Hospital Outsourcing Market Report

Published Date: 31 January 2026 | Report Code: hospital-outsourcing

Hospital Outsourcing Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Hospital Outsourcing market, including valuable insights from 2023 to 2033. It covers market trends, forecasts, and regional breakdowns to help stakeholders make informed decisions.

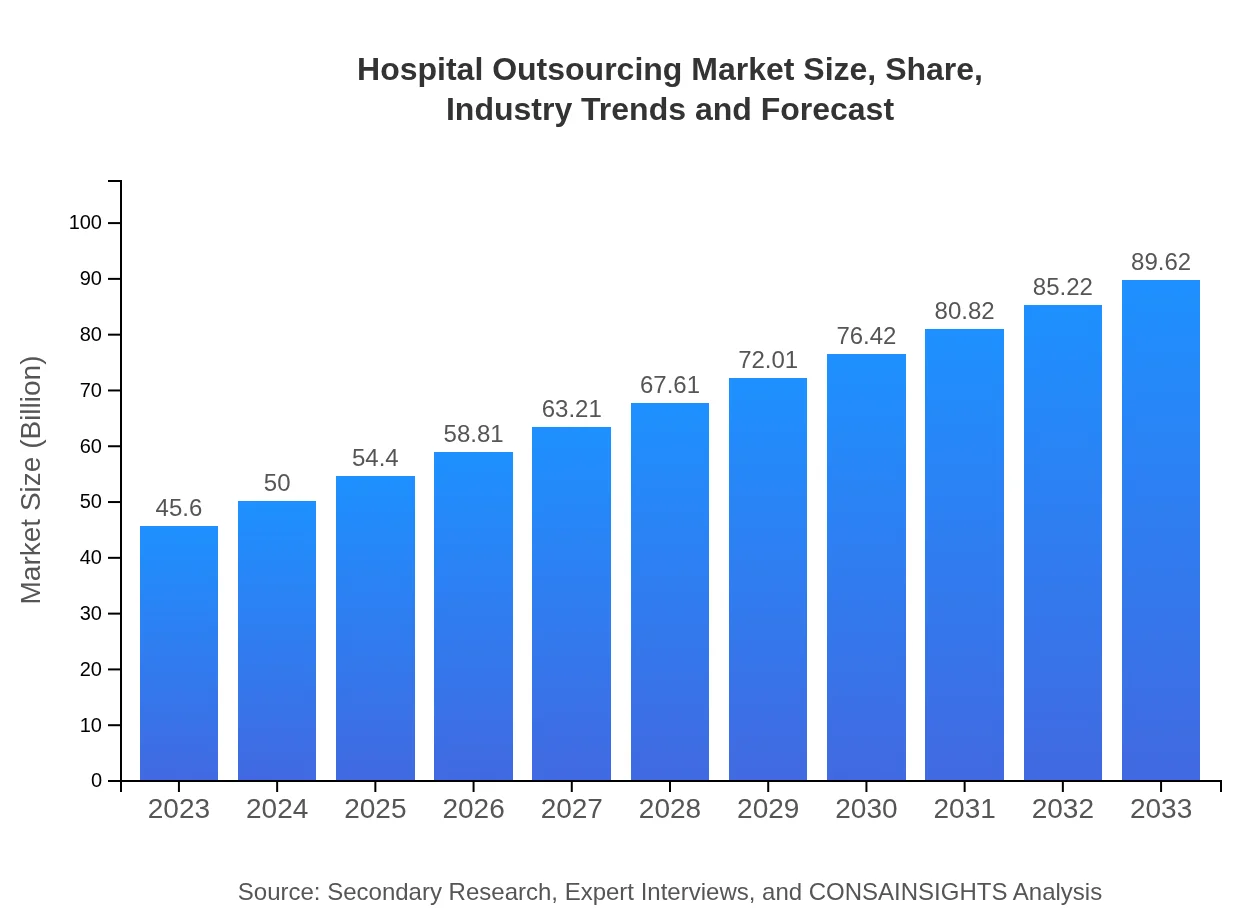

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $45.60 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $89.62 Billion |

| Top Companies | McKesson Corporation, QuintilesIMS, Concentra, Cerner Corporation, Optum |

| Last Modified Date | 31 January 2026 |

Hospital Outsourcing Market Overview

Customize Hospital Outsourcing Market Report market research report

- ✔ Get in-depth analysis of Hospital Outsourcing market size, growth, and forecasts.

