Humectants Market Report

Published Date: 31 January 2026 | Report Code: humectants

Humectants Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the humectants market, focusing on market size, trends, segmentation, and forecasts from 2023 to 2033. It includes competitive insights, regional dynamics, and technological advancements shaping the industry.

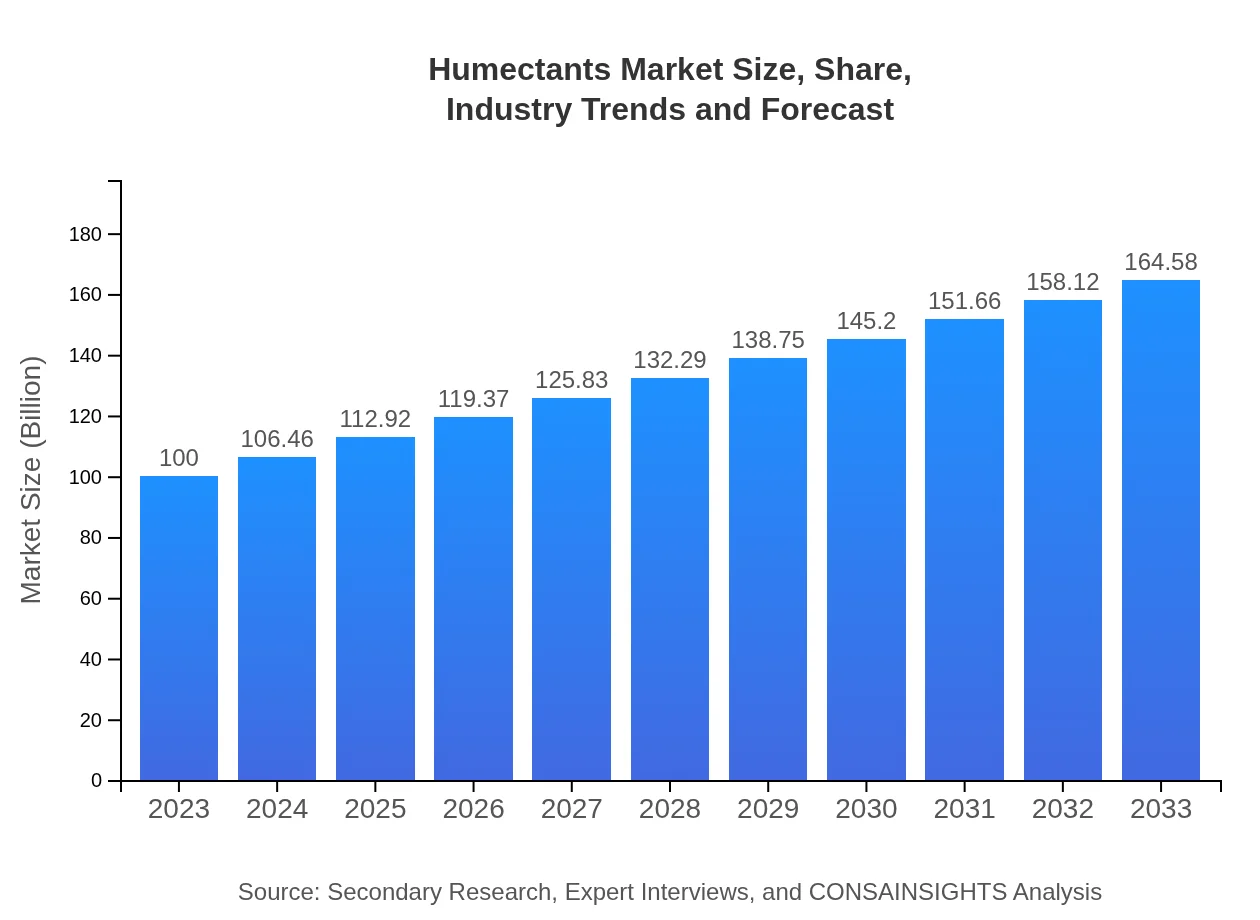

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $100.00 Million |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $164.58 Million |

| Top Companies | BASF SE, Dow Chemical Company, Hawkins, Inc., Glycerin Solutions LLC |

| Last Modified Date | 31 January 2026 |

Humectants Market Overview

Customize Humectants Market Report market research report

- ✔ Get in-depth analysis of Humectants market size, growth, and forecasts.

