Hopped Malt Extract Market Report

Published Date: 31 January 2026 | Report Code: hopped-malt-extract

Hopped Malt Extract Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Hopped Malt Extract market, highlighting trends, growth potential, and regional dynamics with forecasts extending from 2023 to 2033.

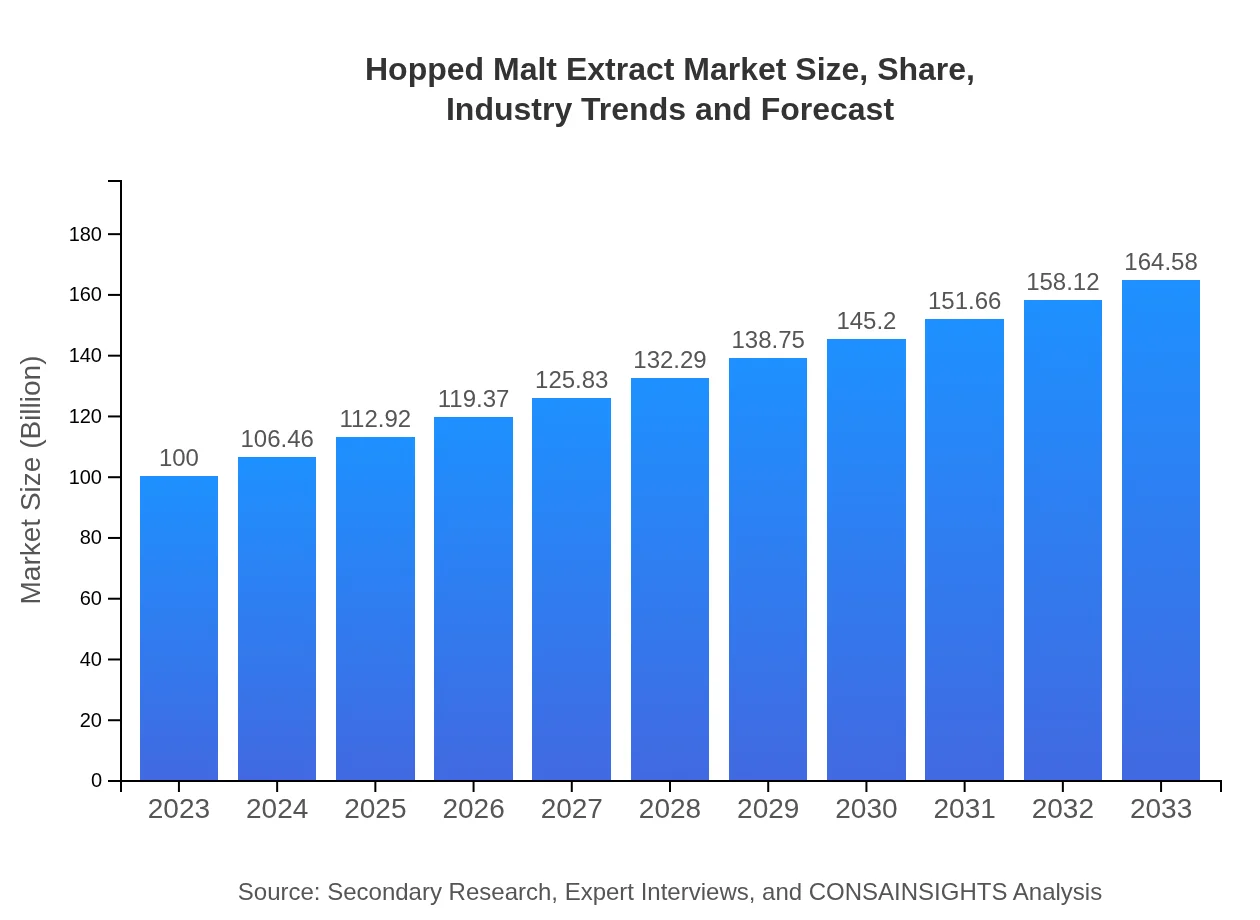

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $100.00 Million |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $164.58 Million |

| Top Companies | Malt Products Corporation, Briess Malt & Ingredients Company, John I. Haas, Inc., Castle Maltings |

| Last Modified Date | 31 January 2026 |

Hopped Malt Extract Market Overview

Customize Hopped Malt Extract Market Report market research report

- ✔ Get in-depth analysis of Hopped Malt Extract market size, growth, and forecasts.

