Hospitalacquired Infection Diagnostics Market Report

Published Date: 31 January 2026 | Report Code: hospitalacquired-infection-diagnostics

Hospitalacquired Infection Diagnostics Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Hospitalacquired Infection Diagnostics market, detailing market size, growth forecasts, segmentation, regional insights, technology trends, and leading industry players for the forecast period of 2023 to 2033.

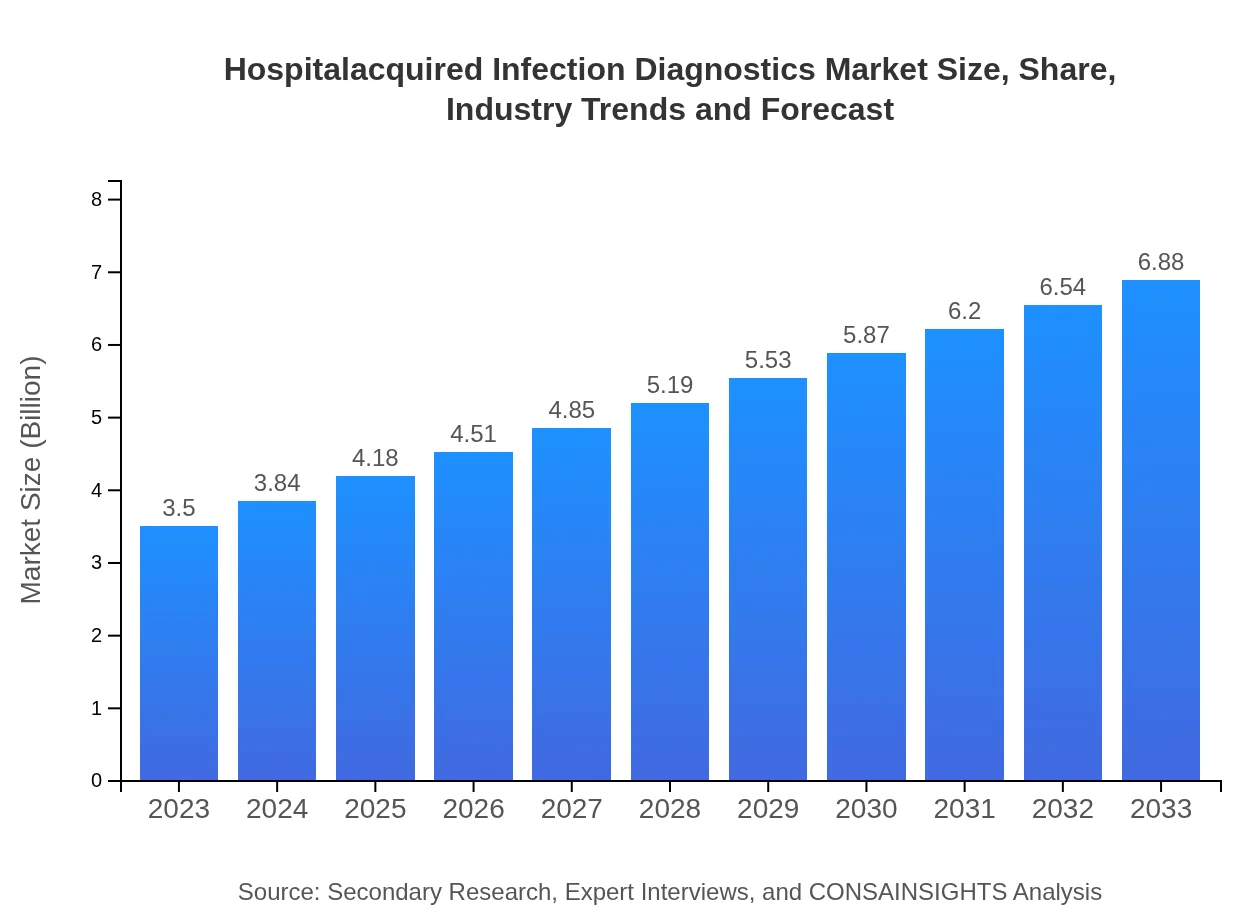

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $6.88 Billion |

| Top Companies | Roche Diagnostics, Abbott Laboratories, BD (Becton, Dickinson and Company), bioMérieux |

| Last Modified Date | 31 January 2026 |

Hospitalacquired Infection Diagnostics Market Overview

Customize Hospitalacquired Infection Diagnostics Market Report market research report

- ✔ Get in-depth analysis of Hospitalacquired Infection Diagnostics market size, growth, and forecasts.

