Hip Replacement Devices Market Report

Published Date: 31 January 2026 | Report Code: hip-replacement-devices

Hip Replacement Devices Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Hip Replacement Devices market, including market size, growth trends, and analysis by region and segment. Insights provided will cover the forecast period from 2023 to 2033.

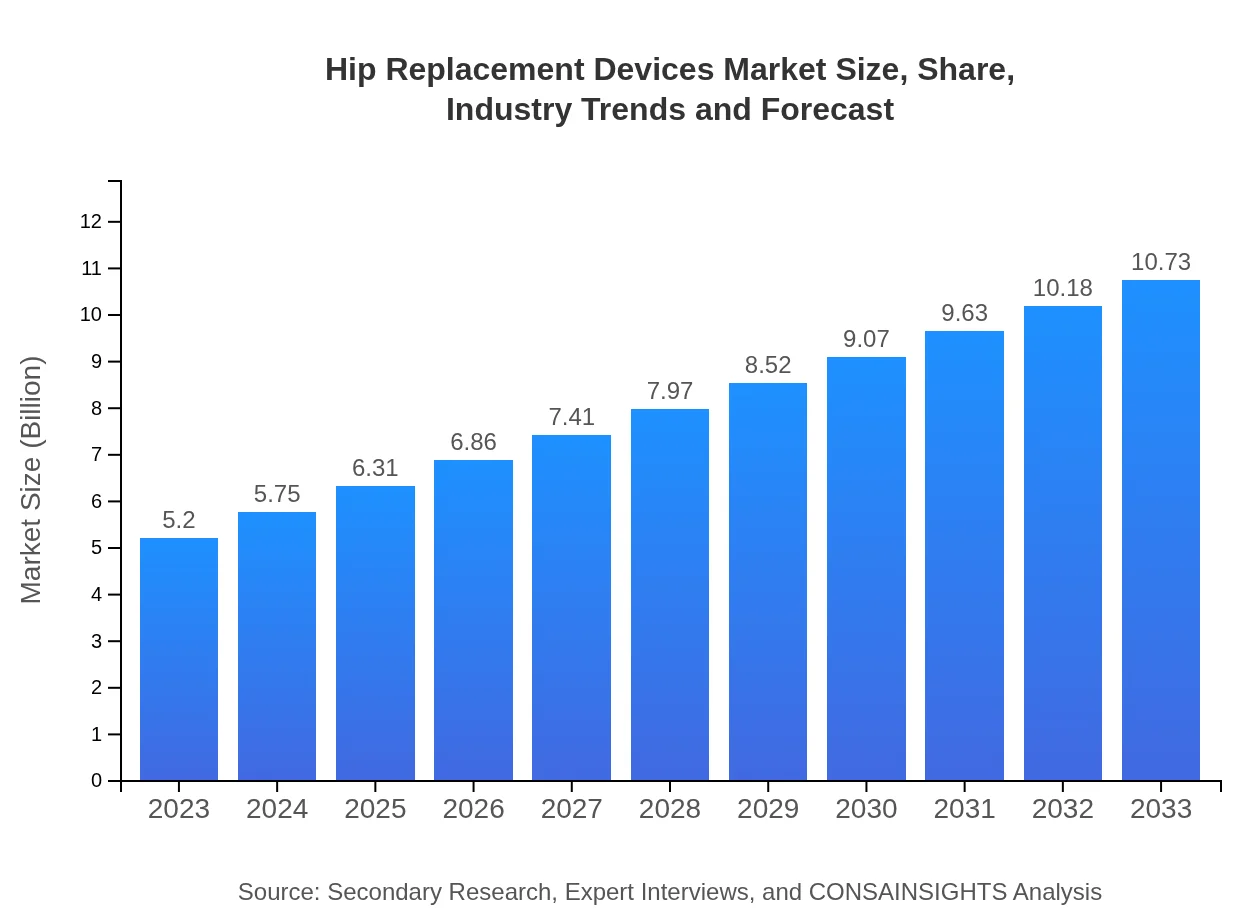

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.20 Billion |

| CAGR (2023-2033) | 7.3% |

| 2033 Market Size | $10.73 Billion |

| Top Companies | DePuy Synthes (Johnson & Johnson), Stryker Corporation, Zimmer Biomet, Smith & Nephew, B. Braun |

| Last Modified Date | 31 January 2026 |

Hip Replacement Devices Market Overview

Customize Hip Replacement Devices Market Report market research report

- ✔ Get in-depth analysis of Hip Replacement Devices market size, growth, and forecasts.

