Hplc Market Report

Published Date: 31 January 2026 | Report Code: hplc

Hplc Market Size, Share, Industry Trends and Forecast to 2033

This report offers a comprehensive analysis of the HPLC market from 2023 to 2033, detailing market size, growth trends, segment analysis, regional insights, and key player contributions across the industry. Valuable insights into forecasts and emerging technologies are also provided.

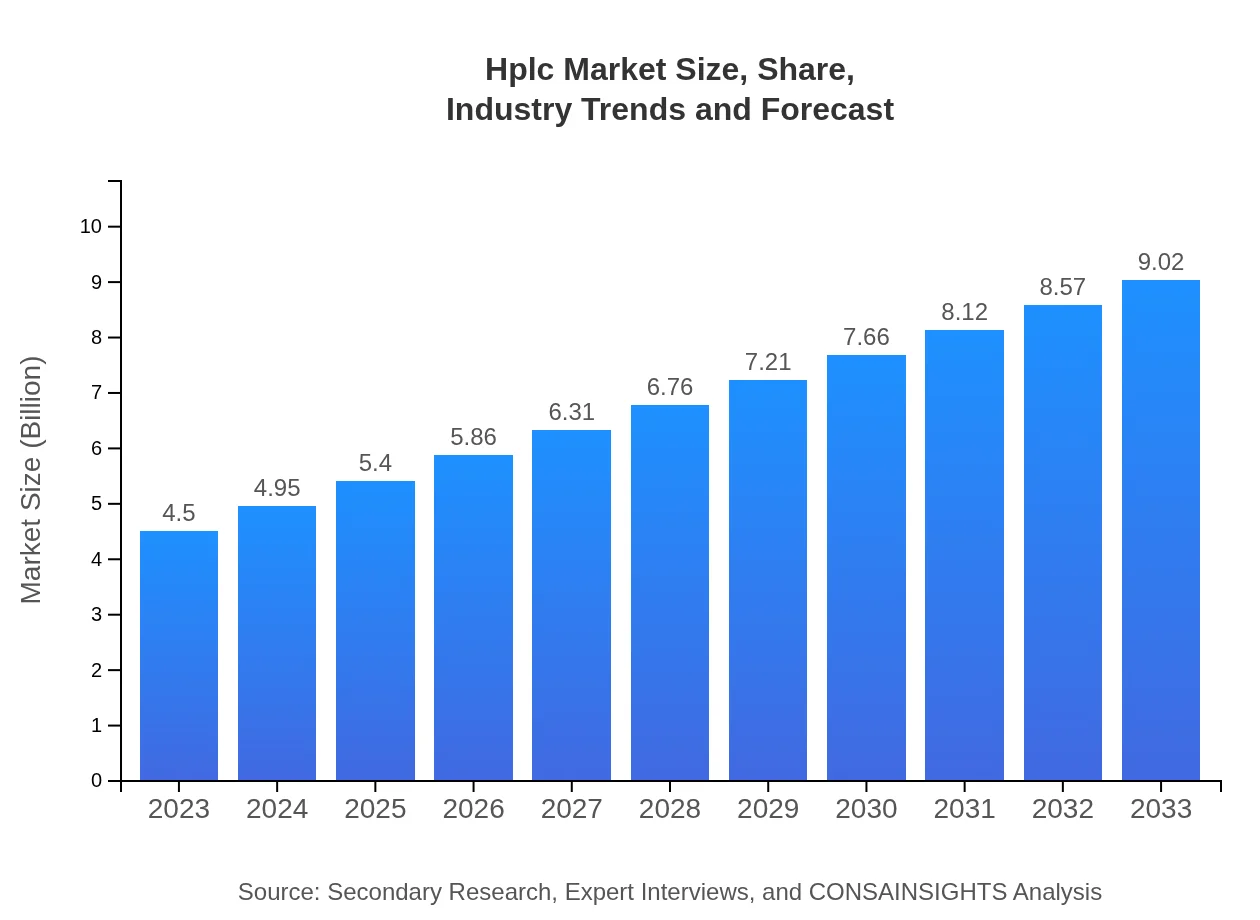

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $4.50 Billion |

| CAGR (2023-2033) | 7% |

| 2033 Market Size | $9.02 Billion |

| Top Companies | Agilent Technologies, Shimadzu Corporation, Thermo Fisher Scientific, PerkinElmer |

| Last Modified Date | 31 January 2026 |

Hplc Market Overview

Customize Hplc Market Report market research report

- ✔ Get in-depth analysis of Hplc market size, growth, and forecasts.

