Hybrid Operating Room Market Report

Published Date: 31 January 2026 | Report Code: hybrid-operating-room

Hybrid Operating Room Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Hybrid Operating Room market, covering market trends, insights, and forecasts from 2023 to 2033, along with regional breakdowns and competitive landscape evaluations.

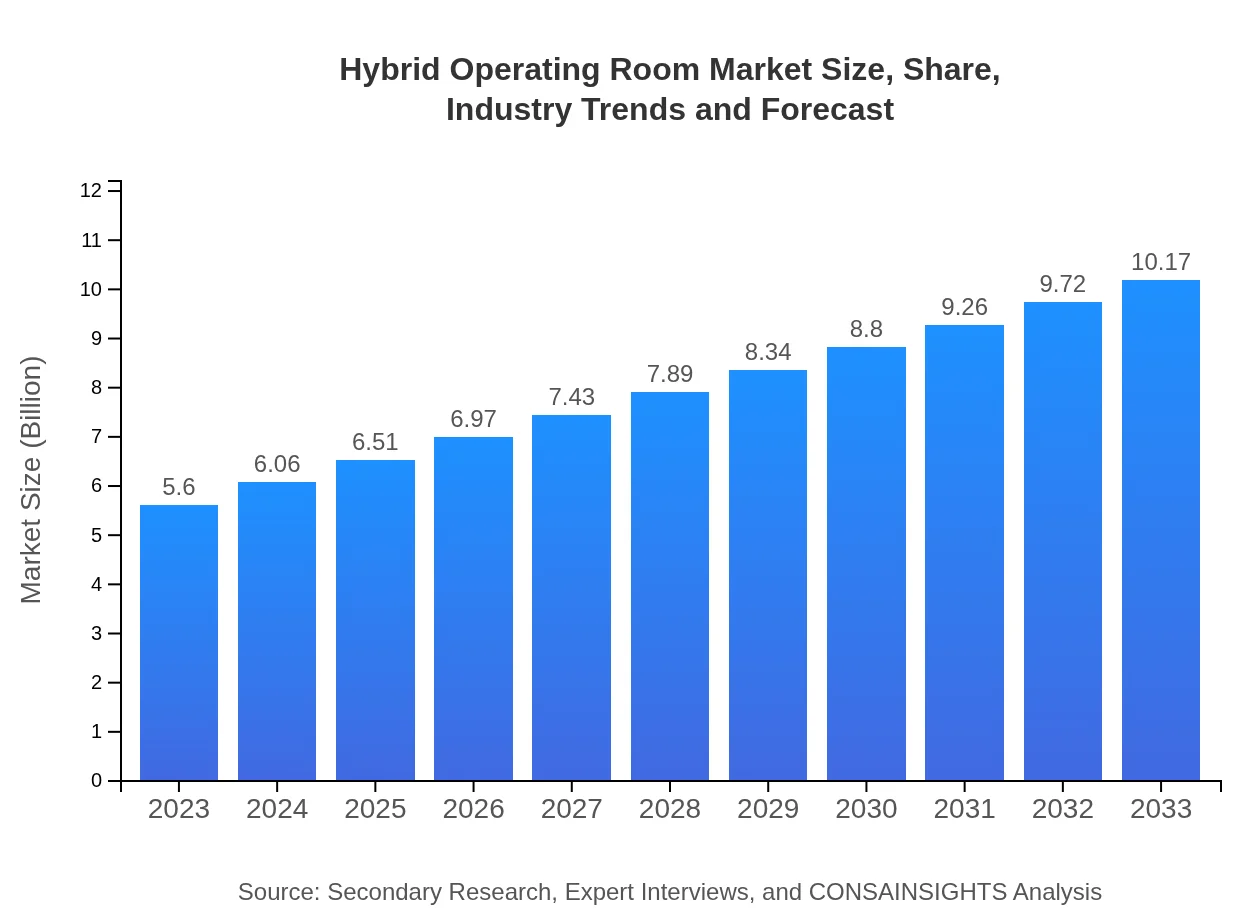

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 6% |

| 2033 Market Size | $10.17 Billion |

| Top Companies | Siemens Healthineers, Philips Healthcare, GE Healthcare, Medtronic |

| Last Modified Date | 31 January 2026 |

Hybrid Operating Room Market Overview

Customize Hybrid Operating Room Market Report market research report

- ✔ Get in-depth analysis of Hybrid Operating Room market size, growth, and forecasts.

