Hospice Market Report

Published Date: 31 January 2026 | Report Code: hospice

Hospice Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the global hospice market, examining trends, forecasts, and challenges impacting the sector from 2023 to 2033. Insights include market size, segmentation, regional dynamics, and key player strategies.

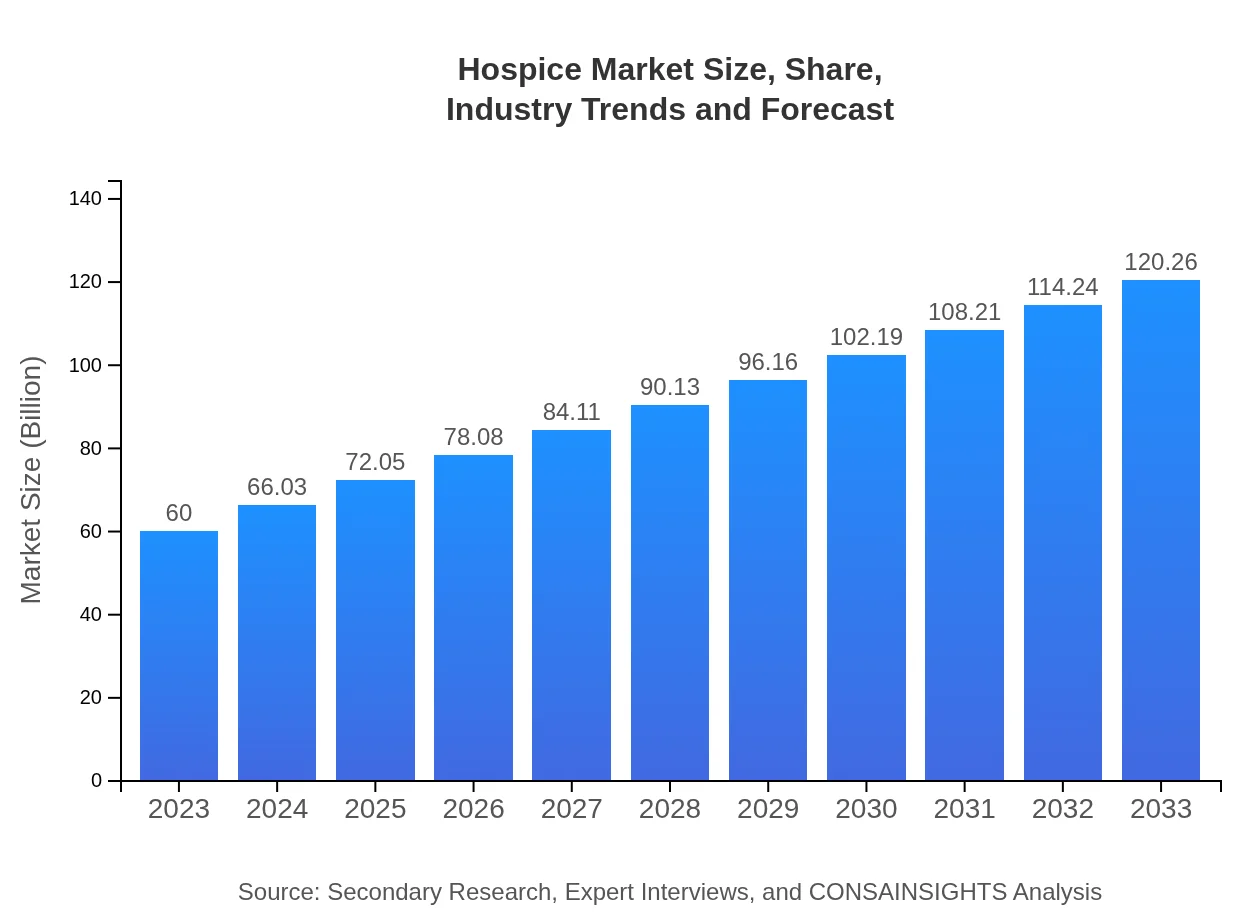

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $60.00 Billion |

| CAGR (2023-2033) | 7% |

| 2033 Market Size | $120.26 Billion |

| Top Companies | VITAS Healthcare, Kindred Healthcare, Gentiva Health Services, Curo Health Services |

| Last Modified Date | 31 January 2026 |

Hospice Market Overview

Customize Hospice Market Report market research report

- ✔ Get in-depth analysis of Hospice market size, growth, and forecasts.

