Home Care Monitoring And Diagnostics Market Report

Published Date: 31 January 2026 | Report Code: home-care-monitoring-and-diagnostics

Home Care Monitoring And Diagnostics Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Home Care Monitoring and Diagnostics market from 2023 to 2033. It covers market size, growth forecasts, technological advancements, regional analyses, and key players, aiding stakeholders in strategic decision-making.

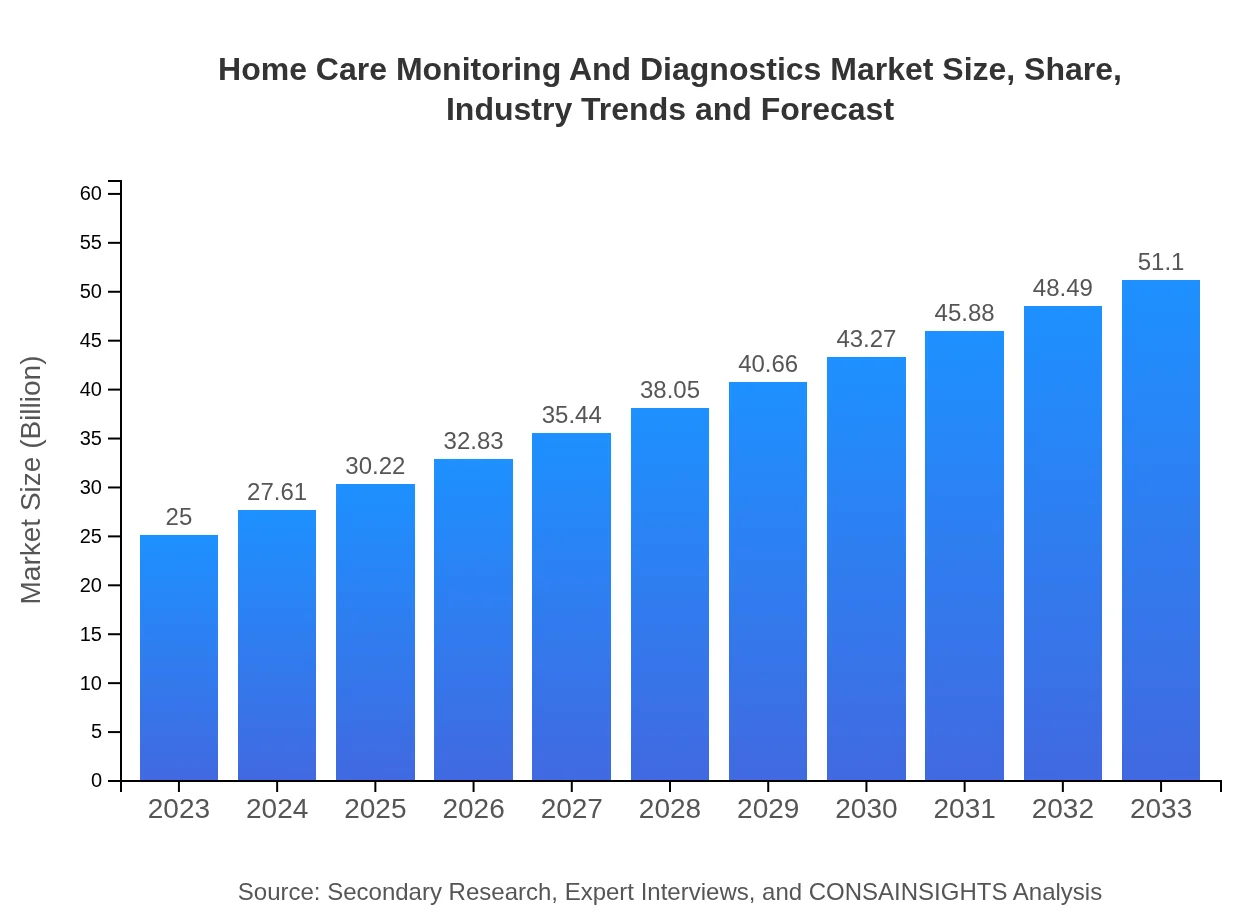

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $25.00 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $51.10 Billion |

| Top Companies | Philips Healthcare, Omron Healthcare, iHealth Labs, Medtronic |

| Last Modified Date | 31 January 2026 |

Home Care Monitoring And Diagnostics Market Overview

Customize Home Care Monitoring And Diagnostics Market Report market research report

- ✔ Get in-depth analysis of Home Care Monitoring And Diagnostics market size, growth, and forecasts.

