Hvac Contained Server Market Report

Published Date: 22 January 2026 | Report Code: hvac-contained-server

Hvac Contained Server Market Size, Share, Industry Trends and Forecast to 2033

This market report provides a comprehensive analysis of the HVAC contained server market, exploring current trends, market size, and future forecasts from 2023 to 2033.

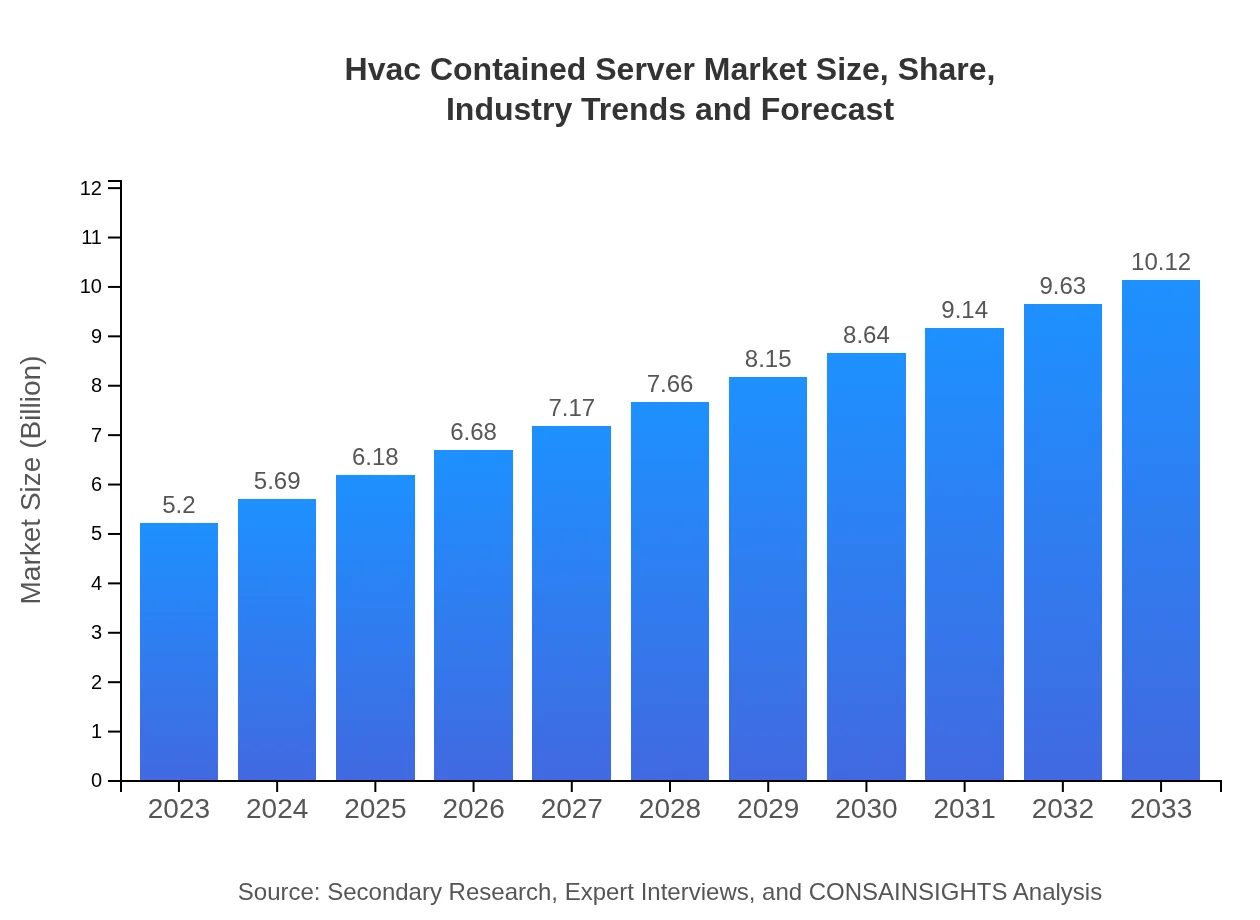

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.20 Billion |

| CAGR (2023-2033) | 6.7% |

| 2033 Market Size | $10.12 Billion |

| Top Companies | Liebert Corporation, Schneider Electric, Trane Technologies, Vertiv Co., Rittal GmbH |

| Last Modified Date | 22 January 2026 |

Hvac Contained Server Market Overview

Customize Hvac Contained Server Market Report market research report

- ✔ Get in-depth analysis of Hvac Contained Server market size, growth, and forecasts.

