Hydrocolloids Market Report

Published Date: 31 January 2026 | Report Code: hydrocolloids

Hydrocolloids Market Size, Share, Industry Trends and Forecast to 2033

This report covers a comprehensive analysis of the hydrocolloids market, showcasing insights, trends, and forecasts from 2023 to 2033. It includes detailed data on market size, regional breakdowns, industry analysis, and competitive landscapes.

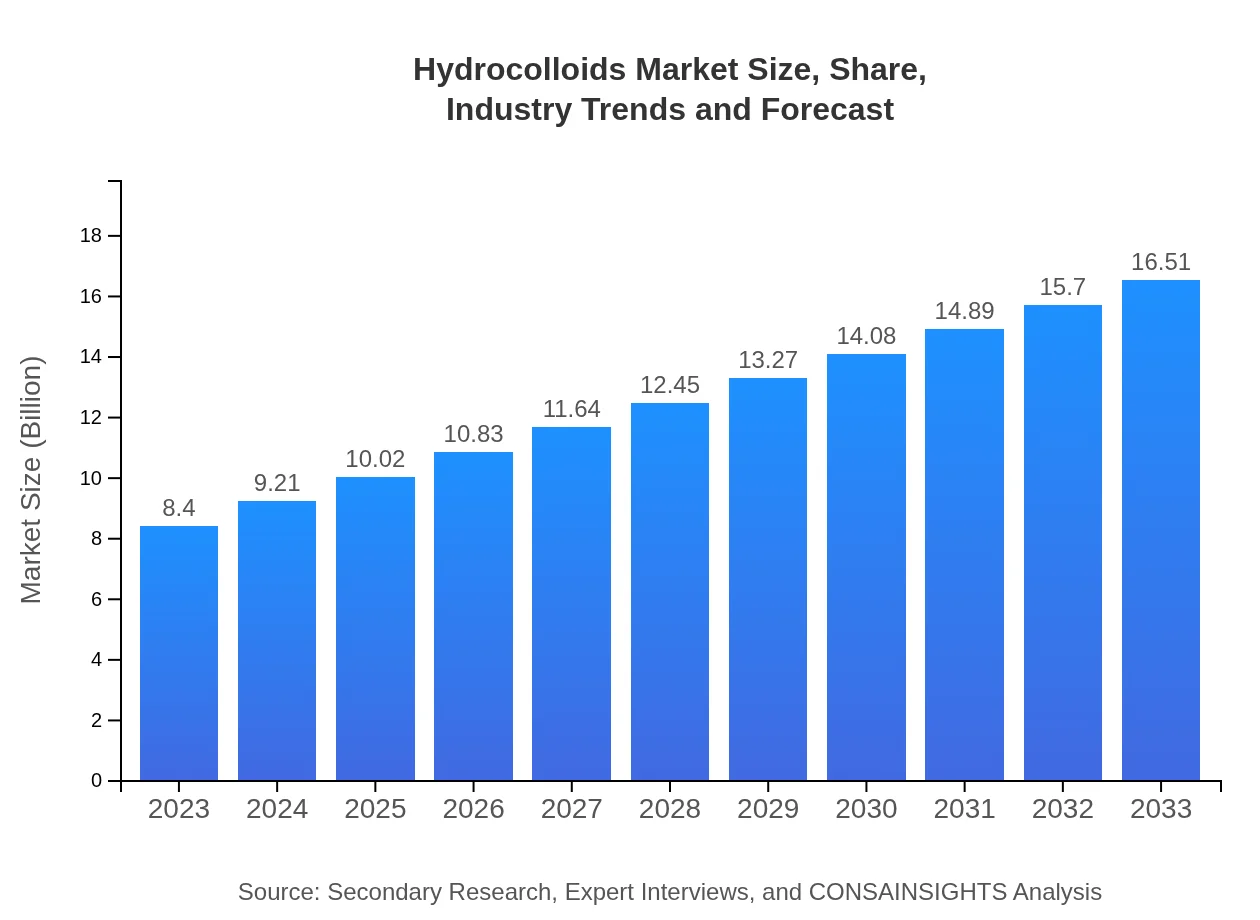

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $8.40 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $16.51 Billion |

| Top Companies | DuPont de Nemours, Inc., Ashland Global Holdings Inc., Tate & Lyle PLC, Kerry Group |

| Last Modified Date | 31 January 2026 |

Hydrocolloids Market Overview

Customize Hydrocolloids Market Report market research report

- ✔ Get in-depth analysis of Hydrocolloids market size, growth, and forecasts.