- ✔ Understand Hospital Outsourcing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Hospital Outsourcing

What is the Market Size & CAGR of Hospital Outsourcing market in 2023?

Hospital Outsourcing Industry Analysis

Hospital Outsourcing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Hospital Outsourcing Market Analysis Report by Region

Europe Hospital Outsourcing Market Report:

Europe's market for hospital outsourcing is expected to grow significantly from $15.86 billion in 2023, reaching $31.17 billion by 2033. Here, strict regulations and the need for operational efficiency spur hospitals to outsource various services.Asia Pacific Hospital Outsourcing Market Report:

The Asia Pacific region shows substantial growth potential, expecting market size to expand from $8.55 billion in 2023 to $16.80 billion by 2033. The increasing healthcare expenditure and a shift towards value-based care models drive the adoption of outsourcing solutions.North America Hospital Outsourcing Market Report:

North America dominates the market, projected to reach $28.93 billion by 2033, up from $14.72 billion in 2023. This growth benefits from a high penetration of outsourcing practices among hospitals, driven by the need to lower costs and enhance patient services.South America Hospital Outsourcing Market Report:

In South America, the market is forecasted to grow from $2.62 billion in 2023 to $5.14 billion by 2033. The rising need to improve hospital efficiencies and quality of patient care promotes the outsourcing trend, helping to alleviate budget constraints.Middle East & Africa Hospital Outsourcing Market Report:

The Middle East and Africa market is estimated to grow from $3.85 billion in 2023 to $7.57 billion by 2033. Growing investments in healthcare infrastructure and the shortage of skilled workforce are facilitating an increasing trend of outsourcing in these regions.Tell us your focus area and get a customized research report.

