Hydrofluoric Acid Market Report

Published Date: 02 February 2026 | Report Code: hydrofluoric-acid

Hydrofluoric Acid Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Hydrofluoric Acid market, covering insights on market trends, forecasts from 2023 to 2033, and details across various segments and regions.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

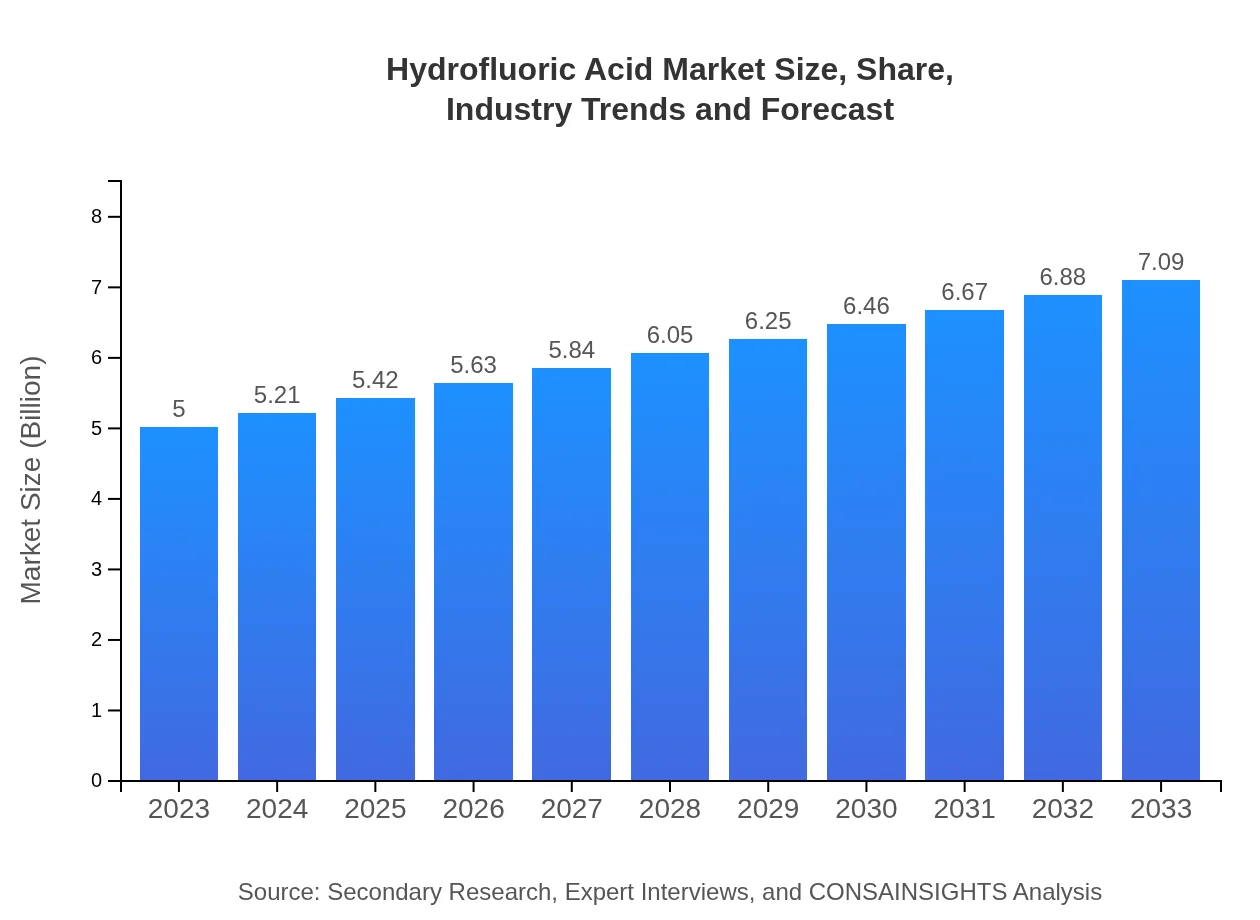

| 2023 Market Size | $5.00 Billion |

| CAGR (2023-2033) | 3.5% |

| 2033 Market Size | $7.09 Billion |

| Top Companies | Solvay S.A., Honeywell International Inc., Daikin Industries, Ltd., Arkema S.A. |

| Last Modified Date | 02 February 2026 |

Hydrofluoric Acid Market Overview

Customize Hydrofluoric Acid Market Report market research report

- ✔ Get in-depth analysis of Hydrofluoric Acid market size, growth, and forecasts.

