Hip Reconstruction Devices Market Report

Published Date: 31 January 2026 | Report Code: hip-reconstruction-devices

Hip Reconstruction Devices Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Hip Reconstruction Devices market, highlighting market size, growth trends, and forecasts from 2023 to 2033. It includes insights on segmentation, regional dynamics, and key players shaping the industry landscape.

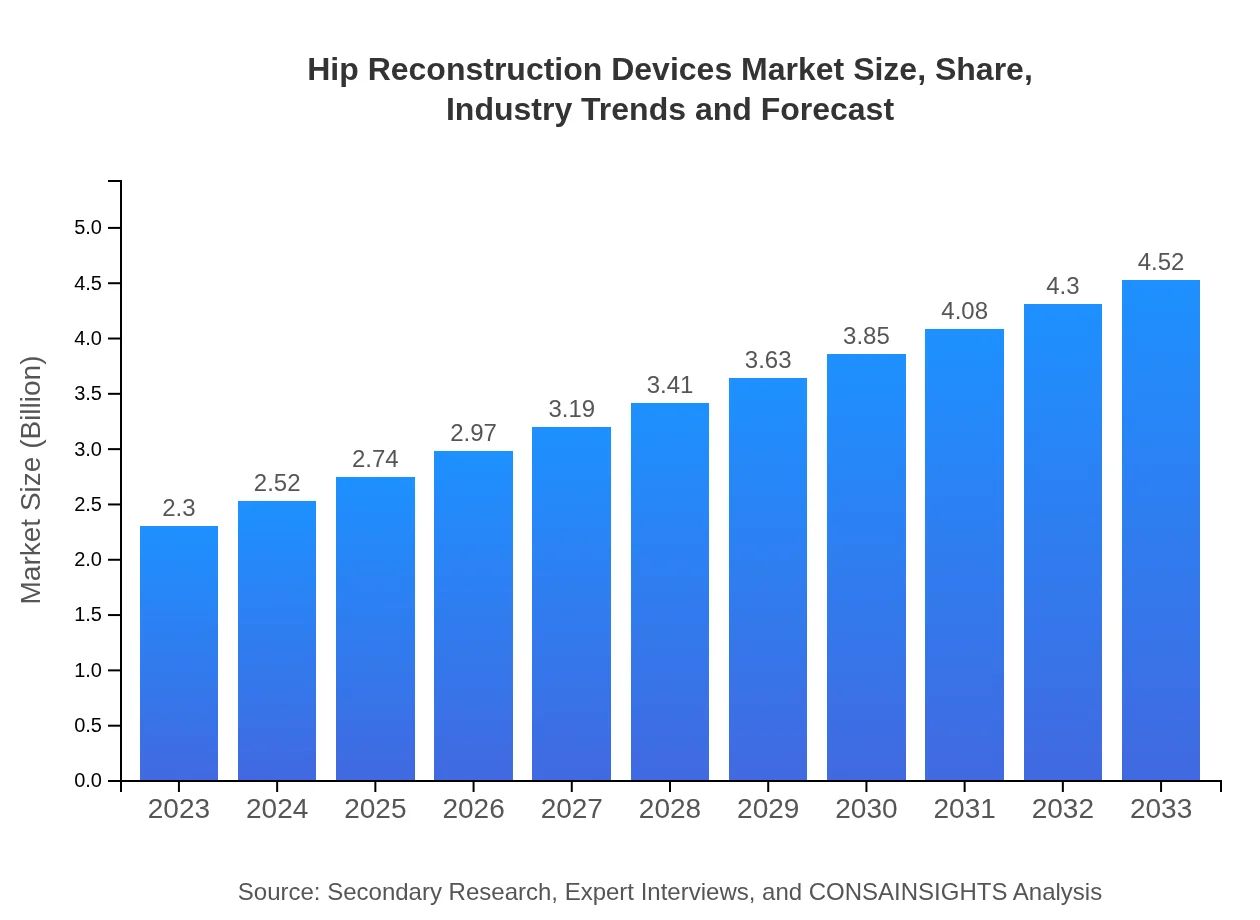

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.30 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $4.52 Billion |

| Top Companies | Johnson & Johnson, Stryker Corporation, Zimmer Biomet, DePuy Synthes |

| Last Modified Date | 31 January 2026 |

Hip Reconstruction Devices Market Overview

Customize Hip Reconstruction Devices Market Report market research report

- ✔ Get in-depth analysis of Hip Reconstruction Devices market size, growth, and forecasts.