- ✔ Understand Hvac Contained Server's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Hvac Contained Server

What is the Market Size & CAGR of Hvac Contained Server Market in 2023 and 2033?

Hvac Contained Server Industry Analysis

Hvac Contained Server Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Hvac Contained Server Market Analysis Report by Region

Europe Hvac Contained Server Market Report:

Europe's HVAC contained server market is expected to climb from $1.51 billion in 2023 to $2.93 billion in 2033. Factors contributing include stringent environmental regulations and significant investments in digital infrastructure and eco-friendly technologies.Asia Pacific Hvac Contained Server Market Report:

In the Asia Pacific region, the HVAC contained server market is expected to witness significant growth from $1.06 billion in 2023 to $2.07 billion in 2033. This increase is fueled by the expansion of data centers driven by digital transformation and increased investment in smart technologies across major economies like China and India.North America Hvac Contained Server Market Report:

In North America, the market size is anticipated to grow from $1.71 billion in 2023 to $3.33 billion in 2033. This robust growth is propelled by the presence of major data center players and a strong focus on energy-efficient and sustainable solutions in various sectors, especially IT.South America Hvac Contained Server Market Report:

The South American HVAC contained server market is projected to grow modestly, from $0.31 billion in 2023 to $0.61 billion in 2033. Economic recovery and increased digitization efforts are central to this growth, alongside a rising tide of local technology initiatives.Middle East & Africa Hvac Contained Server Market Report:

The Middle East and Africa market is projected to increase from $0.61 billion in 2023 to $1.19 billion by 2033, driven by rising data processing needs and government initiatives promoting digital economies.Tell us your focus area and get a customized research report.

