Human Capital Management Market Report

Published Date: 31 January 2026 | Report Code: human-capital-management

Human Capital Management Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Human Capital Management market, detailing its size, trends, and forecasts from 2023 to 2033. It covers various aspects including market segments, regional insights, industry analysis, and leading players, offering valuable insights for stakeholders.

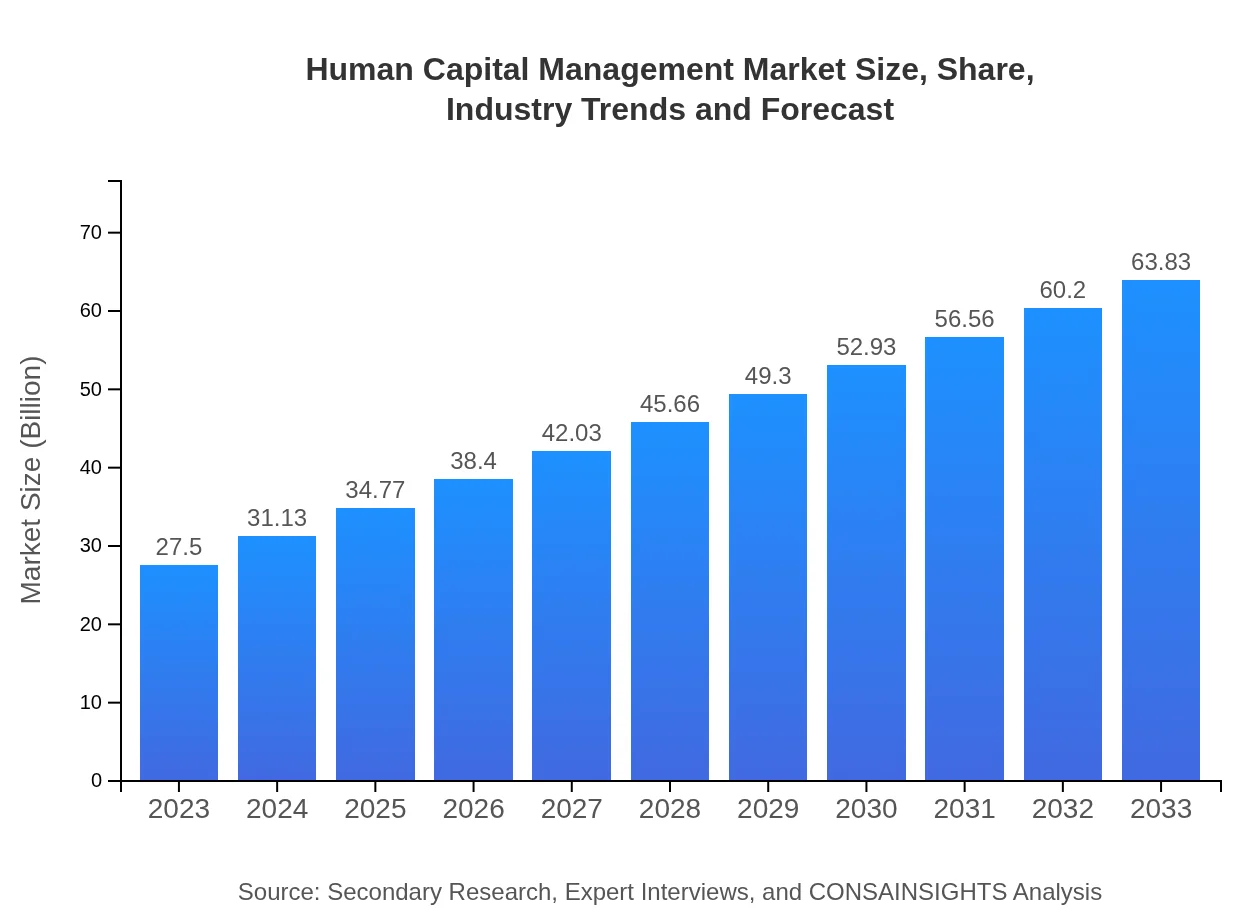

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $27.50 Billion |

| CAGR (2023-2033) | 8.5% |

| 2033 Market Size | $63.83 Billion |

| Top Companies | SAP SuccessFactors, Oracle HCM Cloud, Workday, ADP, Ultimate Software |

| Last Modified Date | 31 January 2026 |

Human Capital Management Market Overview

Customize Human Capital Management Market Report market research report

- ✔ Get in-depth analysis of Human Capital Management market size, growth, and forecasts.