- ✔ Understand Hip Replacement Devices's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Hip Replacement Devices

What is the Market Size & CAGR of Hip Replacement Devices market in 2023?

Hip Replacement Devices Industry Analysis

Hip Replacement Devices Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Hip Replacement Devices Market Analysis Report by Region

Europe Hip Replacement Devices Market Report:

Europe is forecasted to experience a substantial increase in the hip replacement market, growing from $1.50 billion in 2023 to $3.09 billion by 2033. Factors such as a well-established healthcare system, adoption of advanced surgical techniques, and increasing life expectancy contribute to this region’s growth.Asia Pacific Hip Replacement Devices Market Report:

The Asia Pacific region is expected to witness significant growth in the hip replacement devices market, with market size estimated to reach $2.05 billion by 2033. Factors driving growth include increasing geriatric populations, improved healthcare infrastructure, and rising awareness about advanced hip surgeries across countries like China and India.North America Hip Replacement Devices Market Report:

North America remains a dominant player in the hip replacement devices market, projected to rise to $3.98 billion by 2033. The increase in orthopedic surgeries, a high prevalence of joint disorders, and continuous product innovations by leading companies substantiate the market's robust growth.South America Hip Replacement Devices Market Report:

In South America, the hip replacement devices market is poised for steady growth, anticipated to reach $0.95 billion by 2033. The demand is primarily fueled by rising healthcare investment and the expansion of access to orthopedic surgical options in countries like Brazil and Argentina.Middle East & Africa Hip Replacement Devices Market Report:

The Middle East and Africa region is anticipated to see gradual growth in hip replacement devices, reaching $0.67 billion by 2033. This growth is supported by ongoing healthcare improvement initiatives and an increasing number of healthcare facilities offering orthopedic services.Tell us your focus area and get a customized research report.

