High Voltage Direct Current Hvdc Capacitor Market Report

Published Date: 31 January 2026 | Report Code: high-voltage-direct-current-hvdc-capacitor

High Voltage Direct Current Hvdc Capacitor Market Size, Share, Industry Trends and Forecast to 2033

This report presents a comprehensive analysis of the High Voltage Direct Current (HVDC) Capacitor market from 2023 to 2033, including market trends, size, competitive landscape, and forecasts for the growth trajectory in this evolving industry.

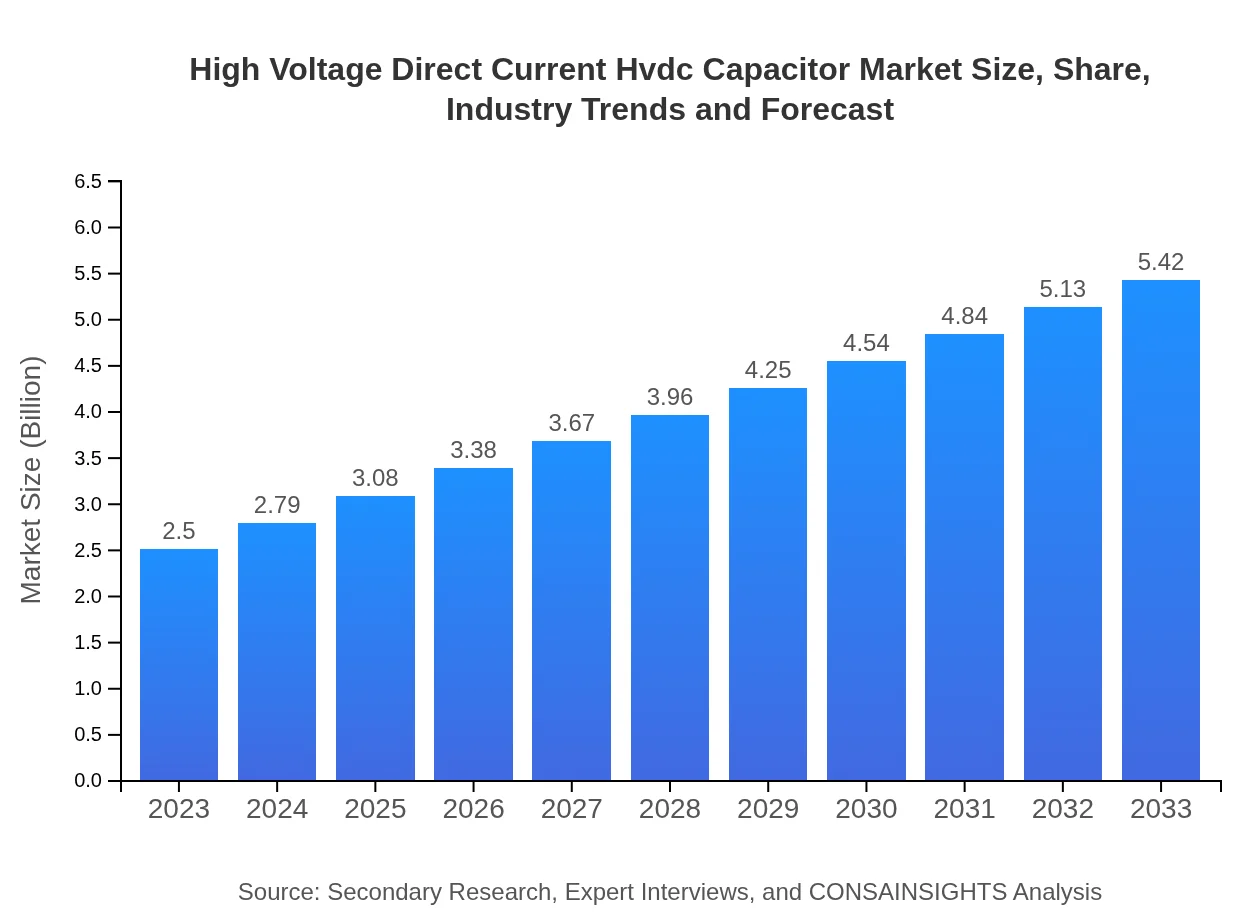

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $5.42 Billion |

| Top Companies | Siemens AG, General Electric, ABB Ltd., Mitsubishi Electric Corporation, Hitachi Ltd. |

| Last Modified Date | 31 January 2026 |

High Voltage Direct Current Hvdc Capacitor Market Overview

Customize High Voltage Direct Current Hvdc Capacitor Market Report market research report

- ✔ Get in-depth analysis of High Voltage Direct Current Hvdc Capacitor market size, growth, and forecasts.

