Hydroxyapatite Market Report

Published Date: 31 January 2026 | Report Code: hydroxyapatite

Hydroxyapatite Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Hydroxyapatite market, covering market size, trends, forecasts, and detailed analyses for the period 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

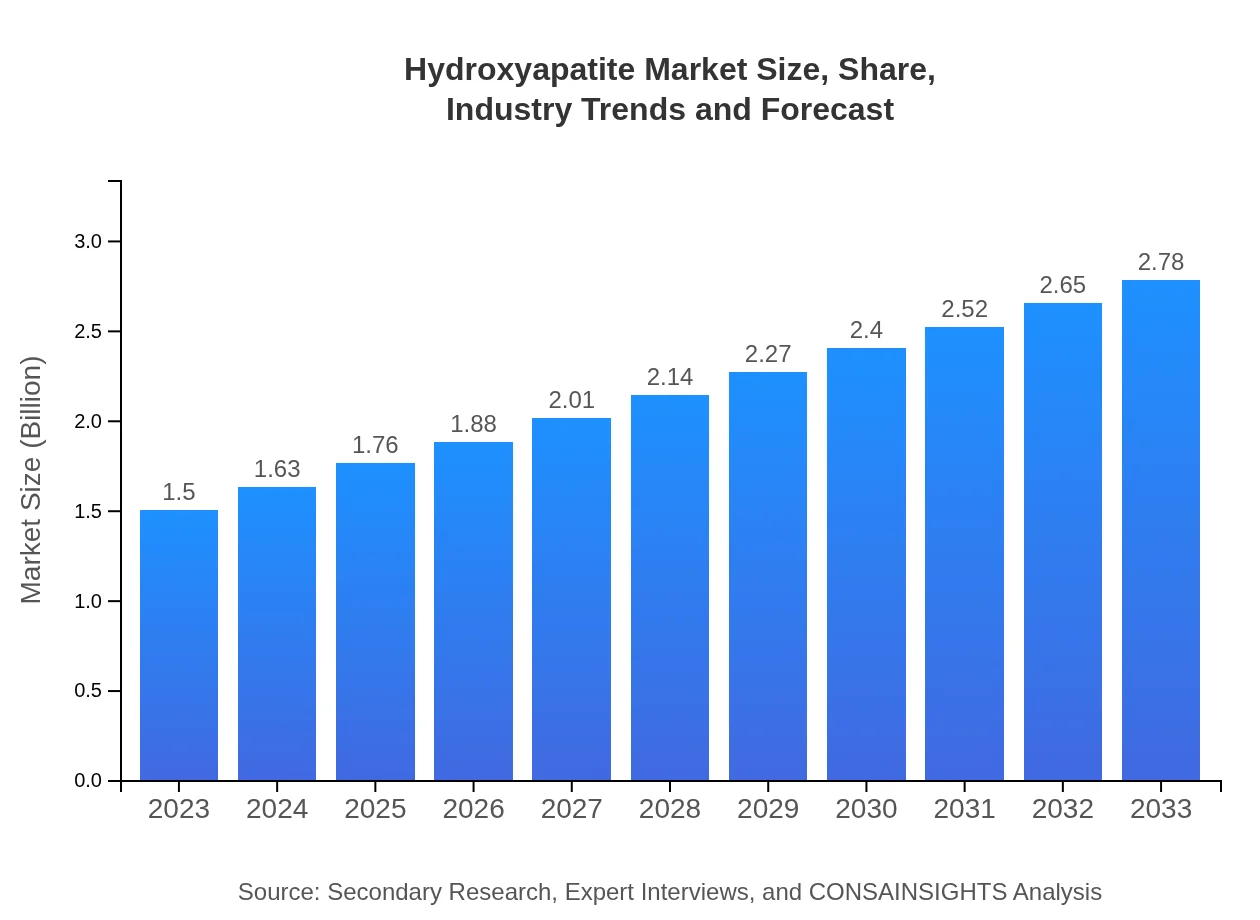

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $2.78 Billion |

| Top Companies | Lifecore Biomedical, LLC, Cam Bioceramics, Hapcen, Sintratech, Biomatlante |

| Last Modified Date | 31 January 2026 |

Hydroxyapatite Market Overview

Customize Hydroxyapatite Market Report market research report

- ✔ Get in-depth analysis of Hydroxyapatite market size, growth, and forecasts.

