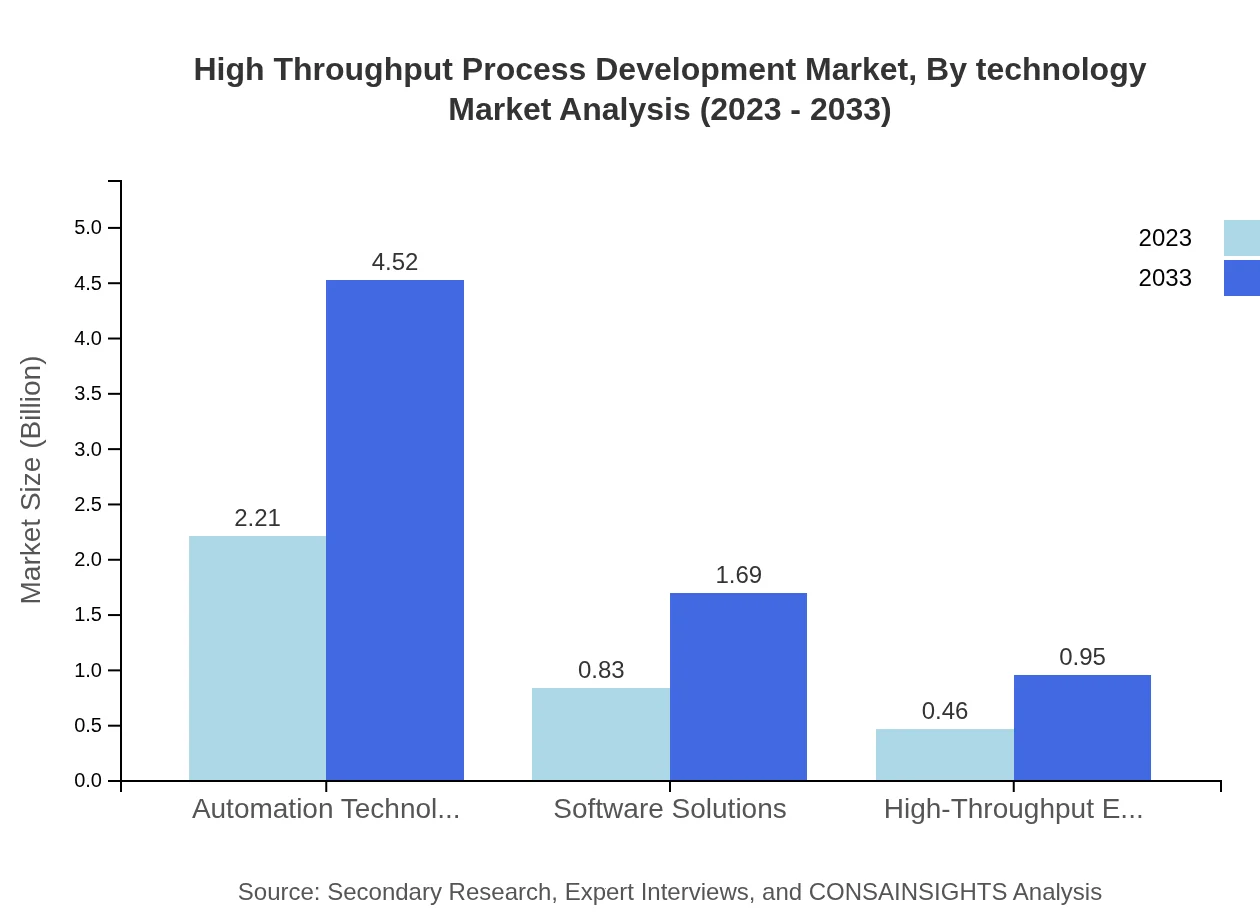

High Throughput Process Development Market Analysis By Technology

Technology-wise, automation technologies and software solutions are crucial, both demonstrating a market size of $0.83 billion in 2023 and projected to see growth driven by new innovations enhancing efficiency in development processes.

