Human Milk Oligosaccharides Market Report

Published Date: 31 January 2026 | Report Code: human-milk-oligosaccharides

Human Milk Oligosaccharides Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Human Milk Oligosaccharides (HMO) market, detailing market trends, size, forecasts from 2023 to 2033, and key industry insights. It covers market segmentation, regional analysis, and insights into global market leaders.

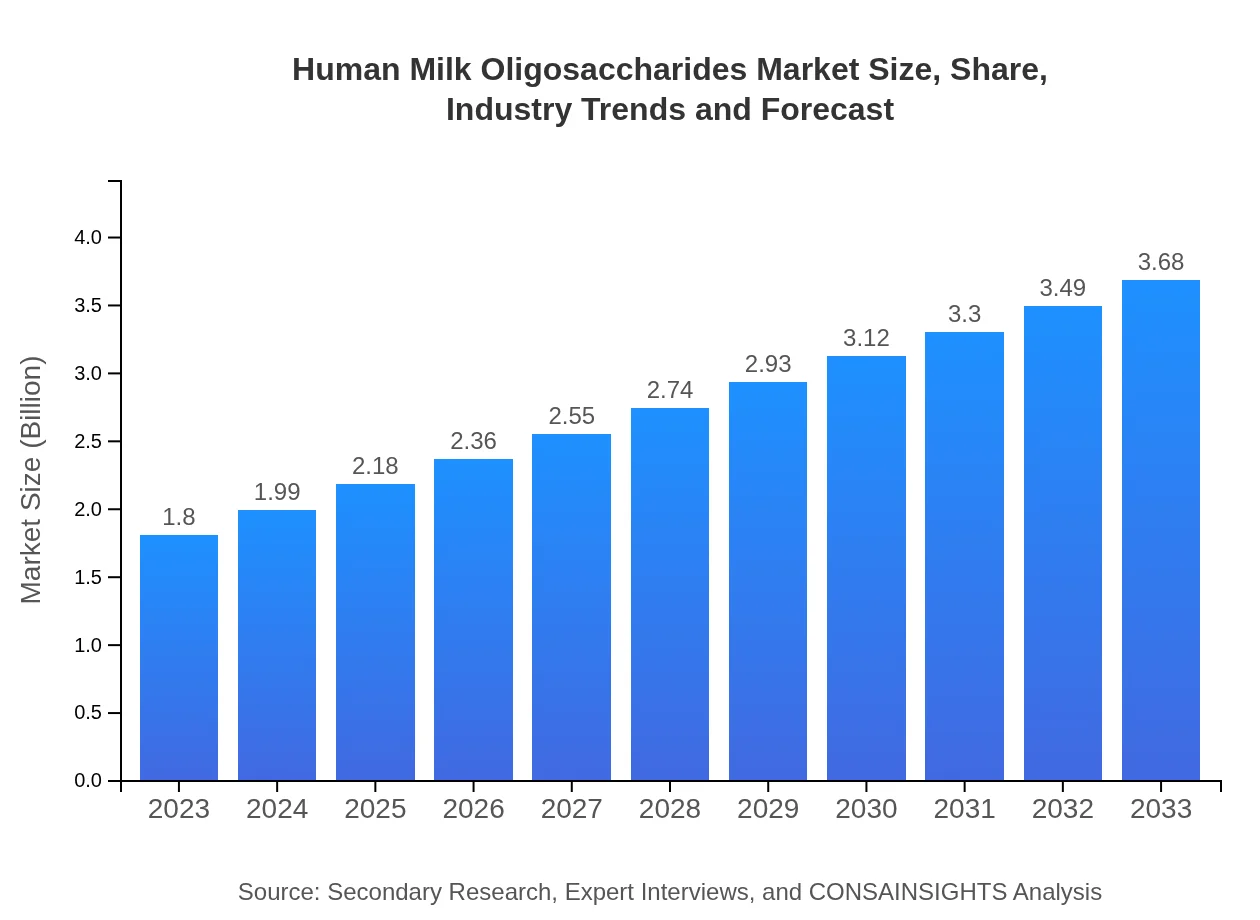

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.80 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $3.68 Billion |

| Top Companies | Basel, Switzerland - Nestlé S.A., Global - DuPont de Nemours, Inc., Germany - Glycom A/S, USA - Abbott Laboratories |

| Last Modified Date | 31 January 2026 |

Human Milk Oligosaccharides Market Overview

Customize Human Milk Oligosaccharides Market Report market research report

- ✔ Get in-depth analysis of Human Milk Oligosaccharides market size, growth, and forecasts.