- ✔ Understand Hopped Malt Extract's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Hopped Malt Extract

What is the Market Size & CAGR of Hopped Malt Extract market in 2033?

Hopped Malt Extract Industry Analysis

Hopped Malt Extract Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Hopped Malt Extract Market Analysis Report by Region

Europe Hopped Malt Extract Market Report:

Europe's Hopped Malt Extract market was valued at $27.64 million in 2023 and is expected to reach $45.49 million by 2033, driven by high demand from established beverage industries and a penchant for craft beers.Asia Pacific Hopped Malt Extract Market Report:

In 2023, the Asia-Pacific Hopped Malt Extract market was valued at $18.99 million, with expectations to grow to $31.25 million by 2033. The region's rising disposable incomes and growing interest in craft beverage preparations are key growth drivers.North America Hopped Malt Extract Market Report:

The North American market is projected to grow from $38.88 million in 2023 to $63.99 million by 2033. The presence of a strong craft brewing culture and high consumption rates of alcoholic beverages bolster its market share.South America Hopped Malt Extract Market Report:

The South American market for Hopped Malt Extract is anticipated to rise from $5 million in 2023 to $8.23 million by 2033. Increasing popularity for craft beers among younger consumers is anticipated to fuel this growth.Middle East & Africa Hopped Malt Extract Market Report:

The Middle East and Africa market is estimated to see growth from $9.49 million in 2023 to $15.62 million by 2033, aided by increasing beverage consumption and a growing trend of local brewing.Tell us your focus area and get a customized research report.