- ✔ Understand Hydrocolloids's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Hydrocolloids

What is the Market Size & CAGR of Hydrocolloids market in 2023?

Hydrocolloids Industry Analysis

Hydrocolloids Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Hydrocolloids Market Analysis Report by Region

Europe Hydrocolloids Market Report:

The European market for hydrocolloids was valued at $2.78 billion in 2023 and is projected to reach $5.46 billion by 2033. Factors underlying this growth include increased health awareness and consumer preferences for clean-label products, combined with stringent food safety regulations.Asia Pacific Hydrocolloids Market Report:

The Asia Pacific hydrocolloids market was valued at approximately $1.54 billion in 2023 and is expected to reach $3.02 billion by 2033, growing at a CAGR of around 7.2%. The region's growth is driven by increasing disposable incomes, urbanization, and a rapid growth in the food and beverage sector, particularly in countries like China and India.North America Hydrocolloids Market Report:

North America's hydrocolloids market was valued at $2.91 billion in 2023 and is estimated to grow to $5.73 billion by 2033, propelled by the high consumption of convenience and processed foods and the presence of key market players delivering innovative products.South America Hydrocolloids Market Report:

In South America, the market was valued at $0.47 billion in 2023, projected to expand to $0.92 billion by 2033. Factors such as growing health consciousness and rising demand for processed food products contribute to this growth.Middle East & Africa Hydrocolloids Market Report:

The Middle East and Africa's hydrocolloids market, valued at $0.70 billion in 2023, is expected to grow to $1.38 billion by 2033. Growth is supported by increased demand in the food processing industry and the gradual adoption of advanced food ingredients.Tell us your focus area and get a customized research report.

