Hvac Services Market Report

Published Date: 22 January 2026 | Report Code: hvac-services

Hvac Services Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the HVAC services market, detailing market trends, sizes, segments, and regional insights for the forecast period from 2023 to 2033.

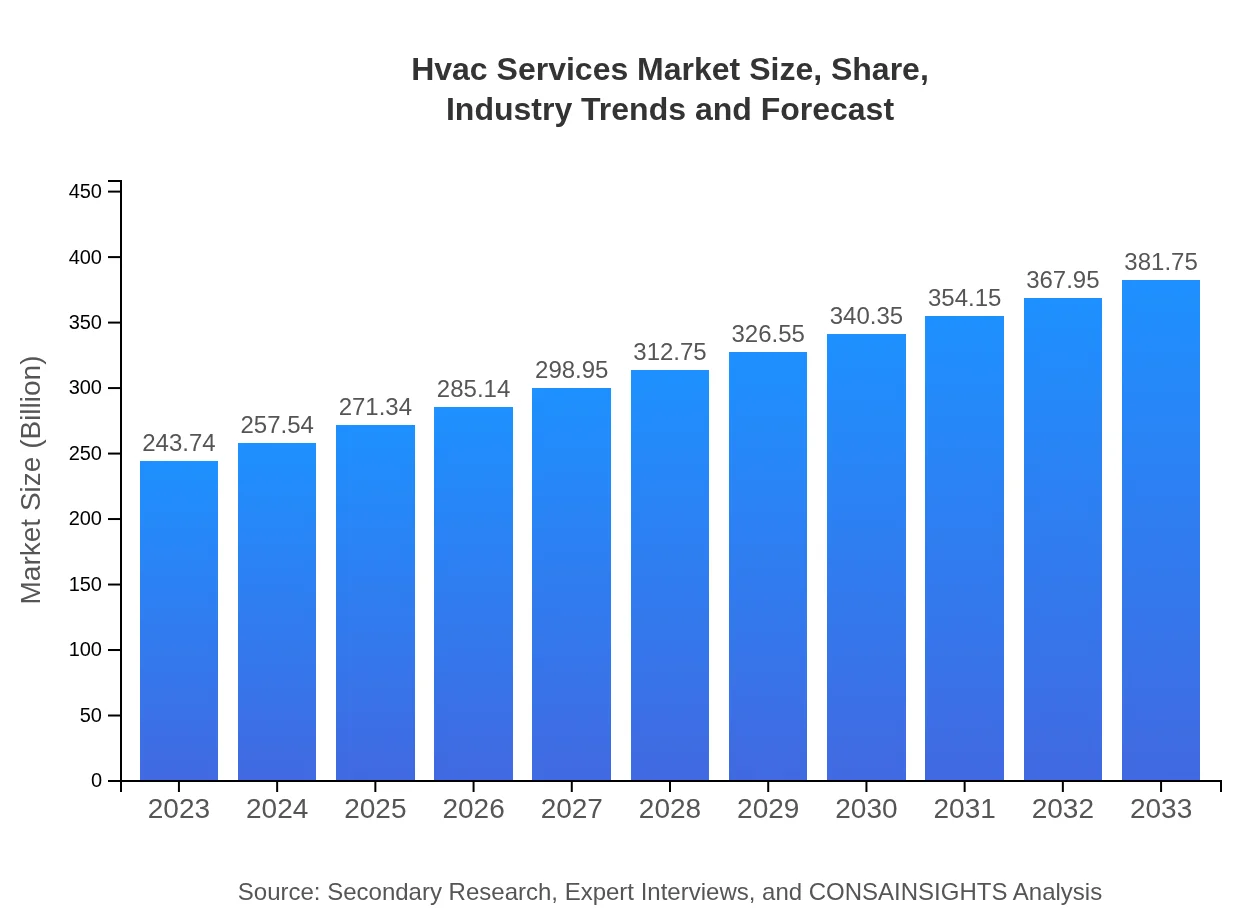

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $243.74 Billion |

| CAGR (2023-2033) | 4.5% |

| 2033 Market Size | $381.75 Billion |

| Top Companies | Carrier Global Corporation, Trane Technologies PLC, Johnson Controls International, Daikin Industries, Ltd. |

| Last Modified Date | 22 January 2026 |

Hvac Services Market Overview

Customize Hvac Services Market Report market research report

- ✔ Get in-depth analysis of Hvac Services market size, growth, and forecasts.