- ✔ Understand Humectants's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Humectants

What is the Market Size & CAGR of Humectants market in 2023?

Humectants Industry Analysis

Humectants Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Humectants Market Analysis Report by Region

Europe Humectants Market Report:

The European humectants market is projected to grow from $27.38 billion in 2023 to $45.06 billion by 2033. The region benefits from a sophisticated consumer base that values quality and sustainability. Innovations in product formulation, driven by consumer demand and regulatory frameworks, are expected to enhance growth in this market sector.Asia Pacific Humectants Market Report:

The Asia Pacific region holds a significant share in the global humectants market, valued at approximately $19.36 billion in 2023. By 2033, it is expected to grow to $31.86 billion. The growth is driven by rising urbanization, increasing disposable incomes, and the burgeoning cosmetic industry, particularly in countries like China and India, where consumer demand for skincare products is escalating.North America Humectants Market Report:

North America is a prominent market for humectants, valued at $37.72 billion in 2023 and expected to reach $62.08 billion by 2033. Factors such as the high inclination towards personal care products, advancements in product formulations, and strong regulatory backing for product safety and effectiveness will continue to drive this market forward.South America Humectants Market Report:

In South America, the humectants market is projected to expand from $8.87 billion in 2023 to $14.60 billion in 2033. The growth in personal care and food industries, alongside a rising trend towards health-conscious products, significantly contribute to this expansion. Local production and sourcing of natural ingredients are shifting the market dynamics favorably.Middle East & Africa Humectants Market Report:

The humectants market in the Middle East and Africa is expected to see growth from $6.67 billion in 2023 to $10.98 billion in 2033. The increase in disposable incomes, combined with a growing population interested in personal care and hygiene products, will propel market growth in this region.Tell us your focus area and get a customized research report.