- ✔ Understand Hospice's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Hospice

What is the Market Size & CAGR of Hospice market in 2023?

Hospice Industry Analysis

Hospice Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Hospice Market Analysis Report by Region

Europe Hospice Market Report:

The European hospice market is expected to grow from $14.99 billion in 2023 to $30.04 billion by 2033. Increasing patient-centred care initiatives and a heightened focus on end-of-life care quality are core drivers of this growth. Different regulations across nations are influencing service delivery methods, with some countries adopting more integrated approaches.Asia Pacific Hospice Market Report:

In 2023, the Asia Pacific hospice market is valued at approximately $12.28 billion and is projected to grow to $24.61 billion by 2033. Factors driving this growth include increasing life expectancy, rising chronic disease prevalence, and improving healthcare infrastructure in the region. Cultural shifts towards recognizing the importance of palliative care are enhancing the adoption of hospice services.North America Hospice Market Report:

In North America, the hospice market is projected to grow from $21.23 billion in 2023 to $42.56 billion by 2033. The growth is driven by an aging population, high prevalence of chronic diseases, and a shift towards home healthcare. Innovative models of care, including telemedicine, are also gaining traction, reshaping service delivery in hospice care.South America Hospice Market Report:

The hospice market in South America is valued at $5.71 billion in 2023, with an expected growth to $11.45 billion by 2033. This growth is fueled by increased awareness of palliative care and supportive governmental policies. However, challenges such as healthcare accessibility in rural areas may limit faster market expansion.Middle East & Africa Hospice Market Report:

The hospice market for the Middle East and Africa is valued at $5.79 billion in 2023, anticipating growth to $11.61 billion by 2033. The market is expanding due to rising healthcare investment, heightened awareness of hospice care, and gradual reforms aimed at integrating palliative care into health systems, despite ongoing challenges related to healthcare infrastructure.Tell us your focus area and get a customized research report.