- ✔ Understand Human Milk Oligosaccharides's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Human Milk Oligosaccharides

What is the Market Size & CAGR of Human Milk Oligosaccharides market in 2023?

Human Milk Oligosaccharides Industry Analysis

Human Milk Oligosaccharides Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Human Milk Oligosaccharides Market Analysis Report by Region

Europe Human Milk Oligosaccharides Market Report:

The European market for HMOs is projected to expand from approximately 0.59 billion USD in 2023 to 1.21 billion USD by 2033. This growth is driven by strong regulations surrounding infant nutrition markets and increased R&D investments by key industry players focused on product innovation.Asia Pacific Human Milk Oligosaccharides Market Report:

The Asia Pacific region represented a market size of approximately 0.32 billion USD in 2023 and is anticipated to grow to 0.66 billion USD by 2033. This growth is driven by increasing birth rates, rising disposable incomes, and expanding urbanization, which are leading to higher consumption of infant formula products enriched with HMOs.North America Human Milk Oligosaccharides Market Report:

In North America, the market is estimated to be valued at 0.64 billion USD in 2023, expected to rise to 1.31 billion USD by 2033. Factors fueling this growth include high consumer awareness of pediatric health and rising demand for premium infant formula products fortified with human milk oligosaccharides.South America Human Milk Oligosaccharides Market Report:

The South American market is currently valued at 0.17 billion USD in 2023, projected to reach 0.34 billion USD by 2033. Growth in this region is attributed to changing dietary habits and improved healthcare practices. Increasing awareness about the health benefits of HMOs is also influencing consumer choices in infant nutrition.Middle East & Africa Human Milk Oligosaccharides Market Report:

The Middle East and Africa market is expected to see gradual growth, moving from 0.08 billion USD in 2023 to about 0.16 billion USD by 2033. Increasing awareness of nutritional science and a growing emphasis on infant health could serve as catalysts for this growth across the region.Tell us your focus area and get a customized research report.