- ✔ Understand High Voltage Direct Current Hvdc Capacitor's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in High Voltage Direct Current Hvdc Capacitor

What is the Market Size & CAGR of High Voltage Direct Current Hvdc Capacitor market in 2023?

High Voltage Direct Current Hvdc Capacitor Industry Analysis

High Voltage Direct Current Hvdc Capacitor Market Segmentation and Scope

Tell us your focus area and get a customized research report.

High Voltage Direct Current Hvdc Capacitor Market Analysis Report by Region

Europe High Voltage Direct Current Hvdc Capacitor Market Report:

The European market is expected to expand significantly, increasing from $0.78 billion in 2023 to $1.68 billion by 2033, supported by stringent regulations on emissions and investments in clean energy solutions.Asia Pacific High Voltage Direct Current Hvdc Capacitor Market Report:

In the Asia-Pacific region, the HVDC capacitor market is estimated to grow from $0.46 billion in 2023 to $1.00 billion by 2033. This growth is attributed to strong investments in energy infrastructure and the shift towards renewable energy.North America High Voltage Direct Current Hvdc Capacitor Market Report:

In North America, the HVDC capacitor market is anticipated to grow from $0.96 billion in 2023 to $2.09 billion by 2033, driven by technological advancements and increased adoption of HVDC systems in grid modernization projects.South America High Voltage Direct Current Hvdc Capacitor Market Report:

The South American market is projected to decline slightly from -$0.02 billion in 2023 to -$0.05 billion by 2033, primarily due to economic instability and reduced investments in infrastructure developments.Middle East & Africa High Voltage Direct Current Hvdc Capacitor Market Report:

The market in the Middle East and Africa is forecasted to grow from $0.33 billion in 2023 to $0.71 billion by 2033, spurred by infrastructure developments and the need for reliable power transmission across the region.Tell us your focus area and get a customized research report.

