Hospital Information System Market Report

Published Date: 31 January 2026 | Report Code: hospital-information-system

Hospital Information System Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Hospital Information System (HIS) market from 2023 to 2033, covering current trends, market size, segmentation, regional insights, and forecasts for growth. It aims to inform stakeholders about key developments and projections in the HIS industry.

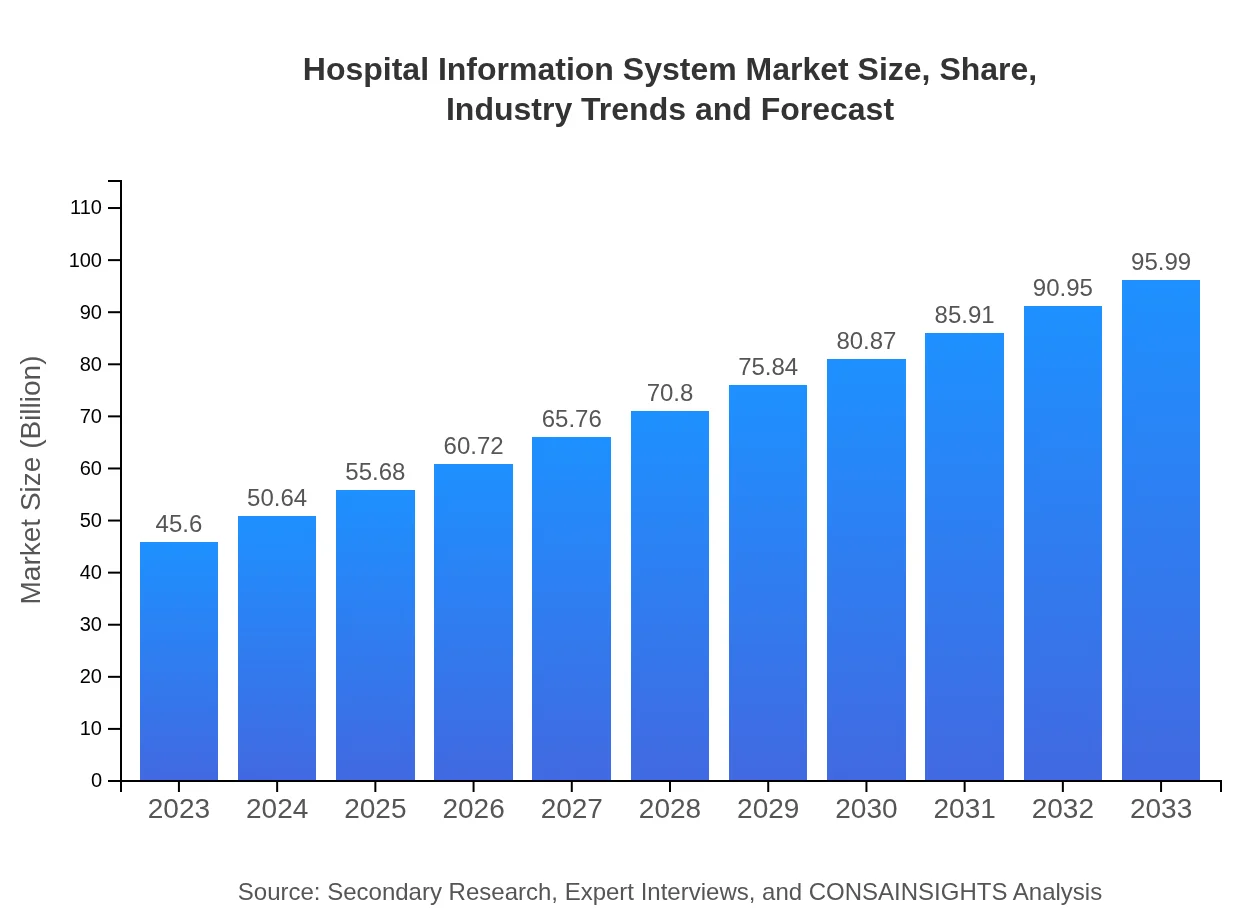

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $45.60 Billion |

| CAGR (2023-2033) | 7.5% |

| 2033 Market Size | $95.99 Billion |

| Top Companies | Epic Systems Corporation, Cerner Corporation, Allscripts Healthcare Solutions, McKesson Corporation |

| Last Modified Date | 31 January 2026 |

Hospital Information System Market Overview

Customize Hospital Information System Market Report market research report

- ✔ Get in-depth analysis of Hospital Information System market size, growth, and forecasts.