- ✔ Understand Hybrid Operating Room's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Hybrid Operating Room

What is the Market Size & CAGR of Hybrid Operating Room market in 2023?

Hybrid Operating Room Industry Analysis

Hybrid Operating Room Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Hybrid Operating Room Market Analysis Report by Region

Europe Hybrid Operating Room Market Report:

The European Hybrid Operating Room market is valued at $1.38 billion in 2023, expecting to grow to $2.51 billion by 2033. The region benefits from robust regulatory standards, technological advancements, and increasing investments in healthcare infrastructure. Countries like Germany and France are at the forefront of adopting hybrid systems, driven by the rising prevalence of surgical interventions and the focus on patient-centric care.Asia Pacific Hybrid Operating Room Market Report:

The Asia Pacific Hybrid Operating Room market is anticipated to grow from $1.15 billion in 2023 to $2.09 billion in 2033. The growth is driven by increasing health consciousness, rising disposable incomes, and expanding healthcare infrastructure across countries such as China and India. Additionally, the prevalence of chronic diseases and the increasing adoption of advanced surgical equipment improve market prospects in the region.North America Hybrid Operating Room Market Report:

North America constitutes a prominent segment of the Hybrid Operating Room market, with a size of $1.79 billion in 2023 projected to reach $3.26 billion by 2033. The strong healthcare sector, coupled with advanced technologies and high surgical volumes, fuels the market's expansion. The rising prevalence of surgical procedures, especially in cardiovascular and orthopedic fields, significantly boosts the demand for hybrid operating rooms.South America Hybrid Operating Room Market Report:

In South America, the Hybrid Operating Room market was valued at $0.51 billion in 2023 and is projected to reach $0.92 billion by 2033. Factors such as improvements in healthcare access and an emphasis on modernizing hospital infrastructure contribute to market growth. Furthermore, the increasing trend of adopting minimally invasive surgeries enhances the demand for hybrid operating rooms in the region.Middle East & Africa Hybrid Operating Room Market Report:

The Middle East and Africa market size is projected to grow from $0.77 billion in 2023 to $1.40 billion by 2033. Growth drivers include increasing healthcare expenditures, rising awareness about advanced surgical technologies, and government initiatives aimed at upgrading healthcare facilities. The demand for hybrid operating rooms is also driven by the need for improved surgical outcomes in complex cases prevalent in the region.Tell us your focus area and get a customized research report.

