Hydraulics Market Report

Published Date: 22 January 2026 | Report Code: hydraulics

Hydraulics Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Hydraulics market, focusing on market trends, size, segmentation, and regional insights from 2023 to 2033. It aims to deliver key data and forecasts to inform stakeholders about the industry's future directions.

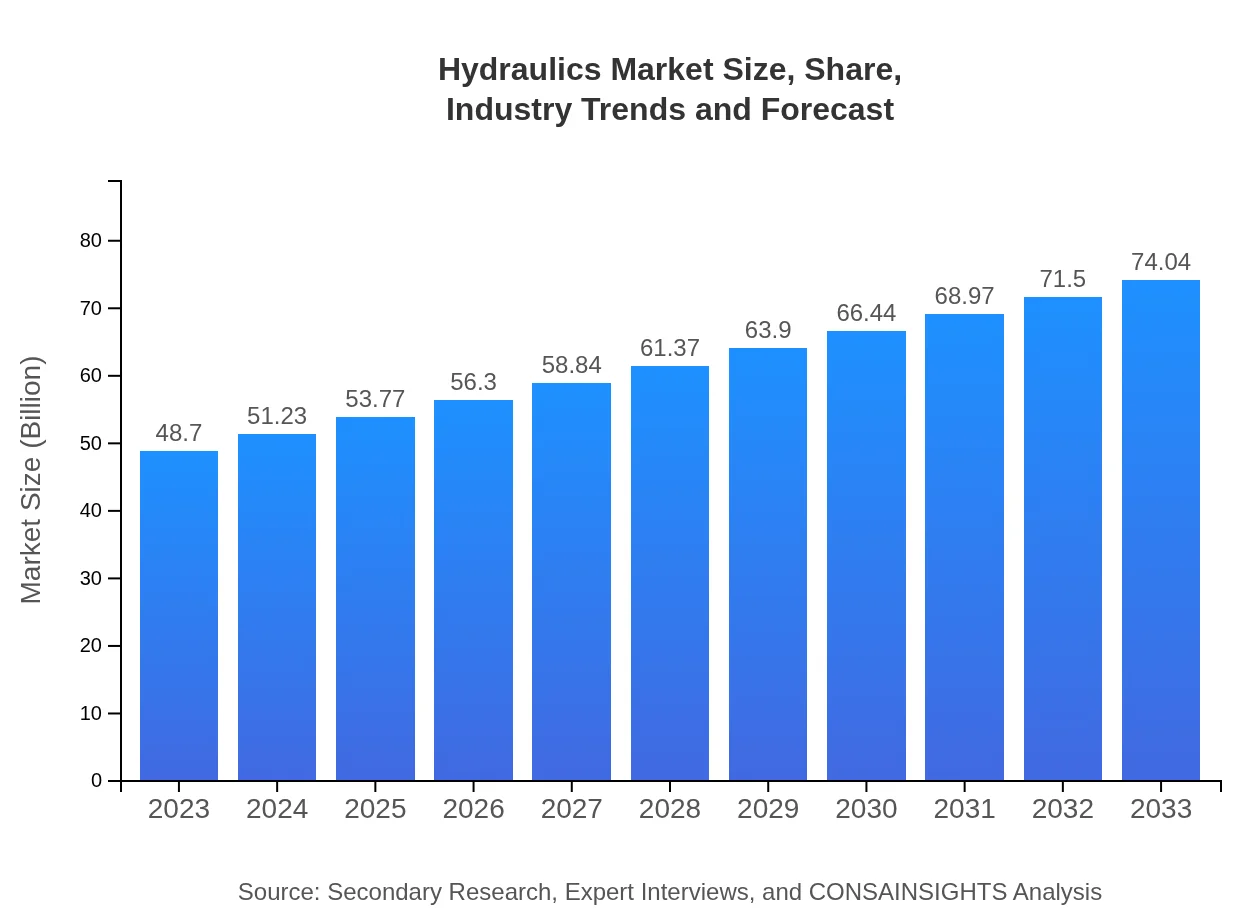

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $48.70 Billion |

| CAGR (2023-2033) | 4.2% |

| 2033 Market Size | $74.04 Billion |

| Top Companies | Bosch Rexroth, Parker Hannifin Corporation, Eaton Corporation, Hydac International |

| Last Modified Date | 22 January 2026 |

Hydraulics Market Overview

Customize Hydraulics Market Report market research report

- ✔ Get in-depth analysis of Hydraulics market size, growth, and forecasts.