- ✔ Understand Human Capital Management's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Human Capital Management

What is the Market Size & CAGR of Human Capital Management market in 2033?

Human Capital Management Industry Analysis

Human Capital Management Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Human Capital Management Market Analysis Report by Region

Europe Human Capital Management Market Report:

Europe's HCM market is anticipated to expand significantly from $8.87 billion in 2023 to $20.58 billion in 2033. Companies in this region are focusing on enhancing data analytics capabilities in HR functions, in response to regulatory pressures and a competitive talent landscape.Asia Pacific Human Capital Management Market Report:

In the Asia Pacific region, the Human Capital Management market is expected to grow from $5.26 billion in 2023 to $12.22 billion in 2033. The increasing adoption of digital HR solutions among enterprises, coupled with government initiatives supporting digital transformation, fuels this growth. The emphasis on workforce skill development in emerging economies further drives HCM solution adoption.North America Human Capital Management Market Report:

North America dominates the Human Capital Management market, with a projected market size of $9.09 billion in 2023, increasing to $21.09 billion by 2033. This growth is driven by the strong presence of established HCM solution providers, technological advancements, and rising investments in employee experience technologies by corporations across diverse industries.South America Human Capital Management Market Report:

The HCM market in South America is projected to rise from $1.01 billion in 2023 to $2.35 billion by 2033. Although the region faces economic challenges, the growing awareness of HCM benefits among organizations is contributing to market expansion. Innovative local startups are emerging, offering tailored solutions for regional businesses.Middle East & Africa Human Capital Management Market Report:

In the Middle East and Africa, the HCM market is likely to increase from $3.27 billion in 2023 to $7.60 billion by 2033. The growing focus on digitalization and HR transformation initiatives across industries, alongside increased investment in employee management solutions, is driving market growth.Tell us your focus area and get a customized research report.