- ✔ Understand Home Care Monitoring And Diagnostics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Home Care Monitoring And Diagnostics

What is the Market Size & CAGR of Home Care Monitoring And Diagnostics market in 2033?

Home Care Monitoring And Diagnostics Industry Analysis

Home Care Monitoring And Diagnostics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Home Care Monitoring And Diagnostics Market Analysis Report by Region

Europe Home Care Monitoring And Diagnostics Market Report:

The European market is projected to grow from USD 7.97 billion in 2023 to USD 16.30 billion by 2033. The robust healthcare infrastructure, greater public acceptance of home care services, and proactive government initiatives are supportive factors behind this growth.Asia Pacific Home Care Monitoring And Diagnostics Market Report:

In the Asia Pacific region, the market is set to grow from USD 4.77 billion in 2023 to USD 9.75 billion by 2033. This growth is driven by increasing healthcare investments, rising disposable incomes, and a growing aging population that is turning to home care services. Adoption of smart healthcare devices and government initiatives promoting health awareness further enhance market potential.North America Home Care Monitoring And Diagnostics Market Report:

North America is expected to see significant growth, with market size increasing from USD 8.29 billion in 2023 to USD 16.95 billion by 2033. The high prevalence of chronic diseases, technological advancements, and the increasing penetration of telehealth services are key drivers within this market.South America Home Care Monitoring And Diagnostics Market Report:

In South America, the market is projected to grow from USD 0.69 billion in 2023 to USD 1.41 billion by 2033. Factors such as improvements in healthcare access, government policies aimed at enhancing healthcare systems, and rising demand for home health services are contributing to this expansion.Middle East & Africa Home Care Monitoring And Diagnostics Market Report:

The Middle East and Africa market is forecasted to expand from USD 3.28 billion in 2023 to USD 6.70 billion by 2033. Growth is driven by increased healthcare spending, rising awareness of health management technologies, and an ongoing improvement in healthcare services across the region.Tell us your focus area and get a customized research report.