- ✔ Understand Hydraulics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Hydraulics

What is the Market Size & CAGR of Hydraulics market in 2023?

Hydraulics Industry Analysis

Hydraulics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Hydraulics Market Analysis Report by Region

Europe Hydraulics Market Report:

Europe’s hydraulics market is anticipated to grow from $14.76 billion in 2023 to $22.43 billion by 2033. The region's focus on sustainability and energy-efficient technologies is driving demand for innovative hydraulic solutions.Asia Pacific Hydraulics Market Report:

The Asia-Pacific region is experiencing rapid growth in the hydraulics market, projected to expand from $8.42 billion in 2023 to $12.79 billion by 2033. Key drivers include rising construction activities and increasing demand from the agricultural sector.North America Hydraulics Market Report:

North America leads the hydraulics sector with a market size poised to increase from $18.48 billion in 2023 to $28.10 billion by 2033, fueled by advancements in technology and rising demands in automotive and aerospace applications.South America Hydraulics Market Report:

In South America, the hydraulics market is expected to grow from $1.84 billion in 2023 to $2.79 billion in 2033, driven largely by oil and gas exploration activities and infrastructure projects.Middle East & Africa Hydraulics Market Report:

The Middle East and Africa represent a significant market, projected to grow from $5.21 billion in 2023 to $7.92 billion by 2033. This growth is underpinned by developments in oil and gas sectors and infrastructural growth.Tell us your focus area and get a customized research report.