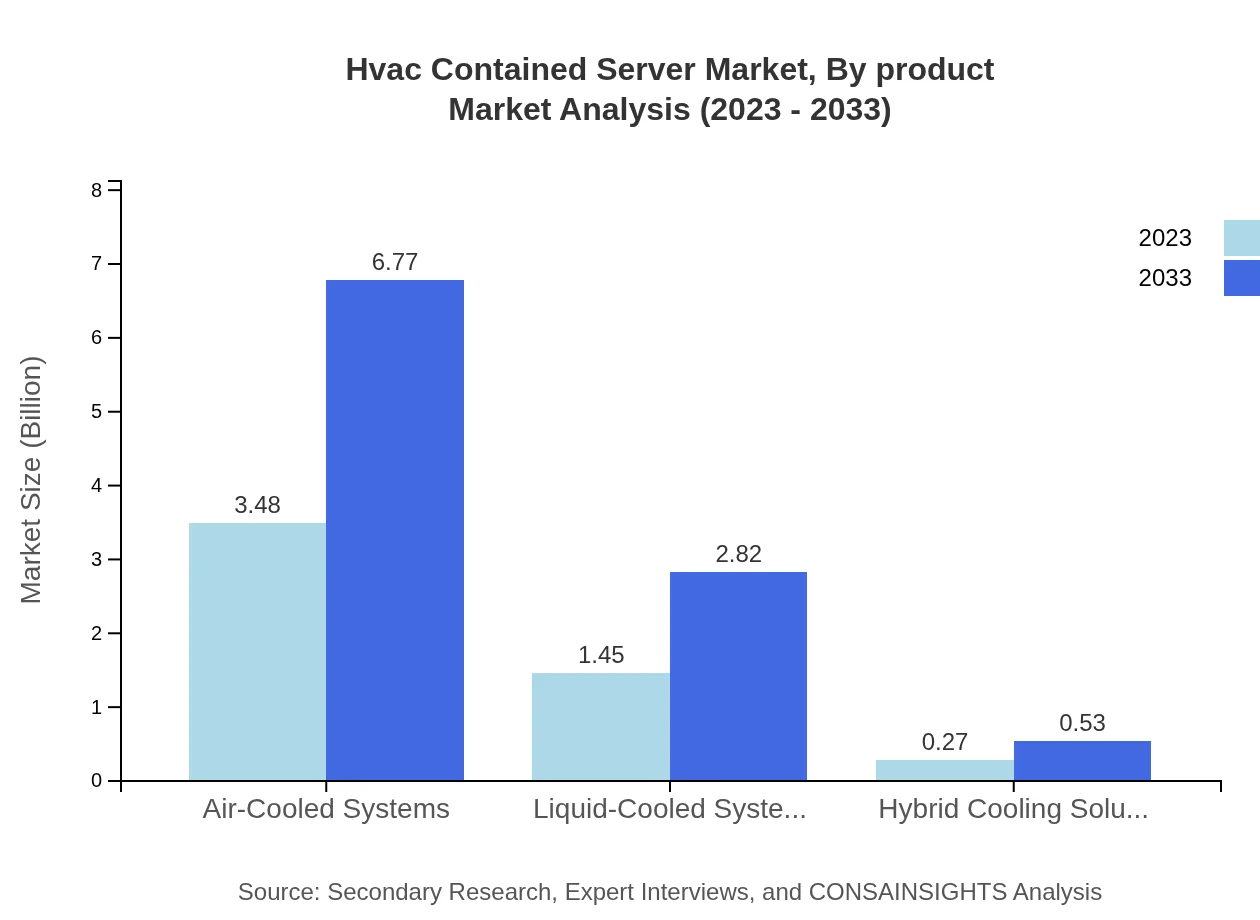

Hvac Contained Server Market Analysis By Product

The HVAC contained server market is dominated by air-cooled systems, with market sizes expected to grow from $3.48 billion in 2023 to $6.77 billion in 2033. Liquid-cooled systems are also experiencing growth, projected to increase from $1.45 billion in 2023 to $2.82 billion by 2033. Hybrid cooling solutions present a smaller but significant segment, with anticipated growth from $0.27 billion to $0.53 billion over the same period.

