Hip Replacement Market Report

Published Date: 31 January 2026 | Report Code: hip-replacement

Hip Replacement Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report examines the Hip Replacement market from 2023 to 2033, offering insights into market size, trends, competitive landscape, and regional analysis, providing stakeholders with vital information for strategic decision-making.

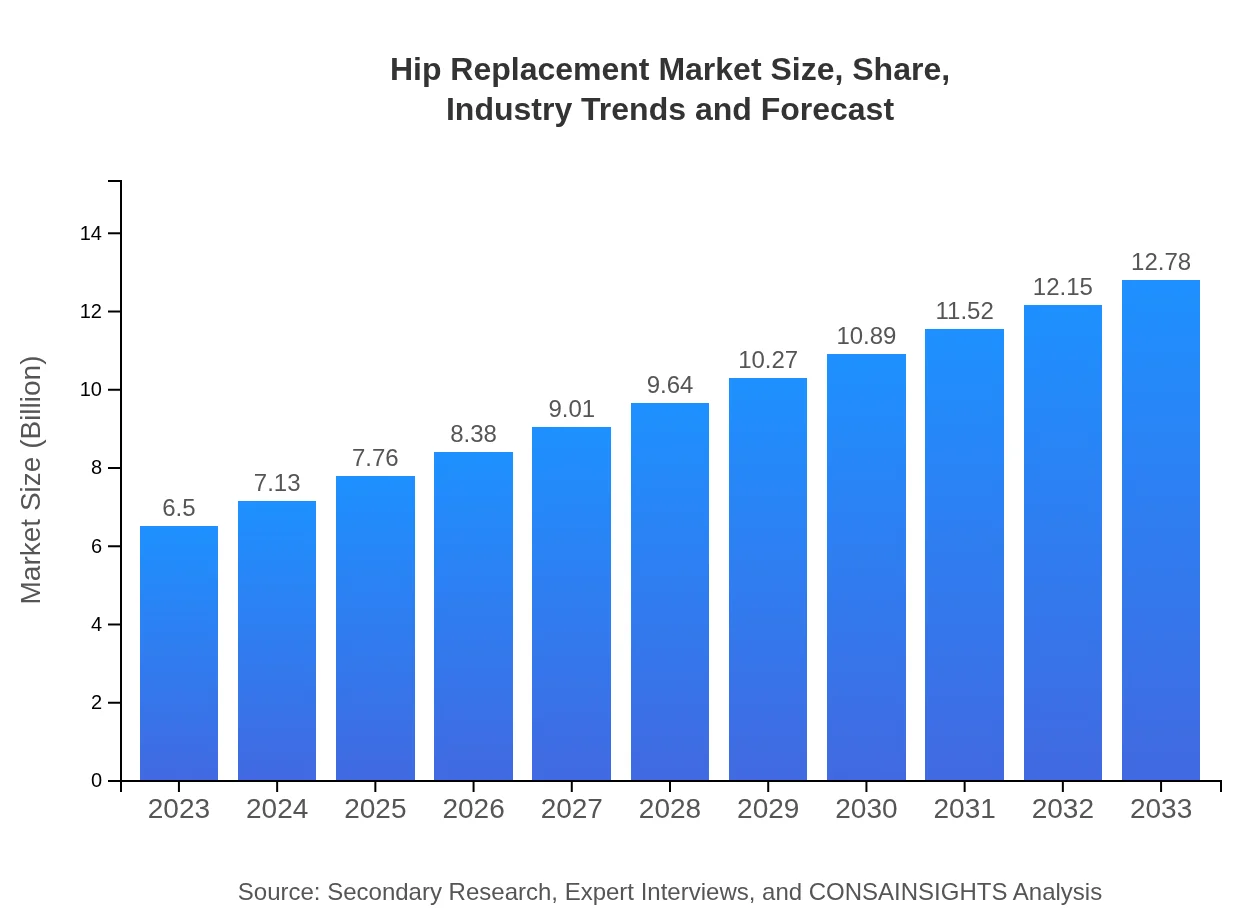

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $6.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $12.78 Billion |

| Top Companies | Johnson & Johnson, Stryker Corporation, Zimmer Biomet |

| Last Modified Date | 31 January 2026 |

Hip Replacement Market Overview

Customize Hip Replacement Market Report market research report

- ✔ Get in-depth analysis of Hip Replacement market size, growth, and forecasts.