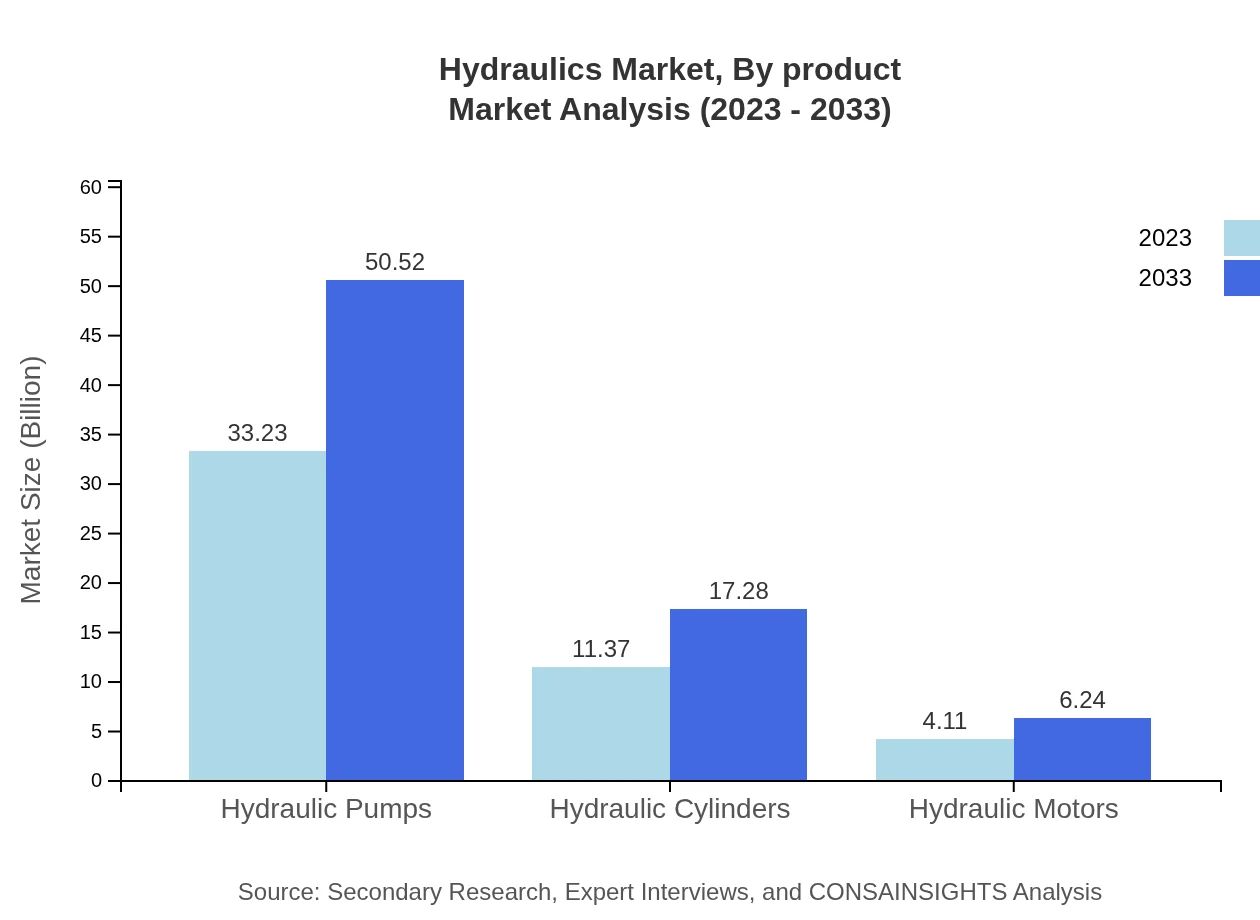

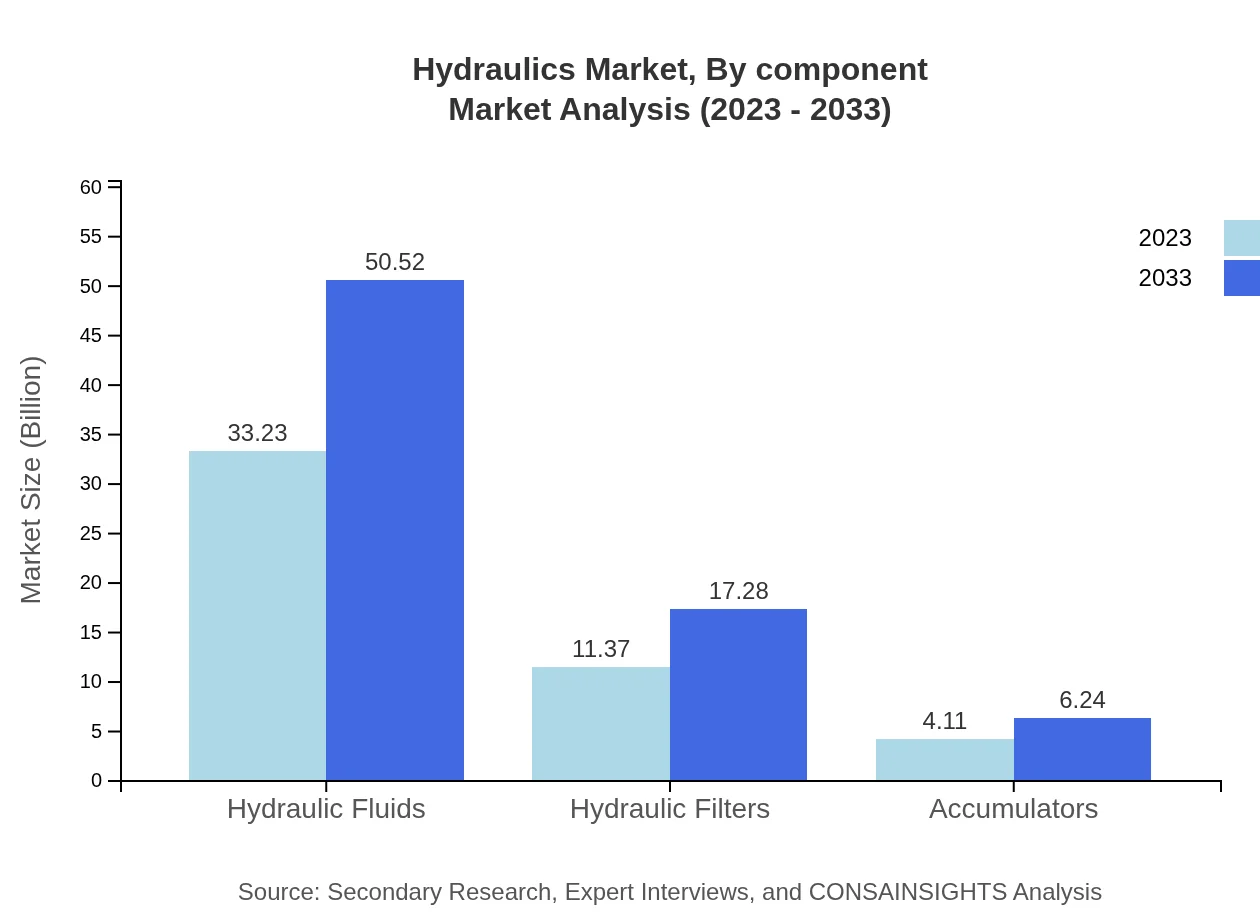

Hydraulics Market Analysis By Product

The product segmentation of the hydraulics market showcases a predominance of hydraulic pumps, which are projected to maintain a significant market share, reflecting a market size rise from $33.23 billion in 2023 to $50.52 billion by 2033. Hydraulic cylinders and filters also display robust growth patterns.