- ✔ Understand Hip Reconstruction Devices's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Hip Reconstruction Devices

What is the Market Size & CAGR of Hip Reconstruction Devices market in 2023?

Hip Reconstruction Devices Industry Analysis

Hip Reconstruction Devices Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Hip Reconstruction Devices Market Analysis Report by Region

Europe Hip Reconstruction Devices Market Report:

The European market is expected to grow from $0.61 billion in 2023 to $1.20 billion by 2033. Innovations in device designs, combined with robust healthcare systems and awareness of hip-related disorders, are driving market expansion across Western and Eastern Europe.Asia Pacific Hip Reconstruction Devices Market Report:

The Asia Pacific region's Hip Reconstruction Devices market is projected to grow from $0.50 billion in 2023 to $0.98 billion by 2033, reflecting increased healthcare access, a surge in orthopedic procedures, and rising disposable incomes. The booming elderly population in countries like China and Japan further drives demand.North America Hip Reconstruction Devices Market Report:

North America is anticipated to dominate the market with sizes estimated at $0.81 billion in 2023 and reaching $1.59 billion by 2033, primarily due to the U.S. leading in healthcare expenditure and technological advancements in hip reconstruction procedures.South America Hip Reconstruction Devices Market Report:

In South America, the market size is expected to expand from $0.20 billion in 2023 to $0.40 billion by 2033. Economic advancements, improved healthcare infrastructure, and a growing focus on orthopedic health contribute to this growth trajectory.Middle East & Africa Hip Reconstruction Devices Market Report:

The Middle East and Africa region shows potential growth, with market size projected to double from $0.18 billion in 2023 to $0.36 billion by 2033. Increased investments in healthcare facilities and growing awareness of hip reconstruction options are expected to stimulate demand.Tell us your focus area and get a customized research report.