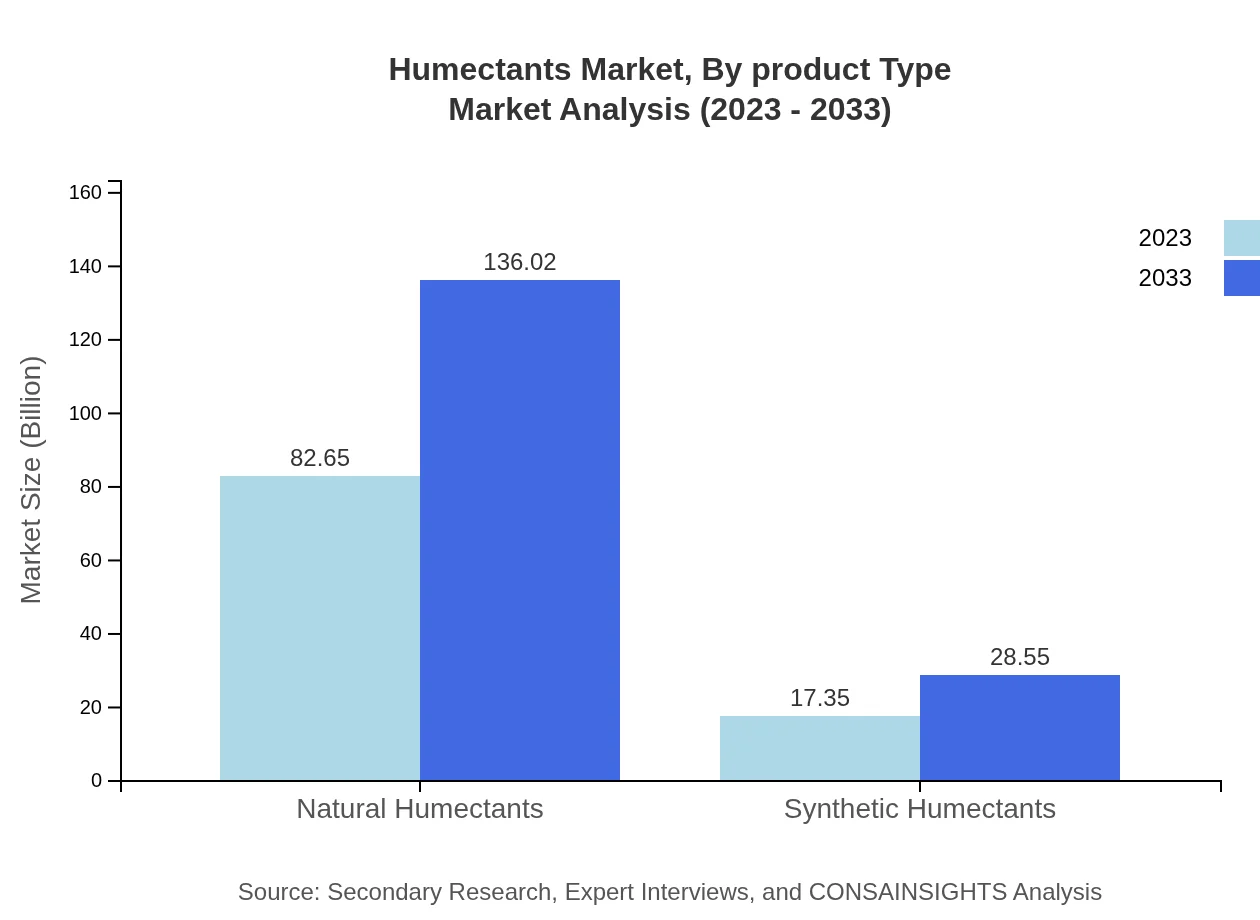

Humectants Market Analysis By Product Type

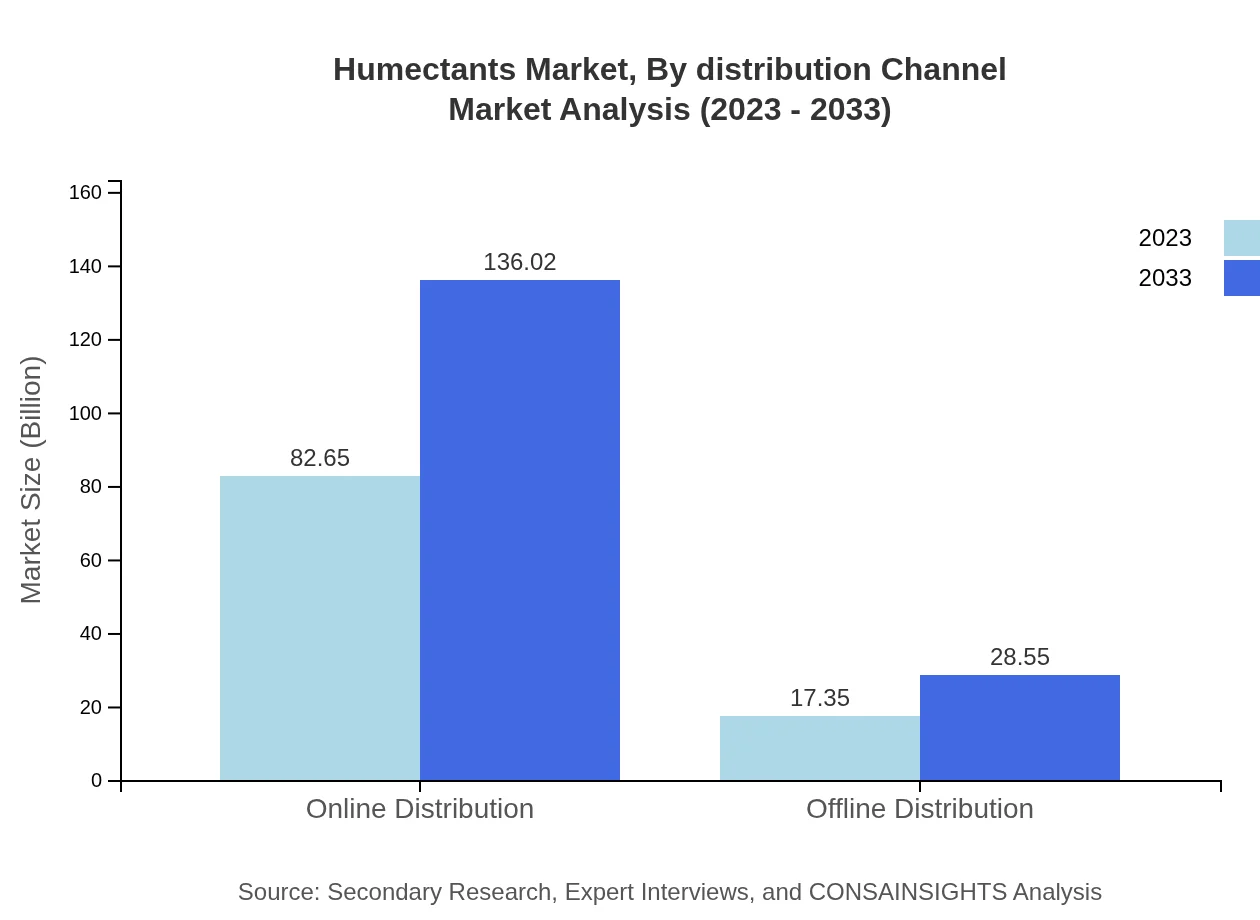

The product type segment illustrates robust growth patterns for various humectants, with natural humectants dominating the landscape. In 2023, the market for natural humectants is valued at $82.65 billion, expected to grow to $136.02 billion by 2033. Synthetic humectants also show promise, increasing from $17.35 billion in 2023 to $28.55 billion in 2033.