- ✔ Understand Hospital Information System's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Hospital Information System

What is the Market Size & CAGR of Hospital Information System market in 2023 and 2033?

Hospital Information System Industry Analysis

Hospital Information System Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Hospital Information System Market Analysis Report by Region

Europe Hospital Information System Market Report:

The European HIS market is expected to grow from $14.73 billion in 2023 to $31.01 billion by 2033. The focus on improving healthcare quality and government initiatives aimed at digital transformation play significant roles in this expansion, particularly in countries like Germany and the UK.Asia Pacific Hospital Information System Market Report:

The Asia Pacific region is poised for significant growth, projected to reach approximately $17.56 billion by 2033, up from $8.34 billion in 2023. Increasing healthcare expenditures and a rising demand for hospital automation solutions are driving this growth. Countries like China and India are leading the way due to rapid urbanization and government initiatives promoting healthcare digitization.North America Hospital Information System Market Report:

North America remains the largest market for Hospital Information Systems, expected to grow from $16.04 billion in 2023 to $33.77 billion by 2033. The presence of technologically advanced healthcare facilities, strong regulatory support, and a high level of competition among major players contribute to this robust growth.South America Hospital Information System Market Report:

The South American HIS market is anticipated to grow from $0.58 billion in 2023 to $1.23 billion by 2033. This growth is attributed to ongoing investments in modernizing healthcare infrastructure and improving service delivery in countries like Brazil and Argentina.Middle East & Africa Hospital Information System Market Report:

The Middle East and Africa HIS market is projected to increase from $5.91 billion in 2023 to $12.43 billion by 2033, driven by the rising demand for advanced hospital management systems and substantial investments by governments in healthcare infrastructure.Tell us your focus area and get a customized research report.