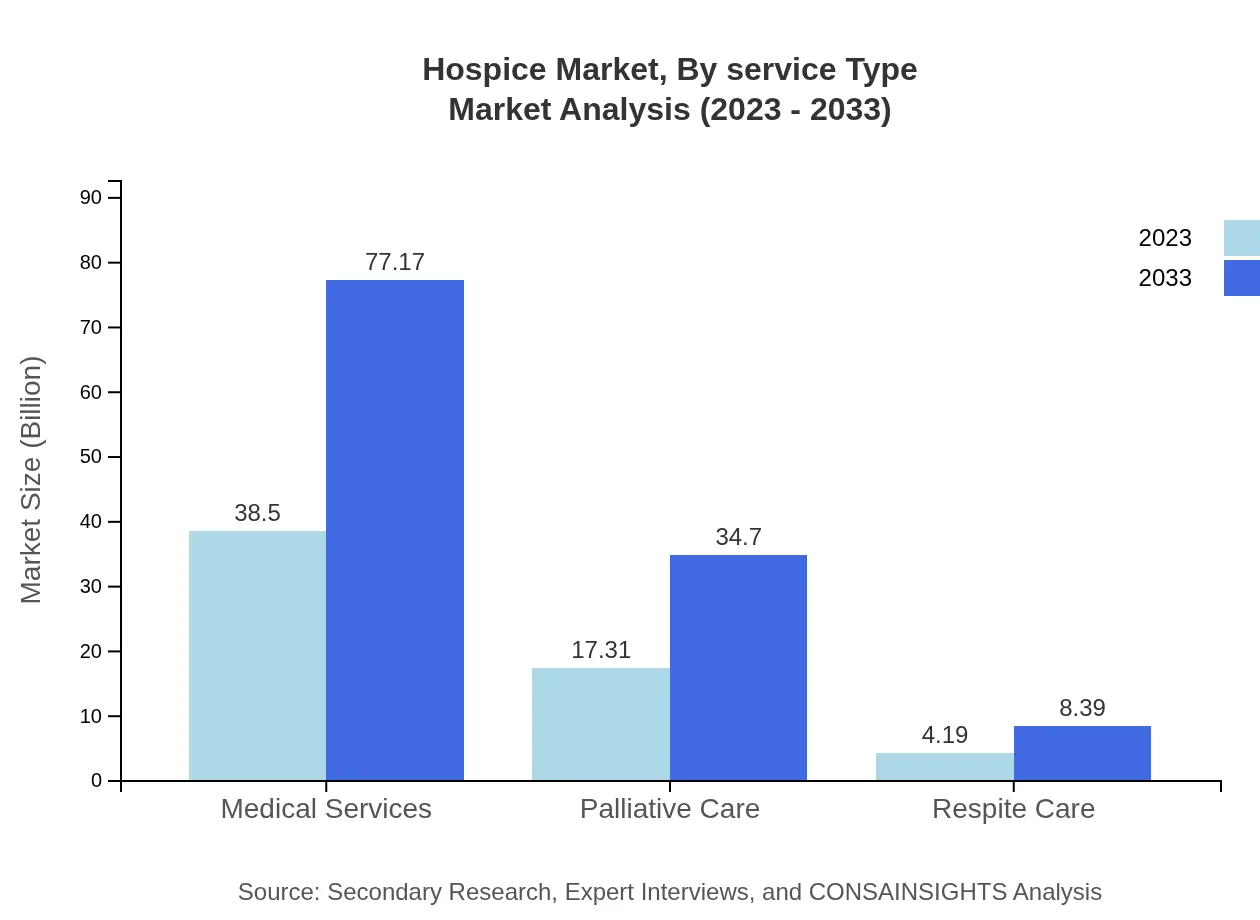

Hospice Market Analysis By Service Type

The hospice market by service type includes medical services, palliative care, respite care, and in-home care. Medical services dominate the market with a size of $38.50 billion in 2023, projected to reach $77.17 billion by 2033, holding a 64.17% market share. Palliative care anticipates growth from $17.31 billion to $34.70 billion, representing a 28.85% share, while respite care will see growth from $4.19 billion to $8.39 billion, holding a 6.98% share.

