High Throughput Screening Market Report

Published Date: 31 January 2026 | Report Code: high-throughput-screening

High Throughput Screening Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the High Throughput Screening (HTS) market from 2023 to 2033, focusing on market size, trends, segmentation, and regional insights, highlighting growth opportunities and the competitive landscape.

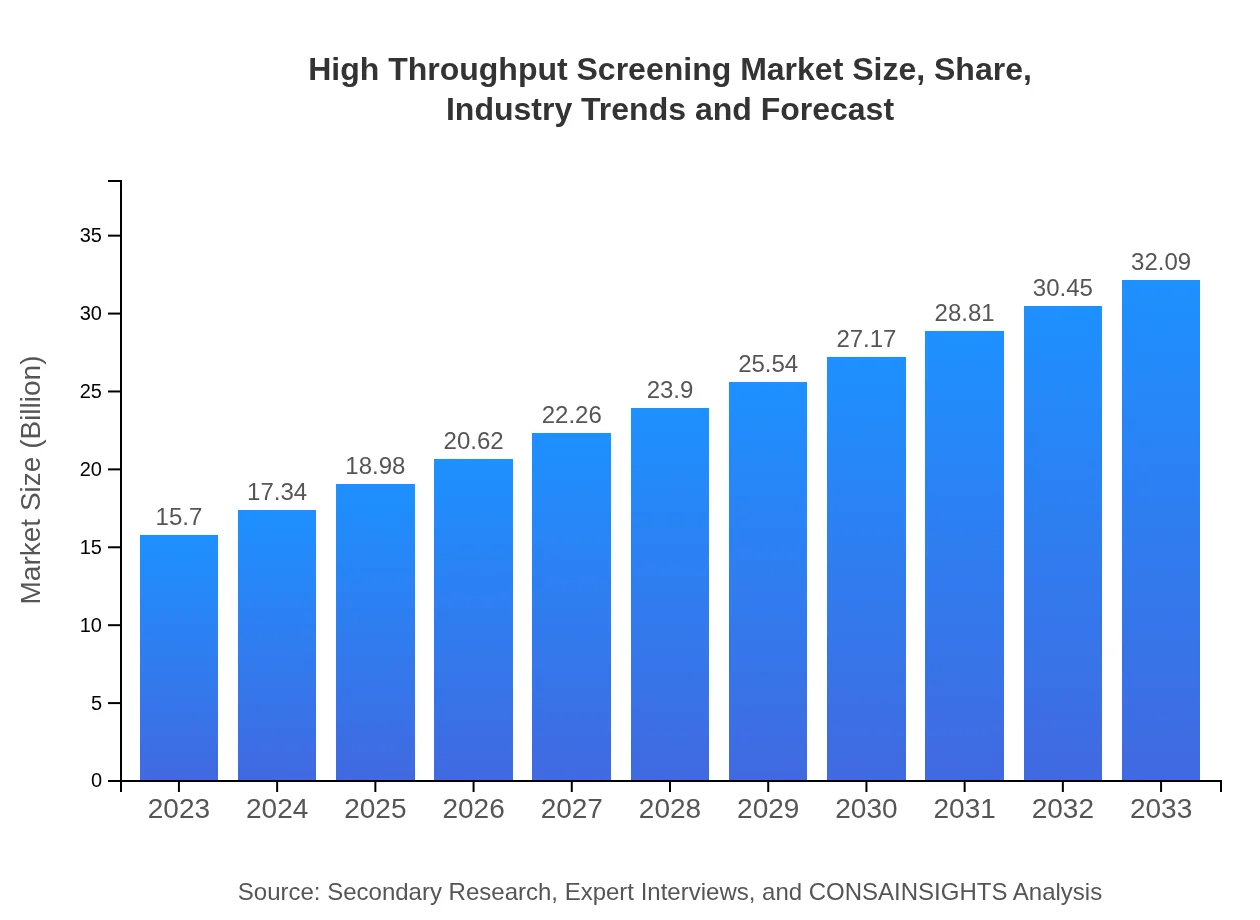

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.70 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $32.09 Billion |

| Top Companies | Thermo Fisher Scientific, Roche Holding AG, PerkinElmer Inc., Agilent Technologies, Biocrates Life Sciences AG |

| Last Modified Date | 31 January 2026 |

High Throughput Screening Market Overview

Customize High Throughput Screening Market Report market research report

- ✔ Get in-depth analysis of High Throughput Screening market size, growth, and forecasts.

