Hydraulic Fracturing And Services Market Report

Published Date: 31 January 2026 | Report Code: hydraulic-fracturing-and-services

Hydraulic Fracturing And Services Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Hydraulic Fracturing And Services market from 2023 to 2033. It includes insights on market size, growth trends, regional analysis, technological advancements, and competitive landscape elements.

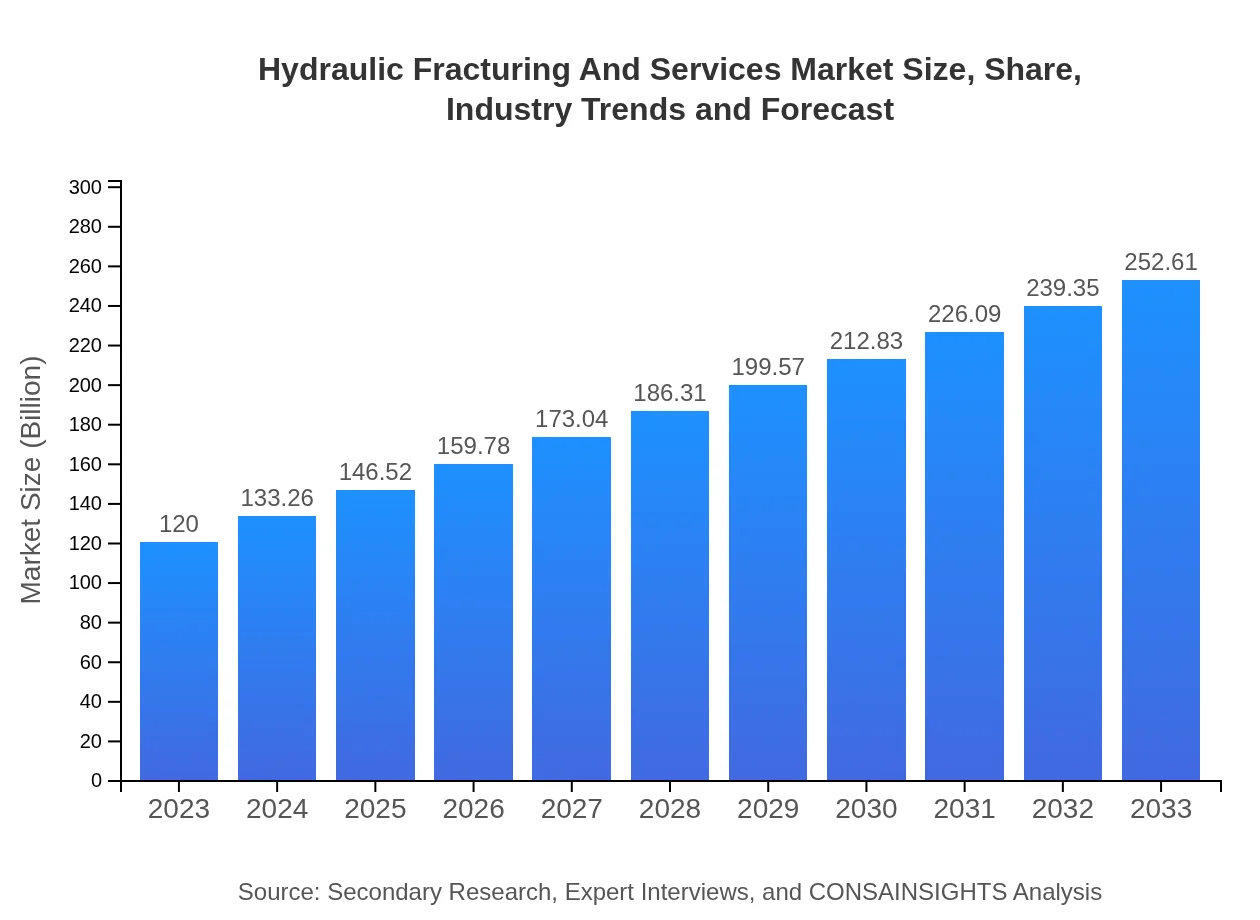

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $120.00 Billion |

| CAGR (2023-2033) | 7.5% |

| 2033 Market Size | $252.61 Billion |

| Top Companies | Halliburton, Schlumberger, Baker Hughes |

| Last Modified Date | 31 January 2026 |

Hydraulic Fracturing And Services Market Overview

Customize Hydraulic Fracturing And Services Market Report market research report

- ✔ Get in-depth analysis of Hydraulic Fracturing And Services market size, growth, and forecasts.