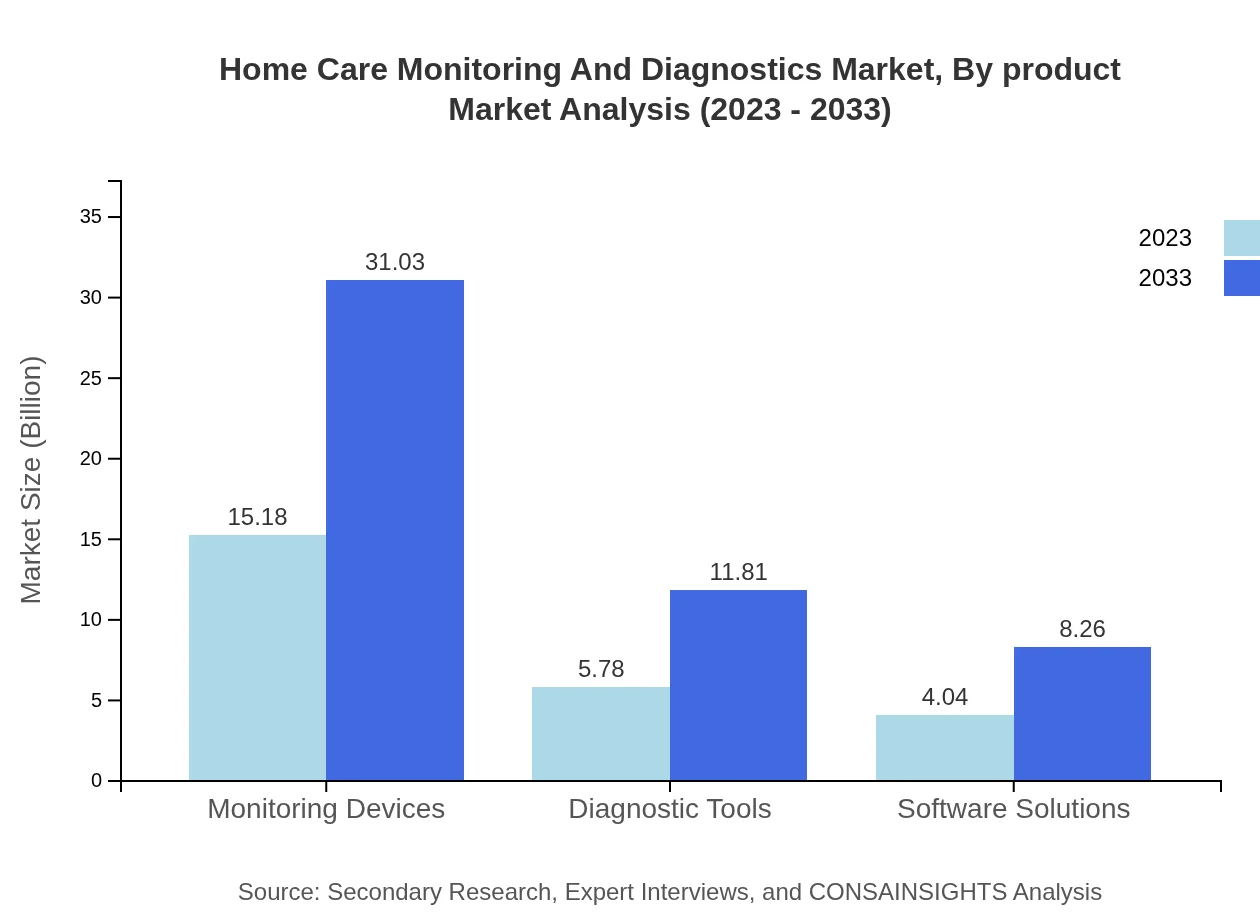

Home Care Monitoring And Diagnostics Market Analysis By Product

The Home Care Monitoring and Diagnostics market is predominantly driven by monitoring devices, diagnosed to grow from USD 15.18 billion in 2023 to USD 31.03 billion by 2033, capturing a substantial 60.72% market share. Diagnostic tools are also gaining traction, anticipated to increase from USD 5.78 billion to USD 11.81 billion with an enduring market share of 23.11%. Software solutions, essential for data management and analysis, are projected to expand from USD 4.04 billion to USD 8.26 billion.