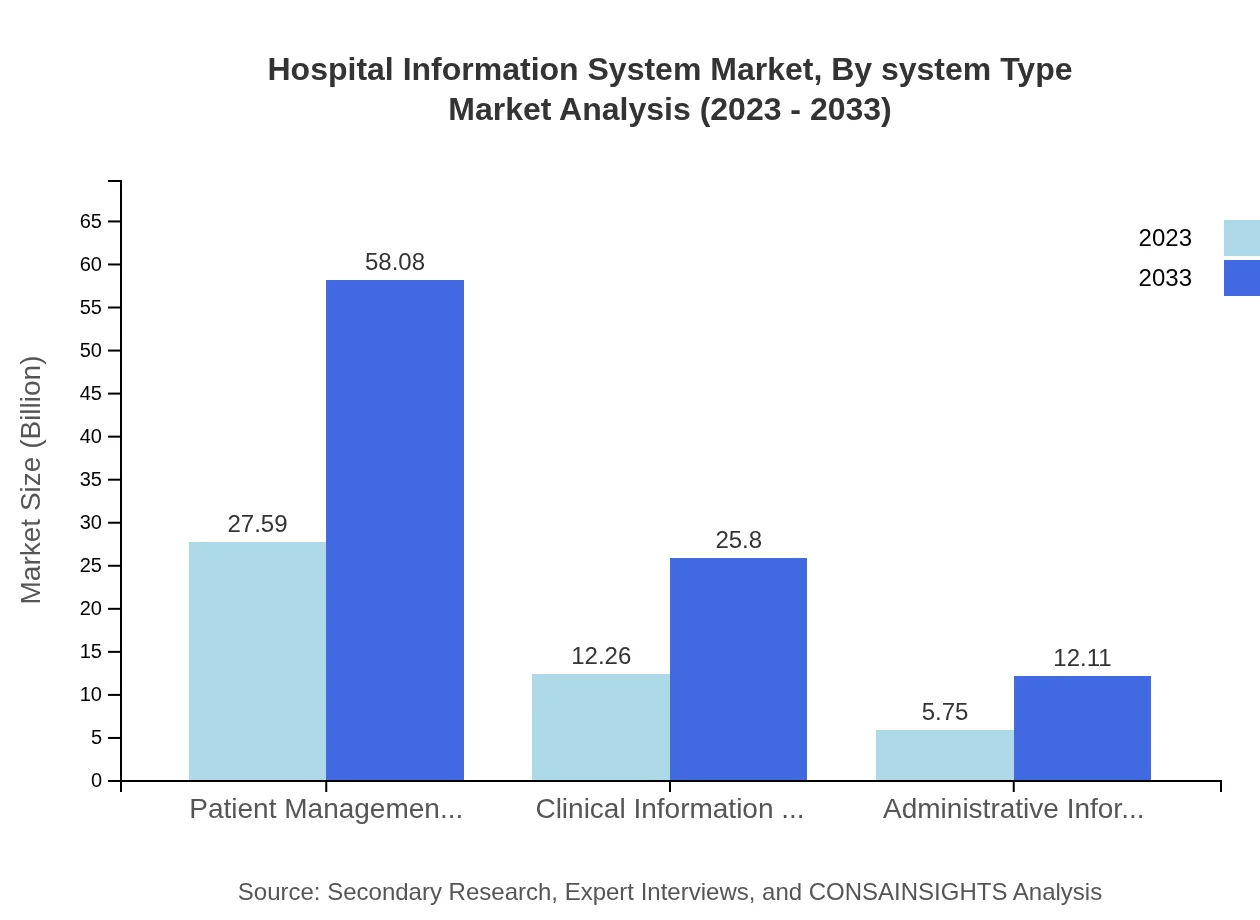

Hospital Information System Market Analysis By System Type

The HIS market is dominated by Patient Management Systems, which account for approximately $27.59 billion in 2023 and are forecasted to reach $58.08 billion by 2033, claiming a 60.5% market share. EHRs and Clinical Information Systems also represent significant segments, with the latter projected to grow from $12.26 billion to $25.80 billion over the same period.