- ✔ Understand Hvac Services's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Hvac Services

What is the Market Size & CAGR of Hvac Services market in 2023?

Hvac Services Industry Analysis

Hvac Services Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Hvac Services Market Analysis Report by Region

Europe Hvac Services Market Report:

The European market is projected to grow from USD 73.61 billion in 2023 to USD 115.29 billion in 2033, shaped by environmental regulations focusing on reducing carbon footprints and promoting sustainable energy sources within HVAC solutions.Asia Pacific Hvac Services Market Report:

In the Asia Pacific region, the HVAC services market is expected to grow from USD 45.24 billion in 2023 to USD 70.85 billion in 2033, driven by urbanization and industrialization efforts in countries like China and India, which are witnessing explosive growth in construction activities.North America Hvac Services Market Report:

In North America, the market will expand from USD 88.70 billion in 2023 to USD 138.92 billion in 2033, supported by strong construction activity, retrofitting of existing infrastructures, and a shift toward energy-efficient HVAC systems amidst stringent regulatory standards.South America Hvac Services Market Report:

The South American market is anticipated to grow from USD 10.46 billion in 2023 to USD 16.38 billion by 2033. Factors such as a growing middle class and increasing disposable income fuel rising demand for comfortable living environments, particularly in urban areas.Middle East & Africa Hvac Services Market Report:

The Middle East and Africa HVAC services market is set to increase from USD 25.74 billion in 2023 to USD 40.31 billion in 2033. This growth is highly driven by increasing temperatures and a booming construction sector, particularly in the Gulf Cooperation Council (GCC) states.Tell us your focus area and get a customized research report.