- ✔ Understand Hydraulic Fracturing And Services's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Hydraulic Fracturing And Services

What is the Market Size & CAGR of Hydraulic Fracturing And Services market in 2033?

Hydraulic Fracturing And Services Industry Analysis

Hydraulic Fracturing And Services Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Hydraulic Fracturing And Services Market Analysis Report by Region

Europe Hydraulic Fracturing And Services Market Report:

Europe's hydraulic fracturing market is set to rise from $38.00 billion in 2023 to $80.00 billion by 2033. The EU's initiatives to reduce energy dependence and enhance domestic energy production are propelling investments in hydraulic fracturing projects.Asia Pacific Hydraulic Fracturing And Services Market Report:

In the Asia Pacific region, the hydraulic fracturing market is anticipated to grow from $23.51 billion in 2023 to $49.49 billion by 2033. This growth is driven by increased energy demands, particularly in countries like China and India, where natural gas and oil reserves are being explored more aggressively.North America Hydraulic Fracturing And Services Market Report:

North America remains the largest market for hydraulic fracturing services, expected to reach $81.75 billion by 2033, up from $38.83 billion in 2023. The growing shale oil and gas production in the U.S. is a key driver, supported by technological advancements and increasing efficiency in operations.South America Hydraulic Fracturing And Services Market Report:

The South American market is projected to expand from $11.62 billion in 2023 to $24.45 billion by 2033. Countries like Brazil and Argentina are enhancing their hydraulic fracturing operations to boost their energy sectors, capitalizing on vast shale reserves.Middle East & Africa Hydraulic Fracturing And Services Market Report:

The Middle East and Africa market is projected to increase from $8.04 billion in 2023 to $16.92 billion by 2033. The region is exploring hydraulic fracturing to maximize oil extraction, despite facing regulatory challenges.Tell us your focus area and get a customized research report.