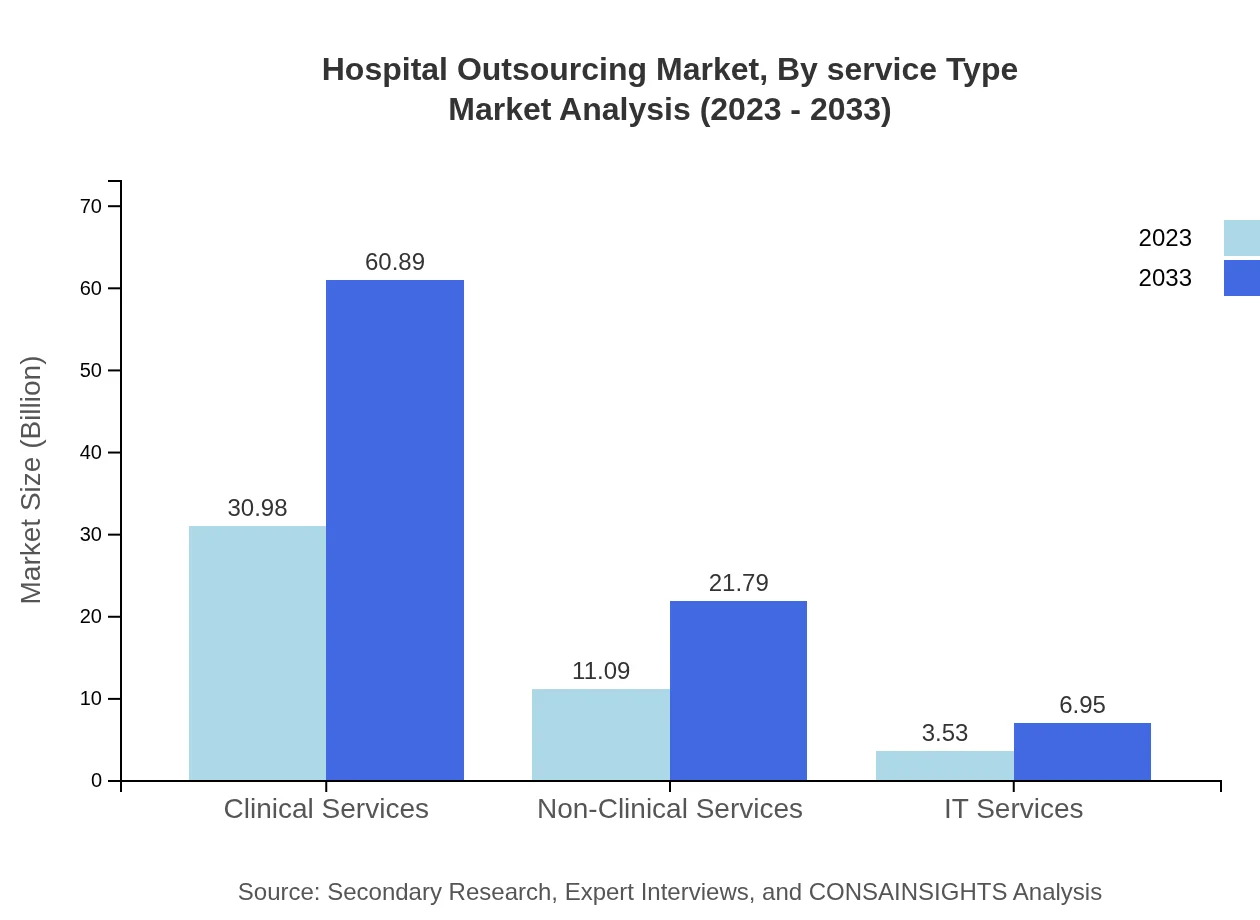

Hospital Outsourcing Market Analysis By Service Type

The service type segment reveals that Administrative Processes lead the market, projected to expand from $30.98 billion in 2023 to $60.89 billion in 2033. This is followed by Clinical Services, with a similar trajectory of growth from $30.98 billion to $60.89 billion, due to increasing demands for specialized care. Financial and IT services represent smaller shares but show promising growth as hospitals modernize their financial and technological infrastructures. This comprehensive service approach is being adopted broadly to sustain competitive advantages.

