Human Capital Management Software Market Report

Published Date: 31 January 2026 | Report Code: human-capital-management-software

Human Capital Management Software Market Size, Share, Industry Trends and Forecast to 2033

This detailed report explores the Human Capital Management Software market, providing insights on current trends, performance metrics, and forecasts from 2023 to 2033, including market size and growth expectations.

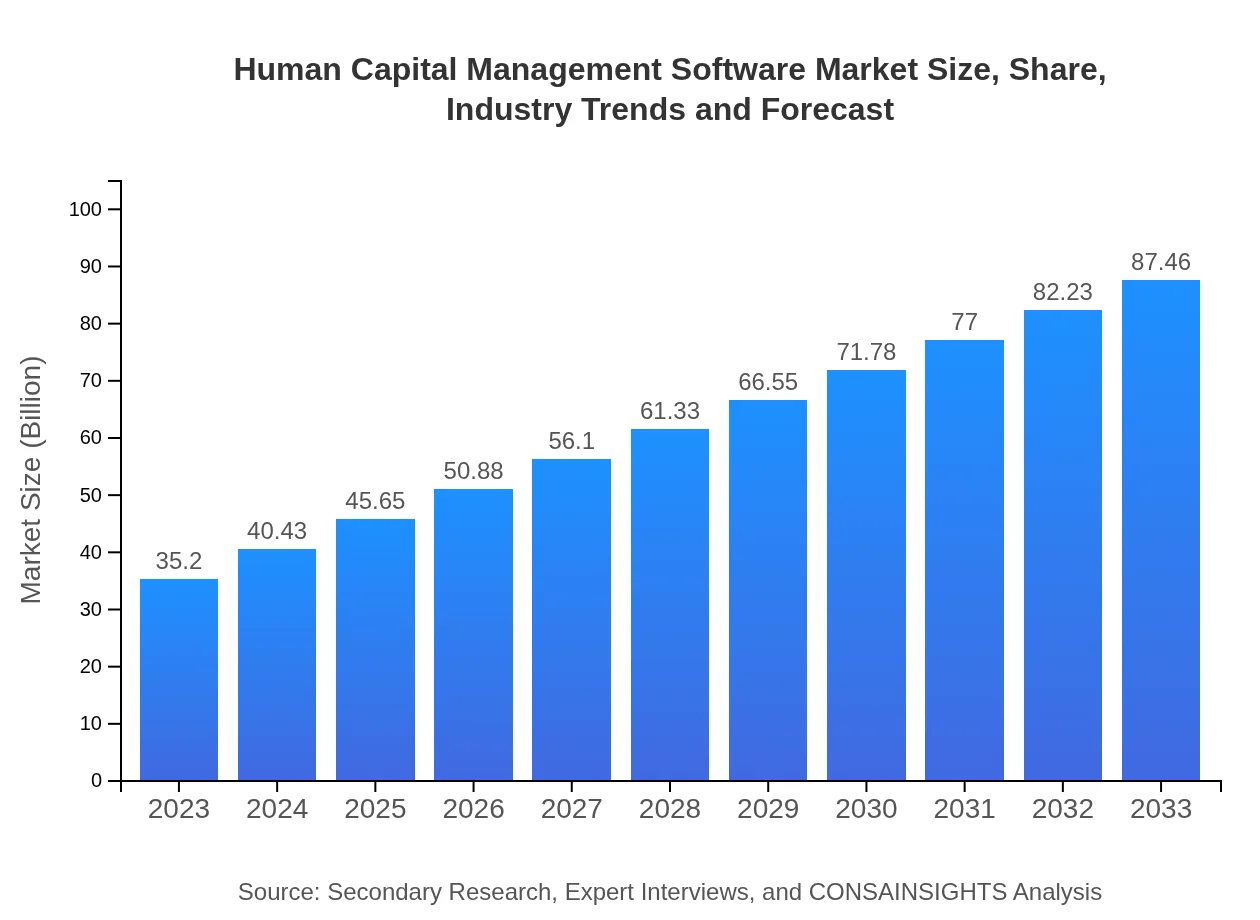

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $35.20 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $87.46 Billion |

| Top Companies | SAP SuccessFactors, Workday, Oracle HCM Cloud, ADP Workforce Now, Ultimate Software |

| Last Modified Date | 31 January 2026 |

Human Capital Management Software Market Overview

Customize Human Capital Management Software Market Report market research report

- ✔ Get in-depth analysis of Human Capital Management Software market size, growth, and forecasts.