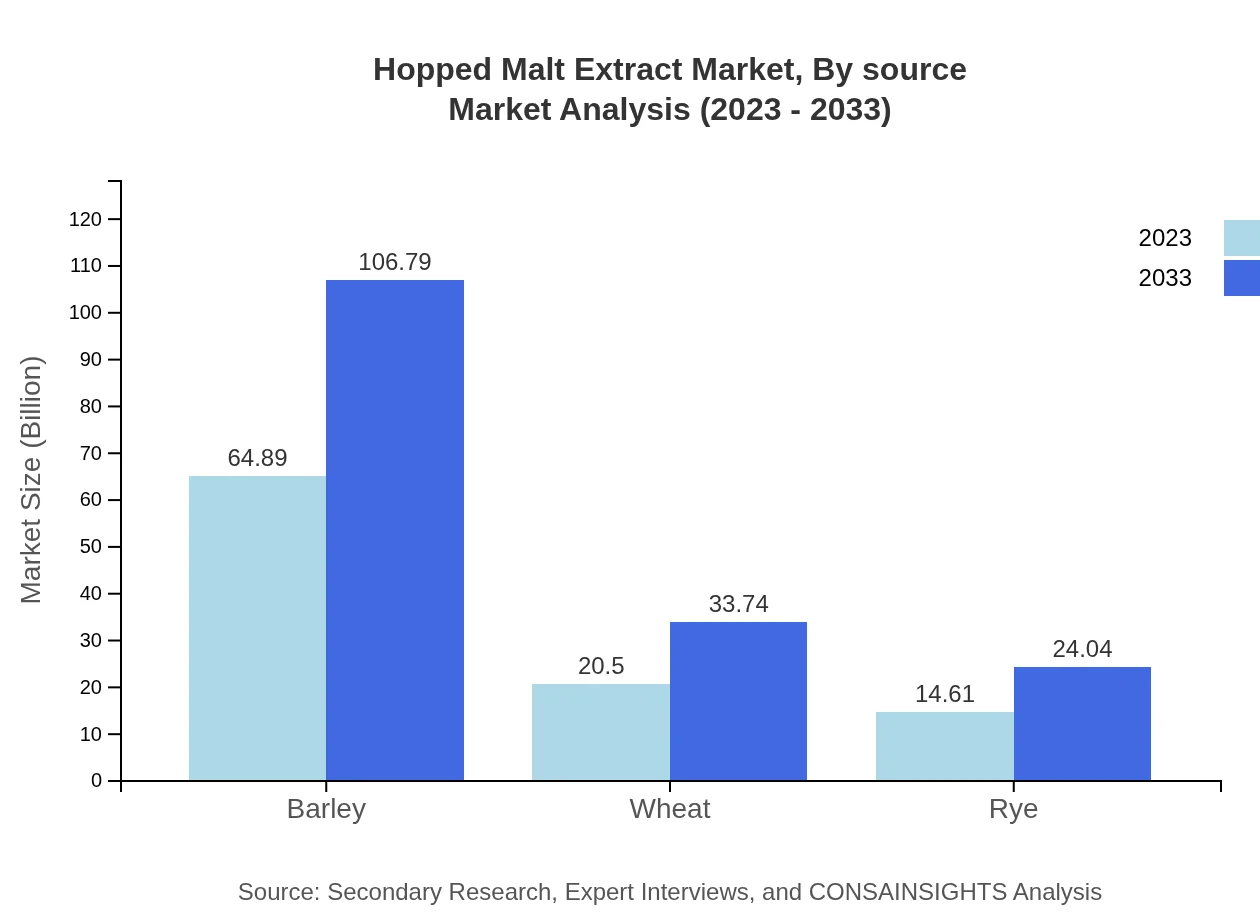

Hopped Malt Extract Market Analysis By Product Type

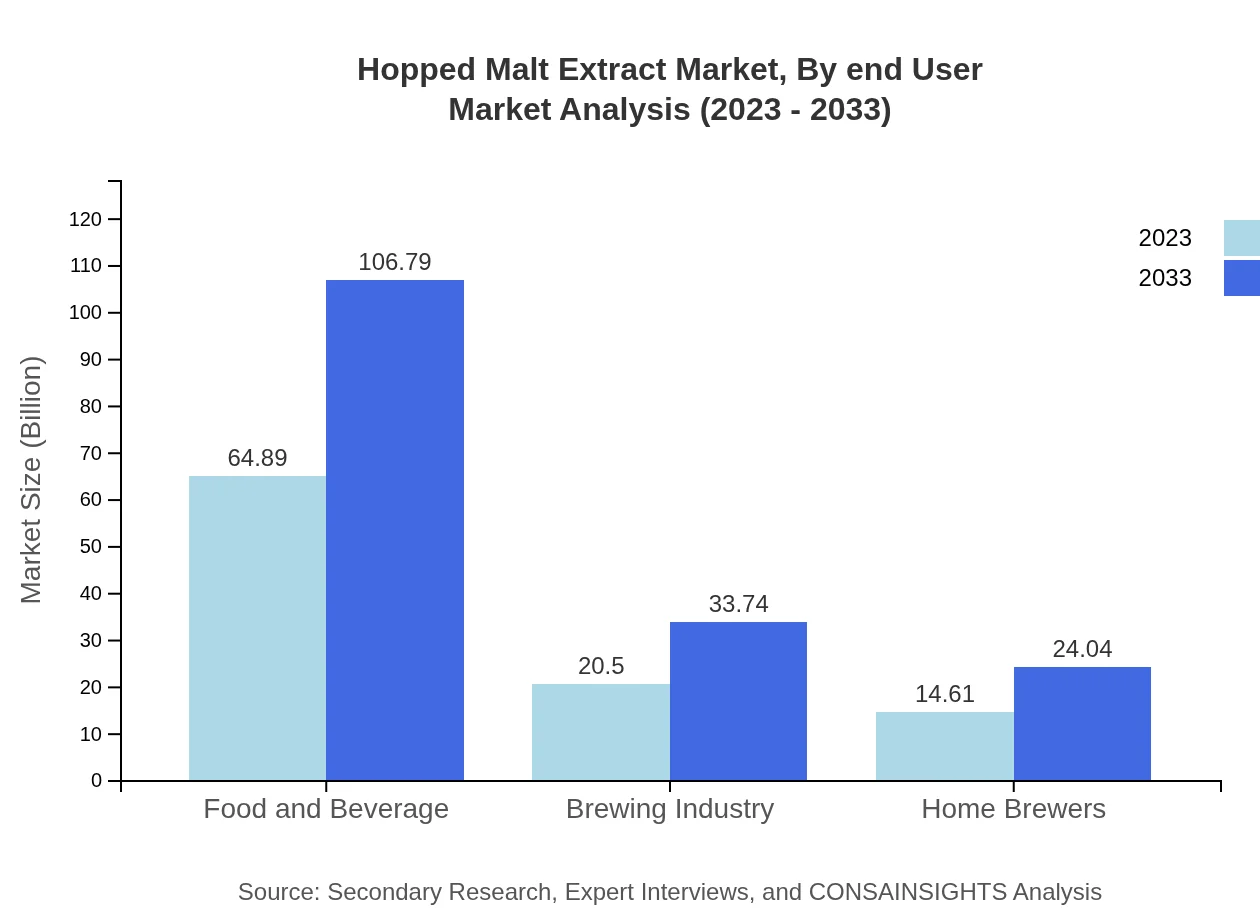

The Hopped Malt Extract market by product type reveals significant insights: 1. Barley: Valued at $64.89 million in 2023 and projected to reach $106.79 million by 2033, Barley dominates the market due to its flavor contributions and ease of cultivation. 2. Wheat: Expected to grow from $20.50 million in 2023 to $33.74 million by 2033, wheat is increasingly gaining traction in specific beer types. 3. Rye: With a value of $14.61 million in 2023, expected to reach $24.04 million by 2033, rye's unique flavoring is appealing to craft brewers.