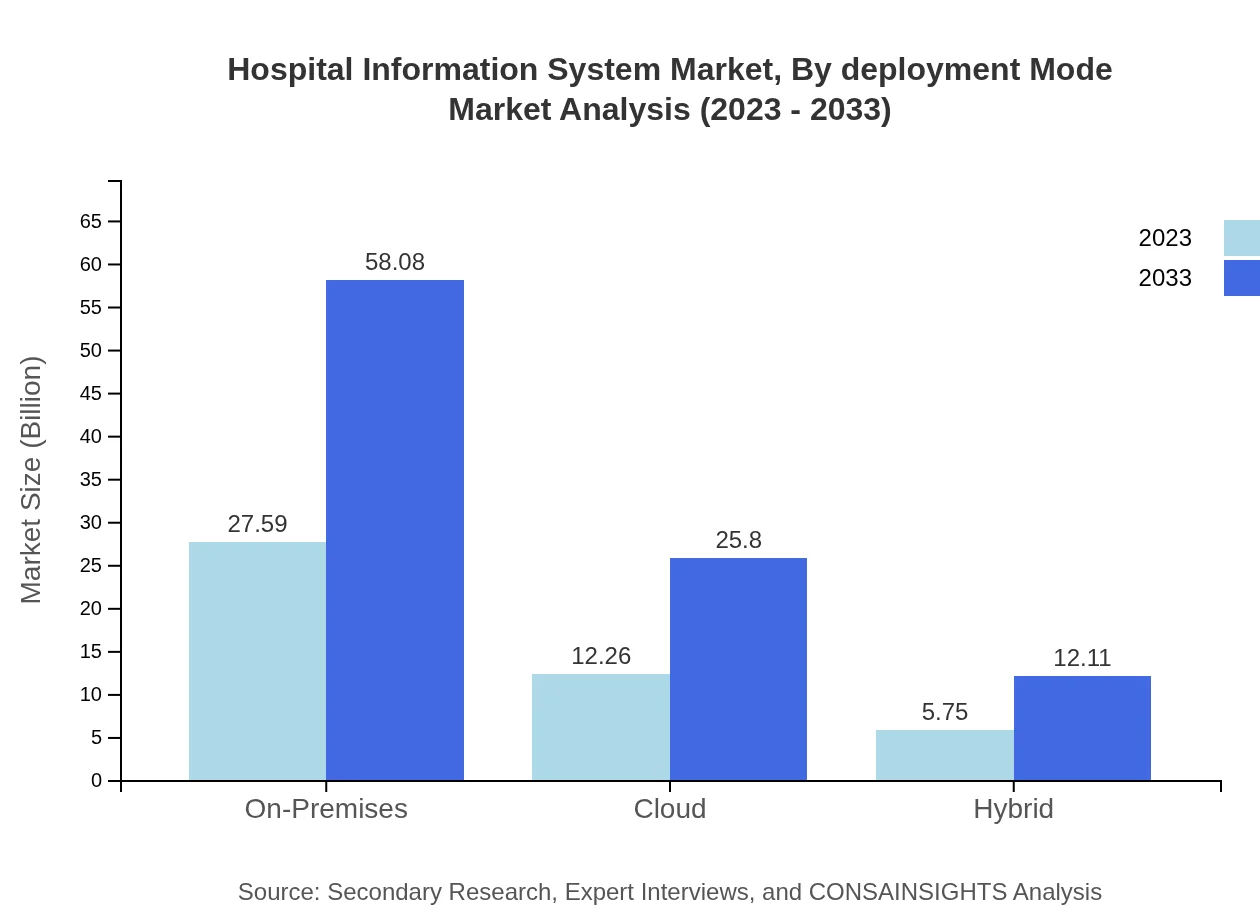

Hospital Information System Market Analysis By Deployment Mode

Deployment types reflect a strong preference for cloud solutions, which are expected to grow from $12.26 billion in 2023 to $25.80 billion in 2033. On-premises systems will maintain a competitive edge but are projected to grow at a slower pace compared to hybrid models.