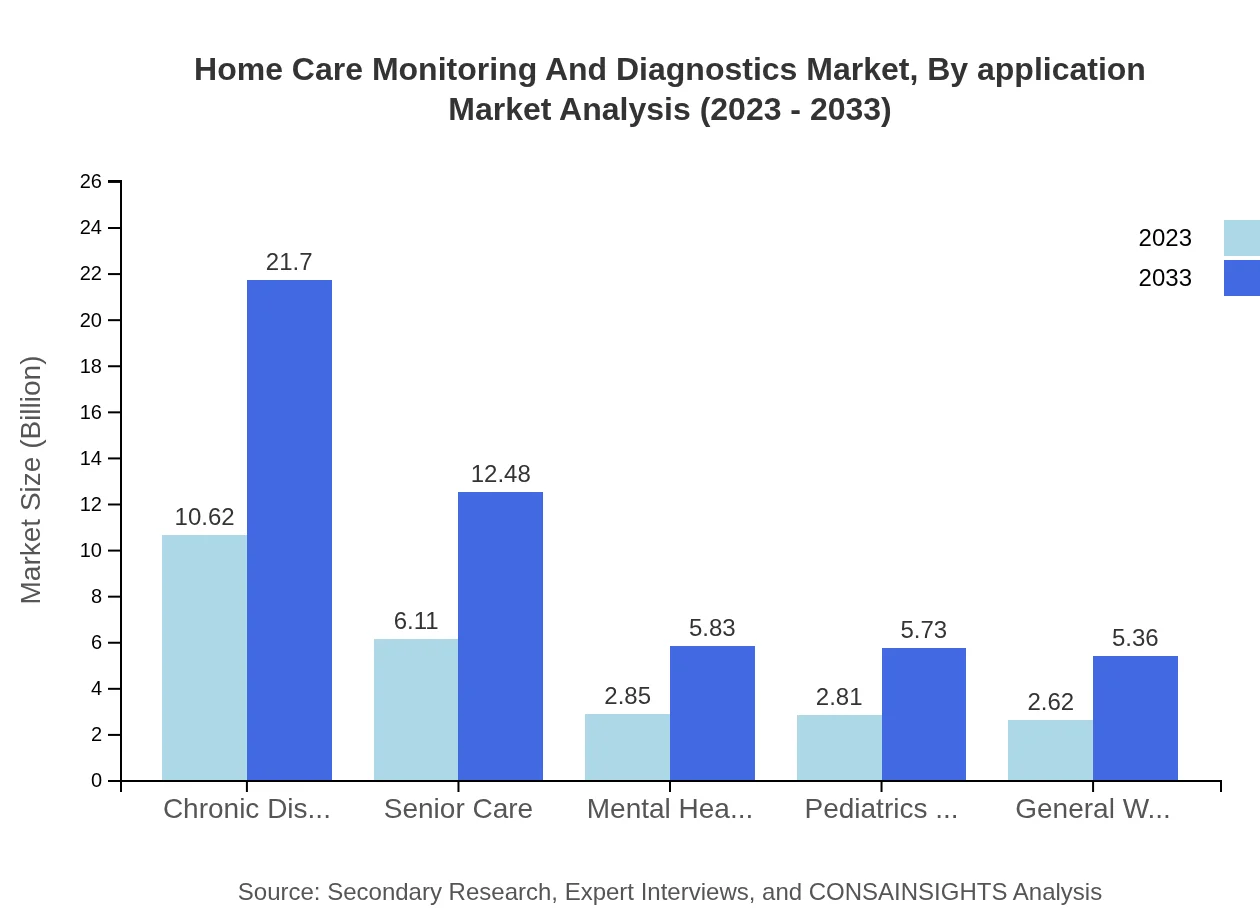

Home Care Monitoring And Diagnostics Market Analysis By Application

Key applications in the Home Care Monitoring and Diagnostics market include Chronic Diseases Management, expected to grow significantly from USD 10.62 billion in 2023 to USD 21.70 billion by 2033, representing 42.46% of the total market share. Senior Care applications are also on the rise, set to grow from USD 6.11 billion to USD 12.48 billion, marking a 24.43% share. Increasing attention toward mental health monitoring and pediatrics care continues to reflect evolving consumer needs.