- ✔ Understand Hospitalacquired Infection Diagnostics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Hospitalacquired Infection Diagnostics

What is the Market Size & CAGR of Hospitalacquired Infection Diagnostics market in 2023?

Hospitalacquired Infection Diagnostics Industry Analysis

Hospitalacquired Infection Diagnostics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Hospitalacquired Infection Diagnostics Market Analysis Report by Region

Europe Hospitalacquired Infection Diagnostics Market Report:

Europe is witnessing a progressive increase in the HAI diagnostics market, from $1.06 billion in 2023 to $2.08 billion by 2033. The rise is attributed to stringent regulations regarding infection control and heightened awareness campaigns. Countries like Germany and the UK are investing significantly in infection prevention technologies, driving demand for diagnostic services.Asia Pacific Hospitalacquired Infection Diagnostics Market Report:

In the Asia-Pacific region, the hospital-acquired infection diagnostics market is expected to grow from $0.66 billion in 2023 to $1.29 billion by 2033, reflecting a rising demand for advanced diagnostic solutions. Factors such as increasing healthcare expenditure, a growing elderly population, and the prevalence of HAIs are primary drivers. Countries like India and China are investing in healthcare infrastructure and infection control measures, leading to enhanced diagnostic capabilities in hospitals.North America Hospitalacquired Infection Diagnostics Market Report:

The North American region dominates the hospital-acquired infection diagnostics market with a size of $1.32 billion in 2023, projected to reach $2.59 billion by 2033. The strong emphasis on patient safety, regulatory improvements, and the use of innovative technologies in hospitals supports this growth. Additionally, the region's robust healthcare infrastructure and high awareness of HAIs will continue to drive investments in diagnostic solutions.South America Hospitalacquired Infection Diagnostics Market Report:

The South American market is predicted to expand from $0.01 billion in 2023 to $0.03 billion by 2033. The slow growth is attributed to economic challenges, but increasing awareness about infection control in healthcare settings is fostering demand for diagnostic tests. Brazil and Argentina are likely to lead the growth, supported by improved healthcare policies and increased access to modern diagnostic technologies.Middle East & Africa Hospitalacquired Infection Diagnostics Market Report:

The Middle East and Africa market is expected to grow from $0.46 billion in 2023 to $0.90 billion by 2033. Growing healthcare needs, coupled with a rising number of health facilities and awareness of hospital-acquired infections, are key factors boosting the market. Health initiatives in Saudi Arabia and the UAE aim to enhance hospital safety, thereby increasing the demand for effective diagnostic solutions.Tell us your focus area and get a customized research report.