- ✔ Understand Hip Replacement's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Hip Replacement

What is the Market Size & CAGR of Hip Replacement market in 2023?

Hip Replacement Industry Analysis

Hip Replacement Market Segmentation and Scope

Tell us your focus area and get a customized research report.

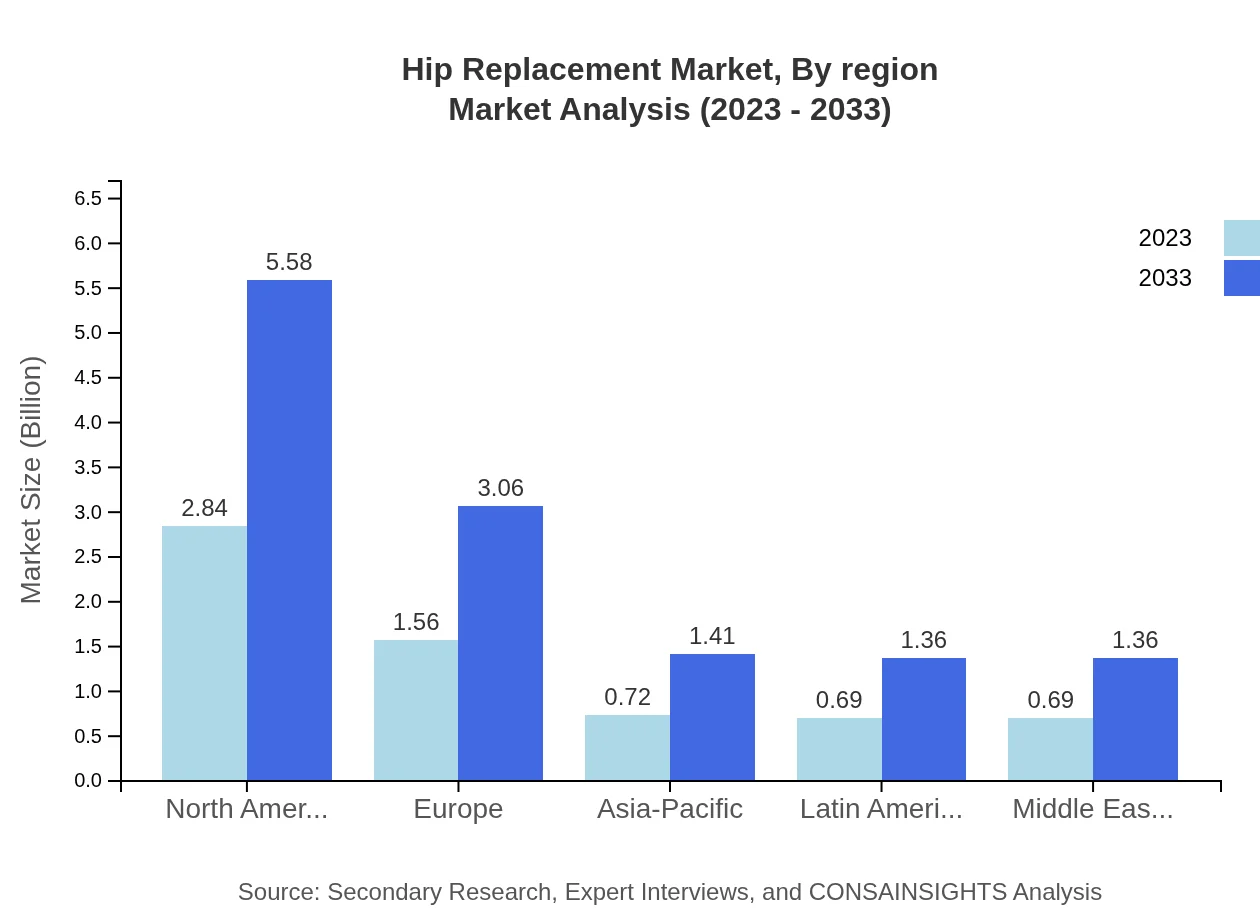

Hip Replacement Market Analysis Report by Region

Europe Hip Replacement Market Report:

