Histology And Cytology Market Report

Published Date: 31 January 2026 | Report Code: histology-and-cytology

Histology And Cytology Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Histology and Cytology market for the forecast period from 2023 to 2033, delivering insights into market size, trends, technological advancements, and regional dynamics.

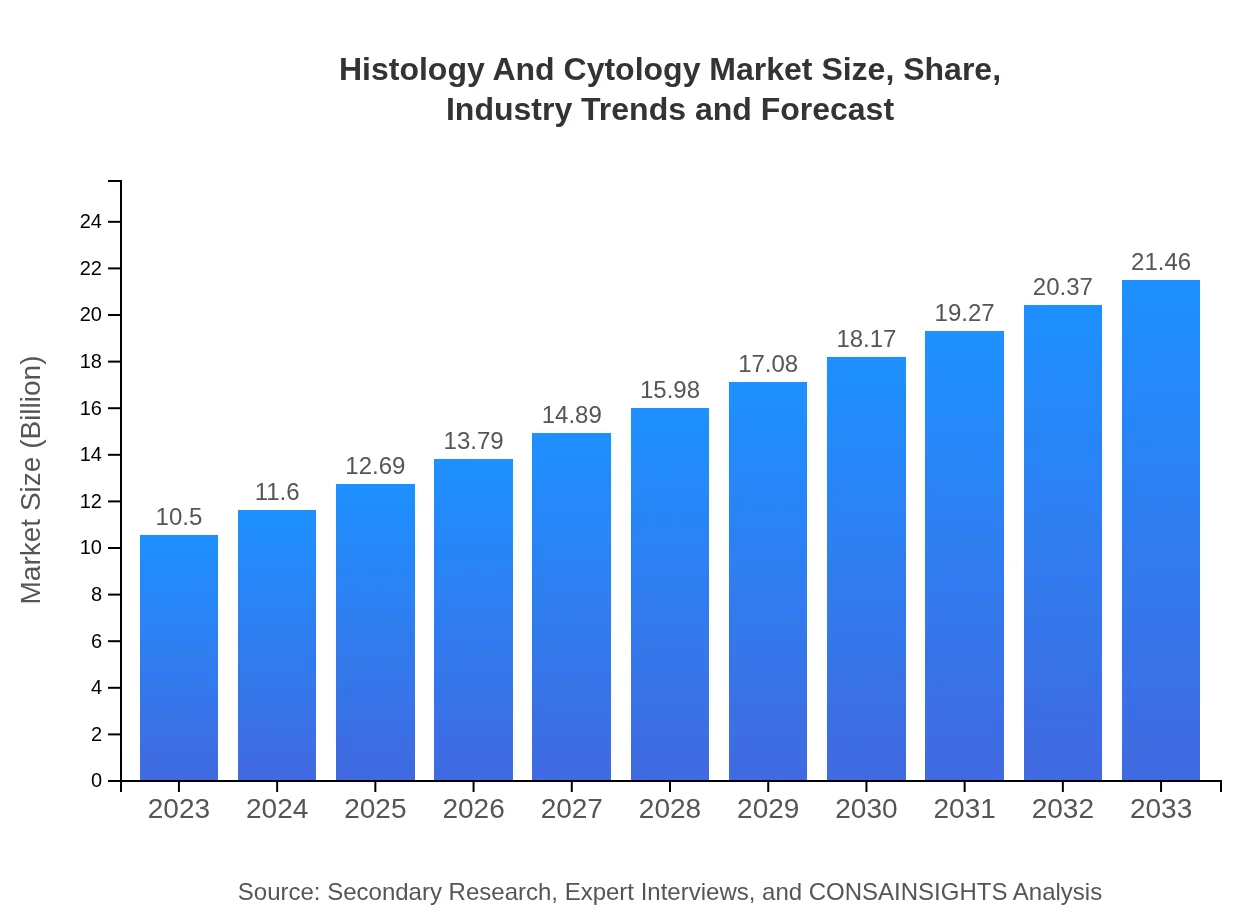

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $21.46 Billion |

| Top Companies | Thermo Fisher Scientific, Agilent Technologies, Merck Group, Roche Diagnostics, BD (Becton, Dickinson and Company) |

| Last Modified Date | 31 January 2026 |

Histology And Cytology Market Overview

Customize Histology And Cytology Market Report market research report

- ✔ Get in-depth analysis of Histology And Cytology market size, growth, and forecasts.

