Hiv Aids Diagnostics Market Report

Published Date: 31 January 2026 | Report Code: hiv-aids-diagnostics

Hiv Aids Diagnostics Market Size, Share, Industry Trends and Forecast to 2033

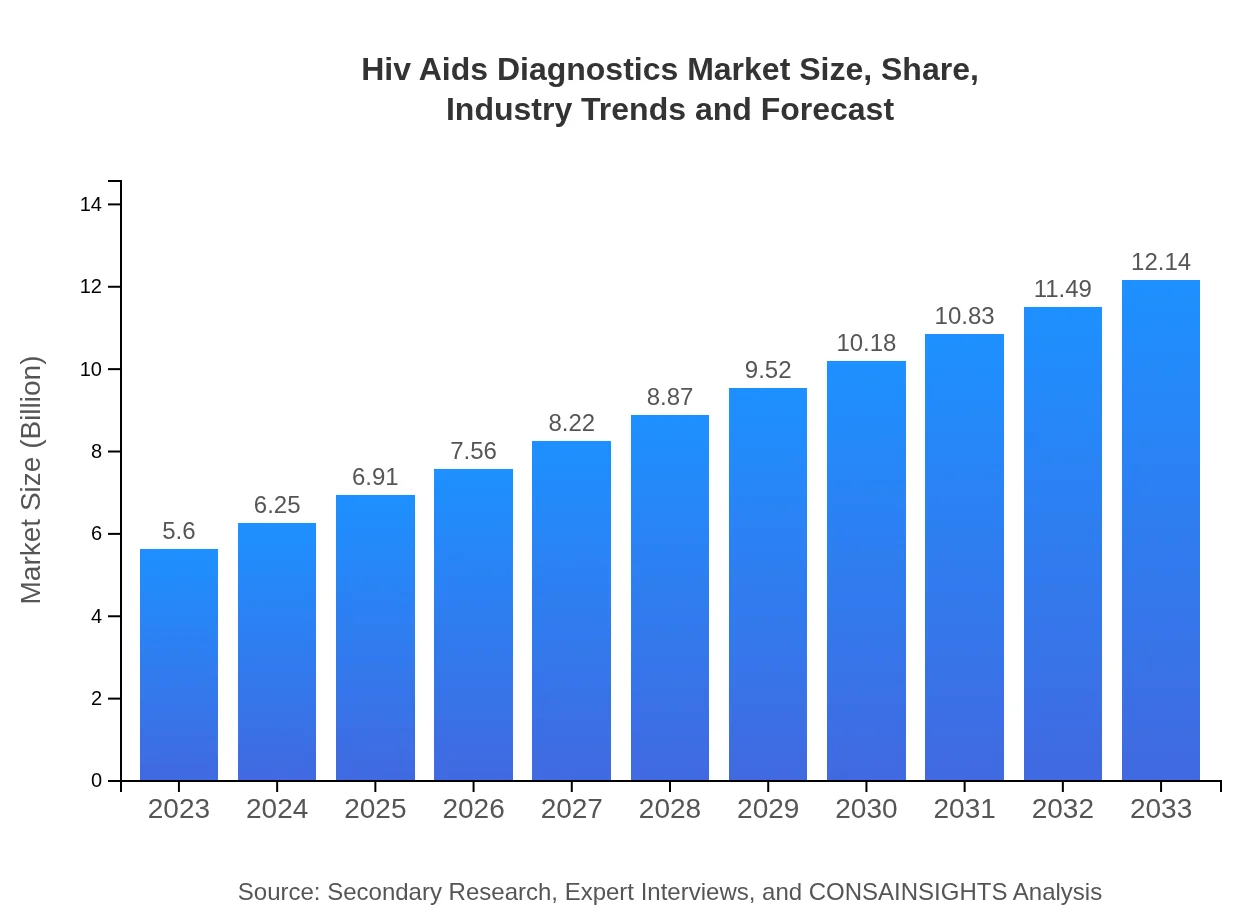

This report covers the comprehensive analysis of the HIV/AIDS diagnostics market, highlighting market trends, projections, and segmentation insights from 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $12.14 Billion |

| Top Companies | Abbott Laboratories, Roche Diagnostics, Siemens Healthineers, Thermo Fisher Scientific, Becton, Dickinson and Company |

| Last Modified Date | 31 January 2026 |

Hiv Aids Diagnostics Market Overview

Customize Hiv Aids Diagnostics Market Report market research report

- ✔ Get in-depth analysis of Hiv Aids Diagnostics market size, growth, and forecasts.