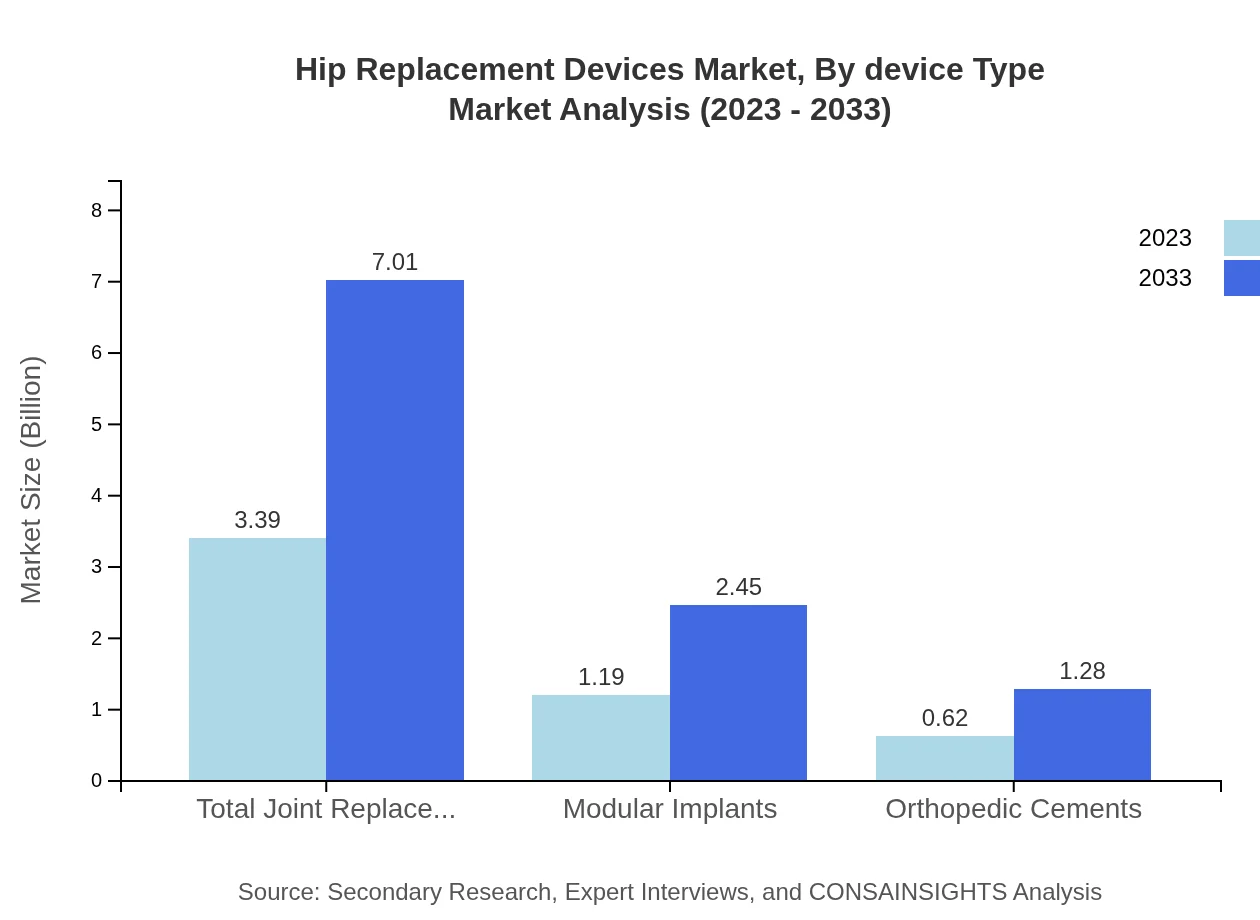

Hip Replacement Devices Market Analysis By Device Type

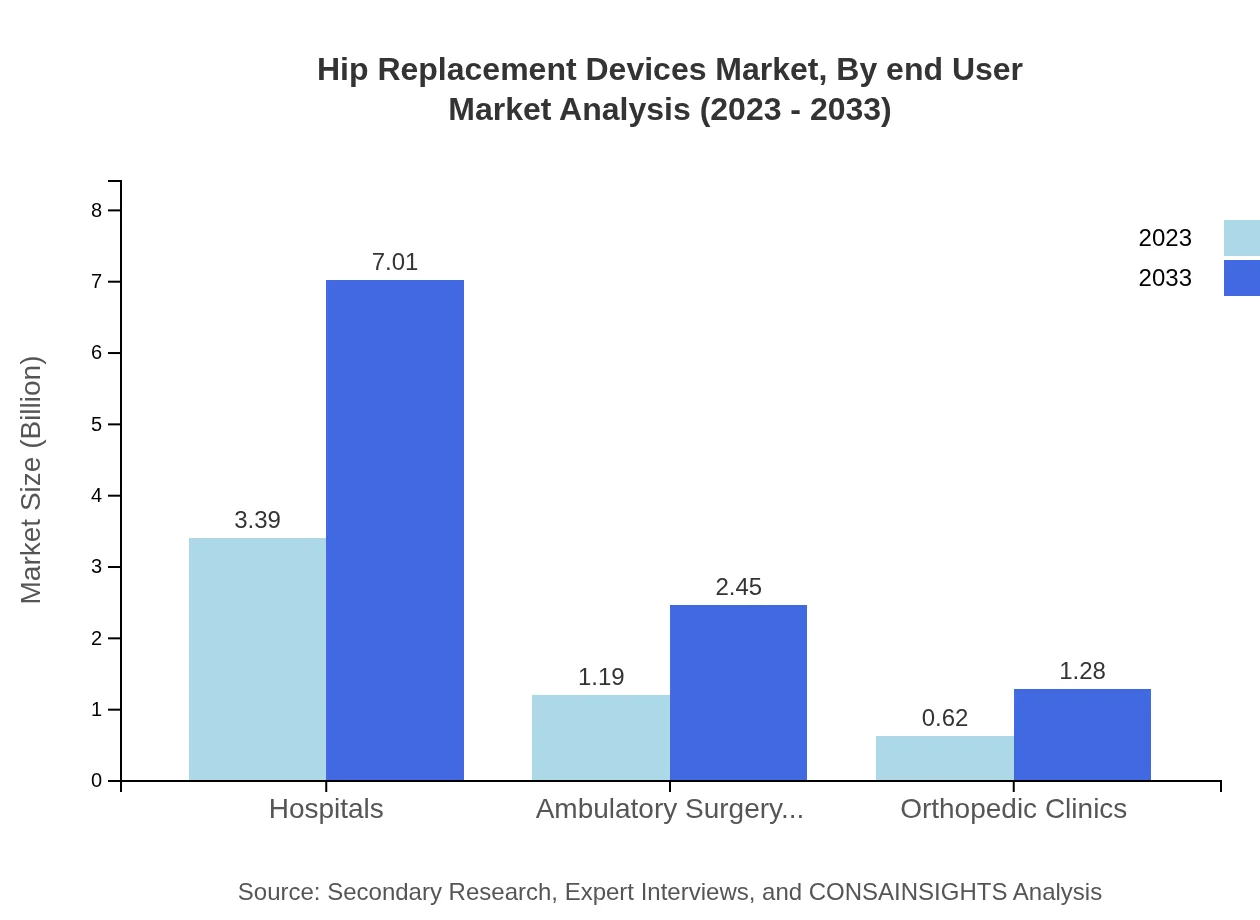

The market for hip replacement devices is significantly influenced by device types, with total joint replacements being the largest segment, accounting for approximately 65.28% of the market share in 2023. Hospitals are the primary end-users, with a market size projected to grow from $3.39 billion in 2023 to $7.01 billion by 2033, demonstrating the segment's critical role in the overall market strategy.