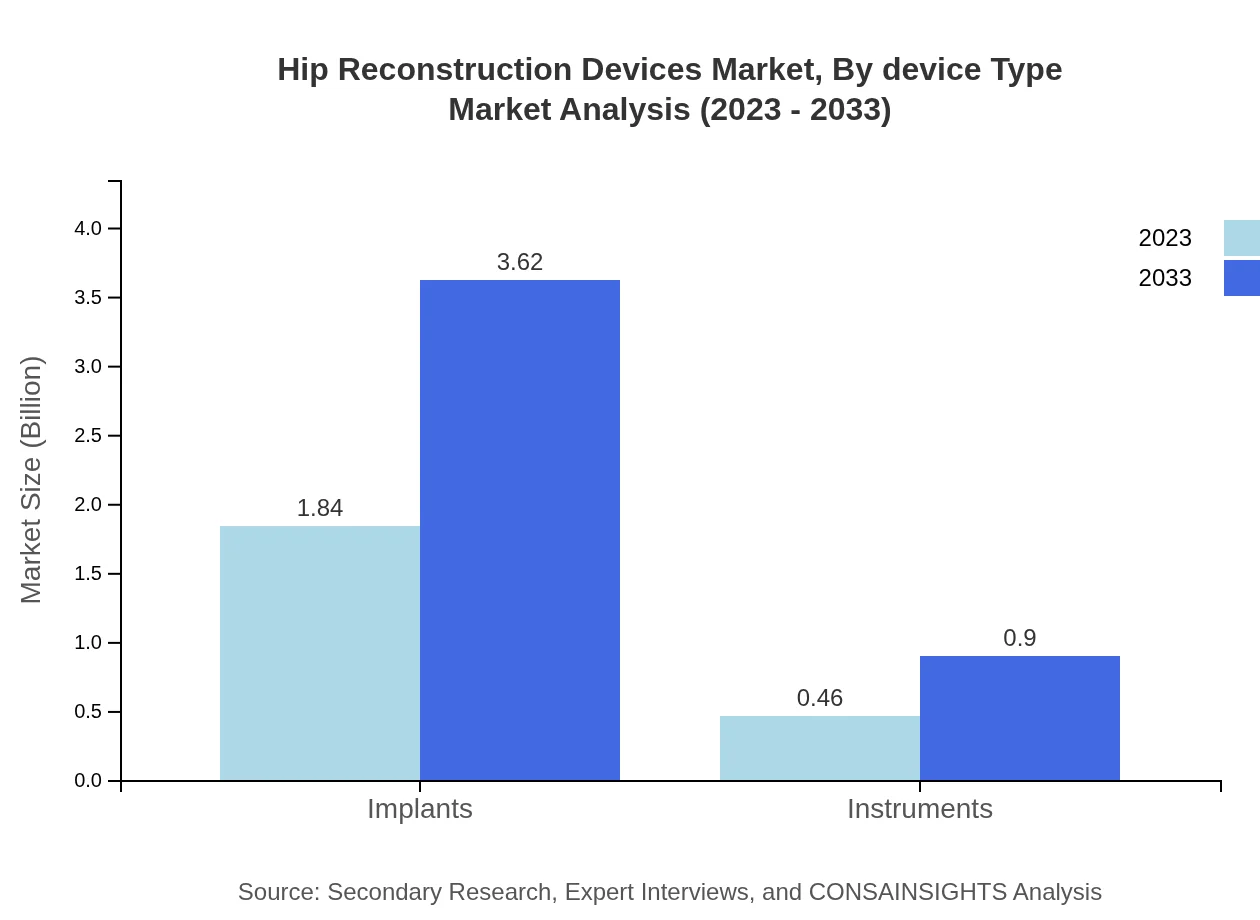

Hip Reconstruction Devices Market Analysis By Device Type

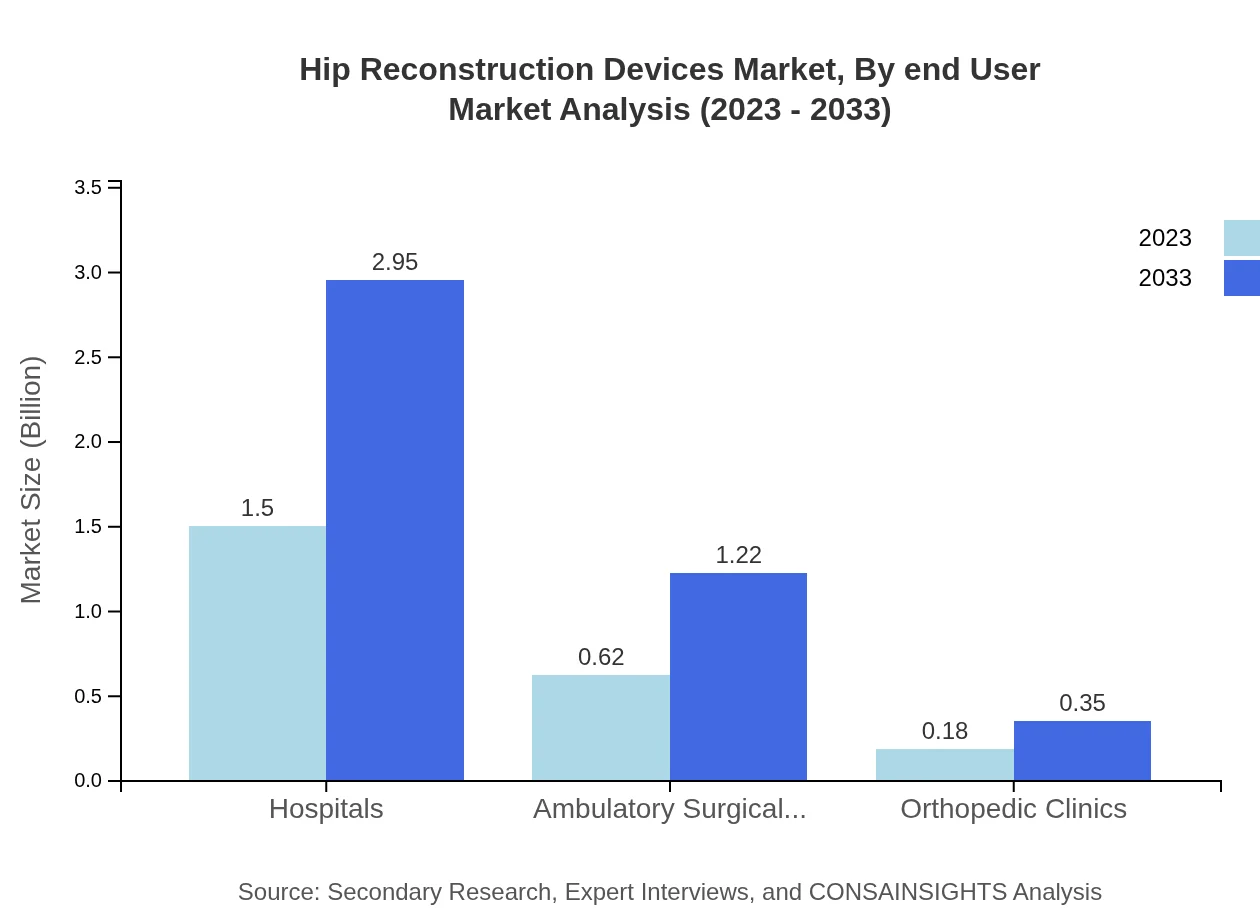

In 2023, the Hospitals segment leads with a market size of $1.50 billion, increasing to $2.95 billion by 2033, while other segments like Ambulatory Surgical Centers and Orthopedic Clinics also exhibit significant growth. Specifically, Ambulatory Surgical Centers are projected to grow from $0.62 billion to $1.22 billion, and Orthopedic Clinics from $0.18 billion to $0.35 billion.