- ✔ Understand Histology And Cytology's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Histology And Cytology

What is the Market Size & CAGR of Histology And Cytology market in 2023?

Histology And Cytology Industry Analysis

Histology And Cytology Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Histology And Cytology Market Analysis Report by Region

Europe Histology And Cytology Market Report:

Europe's market is forecasted to grow from USD 2.62 billion in 2023 to USD 5.36 billion by 2033. The region benefits from strong regulatory support for innovative medical technologies, a large population of research and clinical laboratories, and increasing awareness regarding health screening.Asia Pacific Histology And Cytology Market Report:

The Asia-Pacific region is witnessing significant growth in the Histology and Cytology market, with a size estimated at USD 2.16 billion in 2023, expected to reach USD 4.42 billion by 2033. Factors driving this growth include increased healthcare investments, a growing patient population, and advancements in diagnostic technologies.North America Histology And Cytology Market Report:

In North America, the market size is expected to increase from USD 3.41 billion in 2023 to USD 6.98 billion in 2033. The expansion is driven by a high prevalence of chronic diseases, significant investments in research and development, and advanced healthcare facilities that adopt innovative diagnostic solutions.South America Histology And Cytology Market Report:

The South American market is projected to grow from USD 1.02 billion in 2023 to USD 2.08 billion in 2033. Growth in this region is primarily influenced by improving healthcare infrastructure, increased awareness regarding early disease detection, and rising governmental and private funding for healthcare.Middle East & Africa Histology And Cytology Market Report:

The Middle East and Africa market is projected to grow from USD 1.28 billion in 2023 to USD 2.62 billion in 2033. The growth in this region is helped by improvements in healthcare services, increased investments from both the public and private sectors, and expanding access to necessary medical technologies.Tell us your focus area and get a customized research report.