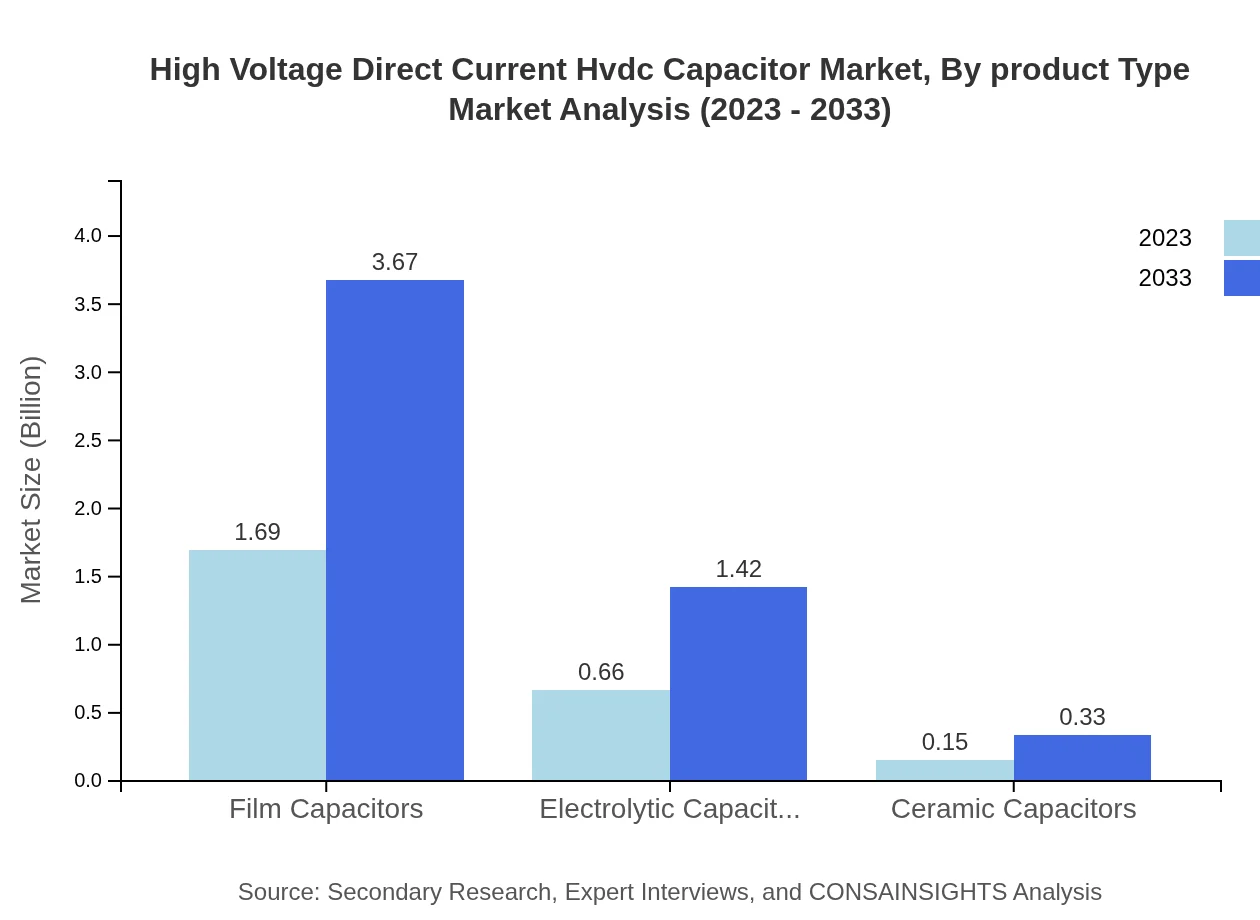

High Voltage Direct Current Hvdc Capacitor Market Analysis By Product Type

The product type segment reveals that film capacitors lead the market in size and share, projected to grow from $1.69 billion in 2023 to $3.67 billion by 2033, while electrolytic capacitors can expect growth from $0.66 billion to $1.42 billion in the same period.