Hvac Contained Server Market Analysis By Application

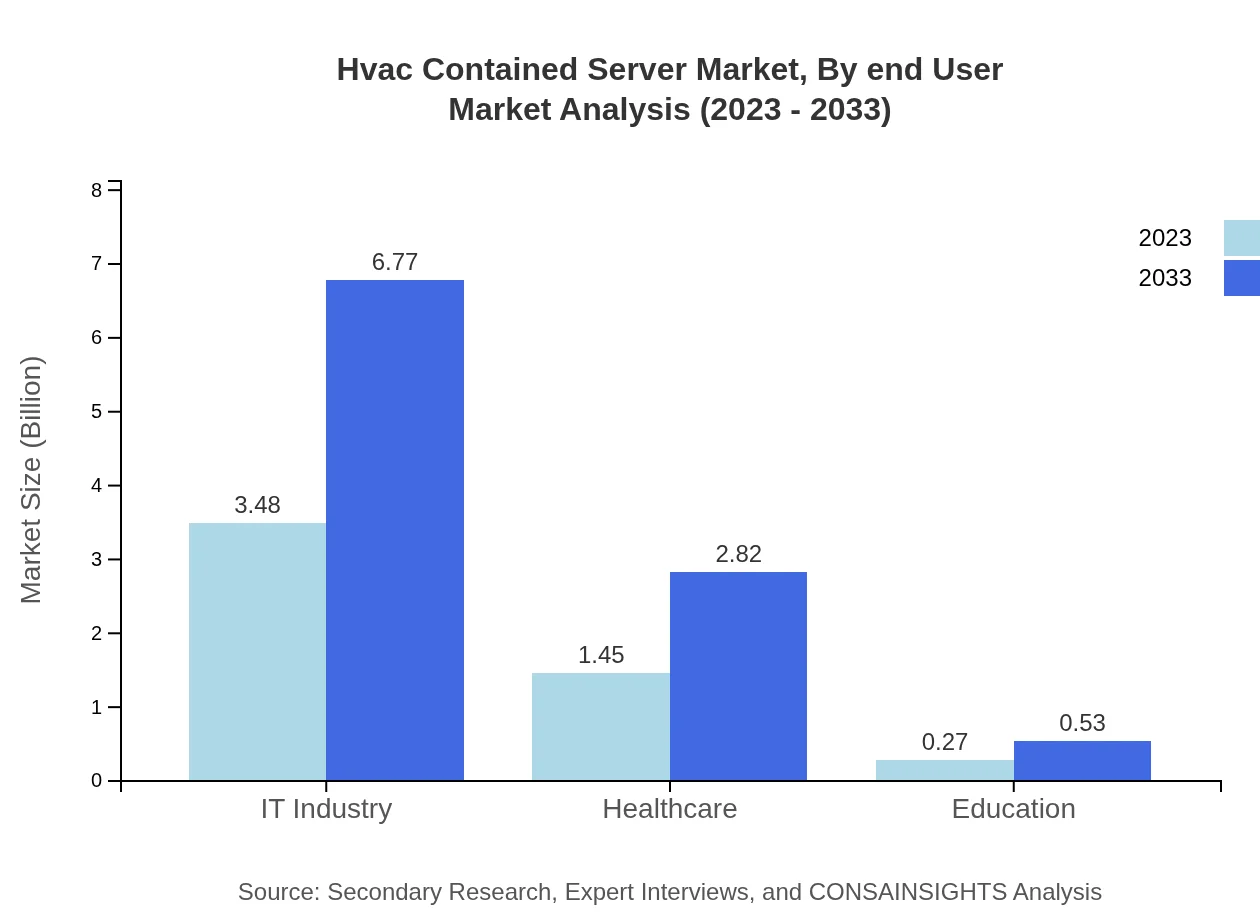

In terms of applications, the IT industry represents the largest share of the market, holding a size of $3.48 billion in 2023 and projected to expand to $6.77 billion by 2033. The healthcare sector follows, with a market size of $1.45 billion in 2023 expected to grow to $2.82 billion by 2033, while the education sector contributes the smallest share, projected to grow from $0.27 billion to $0.53 billion.