- ✔ Understand Hplc's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Hplc

What is the Market Size & CAGR of Hplc market in 2023?

Hplc Industry Analysis

Hplc Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Hplc Market Analysis Report by Region

Europe Hplc Market Report:

Europe's HPLC market is valued at $1.41 billion in 2023 with an anticipated growth to $2.83 billion by 2033. Factors such as stringent regulatory standards in pharmaceuticals and biochemistry, alongside a strong academic foundation, facilitate demand for HPLC systems for consistent and reliable analyses.Asia Pacific Hplc Market Report:

The HPLC market in the Asia Pacific region, estimated at $0.72 billion in 2023, is projected to reach $1.44 billion by 2033, growing rapidly due to increased investment in pharmaceutical R&D and expanding biotech industries. Countries like China and India are major contributors, driven by the rising need for effective analytical solutions in research and quality assurance.North America Hplc Market Report:

North America leads the HPLC market with a size of $1.71 billion in 2023, projected to reach $3.43 billion by 2033. The region is characterized by high spending on research activities, significant presence of pharmaceutical companies, and a drive toward innovative diagnostic technologies that rely on advanced chromatographic systems.South America Hplc Market Report:

In South America, the HPLC market size is expected to grow from $0.30 billion in 2023 to $0.60 billion by 2033. The growth is primarily propelled by the expanding pharmaceutical sector and the emphasis on food safety regulations, leading to increased adoption of HPLC technologies in laboratories across the region.Middle East & Africa Hplc Market Report:

The Middle East and Africa HPLC market, valued at $0.36 billion in 2023 and expected to double to $0.72 billion by 2033, is driven by an increase in healthcare infrastructure, greater investments in laboratory capabilities, and a rising focus on environmental assessments, enhancing the region's analytical laboratory capabilities.Tell us your focus area and get a customized research report.