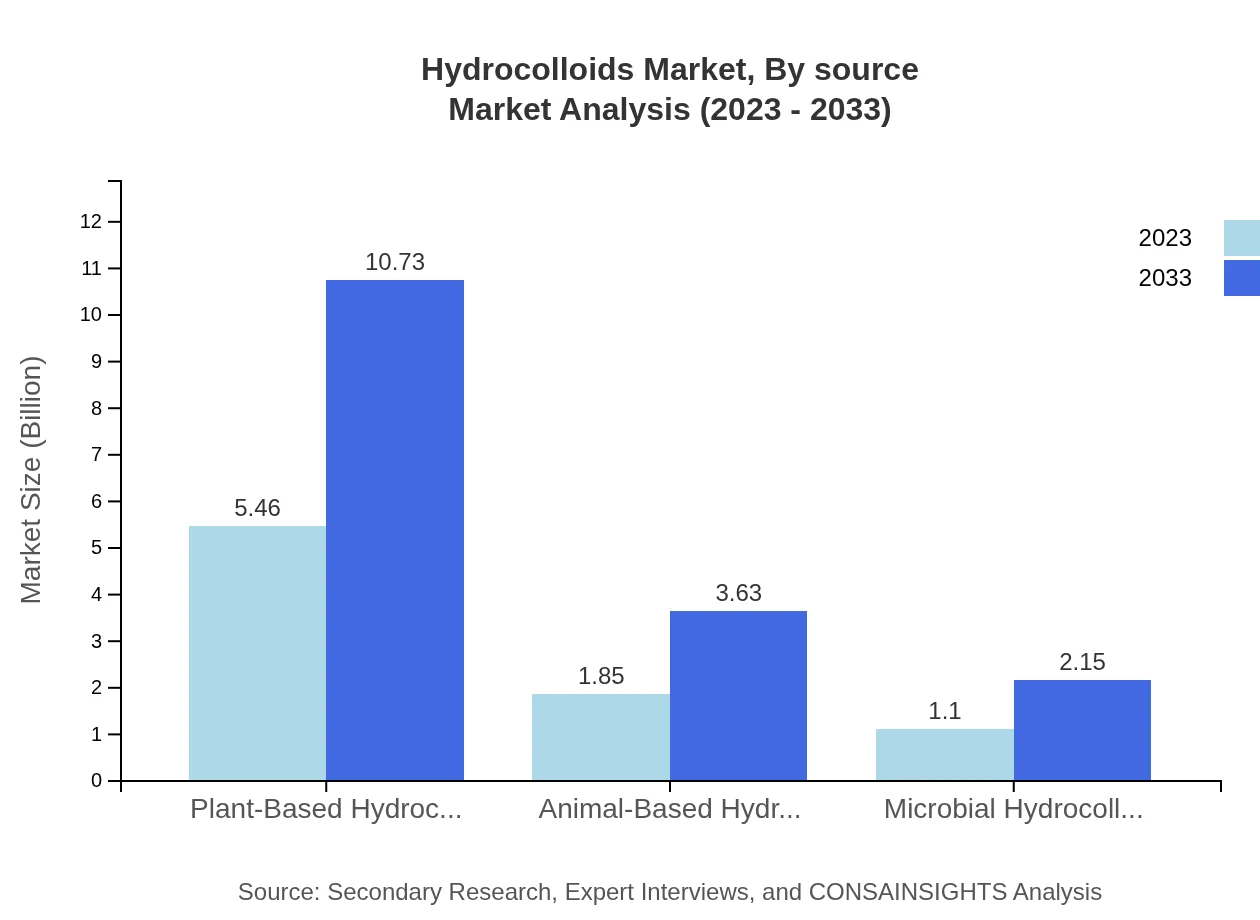

Hydrocolloids Market Analysis By Source

The hydrocolloids market is primarily segmented into: - **Plant-Based Hydrocolloids**: Market size projected to grow from $5.46 billion in 2023 to $10.73 billion by 2033, dominating the market share at 64.97%. - **Animal-Based Hydrocolloids**: Expected size ramping up from $1.85 billion in 2023 to $3.63 billion by 2033, holding a market share of 21.99%. - **Microbial Hydrocolloids**: Showing smaller growth, from $1.10 billion in 2023 to $2.15 billion by 2033, with a 13.04% market share.