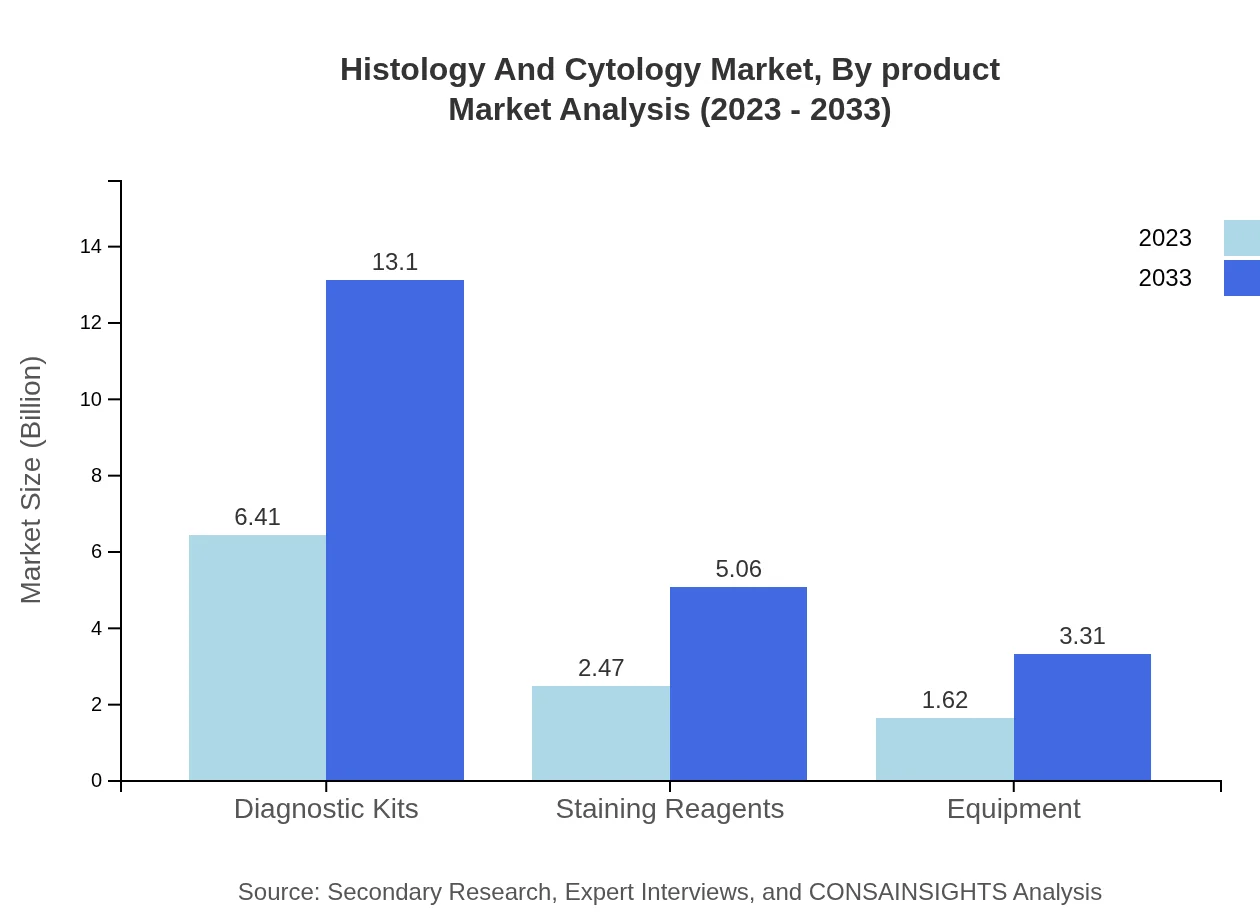

Histology And Cytology Market Analysis By Product

Diagnostic Kits dominate the Histology and Cytology market, estimated at USD 6.41 billion in 2023, and anticipated to grow to USD 13.10 billion by 2033, maintaining a market share of 61.03%. Staining reagents, crucial for specimen preparation, are valued at USD 2.47 billion in 2023 and expected to reach USD 5.06 billion in 2033 (23.56% market share), while the equipment segment is projected to increase from USD 1.62 billion to USD 3.31 billion during the same period, holding a 15.41% share.