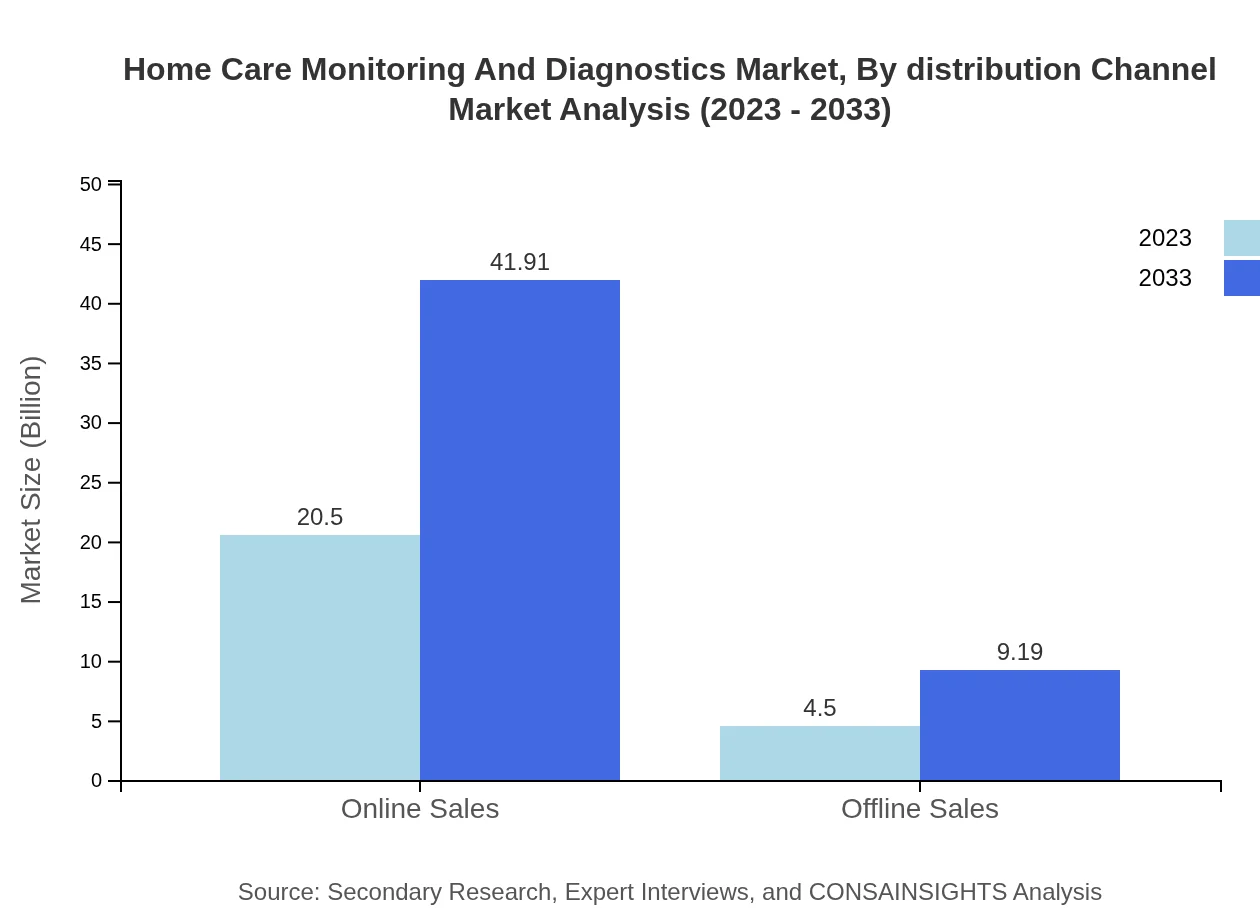

Home Care Monitoring And Diagnostics Market Analysis By Distribution Channel

Distribution channels in the Home Care Monitoring and Diagnostics market include Online Sales, which dominate with a 82.02% market share expected to grow from USD 20.50 billion to USD 41.91 billion by 2033, fueled by growing e-commerce adoption. Offline Sales remains significant, projected to expand from USD 4.50 billion to USD 9.19 billion, representing a 17.98% share as traditional retail channels adapt to consumer preferences.