- ✔ Understand Hydroxyapatite's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Hydroxyapatite

What is the Market Size & CAGR of Hydroxyapatite market in 2023?

Hydroxyapatite Industry Analysis

Hydroxyapatite Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Hydroxyapatite Market Analysis Report by Region

Europe Hydroxyapatite Market Report:

Europe's Hydroxyapatite market was valued at $0.55 billion in 2023 and is projected to reach $1.02 billion by 2033. Strong regulatory support and innovation in biomaterials are key growth drivers.Asia Pacific Hydroxyapatite Market Report:

In the Asia Pacific, the Hydroxyapatite market reached $0.28 billion in 2023, projected to grow to $0.51 billion by 2033. The presence of key manufacturers and rising healthcare infrastructure are pivotal factors fueling expansion.North America Hydroxyapatite Market Report:

North America represents a significant market, with a value of $0.50 billion in 2023 expected to rise to $0.92 billion by 2033. The advanced healthcare system and high expenditure on medical research contribute to this growth.South America Hydroxyapatite Market Report:

The South American market for Hydroxyapatite was valued at $0.09 billion in 2023, with expected growth to $0.17 billion by 2033. Increasing awareness regarding dental care and bone health is anticipated to drive demand.Middle East & Africa Hydroxyapatite Market Report:

In the Middle East and Africa, the market size was $0.08 billion in 2023, anticipated to grow to $0.15 billion by 2033. Focus on improving healthcare facilities and increasing consumer awareness of bone health are contributing factors.Tell us your focus area and get a customized research report.