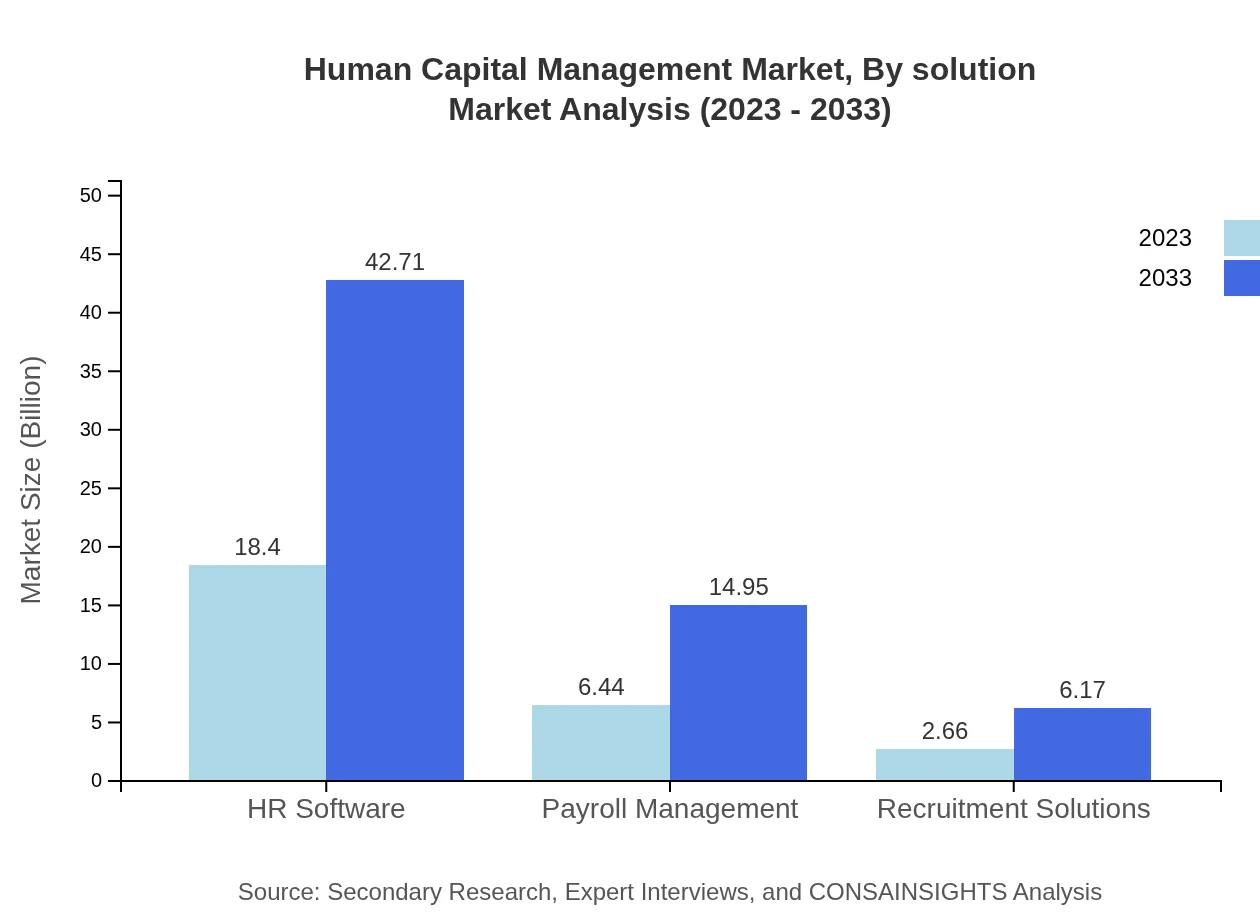

Human Capital Management Market Analysis By Solution

The Human Capital Management market by solution includes segments like HR Software, Payroll Management, and Recruitment Solutions. HR Software is the largest segment, expected to grow from $18.40 billion in 2023 to $42.71 billion in 2033, accounting for approximately 66.91% of the market share in both years. Payroll Management also shows robust growth, expanding from $6.44 billion to $14.95 billion over the forecast period.