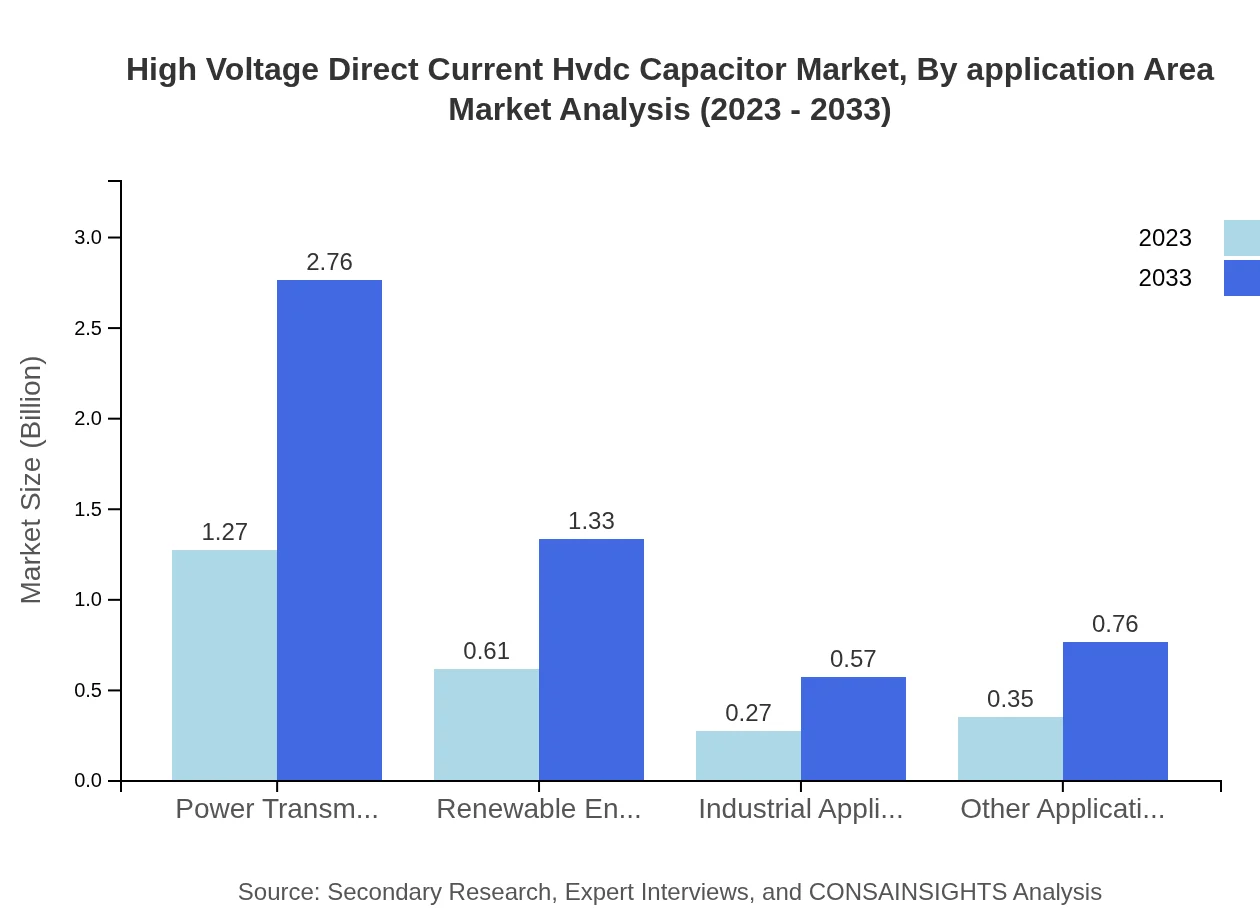

High Voltage Direct Current Hvdc Capacitor Market Analysis By Application Area

By application area, the power transmission sector commands the largest share, representing a market value of $1.27 billion in 2023, expecting to reach $2.76 billion by 2033. Renewable energy applications will also see substantial growth, from $0.61 billion to $1.33 billion.