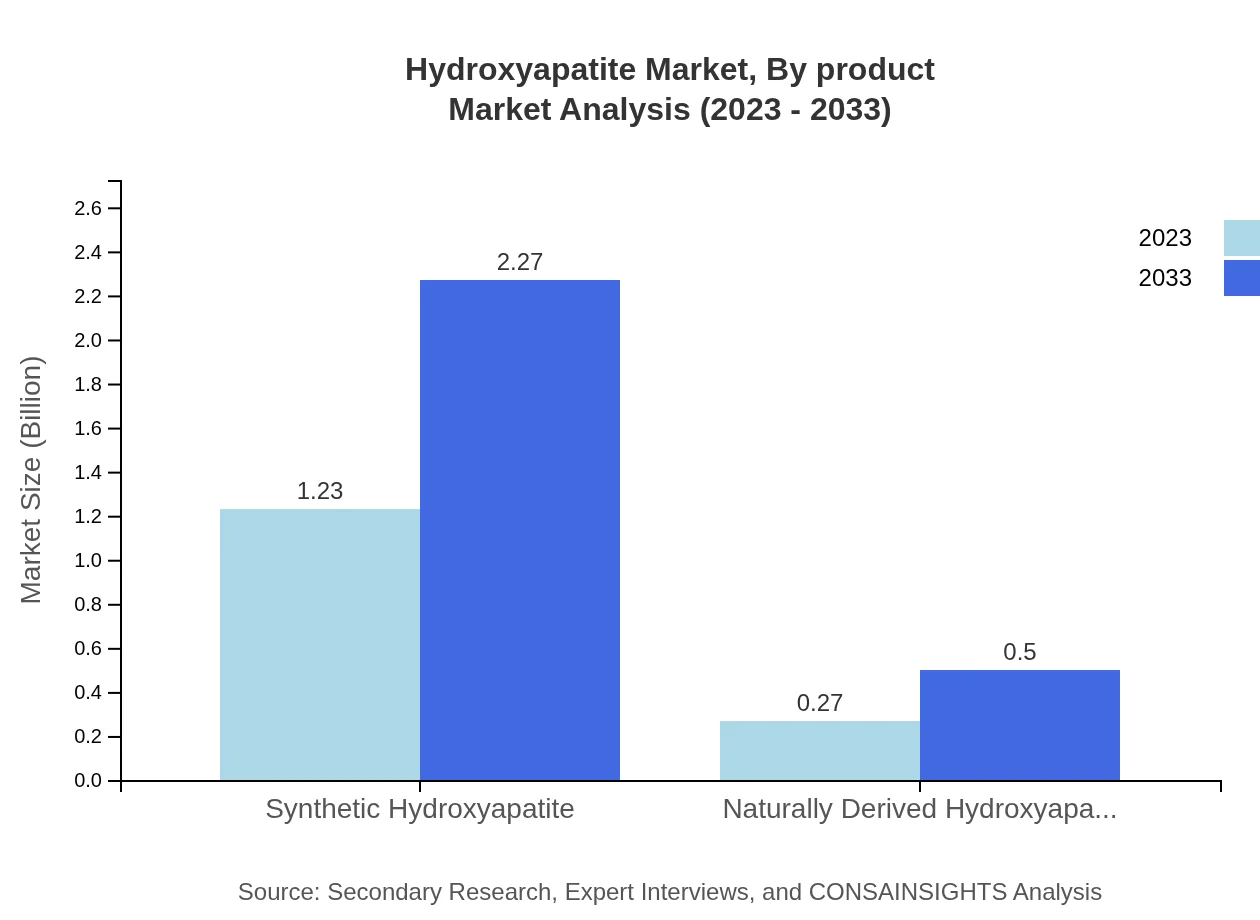

Hydroxyapatite Market Analysis By Product

The Hydroxyapatite market is dominated by synthetic Hydroxyapatite, holding approximately 81.85% of the market share in 2023, estimated to reach a size of $2.27 billion by 2033. Natural Hydroxyapatite holds the remainder with a significant growth trajectory, catering to applications needing organic certification.