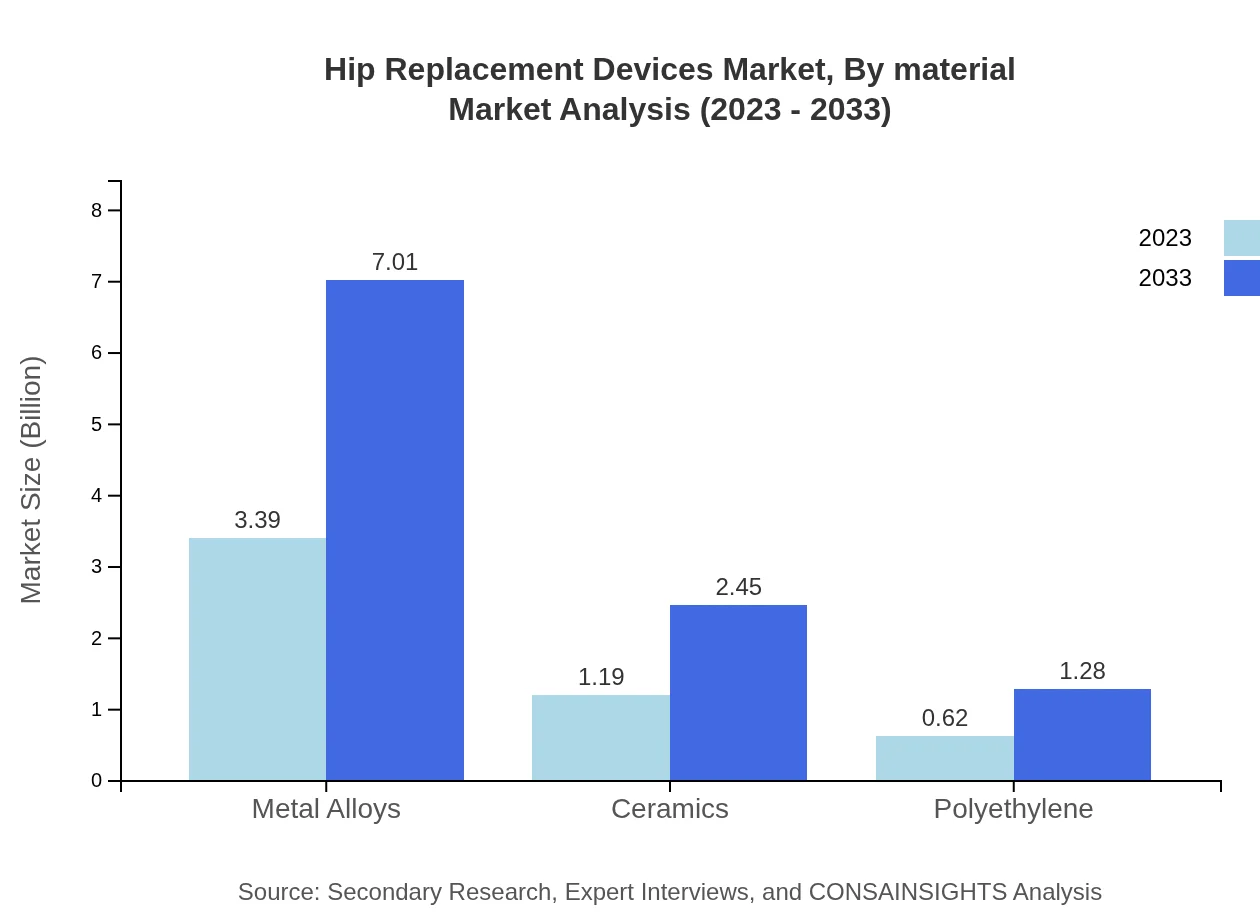

Hip Replacement Devices Market Analysis By Material

With material choice being pivotal in implant performance, metal alloys dominate the share, constituting 65.28% in 2023. This segment is expected to grow significantly due to their durability and strength, with projections of climbing to $7.01 billion by 2033. The ceramic and polyethylene segments also show promise, combining biocompatibility and wear resistance.

