Home Insurance Market Report

Published Date: 31 January 2026 | Report Code: home-insurance

Home Insurance Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Home Insurance market from 2023 to 2033, offering insights into market size, growth trends, segmentation, regional analysis, technology impacts, competitive landscape, and future forecasts.

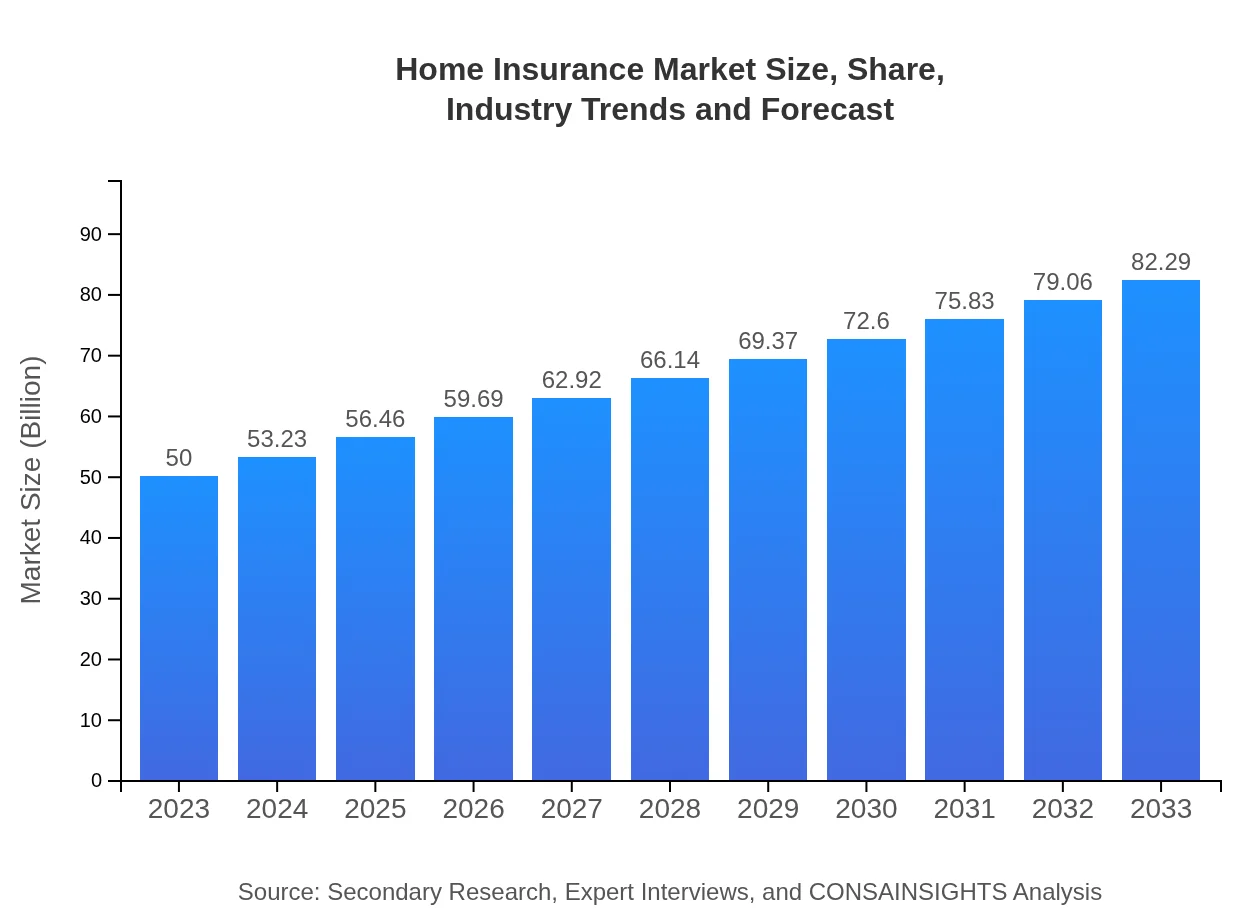

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $50.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $82.29 Billion |

| Top Companies | State Farm, Allstate, American Family Insurance, Chubb, AXA |

| Last Modified Date | 31 January 2026 |

Home Insurance Market Overview

Customize Home Insurance Market Report market research report

- ✔ Get in-depth analysis of Home Insurance market size, growth, and forecasts.