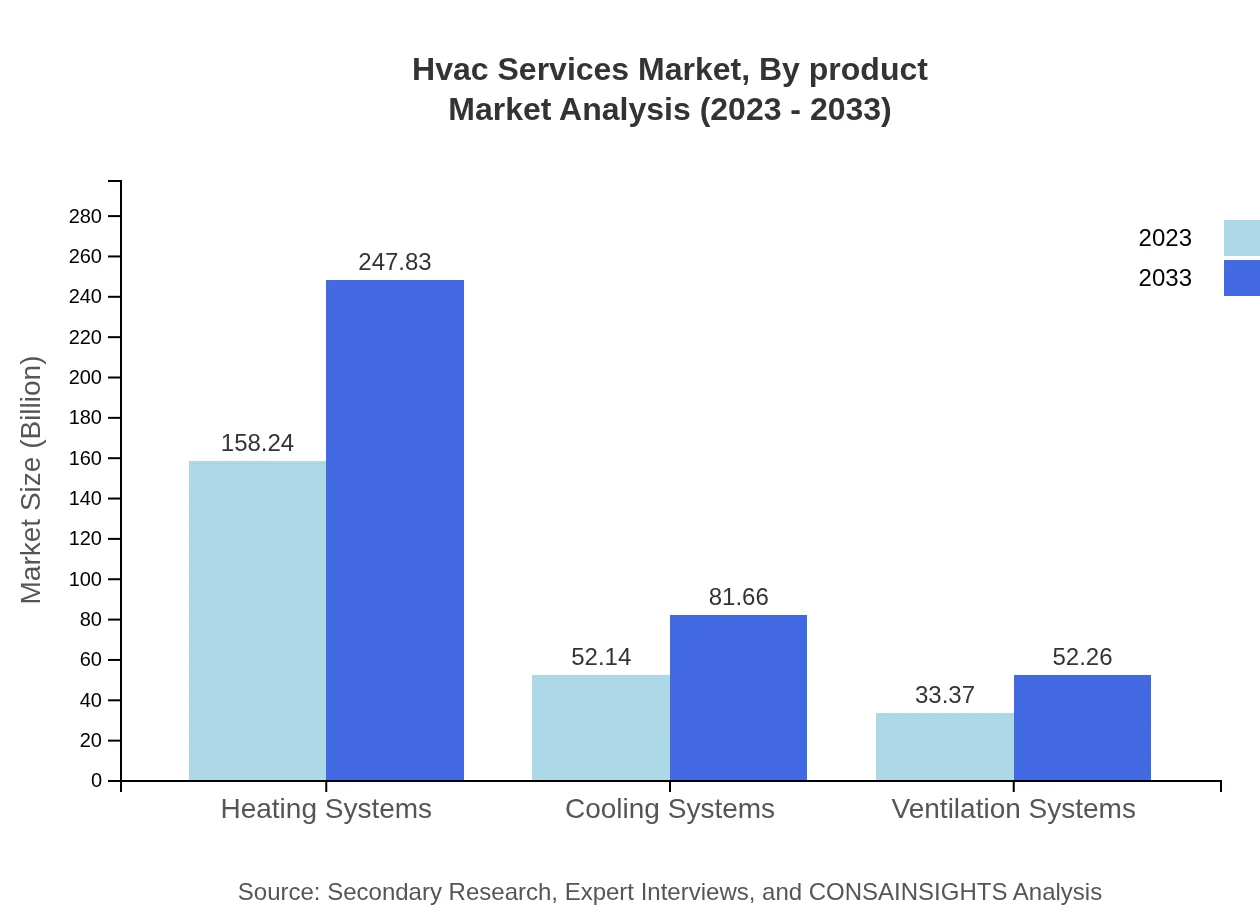

Hvac Services Market Analysis By Product

The HVAC services market, by product, includes heating systems, cooling systems, and ventilation systems. Heating systems dominate with a market size of USD 158.24 billion in 2023, projected to reach USD 247.83 billion by 2033, maintaining a share of 64.92%. Cooling systems follow, valued at USD 52.14 billion in 2023 and expected to grow to USD 81.66 billion by 2033, holding a 21.39% market share. Ventilation systems, while smaller, also exhibit growth, moving from USD 33.37 billion to USD 52.26 billion within the same period.