- ✔ Understand Hydrofluoric Acid's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Hydrofluoric Acid

What is the Market Size & CAGR of Hydrofluoric Acid market in 2023?

Hydrofluoric Acid Industry Analysis

Hydrofluoric Acid Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Hydrofluoric Acid Market Analysis Report by Region

Europe Hydrofluoric Acid Market Report:

The European Hydroflic Acid is forecasted to grow from 1.50 billion USD in 2023 to 2.12 billion USD in 2033, fueled by stringent regulations that necessitate safer production methods, coupled with demand from various end-use industries.Asia Pacific Hydrofluoric Acid Market Report:

In the Asia-Pacific region, the Hydrofluoric Acid market is anticipated to grow from 0.88 billion USD in 2023 to 1.25 billion USD in 2033, driven primarily by rapid industrialization and increasing investments in the electronics sector.North America Hydrofluoric Acid Market Report:

North America is projected to see an increase in market size from 1.89 billion USD in 2023 to 2.69 billion USD in 2033. The robust growth in the electronics and semiconductor industries is a key driver, supported by technological advancements and increased production capacity.South America Hydrofluoric Acid Market Report:

The South American market for Hydrofluoric Acid is expected to rise from 0.14 billion USD in 2023 to 0.20 billion USD in 2033. Growth is supported by the expansion of mining and chemical industries, although economic fluctuations pose challenges.Middle East & Africa Hydrofluoric Acid Market Report:

The Middle East and Africa market is expected to grow from 0.59 billion USD in 2023 to 0.84 billion USD in 2033. This growth is backed by an increase in petrochemical activities and growing industrial applications in the region.Tell us your focus area and get a customized research report.