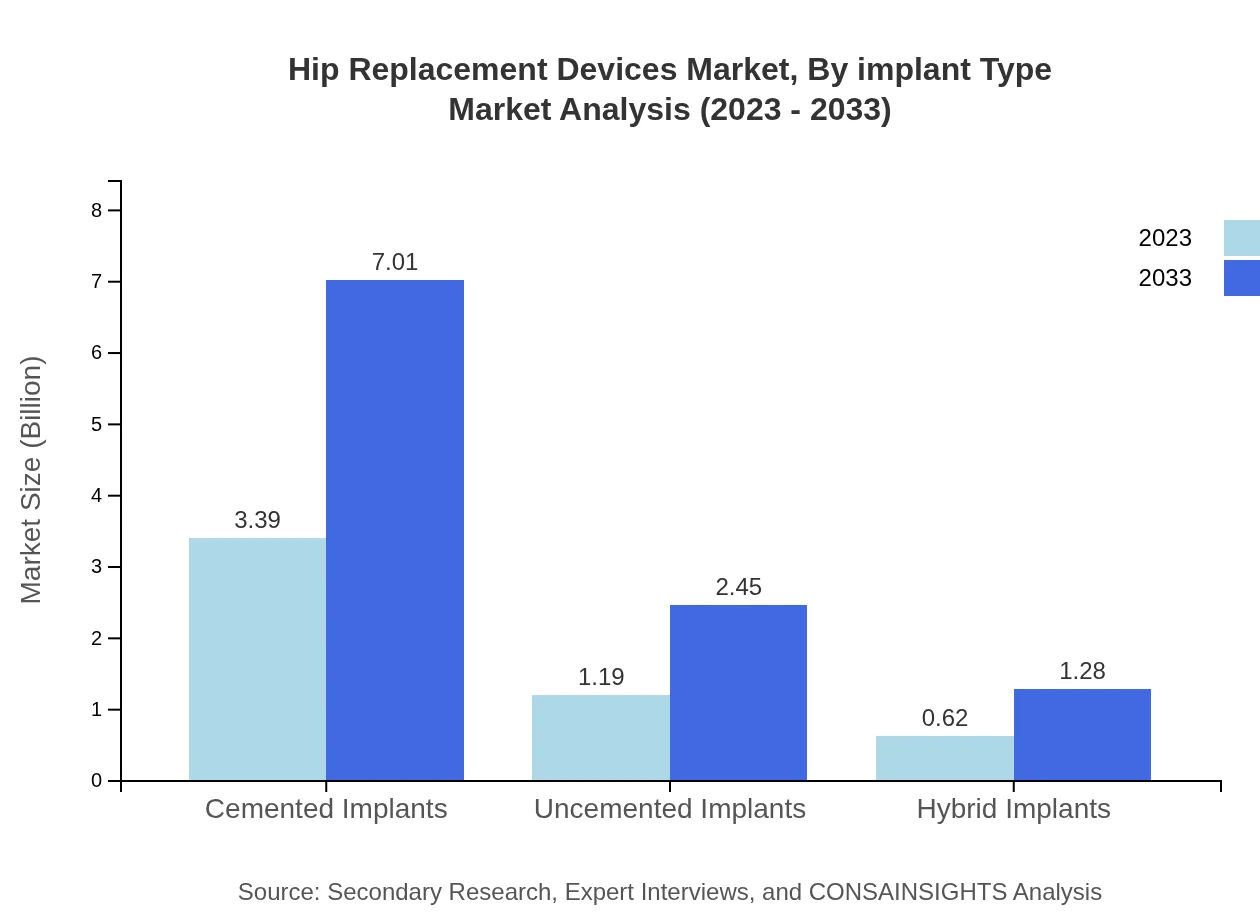

Hip Replacement Devices Market Analysis By Implant Type

Within the implant type segment, cemented implants are leading in both market size and share, estimated to account for a substantial portion of the market due to their wide acceptance. Uncemented and hybrid implants are gaining traction, with expected growth as surgeons increasingly favor options that promote bone integration.

Hip Replacement Devices Market Analysis By End User

The end-user segment is heavily dominated by hospitals, which will maintain a 65.28% share through 2033. Ambulatory surgery centers are also becoming increasingly relevant, reflecting a shift towards outpatient procedures that lower healthcare costs and enhance patient recovery experiences.