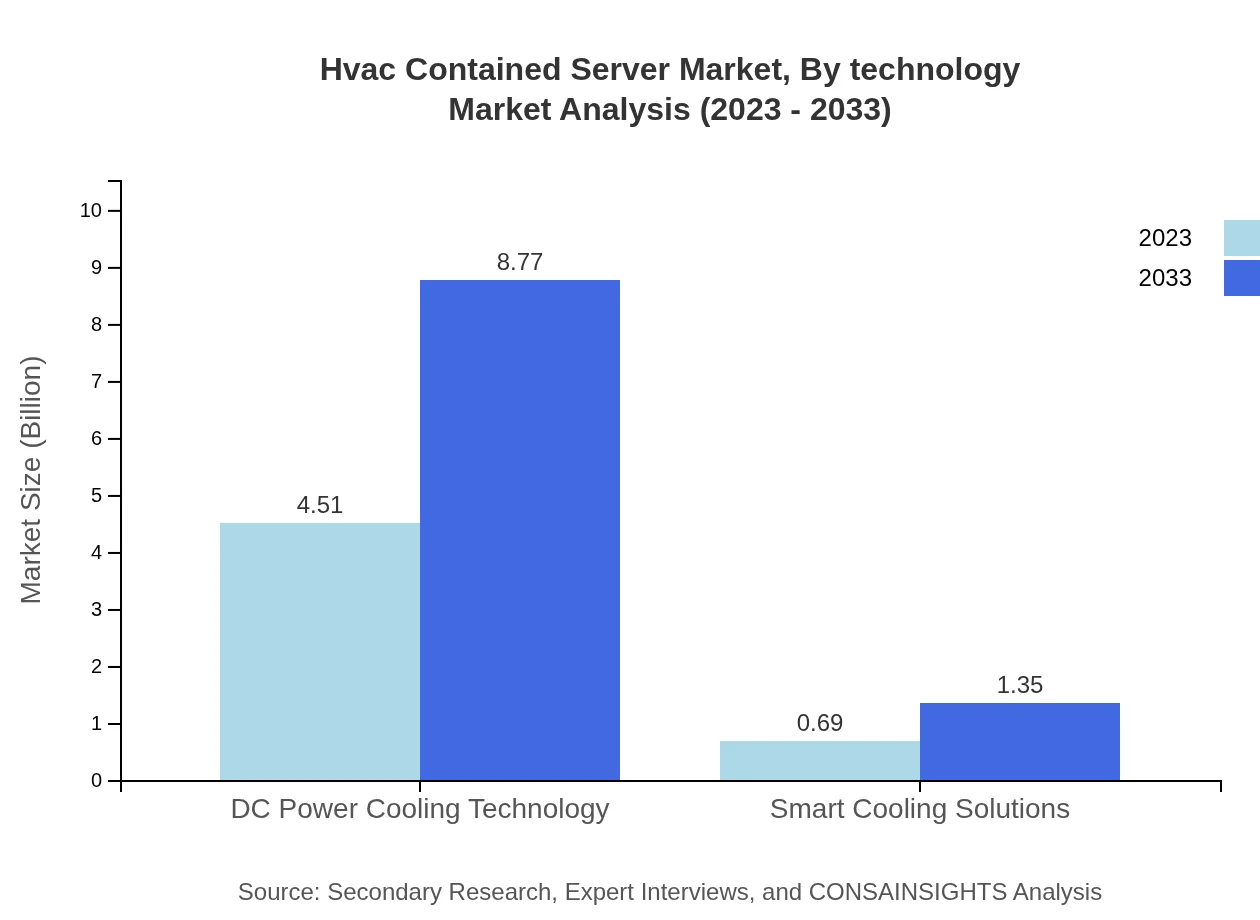

Hvac Contained Server Market Analysis By Technology

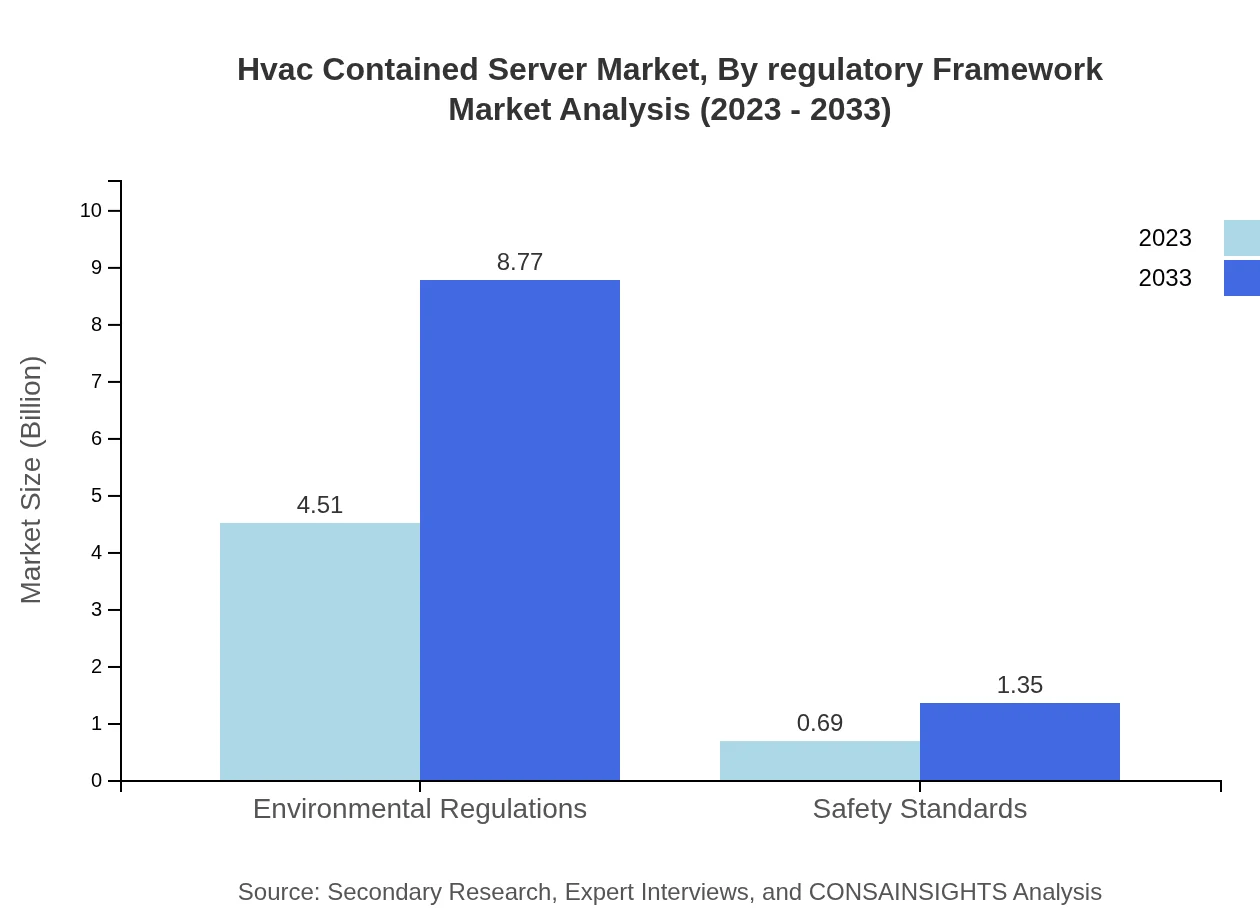

Technological advancements are pivotal in shaping the HVAC contained server market. DC Power Cooling Technology dominates with a market share of approximately 86.65% in 2023, expected to maintain its status by reaching $8.77 billion by 2033. Smart Cooling Solutions are also growing in importance, increasing from $0.69 billion in 2023 to $1.35 billion in 2033, highlighting the demand for innovative cooling techniques.