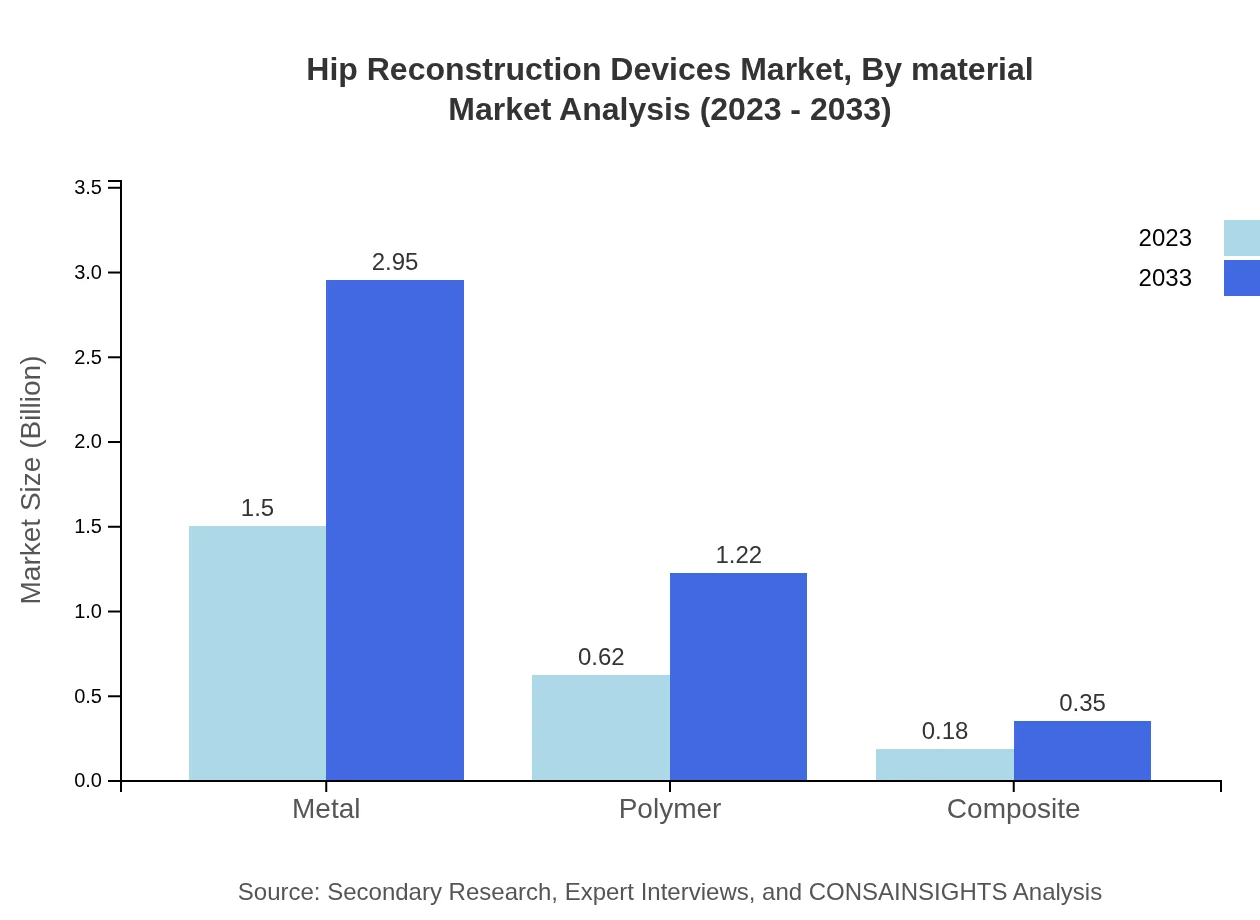

Hip Reconstruction Devices Market Analysis By Material

The market by material shows that Metal dominates with a market size of $1.50 billion in 2023, projected to double by 2033. Polymer devices lead in innovation and patient acceptance, with sizes of $0.62 billion to $1.22 billion. Composite materials capture niche applications with an increase from $0.18 billion to $0.35 billion.