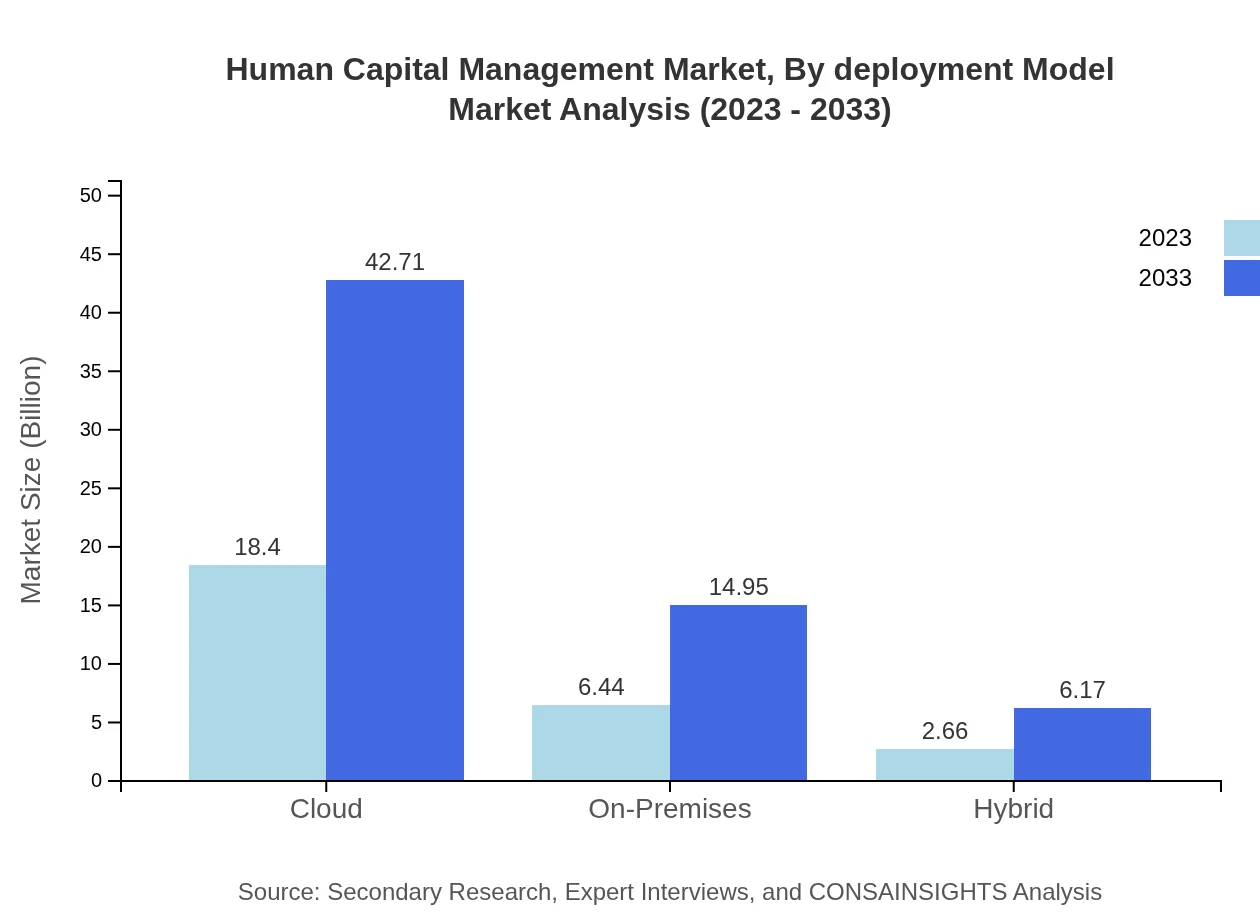

Human Capital Management Market Analysis By Deployment Model

The deployment model segment includes Cloud, On-Premises, and Hybrid solutions. Cloud-based HCM solutions lead the market due to their scalability and flexibility, with growth projected from $18.40 billion in 2023 to $42.71 billion by 2033. Conversely, On-Premises solutions are expected to rise from $6.44 billion to $14.95 billion, maintaining a significant market share.