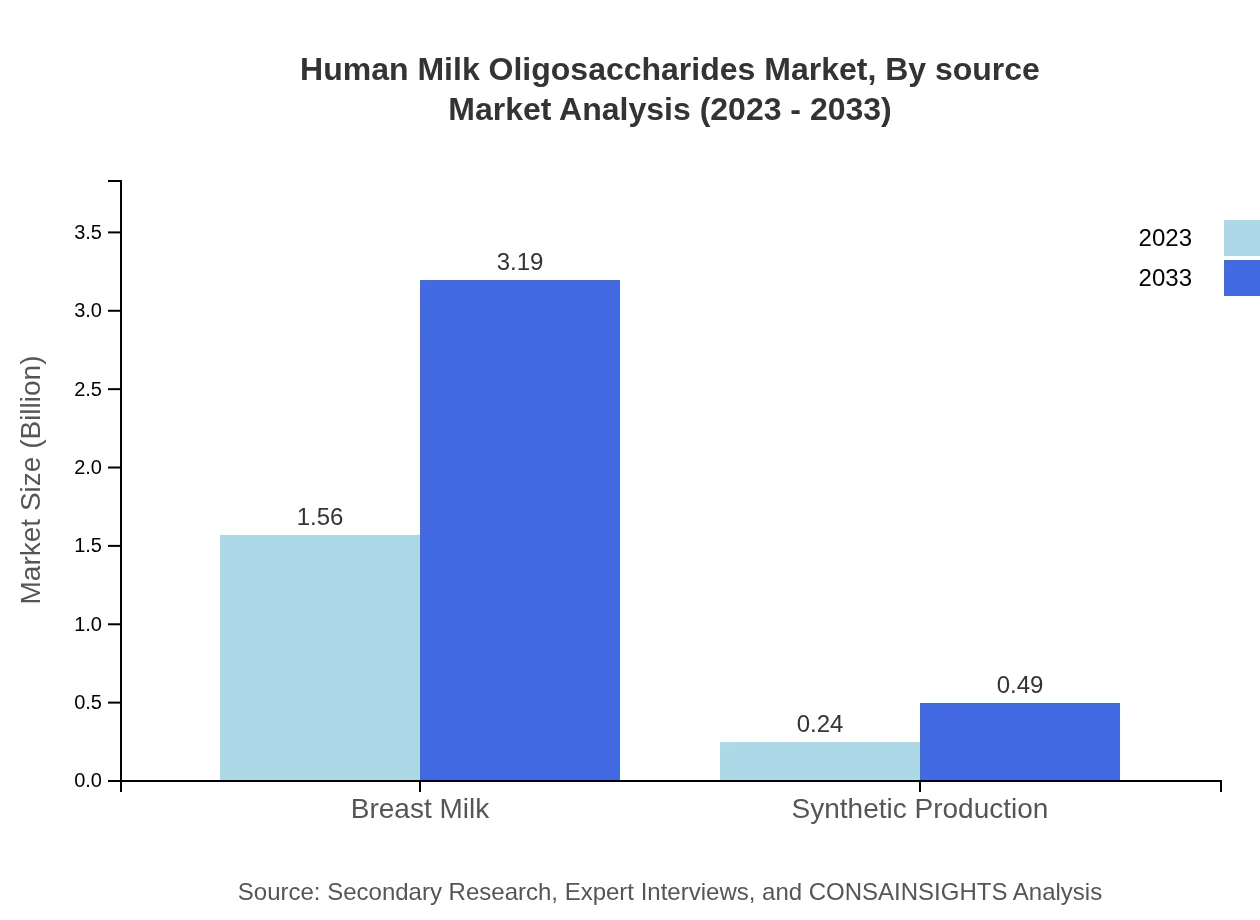

Human Milk Oligosaccharides Market Analysis By Source

The Human Milk Oligosaccharides market based on source is distinctive, encompassing breast milk and synthetic production. In 2023, breast milk-derived HMOs dominate the market with a size of 1.56 billion USD, projected to increase to 3.19 billion USD by 2033, indicating a strong consumer preference for natural products. Synthetic HMOs are also gaining traction, especially in formulated products, showing growth from 0.24 billion USD in 2023 to 0.49 billion USD by 2033, as manufacturers seek to innovate and reduce costs.