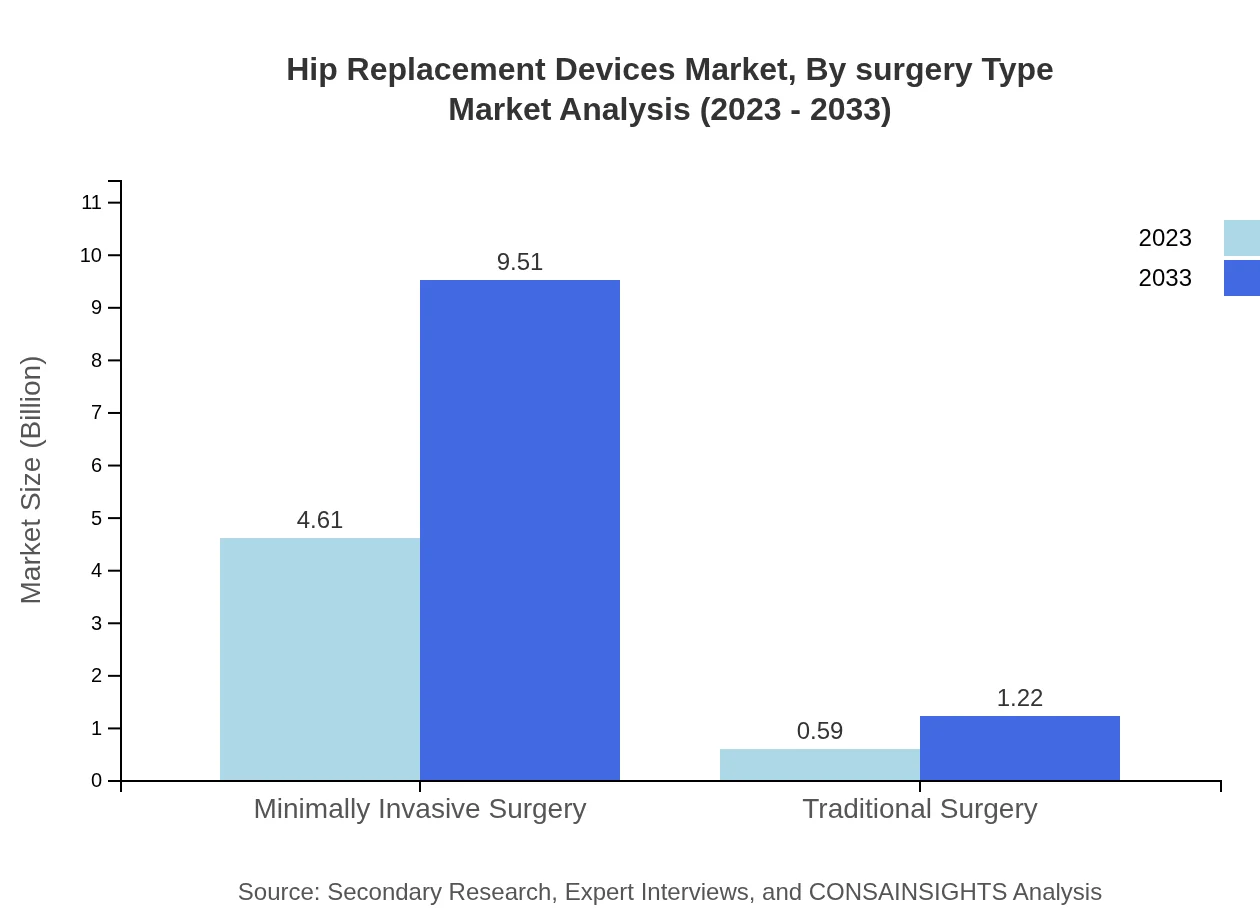

Hip Replacement Devices Market Analysis By Surgery Type

Minimally invasive surgeries are expected to capture the largest share of the surgery type market, accounting for 88.63% in 2023, as these techniques lead to shorter recovery times and reduced postoperative discomfort. Traditional surgery methods, despite declining popularity, will also play a role in specific cases.

Hip Replacement Devices Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Hip Replacement Devices Industry

DePuy Synthes (Johnson & Johnson):

A major player in orthopedic solutions, DePuy Synthes specializes in advanced hip and knee replacement devices and continuous innovation in surgical techniques.Stryker Corporation:

Known for its comprehensive range of orthopedic products, Stryker focuses on developing cutting-edge hip implants enhanced by minimally invasive surgical approaches.Zimmer Biomet:

Zimmer Biomet offers a wide range of hip replacement devices, focusing on improving patient outcomes through innovative product offerings and surgical solutions.Smith & Nephew:

With a robust portfolio in sports medicine and advanced wound management, Smith & Nephew also plays a significant role in the hip replacement market with effective implant solutions.B. Braun:

A key player in the healthcare industry, B. Braun offers advanced orthopedic solutions that target minimally invasive surgery and effective patient care strategies.We're grateful to work with incredible clients.

FAQs

What is the market size of hip Replacement Devices?

The global market size for hip replacement devices is valued at approximately $5.2 billion in 2023 and is projected to grow at a CAGR of 7.3%, expected to reach significant market potential by 2033.

What are the key market players or companies in this hip Replacement Devices industry?

Key players in the hip replacement devices industry include major manufacturers such as Smith & Nephew, Stryker Corporation, Zimmer Biomet, and DePuy Synthes, who are leading in innovation and market share.

What are the primary factors driving the growth in the hip Replacement Devices industry?

The growth of the hip replacement devices industry is primarily driven by the increasing aging population, rising prevalence of hip-related disorders, and advancements in surgical techniques and implant technologies that enhance patient outcomes.

Which region is the fastest Growing in the hip Replacement Devices?

The Asia-Pacific region is the fastest-growing market for hip replacement devices, projected to grow from $0.99 billion in 2023 to $2.05 billion by 2033, reflecting a rising demand for orthopedic interventions.

Does ConsaInsights provide customized market report data for the hip Replacement Devices industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the hip replacement devices industry, providing insights that support strategic decision-making for stakeholders.

What deliverables can I expect from this hip Replacement Devices market research project?

Deliverables from the hip replacement devices market research project typically include detailed market analysis reports, growth forecasts, competitive landscape overviews, and segmentation insights tailored for informed business strategies.

What are the market trends of hip Replacement Devices?

Current trends in the hip replacement devices market include a shift towards minimally invasive surgical techniques, increased use of advanced biomaterials, and customization of implants to improve functionality and patient satisfaction.