- ✔ Understand Hiv Aids Diagnostics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Hiv Aids Diagnostics

What is the Market Size & CAGR of Hiv Aids Diagnostics market in 2023?

Hiv Aids Diagnostics Industry Analysis

Hiv Aids Diagnostics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Hiv Aids Diagnostics Market Analysis Report by Region

Europe Hiv Aids Diagnostics Market Report:

Europe’s market is anticipated to expand from $1.81 billion in 2023 to $3.93 billion by 2033, driven by stringent health regulations and ongoing public health campaigns supporting testing.Asia Pacific Hiv Aids Diagnostics Market Report:

The Asia Pacific region is projected to grow from $1.06 billion in 2023 to $2.30 billion by 2033, reflecting a significant annual growth rate driven by increased HIV awareness and government initiatives focusing on testing.North America Hiv Aids Diagnostics Market Report:

North America is expected to grow from $1.89 billion in 2023 to $4.10 billion by 2033. The region's growth is fueled by high healthcare spending, superior diagnostic technologies, and increasing prevalence of HIV.South America Hiv Aids Diagnostics Market Report:

In South America, the market size is expected to rise from $0.19 billion in 2023 to $0.42 billion by 2033. This growth is largely due to rising incidences of HIV and improved healthcare infrastructure.Middle East & Africa Hiv Aids Diagnostics Market Report:

The Middle East and Africa are expected to see growth from $0.64 billion in 2023 to $1.39 billion by 2033. The region's growth is supported by international funding and development programs targeting HIV/AIDS.Tell us your focus area and get a customized research report.