- ✔ Understand High Throughput Screening's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in High Throughput Screening

What is the Market Size & CAGR of High Throughput Screening market in 2023?

High Throughput Screening Industry Analysis

High Throughput Screening Market Segmentation and Scope

Tell us your focus area and get a customized research report.

High Throughput Screening Market Analysis Report by Region

Europe High Throughput Screening Market Report:

Europe is also witnessing a steady increase in the HTS market, expected to grow from $5.37 billion in 2023 to $10.99 billion by 2033. This growth is driven by stringent regulations demanding higher efficiency in drug discovery processes and strong support for biopharmaceuticals.Asia Pacific High Throughput Screening Market Report:

The Asia Pacific region is experiencing significant growth in the High Throughput Screening market, projected to expand to approximately $5.85 billion by 2033 from $2.86 billion in 2023. Driven by the increasing number of pharmaceutical startups and the expansion of research institutions, this region stands to benefit from lower labor costs and rapid adoption of new technologies.North America High Throughput Screening Market Report:

North America continues to lead the High Throughput Screening market with a market size projected to reach $10.99 billion by 2033, up from $5.38 billion in 2023. Strong investment in R&D operations by pharmaceutical companies and technological advancements are key factors driving this region's growth.South America High Throughput Screening Market Report:

In South America, the HTS market is expected to grow from $1.29 billion in 2023 to $2.63 billion by 2033. The growth is attributed to rising healthcare investments and increased research activities aimed at drug discovery.Middle East & Africa High Throughput Screening Market Report:

In the Middle East and Africa, the HTS market is anticipated to grow from $0.80 billion in 2023 to $1.64 billion by 2033, spurred by a surge in medical research and collaborations with international pharmaceutical companies.Tell us your focus area and get a customized research report.