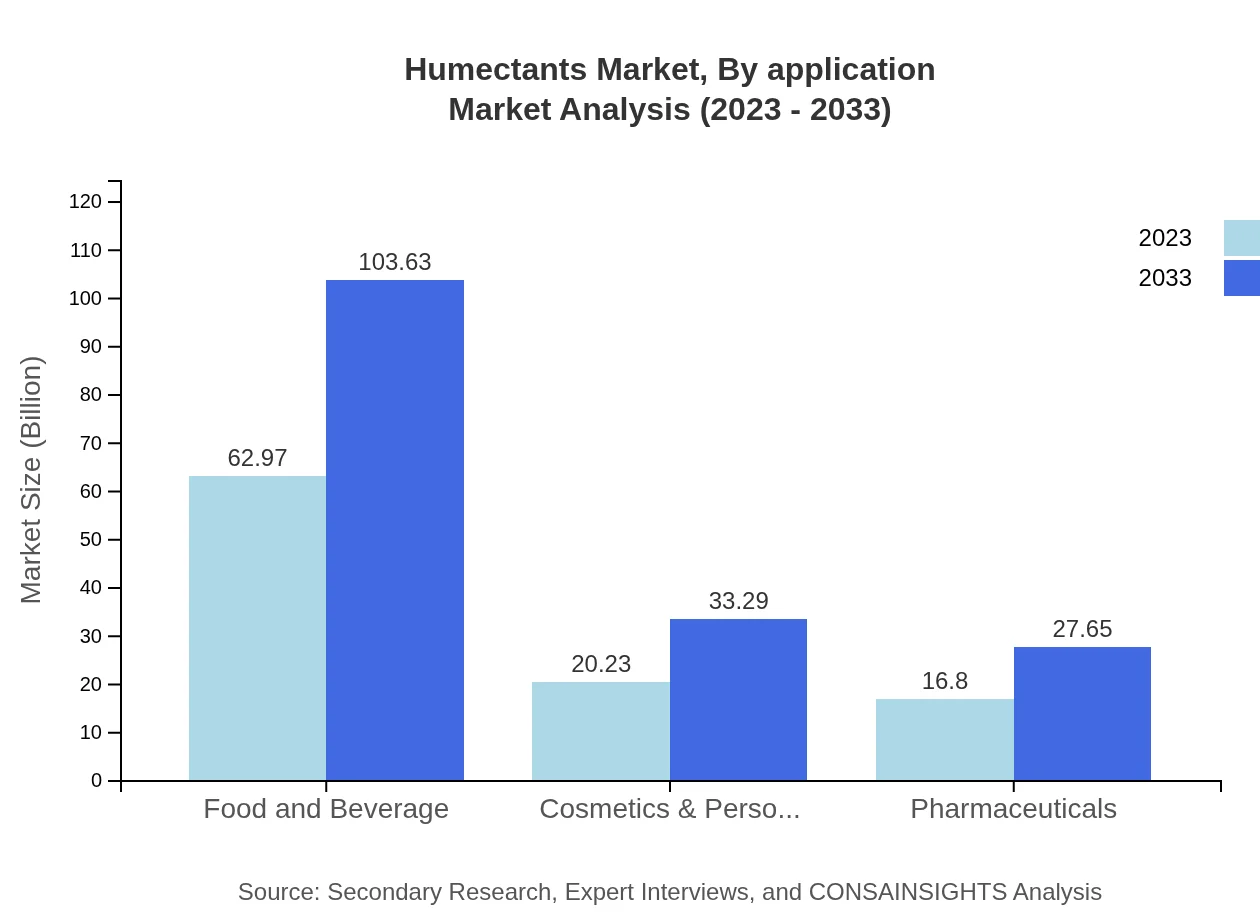

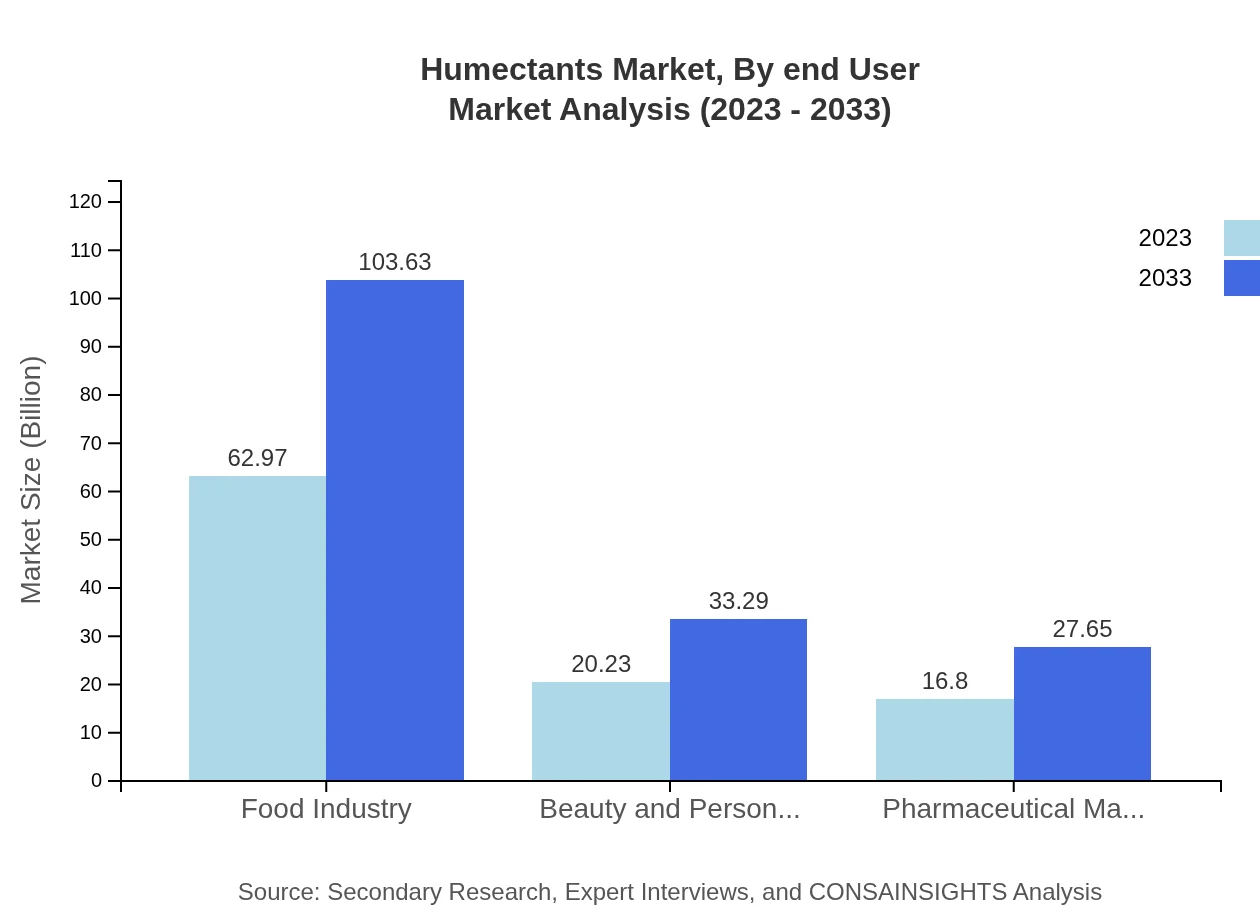

Humectants Market Analysis By Application

The Food Industry remains the largest application segment for humectants with a size of $62.97 billion in 2023, projected to rise to $103.63 billion in 2033. The beauty and personal care segment is also significant, with market values of $20.23 billion and expected growth to $33.29 billion by 2033.