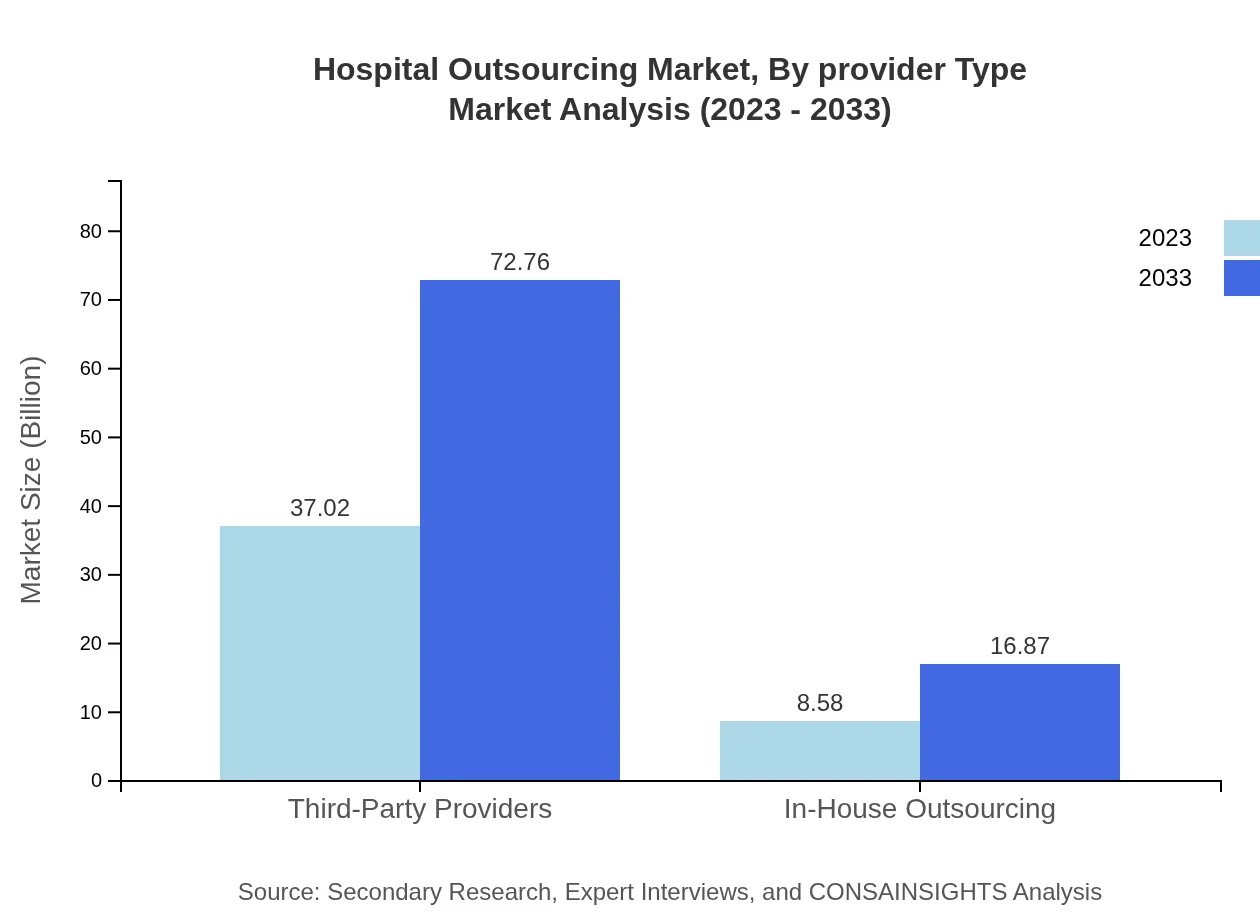

Hospital Outsourcing Market Analysis By Provider Type

The third-party providers are expected to dominate this segment significantly, growing from $37.02 billion in 2023 to $72.76 billion by 2033. The trend towards leveraging expertise and specialized services offered by third-party players is driving this growth. In-house outsourcing also sees a steady increase, from $8.58 billion to $16.87 billion, as institutions look to maintain certain control and quality over vital operations.