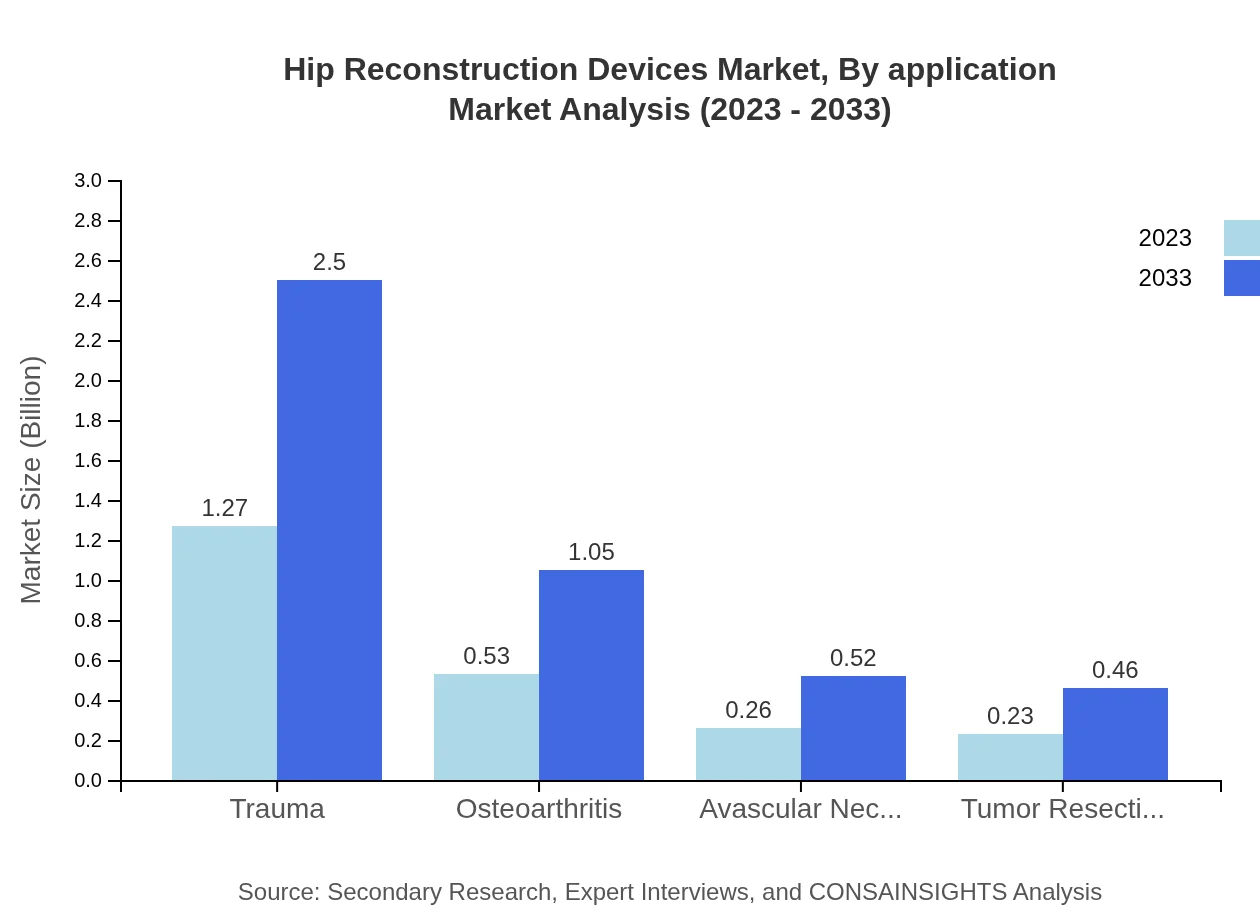

Hip Reconstruction Devices Market Analysis By Application

Trauma as an application leads with a market share of 55.34% in 2023 (size of $1.27 billion). Osteoarthritis follows with significant growth potential from $0.53 billion in 2023 to $1.05 billion in 2033, reflecting the increasing aging population's needs.

Hip Reconstruction Devices Market Analysis By End User

Hospitals currently constitute the largest share of the market (65.3%), anticipated to maintain this position throughout the forecast period. Ambulatory Surgical Centers and Orthopedic Clinics are also expected to grow, serving the rising patient volume.