- ✔ Understand Home Insurance's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Home Insurance

What is the Market Size & CAGR of Home Insurance market in 2023?

Home Insurance Industry Analysis

Home Insurance Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Home Insurance Market Analysis Report by Region

Europe Home Insurance Market Report:

In Europe, the home insurance market is expected to grow from $16.53 billion in 2023 to $27.20 billion by 2033, reflecting strong demand for digital insurance solutions and eco-friendly insurance policies.Asia Pacific Home Insurance Market Report:

In 2023, the Home Insurance market in Asia Pacific was valued at $9.12 billion and is expected to grow to $15.01 billion by 2033, driven by rapid urbanization and rising incomes. The emergence of middle-class consumers is anticipated to boost demand for home insurance packages.North America Home Insurance Market Report:

North America, leading the market with a valuation of $17.30 billion in 2023, is likely to reach $28.48 billion by 2033. The growth in this region is primarily driven by high property values and increasing insurance requirements for homeowners.South America Home Insurance Market Report:

The South American market, valued at $2.96 billion in 2023, is projected to increase to $4.87 billion by 2033. This growth is fueled by a growing awareness of the need for property insurance, coupled with improvements in economic conditions across the region.Middle East & Africa Home Insurance Market Report:

In the Middle East and Africa, the market was valued at $4.08 billion in 2023 and is expected to reach $6.72 billion by 2033. The insurance industry in this region is witnessing enhancements in regulatory frameworks, promoting home insurance uptake.Tell us your focus area and get a customized research report.