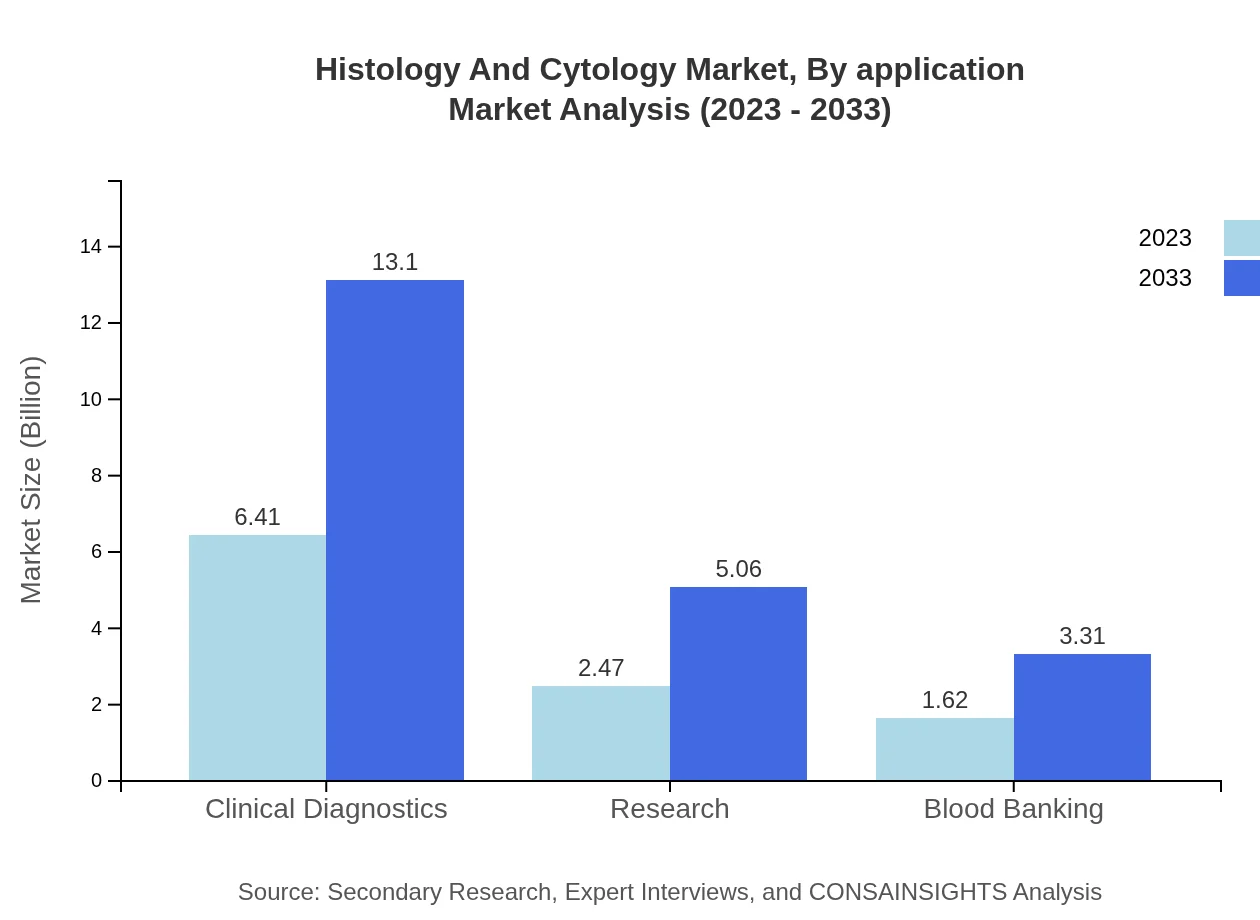

Histology And Cytology Market Analysis By Application

Key applications in the market include Clinical Diagnostics (USD 6.41 billion in 2023, rising to USD 13.10 billion by 2033) and Research (USD 2.47 billion in 2023, projected to reach USD 5.06 billion by 2033). Clinical Diagnostics continues to share a significant segment of 61.03% due to heightened demand for disease testing and monitoring.