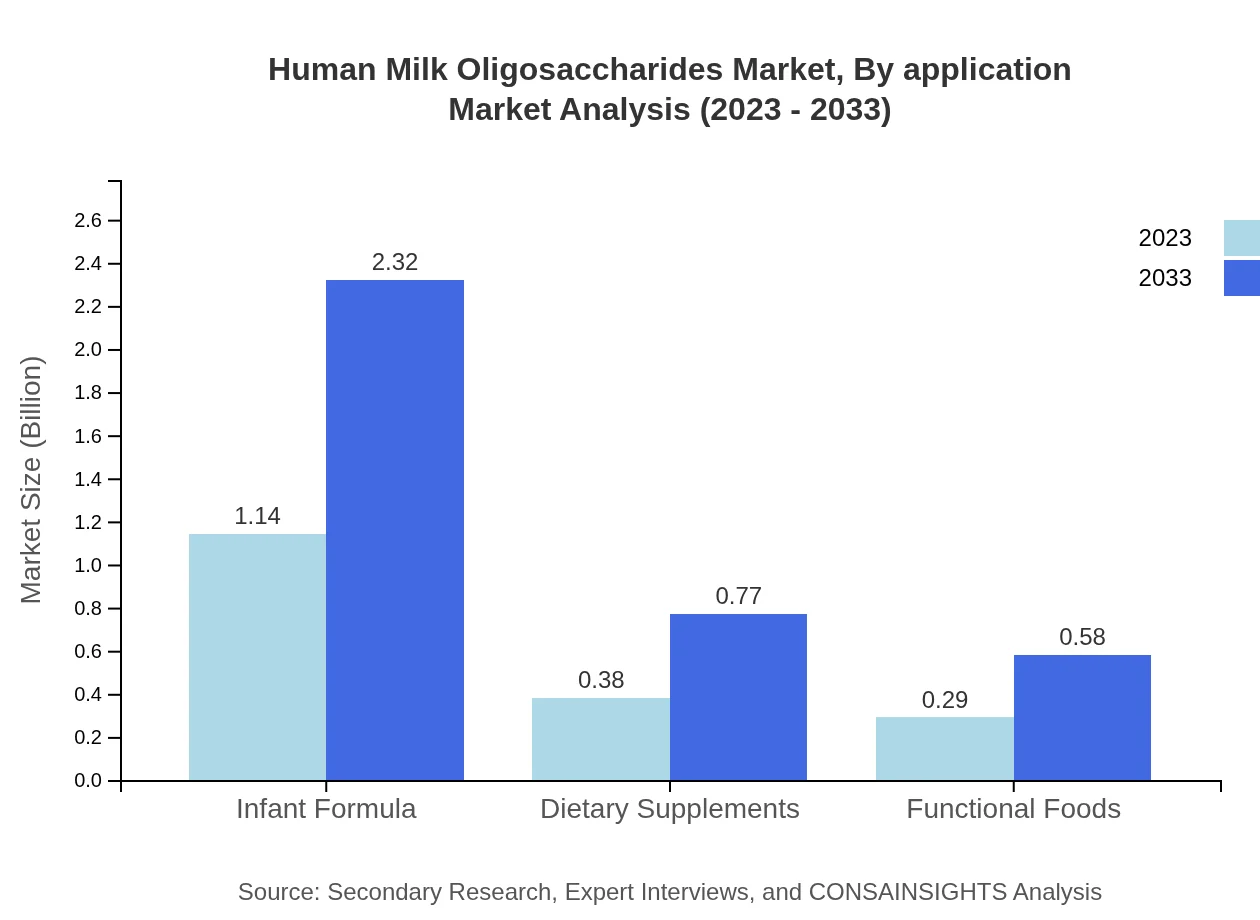

Human Milk Oligosaccharides Market Analysis By Application

The application of Human Milk Oligosaccharides spans across infant formula, healthcare products, and dietary supplements among others. In 2023, the market was valued at 1.14 billion USD for infant formula, anticipated to double by 2033. This segment holds a substantial market share of around 63.18%. Healthcare applications also show promise, especially as awareness of gut health increases, with projected growth from 0.38 billion USD to 0.77 billion USD by 2033.