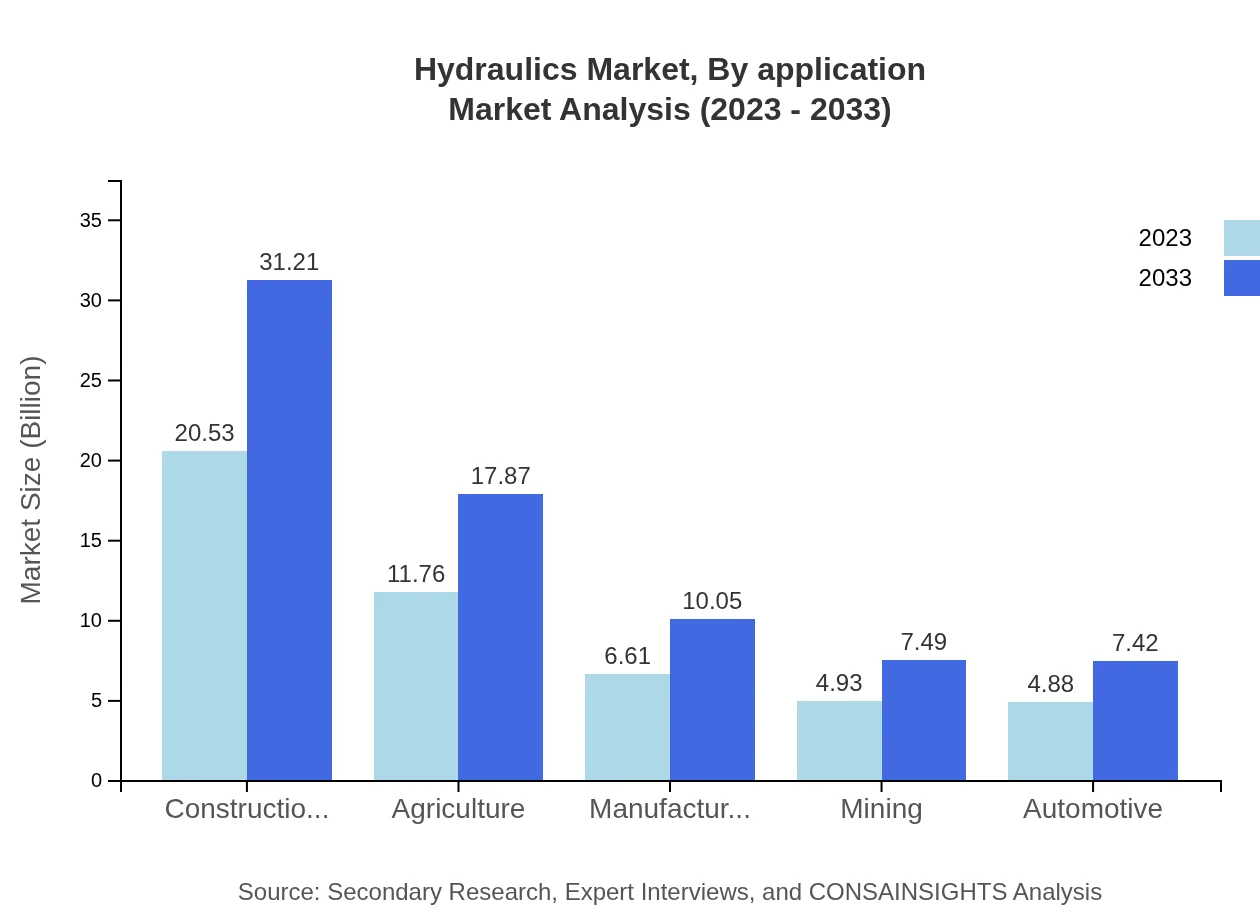

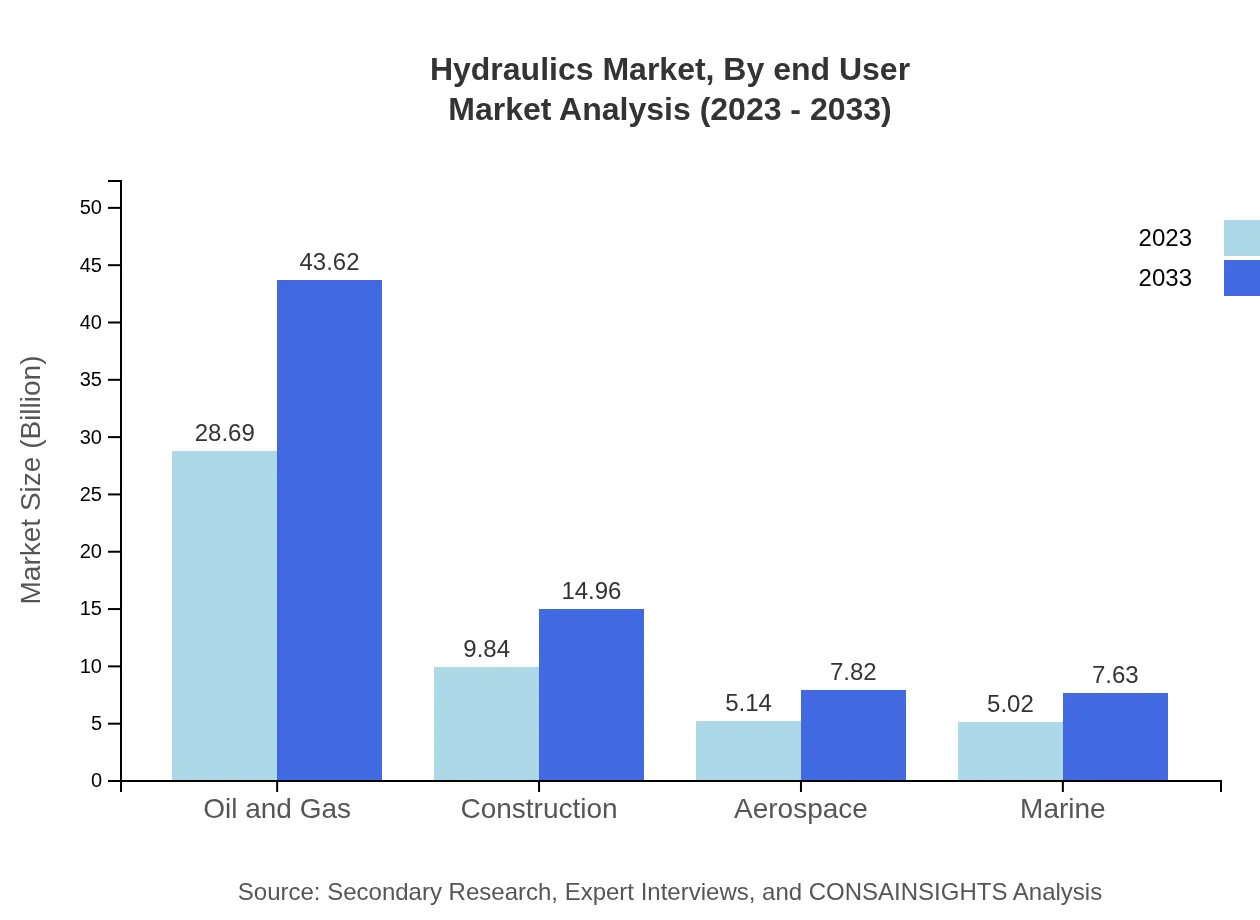

Hydraulics Market Analysis By Application

The application analysis indicates that the oil and gas sector will retain its position as the largest user of hydraulic systems, growing from $28.69 billion in 2023 to $43.62 billion by 2033. Following closely are applications in construction and manufacturing.