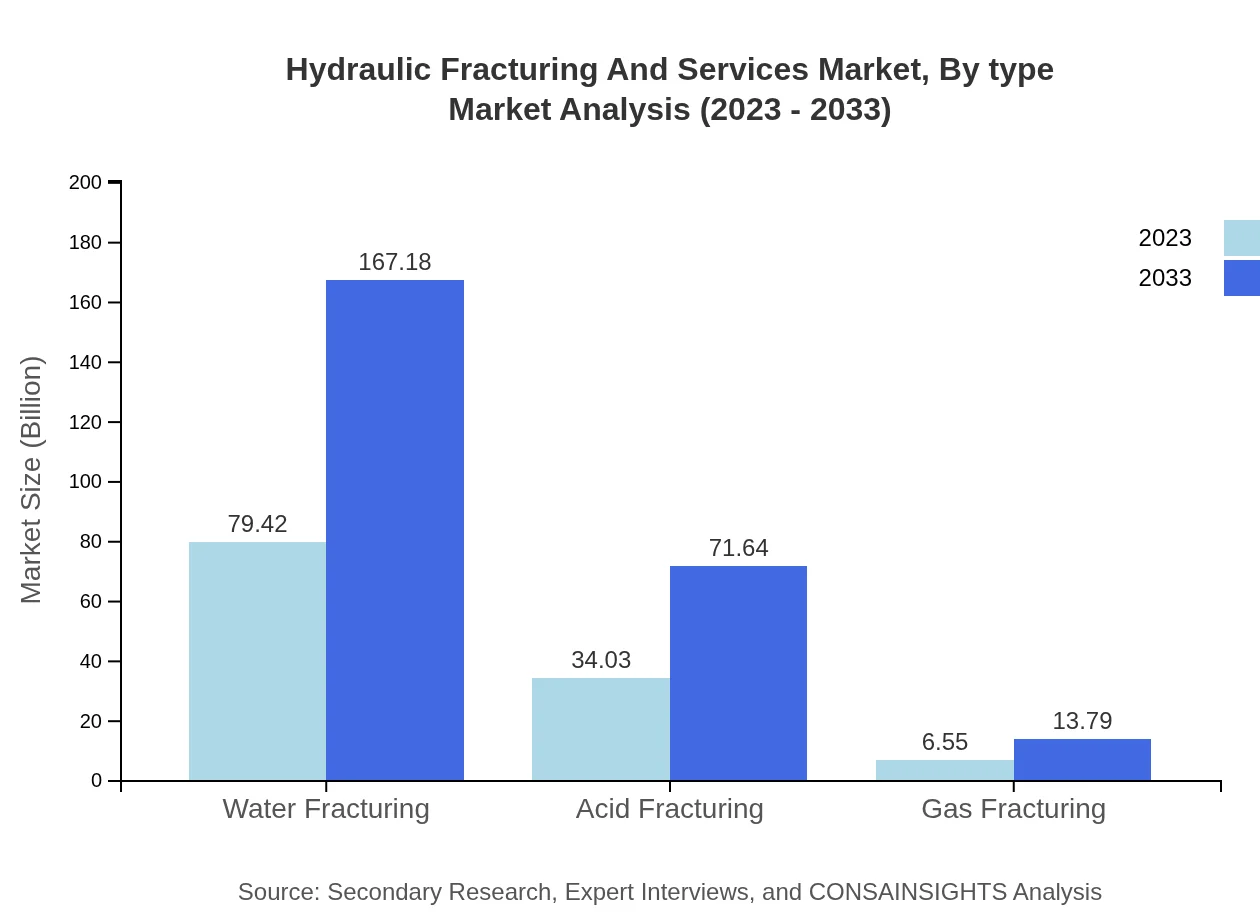

Hydraulic Fracturing And Services Market Analysis By Type

The hydraulic fracturing market is dominated by two primary methods: Water Fracturing and Acid Fracturing. Water Fracturing holds a significant market share, projected to grow from $79.42 billion in 2023 to $167.18 billion in 2033. Acid Fracturing is also expected to see growth, increasing from $34.03 billion in 2023 to $71.64 billion in 2033.