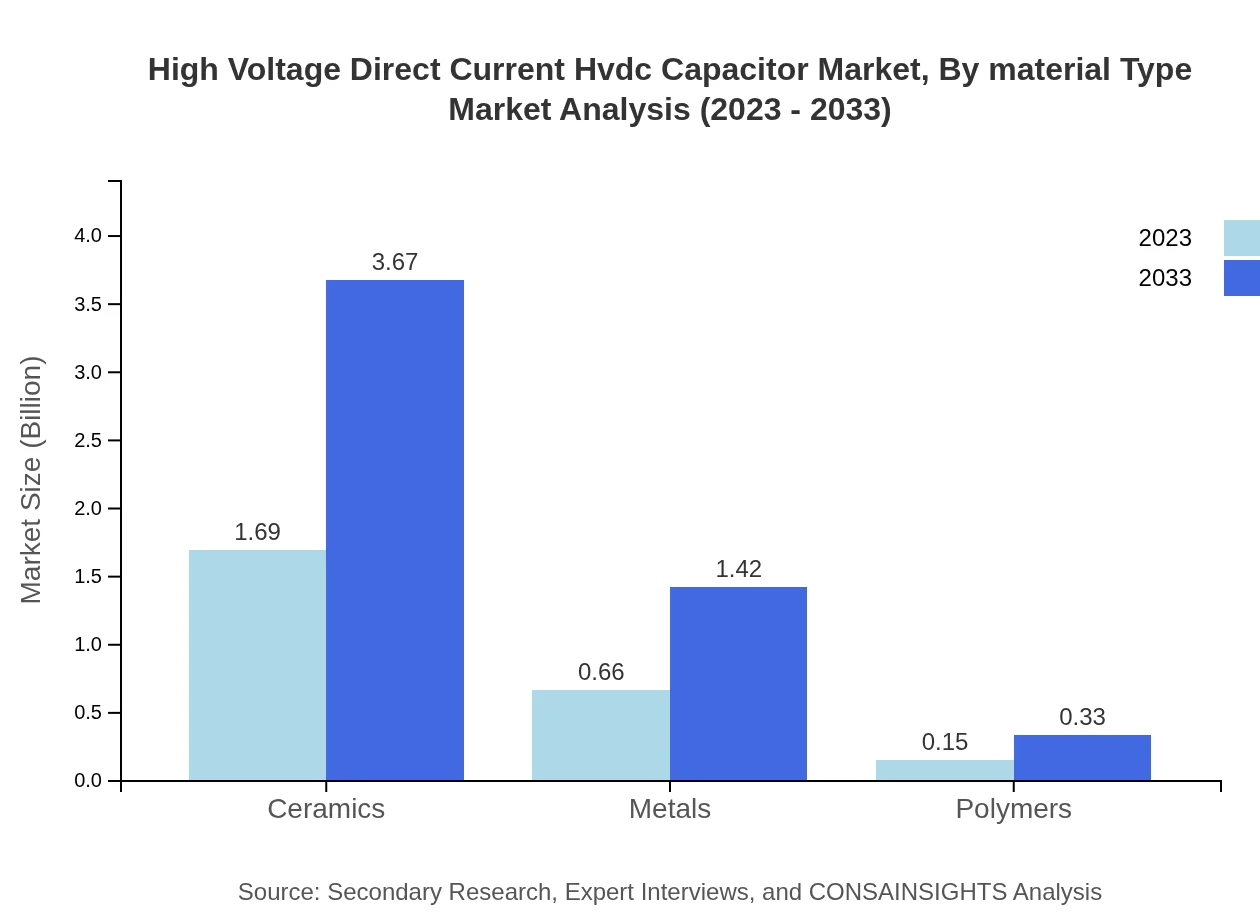

High Voltage Direct Current Hvdc Capacitor Market Analysis By Material Type

Analysis indicates that both ceramics and metals will maintain a steady market size, with ceramics remaining constant at approximately $1.69 billion and metals growing from $0.66 billion to $1.42 billion by 2033.