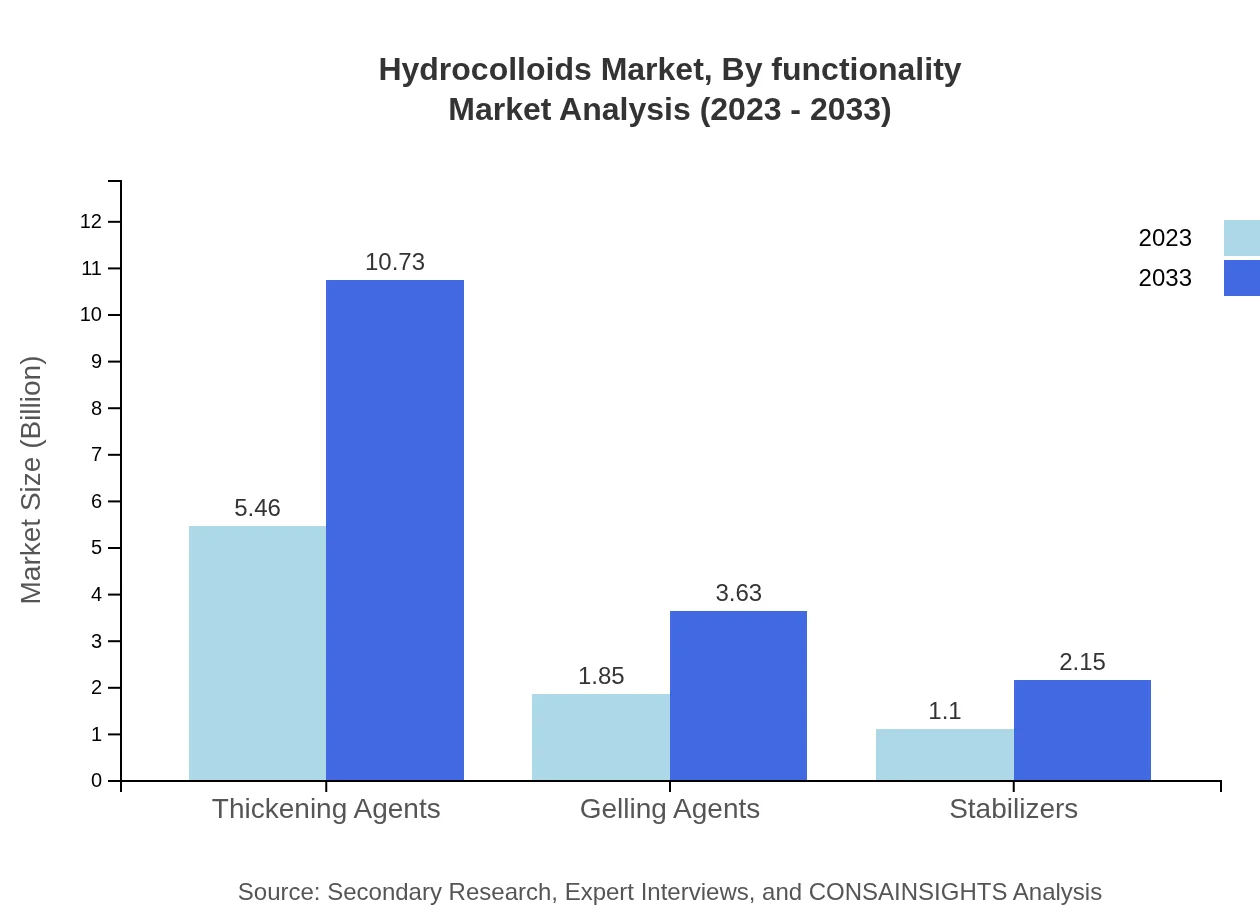

Hydrocolloids Market Analysis By Functionality

The hydrocolloids market is segmented by functionality, including: - **Thickening Agents**: Market to grow from $5.46 billion in 2023 to $10.73 billion by 2033, maintaining a share of 64.97%. - **Gelling Agents**: Expected to increase from $1.85 billion in 2023 to $3.63 billion by 2033, having a market share of 21.99%. - **Emulsifiers**: Projected to scale from $1.10 billion in 2023 to $2.15 billion by 2033, and representing a 13.04% market share.