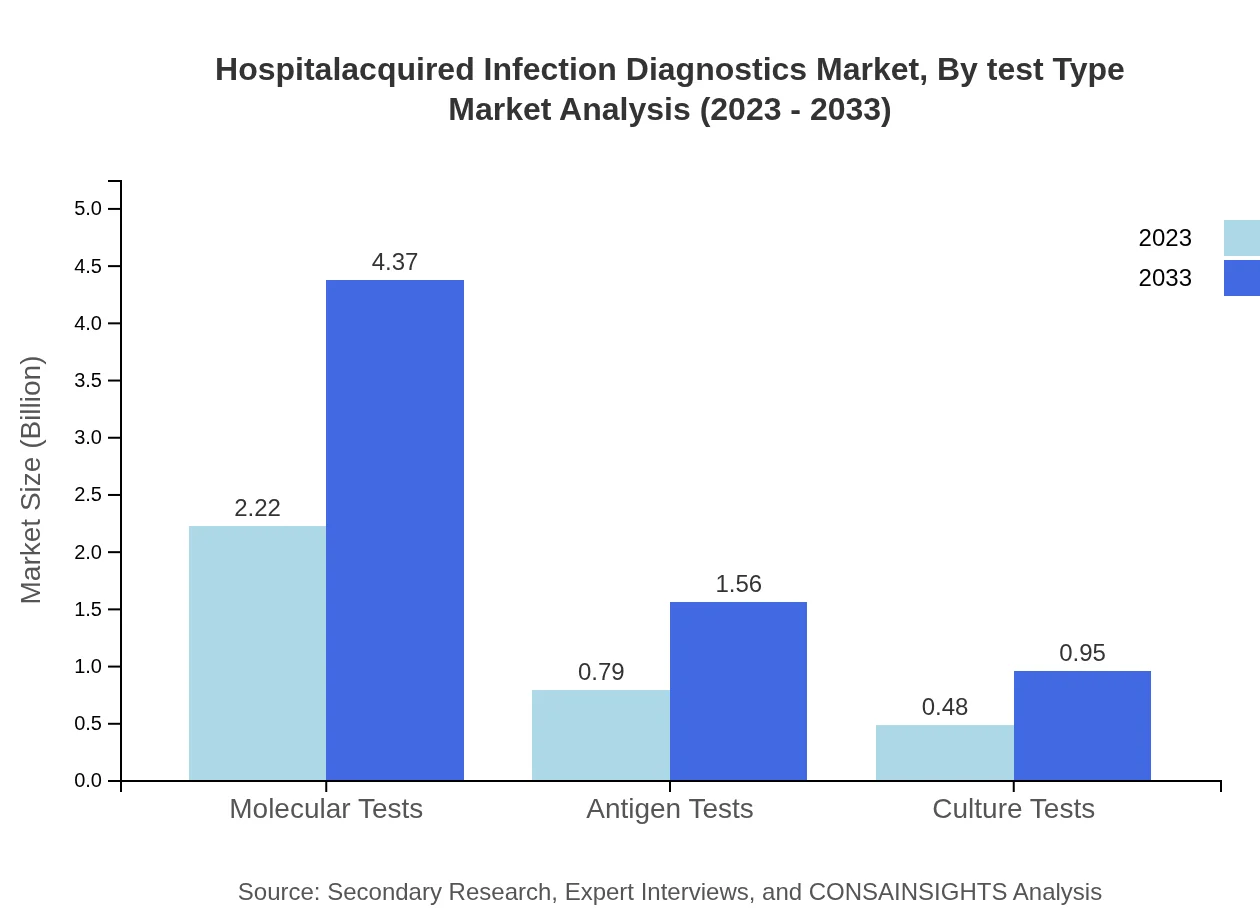

Hospitalacquired Infection Diagnostics Market Analysis By Test Type

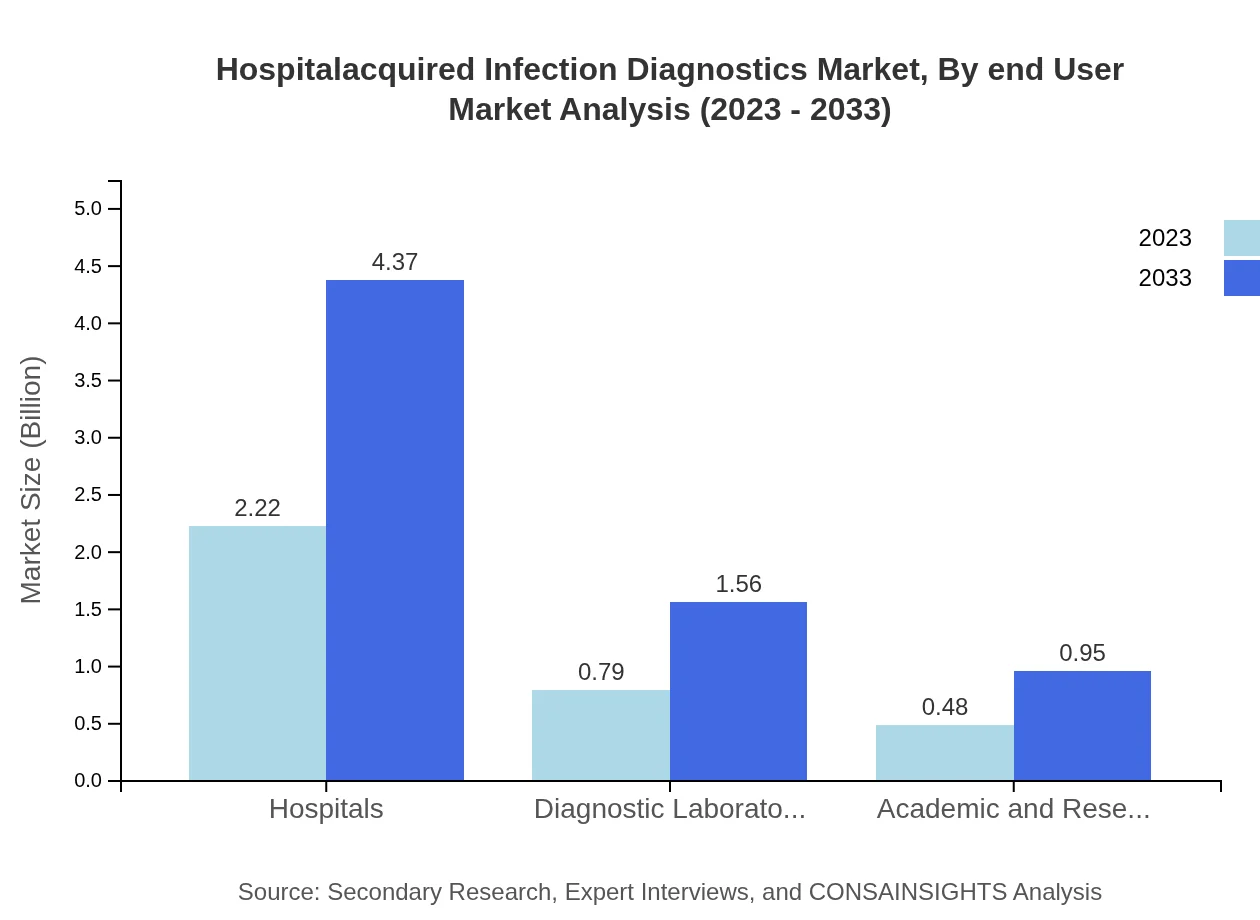

The Hospital-Acquired Infection Diagnostics market is primarily segmented into molecular tests, antigen tests, and culture tests. Molecular tests dominate with a market size of $2.22 billion in 2023 and are expected to grow to $4.37 billion by 2033, holding a 63.51% market share. Antigen tests and culture tests contribute significantly, with market sizes of $0.79 billion and $0.48 billion in 2023 respectively, both growing similarly over the forecast period. This reflects a growing preference for rapid and precise testing methodologies among healthcare providers.