The European hip replacement market is expected to grow from $2.03 billion in 2023 to $3.98 billion by 2033, significantly aided by technologically advanced healthcare practices and supportive government policies.Asia Pacific Hip Replacement Market Report:

In the Asia Pacific region, the hip replacement market size reached $1.04 billion in 2023 and is expected to grow to $2.05 billion by 2033, driven by an increasing elderly population and advancements in healthcare technologies.North America Hip Replacement Market Report:

North America leads the global market with a size of $2.50 billion anticipated to reach $4.91 billion by 2033. The region benefits from well-established healthcare systems and high acceptance rates of surgical procedures.South America Hip Replacement Market Report:

The South America market, valued at $0.61 billion in 2023, is projected to expand to $1.19 billion by 2033 as healthcare services improve and awareness of hip replacement procedures rises.Middle East & Africa Hip Replacement Market Report:

The Middle East and Africa market size, currently at $0.33 billion, is projected to increase to $0.64 billion by 2033, driven by improvements in healthcare infrastructure and rising consumer awareness.Tell us your focus area and get a customized research report.

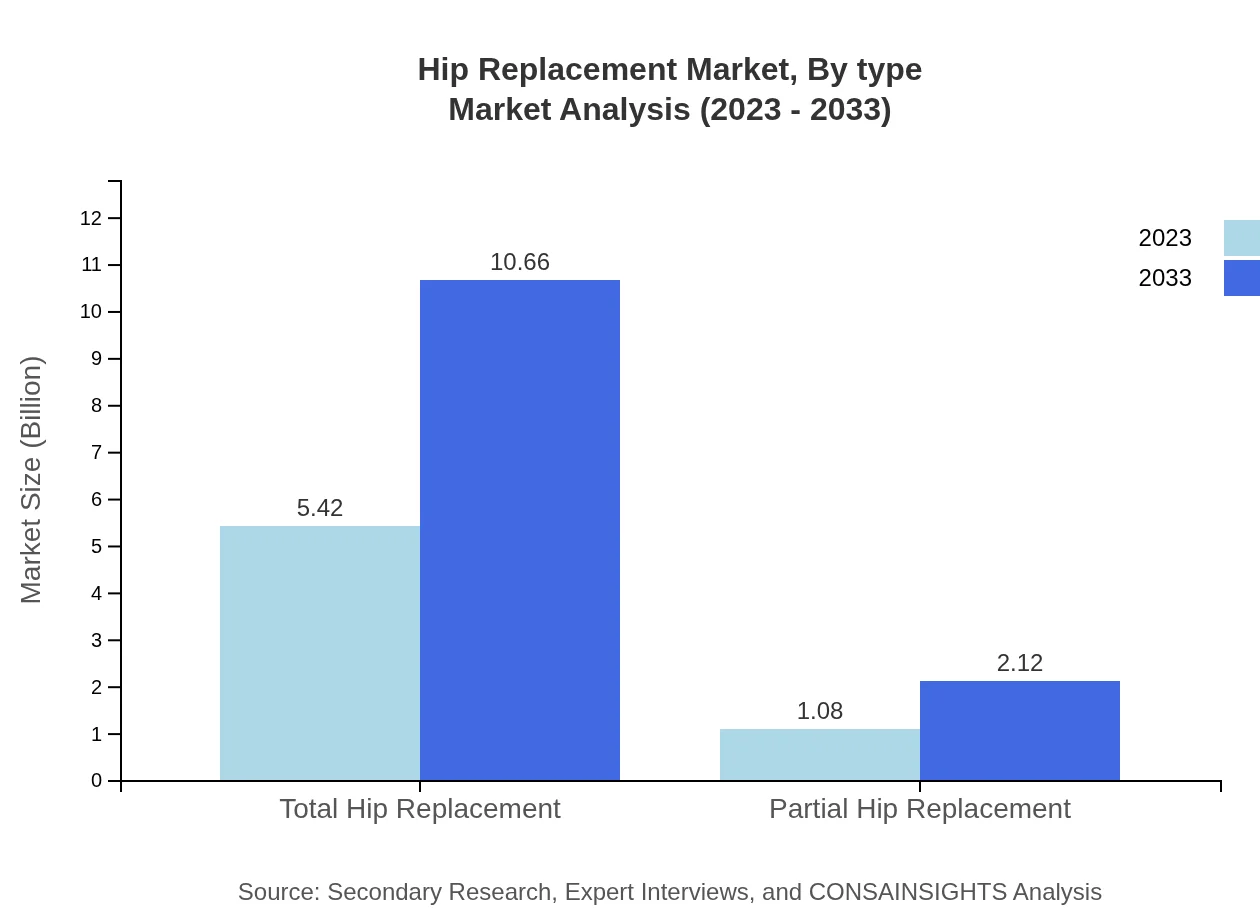

Hip Replacement Market Analysis By Type

The hip replacement market is primarily segmented into total hip replacement and partial hip replacement. Total hip replacement accounts for a revenue of $5.42 billion in 2023, projected to rise to $10.66 billion by 2033, securing an 83.42% market share throughout the forecast period.