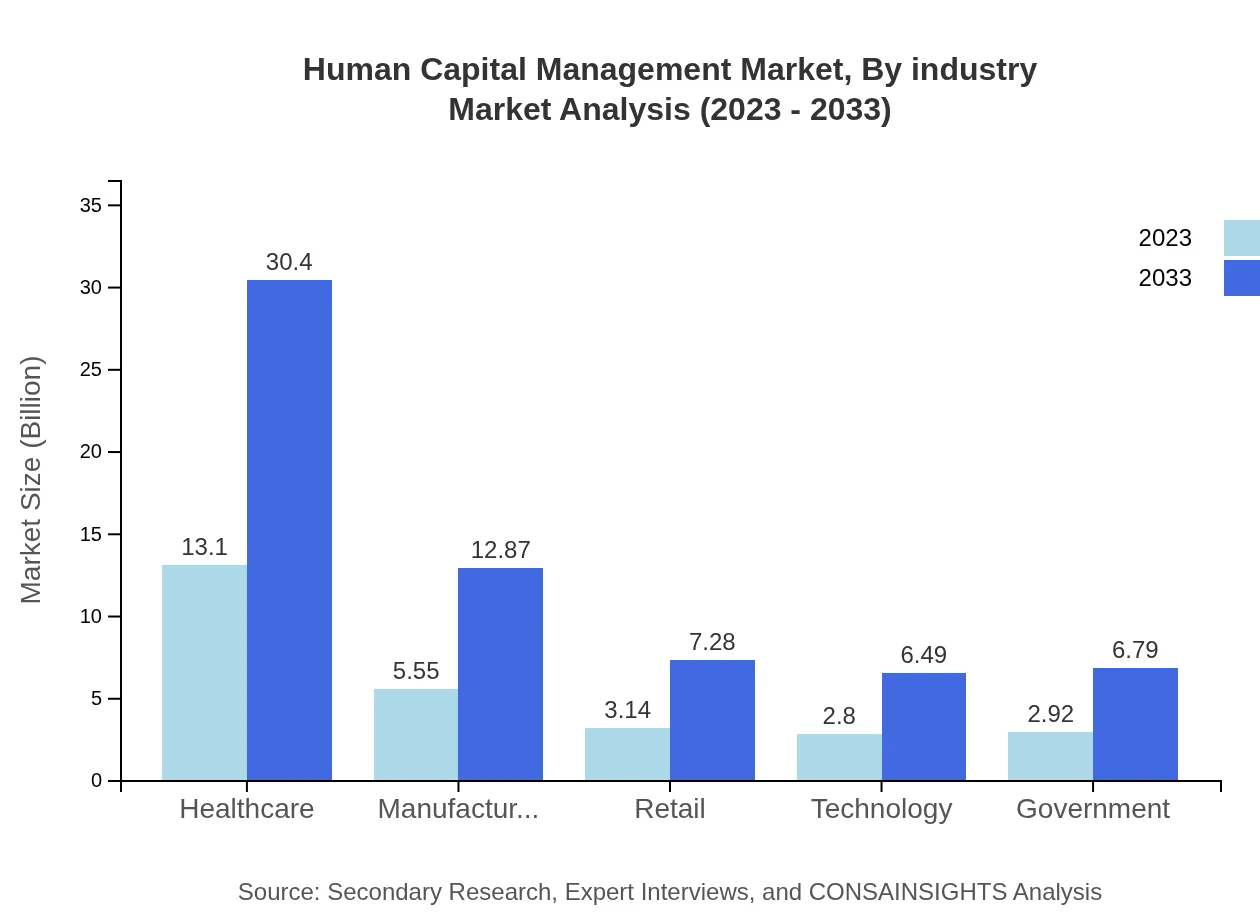

Human Capital Management Market Analysis By Industry

Industries such as Healthcare, Manufacturing, and Retail significantly influence the HCM market, with Healthcare expected to grow from $13.10 billion in 2023 to $30.40 billion in 2033. Manufacturing and Retail also show growth potential, underlining the necessity for effective workforce management solutions across diverse sectors.