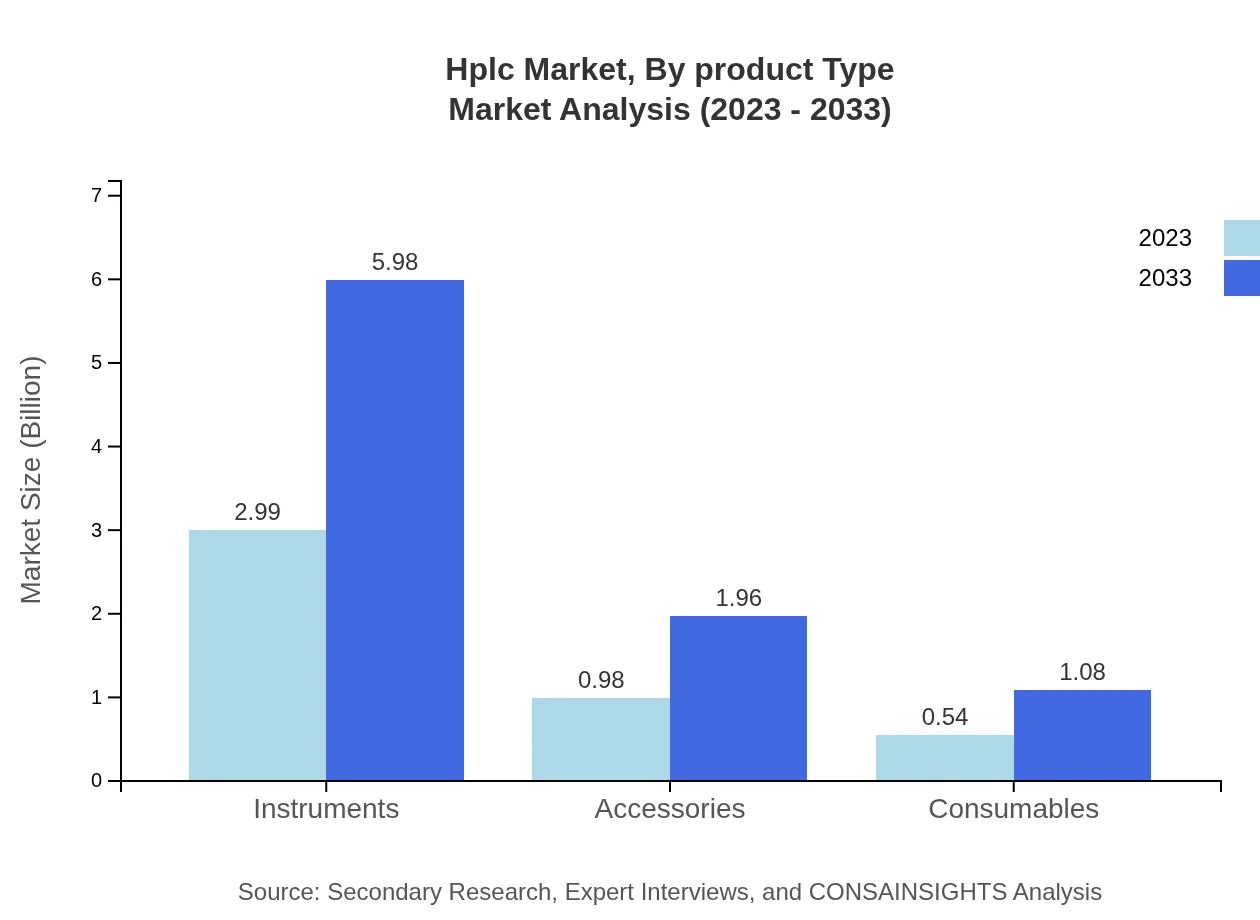

Hplc Market Analysis By Product Type

The HPLC market segmented by product type reveals that instruments dominate with a market size of $2.99 billion in 2023, projected to reach $5.98 billion by 2033, owing to advancements in chromatography technologies. Accessories and consumables play vital supportive roles, with consumables expected to grow significantly due to ongoing R&D activities and increased testing requirements in various sectors.