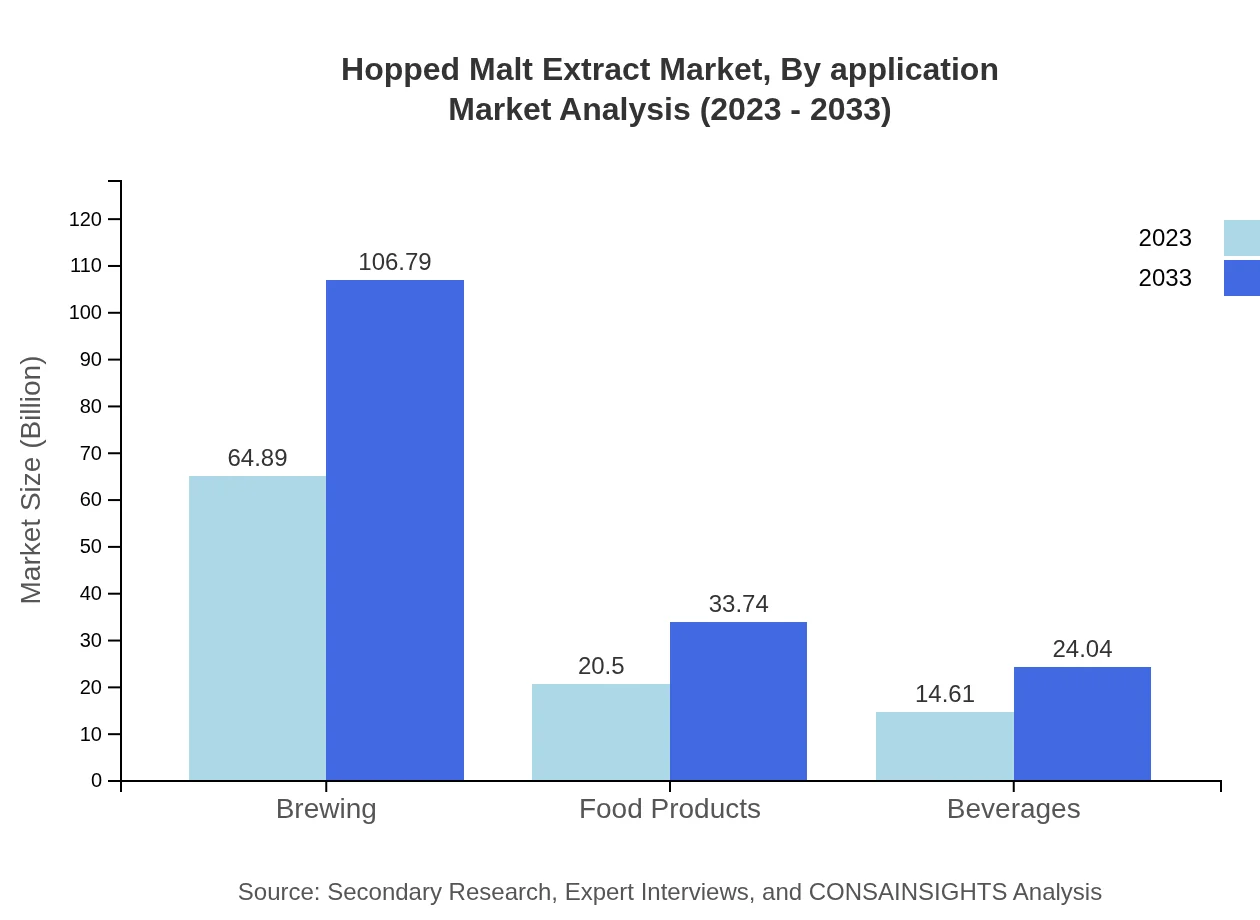

Hopped Malt Extract Market Analysis By Application

By application, the Hopped Malt Extract market shows promising data: 1. Brewing Industry: The segment, valued at $20.50 million in 2023, is anticipated to reach $33.74 million by 2033, driven by continuous innovations in craft brewing. 2. Home Brewers: This segment is of growing importance, projected to expand from $14.61 million in 2023 to $24.04 million by 2033, fueled by increasing interest in home brewing products.