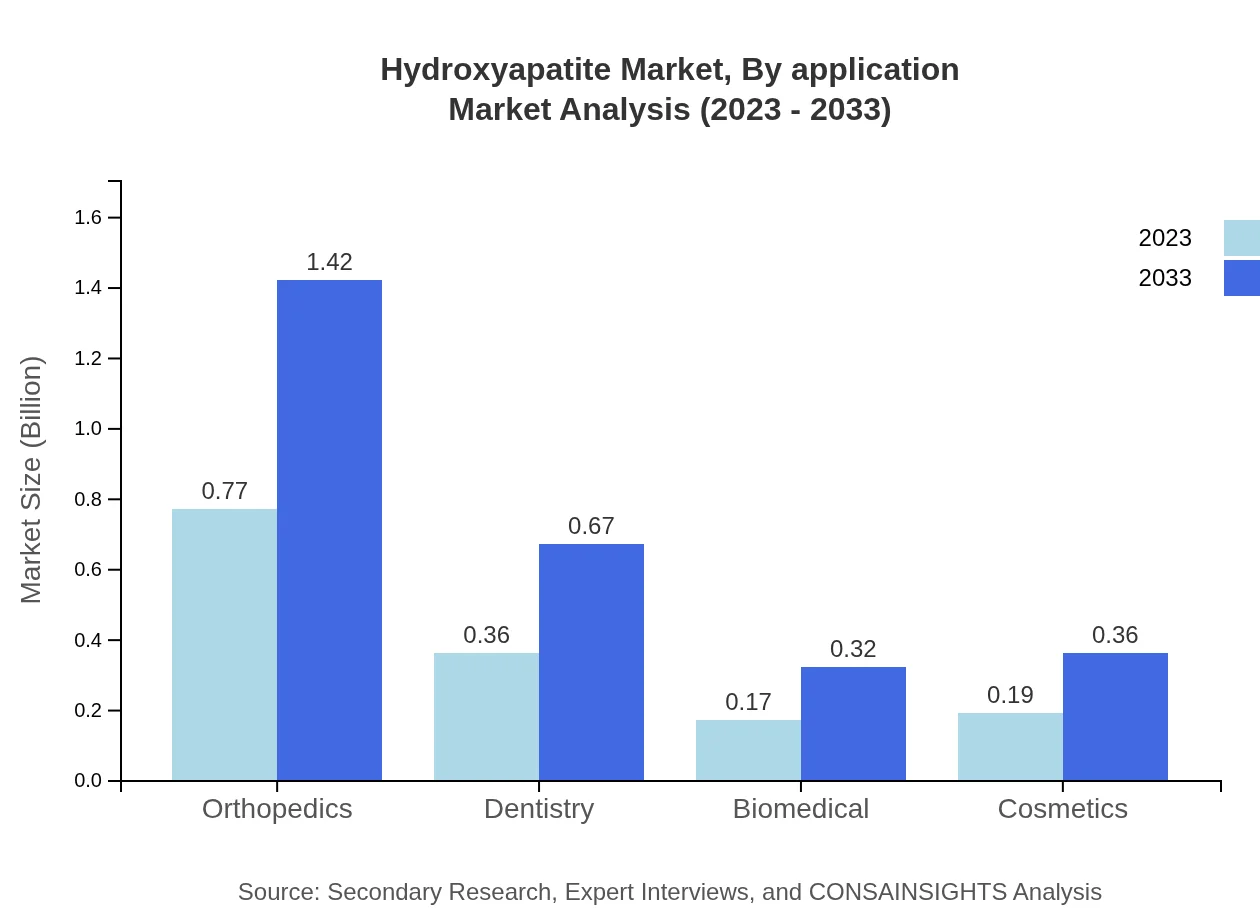

Hydroxyapatite Market Analysis By Application

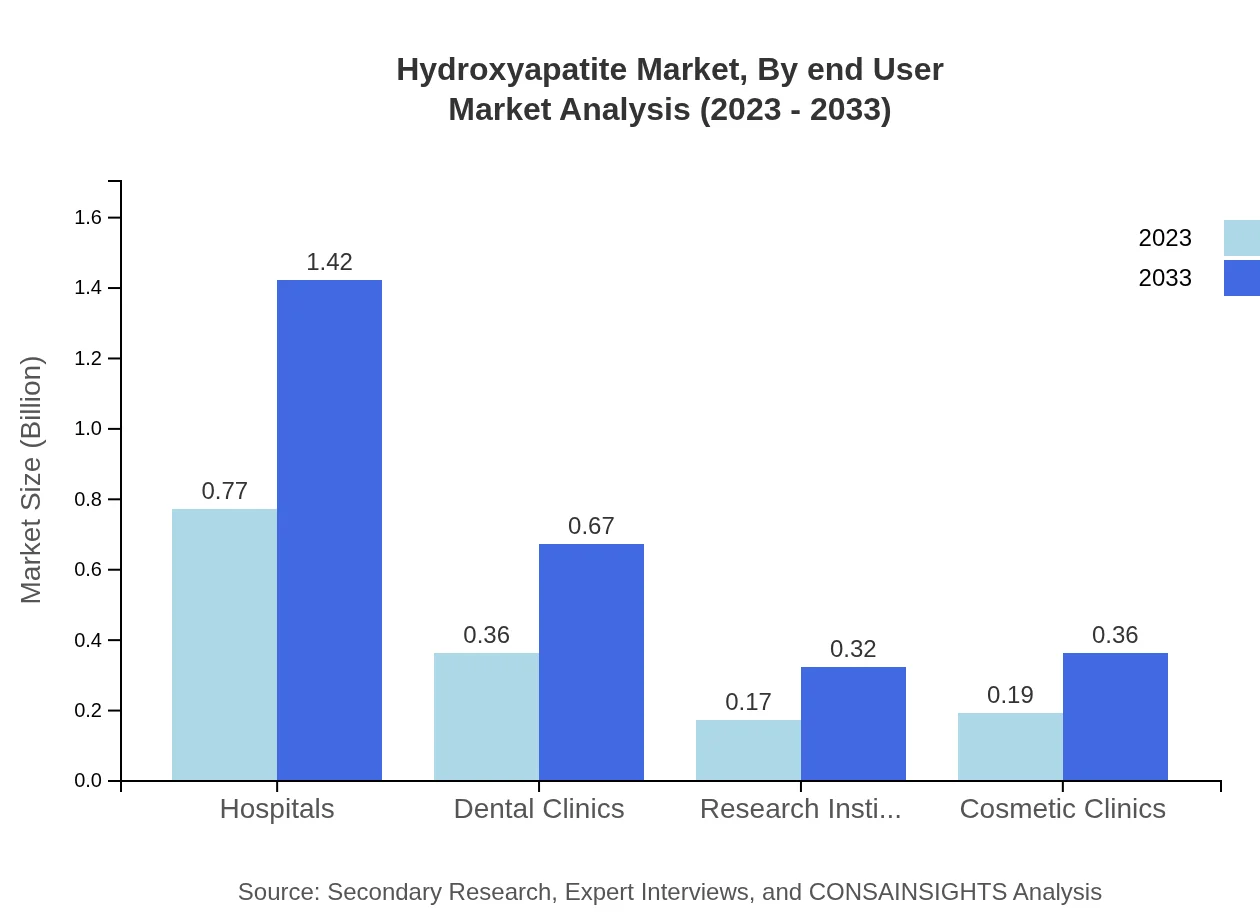

Hospitals account for a substantial share of the market, valued at $0.77 billion in 2023, projected to grow to $1.42 billion by 2033. Dental clinics, research institutes, and cosmetic clinics also represent important segments with specific needs and growth potential.