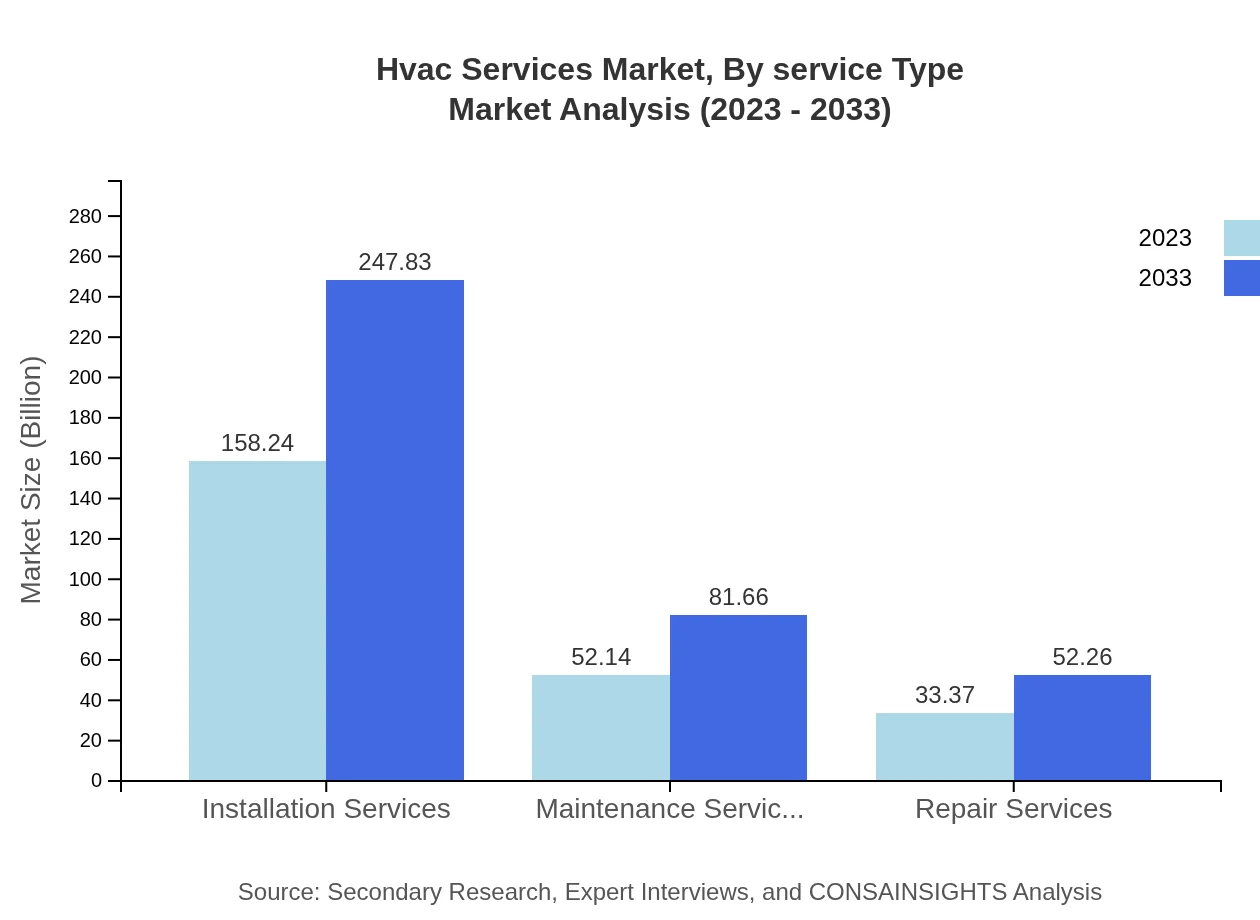

Hvac Services Market Analysis By Service Type

The service type breakdown reveals installation services at USD 158.24 billion in 2023, expected to expand to USD 247.83 billion by 2033. Maintenance services follow, starting at USD 52.14 billion and growing to USD 81.66 billion, while repair services move from USD 33.37 billion to USD 52.26 billion, emphasizing the importance of effective service contracts in ensuring system longevity and efficiency.