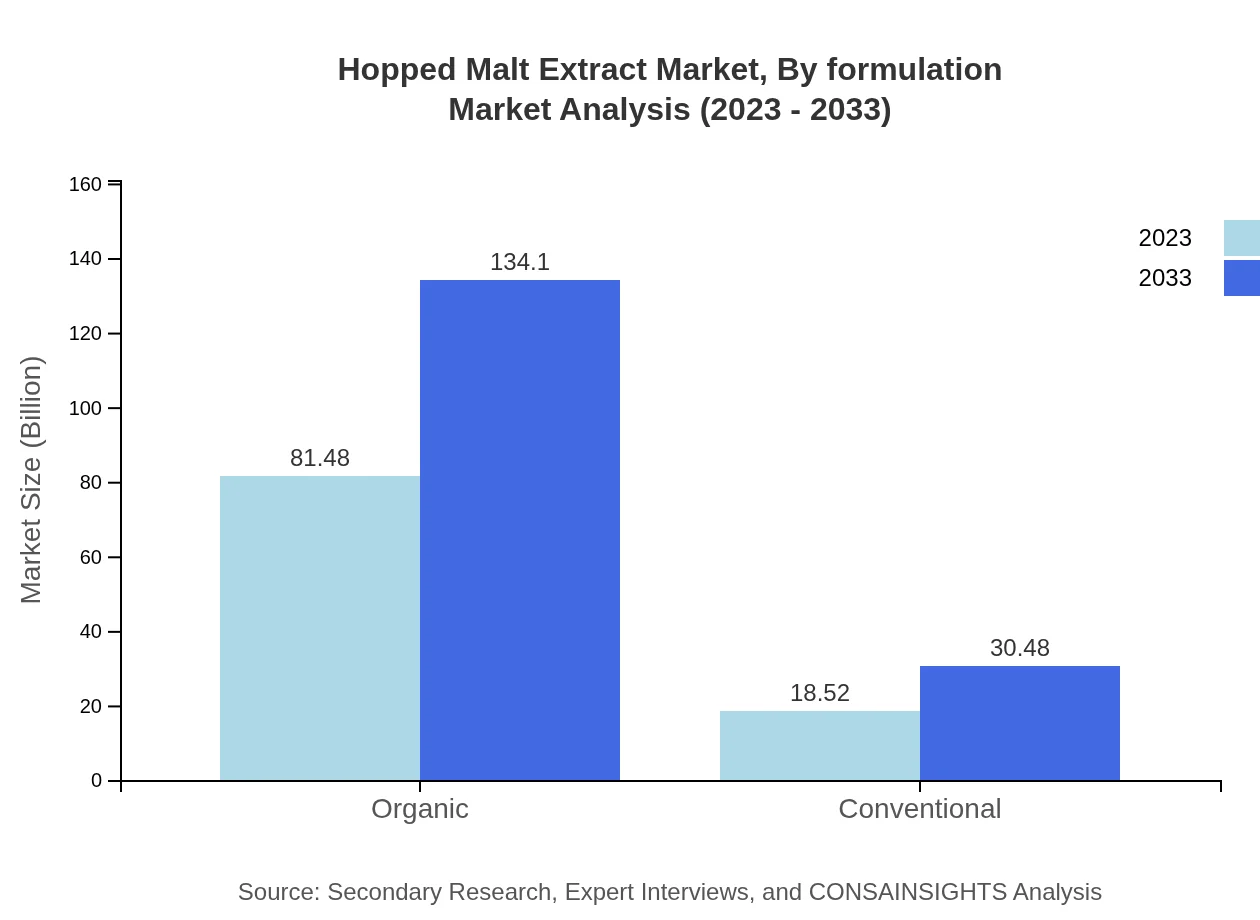

Hopped Malt Extract Market Analysis By Source

The source analysis indicates a shift towards organic materials: 1. Organic sources are projected to grow from $81.48 million in 2023 to $134.10 million by 2033, reflecting consumer preference for organic ingredients. 2. Conventional sources are set to rise from $18.52 million in 2023 to $30.48 million by 2033, focusing on affordability.