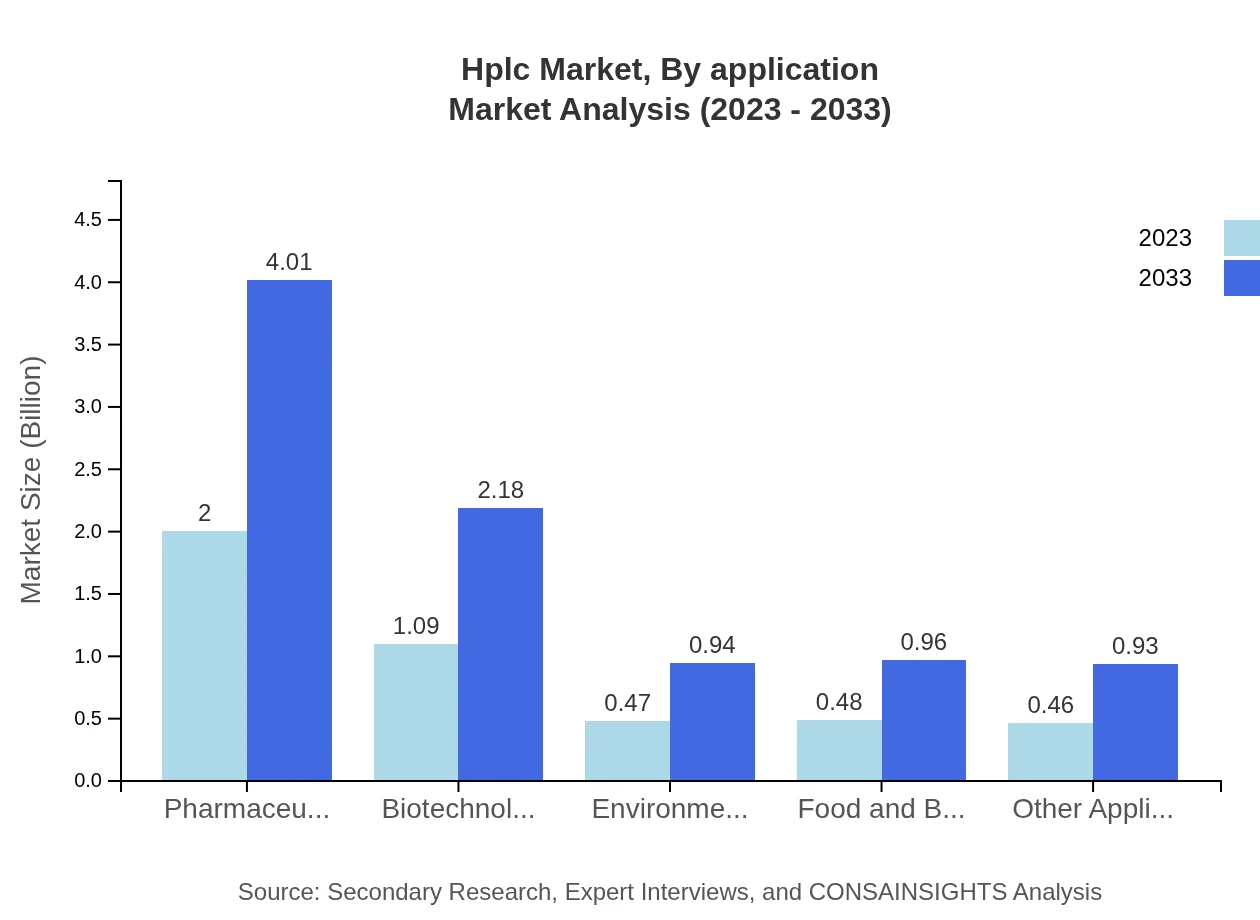

Hplc Market Analysis By Application

Pharmaceutical applications lead the HPLC market with a significant size of $2.00 billion in 2023, set to reach $4.01 billion by 2033, reflecting growing drug development activities. Academic institutions also represent a substantial segment, while applications in environmental testing and food safety continue to rise, demonstrating the technology's versatility.