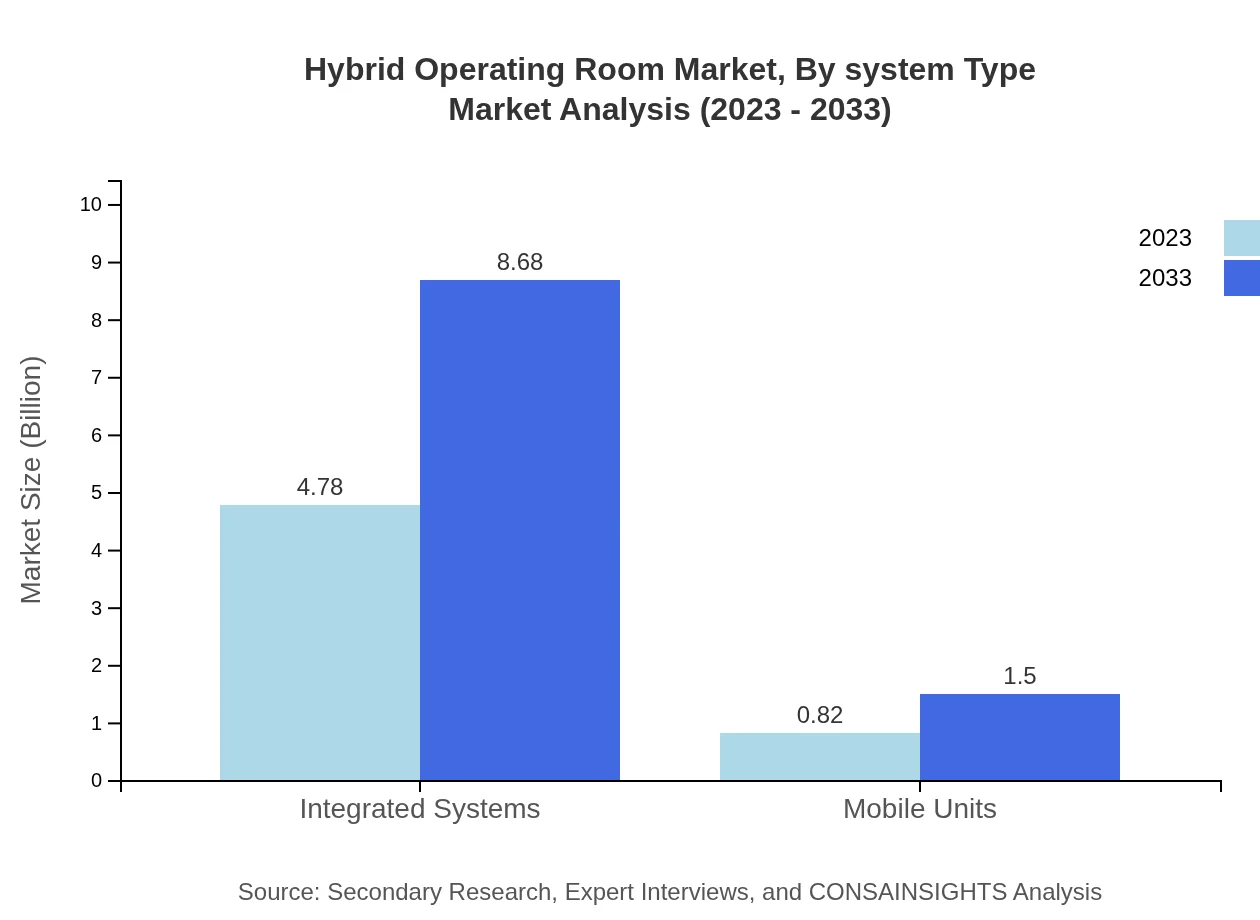

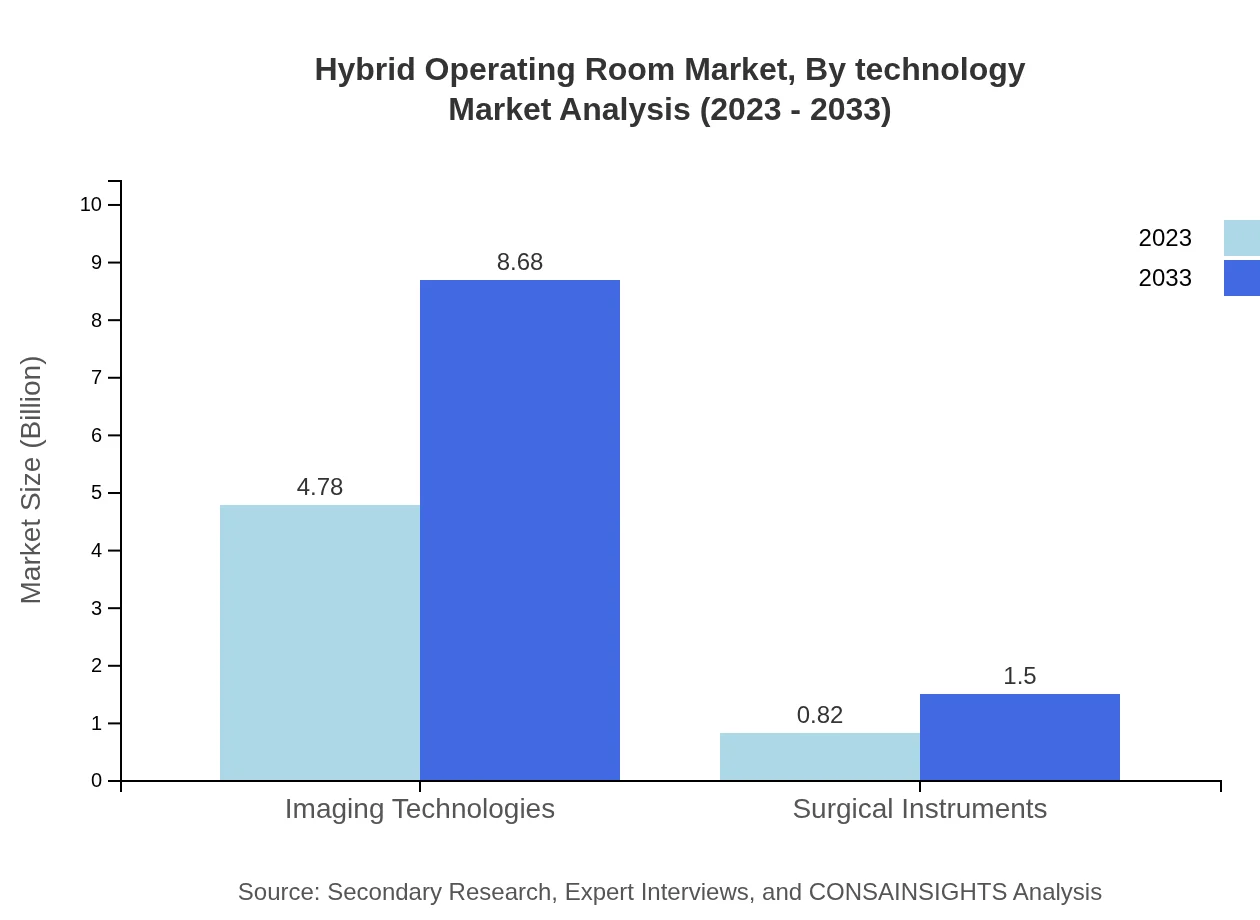

Hybrid Operating Room Market Analysis By System Type

The Hybrid Operating Room market is predominantly segmented into integrated systems and mobile units. Integrated systems are projected to dominate the market with a size of $4.78 billion in 2023, increasing to $8.68 billion by 2033, capturing an extensive share due to their comprehensive capabilities in multi-specialty surgery environments. Mobile units, while smaller, are critical in enhancing service delivery in less accessible areas, reaching $0.82 billion in 2023 with expected growth to $1.50 billion by 2033.