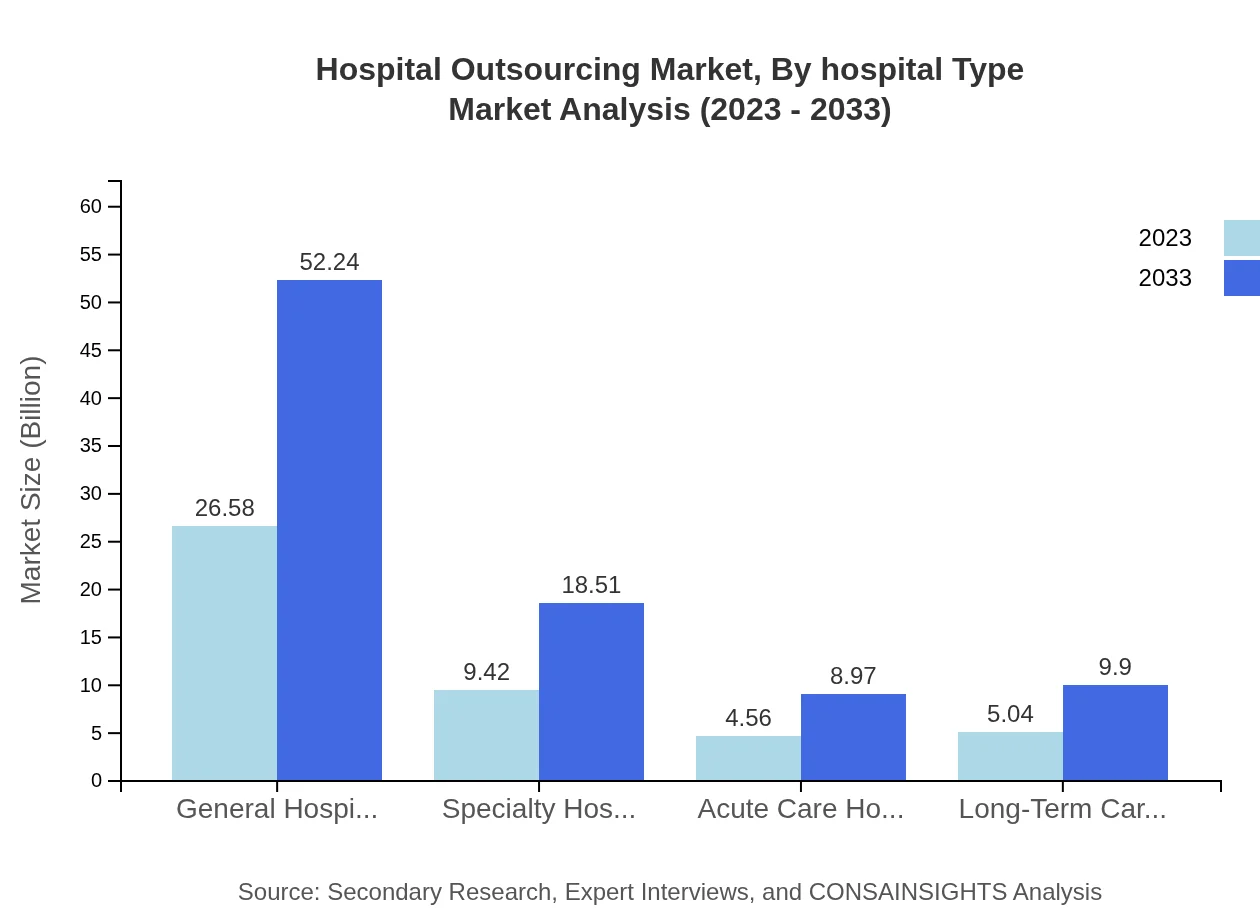

Hospital Outsourcing Market Analysis By Hospital Type

General Hospitals are the largest segment, anticipated to grow from $26.58 billion in 2023 to $52.24 billion by 2033, reflecting the sheer volume of operations and patient treatment. Specialty hospitals follow with an increase from $9.42 billion to $18.51 billion, as more specialized healthcare services emerge. Meanwhile, acute and long-term care hospitals each also expect growth but at lower rates, indicative of niche operational requirements.

