Iceland Pharmaceutical Market Report

Published Date: 31 January 2026 | Report Code: iceland-pharmaceutical

Iceland Pharmaceutical Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Iceland Pharmaceutical market, highlighting current trends, growth forecasts, and market dynamics from 2023 to 2033, along with insights into technology, product performance, and key players in the industry.

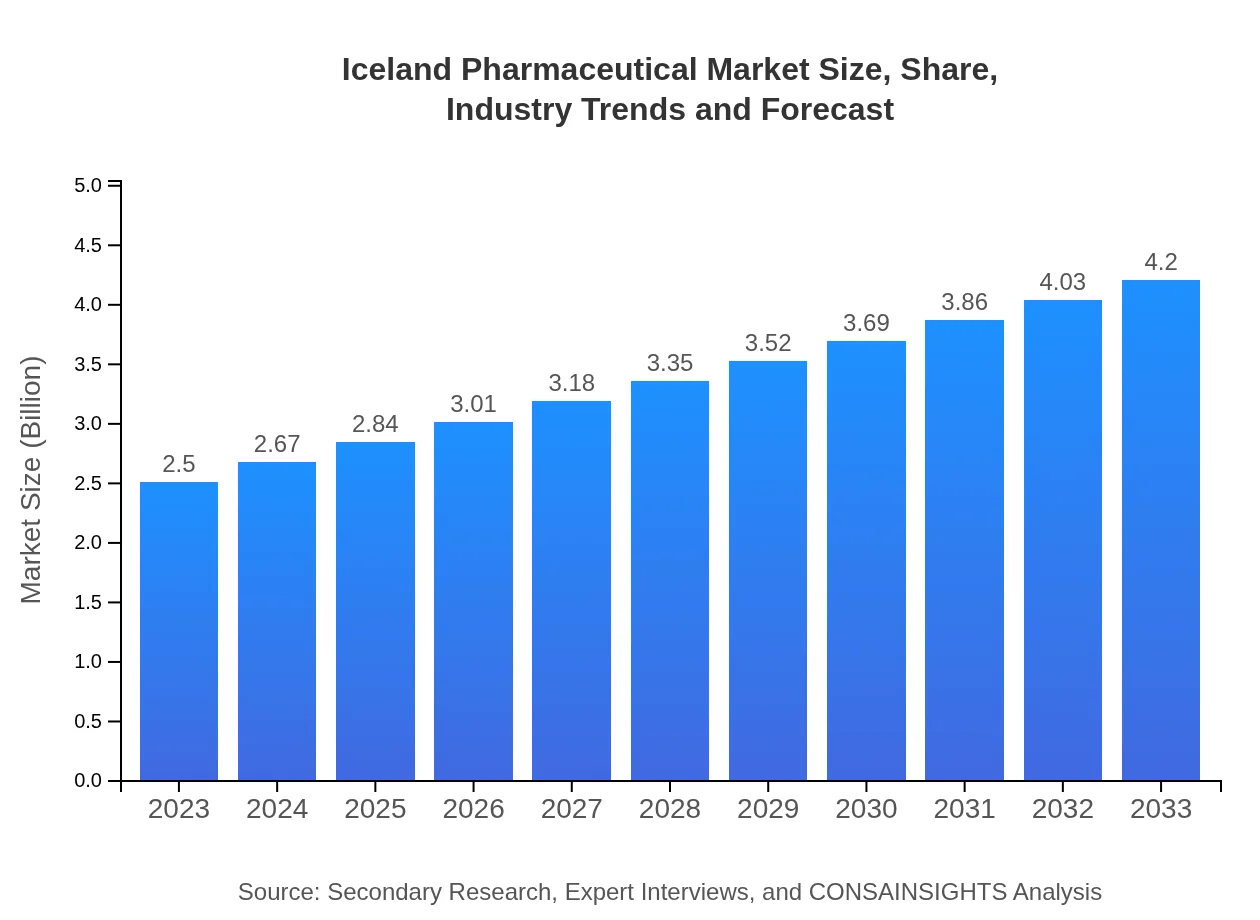

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $4.20 Billion |

| Top Companies | Actavis, Alvotech |

| Last Modified Date | 31 January 2026 |

Iceland Pharmaceutical Market Overview

Customize Iceland Pharmaceutical Market Report market research report

- ✔ Get in-depth analysis of Iceland Pharmaceutical market size, growth, and forecasts.