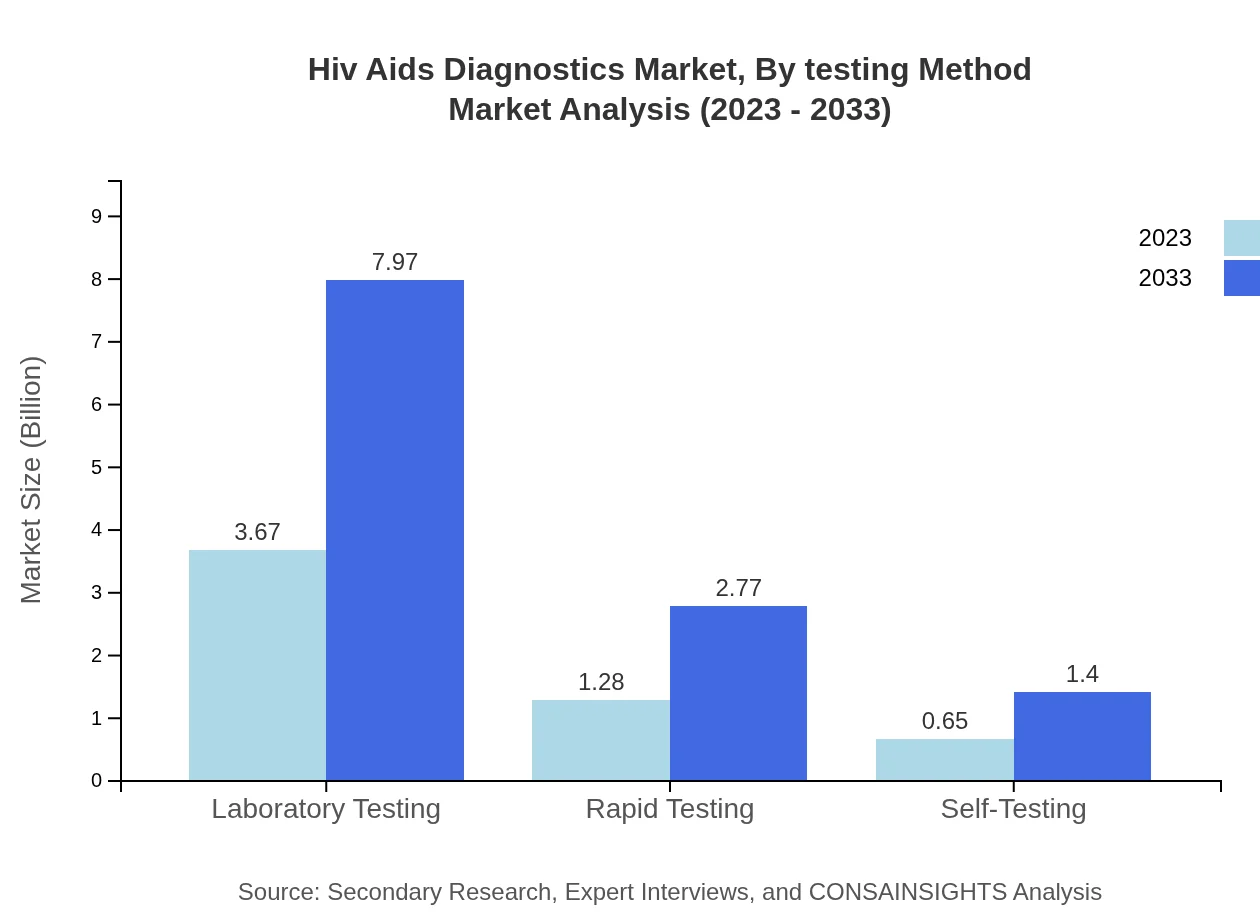

Hiv Aids Diagnostics Market Analysis By Testing Method

The testing method segment remains pivotal, with molecular diagnostics leading in effectiveness. Rapid testing is gaining traction, providing immediate results which are crucial in managing public health concerns.