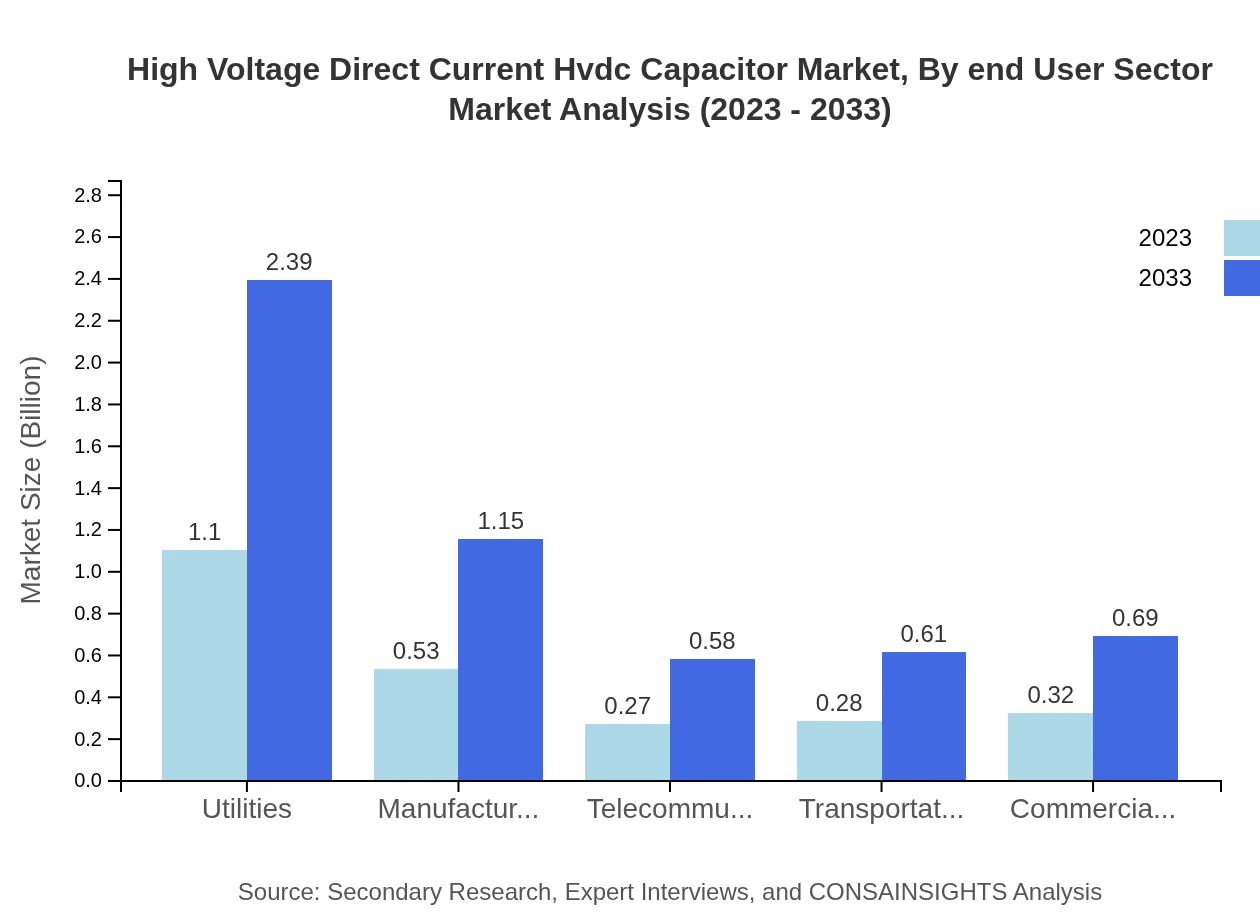

High Voltage Direct Current Hvdc Capacitor Market Analysis By End User Sector

Utilities dominate the end-user sector, accounting for $1.10 billion in 2023, with expectations of growing to $2.39 billion by 2033. The manufacturing sector also remains pivotal with consistent growth.