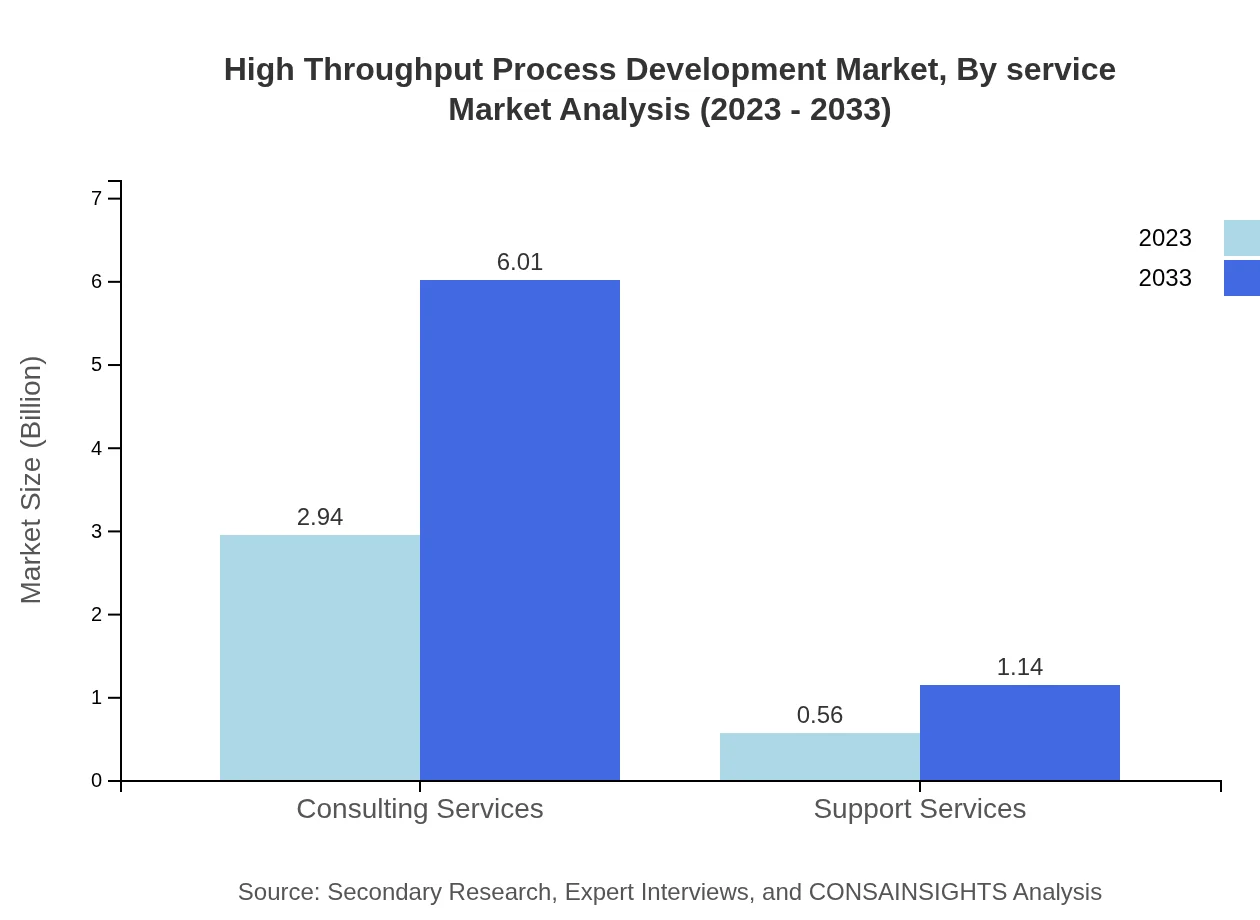

High Throughput Process Development Market Analysis By Service

The service segment includes consulting services which hold a market value of $2.94 billion in 2023, set to reach $6.01 billion by 2033. Support services are also emerging, indicating the sector's demand for comprehensive support throughout the development life cycle.

High Throughput Process Development Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in High Throughput Process Development Industry

Thermo Fisher Scientific:

A leader in laboratory equipment and reagents providing high-throughput screening solutions enabling faster drug discovery.Waters Corporation:

Specializes in mass spectrometry and chromatography solutions that streamline high-throughput analysis in pharmaceuticals.Agilent Technologies:

Offers advanced instrumentation and software solutions supporting high-throughput methodologies essential for modern laboratories.PerkinElmer:

Provides high-throughput screening and data analytics tools enhancing efficiency in drug development.Sartorius:

Focuses on bioprocess solutions, aiding in high-throughput bioprocess development and optimization.We're grateful to work with incredible clients.

FAQs

What is the market size of high Throughput process development?

The high-throughput process development market is currently valued at approximately $3.5 billion in 2023, with an expected compound annual growth rate (CAGR) of 7.2% projected through 2033, indicating robust growth and investment opportunities within the sector.

What are the key market players or companies in the high Throughput process development industry?

Key players in the high-throughput process development industry include major pharmaceutical and biotechnology companies focusing on automation technologies and innovative bioprocess solutions, although specific company names may vary based on market analysis.

What are the primary factors driving the growth in the high Throughput process development industry?

The growth of the high-throughput process development industry is driven by increasing demand for novel drug development, advancements in automation technology, and the rise of biotechnological innovations aimed at improving efficiency and reducing costs in research and development.

Which region is the fastest Growing in the high Throughput process development?

The North American region is the fastest-growing market for high-throughput process development, projected to grow from $1.15 billion in 2023 to $2.35 billion by 2033, fueled by significant investments in biopharmaceutical research and development.

Does ConsaInsights provide customized market report data for the high Throughput process development industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the high-throughput process development industry, allowing stakeholders to gain insights pertinent to their unique business goals and questions.

What deliverables can I expect from this high Throughput process development market research project?

Deliverables from the high-throughput process development market research project include comprehensive reports detailing market size, growth forecasts, competitive analysis, regional insights, and trends across various segments within the industry.

What are the market trends of high Throughput process development?

Current market trends in high-throughput process development include the increasing adoption of automation technologies, a shift towards integrated bioprocessing solutions, and an emphasis on enhancing throughput efficiency in drug discovery and development.

What are the key segments in the high Throughput process development market?

Key segments in the high-throughput process development market include consulting services, pharmaceuticals, biotechnology, and automation technologies, with each segment showing significant growth potential and different market shares in the overall landscape.