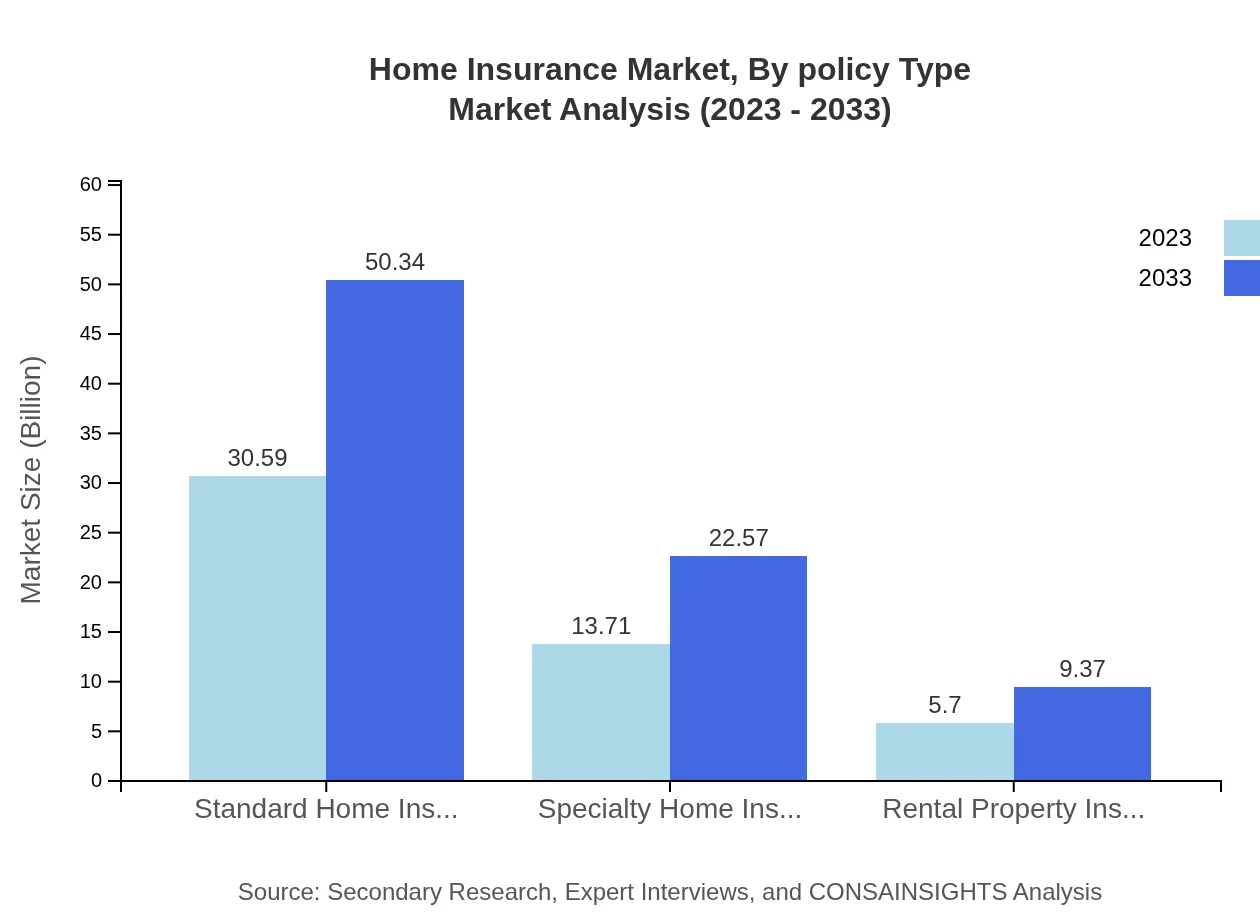

Home Insurance Market Analysis By Policy Type

The Home Insurance market, by policy type, includes segments such as standard home insurance policies and specialty home insurance policies. In 2023, standard home insurance policies accounted for $30.59 billion and are projected to grow to $50.34 billion by 2033, holding a steady market share of 61.18%. Specialty policies, valued at $13.71 billion in 2023, will reach $22.57 billion by 2033, representing 27.43% market share.