- ✔ Understand Human Capital Management Software's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Human Capital Management Software

What is the Market Size & CAGR of Human Capital Management Software market in 2023?

Human Capital Management Software Industry Analysis

Human Capital Management Software Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Human Capital Management Software Market Analysis Report by Region

Europe Human Capital Management Software Market Report:

Europe's HCM software market will grow from $10.40 billion in 2023 to $25.84 billion by 2033. Regulatory compliance and a substantial emphasis on employee satisfaction are key forces propelling this market forward.Asia Pacific Human Capital Management Software Market Report:

The Asia Pacific region is witnessing significant growth in the HCM software market, with the market size projected to expand from $5.98 billion in 2023 to $14.86 billion by 2033. Key drivers include expanding enterprises across diverse sectors, heightened adoption of technological solutions, and a shifting focus towards employee welfare and development.North America Human Capital Management Software Market Report:

North America remains the largest market for HCM software, expected to grow from $13.64 billion in 2023 to $33.89 billion by 2033. This growth is driven by a highly competitive business environment that prioritizes human resources management and innovation in HR technologies.South America Human Capital Management Software Market Report:

In South America, the HCM market is smaller but growing steadily, with a projected increase from $0.38 billion in 2023 to $0.94 billion by 2033. Companies in this regional landscape are beginning to recognize the strategic importance of HCM tools to enhance workforce productivity amid economic variance.Middle East & Africa Human Capital Management Software Market Report:

The Middle East and Africa's HCM market is anticipated to expand from $4.80 billion in 2023 to $11.93 billion by 2033. The increasing focus on talent management and digital transformation initiatives is fueling growth in this region.Tell us your focus area and get a customized research report.