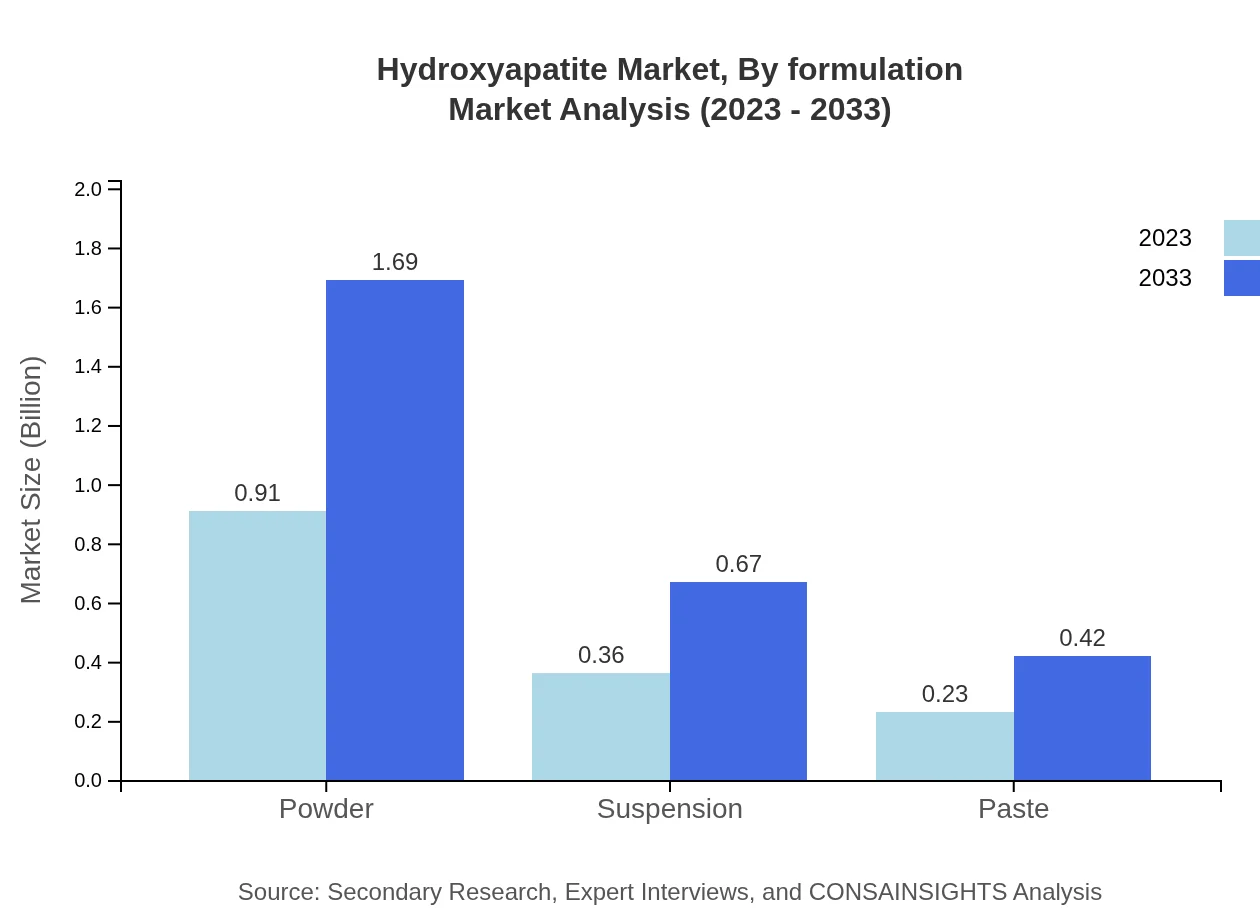

Hydroxyapatite Market Analysis By Formulation

In terms of formulation, powder Hydroxyapatite maintains a dominant share of 60.78% in 2023, with a market size of $0.91 billion. Suspensions and pastes are also significant, reflecting various applications in medical and cosmetic products.

Hydroxyapatite Market Analysis By End User

The end-user segment is led by both hospitals and dental clinics, each representing notable market shares and growth rates, driven by the increasing need for advanced biomaterials in medical applications.

Hydroxyapatite Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Hydroxyapatite Industry

Lifecore Biomedical, LLC:

Specializes in developing and manufacturing Hydroxyapatite products for use in surgical and dental applications.Cam Bioceramics:

A leader in the production of synthetic Hydroxyapatite for orthobiologics and dental applications.Hapcen:

Focuses on the development of innovative Hydroxyapatite coatings for dental implants and bone fillings.Sintratech:

Offers a range of Hydroxyapatite products primarily for research and clinical applications in regenerative medicine.Biomatlante:

Develops and commercializes Hydroxyapatite products that are environmentally friendly and clinically relevant.We're grateful to work with incredible clients.

FAQs

What is the market size of hydroxyapatite?

The hydroxyapatite market is valued at $1.5 billion in 2023, with a projected CAGR of 6.2% through 2033. This growth signifies an increasing demand across various applications, especially in the biomedical sector.

What are the key market players or companies in the hydroxyapatite industry?

Key players in the hydroxyapatite market include strategic manufacturers and suppliers focusing on innovative applications. Their research investments enhance product development, driving competition and market expansion, especially in medical devices and dental applications.

What are the primary factors driving the growth in the hydroxyapatite industry?

Key growth drivers for the hydroxyapatite market include a rising aging population, increasing dental and orthopedic procedures, and the growing demand for biocompatible materials in healthcare applications. Innovations in manufacturing techniques also contribute significantly.

Which region is the fastest Growing in the hydroxyapatite?

The fastest-growing region in the hydroxyapatite market is projected to be Europe, where the market is expected to grow from $0.55 billion in 2023 to $1.02 billion by 2033. Asia Pacific and North America follow closely in growth potential.

Does ConsaInsights provide customized market report data for the hydroxyapatite industry?

Yes, ConsaInsights offers customized market report data tailored specifically for the hydroxyapatite industry. This allows businesses to gain insights that align with their strategic goals, ensuring they have the most relevant information.

What deliverables can I expect from this hydroxyapatite market research project?

From the hydroxyapatite market research project, you can expect comprehensive reports, market analysis, competitive landscape summaries, and forecasts segmented by application and region. These deliverables aim to guide strategic planning and investment.

What are the market trends of hydroxyapatite?

Current trends in the hydroxyapatite market include increasing adoption of synthetic hydroxyapatite for various biomedical applications, innovation in manufacturing processes, and growing collaborations among research institutions to foster new product development.