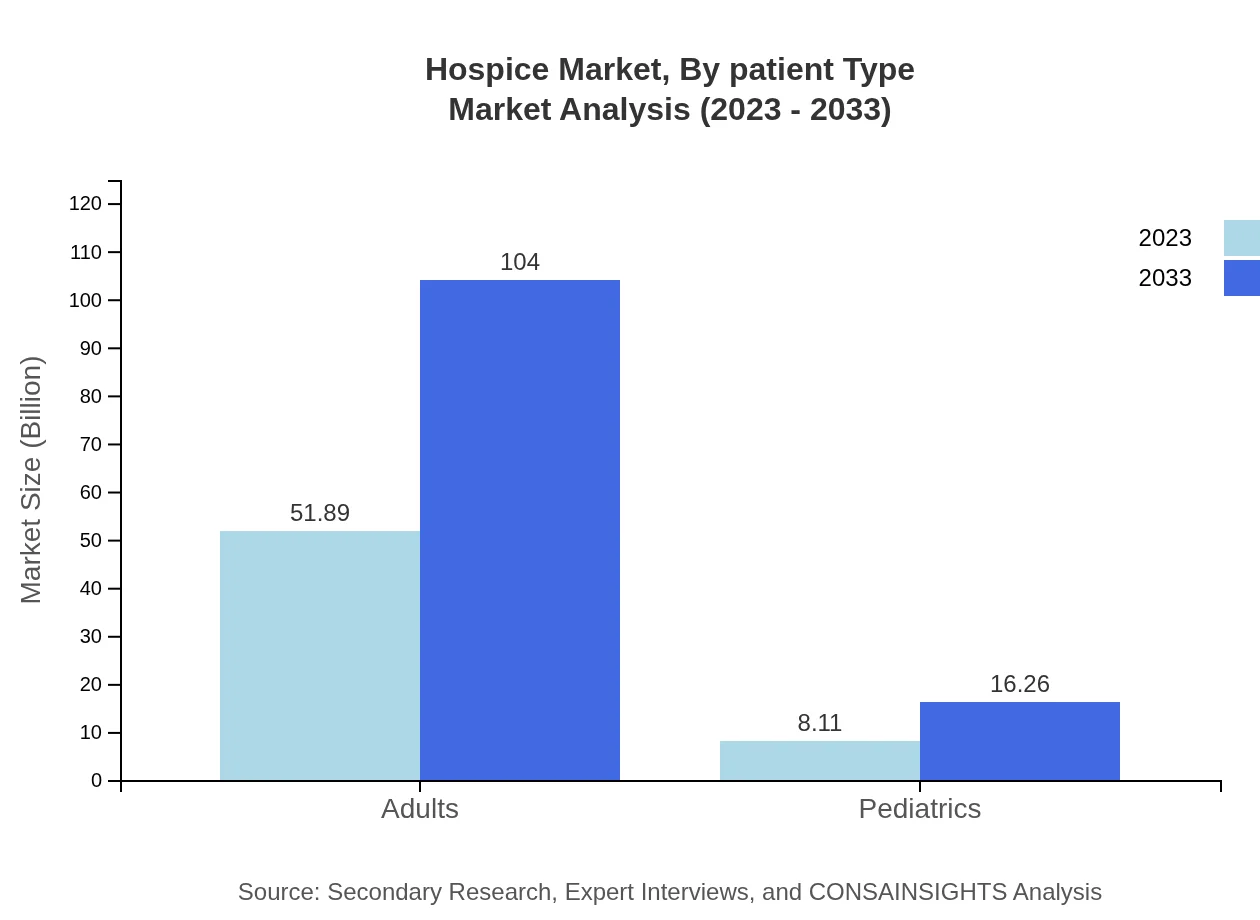

Hospice Market Analysis By Patient Type

With a strong focus on adult care, the hospice market for adults reflects significant growth, expected to move from $51.89 billion in 2023 to $104.00 billion by 2033, capturing an 86.48% market share. In contrast, pediatric hospice care, though smaller, is growing steadily from $8.11 billion to $16.26 billion, representing a 13.52% market share.