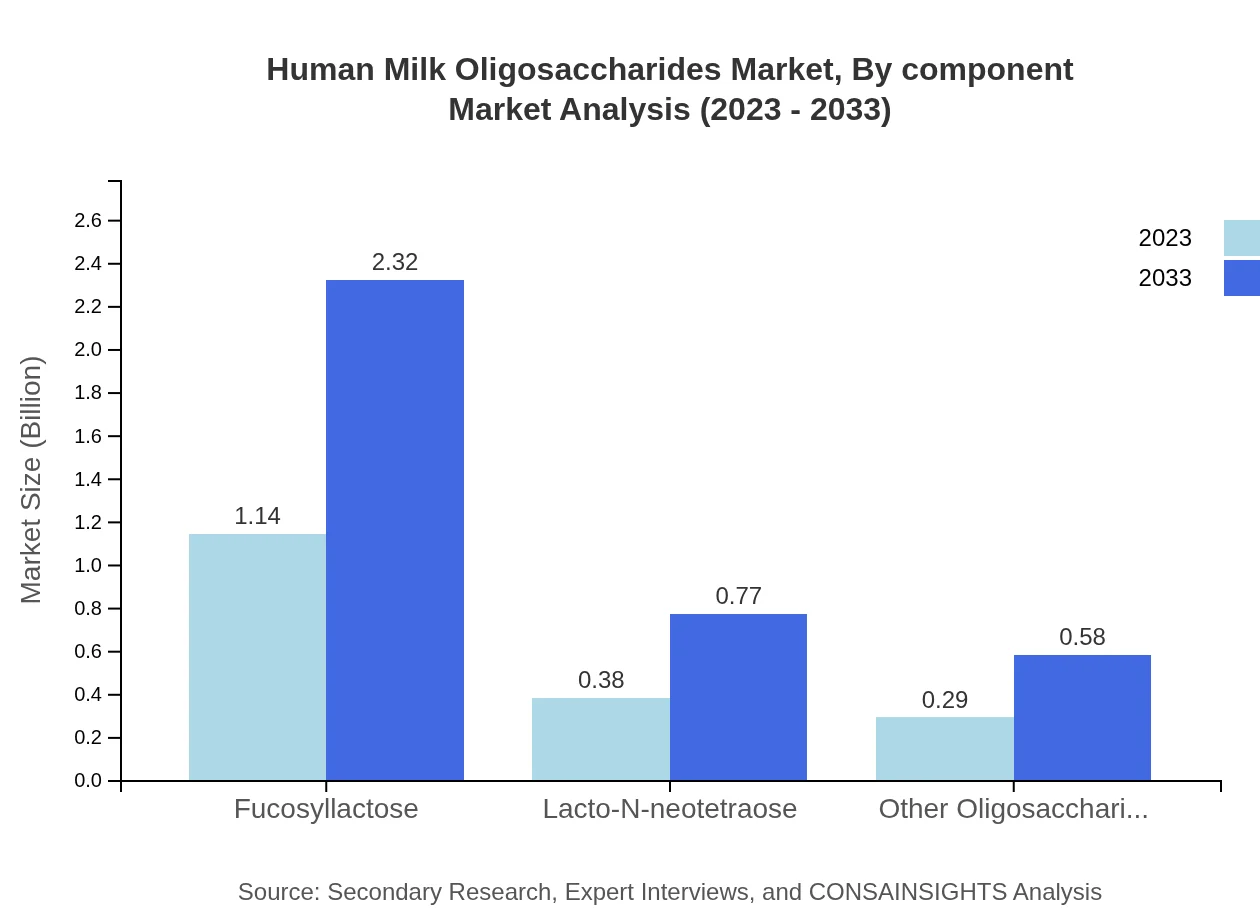

Human Milk Oligosaccharides Market Analysis By Component

The components of the Human Milk Oligosaccharides market include fucosyllactose, Lacto-N-neotetraose, and other oligosaccharides. Fucosyllactose is the market leader, with a size of 1.14 billion USD in 2023, maintaining a share of 63.18%. Other components are also expected to grow, with lacto-N-neotetraose projected to increase from 0.38 billion USD to 0.77 billion USD by 2033.