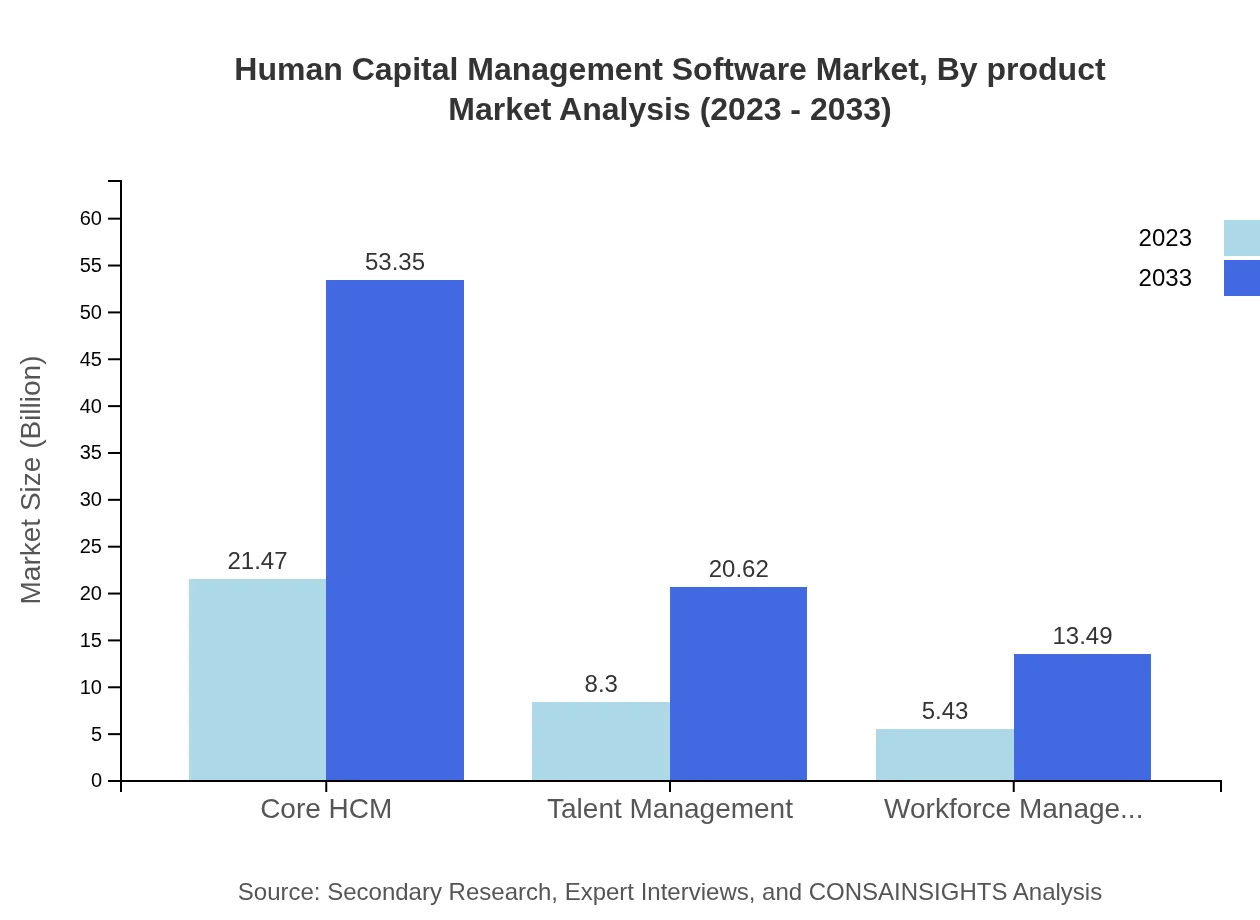

Human Capital Management Software Market Analysis By Product

The product segments of HCM software, such as Employee Self-Service, Talent Management, and Analytics and Reporting, represent significant opportunities for growth. In 2023, Employee Self-Service leads the market at $21.47 billion, expected to grow to $53.35 billion by 2033, reflecting the growing preference for user-friendly interfaces and employee autonomy.