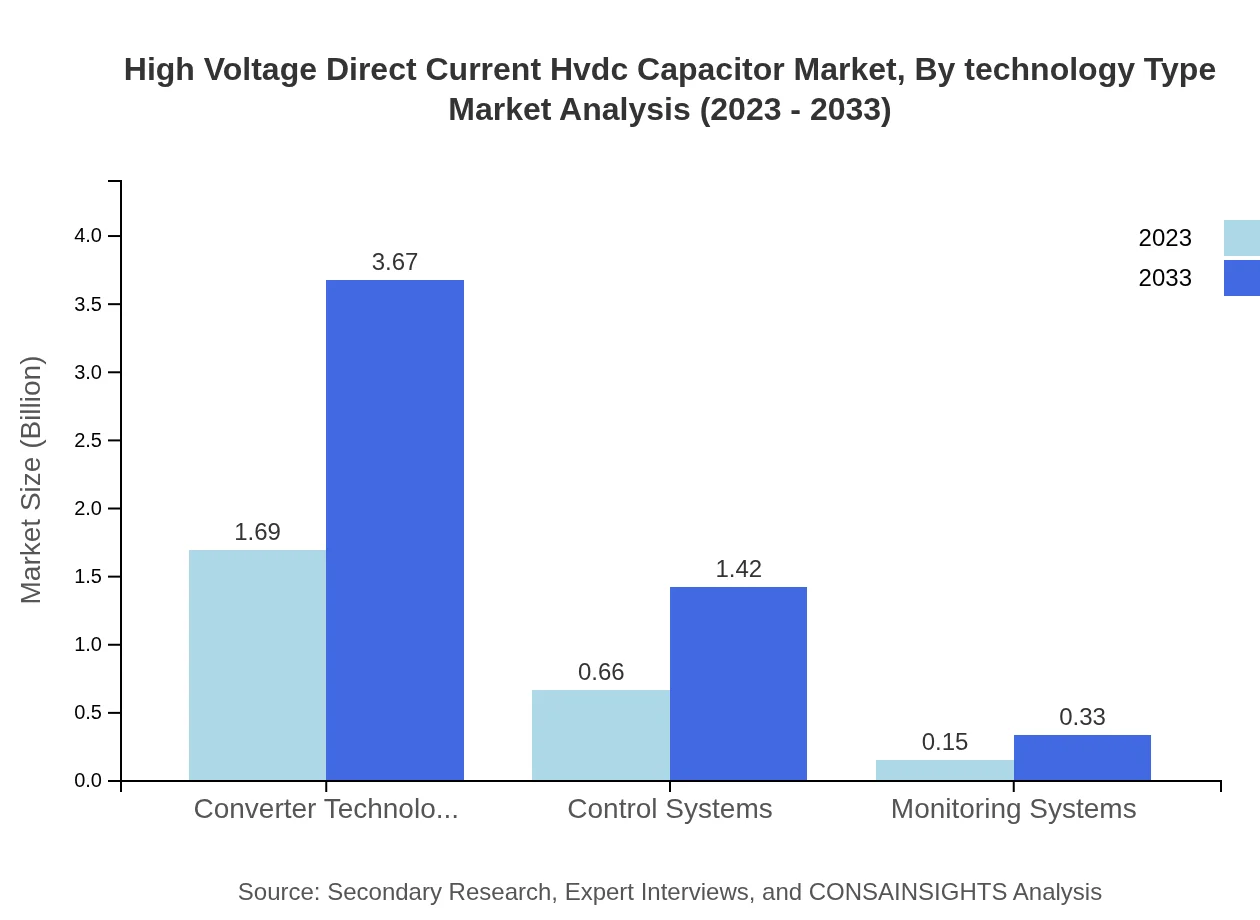

High Voltage Direct Current Hvdc Capacitor Market Analysis By Technology Type

Technological advancements in control systems are expected to expand from $0.66 billion in 2023 to $1.42 billion by 2033, illustrating an important trend towards optimization and efficiency in HVDC systems.

High Voltage Direct Current Hvdc Capacitor Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in High Voltage Direct Current Hvdc Capacitor Industry

Siemens AG:

Siemens AG is a leading player in the HVDC capacitor and technology sector, focusing on innovative solutions for electrical power transmission and distribution.General Electric:

General Electric is a key provider of HVDC technology solutions, specializing in substations and capacitor systems that enhance grid reliability and efficiency.ABB Ltd.:

ABB Ltd. excels in the HVDC capacitor market, offering a broad range of products for power transmission, known for their commitment to sustainability and innovation.Mitsubishi Electric Corporation:

Mitsubishi Electric is a prominent player in HVDC capacitor technology, focusing on advanced solutions for efficient power transmission and renewable energy integration.Hitachi Ltd.:

Hitachi Ltd. offers comprehensive HVDC solutions, integrating capacitor technologies that support the modernization of electrical grids globally.We're grateful to work with incredible clients.

FAQs

What is the market size of high Voltage Direct Current Hvdc Capacitor?

The global market size for high-voltage direct current (HVDC) capacitors is projected to reach approximately $2.5 billion by 2033, growing at a CAGR of 7.8% from 2023. This growth indicates a strong demand trajectory in the HVDC capacitor market.

What are the key market players or companies in the high Voltage Direct Current Hvdc Capacitor industry?

Key players in the HVDC capacitor market include major companies like Siemens AG, ABB Ltd, General Electric, and Schneider Electric. These firms are pivotal in driving innovation, enhancing product offerings, and expanding their market presence globally.

What are the primary factors driving the growth in the high Voltage Direct Current Hvdc Capacitor industry?

The growth in the HVDC capacitor industry is driven by the increasing demand for renewable energy, the need for improved grid connectivity, and advancements in technology. Additionally, government policies promoting sustainable energy solutions further bolster market expansion.

Which region is the fastest Growing in the high Voltage Direct Current Hvdc Capacitor market?

The fastest-growing region for HVDC capacitors from 2023 to 2033 is North America, with the market projected to increase from $0.96 billion in 2023 to $2.09 billion in 2033. This reflects a robust growth environment due to infrastructure investments.

Does ConsaInsights provide customized market report data for the high Voltage Direct Current Hvdc Capacitor industry?

Yes, ConsaInsights offers customized market report data tailored specifically for the HVDC capacitor industry. Clients can obtain insights that cater to their unique business needs, ensuring relevance and strategic value.

What deliverables can I expect from this high Voltage Direct Current Hvdc Capacitor market research project?

Deliverables from this market research project typically include a comprehensive market analysis, segment-wise insights, competitive landscape evaluation, growth forecasts, and strategic recommendations tailored for stakeholders in the HVDC capacitor sector.

What are the market trends of high Voltage Direct Current Hvdc Capacitor?

Current market trends in the HVDC capacitor industry include a shift towards advanced capacitor technologies, increasing investments in renewable energy infrastructure, and a growing focus on energy efficiency solutions, all contributing to competitive advantages.