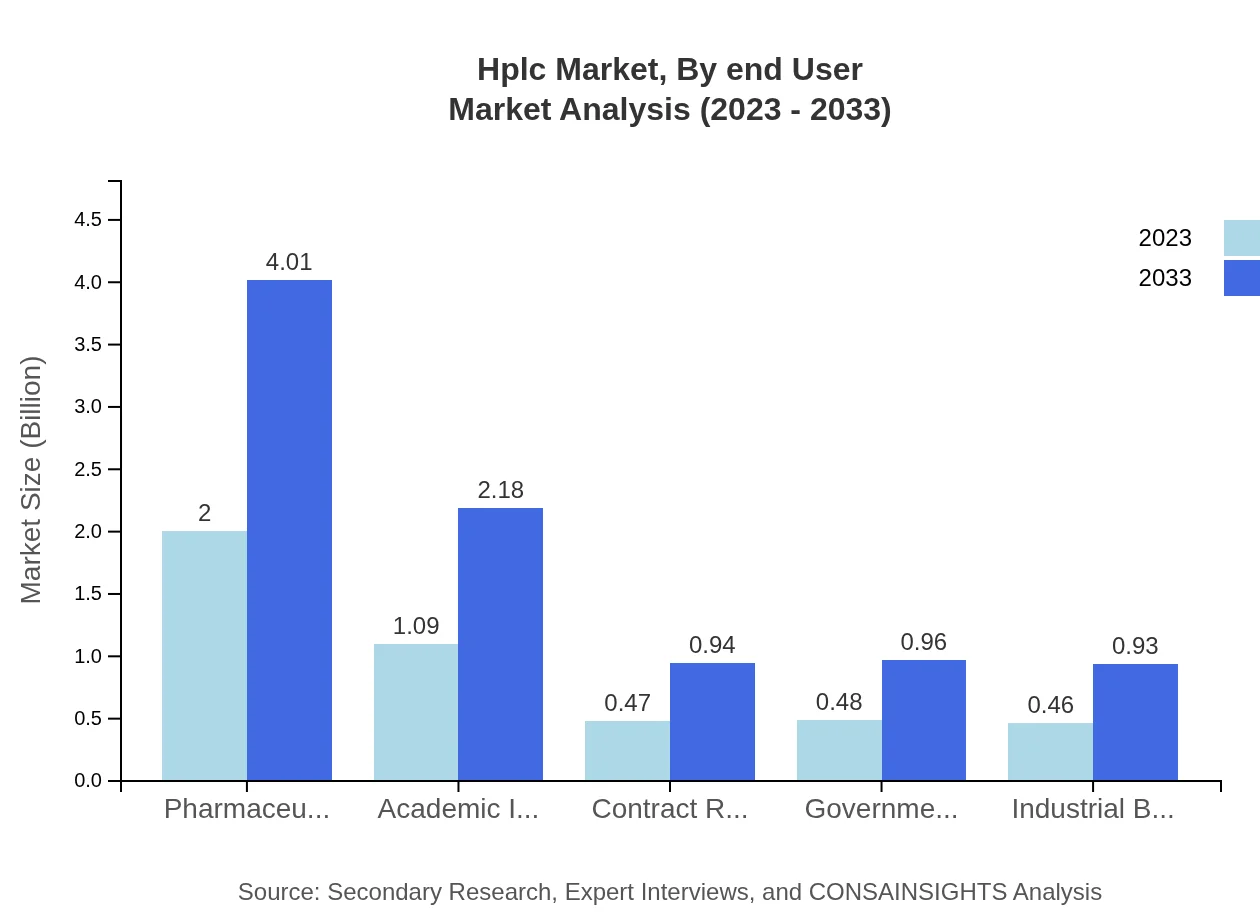

Hplc Market Analysis By End User

The end-user segmentation highlights pharmaceutical companies as the biggest consumer of HPLC technology, maintaining a market share of 44.45% in 2023 and 2033 alike, signifying consistent investment in advanced analytical techniques. Educational and research institutions follow closely, emphasizing their role in developing new applications and methodologies in chromatography.