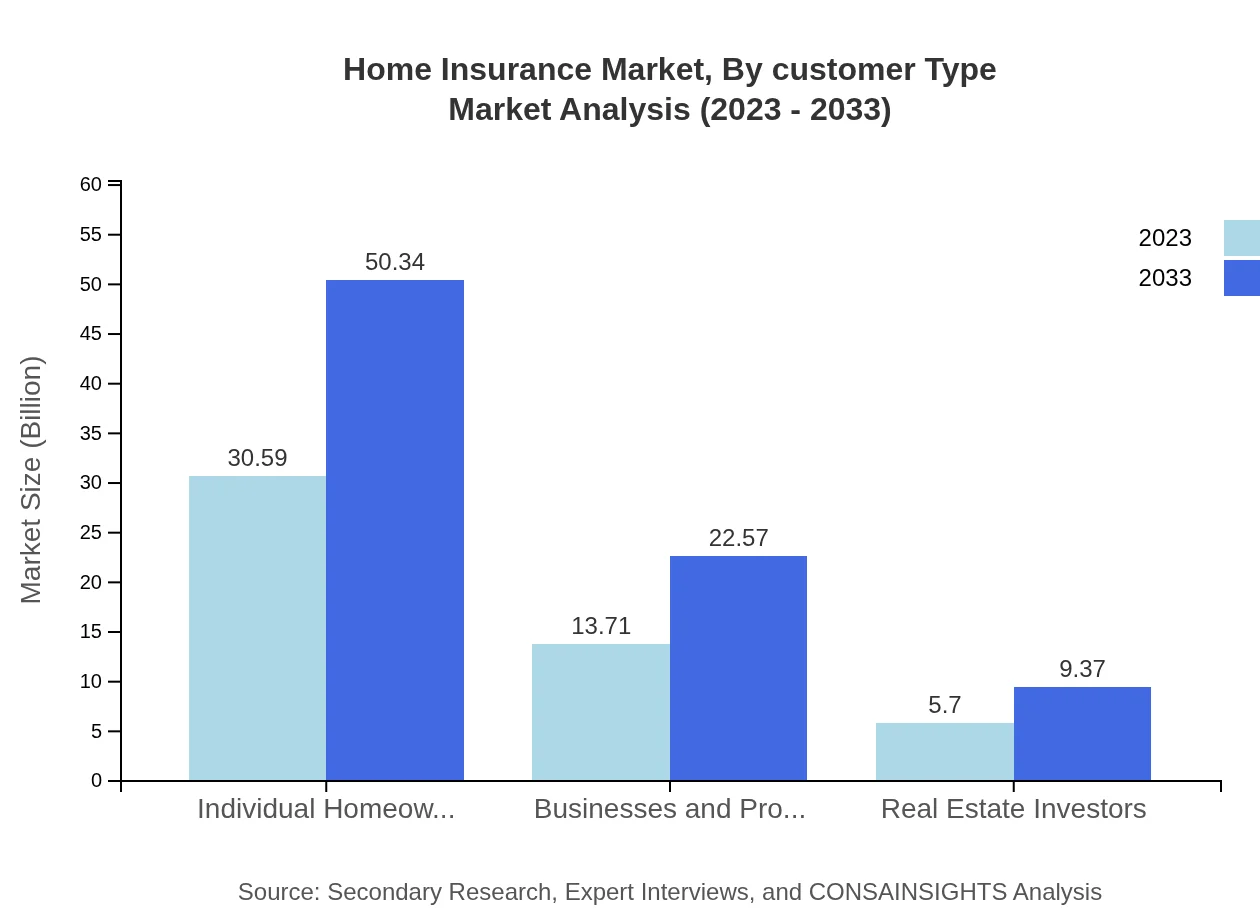

Home Insurance Market Analysis By Customer Type

By customer type, the market includes segments like individual homeowners, businesses and property management, and real estate investors. Individual homeowners represent the largest segment, valued at $30.59 billion in 2023 and projected to grow to $50.34 billion by 2033, maintaining a share of 61.18%. Businesses and property management will increase from $13.71 billion in 2023 to $22.57 billion by 2033 (27.43% share).