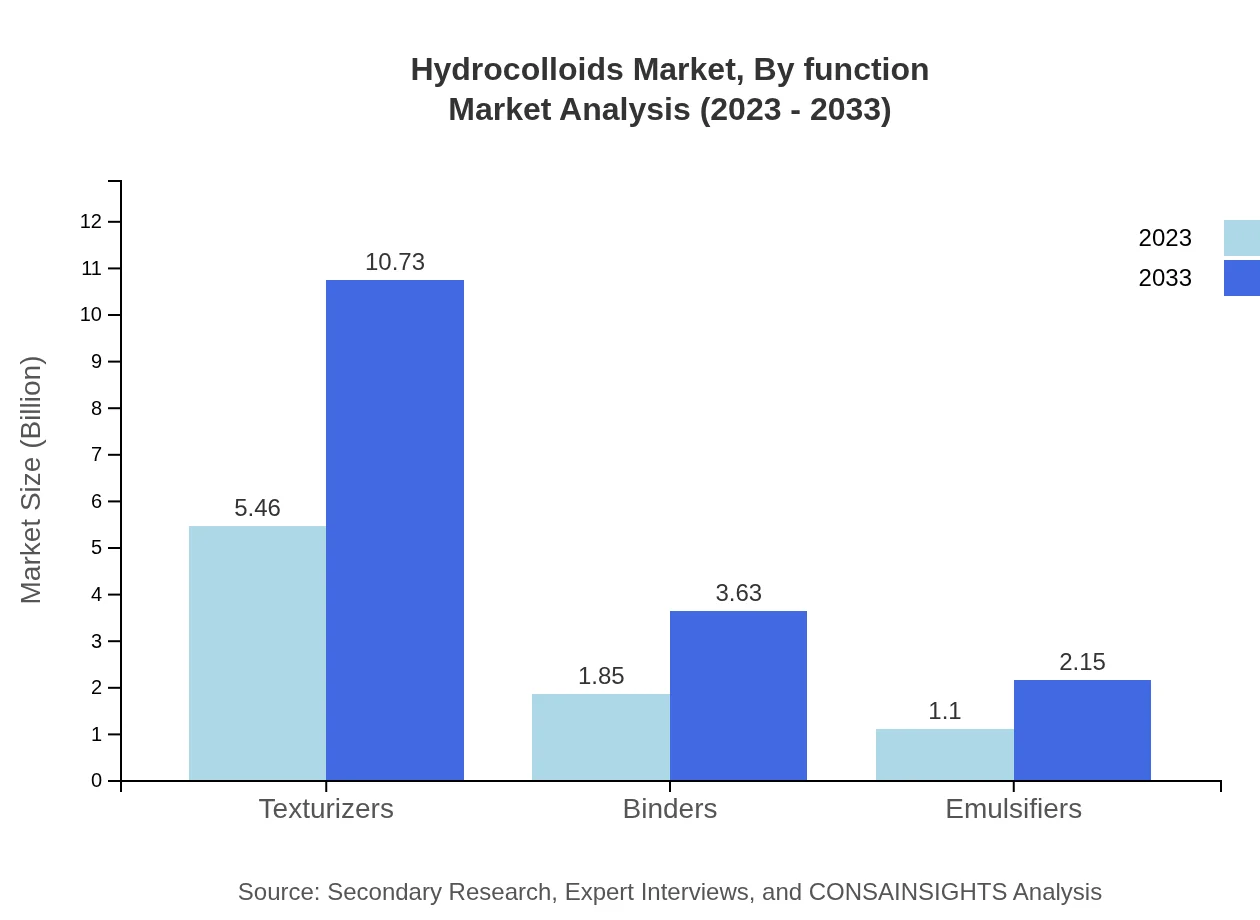

Hydrocolloids Market Analysis By Function

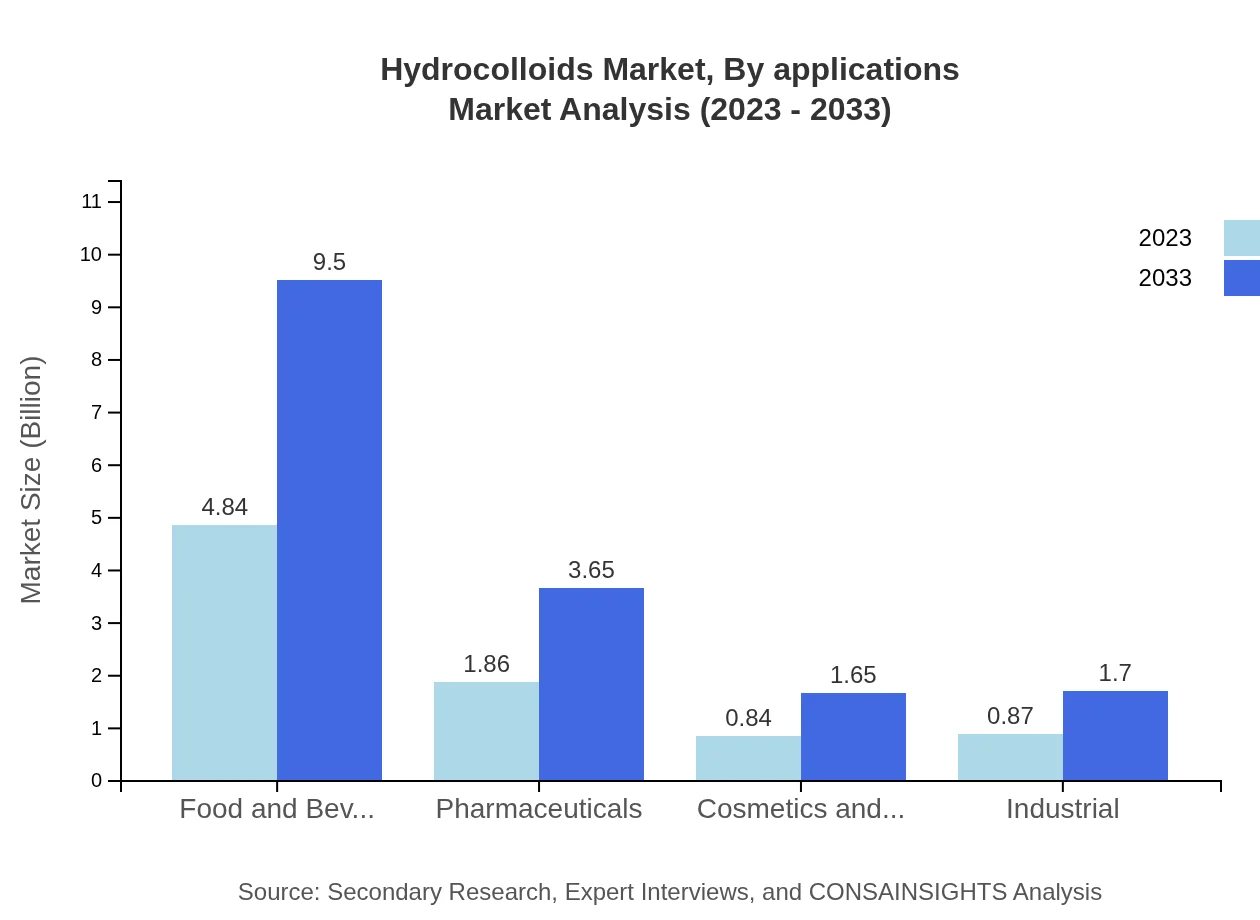

The market is characterized by different functional applications, primarily: - **Food and Beverages**: Showcases the largest share, valued at $4.84 billion in 2023 and reaching approximately $9.50 billion by 2033 (57.57% market share). - **Pharmaceuticals**: Expected to grow from $1.86 billion in 2023 to $3.65 billion by 2033, accounting for 22.10% share. - **Cosmetics**: Requests a consistent growth pattern from $0.84 billion in 2023 to $1.65 billion by 2033 for a 10.02% market share. - **Industrial Applications**: Market growing from $0.87 billion in 2023 to about $1.70 billion by 2033, capturing 10.31% of market share.

Hydrocolloids Market Analysis By Applications

Hydrocolloids are used across varied applications with significant insights: - The food and beverages sector remains dominant and is expected to grow substantially. - Increased focus on biomedical applications is opening up new avenues for hydrocolloids in pharmaceuticals, especially in drug delivery systems.

Hydrocolloids Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Hydrocolloids Industry

DuPont de Nemours, Inc.:

A leader in the hydrocolloids market focusing on innovative food ingredients for improved nutrition and taste.Ashland Global Holdings Inc.:

Specializes in creative solutions for hydrocolloids with a broad range of products used in food, personal care, and pharmaceuticals.Tate & Lyle PLC:

Known for its expertise in food and beverage ingredients including a comprehensive portfolio of hydrocolloids.Kerry Group:

Provides taste and nutrition solutions, leveraging hydrocolloids for functional and sensory properties.We're grateful to work with incredible clients.

FAQs

What is the market size of hydrocolloids?