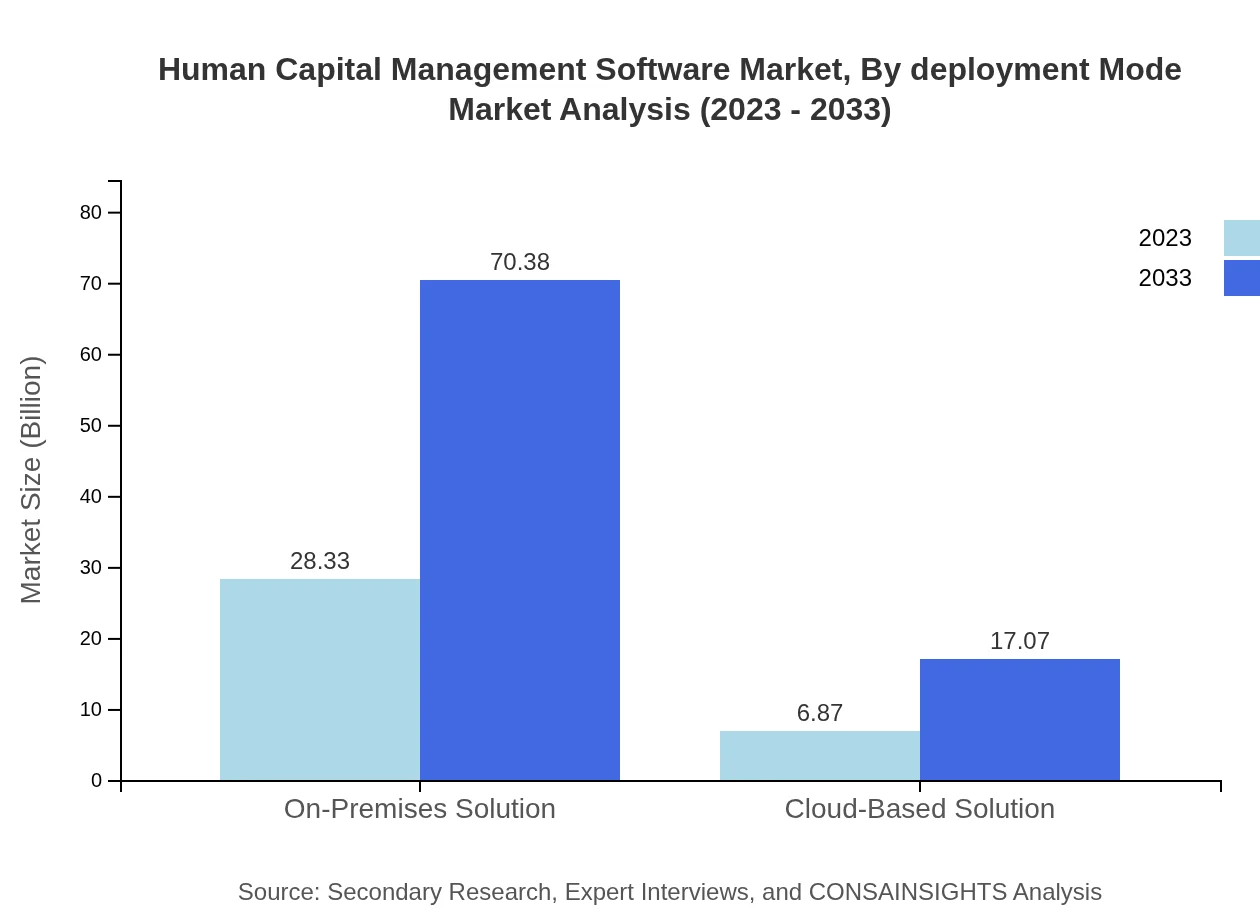

Human Capital Management Software Market Analysis By Deployment Mode

Deployment mode segmentation shows a clear distinction between on-premises and cloud-based solutions. On-premises solutions constitute a major share of the market at $28.33 billion in 2023, projected to reach $70.38 billion by 2033. However, cloud-based options are gaining traction, with a surge from $6.87 billion to $17.07 billion over the same period, appealing to SMBs seeking flexibility and scalability.