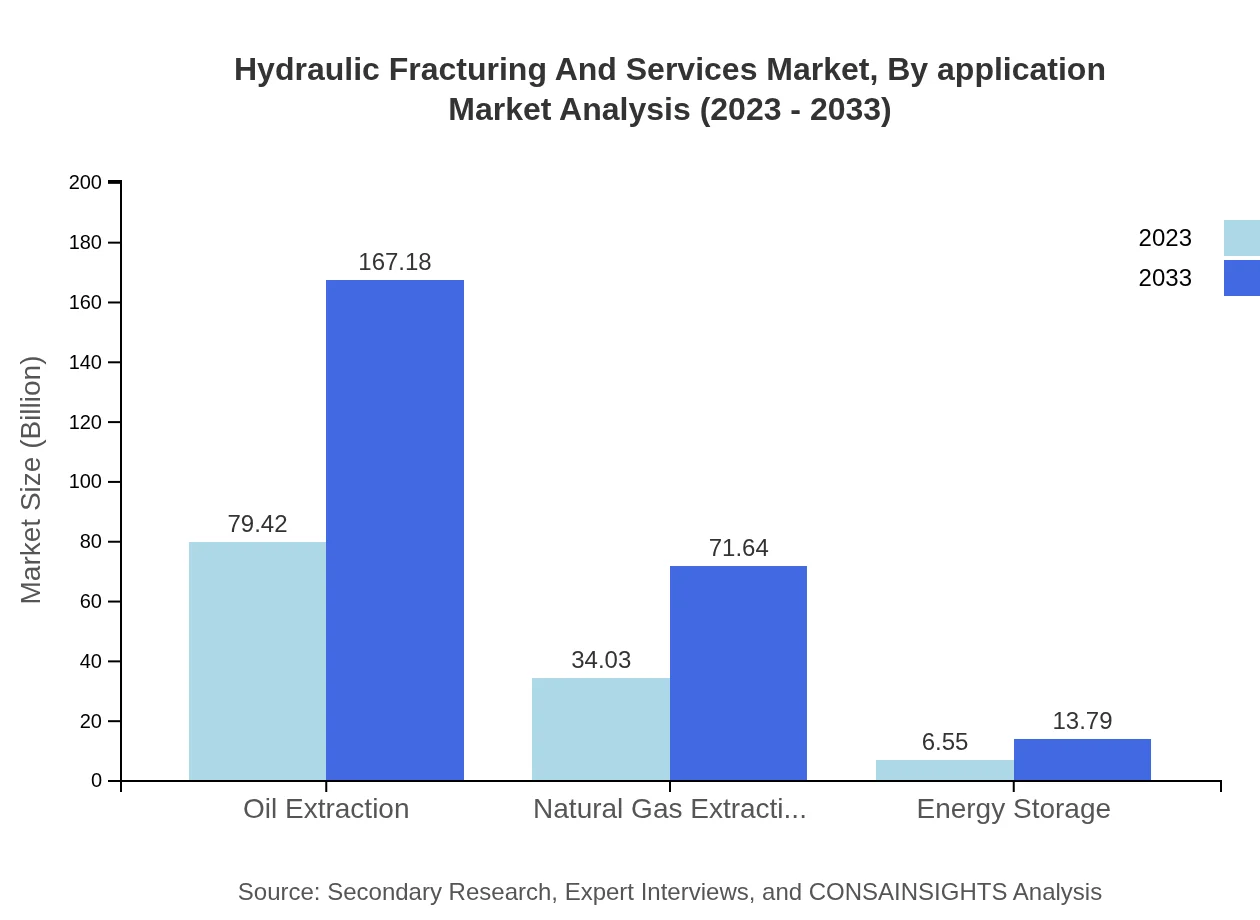

Hydraulic Fracturing And Services Market Analysis By Application

Applications for hydraulic fracturing include Oil Extraction and Natural Gas Extraction. Oil Extraction is a key driver in the sector, expected to grow significantly from $79.42 billion in 2023 to $167.18 billion in 2033, while Natural Gas Extraction is projected to rise from $34.03 billion to $71.64 billion during the same period.