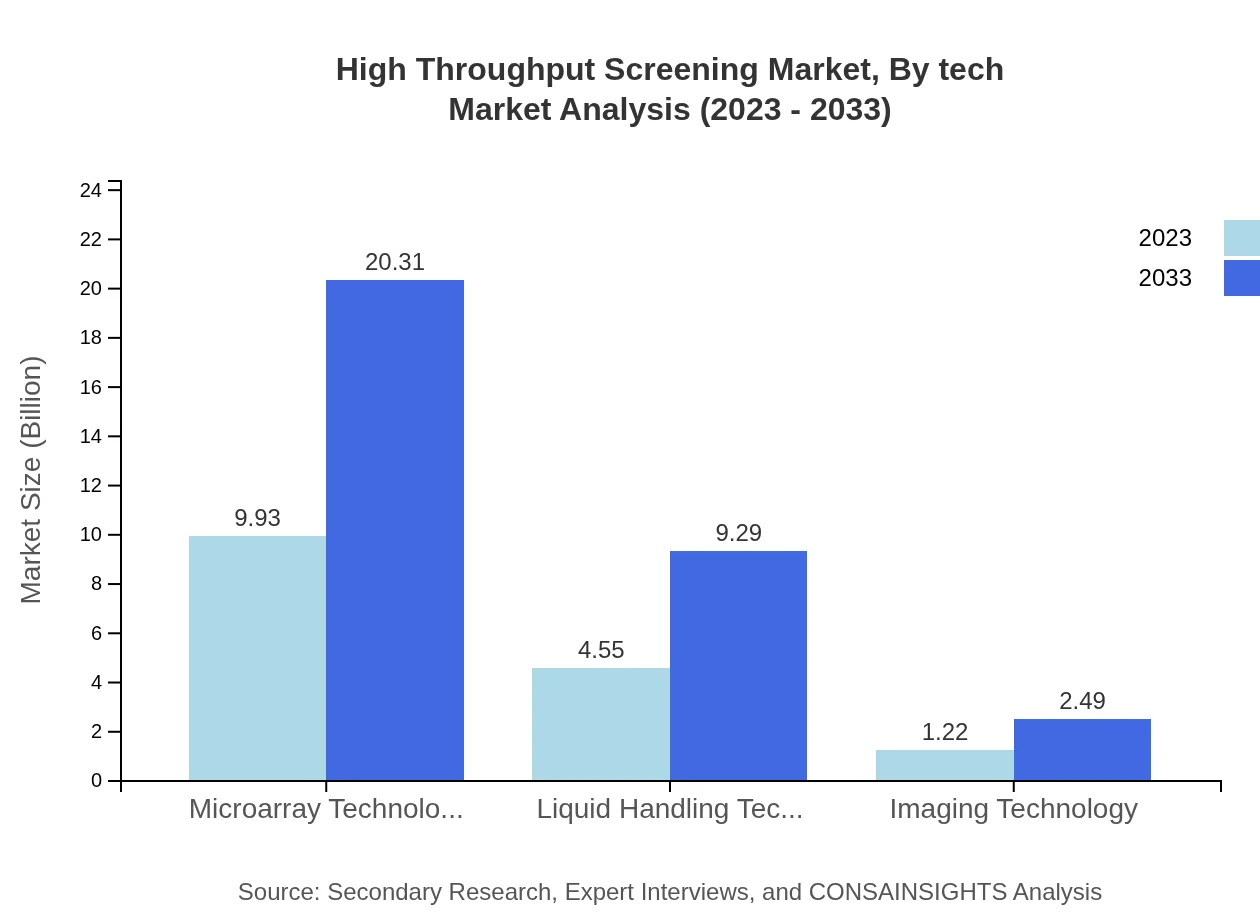

High Throughput Screening Market Analysis By Tech

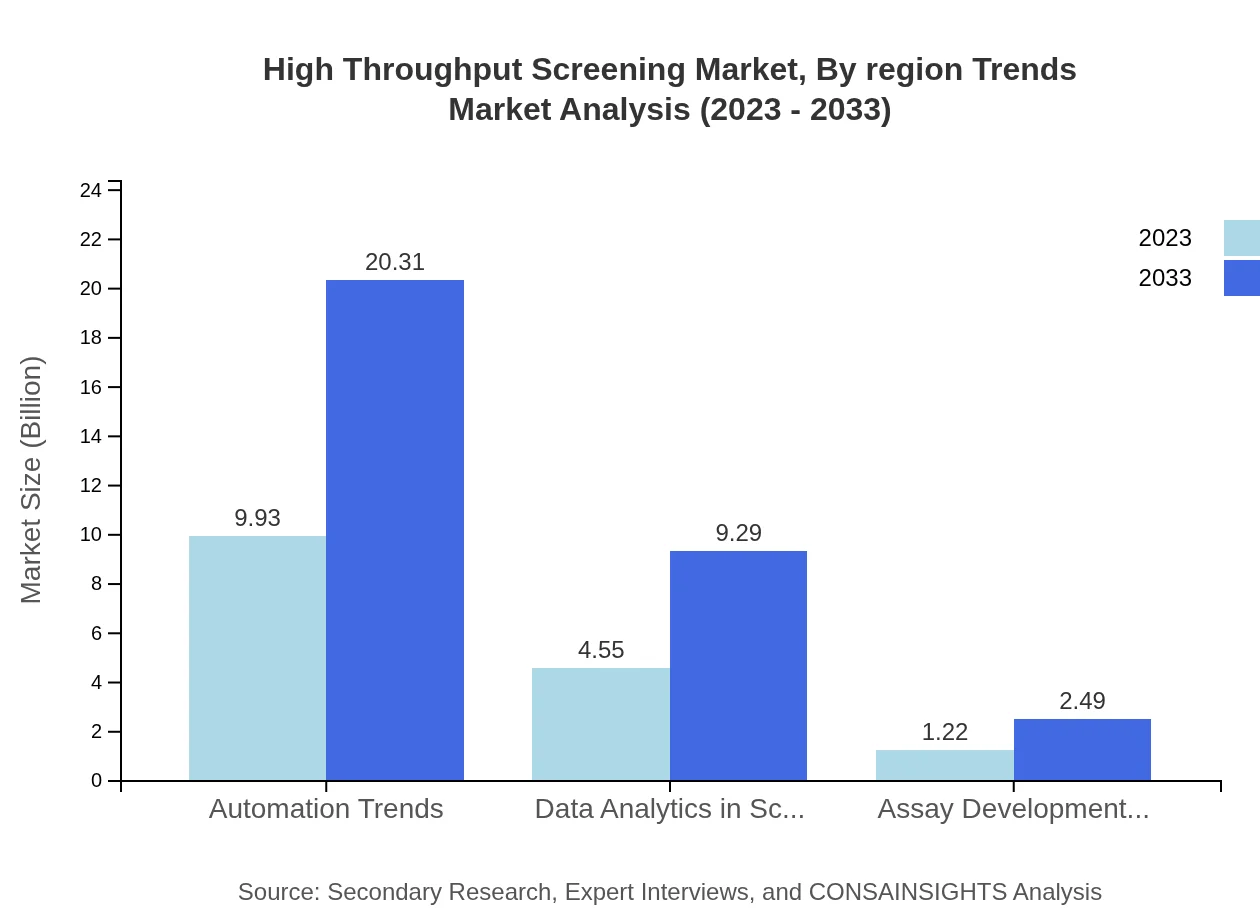

The major technologies in the High Throughput Screening market include Microarray Technology, which is expected to grow from a market size of $9.93 billion in 2023 to $20.31 billion in 2033. Liquid Handling Technology is projected to increase from $4.55 billion in 2023 to $9.29 billion by 2033, while Imaging Technology is anticipated to grow from $1.22 billion to $2.49 billion during the same period. Automation and data analytics are trends driving significant advancements across these technologies.