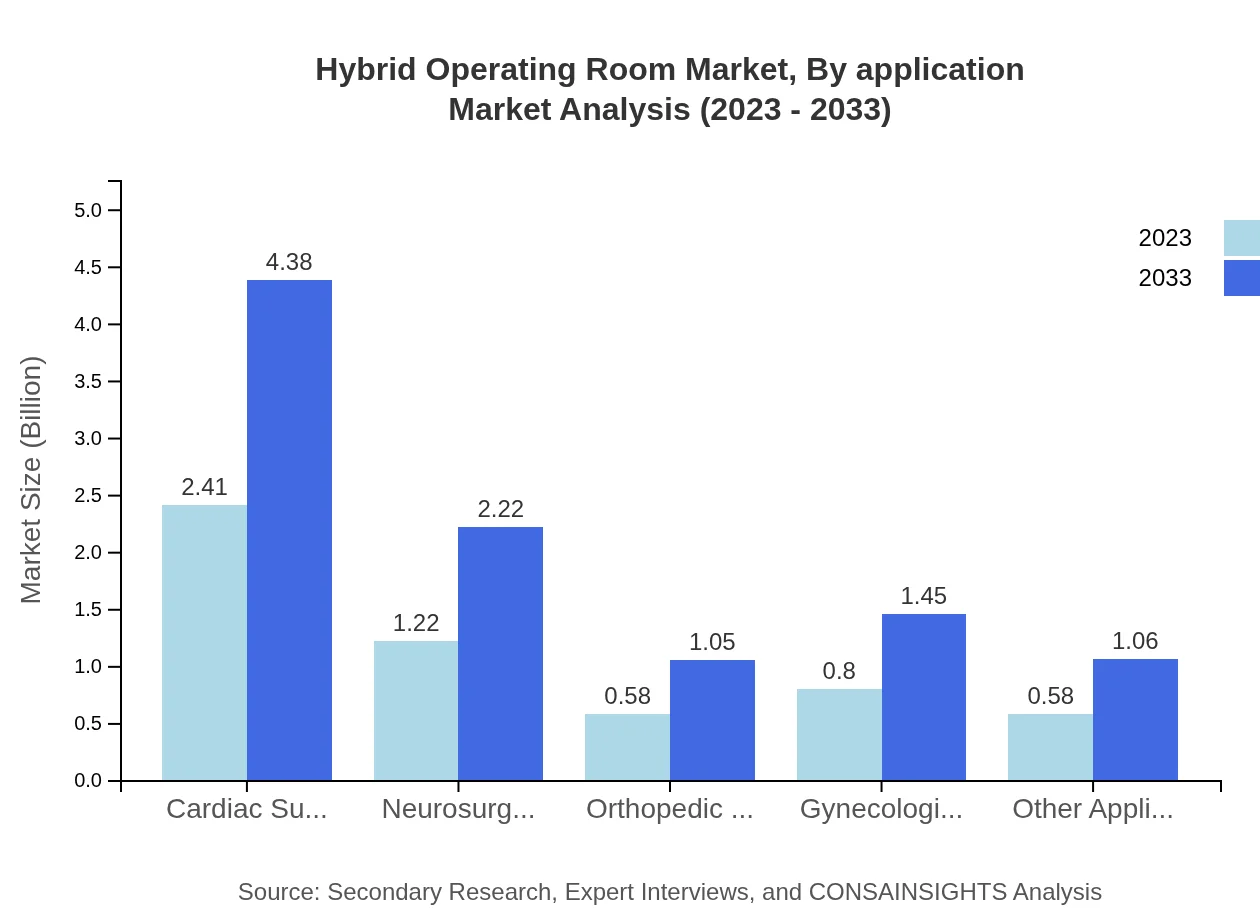

Hybrid Operating Room Market Analysis By Application

The market is segmented based on applications, including cardiac, neurosurgery, orthopedic, gynecological, and other surgical applications. Cardiac surgery remains the largest segment, valued at $2.41 billion in 2023 and expected to reach $4.38 billion by 2033, followed by neurosurgery, valued at $1.22 billion in 2023. The increasing complexity of surgeries boosts demand across these application segments.