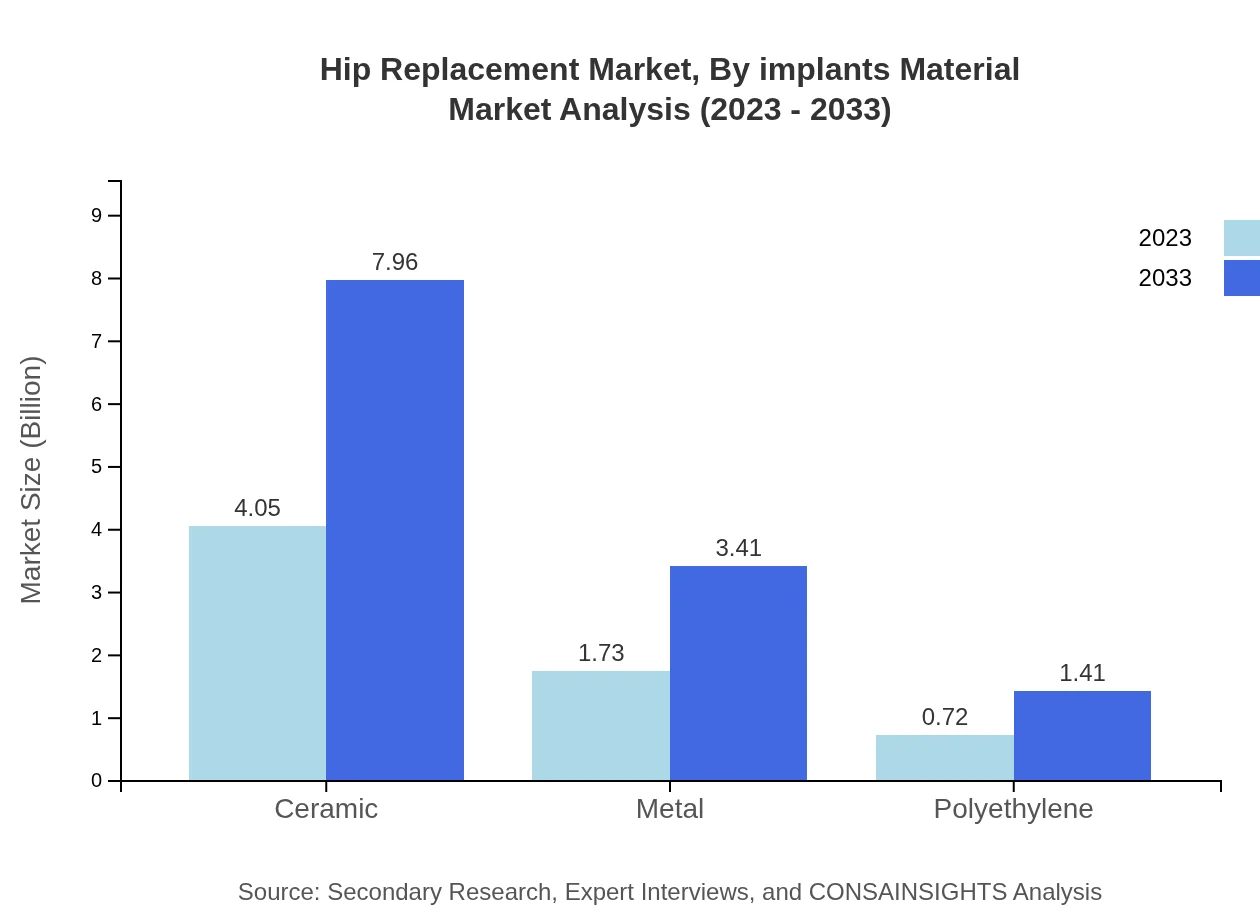

Hip Replacement Market Analysis By Implants Material

Implant materials are a major factor influencing market performance, predominantly using ceramic, metal, and polyethylene. Ceramic implants, valued at $4.05 billion in 2023, are expected to grow to $7.96 billion in 2033, capturing 62.29% of the total market share.