The hydrocolloids market is projected to reach $8.4 billion by 2033, growing at a CAGR of 6.8%. In 2023, the market is valued at approximately $4.3 billion, indicating strong growth opportunities in various segments.

What are the key market players or companies in the hydrocolloids industry?

Key players in the hydrocolloids market include multinational corporations and specialized firms that focus on plant-based, animal-based, and microbial hydrocolloids, ensuring diverse offerings across food, pharmaceuticals, and industrial applications.

What are the primary factors driving the growth in the hydrocolloids industry?

Key drivers of growth include increasing demand for natural food additives, advancements in food technology, and the rising health-consciousness among consumers, leading to a surge in applications across food, cosmetics, and pharmaceuticals.

Which region is the fastest Growing in the hydrocolloids market?

The fastest-growing region is projected to be Europe, with a market size anticipated to increase from $2.78 billion in 2023 to $5.46 billion by 2033, showcasing the region's robust demand for hydrocolloid applications.

Does ConsaInsights provide customized market report data for the hydrocolloids industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the hydrocolloids industry, allowing clients to gain insights based on unique parameters such as geography, application, and product type.

What deliverables can I expect from this hydrocolloids market research project?

Deliverables include comprehensive market analysis reports, segmented data on various hydrocolloid types, competitive landscape insights, and forecasts, ensuring a detailed understanding of market dynamics and trends.

What are the market trends of hydrocolloids?

Current trends indicate a shift towards plant-based hydrocolloids, sustainable sourcing, and innovations in food formulations. The demand for clean label products is also driving market advancements and expanding the application base.