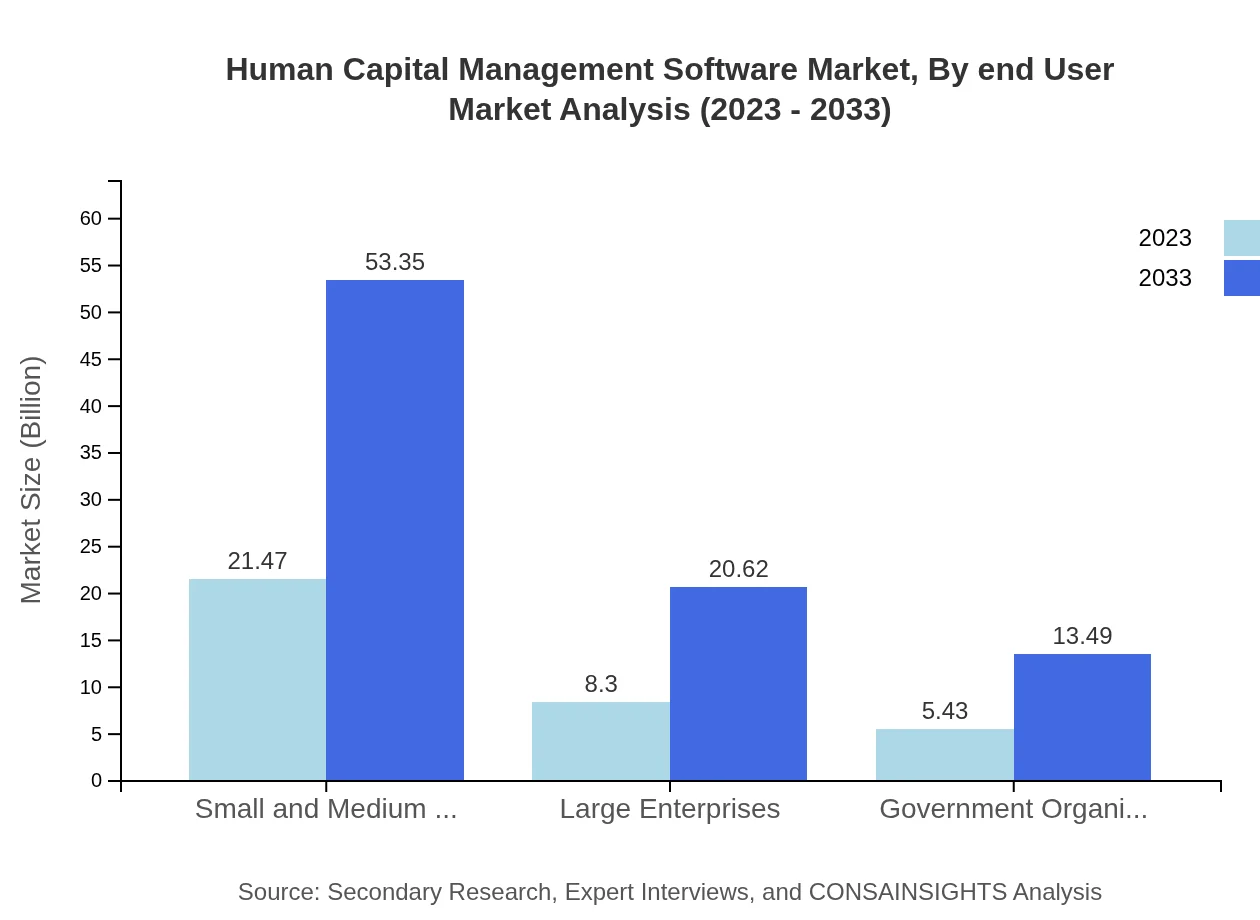

Human Capital Management Software Market Analysis By End User

For end-users, SMBs represent the largest segment, projected to maintain a steady share of 61%. By 2033, the focus on employee-centric policies in large enterprises and government sectors will also contribute significantly, with notable growth anticipated in healthcare and educational sectors, each expanding from $21.47 billion to $53.35 billion and $8.30 billion to $20.62 billion, respectively.