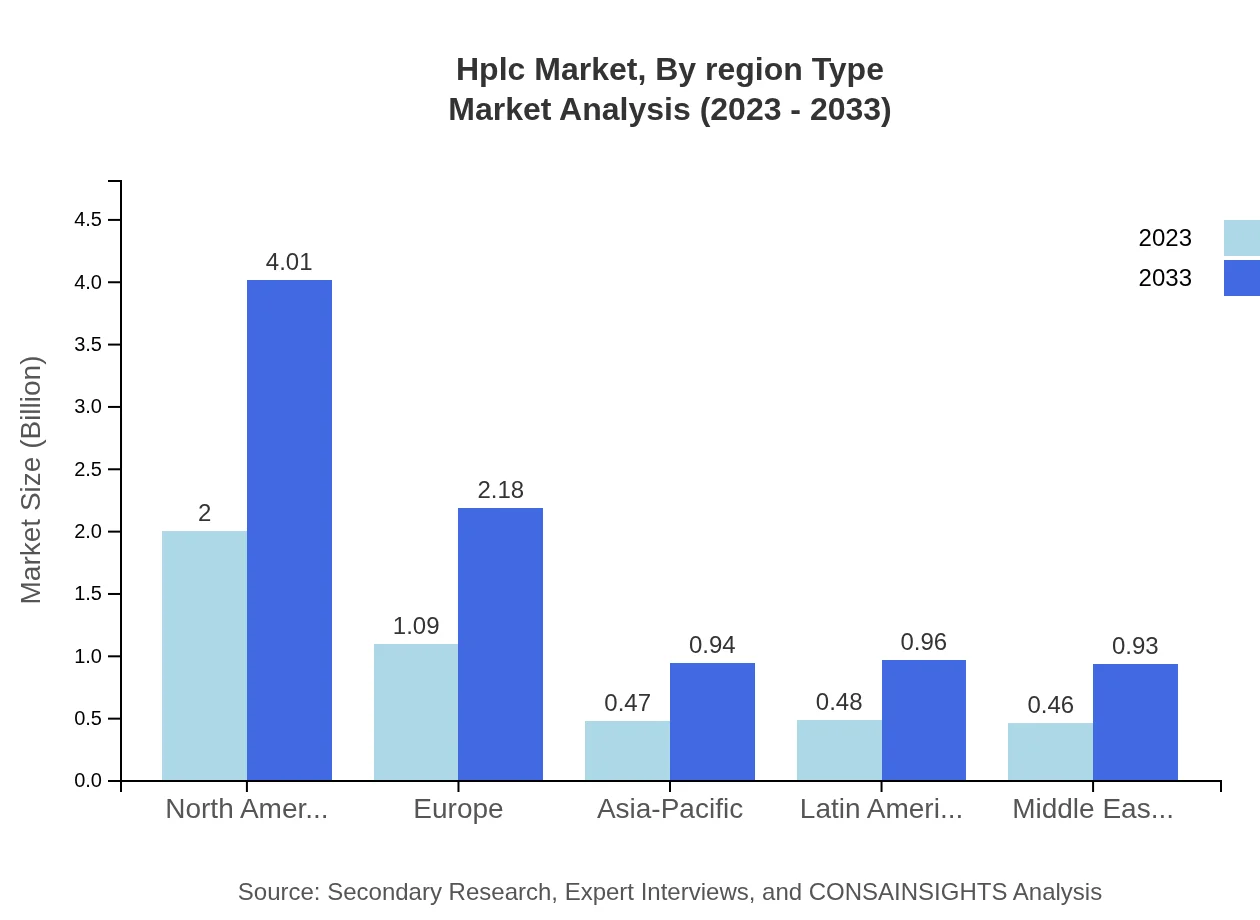

Hplc Market Analysis By Region Type

Regional segmentation illustrates North America holding a dominant position with 44.45% market share in both 2023 and 2033, followed by Europe and Asia-Pacific, each demonstrating robust growth. These regions are likely to continue leading due to the presence of major pharmaceutical firms, increased research funding, and regulatory pressures driving adoption.

Hplc Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Hplc Industry

Agilent Technologies:

A leading player in the HPLC market, Agilent specializes in analytical instruments and solutions that enhance laboratory productivity and accuracy.Shimadzu Corporation:

Shimadzu offers high-quality HPLC instruments known for their reliability and user-friendly features, catering to pharmaceutical and environmental industries.Thermo Fisher Scientific:

A prominent provider of laboratory equipment and instruments, Thermo Fisher is renowned for its innovative HPLC technologies aimed at improving separation performance and efficiency.PerkinElmer:

PerkinElmer designs and manufactures reliable HPLC systems, serving diverse applications including life sciences and food safety.We're grateful to work with incredible clients.

FAQs

What is the market size of HPLC?

The global HPLC market is projected to be valued at approximately $4.5 billion in 2023, with a robust CAGR of 7%. It is expected to expand significantly over the coming decade, driven by the increasing demand for analytical techniques.

What are the key market players or companies in the HPLC industry?

Key players in the HPLC market include Agilent Technologies, Waters Corporation, Thermo Fisher Scientific, and PerkinElmer. These companies dominate the market through innovation, product expansion, and strategic partnerships.

What are the primary factors driving the growth in the HPLC industry?

Growth in the HPLC industry is driven by rising pharmaceutical research activities, advancements in chromatography technologies, and increased use of HPLC in environmental and food testing applications.

Which region is the fastest Growing in the HPLC market?

The fastest-growing region in the HPLC market is North America, expected to grow from $1.71 billion in 2023 to $3.43 billion by 2033, reflecting strong investment in pharmaceutical and biotech industries.

Does ConsaInsights provide customized market report data for the HPLC industry?

Yes, ConsaInsights provides customized market report data tailored to specific needs in the HPLC industry, offering insights on regional markets, segments, and competitive analysis.

What deliverables can I expect from this HPLC market research project?

Expect comprehensive deliverables including detailed market analysis, segmentation insights, competitive landscape, and future growth forecasts to aid strategic decision-making in the HPLC market.

What are the market trends of HPLC?

Current trends in the HPLC market include increasing automation in laboratories, a shift towards miniaturized systems, and rising demand for high-throughput screening in pharmaceutical applications.