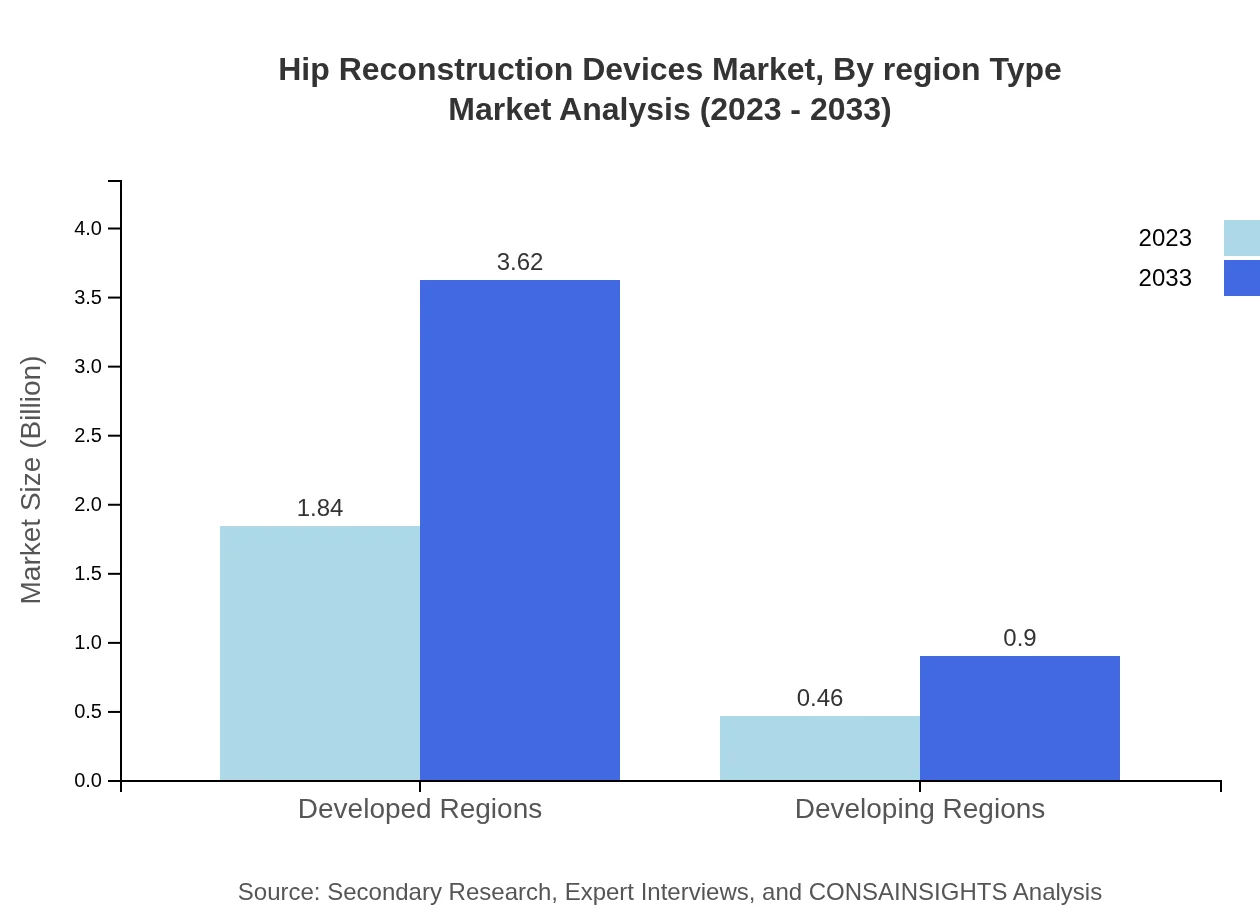

Hip Reconstruction Devices Market Analysis By Region Type

Developed regions, particularly North America and Europe, dominate with a combined market size projected to reach $5.20 billion by 2033. Developing regions also show promise with growth from $0.46 billion to $0.90 billion, driven by increasing healthcare investments.

Hip Reconstruction Devices Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Hip Reconstruction Devices Industry

Johnson & Johnson:

A leading player in the orthopedic industry, contributing significantly through innovation in hip reconstruction technologies and extensive global distribution.Stryker Corporation:

Known for its advanced implants and surgical instruments, Stryker leads the market with a strong portfolio that enhances surgical outcomes.Zimmer Biomet:

A pioneer in joint replacement and hip reconstruction, Zimmer Biomet focuses on research and development to improve device performance.DePuy Synthes:

A subsidiary of Johnson & Johnson, expertly delivering tailored orthopedic solutions including a range of hip reconstruction devices.We're grateful to work with incredible clients.

FAQs

What is the market size of hip Reconstruction Devices?

The global hip reconstruction devices market is valued at approximately $2.3 billion in 2023. It is projected to grow at a CAGR of 6.8% over the next decade, indicating a significant expansion in demand and development in this sector.

What are the key market players or companies in this hip Reconstruction Devices industry?

The hip reconstruction devices market includes major players such as DePuy Synthes, Stryker Corporation, Zimmer Biomet, Smith & Nephew, and Medtronic. These companies have established a strong presence through innovation and strategic partnerships.

What are the primary factors driving the growth in the hip reconstruction devices industry?

Key factors driving market growth include the rising incidence of hip-related conditions such as osteoarthritis and avascular necrosis, advancements in surgical techniques, and an increasing aging population requiring orthopedic interventions.

Which region is the fastest Growing in the hip reconstruction devices market?

North America is forecasted to be the fastest-growing region, expanding from $0.81 billion in 2023 to $1.59 billion by 2033. Europe and Asia Pacific also show rapid growth due to healthcare advancements and increasing patient awareness.

Does ConsaInsights provide customized market report data for the hip reconstruction devices industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs in the hip reconstruction devices industry, including detailed analysis on market size, trends, and competitive landscape.

What deliverables can I expect from this hip reconstruction devices market research project?

Deliverables typically include an executive summary, comprehensive market analysis, competitive landscape review, segmentation analysis, and forecasted growth data, along with actionable insights tailored to your strategic needs.

What are the market trends of hip reconstruction devices?

Market trends include increased adoption of minimally invasive surgical techniques, innovation in implant materials, and a focus on patient-centered care. Additionally, telehealth practices are emerging as part of pre- and post-operative management.