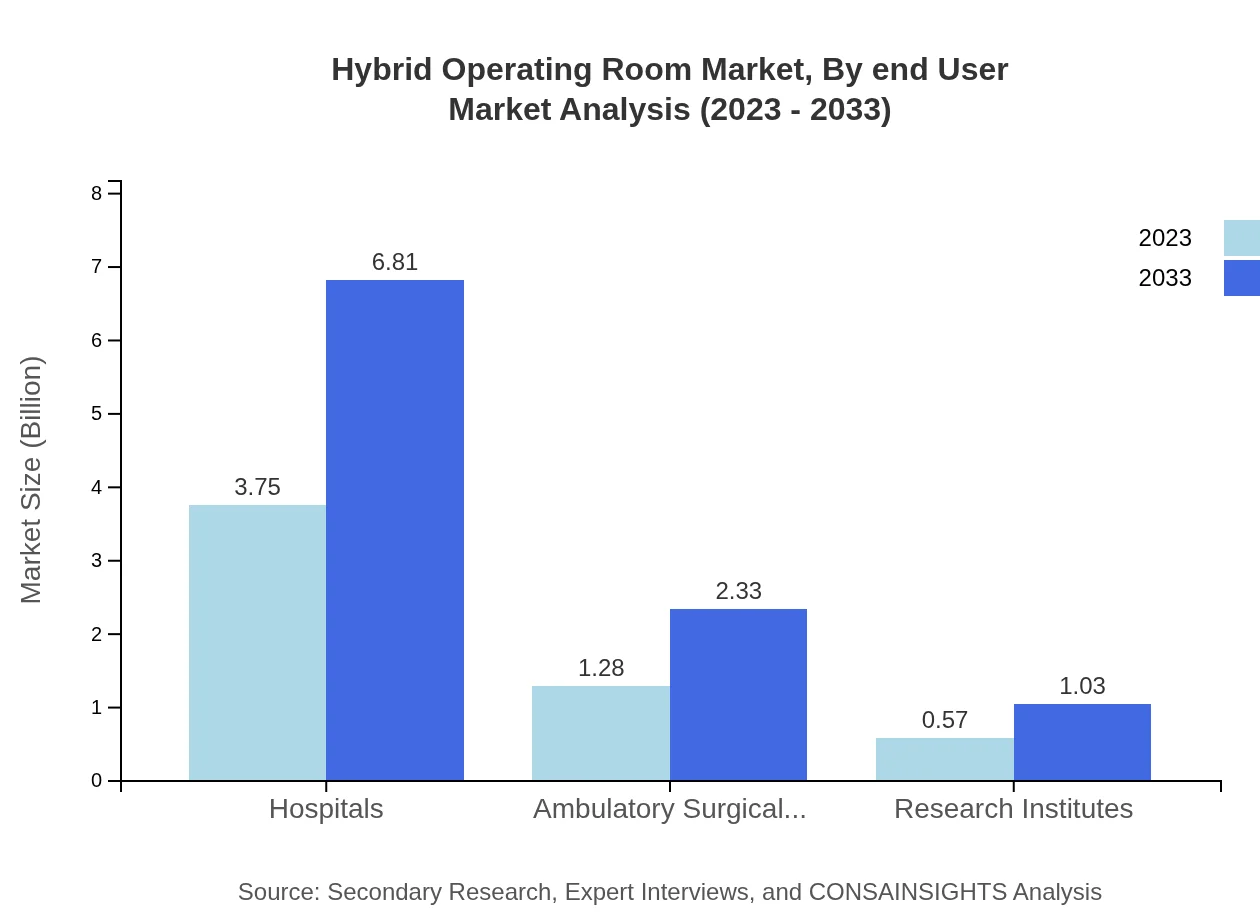

Hybrid Operating Room Market Analysis By End User

End-user segmentation involves hospitals and ambulatory surgical centers. Hospitals, with a market share of approximately 66.95% in 2023, dominate the hybrid operating room market due to higher surgical volumes and advanced infrastructure capabilities. Ambulatory surgical centers, holding 22.93% market share, are witnessing increasing adoption as outpatient surgeries rise, reaching $2.33 billion by 2033.

Hybrid Operating Room Market Analysis By Technology

Technological advancements significantly shape the hybrid operating room market. The integration of imaging technologies and intraoperative monitoring systems are pivotal. Imaging technologies, representing 85.28% market share, enhance surgical precision and efficiency. The segment is expected to grow from $4.78 billion in 2023 to $8.68 billion by 2033, driven by ongoing innovations.