Hydrofluoric Acid Market Analysis By Grade

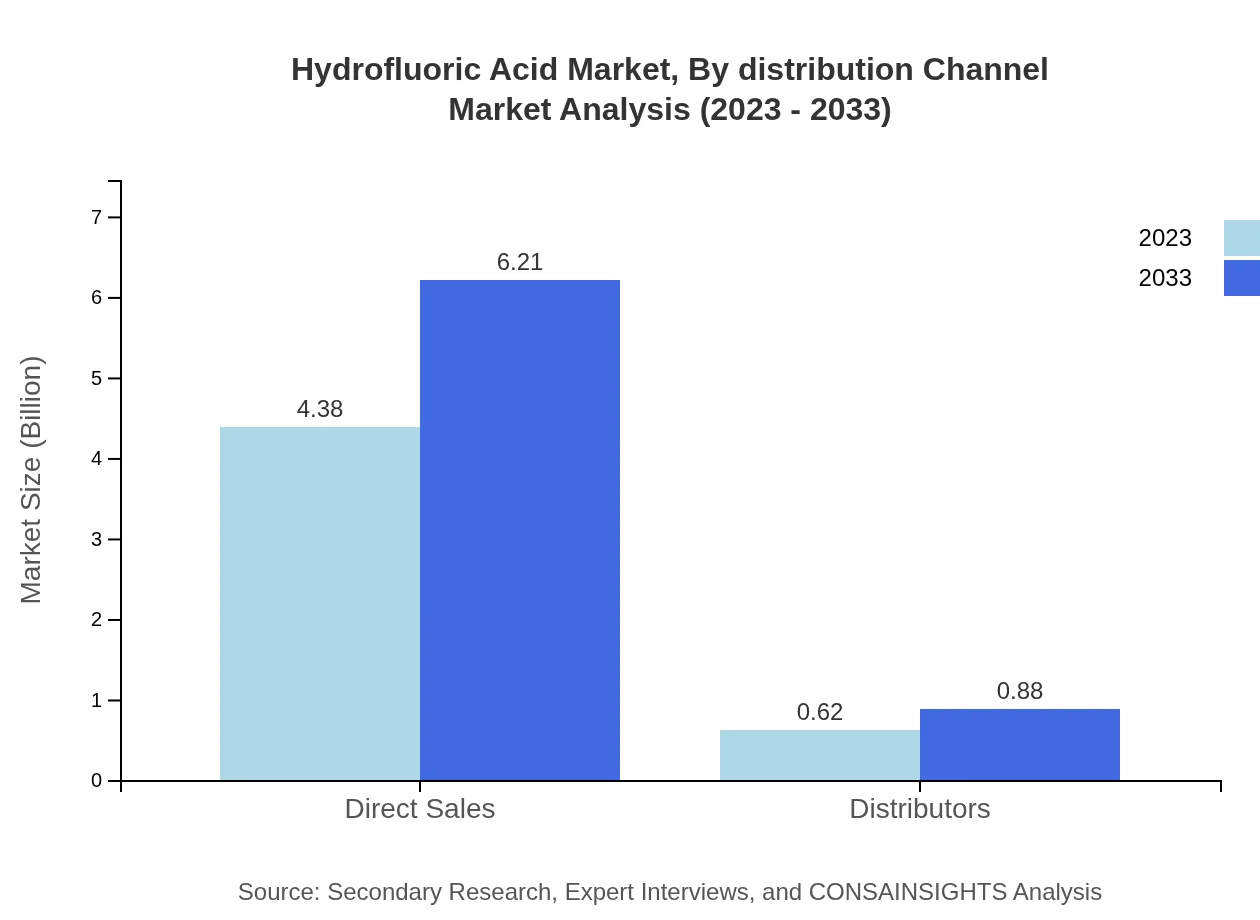

The Hydrofluoric Acid market by grade showcases significant demand for industrial-grade, comprising 87.57% of the market share in 2023, forecasted to maintain the same share in 2033 with a market size increase from 4.38 billion USD to 6.21 billion USD. The electronics-grade segment, while smaller, is also growing, moving from 0.62 billion USD in 2023 to 0.88 billion USD in 2033.

Hydrofluoric Acid Market Analysis By Application

In the application sector, the chemical industry holds a significant share at 60.67% of the market for Hydrofluoric Acid, projected to grow from 3.03 billion USD in 2023 to 4.30 billion USD by 2033. The electronics industry closely follows, with shares growing from 26.2% to 26.2%, and market sizes expanding from 1.31 billion USD to 1.86 billion USD.