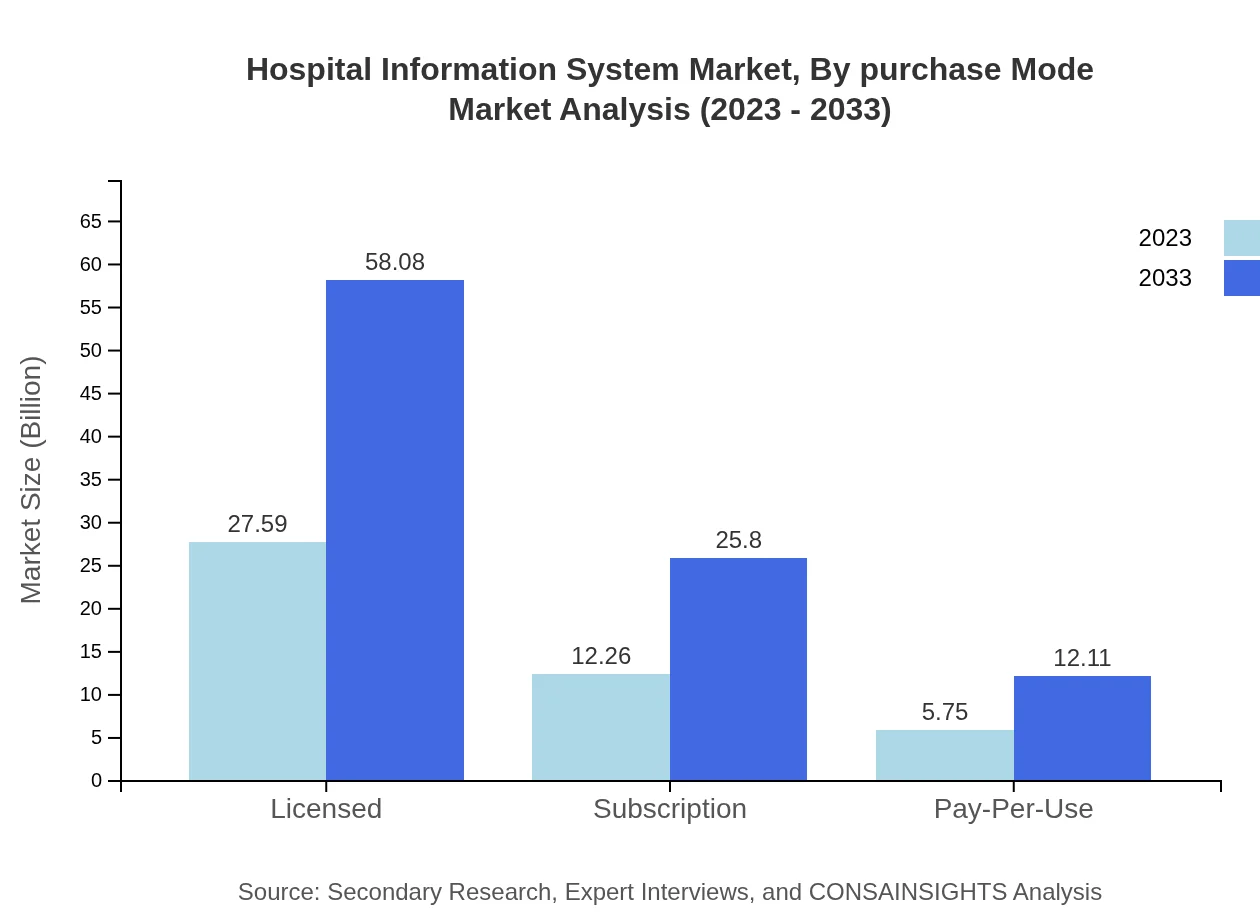

Hospital Information System Market Analysis By Purchase Mode

The licensed mode is the leading procurement strategy, projected to grow from $27.59 billion in 2023 to $58.08 billion by 2033. Subscription-based models are becoming increasingly popular as organizations look for flexibility and reduced up-front costs.