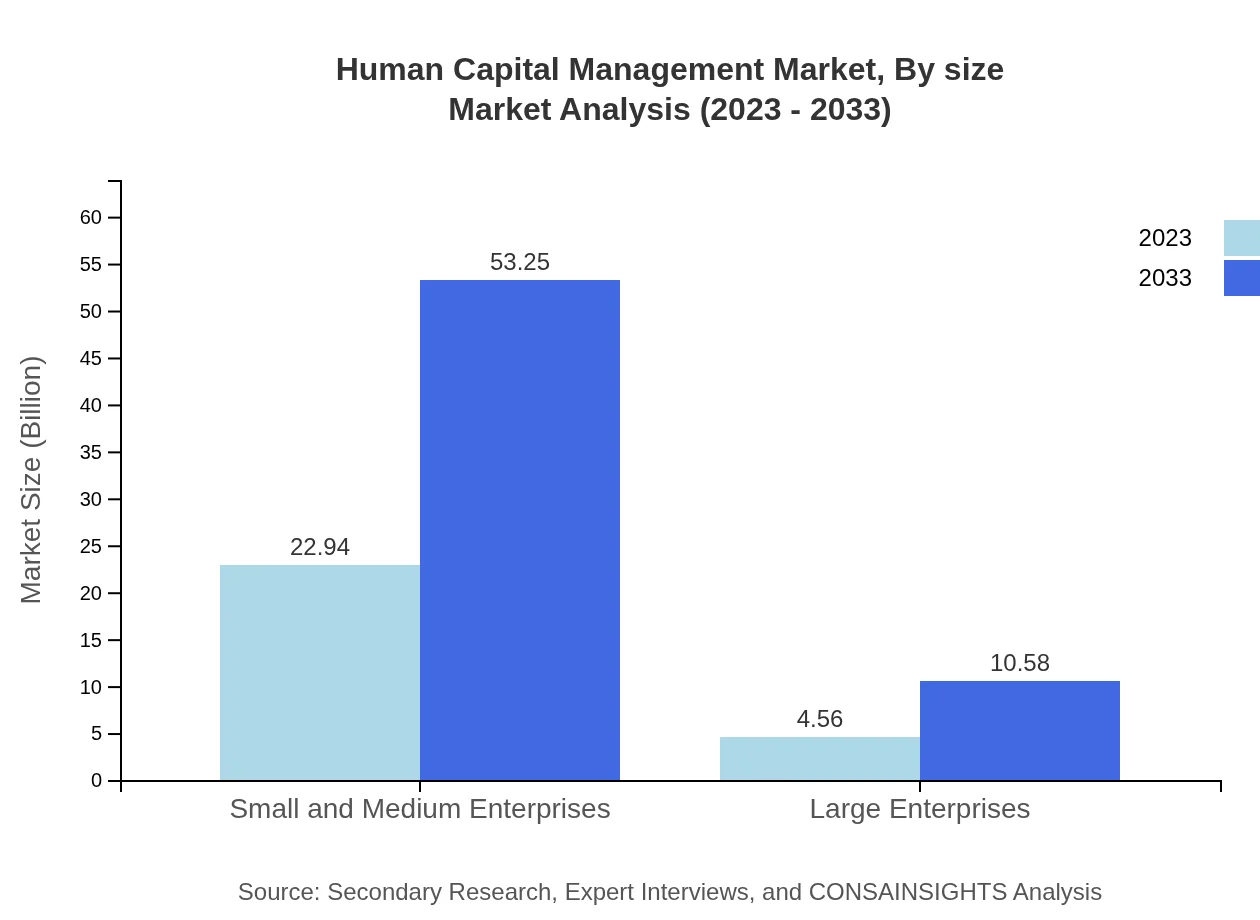

Human Capital Management Market Analysis By Size

The market segmentation by organization size reveals a distinct demand from Small and Medium Enterprises (SMEs) and Large Enterprises. SMEs represent a larger share of the market with $22.94 billion expected in 2023, growing to $53.25 billion by 2033, while large enterprises are projected to rise from $4.56 billion to $10.58 billion.