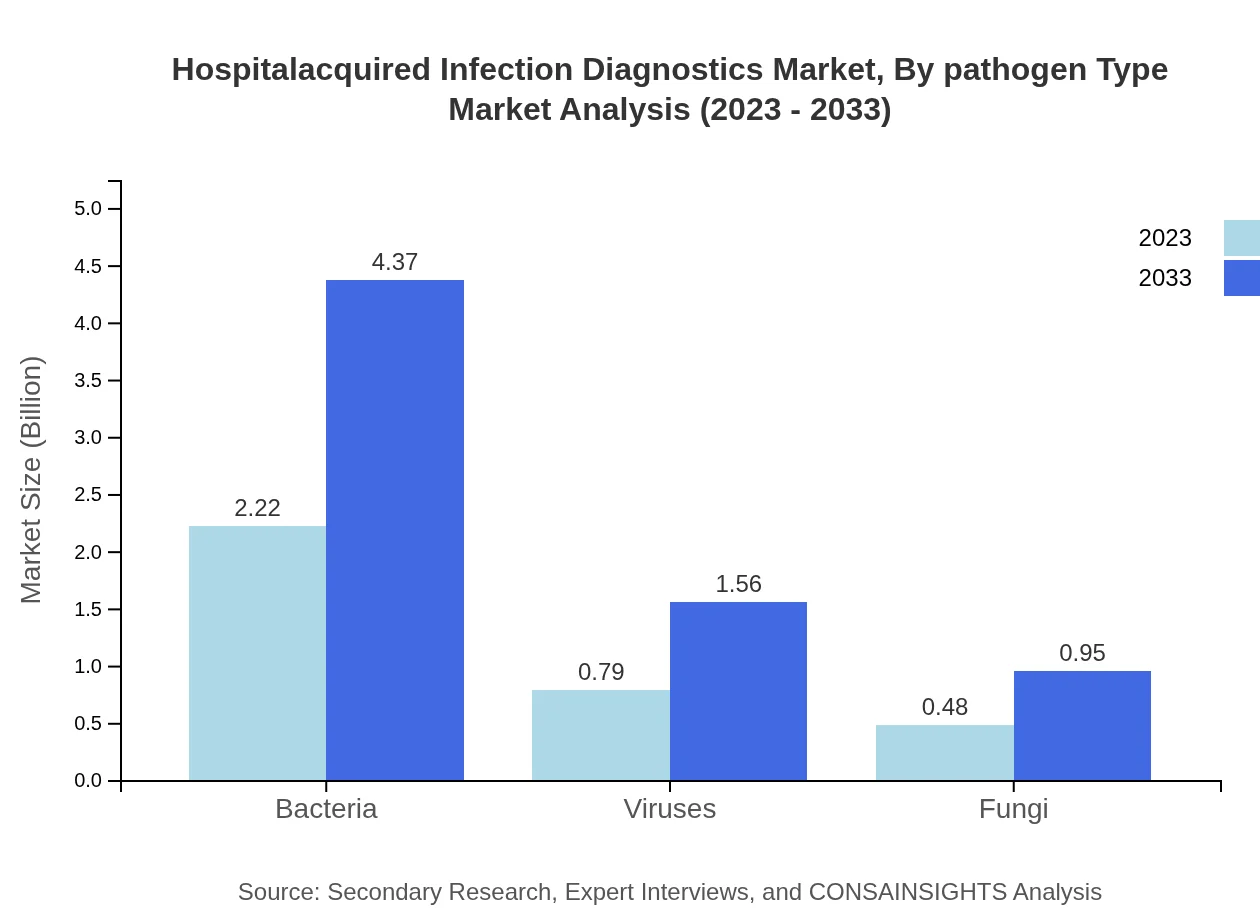

Hospitalacquired Infection Diagnostics Market Analysis By Pathogen Type

In pathogen-type segmentation, diagnostics for bacteria account for the largest share, representing $2.22 billion in 2023, with a steady increase to $4.37 billion by 2033. The demand for virus and fungi diagnostics, estimated at $0.79 billion and $0.48 billion respectively in 2023, is also on an upward trend as healthcare entities seek to comprehensively manage HAIs, resulting in a balanced approach to pathogen identification.