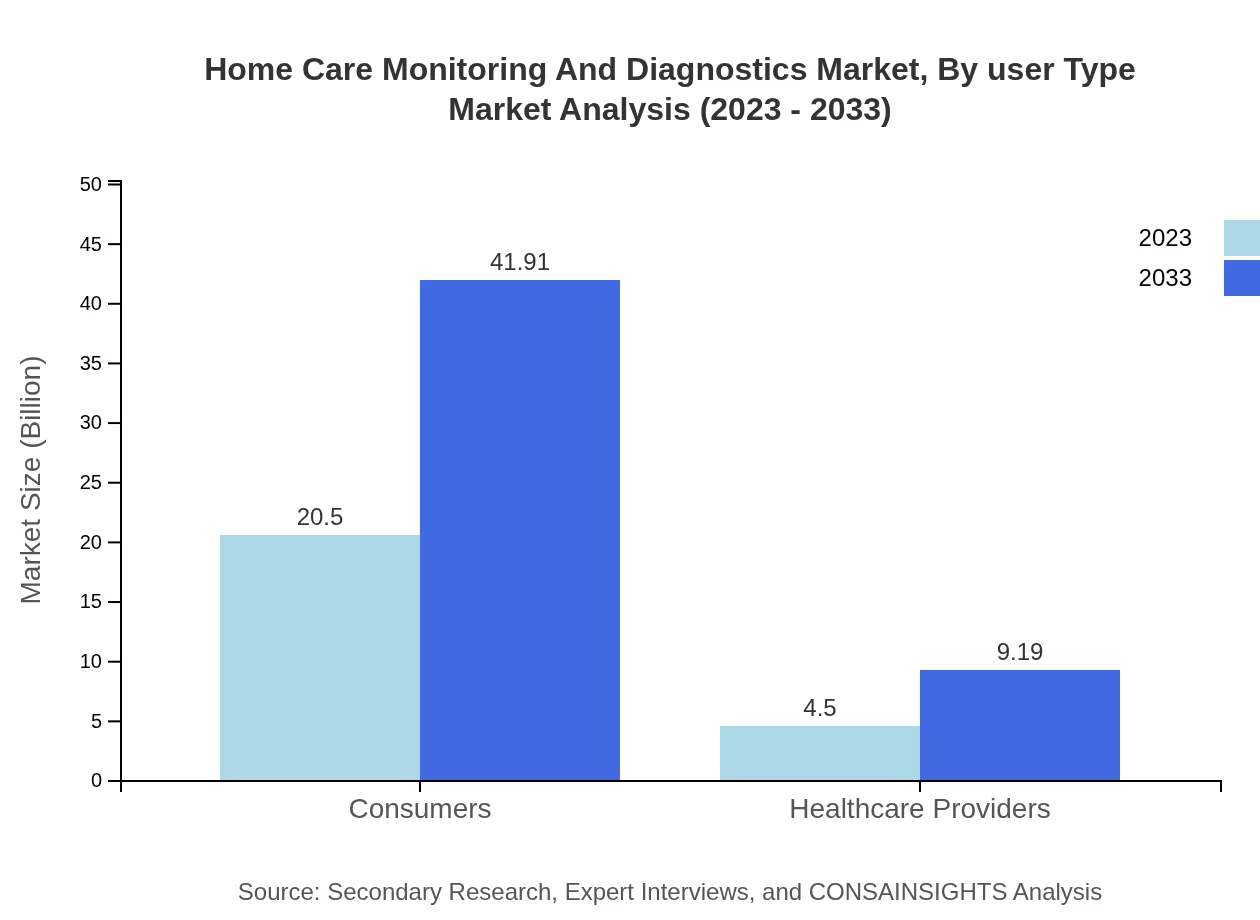

Home Care Monitoring And Diagnostics Market Analysis By User Type

The market's user types are segmented into Consumers and Healthcare Providers. Consumer-centric solutions dominate the sector with an impressive 82.02% share, expected to maintain growth from USD 20.50 billion to USD 41.91 billion through extended accessibility and improved health management awareness. Healthcare Providers are also crucial, projected to grow from USD 4.50 billion to USD 9.19 billion, signifying 17.98% of the market.