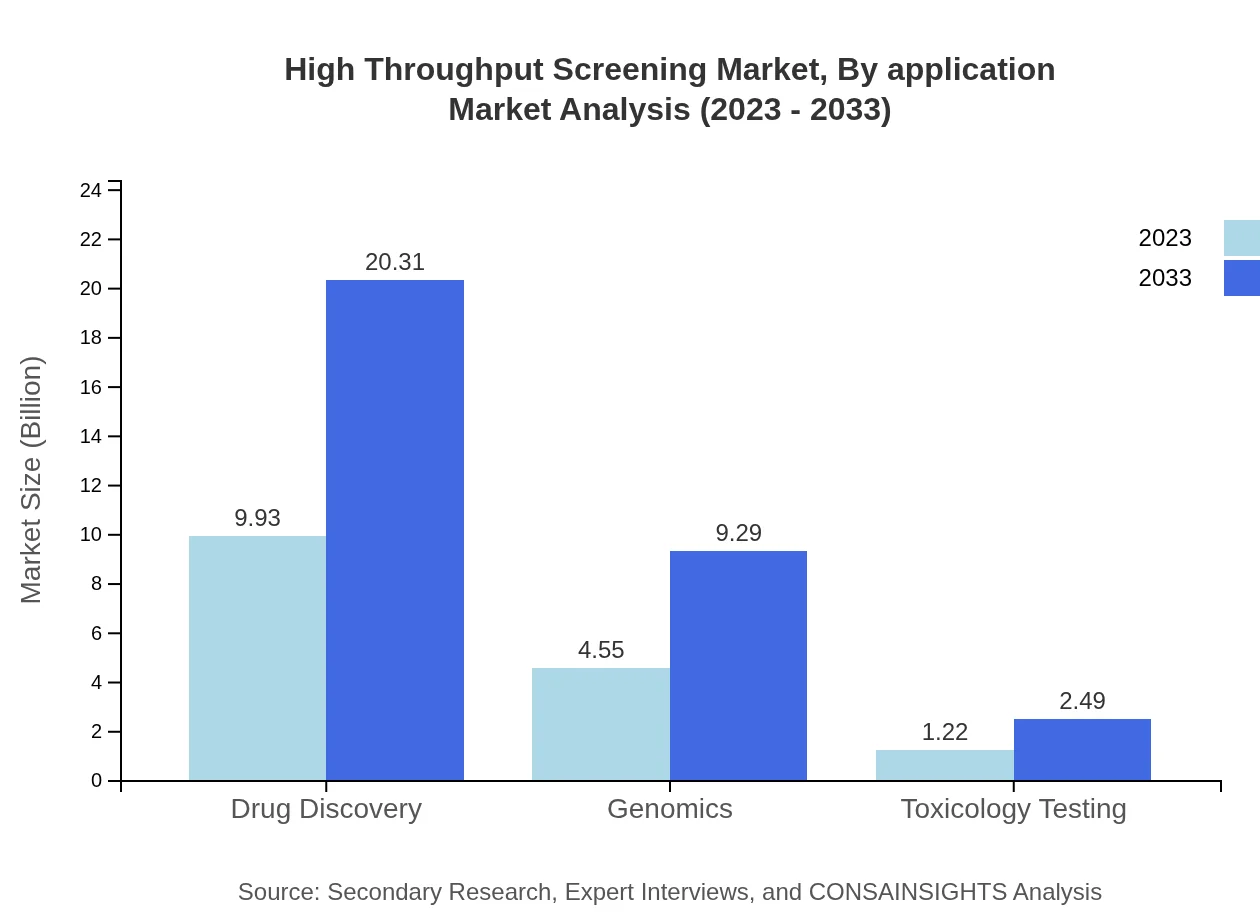

High Throughput Screening Market Analysis By Application

The application segments include Drug Discovery, which leads the market with a size of $9.93 billion in 2023 and is estimated to reach $20.31 billion by 2033. Genomics and Toxicology Testing are also relevant applications, each expected to expand significantly over the forecast period, given the increasing focus on asset safety in drug development.