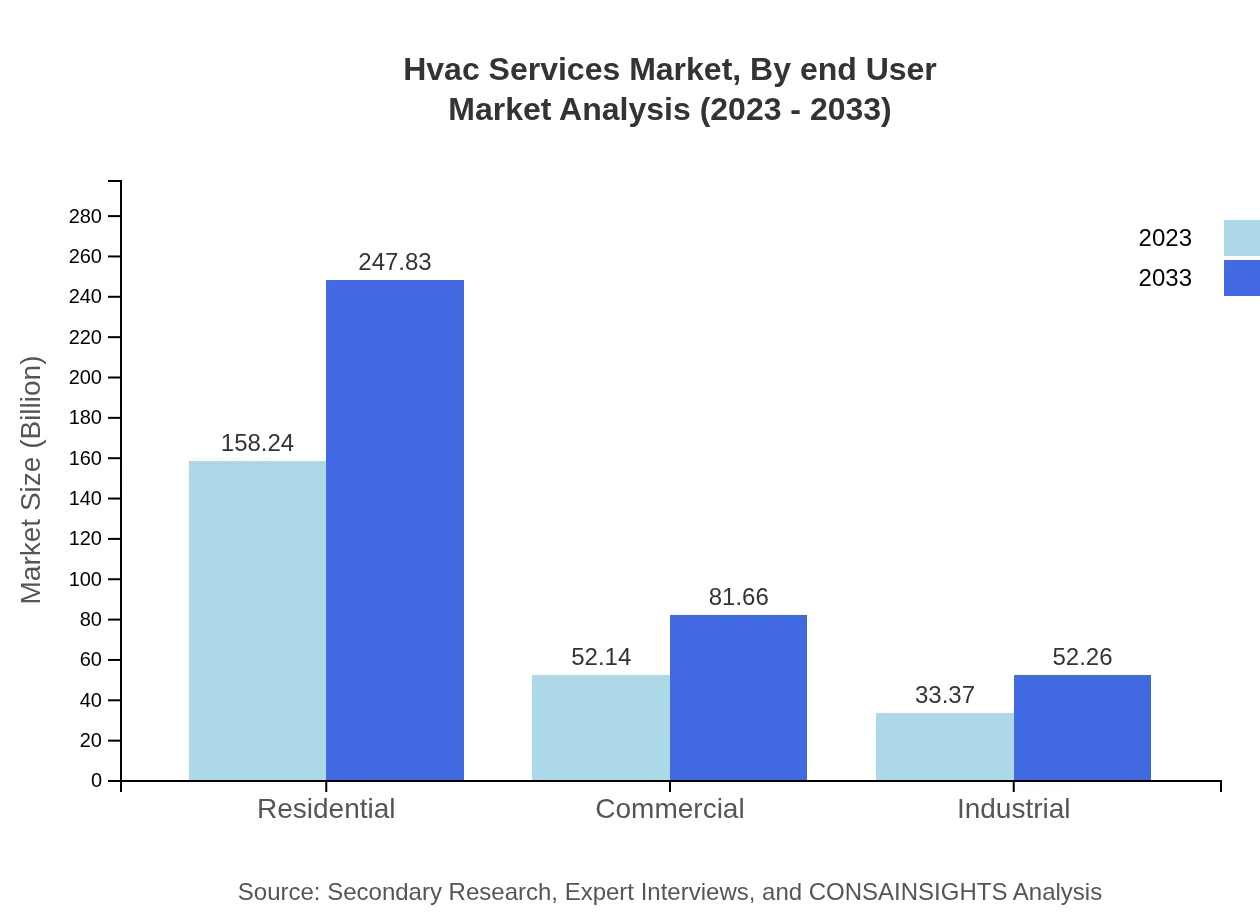

Hvac Services Market Analysis By End User

The end-user analysis shows residential applications leading at USD 158.24 billion in 2023 with a stable share of 64.92%. Commercial services also grow from USD 52.14 billion to USD 81.66 billion, while industrial segments start at USD 33.37 billion and reach USD 52.26 billion, reflecting wider acceptance and dependence on HVAC systems in various settings.