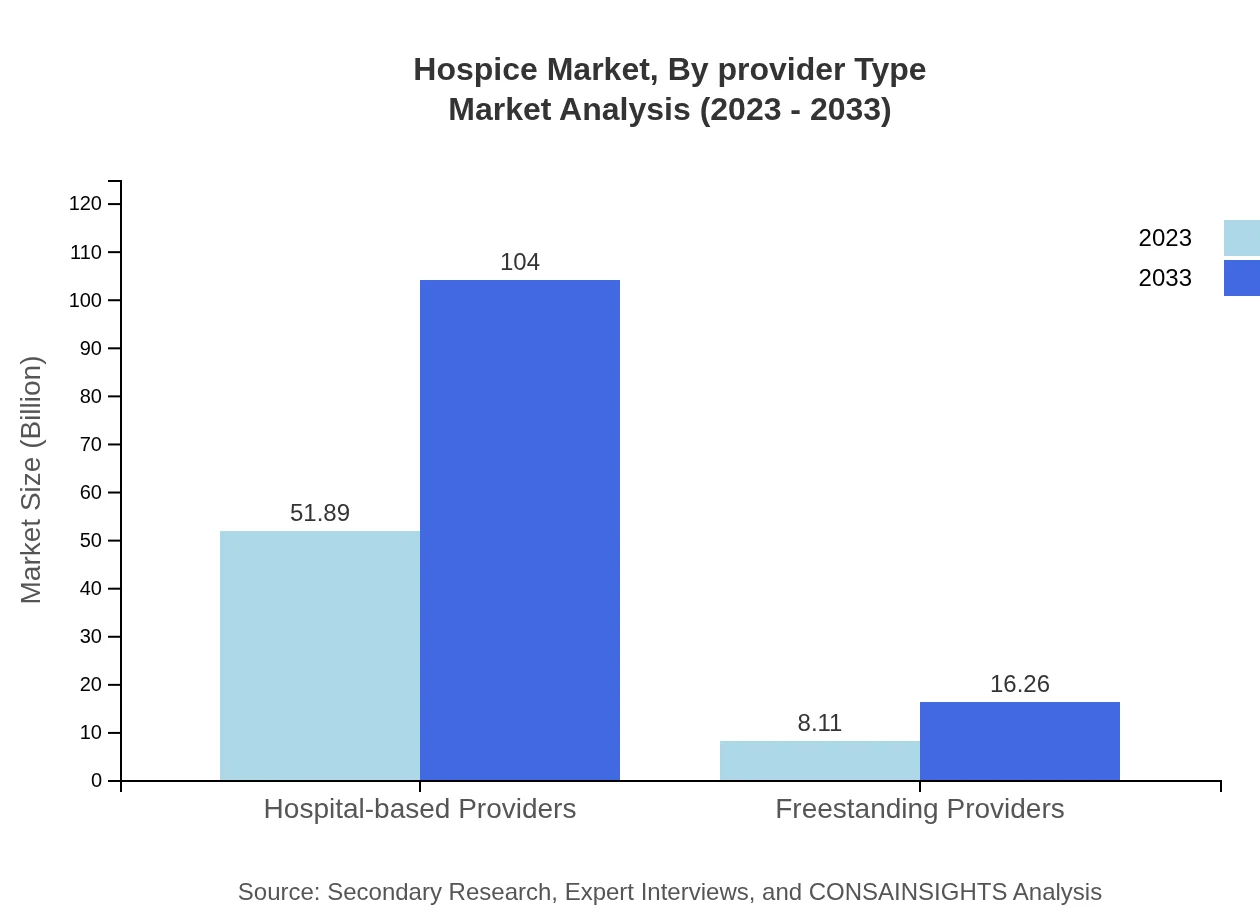

Hospice Market Analysis By Provider Type

The market by provider type includes hospital-based providers, freestanding providers, and in-home care services. Hospital-based providers currently lead the market at $51.89 billion, growing to $104.00 billion by 2033, maintaining an 86.48% market share. Freestanding providers will expand from $8.11 billion to $16.26 billion, holding a 13.52% share.