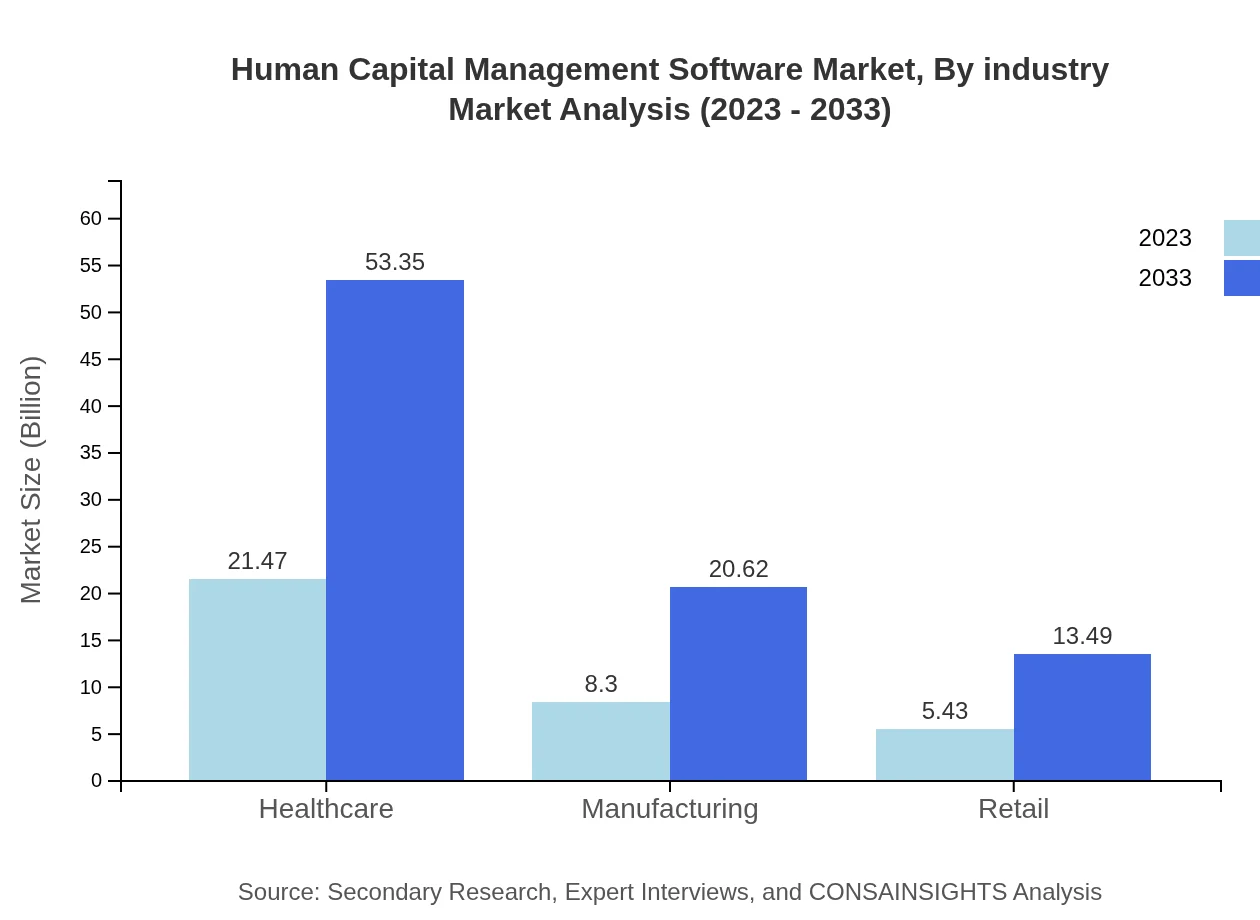

Human Capital Management Software Market Analysis By Industry

The industry segmentation highlights that healthcare and manufacturing remain the most prominent users of HCM solutions, valued at $21.47 billion and $8.30 billion in 2023. With growth projections indicating a rising demand for focused solutions within specific industries, tailored software offerings will see increased adoption.