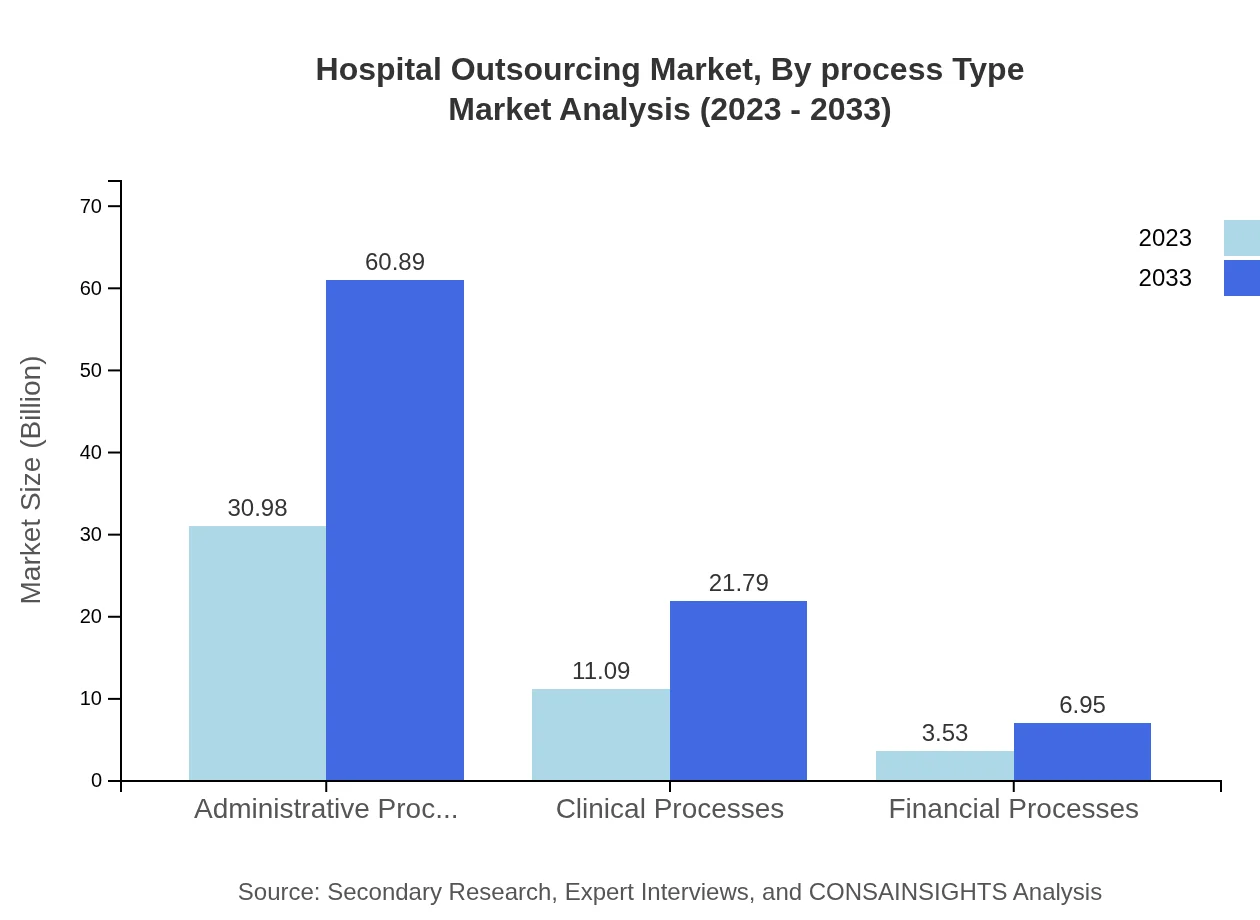

Hospital Outsourcing Market Analysis By Process Type

In terms of process type, the market is largely driven by Clinical Processes, expected to grow from $11.09 billion in 2023 to $21.79 billion by 2033. Administrative processes hold a larger market share, projected to maintain stable growth. Financial processes are slower in growth relative to clinical and administrative processes but remain relevant as healthcare concerns elevate the need for sound financial operations amidst rising costs.

Hospital Outsourcing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Hospital Outsourcing Industry

McKesson Corporation:

McKesson Corporation is a leading healthcare supply chain management solutions provider, known for its extensive distribution network and supply chain optimization services.QuintilesIMS:

QuintilesIMS is a major player in healthcare outsourcing, specializing in clinical development and commercial solutions to help improve patient outcomes.Concentra:

Concentra provides an array of services including urgent care and occupational health, catering to the outsourcing needs of various healthcare facilities.Cerner Corporation:

Cerner is a health information technology company that provides solutions for healthcare providers, with a strong focus on EHR technology and data analytics.Optum:

A subsidiary of UnitedHealth Group, Optum offers healthcare management solutions that include pharmacy care, and healthcare analytics, driving operational efficiencies in hospitals.We're grateful to work with incredible clients.

FAQs

What is the market size of hospital Outsourcing?

The hospital outsourcing market is valued at approximately $45.6 billion in 2023, with a projected Compound Annual Growth Rate (CAGR) of 6.8% through 2033, reflecting a robust trend towards outsourcing various hospital functions.

What are the key market players or companies in this hospital Outsourcing industry?

Key players in the hospital outsourcing market include large healthcare service providers, IT service firms, and specialized outsourcing companies. Notable names include Accenture, Cerner Corporation, and Optum, contributing significantly to the market's growth and innovation.

What are the primary factors driving the growth in the hospital outsourcing industry?

Growth in the hospital outsourcing industry is primarily driven by rising healthcare costs, a focus on operational efficiency, advancements in technology, and the increasing need for hospitals to improve patient care and satisfaction while managing budget constraints.

Which region is the fastest Growing in the hospital Outsourcing?

The Middle East and Africa are emerging as the fastest-growing regions in the hospital outsourcing market, with a growth from $3.85 billion in 2023 to $7.57 billion by 2033. This growth is attributed to increasing healthcare investments and the demand for high-quality medical services.

Does ConsaInsights provide customized market report data for the hospital outsourcing industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the hospital outsourcing industry. This includes in-depth analysis, segmentation data, and forecasts designed to support strategic decision-making.

What deliverables can I expect from this hospital outsourcing market research project?

Deliverables from the hospital outsourcing market research project typically include comprehensive market analysis reports, trend forecasts, competitive landscape studies, and strategic insights tailored to address specific business needs and objectives.

What are the market trends of hospital outsourcing?

Current market trends in hospital outsourcing include a shift towards digital transformation, increasing reliance on third-party service providers, and a growing emphasis on patient-centered care. Additionally, there's an expansion in outsourcing administrative and non-clinical services.