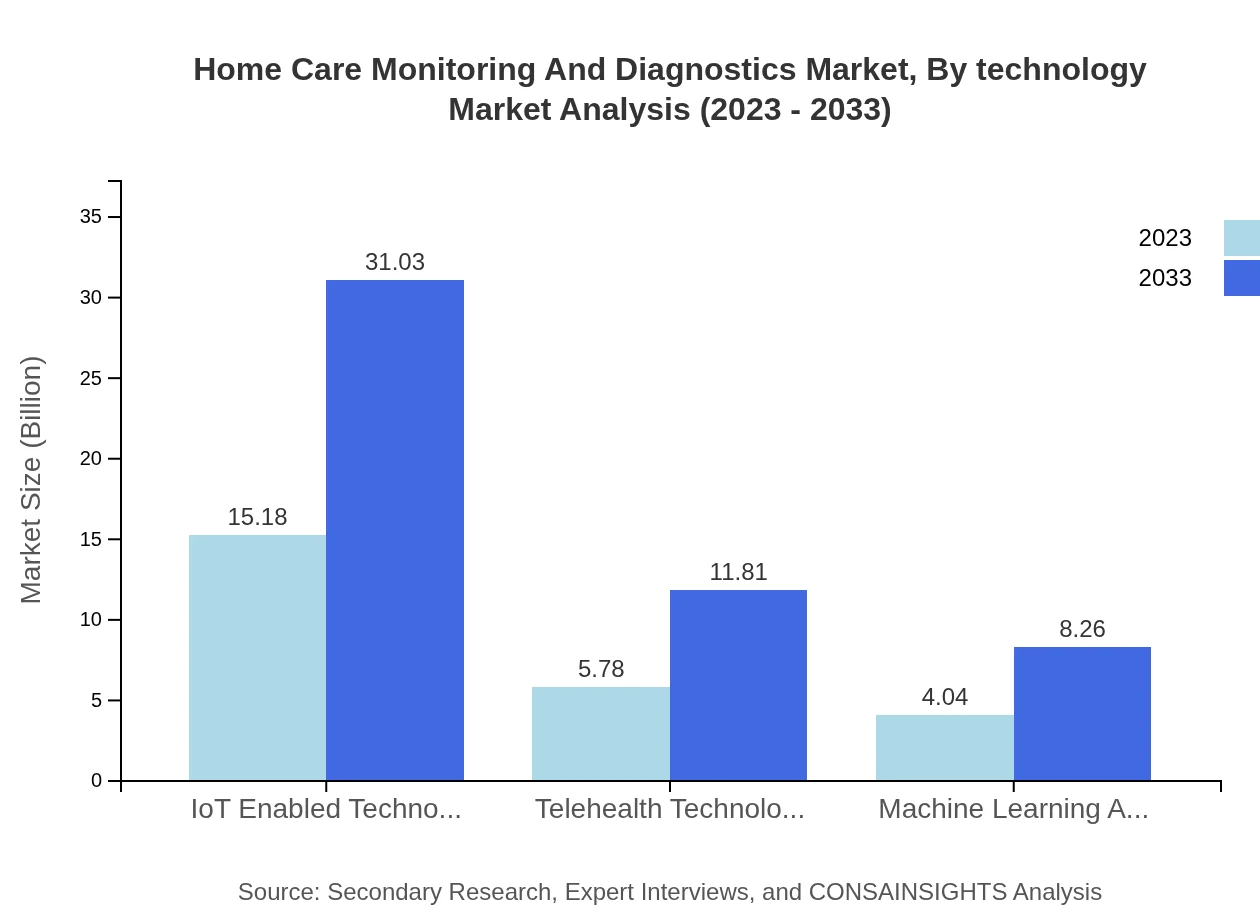

Home Care Monitoring And Diagnostics Market Analysis By Technology

Technology segmentation includes IoT Enabled Technologies leading the market with 60.72% share, projected to grow from USD 15.18 billion in 2023 to USD 31.03 billion by 2033. Telehealth Technologies will grow from USD 5.78 billion to USD 11.81 billion (23.11% share), while Machine Learning Applications expand from USD 4.04 billion to USD 8.26 billion (16.17% share), showcasing the role of tech in enhancing home care capabilities.

Home Care Monitoring And Diagnostics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Home Care Monitoring And Diagnostics Industry

Philips Healthcare:

Philips Healthcare is a leading provider of health technology solutions, specializing in advanced home monitoring devices that prioritize patient-centered care and enhance clinical workflows.Omron Healthcare:

Omron Healthcare offers innovative medical devices designed for home use, focusing on blood pressure monitoring and chronic disease management to empower patients in maintaining their health.iHealth Labs:

iHealth Labs provides intuitive home health monitoring solutions, integrating mobile and cloud technologies that allow users to easily track their health metrics.Medtronic :

Medtronic is known for its pioneering medical technologies, including remote patient monitoring systems that significantly improve chronic disease management.We're grateful to work with incredible clients.

FAQs

What is the market size of home Care Monitoring And Diagnostics?

The global market size for home care monitoring and diagnostics is estimated to be around $25 billion in 2023, with a projected CAGR of 7.2% through 2033, reflecting robust growth in this sector.

What are the key market players or companies in the home Care Monitoring And Diagnostics industry?

Key players in the home care monitoring and diagnostics industry include companies specializing in IoT devices, telehealth systems, and software solutions. Major names such as Philips Healthcare, Abbott Laboratories, and Medtronic shape the competitive landscape.

What are the primary factors driving the growth in the home Care Monitoring And Diagnostics industry?

Growth in the home care monitoring and diagnostics sector is primarily driven by the increasing elderly population, rising demand for remote patient monitoring, advancements in technology, and a shift towards home-based healthcare services.

Which region is the fastest Growing in the home Care Monitoring And Diagnostics?

The fastest-growing region in the home care monitoring and diagnostics market is Europe, with a market projected to grow from $7.97 billion in 2023 to $16.30 billion by 2033, indicating significant investment in healthcare innovation.

Does ConsaInsights provide customized market report data for the home Care Monitoring And Diagnostics industry?

Yes, ConsaInsights offers customized market report data for the home care monitoring and diagnostics industry, allowing clients to tailor reports based on specific needs and regional or segment-focused insights.

What deliverables can I expect from this home Care Monitoring And Diagnostics market research project?

Deliverables from the home care monitoring and diagnostics market research project include detailed market analysis, trends, forecasts, competitive insights, and recommendations tailored to your business needs.

What are the market trends of home Care Monitoring And Diagnostics?

Current market trends in home care monitoring and diagnostics include a rise in telehealth adoption, integration of AI and machine learning in diagnostics, and a growing focus on chronic disease management and mental health monitoring.