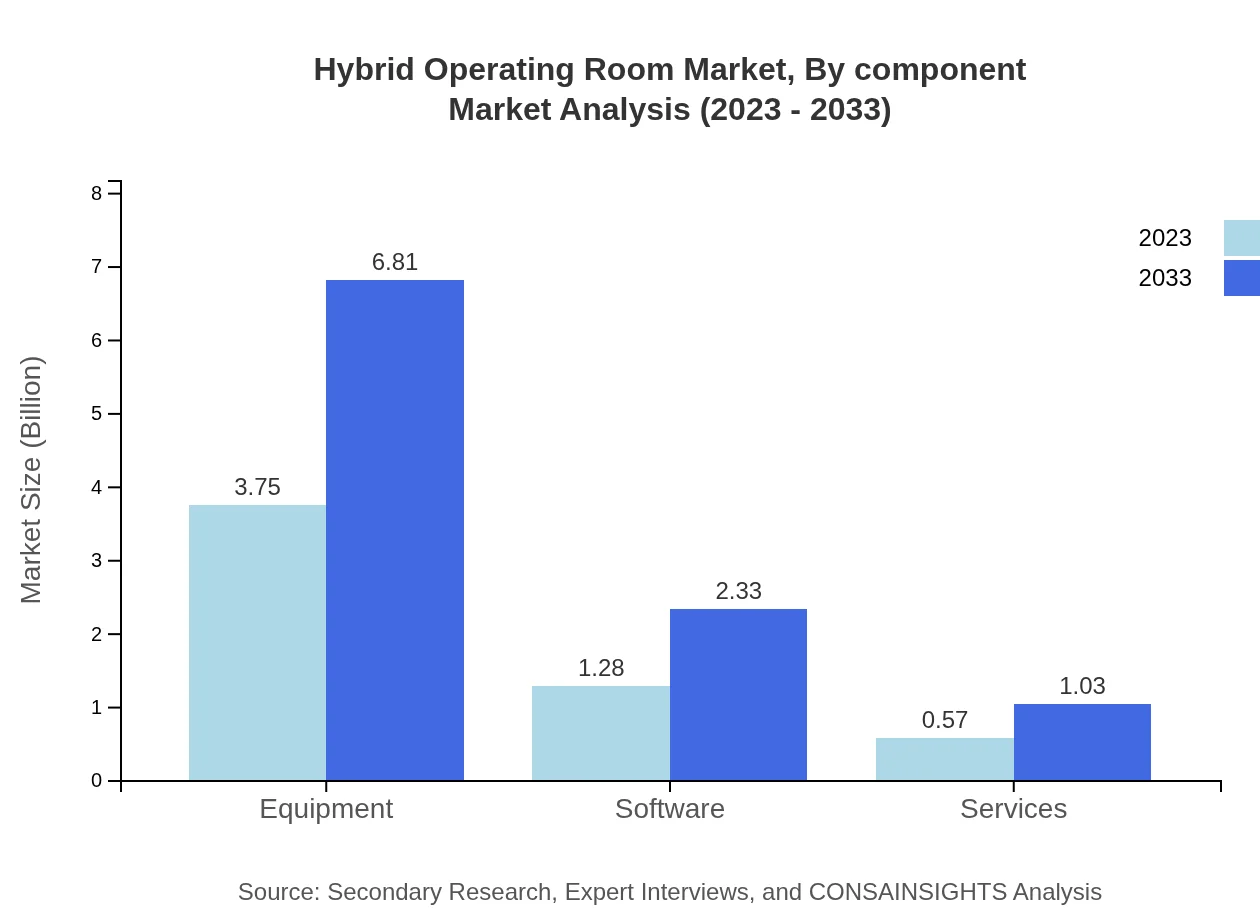

Hybrid Operating Room Market Analysis By Component

The components of the hybrid operating room include equipment, software, and services. Equipment accounts for approximately 66.95% of the market, valued at $3.75 billion in 2023, while software contributes 22.93%, growing towards $2.33 billion by 2033, reflecting the increased focus on data management and operational efficiencies.

Hybrid Operating Room Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Hybrid Operating Room Industry

Siemens Healthineers:

A leader in imaging technology and integral systems for hybrid operating rooms, recognized for innovative surgical imaging solutions that enhance procedural efficiency.Philips Healthcare:

Renowned for its advanced healthcare technologies including surgical and diagnostic imaging solutions, supporting enhanced outcomes in hybrid surgical environments.GE Healthcare:

A pivotal player in medical imaging and imaging-guided therapies that facilitate improved surgery and patient care in hybrid operating rooms.Medtronic :

Offers a wide variety of advanced surgical instruments and imaging technologies crucial to maximizing the performance of hybrid operating rooms.We're grateful to work with incredible clients.

FAQs

What is the market size of hybrid Operating Room?

The global market size for hybrid operating rooms is projected to reach approximately $5.6 billion by 2033, growing at a CAGR of 6% from 2023. This signifies significant expansion in the healthcare sector, driven by advanced surgical technologies.

What are the key market players or companies in this hybrid Operating Room industry?

Key players in the hybrid operating room market include major medical device manufacturers and technology companies that specialize in surgical equipment, imaging technologies, and integration solutions, driving innovation and market competition.

What are the primary factors driving the growth in the hybrid operating room industry?

Key growth factors in the hybrid operating room industry include the increased demand for advanced surgical procedures, technological advancements, and the growing prevalence of chronic diseases, necessitating integrated surgical environments.

Which region is the fastest Growing in the hybrid operating room?

North America is currently the fastest-growing region in the hybrid operating room market, projected to rise from $1.79 billion in 2023 to $3.26 billion by 2033, driven by technological advancements and healthcare expenditure.

Does ConsaInsights provide customized market report data for the hybrid operating room industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs, providing in-depth insights and analysis for the hybrid operating room industry to support strategic decision-making.

What deliverables can I expect from this hybrid operating room market research project?

Expect detailed market analysis reports including market size, growth forecasts, key player profiles, regional analysis, and insights into emerging trends and technologies within the hybrid operating room sector.

What are the market trends of hybrid operating room?

Trends in the hybrid operating room market include the integration of imaging technologies, advancements in surgical instruments, and increasing focus on minimally invasive procedures, all contributing to enhanced surgical outcomes.