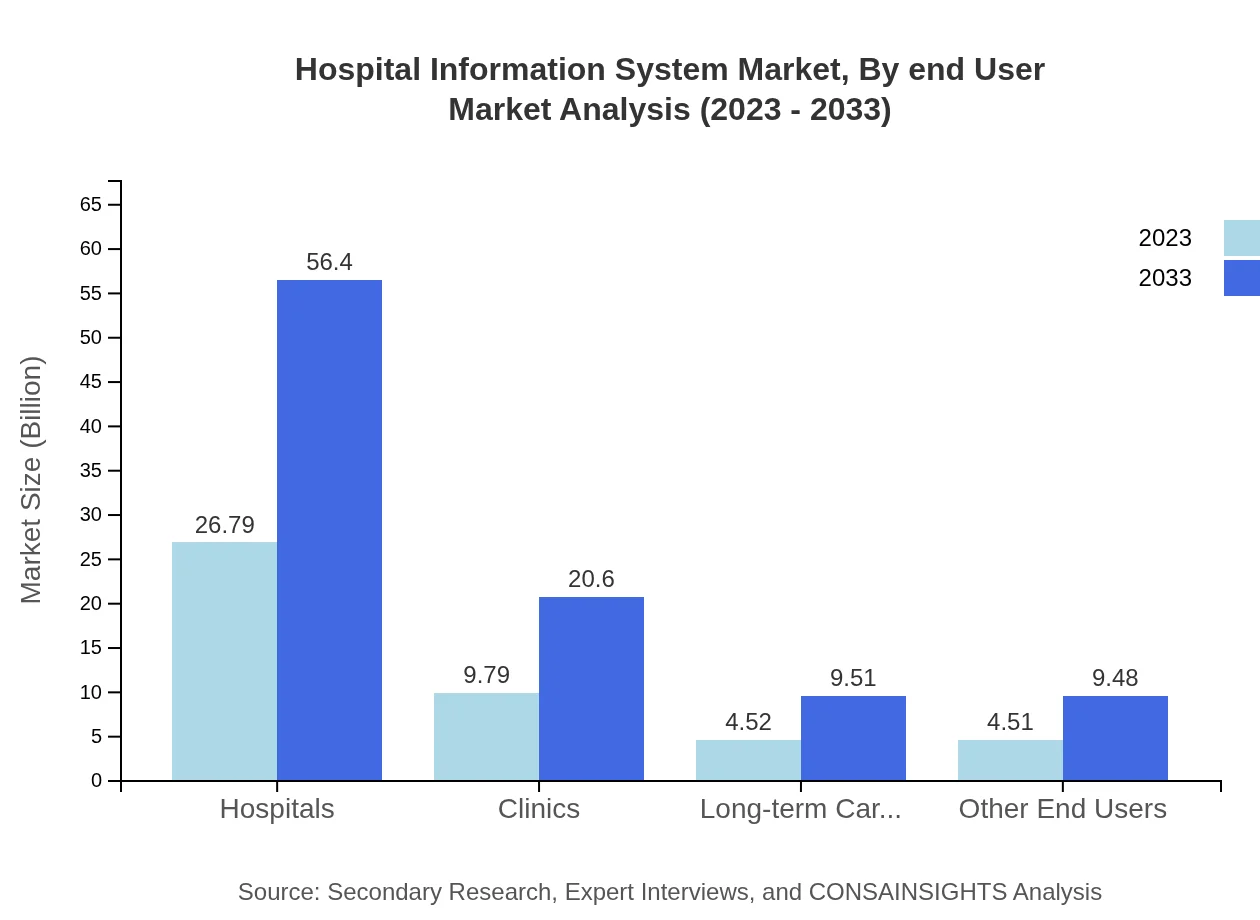

Hospital Information System Market Analysis By End User

Hospitals represent the largest share, valued at $26.79 billion in 2023 and expected to reach $56.40 billion by 2033. Clinics and long-term care facilities also play significant roles, with clinics expected to grow from $9.79 billion to $20.60 billion.