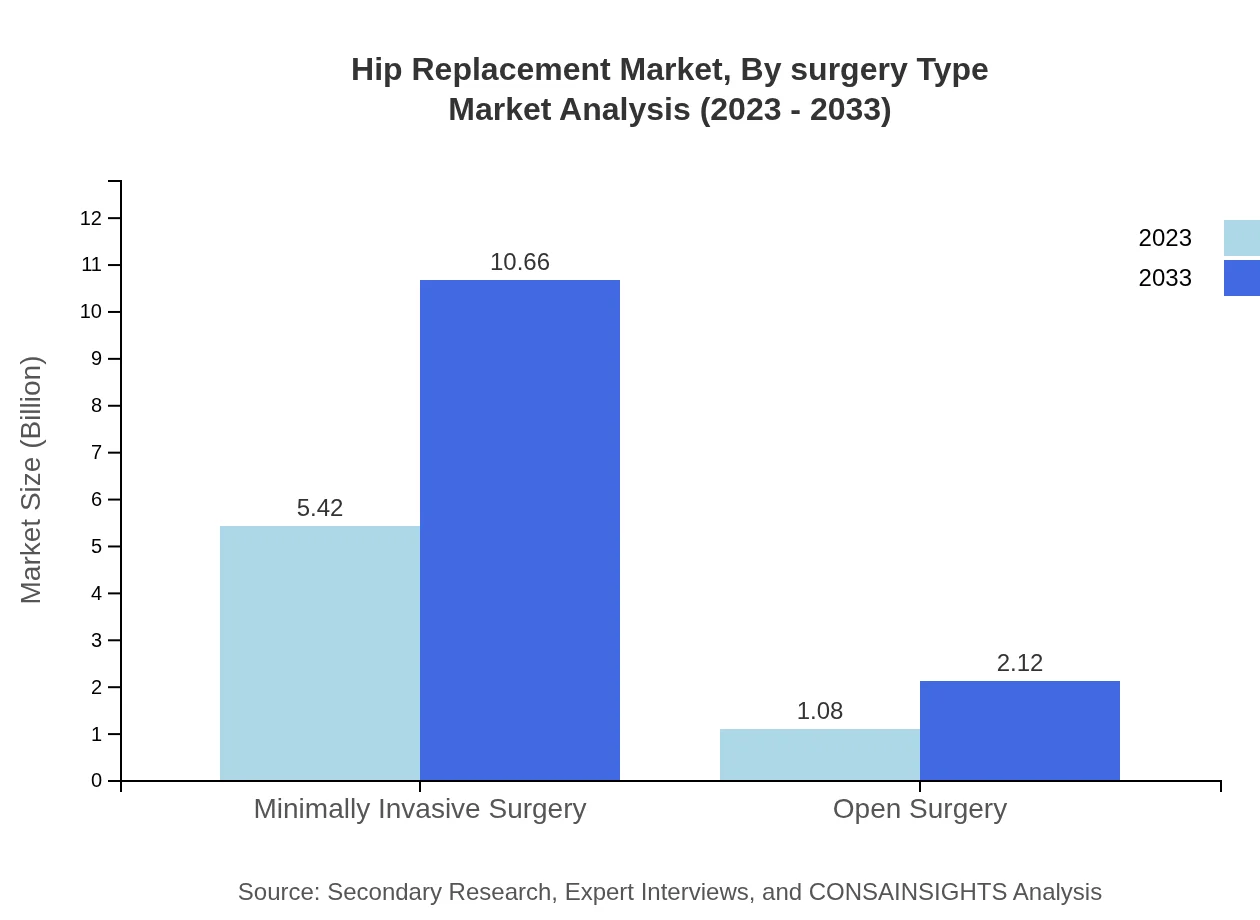

Hip Replacement Market Analysis By Surgery Type

The market is also differentiated by surgery types, including minimally invasive surgery and open surgery. Minimally invasive techniques are forecasted to increase from $5.42 billion in 2023 to $10.66 billion by 2033, consistently maintaining an 83.42% share.