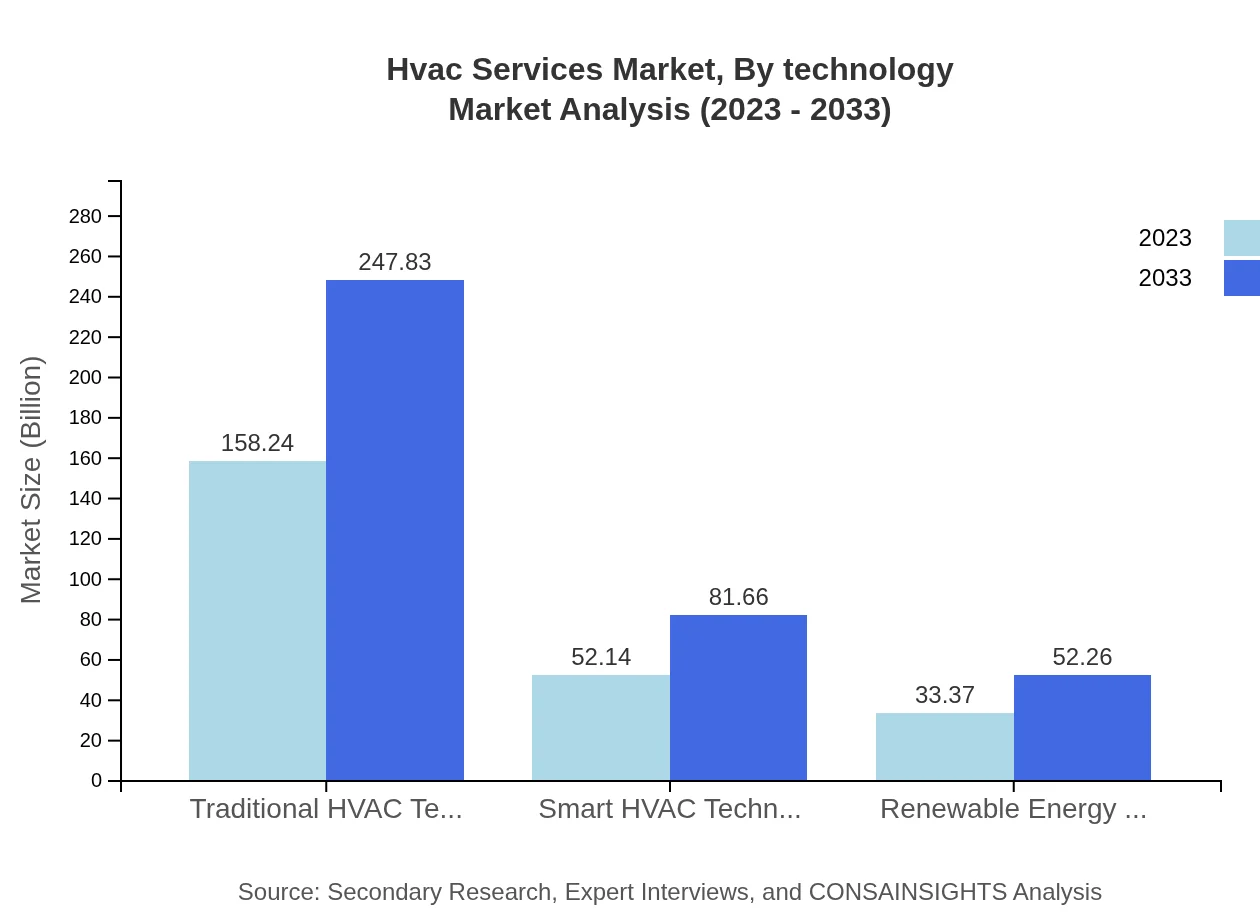

Hvac Services Market Analysis By Technology

The market by technology highlights traditional HVAC systems dominating the landscape at USD 158.24 billion in 2023, with a projected increase to USD 247.83 billion. Smart HVAC technologies are gaining traction, anticipated to grow from USD 52.14 billion to USD 81.66 billion, while renewable energy HVAC systems will also see an uptick from USD 33.37 billion to USD 52.26 billion, indicating innovation trends towards sustainability.

Hvac Services Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in HVAC Services Industry

Carrier Global Corporation:

A leading provider of heating, ventilation, and air conditioning solutions, known for its innovative technologies and commitment to sustainability.Trane Technologies PLC:

Focuses on energy-efficient HVAC systems and smart building solutions, recognized for their integrated approach to system performance.Johnson Controls International:

Offers a range of HVAC products and services, emphasizing building efficiency and advanced control systems.Daikin Industries, Ltd.:

A global leader in air conditioning manufacturing, Daikin promotes environmentally friendly refrigerants and energy-efficient systems.We're grateful to work with incredible clients.

FAQs

What is the market size of HVAC Services?

The global HVAC services market is currently valued at $243.74 billion and is expected to achieve a CAGR of 4.5% from 2023 to 2033, reflecting steady growth driven by increased demand across various sectors.

What are the key market players in the HVAC Services industry?

Key players in the HVAC services market include major companies such as Carrier Global Corporation, Trane Technologies, Lennox International, Daikin Industries, and Rheem Manufacturing, all contributing significantly to innovation and market expansion.

What are the primary factors driving the growth in the HVAC Services industry?

Factors such as rising construction activities, growing urbanization, advancements in HVAC technologies, and increasing focus on energy efficiency are propelling the HVAC services market towards significant growth in the coming years.

Which region is the fastest Growing in the HVAC Services market?

The Asia-Pacific region is anticipated to be the fastest-growing area in the HVAC services sector, expanding from $45.24 billion in 2023 to $70.85 billion by 2033, fueled by urban development and increased manufacturing activities.

Does ConsaInsights provide customized market report data for the HVAC Services industry?

Yes, ConsaInsights offers customized market report data tailored to the HVAC services industry, ensuring that clients receive relevant and actionable market insights to support their strategic decision-making.

What deliverables can I expect from this HVAC Services market research project?

Clients can expect comprehensive deliverables, including detailed market analysis, segmentation data, competitive landscape evaluations, and actionable insights tailored to the HVAC services market.

What are the market trends of HVAC Services?

Current market trends indicate a shift towards smart HVAC technologies and energy-efficient systems, alongside an increasing emphasis on sustainability and integration of renewable energy solutions within the HVAC services.