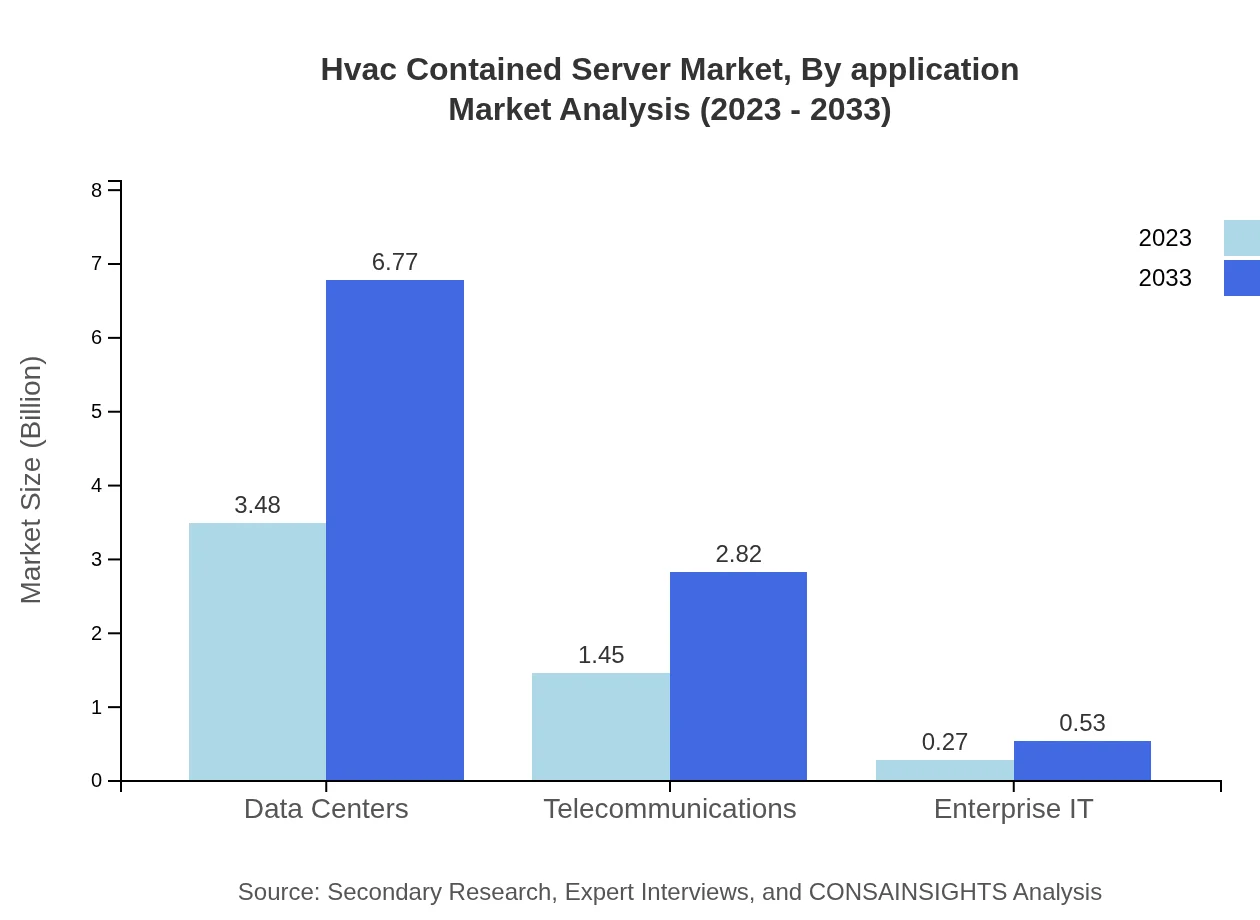

Hvac Contained Server Market Analysis By End User

Across end-user industries, the Data Centers segment leads, expected to grow from $3.48 billion in 2023 to $6.77 billion by 2033, maintaining a dominant market share. Telecommunications also represents a significant sector, projected to grow from $1.45 billion to $2.82 billion, while the Enterprise IT sector remains an emerging segment, anticipated to rise from $0.27 billion to $0.53 billion.

Hvac Contained Server Market Analysis By Regulatory Framework

Regulatory frameworks play a crucial role in shaping market dynamics. Environmental regulations are essential, with the market size expected to increase from $4.51 billion in 2023 to $8.77 billion in 2033, indicating a strong focus on compliance among industry players. Safety standards, while smaller, are also set to grow from $0.69 billion to $1.35 billion, highlighting the importance of safe operational processes across industries.

Hvac Contained Server Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Hvac Contained Server Industry

Liebert Corporation:

Liebert Corporation is a leader in the design, manufacturing, and marketing of mission-critical cooling solutions. Their innovative products ensure stability and efficiency in high-density server facilities.Schneider Electric:

Schneider Electric specializes in energy management and automation solutions, offering products that optimize performance in data center cooling and HVAC contained servers.Trane Technologies:

Trane Technologies focuses on sustainable climate solutions and has developed energy-efficient HVAC systems bespoke for data centers and server rooms.Vertiv Co.:

Vertiv Co. provides critical infrastructure technologies and services for data centers, including innovative HVAC systems designed to improve efficiency in cooling.Rittal GmbH:

Rittal GmbH delivers cutting-edge technology in cooling solutions with a strong emphasis on reliability and energy efficiency in data centers and server applications.We're grateful to work with incredible clients.

FAQs

What is the market size of hvac Contained Server?

The market size of the HVAC-contained server industry is projected at $5.2 billion in 2023, with a robust CAGR of 6.7%, reaching significant growth by 2033.

What are the key market players or companies in this hvac Contained Server industry?

Key players in the HVAC-contained server market include top technology firms specializing in server cooling solutions, data center management, and environmental control systems. These companies drive innovation and contribute to market expansion.

What are the primary factors driving the growth in the hvac Contained Server industry?

Factors driving growth in the HVAC-contained server market include the rise in data center demand, advancements in cooling technology, increasing energy efficiency needs, and heightened environmental awareness among enterprises.

Which region is the fastest Growing in the hvac Contained Server?

North America is the fastest-growing region in the HVAC-contained server market, anticipated to grow from $1.71 billion in 2023 to $3.33 billion by 2033, reflecting increased data center investments.

Does ConsaInsights provide customized market report data for the hvac Contained Server industry?

Yes, ConsaInsights offers customized market report data for the HVAC-contained server industry, allowing clients to gain tailored insights based on their specific requirements and objectives.

What deliverables can I expect from this hvac Contained Server market research project?

From this HVAC-contained server market research project, expect comprehensive deliverables including market size analysis, competitive landscape, regional insights, segmentation data, and future growth forecasting.

What are the market trends of hvac Contained Server?

Current trends in the HVAC-contained server market include the shift towards energy-efficient cooling solutions, increased usage of smart technologies, and a focus on sustainable practices within data center operations.