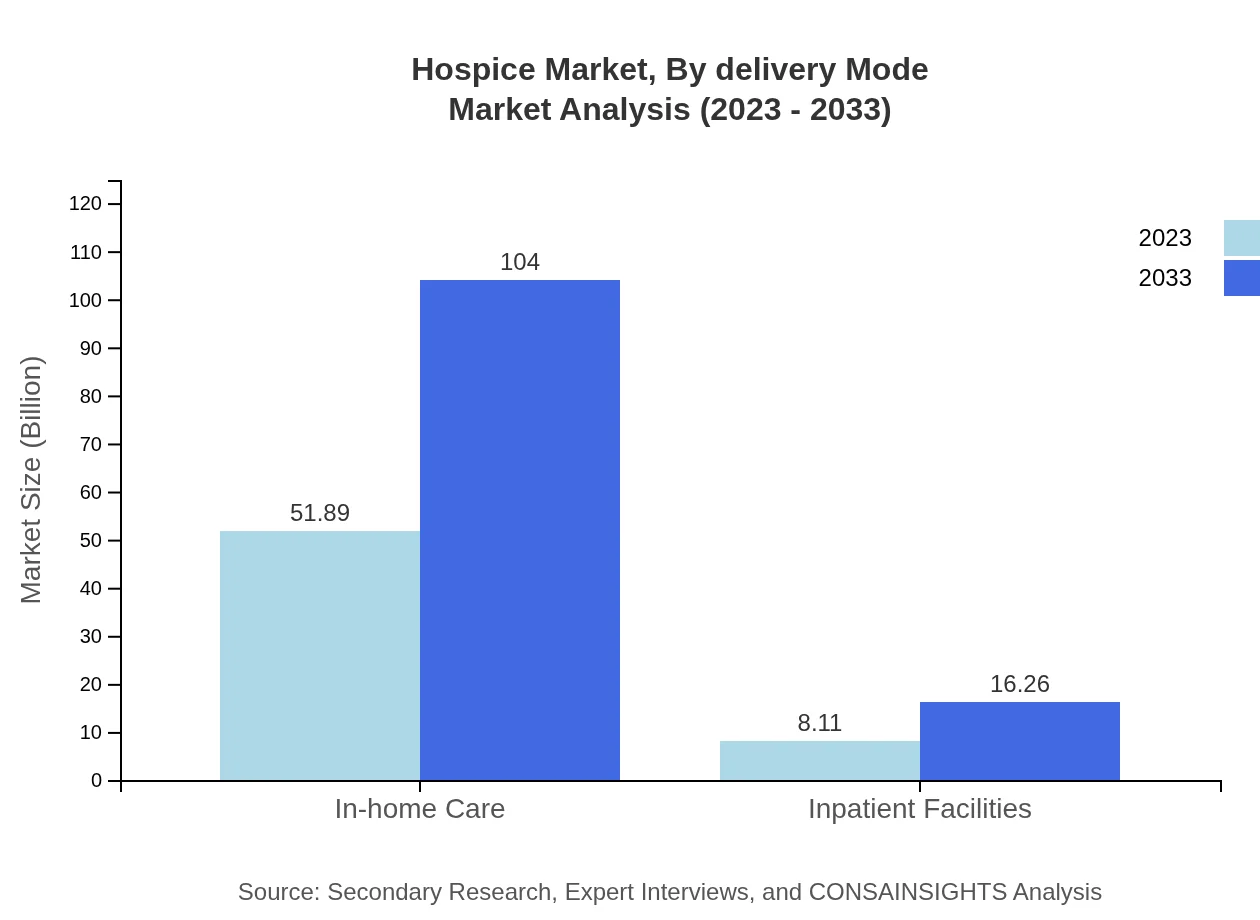

Hospice Market Analysis By Delivery Mode

Delivery modes in the hospice market primarily revolve around in-home care and inpatient facilities. In-home care dominates, expected to grow from $51.89 billion to $104.00 billion by 2033, capturing an 86.48% share. Inpatient facilities represent a smaller but important segment, moving from $8.11 billion to $16.26 billion, retaining a 13.52% market share.

Hospice Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Hospice Industry

VITAS Healthcare:

VITAS Healthcare is one of the leading hospice providers in the U.S., offering comprehensive end-of-life care with a focus on symptom management and enhancing the quality of life for patients and their families.Kindred Healthcare:

Kindred Healthcare is a prominent player in the hospice market, providing innovative care solutions through its large network of hospice agencies and focusing on community-based care delivery.Gentiva Health Services:

Gentiva Health Services is widely recognized for its extensive hospice and home health services, committed to delivering high-quality care and support for patients and their families.Curo Health Services:

Curo Health Services operates both hospice and home health services, focusing on personalized care and effective pain management. They are recognized for their integrated approach to caring for patients with serious illnesses.We're grateful to work with incredible clients.

FAQs

What is the market size of hospice?

The global hospice market is valued at approximately $60 billion in 2023, with an expected CAGR of 7% projecting significant growth over the next decade. By 2033, the market size is anticipated to expand as demand for hospice services increases.

What are the key market players or companies in this hospice industry?

Key players in the hospice industry include major providers such as VITAS Healthcare, Kindred Hospice, and Amedisys. These companies focus on delivering quality care and expanding services to meet the growing demand in the hospice sector.

What are the primary factors driving the growth in the hospice industry?

Factors driving growth in the hospice industry include an aging population, increasing chronic diseases, and a growing preference for home-based care. Additionally, policy changes favoring palliative services are contributing to hospice market expansion.

Which region is the fastest Growing in the hospice market?

The North American hospice market is the fastest-growing region, projected to increase from $21.23 billion in 2023 to $42.56 billion by 2033, supported by favorable healthcare policies and rising demand for hospice care services.

Does ConsaInsights provide customized market report data for the hospice industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the hospice industry, ensuring clients receive detailed insights aligned with their strategic objectives and market requirements.

What deliverables can I expect from this hospice market research project?

Deliverables from the hospice market research project typically include comprehensive reports, market forecasts, competitive analysis, segment insights, and regional comparisons, providing essential information for strategic decision-making.

What are the market trends of hospice?

Emerging trends in the hospice market include increased technology adoption for remote care, enhanced focus on patient-centered services, and expansion of hospice offerings into palliative care, reflecting the evolving needs of patients and families.