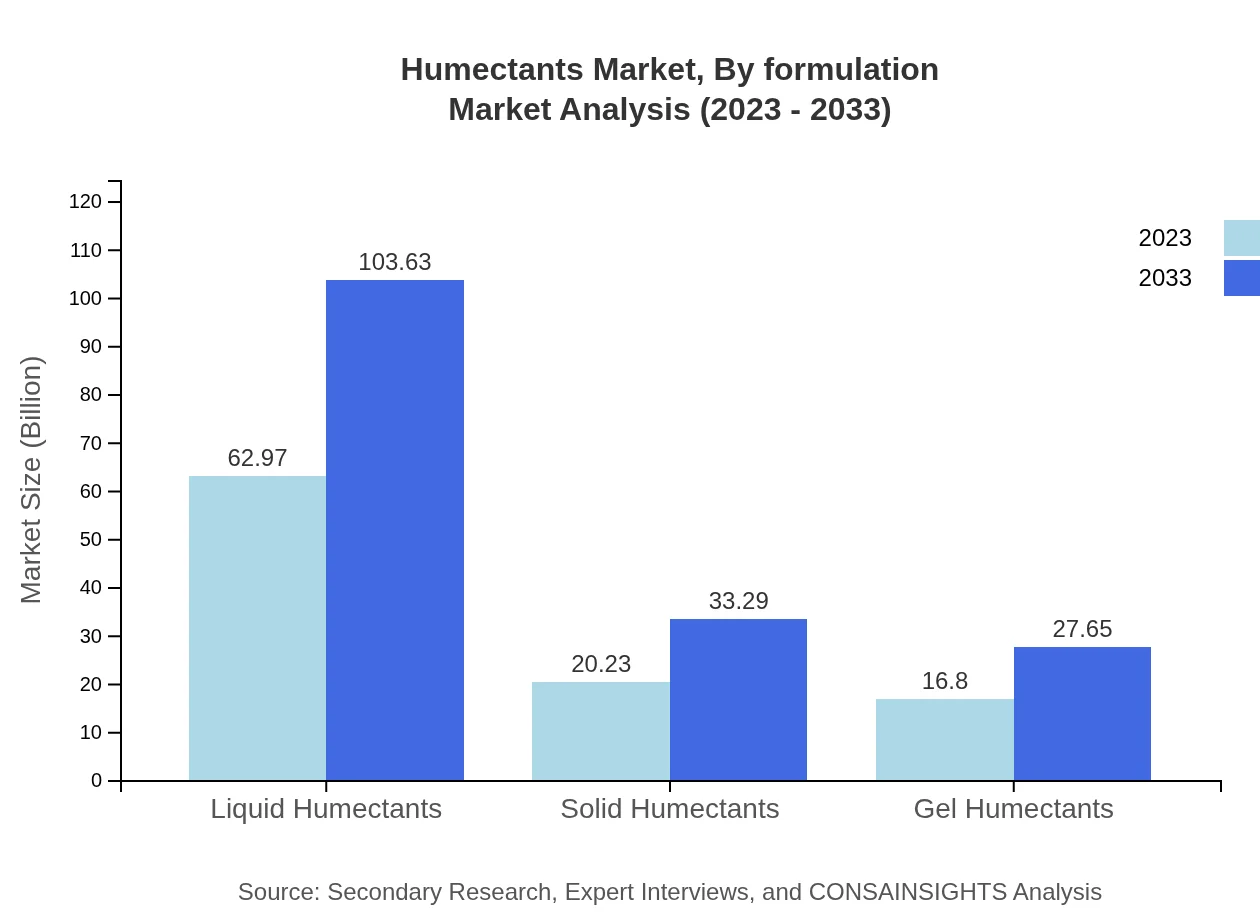

Humectants Market Analysis By Formulation

Different forms of humectants show varied performance in market scenarios. Liquid humectants are widely favored, accounting for $62.97 billion in 2023 and likely increasing to $103.63 billion by 2033, while solid and gel formulations are also growing steadily, supported by innovations in delivery systems.

Humectants Market Analysis By End User

The pharmaceuticals sector plays a vital role in humectants utilization, particularly in moisture retention in formulations, sustaining a market size of $16.80 billion in 2023, expected to grow to $27.65 billion by 2033. The food and beverage sector is critical, reflecting a similar upward trend.

Humectants Market Analysis By Distribution Channel

The market distribution is diversifying with significant contributions from both online and offline channels. Online distribution is growing rapidly, from $82.65 billion in 2023 to $136.02 billion by 2033, leveraging consumer convenience and direct access to products.

Humectants Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Humectants Industry

BASF SE:

A global leader in chemicals, BASF provides a wide range of humectants, emphasizing sustainability and innovation in their formulations to cater to growing consumer demands.Dow Chemical Company:

Known for its advanced materials and chemicals, Dow competes strongly in the humectants sector, focusing on product efficacy and enhanced performance across various applications.Hawkins, Inc.:

A key player in the market, Hawkins integrates high-quality ingredients in food and personal care applications, driving a focus on enhanced customer experiences.Glycerin Solutions LLC:

Specializing in glycerin production, Glycerin Solutions is vital in the humectant market, providing natural solutions that meet dual consumer needs of quality and sustainability.We're grateful to work with incredible clients.

FAQs

What is the market size of humectants?

The global humectants market is projected to reach $100 million by 2033, growing at a CAGR of 5%. In 2023, this market is valued at $100 million, reflecting significant growth potential in various applications.

What are the key market players or companies in this humectants industry?

Key players in the humectants market include major food and beverage producers, cosmetic manufacturers, and pharmaceutical companies. These companies invest in R&D to enhance product effectiveness and cater to consumer preferences.

What are the primary factors driving the growth in the humectants industry?

The growth in the humectants industry is driven by increased demand from the food, beauty, and pharmaceutical sectors. Rising consumer preference for natural ingredients also bolsters market expansion, along with technological advancements in formulation.

Which region is the fastest Growing in the humectants?

North America is the fastest-growing region for humectants, with the market expected to grow from $37.72 million in 2023 to $62.08 million by 2033. Europe and Asia-Pacific also show significant growth rates.

Does ConsaInsights provide customized market report data for the humectants industry?

Yes, ConsaInsights offers customized market reports tailored to specific industry needs. Clients can request detailed analyses, including market size, trends, and competitive landscape information.

What deliverables can I expect from this humectants market research project?

Deliverables include comprehensive market analysis, segmentation data, competitive landscape overview, regional insights, and future growth projections. Customized reports may also feature tailored insights based on client specifications.

What are the market trends of humectants?

Current trends in the humectants market include a shift toward natural and organic ingredients, increased demand in the food and cosmetics sectors, and growing preference for online distribution channels. Innovations in formulation technologies are also notable.