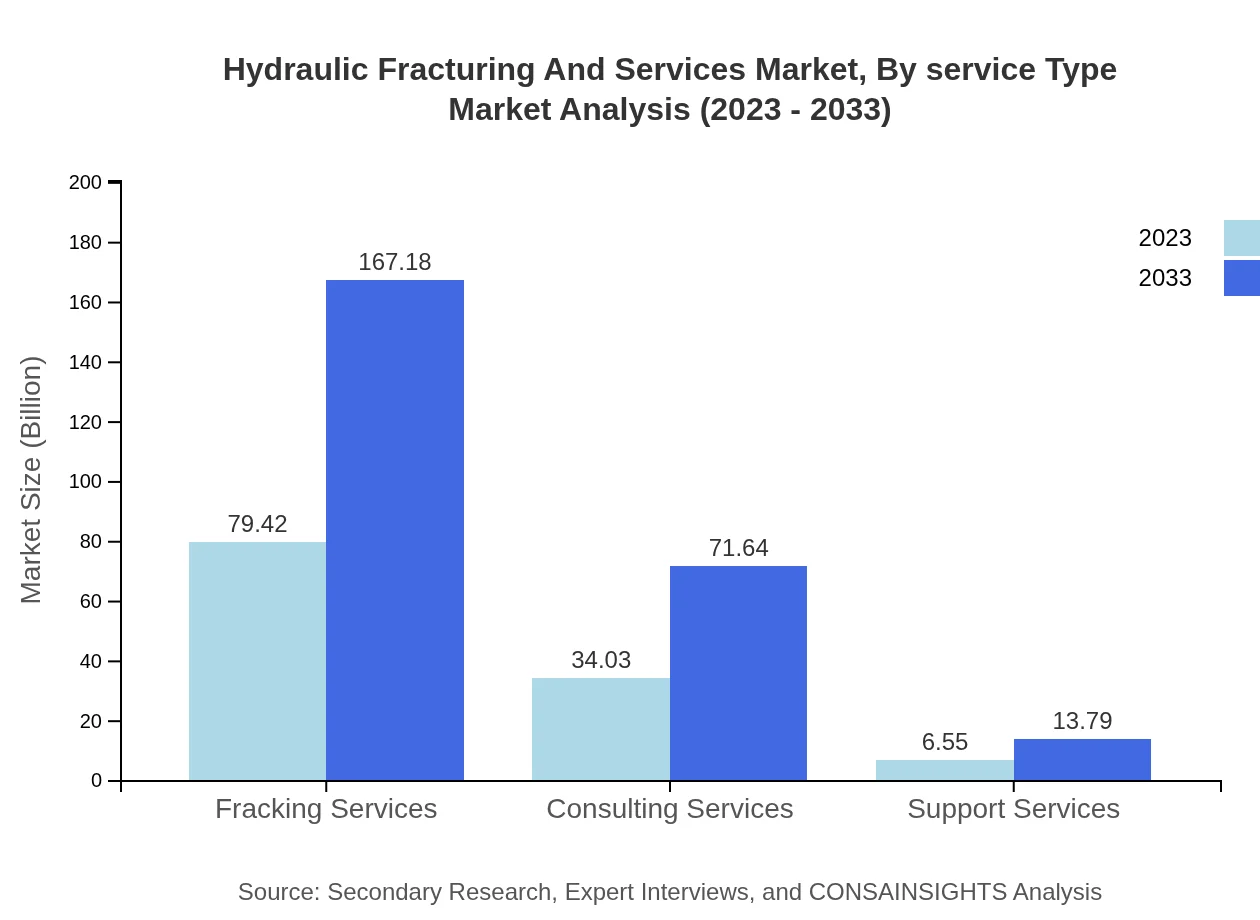

Hydraulic Fracturing And Services Market Analysis By Service Type

The services segment of the hydraulic fracturing market includes Fracking Services, Consulting Services, and Support Services. Fracking Services lead this category, with a market growth expectation from $79.42 billion in 2023 to $167.18 billion by 2033, alongside Consulting Services growing from $34.03 billion to $71.64 billion.