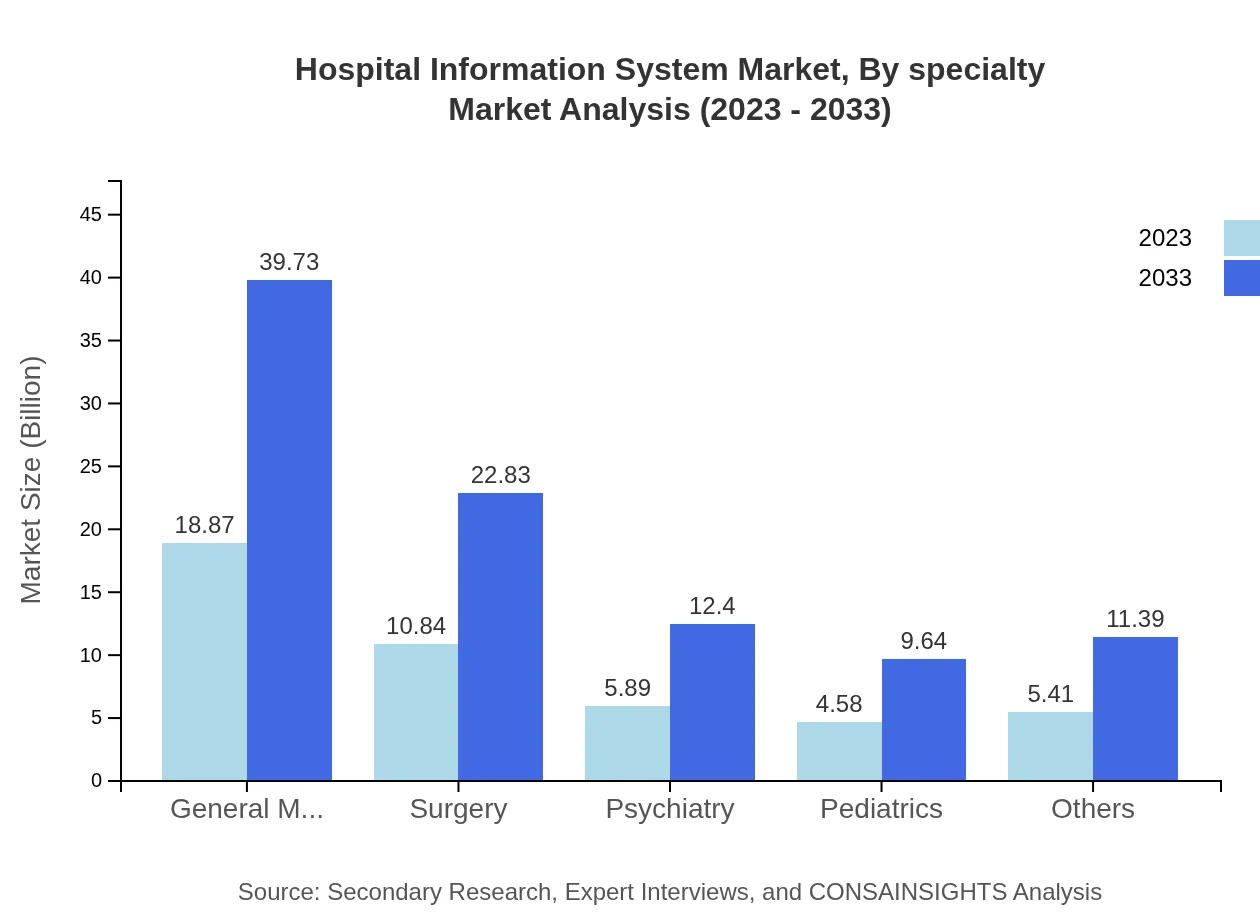

Hospital Information System Market Analysis By Specialty

General Medicine tops the segment by specialty, projected to grow from $18.87 billion in 2023 to $39.73 billion in 2033, while surgery and pediatrics hold substantial shares in the market, showing the diverse applicability of HIS across various medical fields.

Hospital Information System Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Hospital Information System Industry

Epic Systems Corporation:

A leading provider of EHR solutions known for its comprehensive, high-quality software focusing on the needs of large healthcare organizations.Cerner Corporation:

A major player in the HIS market, Cerner offers an array of solutions that cater to hospitals and clinics, emphasizing interoperability and population health management.Allscripts Healthcare Solutions:

Known for its innovative EHR and practice management solutions, Allscripts focuses on improving clinical and financial outcomes in various healthcare settings.McKesson Corporation:

A prominent healthcare services and information technology company, McKesson supports providers with its integrated platforms enhancing operational efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of hospital Information System?

The global Hospital Information System market is valued at approximately $45.6 billion in 2023, with a projected CAGR of 7.5%. By 2033, the market is expected to expand significantly, driven by advancements in healthcare technology.

What are the key market players or companies in this hospital Information System industry?

Key players in the Hospital Information System market include Cerner Corporation, Epic Systems Corporation, Meditech, Allscripts Healthcare Solutions, and McKesson Corporation, among others. These companies lead in innovation and market share, driving industry growth.

What are the primary factors driving the growth in the hospital Information System industry?

The growth of the hospital information system industry is driven by increasing demand for efficient patient management, advancements in medical technology, regulatory reforms, and the need for improved healthcare data management and interoperability among healthcare providers.

Which region is the fastest Growing in the hospital Information System?

The fastest-growing region in the Hospital Information System market is Europe, expected to grow from $14.73 billion in 2023 to $31.01 billion by 2033. North America follows closely, indicating robust market potential across both regions.

Does ConsaInsights provide customized market report data for the hospital Information System industry?

Yes, ConsaInsights specializes in providing customized market reports tailored to specific client needs within the hospital information system industry, ensuring actionable insights and data driven by individual market requirements.

What deliverables can I expect from this hospital Information System market research project?

Deliverables from ConsaInsights include detailed reports on market size, growth projections, competitive landscapes, segmented data analysis, and regional insights, providing a comprehensive overview of the hospital information system industry.

What are the market trends of hospital Information System?

Current market trends in the Hospital Information System industry include the rise of cloud-based solutions, increasing incorporation of AI in healthcare, enhanced focus on patient-centric care models, and greater regulatory focus on data security.