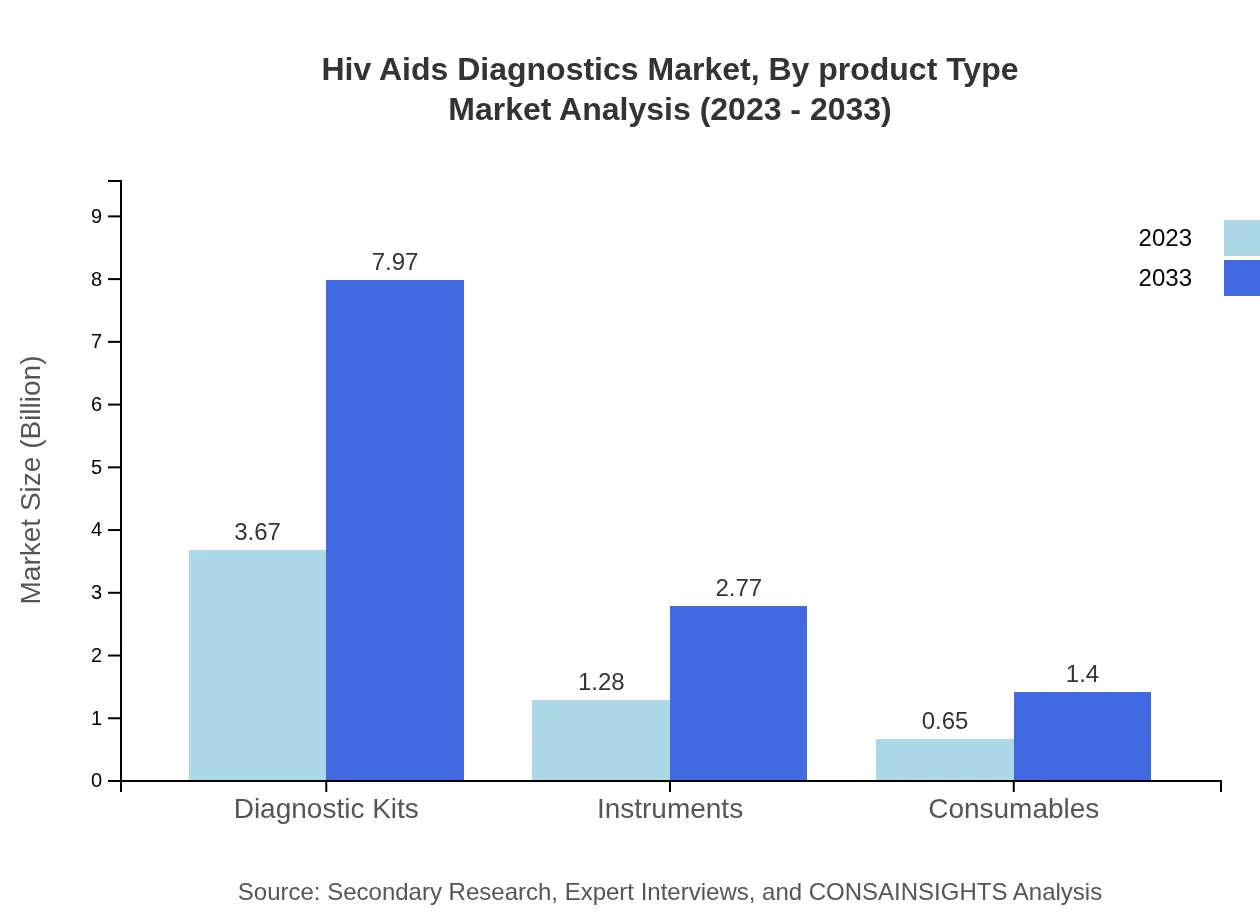

Hiv Aids Diagnostics Market Analysis By Product Type

Diagnostic kits are a dominant segment due to their versatility and ease of use. The product type also includes advanced instruments and consumables, all contributing significantly to market revenues.