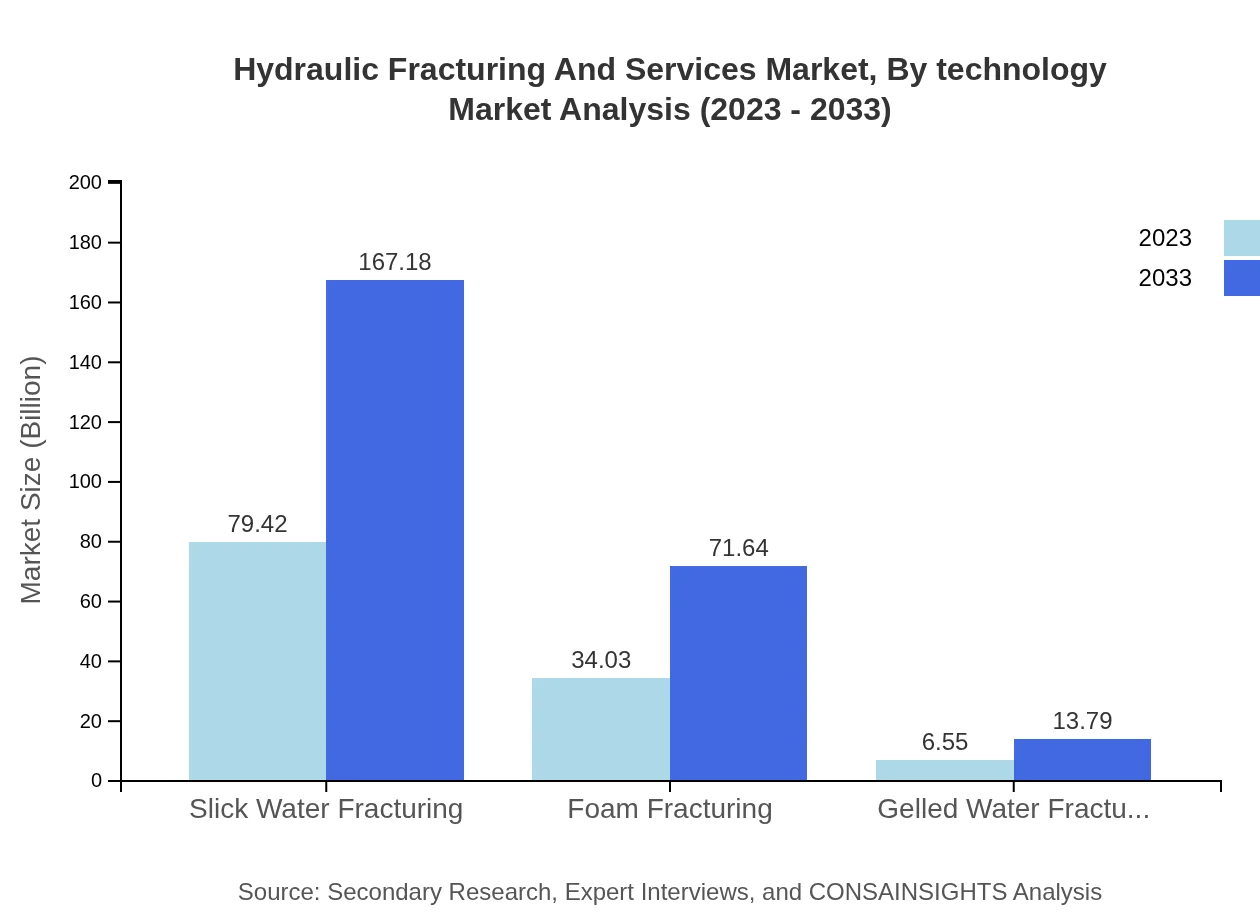

Hydraulic Fracturing And Services Market Analysis By Technology

Technological innovations such as advanced monitoring systems and real-time data analytics play a crucial role in enhancing the efficiency of hydraulic fracturing operations. Continuous improvements in technology are expected to provide competitive advantages and facilitate sustainable practices in the industry.

Hydraulic Fracturing And Services Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Hydraulic Fracturing And Services Industry

Halliburton:

A leading provider of hydraulic fracturing, Halliburton employs advanced technology and extensive expertise to optimize oil and gas production.Schlumberger:

As a key player in the industry, Schlumberger offers hydraulic fracturing services that enhance resource recovery while ensuring environmental safety.Baker Hughes:

Baker Hughes provides innovative hydraulic fracturing solutions that focus on efficiency and reduced environmental impact.We're grateful to work with incredible clients.

FAQs

What is the market size of hydraulic fracturing and services?

The hydraulic fracturing and services market was valued at approximately $120 billion in 2023. It is projected to grow with a CAGR of 7.5%, reaching significant growth over the next decade as demand for energy resources continues to rise.

What are the key market players or companies in this hydraulic fracturing and services industry?

Key players in the hydraulic fracturing market include Halliburton, Schlumberger, Baker Hughes, and National Oilwell Varco. These companies lead in technology, service offerings, and innovation, significantly impacting market dynamics and trends.

What are the primary factors driving the growth in the hydraulic fracturing industry?

Key growth drivers include increased energy demand, advancements in drilling technologies, and the need for efficient extraction methods. Additionally, the shift towards shale gas and oil production is propelling investment in hydraulic fracturing services.

Which region is the fastest Growing in the hydraulic fracturing market?

The Asia Pacific region is expected to be the fastest-growing market for hydraulic fracturing, increasing from $23.51 billion in 2023 to $49.49 billion by 2033, driven by urbanization and industrial energy needs.

Does ConsaInsights provide customized market report data for the hydraulic fracturing industry?

Yes, ConsaInsights specializes in providing customized market reports tailored to client needs in the hydraulic fracturing industry, offering in-depth insights and analysis to support strategic decision-making.

What deliverables can I expect from this hydraulic fracturing market research project?

Deliverables from the hydraulic fracturing market research project typically include detailed market reports, segment analysis, trends, competitive landscape assessments, and strategic recommendations based on comprehensive data analysis.

What are the market trends of hydraulic fracturing?

Current market trends in hydraulic fracturing include the increasing adoption of eco-friendly techniques, such as waterless fracturing, advancements in automation and data analytics, and a rising focus on regulatory compliance and sustainability practices.