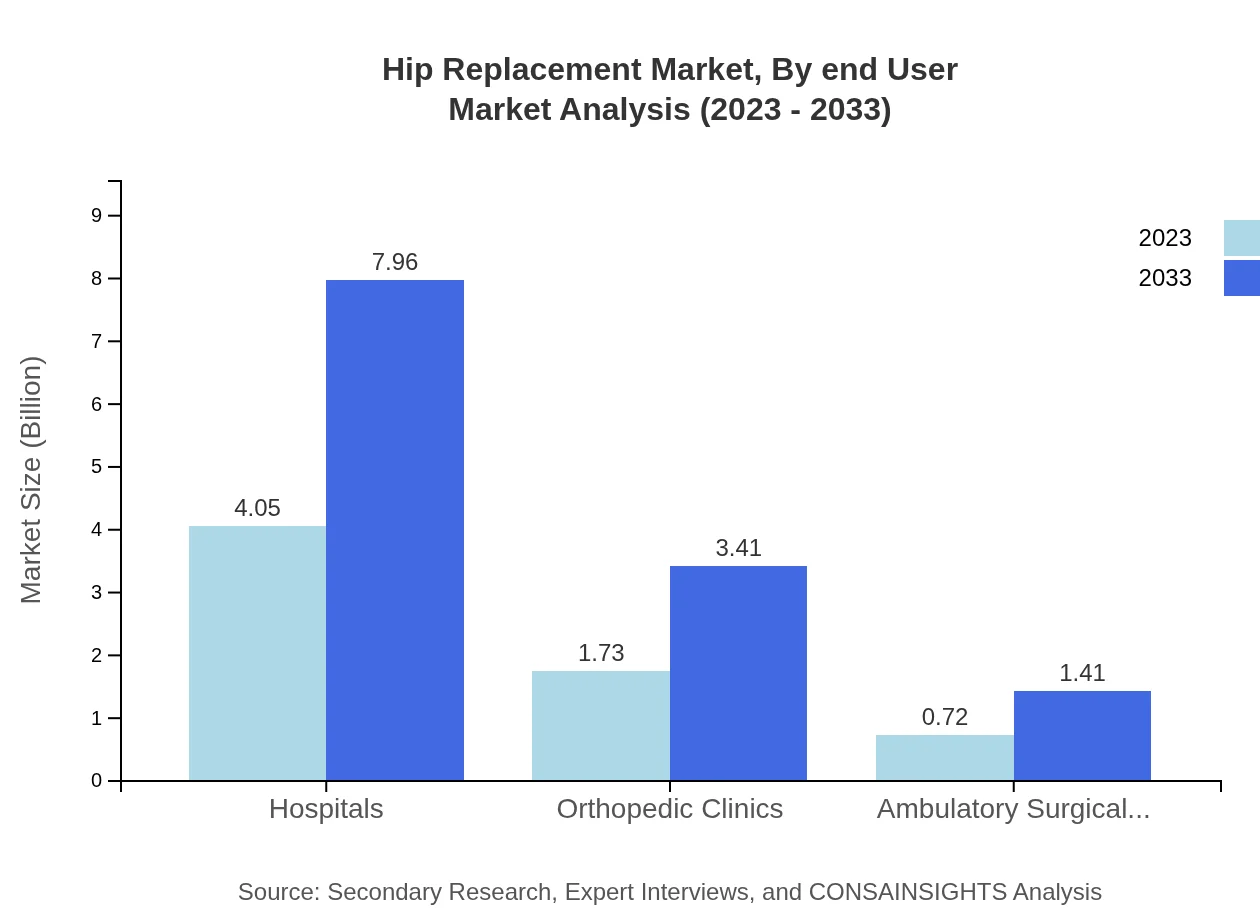

Hip Replacement Market Analysis By End User

Hospitals are the predominant end-user in the hip replacement market, with a value of $4.05 billion in 2023, set to reach $7.96 billion by 2033, representing a 62.29% market share.

Hip Replacement Market Analysis By Region

The market demonstrates significant regional variances in size and growth, with North America leading, followed by Europe and Asia Pacific, driven by factors such as healthcare advancements and demographic shifts.

Hip Replacement Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Hip Replacement Industry

Johnson & Johnson:

A leading player with a strong portfolio in joint reconstruction and biologics, known for innovative products and strong market presence.Stryker Corporation:

Specializes in orthopedic implants and instruments, offering advanced solutions in hip replacement and recognized for commitment to quality.Zimmer Biomet:

Known for its comprehensive orthopedic solutions, Zimmer Biomet drives innovation in hip replacement throughout the globe.We're grateful to work with incredible clients.

FAQs

What is the market size of hip Replacement?

The hip replacement market size was valued at approximately $6.5 billion in 2023 and is projected to grow at a CAGR of 6.8%, reaching significant growth by 2033.

What are the key market players or companies in this hip Replacement industry?

Key players in the hip replacement market include multinational corporations and medical device manufacturers, which dominate various segments. They compete on innovation, product quality, pricing, and distribution strategies to capture market share.

What are the primary factors driving the growth in the hip Replacement industry?

Growth in the hip replacement industry is primarily driven by an aging population, increased prevalence of obesity, advancements in surgical techniques, and rising demand for minimally invasive surgery options.

Which region is the fastest Growing in the hip Replacement market?

The Asia Pacific region is projected to be the fastest-growing market for hip replacements, expected to grow from $1.04 billion in 2023 to $2.05 billion by 2033, highlighting increasing healthcare access.

Does ConsaInsights provide customized market report data for the hip Replacement industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs, providing in-depth analysis, insights, and data on various segments within the hip replacement industry.

What deliverables can I expect from this hip Replacement market research project?

Deliverables from the hip replacement market research project include comprehensive reports, market forecasts, competitive analysis, and actionable insights tailored to inform strategic decision-making.

What are the market trends of hip Replacement?

Current trends in the hip replacement market include the growing adoption of minimally invasive surgical techniques, increased demand for ceramic implants, and a focus on personalized orthopedic solutions.