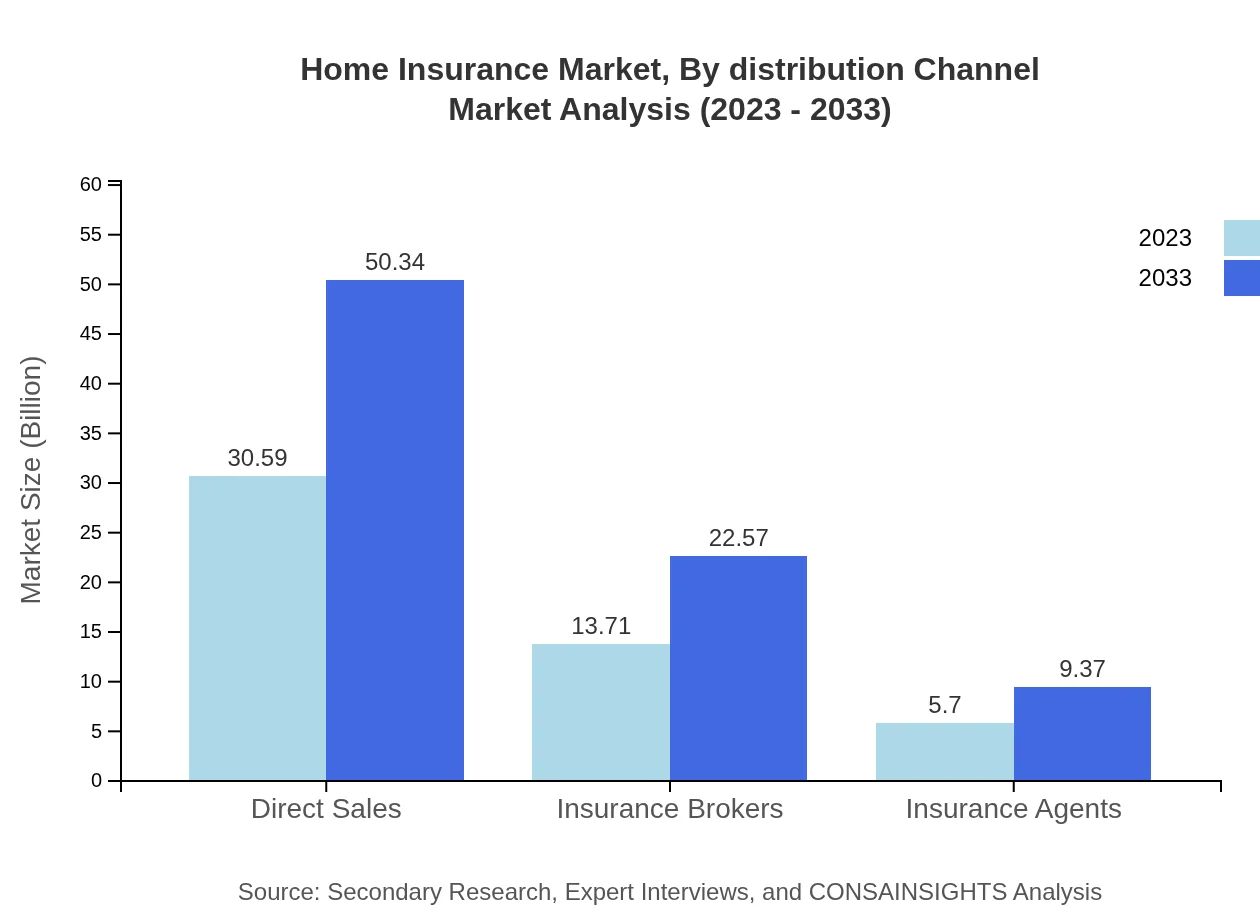

Home Insurance Market Analysis By Distribution Channel

The distribution channel analysis reveals that the direct sales segment generated $30.59 billion in revenue in 2023, expected to reach $50.34 billion by 2033, holding a significant market share of 61.18%. Insurance brokers accounted for $13.71 billion in 2023, growing to $22.57 billion by 2033, representing 27.43% share.