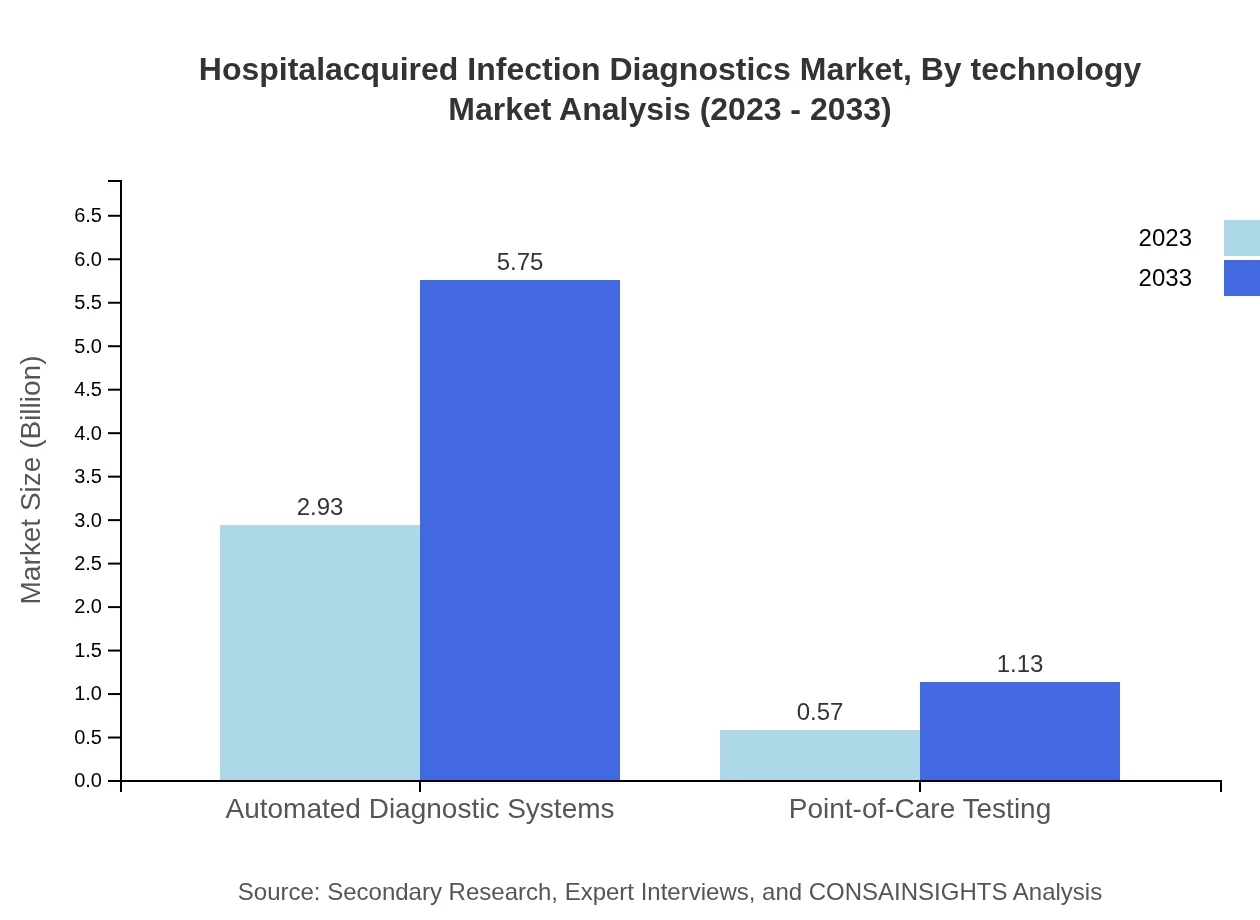

Hospitalacquired Infection Diagnostics Market Analysis By Technology

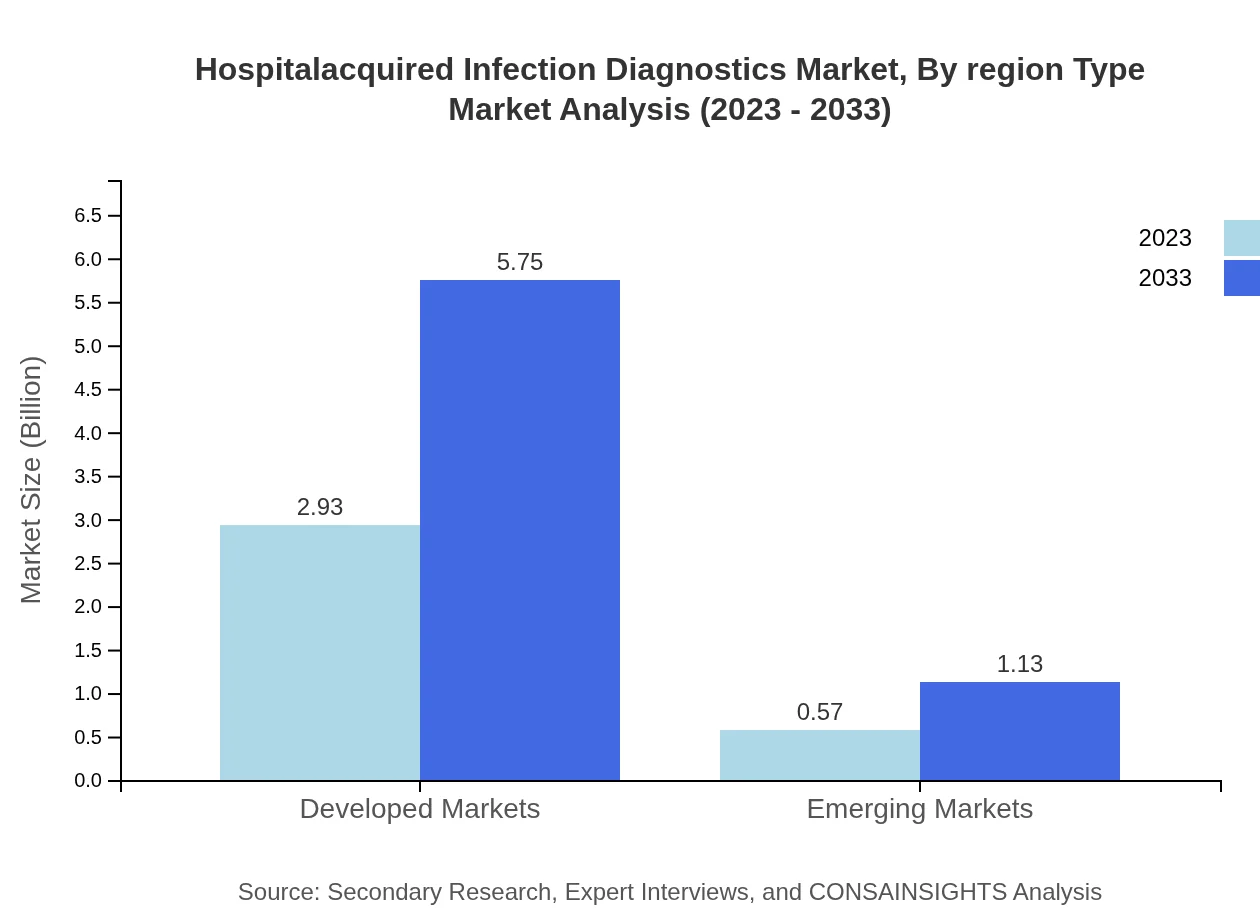

The technology segment reveals a strong inclination towards automated diagnostic systems, which commanded an impressive market size of $2.93 billion in 2023 and is set to grow to $5.75 billion by 2033, accounting for 83.58% of the market share. Point-of-care testing is smaller but gaining traction, moving from $0.57 billion to $1.13 billion over the forecast period, signifying healthcare's shift towards rapid and accessible testing solutions.

Hospitalacquired Infection Diagnostics Market Analysis By End User

Hospitals lead the market for hospital-acquired infection diagnostics, projected to grow from $2.22 billion in 2023 to $4.37 billion by 2033. Diagnostic laboratories and academic research institutions follow, with expected values of $0.79 billion and $0.48 billion respectively in 2023. This segmentation illustrates hospitals' reliance on diagnostics to enhance patient safety through effective infection management.

Hospitalacquired Infection Diagnostics Market Analysis By Region Type

Market performance varies significantly by region, with North America leading by a substantial margin. The projected growth rates in Europe and Asia-Pacific are noteworthy, reflecting a strengthening focus on infection control globally. Emerging markets in South America and the Middle East and Africa are also expanding, though they face infrastructural and regulatory challenges.

Hospitalacquired Infection Diagnostics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Hospitalacquired Infection Diagnostics Industry

Roche Diagnostics:

Roche Diagnostics is a leader in the healthcare industry, providing innovative diagnostic solutions aimed at improving overall patient care and outcomes. Their advanced molecular tests are pivotal in HAI detection and management.Abbott Laboratories:

Abbott Laboratories is renowned for its diverse range of diagnostic products, particularly in point-of-care testing and molecular diagnostics, providing highly accurate results for hospital-acquired infections.BD (Becton, Dickinson and Company):

BD is a global medical technology company that advances the world of health by improving medical discovery, diagnostics, and the delivery of care with their portfolio of infection diagnostics solutions.bioMérieux:

bioMérieux specializes in in vitro diagnostics and offers a comprehensive range of solutions for the rapid detection of pathogens and monitoring antibiotic resistance.We're grateful to work with incredible clients.

FAQs

What is the market size of hospital Acquired Infection Diagnostics?

The hospital-acquired infection diagnostics market size was valued at approximately $3.5 billion in 2023. It is projected to grow at a CAGR of 6.8%, reaching significant expansion by 2033.

What are the key market players or companies in this hospital Acquired Infection Diagnostics industry?

The key players in the hospital-acquired infection diagnostics market include major healthcare companies and laboratories that specialize in infection control products, diagnostics technologies, and antimicrobial stewardship programs.

What are the primary factors driving the growth in the hospital Acquired Infection Diagnostics industry?

Key growth factors include rising infection rates, increased healthcare expenditure, advancements in diagnostic technologies, and stringent regulations on infection control in healthcare settings.

Which region is the fastest Growing in the hospital Acquired Infection Diagnostics?

The fastest-growing region is Europe, which saw a market size of $1.06 billion in 2023, expected to reach $2.08 billion by 2033, indicating significant investment and growth in infection diagnostics.

Does ConsaInsights provide customized market report data for the hospital Acquired Infection Diagnostics industry?

Yes, ConsaInsights offers customized market report data tailored to specific requirements within the hospital-acquired infection diagnostics industry, providing detailed insights and analytics.

What deliverables can I expect from this hospital Acquired Infection Diagnostics market research project?

Deliverables include comprehensive reports, detailed market analyses, trend forecasts, competitive landscape evaluations, and segmented data on regions and diagnostic types.

What are the market trends of hospital Acquired Infection Diagnostics?

Current trends include the increasing adoption of automated diagnostic systems, growth in molecular and antigen testing, and heightened focus on rapid testing to enhance patient outcomes.