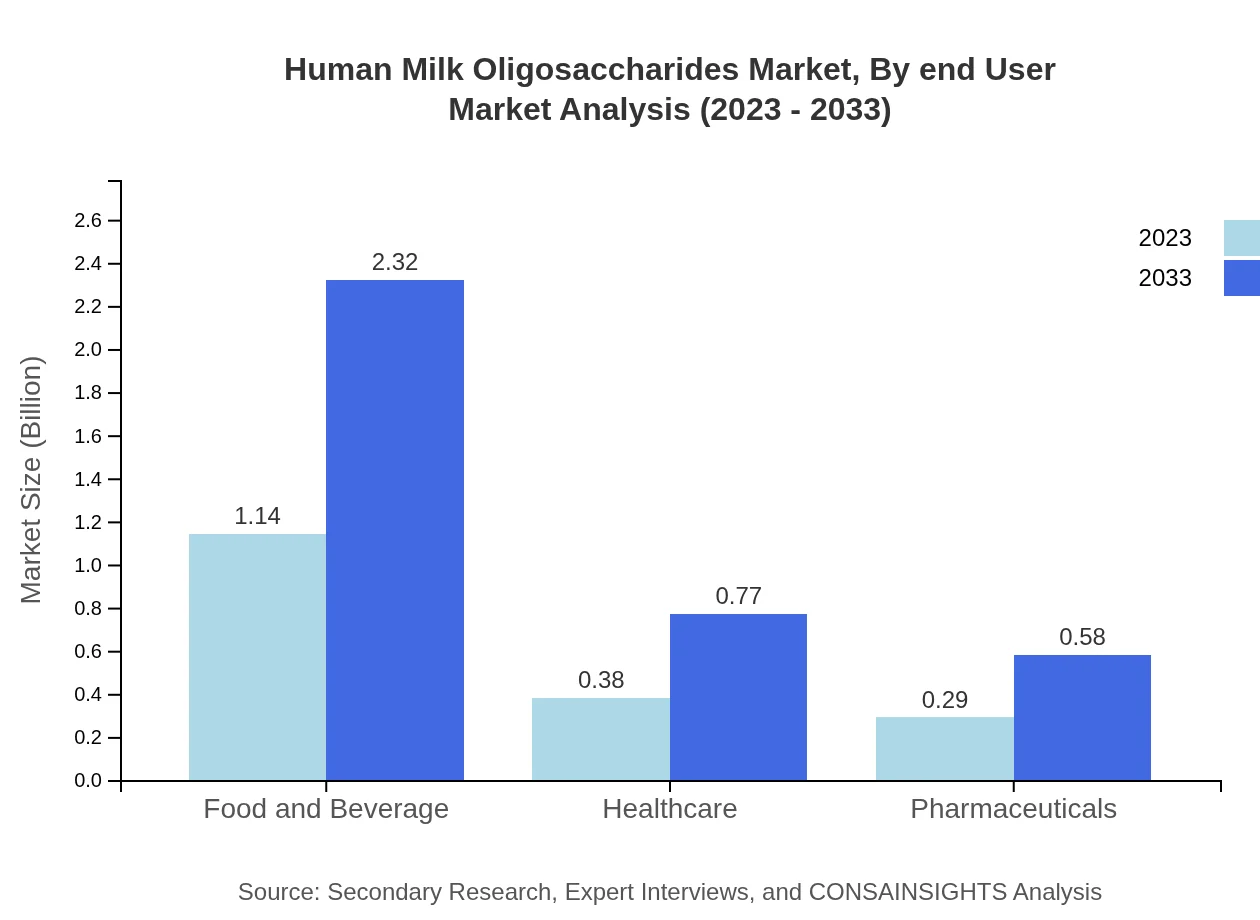

Human Milk Oligosaccharides Market Analysis By End User

End-users of Human Milk Oligosaccharides primarily include food and beverage manufacturers, healthcare providers, and pharmaceutical companies. The food and beverage sector holds a significant market share of 63.18% with projected growth reflecting the increasing adoption of nutritionally dense foods targeting infants and children, while the pharmaceutical sector is expected to see gradual growth as more products emerge focusing on dietary supplements for health enhancement.

Human Milk Oligosaccharides Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Human Milk Oligosaccharides Industry

Basel, Switzerland - Nestlé S.A.:

A global leader in nutrition, Nestlé manufactures a wide range of infant formulas enriched with HMOs designed to improve digestive health and immunity.Global - DuPont de Nemours, Inc.:

DuPont has invested heavily in R&D for synthetic HMO production and engages in partnerships with infant formula brands worldwide.Germany - Glycom A/S:

Glycom specializes in the research and development of HMOs and has established a strong foothold in the infant nutrition segment with innovative HMO products.USA - Abbott Laboratories:

Abbott is a major player in the infant formula market, integrating HMOs into its products to meet consumer demands for nutritional advancement.We're grateful to work with incredible clients.

FAQs

What is the market size of Human Milk Oligosaccharides?

The global market for Human Milk Oligosaccharides is valued at approximately $1.8 billion in 2023, with a projected CAGR of 7.2%. This growth reflects increasing awareness of the health benefits associated with oligosaccharides in infant nutrition and overall wellness.

What are the key market players or companies in the Human Milk Oligosaccharides industry?

Key players in the Human Milk Oligosaccharides market include prominent companies such as Danone, Abbott Laboratories, FrieslandCampina, and Glycom A/S. These companies lead the way in innovation and product development in the healthcare and infant formula sectors.

What are the primary factors driving the growth in the Human Milk Oligosaccharides industry?

Growth in the Human Milk Oligosaccharides industry is driven by rising health consciousness among consumers, a growing demand for infant formula, advancements in synthetic production techniques, and increasing research highlighting the benefits of oligosaccharides in immune health.

Which region is the fastest Growing in the Human Milk Oligosaccharides?

The fastest-growing region in the Human Milk Oligosaccharides market is North America, expected to grow from $0.64 billion in 2023 to $1.31 billion by 2033. Significant investments in healthcare and nutritional research contribute to this growth.

Does ConsaInsights provide customized market report data for the Human Milk Oligosaccharides industry?

Yes, ConsaInsights offers customized market reports for the Human Milk Oligosaccharides industry. Clients can request tailored insights based on specific segments, regions, or emerging trends tailored to their business needs.

What deliverables can I expect from this Human Milk Oligosaccharides market research project?

Deliverables for the Human Milk Oligosaccharides market research project include detailed market analysis, segment breakdown, competitive landscape assessments, and comprehensive forecasts. The reports are designed to aid strategic planning and business development.

What are the market trends of Human Milk Oligosaccharides?

Current trends in the Human Milk Oligosaccharides market include increased formulation of products for dietary supplements, a focus on functional foods, and growing consumer demand for products that promote digestive and immune health.