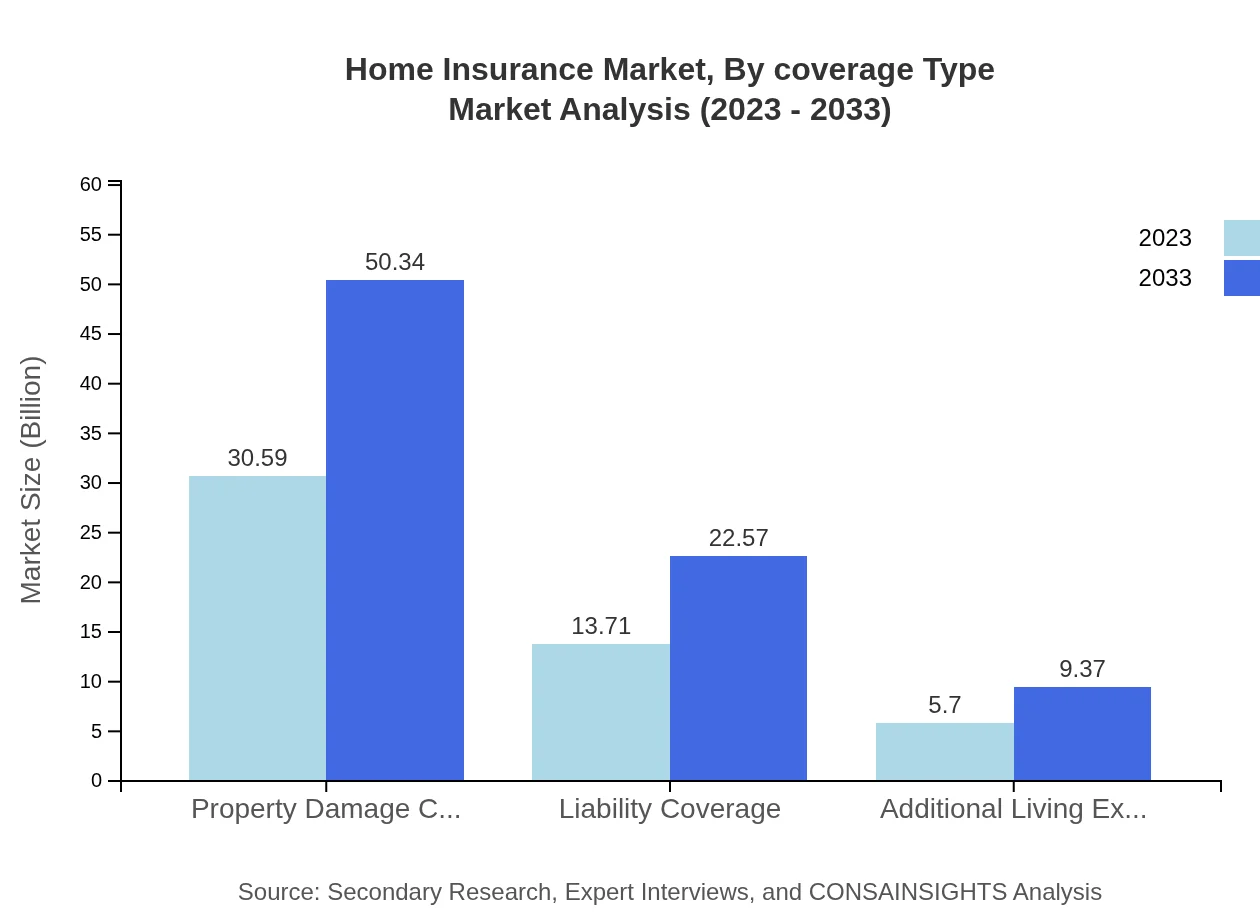

Home Insurance Market Analysis By Coverage Type

Coverage types include property damage, liability, and additional living expenses coverage. Property damage coverage leads with $30.59 billion in 2023 and is expected to grow to $50.34 billion by 2033, while liability coverage will increase from $13.71 billion to $22.57 billion in the same period.

Home Insurance Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Home Insurance Industry

State Farm:

State Farm is the largest provider of home insurance in the United States, known for its customized coverage options and responsive customer service.Allstate:

Allstate offers a range of home insurance products with a focus on innovative technology to enhance the claims process and customer engagement.American Family Insurance:

American Family Insurance provides extensive home insurance services with strong emphasis on community involvement and customer education.Chubb:

Chubb is renowned for its high-value home insurance products and global service, catering to affluent clients with unique coverage needs.AXA:

AXA is a leader in international insurance markets, presenting a robust suite of home insurance products that adapt to local customer needs across various countries.We're grateful to work with incredible clients.

FAQs

What is the market size of home insurance?

The global home insurance market is valued at approximately $50 billion in 2023, with a projected compound annual growth rate (CAGR) of 5%. This growth reflects increasing consumer awareness and demand for home protection solutions over the next decade.

What are the key market players or companies in the home insurance industry?

Key players in the home insurance market include major insurers like State Farm, Allstate, Geico, Liberty Mutual, and Progressive. These companies dominate the market due to their extensive product offerings and widespread distribution channels.

What are the primary factors driving the growth in the home insurance industry?

Factors driving growth in the home insurance sector include increasing incidences of natural disasters, rising property values, urbanization, and the growing emphasis on asset protection among homeowners, all contributing to heightened demand for home insurance policies.

Which region is the fastest Growing in the home insurance?

The fastest-growing region in the home insurance market is Europe, expected to grow from $16.53 billion in 2023 to $27.20 billion by 2033. This surge is driven by regulatory changes and an increasing demand for comprehensive home coverage.

Does Consainsights provide customized market report data for the home insurance industry?

Yes, Consainsights offers customized market report data tailored to clients' specific needs in the home insurance industry, covering various aspects such as market trends, regional insights, and competitive analysis.

What deliverables can I expect from this home insurance market research project?

Expect comprehensive deliverables from the home insurance market research project, including in-depth market analyses, segmented data on policy types, growth forecasts, competitive landscape insights, and regional market size analysis.

What are the market trends of home insurance?

Current market trends in home insurance reveal a shift towards digitalization, increased adoption of smart home technology, customization of insurance products, and enhanced claim process efficiencies, reflecting evolving consumer preferences and technological advancements.