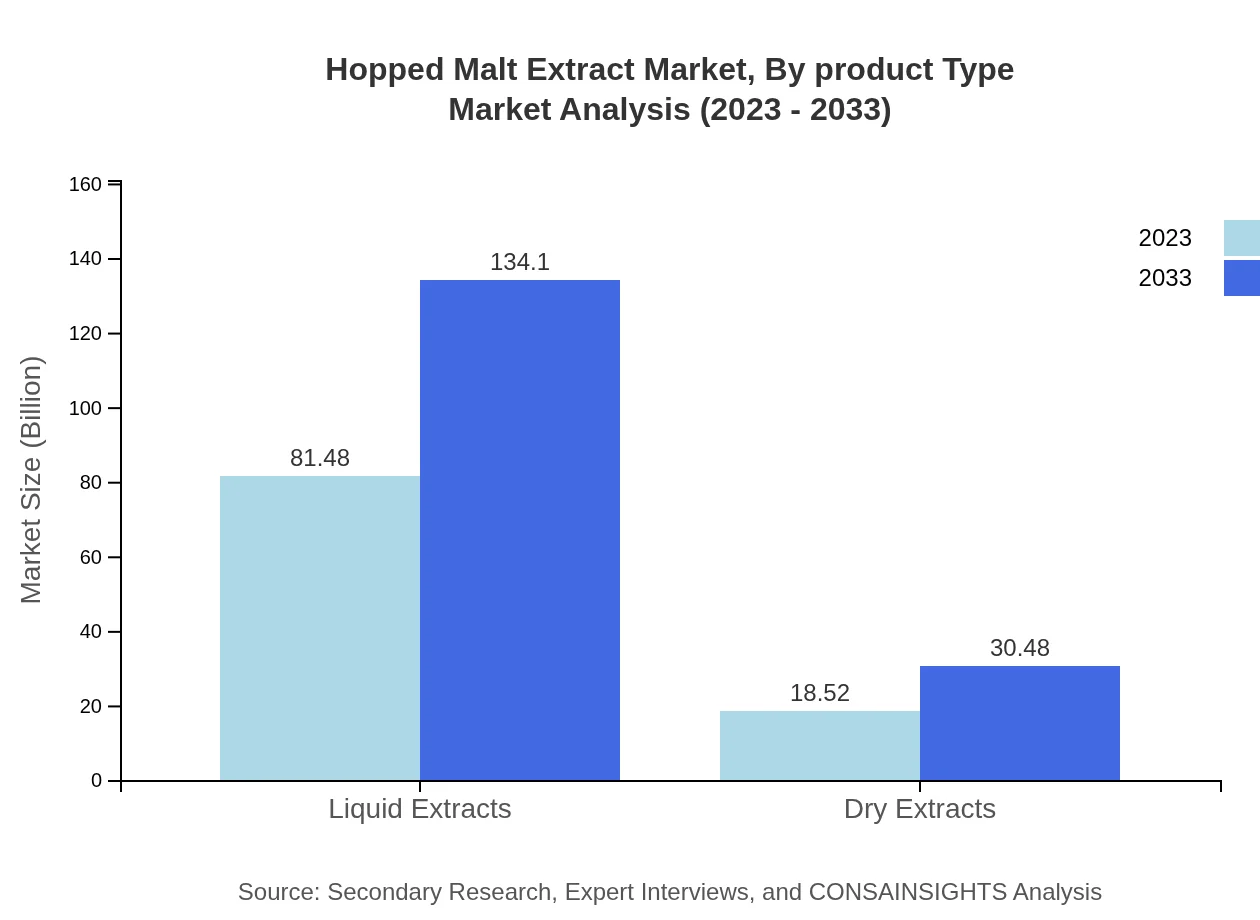

Hopped Malt Extract Market Analysis By Formulation

The formulation breakdown indicates growth potential: 1. Liquid Extracts are expected to maintain a stronghold, growing from $81.48 million in 2023 to $134.10 million by 2033. 2. Dry Extracts show promise, projected to advance from $18.52 million in 2023 to $30.48 million by 2033, appealing to niche applications.

Hopped Malt Extract Market Analysis By End User

End-user analysis highlights significant segments: 1. Commercial Breweries hold a larger market share, with projections growing from $64.89 million in 2023 to $106.79 million by 2033. 2. Home Brewing enthusiasts represent a burgeoning market, from $14.61 million to $24.04 million over the same period, indicating a rising trend in home brewing culture.

Hopped Malt Extract Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Hopped Malt Extract Industry

Malt Products Corporation:

A leader in the manufacture of malt extracts, offering innovative solutions for the brewing industry and contributing to the popularity of craft brewing.Briess Malt & Ingredients Company:

Specializes in malted ingredients, providing high-quality hopped malt extracts that cater to both professional and home brewers.John I. Haas, Inc.:

A prominent supplier of hops and hop extracts, known for its commitment to quality and innovation in the craft brewing sector.Castle Maltings:

An established player that emphasizes organic and sustainable malt production, providing premium extract options to global markets.We're grateful to work with incredible clients.

FAQs

What is the market size of hopped Malt Extract?

The market size of the hopped-malt-extract industry is valued at $100 million in 2023, with a projected CAGR of 5%. This growth reflects the increasing adoption within various food and beverage applications, showing significant potential for expansion by 2033.

What are the key market players or companies in this hopped Malt Extract industry?

Key players in the hopped-malt-extract industry include prominent beverage manufacturers and ingredient suppliers focusing on innovation and product offerings to meet rising consumer demands, especially in specialty brewing and organic food segments.

What are the primary factors driving the growth in the hopped Malt Extract industry?

The growth of the hopped-malt-extract industry is primarily driven by rising demand in the craft beer market, increasing consumer preference for natural ingredients in food products, and the expanding use of malt extracts in diverse applications in the food and beverage sector.

Which region is the fastest Growing in the hopped Malt Extract?

The fastest-growing region for hopped-malt-extract is predicted to be Europe, with a market growth from $27.64 million in 2023 to $45.49 million in 2033, reflecting an increasing trend in craft brewing and organic food production.

Does Consainsights provide customized market report data for the hopped Malt Extract industry?

Yes, Consainsights offers customized market report data tailored to specific needs within the hopped-malt-extract sector, allowing businesses to obtain detailed insights that align with their unique market objectives and strategic plans.

What deliverables can I expect from this hopped Malt Extract market research project?

Deliverables from the hopped-malt-extract market research project include detailed market analysis, regional insights, segment performance evaluations, competitive landscape assessments, and actionable recommendations for navigating market dynamics effectively.

What are the market trends of hopped Malt Extract?

Current market trends in hopped-malt-extract include a shift towards organic and natural ingredients, increased innovation in product formulations, and growing popularity of craft brewing, driving demand across various consumer segments.