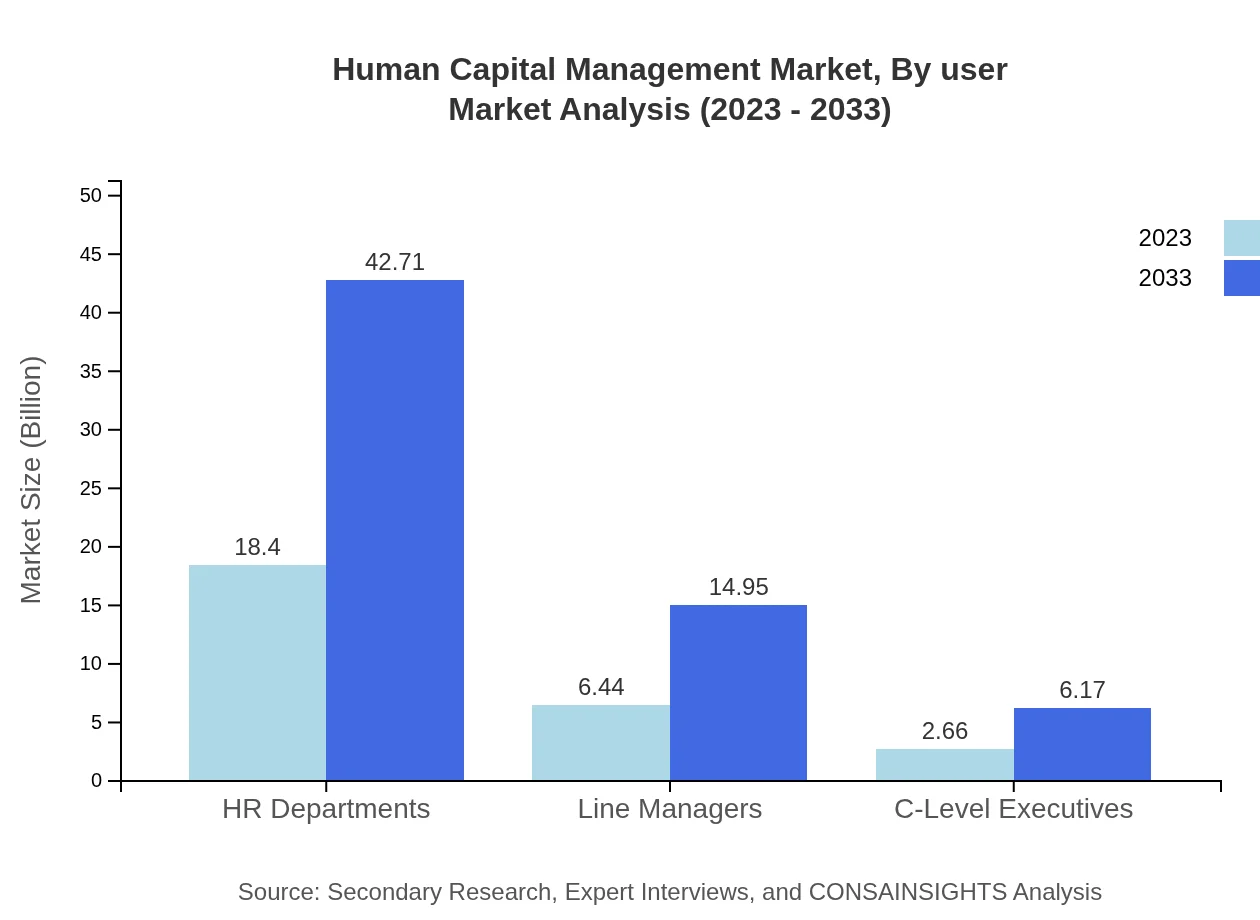

Human Capital Management Market Analysis By User

End-users in the HCM market include HR Departments, Line Managers, and C-Level Executives. HR Departments hold a significant market share of around 66.91%, showcasing their integral role in deploying HCM solutions, while Line Managers and C-Level Executives also contribute to market dynamics with their specific needs and usage patterns.

Human Capital Management Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Human Capital Management Industry

SAP SuccessFactors:

SAP SuccessFactors provides cloud-based HCM solutions that streamline core HR processes, talent management, and workforce analytics, helping organizations to enhance employee engagement and performance.Oracle HCM Cloud:

Oracle HCM Cloud offers an extensive suite of human capital management solutions, enabling organizations to manage all employee-related processes efficiently, from recruitment to retirement.Workday:

Workday is known for its user-friendly cloud-based HCM platform, which integrates finance and human resources to help organizations deliver better workforce insights.ADP:

ADP specializes in payroll and HR management solutions, providing comprehensive services to businesses for better employee management and compliance.Ultimate Software:

Ultimate Software focuses on HR solutions that prioritize employee experience and workforce engagement while leveraging machine learning and analytics.We're grateful to work with incredible clients.

FAQs

What is the market size of Human Capital Management?

The Human Capital Management market is projected to grow significantly, with a market size of $27.5 billion in 2023. It is expected to expand at a CAGR of 8.5%, reaching new heights of efficiency and effectiveness in HR practices by 2033.

What are the key market players or companies in the Human Capital Management industry?

Key players in the Human Capital Management industry include SAP, Oracle, and Workday, among others. These companies dominate the market with innovative solutions and software that streamline HR processes and enhance employee engagement.

What are the primary factors driving the growth in the Human Capital Management industry?

Major factors driving growth in Human Capital Management include technological advancements in HR software, increasing demand for workforce analytics, and the need for compliance with regulations. Companies are also investing in employee-centric approaches to enhance productivity.

Which region is the fastest Growing in the Human Capital Management market?

The Asia Pacific region is the fastest-growing market for Human Capital Management, with growth from $5.26 billion in 2023 to $12.22 billion in 2033, reflecting the region's rapid economic development and increasing adoption of cloud-based HR solutions.

Does ConsaInsights provide customized market report data for the Human Capital Management industry?

Yes, ConsaInsights offers customized market report data tailored to meet specific client needs in the Human Capital Management industry. This allows businesses to make informed decisions based on precise, real-time market insights.

What deliverables can I expect from this Human Capital Management market research project?

Deliverables from the Human Capital Management market research project include comprehensive market analysis reports, regional breakdowns, competitive landscape assessments, and detailed segment insights, facilitating effective strategic planning and market positioning.

What are the market trends of Human Capital Management?

Current trends in Human Capital Management include the integration of artificial intelligence in recruitment processes, the focus on employee wellness programs, and the rise of remote work platforms, all contributing to dynamic changes in workforce management strategies.