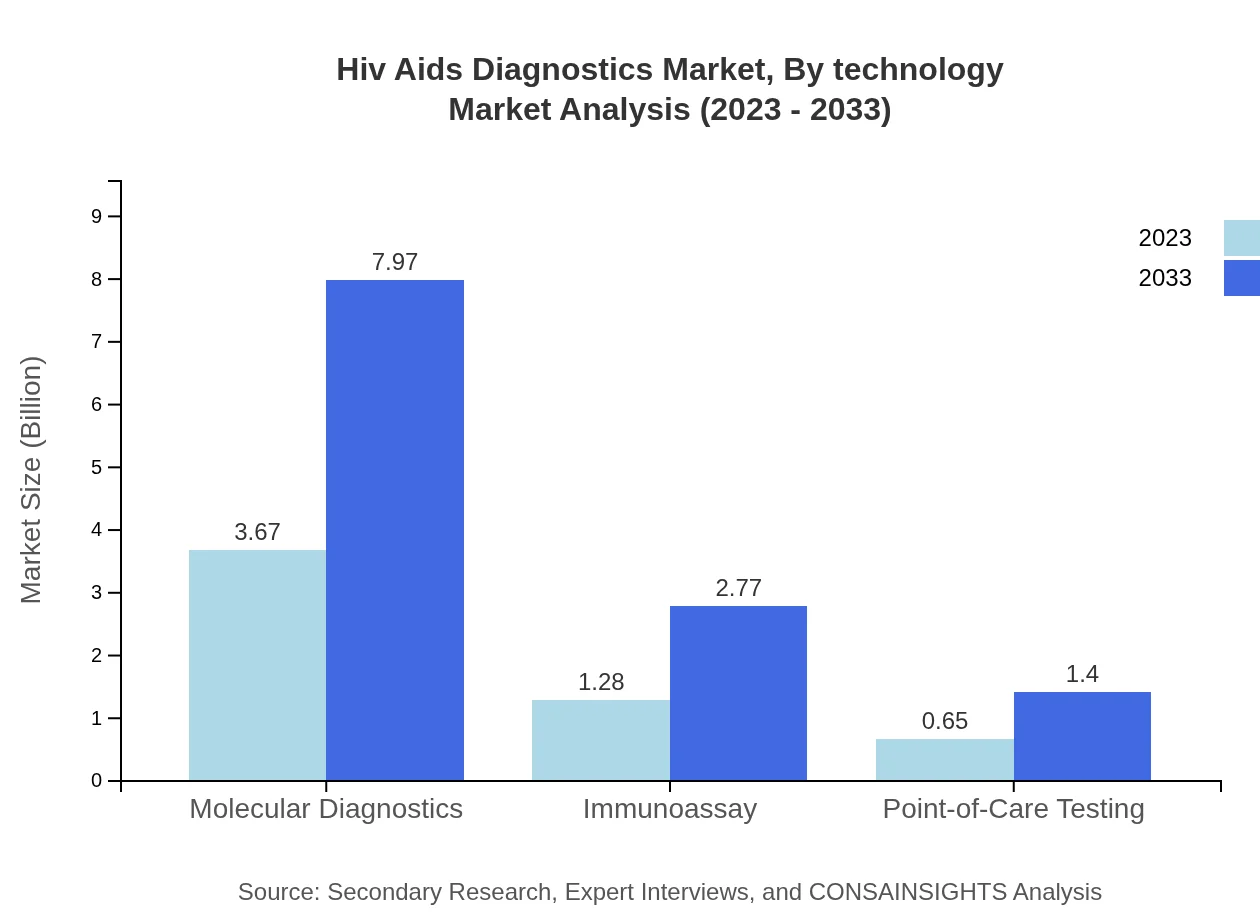

Hiv Aids Diagnostics Market Analysis By Technology

Technological innovation is key to market development. Advances in point-of-care testing and home care options allow for increased accessibility, transforming how diagnoses are made.