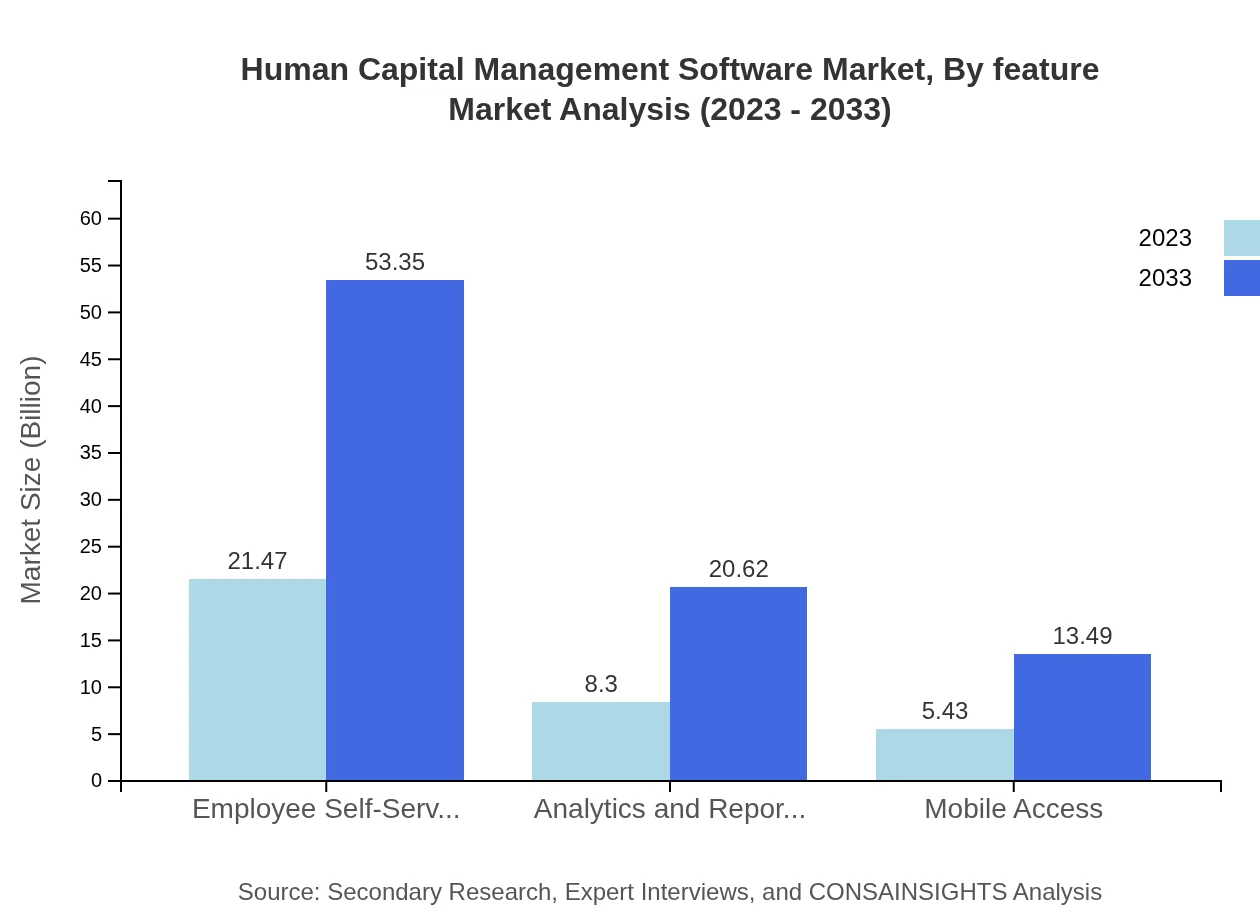

Human Capital Management Software Market Analysis By Feature

Feature segmentation identifies critical functionalities such as Analytics and Reporting, which underscore the need for actionable insights. The market for this segment is anticipated to increase from $8.30 billion in 2023 to $20.62 billion by 2033, demonstrating a shift towards data-driven decision-making in HR practices.

Human Capital Management Software Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Human Capital Management Software Industry

SAP SuccessFactors:

SAP SuccessFactors offers comprehensive cloud-based HCM solutions encompassing core HR functions, talent management, and workforce analytics, helping organizations enhance employee engagement and streamline HR processes.Workday:

Workday provides a unified solution for finance and HR, focusing on innovation, adaptability, and usability, supporting organizations in managing their workforce more effectively.Oracle HCM Cloud:

Oracle's HCM Cloud delivers powerful analytics and comprehensive functionality for workforce management, emphasizing data-driven insights to boost employee performance.ADP Workforce Now:

ADP specializes in payroll solutions, human resources management, and benefits administration, empowering businesses with solutions that adapt to their worker needs.Ultimate Software:

Ultimate Software offers the UltiPro platform, which prioritizes employee experience, including features for payroll, performance management, and workforce analytics.We're grateful to work with incredible clients.

FAQs

What is the market size of Human Capital Management Software?

The Human Capital Management Software market is projected to reach $35.2 billion by 2033, with a CAGR of 9.2%. This growth illustrates the increased adoption of HR technologies across various industry sectors, responding to evolving workforce needs.

What are the key market players or companies in the Human Capital Management Software industry?

Key players in the Human Capital Management Software industry include SAP, Oracle, Workday, ADP, and Ceridian. These companies provide a range of solutions to streamline HR processes, contributing significantly to market dynamics and competition.

What are the primary factors driving the growth in the Human Capital Management Software industry?

Growth in the Human Capital Management Software industry is driven by digital transformation in HR processes, the need for enhanced employee engagement, and the growing emphasis on data analytics for decision-making in workforce management.

Which region is the fastest Growing in the Human Capital Management Software?

The North American region is the fastest-growing market, projected to grow from $13.64 billion in 2023 to $33.89 billion by 2033. Rapid technological advances and high adoption rates in enterprises fuel this growth.

Does ConsaInsights provide customized market report data for the Human Capital Management Software industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the Human Capital Management Software industry, allowing clients to gain deeper insights into market dynamics, trends, and opportunities.

What deliverables can I expect from this Human Capital Management Software market research project?

Deliverables include comprehensive market analysis reports, demographic data, segment-wise analysis, and forecasts. These insights enable informed decision-making for stakeholders looking to invest or expand in the market.

What are the market trends of Human Capital Management Software?

Current market trends include increased adoption of cloud-based solutions, prioritization of employee self-service platforms, and a shift towards data-driven analytics, reflecting the industry's evolution in response to workforce management challenges.