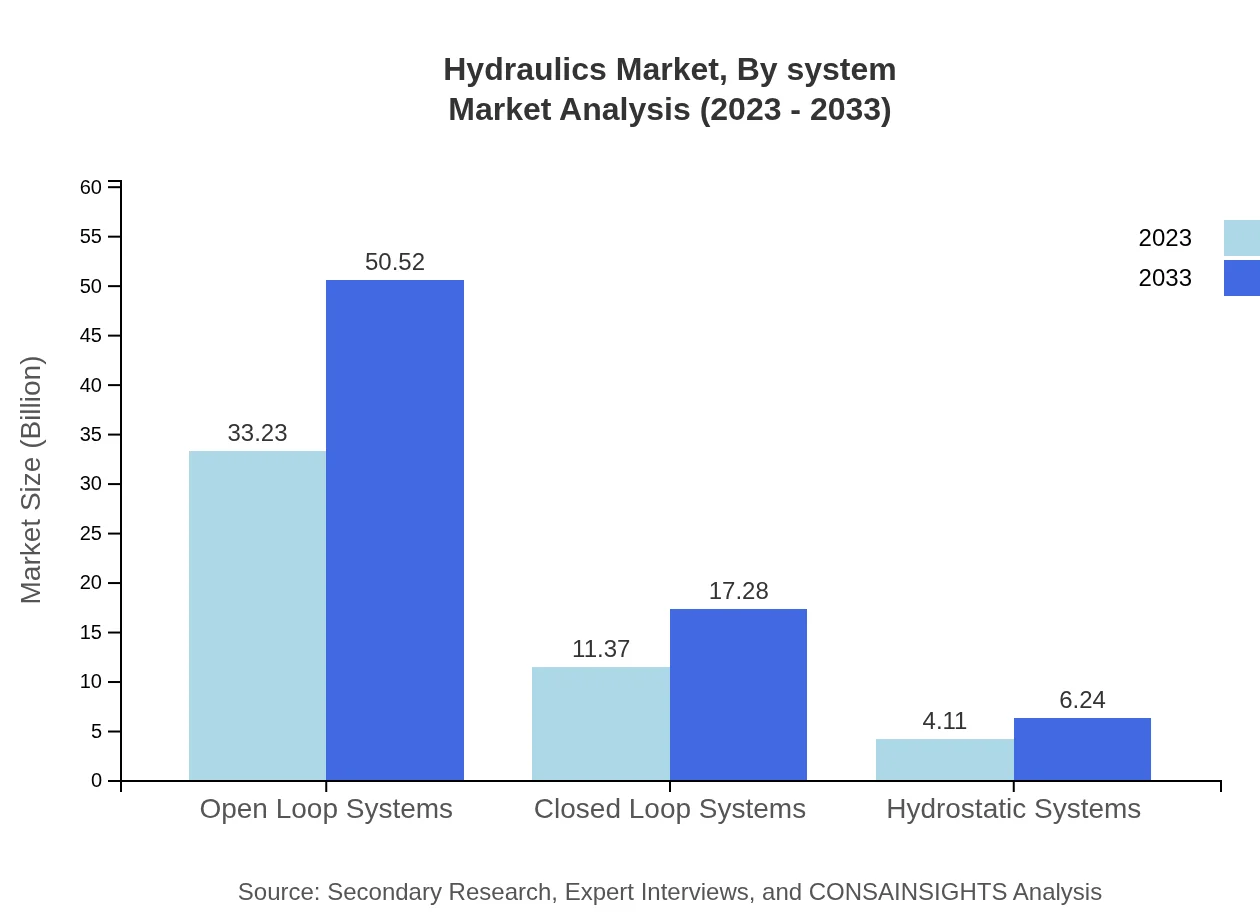

Hydraulics Market Analysis By System

Open loop systems currently dominate with a substantial market share, reflecting $33.23 billion in 2023 and expected to grow similarly by 2033. Closed loop systems will experience substantial growth due to efficiency gains in numerous applications.

Hydraulics Market Analysis By Component

Hydraulic motors will see growth alongside pumps and cylinders, ensuring a balanced component market that supports diverse industry applications with improved efficiency and performance.

Hydraulics Market Analysis By End User

Key end-user segments are projected to witness significant growth, particularly in construction, agriculture, and automotive, with notable contributions from manufacturing and mining, confirming the versatility of hydraulic applications across industries.

Hydraulics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Hydraulics Industry

Bosch Rexroth:

A leading global supplier of drive and control technology; Bosch Rexroth has a strong portfolio in hydraulic and electric drive technologies that emphasize efficiency and sustainability.Parker Hannifin Corporation:

Renowned for its motion and control technologies, Parker Hannifin manufactures a wide range of hydraulic components, focusing on innovation and market adaptability.Eaton Corporation:

Eaton is a key player in the hydraulics market, providing systems and components that optimize performance across many applications in various sectors.Hydac International:

Hydac specializes in hydraulics and system technology, focusing on customer-centric solutions that enhance the efficiency and reliability of hydraulic systems.We're grateful to work with incredible clients.

FAQs

What is the market size of hydraulics?

The hydraulics market is projected to reach approximately $48.7 billion by 2033, growing at a CAGR of 4.2%. This growth highlights the increasing demand for hydraulic systems in various industries spanning construction, manufacturing, and agriculture.

What are the key market players or companies in the hydraulics industry?

The hydraulics industry is dominated by several key players, including Bosch Rexroth, Parker Hannifin, Eaton, and Hydac. These companies are known for their innovative solutions, strong market presence, and comprehensive product offerings that cater to diverse industrial applications.

What are the primary factors driving the growth in the hydraulics industry?

Key factors fueling growth in the hydraulics market include increasing industrialization, rising demand for efficient machinery, and advancements in hydraulic technology. Furthermore, the expansion of sectors such as oil and gas, construction, and agriculture significantly contributes to market growth.

Which region is the fastest Growing in the hydraulics market?

The Asia Pacific region is anticipated to be the fastest-growing market for hydraulics, projected to reach $12.79 billion by 2033. Rapid industrialization and infrastructural advancements drive demand in this region, especially in countries like China and India.

Does ConsaInsights provide customized market report data for the hydraulics industry?

Yes, ConsaInsights offers customized market report data for the hydraulics industry. Clients can request tailored insights and analysis that meet specific business needs, ensuring that the data provided aligns with their strategic decision-making requirements.

What deliverables can I expect from this hydraulics market research project?

Expected deliverables from the hydraulics market research project include detailed market analysis, segmented data reports, competitive landscape overviews, and future trend forecasts. Additionally, actionable insights will aid in strategic planning and investment decisions.

What are the market trends of hydraulics?

Emerging trends in the hydraulics market include a shift towards automation, growing focus on energy-efficient systems, and increased adoption of IoT technologies. Moreover, sustainable practices and innovative hydraulic designs are becoming significant in meeting industry demands.