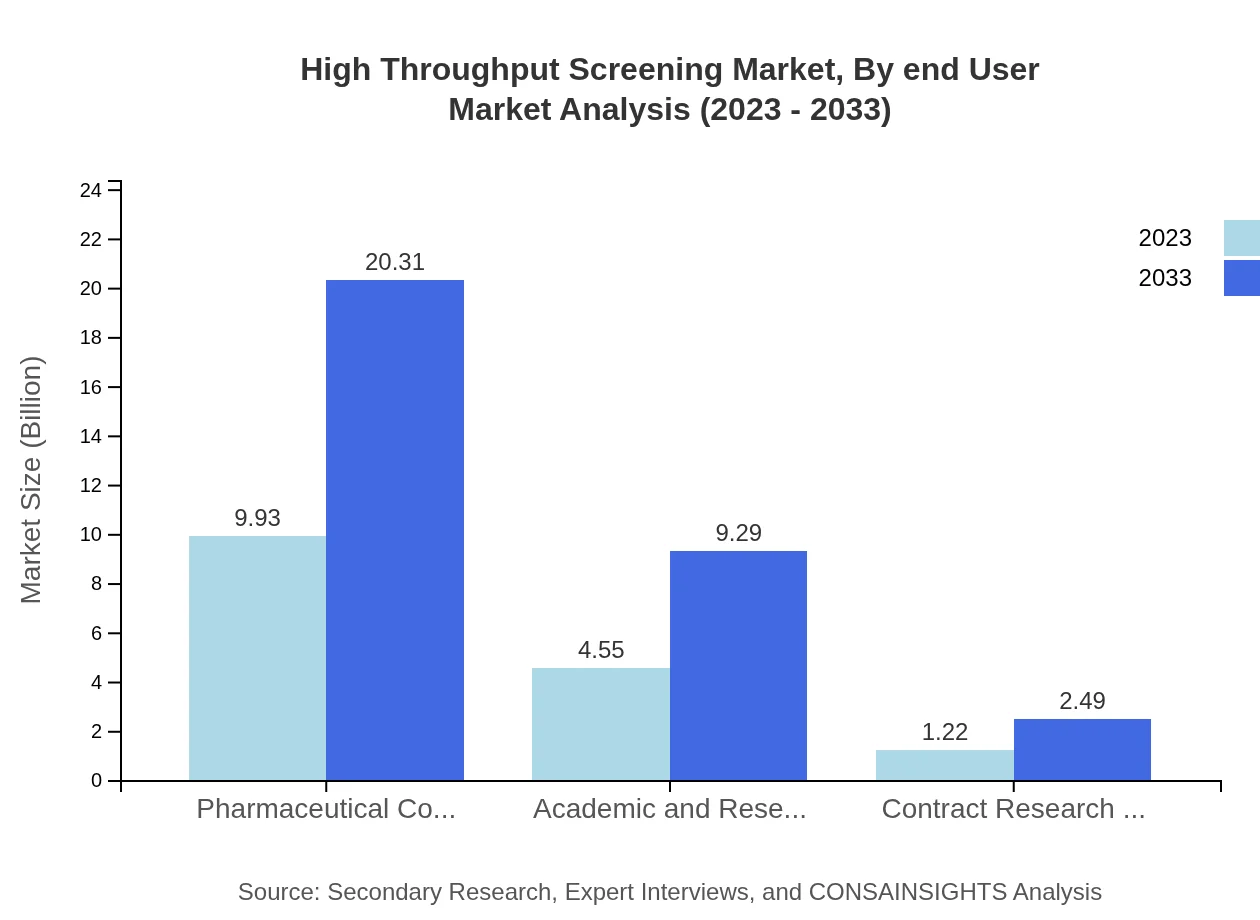

High Throughput Screening Market Analysis By End User

The end-user segment includes Pharmaceutical Companies, who dominate the market with a size of $9.93 billion in 2023 and projected to reach $20.31 billion by 2033. Academic and Research Institutes as well as Contract Research Organizations (CROs) represent other key end-users that are expected to significantly drive the market due to their continual research activities and increasing collaborations with drug development companies.

High Throughput Screening Market Analysis By Region Trends

The High Throughput Screening market is set to evolve with key trends such as increased automation, incorporation of artificial intelligence in data analysis, and innovations in assay development. These trends are expected to improve throughput and reduce turnaround times, ultimately enhancing the efficiency of the drug discovery process.

High Throughput Screening Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in High Throughput Screening Industry

Thermo Fisher Scientific:

A leader in scientific instrumentation, Thermo Fisher provides comprehensive solutions for high throughput screening and laboratory automation.Roche Holding AG:

Roche is a prominent player in the pharmaceutical industry, specializing in diagnostics and drug development, heavily investing in innovative HTS technologies.PerkinElmer Inc.:

PerkinElmer offers a wide range of HTS solutions and advanced analytics to facilitate drug discovery, bioanalytical testing, and complex analysis.Agilent Technologies:

Agilent is committed to improving laboratory productivity through investments in HTS technologies that drive efficiencies in drug development.Biocrates Life Sciences AG:

Biocrates specializes in targeted metabolomics and provides innovative solutions for drug testing using high throughput technologies.We're grateful to work with incredible clients.

FAQs

What is the market size of high Throughput Screening?

The global high-throughput screening market is projected to reach $15.7 billion by 2033, growing from approximately $15.7 billion in 2023. The market is expected to experience a CAGR of 7.2% from 2023 to 2033.

What are the key market players or companies in this high Throughput Screening industry?

Key players in the high-throughput screening industry include leading pharmaceutical companies, key suppliers of screening technologies, and contract research organizations (CROs) that offer specialized services. The landscape is competitive due to innovation.

What are the primary factors driving the growth in the high Throughput Screening industry?

Driving factors for growth include increased adoption in drug discovery, investment in genomics and personalized medicine, technological advancements in automation, and the rising need for cost-effective screening solutions across various fields.

Which region is the fastest Growing in the high Throughput Screening?

The fastest-growing region in the high-throughput screening market is Europe, projected to expand from $5.37 billion in 2023 to $10.99 billion by 2033. Asia Pacific also shows significant growth prospects, anticipated to rise from $2.86 billion to $5.85 billion.

Does ConsaInsights provide customized market report data for the high Throughput Screening industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients within the high-throughput screening industry, ensuring comprehensive insights that are directly relevant to their research and business strategies.

What deliverables can I expect from this high Throughput Screening market research project?

Deliverables from the high-throughput screening market research project typically include detailed market analysis, growth projections, competitive landscape assessment, regional overviews, and segmented data addressing key trends and insights.

What are the market trends of high Throughput Screening?

Current market trends include a shift towards automated screening processes, integration of advanced data analytics in screening methods, increased focus on innovative assay development, and a rise in collaborations between academic institutes and industry players.