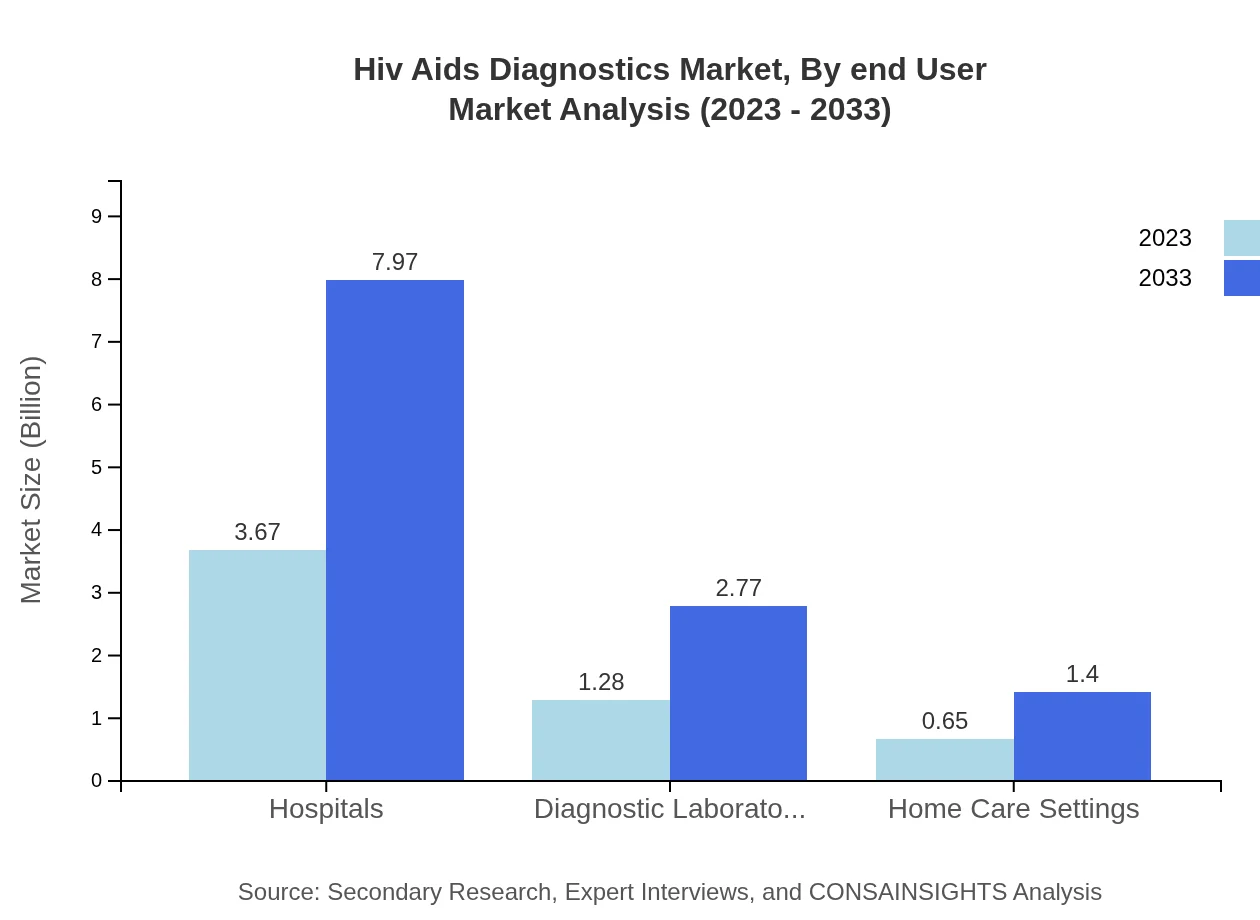

Hiv Aids Diagnostics Market Analysis By End User

Hospitals account for a significant share of the market. Diagnostic laboratories are also crucial, providing essential testing services to support treatment and monitoring.