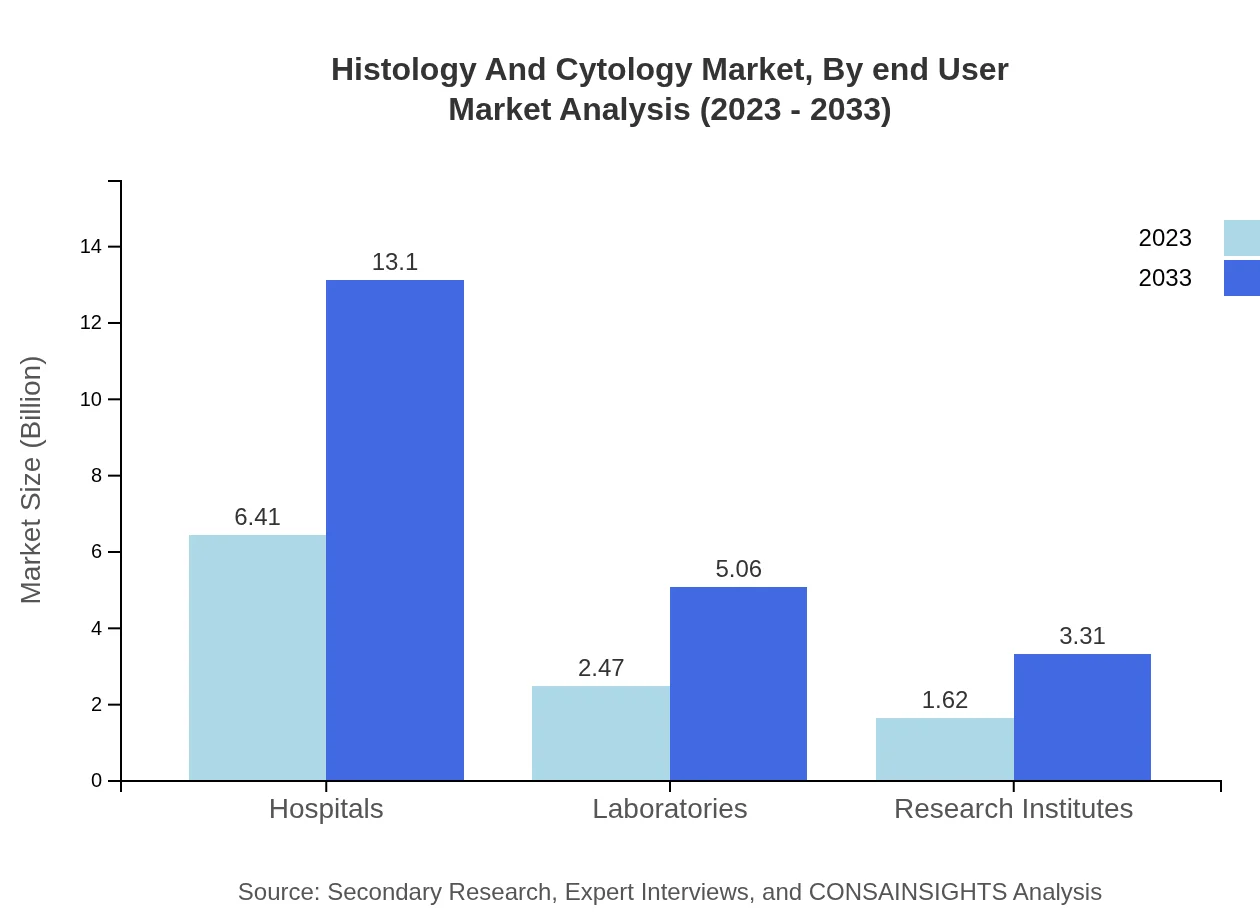

Histology And Cytology Market Analysis By End User

The major end-users in the Histology and Cytology market include Hospitals (USD 6.41 billion in 2023, forecasted to USD 13.10 billion by 2033) and Laboratories (USD 2.47 billion in 2023, expected to grow to USD 5.06 billion). Hospitals hold a substantial market share of 61.03%, reflecting the need for accurate and timely diagnostics in patient care.