Hydrofluoric Acid Market Analysis By End User

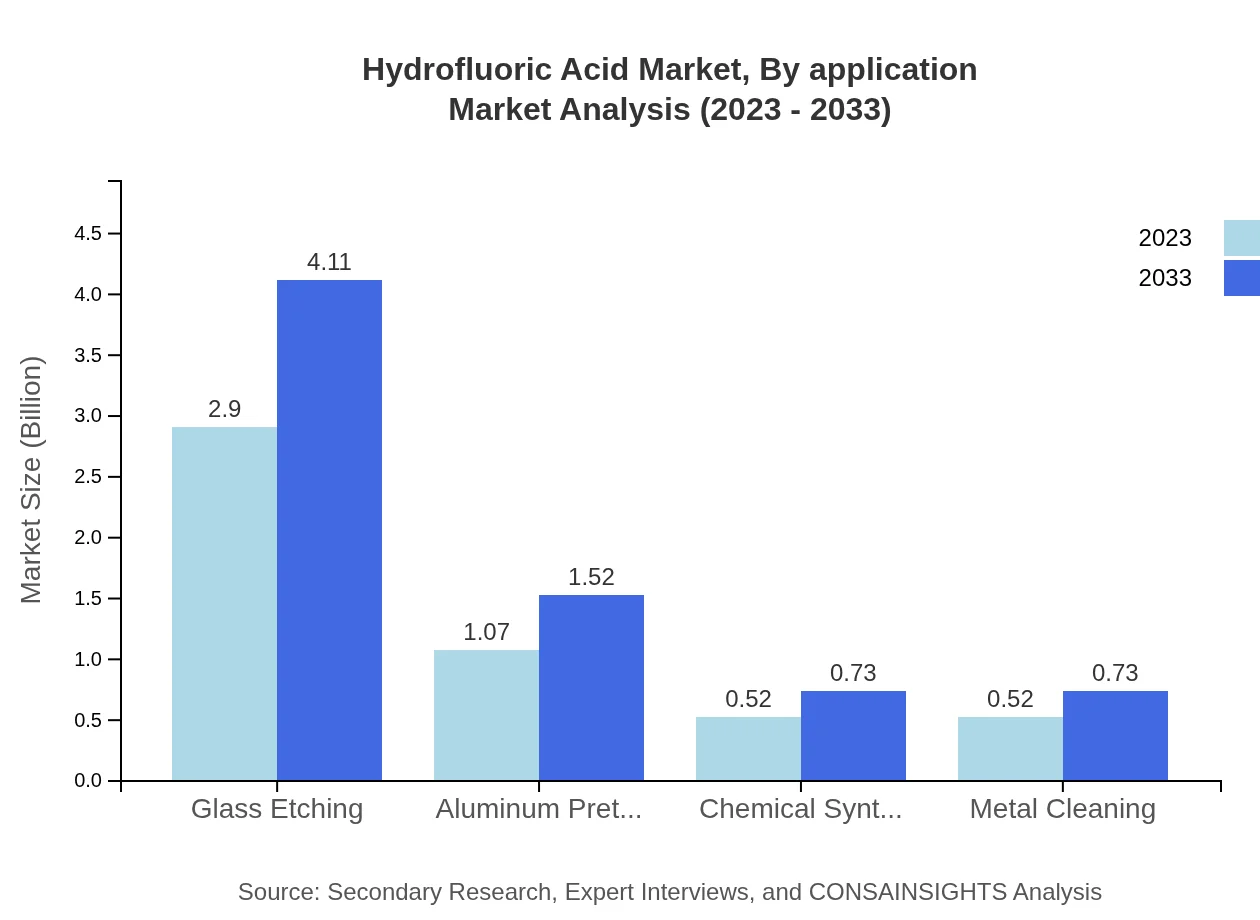

End-user segmentation of the Hydrofluoric Acid market indicates a stronghold in chemical processing applications, while glass etching represents a major use area at 57.91% market share with growth expected from 2.90 billion USD in 2023 to 4.11 billion USD in 2033. The aluminum pretreatment sector has a predictive growth from 1.07 billion USD to 1.52 billion USD during the same period.

Hydrofluoric Acid Market Analysis By Distribution Channel

Distribution channels show that direct sales remain dominant, holding a market share of 87.57% and edging towards 6.21 billion USD by 2033. Meanwhile, distributors make up 12.43% of the share, with growth seen from 0.62 billion USD to 0.88 billion USD, indicating robust distribution networks.

Hydrofluoric Acid Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Hydrofluoric Acid Industry

Solvay S.A.:

A Belgian multinational company, Solvay is a leader in producing specialty chemicals and is significantly involved in developing and supplying Hydrofluoric Acid. Their focus on innovation and sustainability contributes positively to the industry.Honeywell International Inc.:

An American multinational conglomerate, Honeywell produces Hydrofluoric Acid for various chemical applications and excels in advanced material technologies, positioning itself as a market leader with sustainable practices.Daikin Industries, Ltd.:

Based in Japan, Daikin is known for its extensive portfolio in the fluorochemicals sector, including Hydrofluoric Acid. Their commitment to product development and market expansion solidifies their leading position.Arkema S.A.:

A global manufacturer of specialty chemicals, Arkema places strong emphasis on high-performance materials and solutions including Hydrofluoric Acid, contributing to advancements in the electronics and chemical industries.We're grateful to work with incredible clients.

FAQs

What is the market size of hydrofluoric acid?

The hydrofluoric acid market is valued at approximately $5 billion in 2023, with an expected growth at a CAGR of 3.5% through 2033.

What are the key market players or companies in this hydrofluoric acid industry?

Key market players in the hydrofluoric acid industry include prominent chemical manufacturers and suppliers recognized for their contribution to various sectors, particularly electronics and chemicals.

What are the primary factors driving the growth in the hydrofluoric acid industry?

Growth in the hydrofluoric acid industry is driven by demand in semiconductor manufacturing, chemical processing, and glass etching applications, along with advancements in production technologies and increasing industrialization.

Which region is the fastest Growing in the hydrofluoric acid market?

Asia Pacific is the fastest-growing region in the hydrofluoric acid market, projected to expand from $0.88 billion in 2023 to $1.25 billion in 2033, driven by robust industrial growth and electronics demand.

Does ConsaInsights provide customized market report data for the hydrofluoric acid industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs and queries of stakeholders in the hydrofluoric acid industry.

What deliverables can I expect from this hydrofluoric acid market research project?

Expected deliverables include comprehensive market analysis, trend reports, segmentation data, competitive landscape evaluation, and forecasts for market growth and regional developments.

What are the market trends of hydrofluoric acid?

Current trends include increasing use in electronics manufacturing, focus on safety and environmental regulations, and innovations in sustainable production methods, reshaping market dynamics.