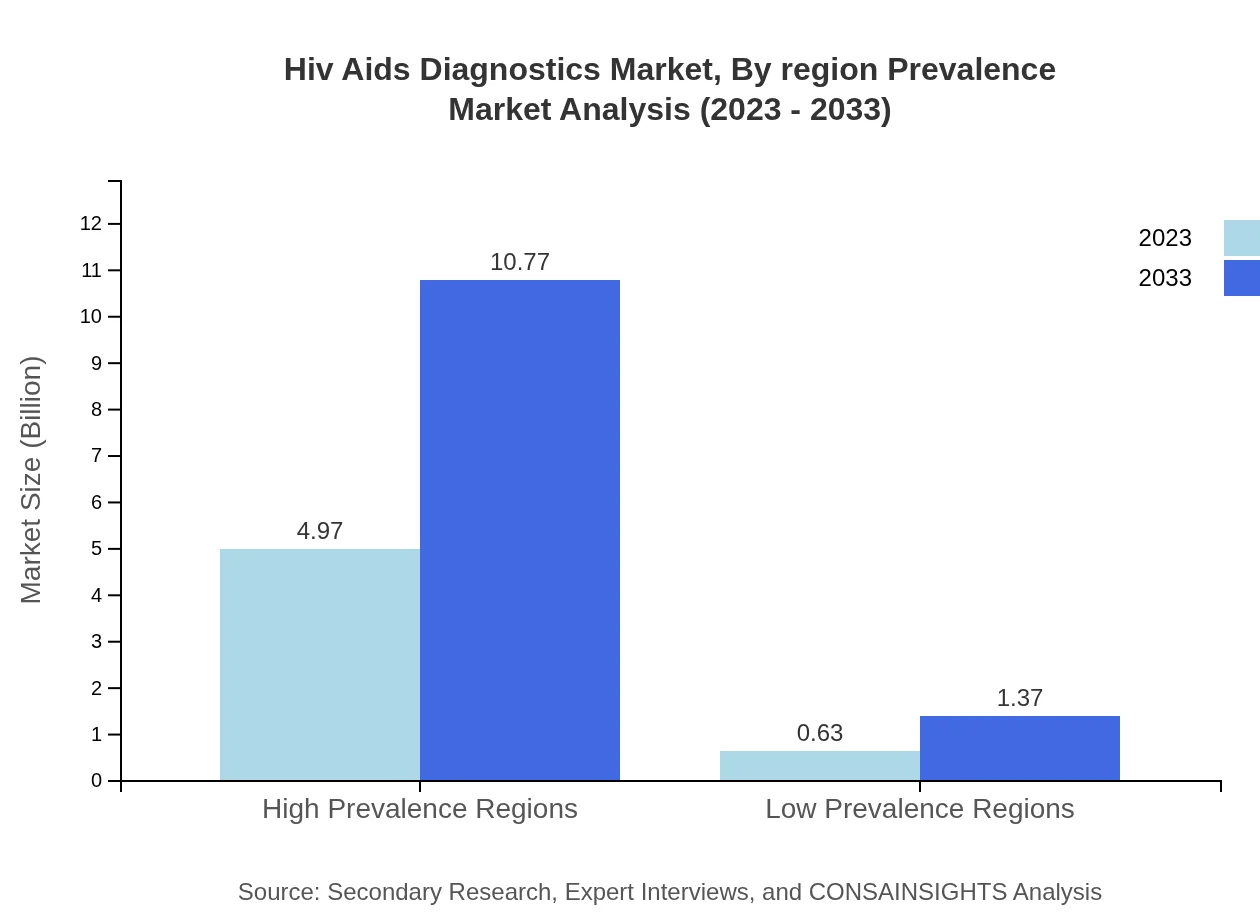

Hiv Aids Diagnostics Market Analysis By Region Prevalence

High prevalence regions dominate market performance, accounting for significant shares as testing initiatives focus there. In contrast, low prevalence regions are growing slowly but steadily as awareness increases.

Hiv Aids Diagnostics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Hiv Aids Diagnostics Industry

Abbott Laboratories:

Abbott is a major player in the global diagnostics market, known for its innovative testing technologies and extensive product lines for HIV/AIDS diagnostics, including rapid tests.Roche Diagnostics:

Roche is a leader in molecular diagnostics and has a strong portfolio in HIV testing, focusing on development and marketing of serological and molecular tests globally.Siemens Healthineers:

Siemens Healthineers specializes in diagnostic imaging and laboratory diagnostics, providing advanced HIV testing solutions to healthcare providers around the world.Thermo Fisher Scientific:

Thermo Fisher Scientific offers a broad range of diagnostic tools for HIV detection and monitoring, emphasizing innovation and customer satisfaction.Becton, Dickinson and Company:

BD is recognized for its contributions to diagnostic technologies and has a growing presence in the HIV/AIDS diagnostics market through its innovative testing kits.We're grateful to work with incredible clients.

FAQs

What is the market size of HIV-AIDS diagnostics?

The HIV-AIDS diagnostics market is projected to reach $5.6 billion by 2033, growing at a CAGR of 7.8%. This growth is driven by advancements in technology and increased awareness regarding HIV testing.

What are the key market players or companies in the HIV-AIDS diagnostics industry?

Key players in the HIV-AIDS diagnostics market include Abbott Laboratories, Roche Diagnostics, and Siemens Healthineers. These companies lead the industry through innovation and a broad portfolio of diagnostic solutions.

What are the primary factors driving the growth in the HIV-AIDS diagnostics industry?

Growth drivers include increasing prevalence of HIV infections, advancements in diagnostic technologies, and heightened awareness and government initiatives promoting testing and treatment options.

Which region is the fastest Growing in the HIV-AIDS diagnostics market?

Asia Pacific is poised as the fastest-growing region in the HIV-AIDS diagnostics market, expected to grow from $1.06 billion in 2023 to $2.30 billion by 2033, reflecting a significant CAGR.

Does ConsaInsights provide customized market report data for the HIV-AIDS diagnostics industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs in the HIV-AIDS diagnostics industry, including detailed market analysis and forecasting.

What deliverables can I expect from this HIV-AIDS diagnostics market research project?

Deliverables include comprehensive market analysis, segmented data, regional insights, and forecasts, alongside actionable recommendations for strategic decision-making.

What are the market trends of HIV-AIDS diagnostics?

Current trends in the HIV-AIDS diagnostics market include a shift towards rapid testing, increased adoption of molecular diagnostics, and the emergence of home-care testing solutions.