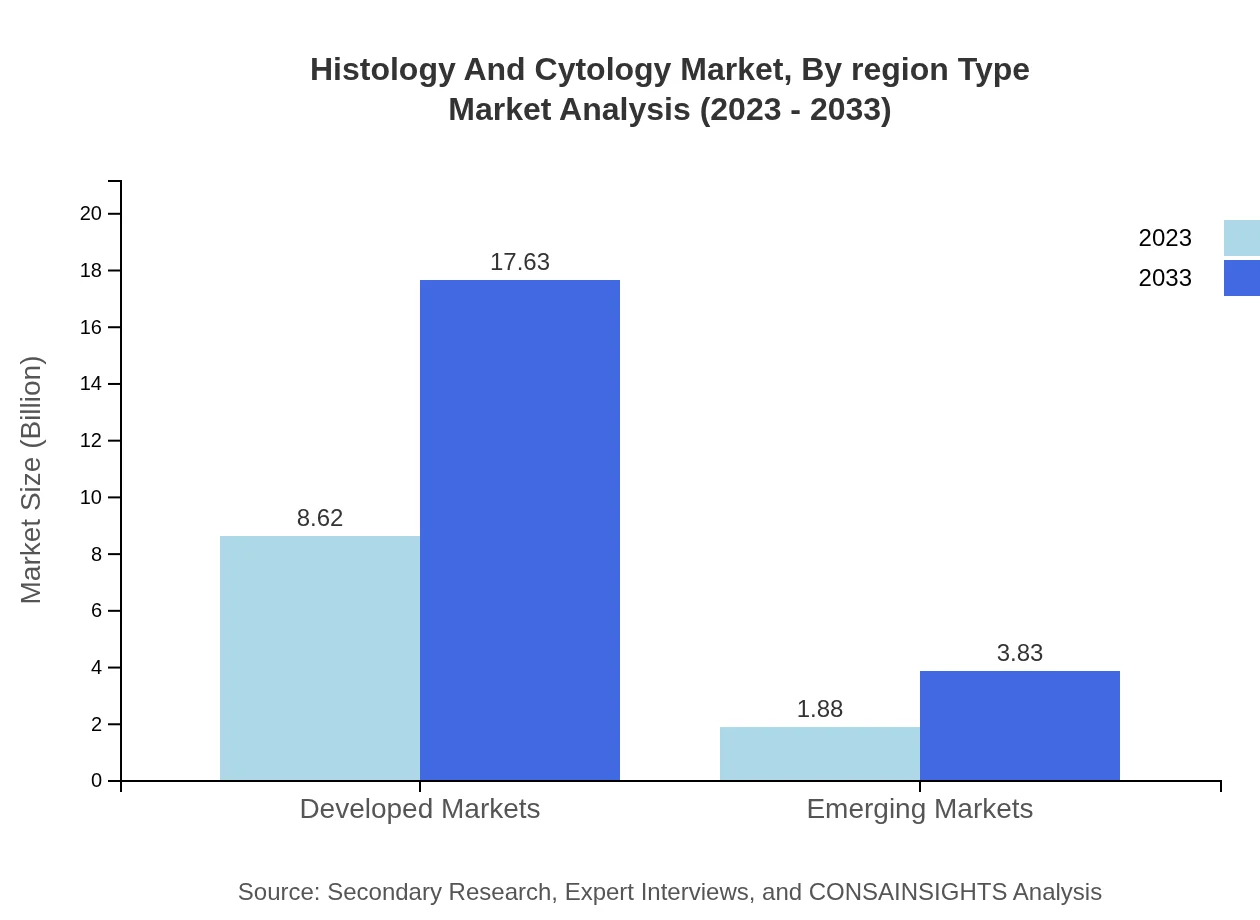

Histology And Cytology Market Analysis By Region Type

Developed Markets are expected to show significant growth from USD 8.62 billion in 2023 to USD 17.63 billion by 2033 (82.14% share), while Emerging Markets will grow from USD 1.88 billion to USD 3.83 billion (17.86% share), demonstrating notable growth potential driven by increasing healthcare access and investment.

Histology And Cytology Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Histology And Cytology Industry

Thermo Fisher Scientific:

Thermo Fisher Scientific is a leading provider of analytical instruments, laboratory equipment, reagents, and services to laboratories and healthcare organizations worldwide, known for its innovative solutions in histology and cytology diagnostics.Agilent Technologies:

Agilent Technologies specializes in life sciences and diagnostics, providing essential instrumentation and solutions for histology and cytology applications, driving advancements in qualitative analytical techniques.Merck Group:

Merck Group is a global leader in pharmaceutical and life science sectors, offering a diverse range of reagents and equipment that support histological and cytological diagnostics, enhancing laboratory productivity.Roche Diagnostics:

A significant player in the diagnostics space, Roche provides a wide array of solutions, including molecular testing and histopathology products, empowering healthcare professionals in disease management.BD (Becton, Dickinson and Company):

BD focuses on improving medical discovery, diagnostics, and the delivery of care through its comprehensive portfolio in laboratory devices and diagnostic reagents for histology and cytology applications.We're grateful to work with incredible clients.

FAQs

What is the market size of histology And Cytology?

The global histology and cytology market is valued at approximately $10.5 billion in 2023 and is projected to grow with a CAGR of 7.2%, reaching notable market expansion by 2033.

What are the key market players or companies in the histology And Cytology industry?

Key players in the histology and cytology market include major companies like Thermo Fisher Scientific, Merck KGaA, and Siemens Healthineers, which are crucial in developing innovative diagnostic kits and technologies.

What are the primary factors driving the growth in the histology And Cytology industry?

Growth drivers in the histology and cytology market include increased prevalence of chronic diseases, advancements in diagnostic techniques, and rising laboratory automation leading to higher efficiencies in sample processing.

Which region is the fastest Growing in the histology And Cytology?

Asia Pacific is the fastest-growing region in the histology and cytology market, with its market expected to expand from $2.16 billion in 2023 to $4.42 billion by 2033, reflecting rapid healthcare improvements.

Does ConsaInsights provide customized market report data for the histology And Cytology industry?

Yes, ConsaInsights offers tailored market report data for the histology and cytology industry, allowing clients to gain insights that fit their specific needs and strategic goals.

What deliverables can I expect from this histology And Cytology market research project?

Deliverables include comprehensive market analysis reports, segment dynamics, competitive landscape assessments, growth projections, and actionable insights designed to inform business strategies.

What are the market trends of histology And Cytology?

Current trends include a surge in diagnostic kits, especially focused on clinical diagnostics, along with innovations in staining reagents, and an increasing reliance on automation in laboratories to enhance testing accuracy and efficiency.