- ✔ Understand Iceland Pharmaceutical's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Iceland Pharmaceutical

What is the Market Size & CAGR of Iceland Pharmaceutical market in 2023?

Iceland Pharmaceutical Industry Analysis

Iceland Pharmaceutical Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Iceland Pharmaceutical Market Analysis By Product

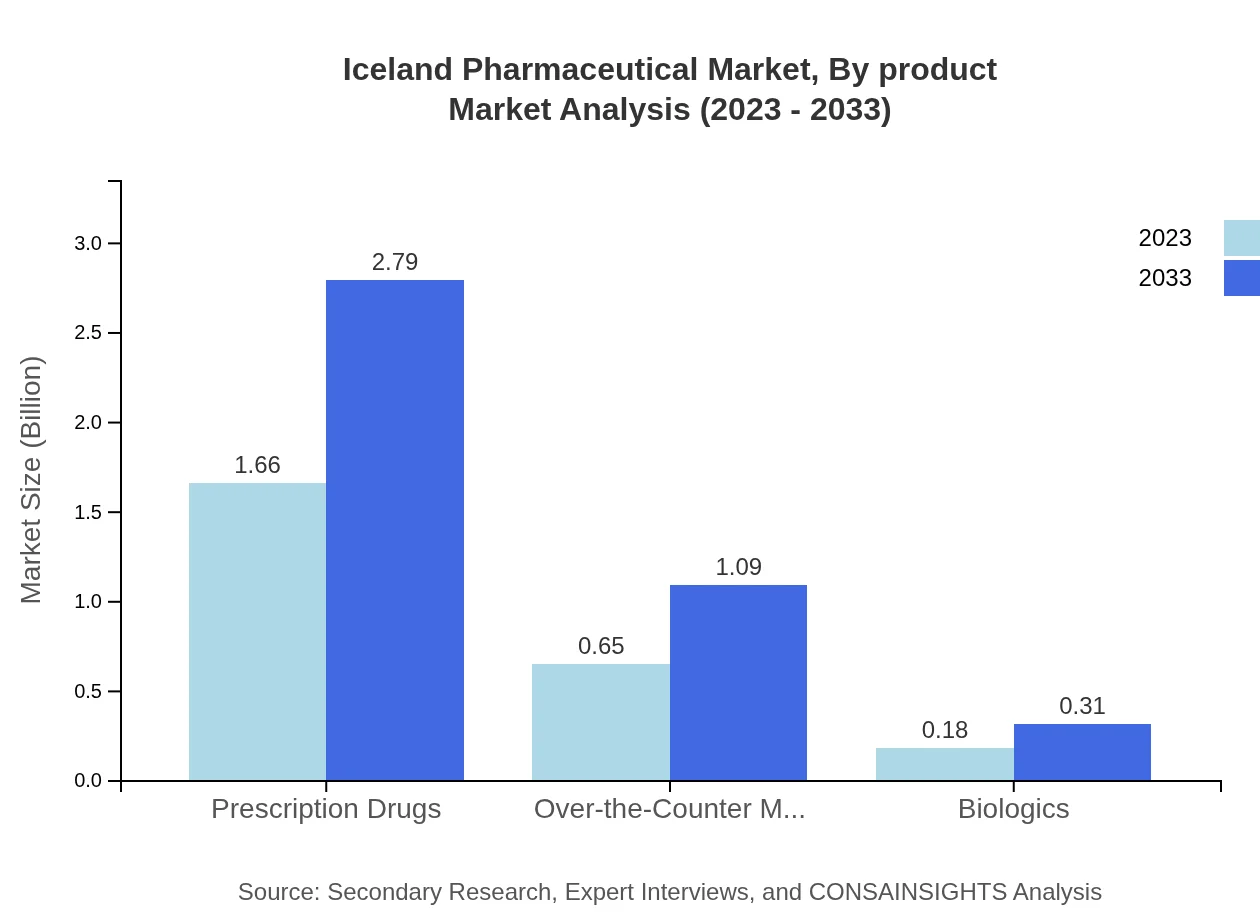

In 2023, the Iceland Pharmaceutical market for prescription drugs stands at $1.66 billion, anticipated to grow to $2.79 billion by 2033. Over-the-counter medications hold a market value of $0.65 billion, expected to reach $1.09 billion. Biologics represent a smaller segment at $0.18 billion, with projections of increasing to $0.31 billion, reflecting the growing interest in advanced therapies.

Iceland Pharmaceutical Market Analysis By Therapy

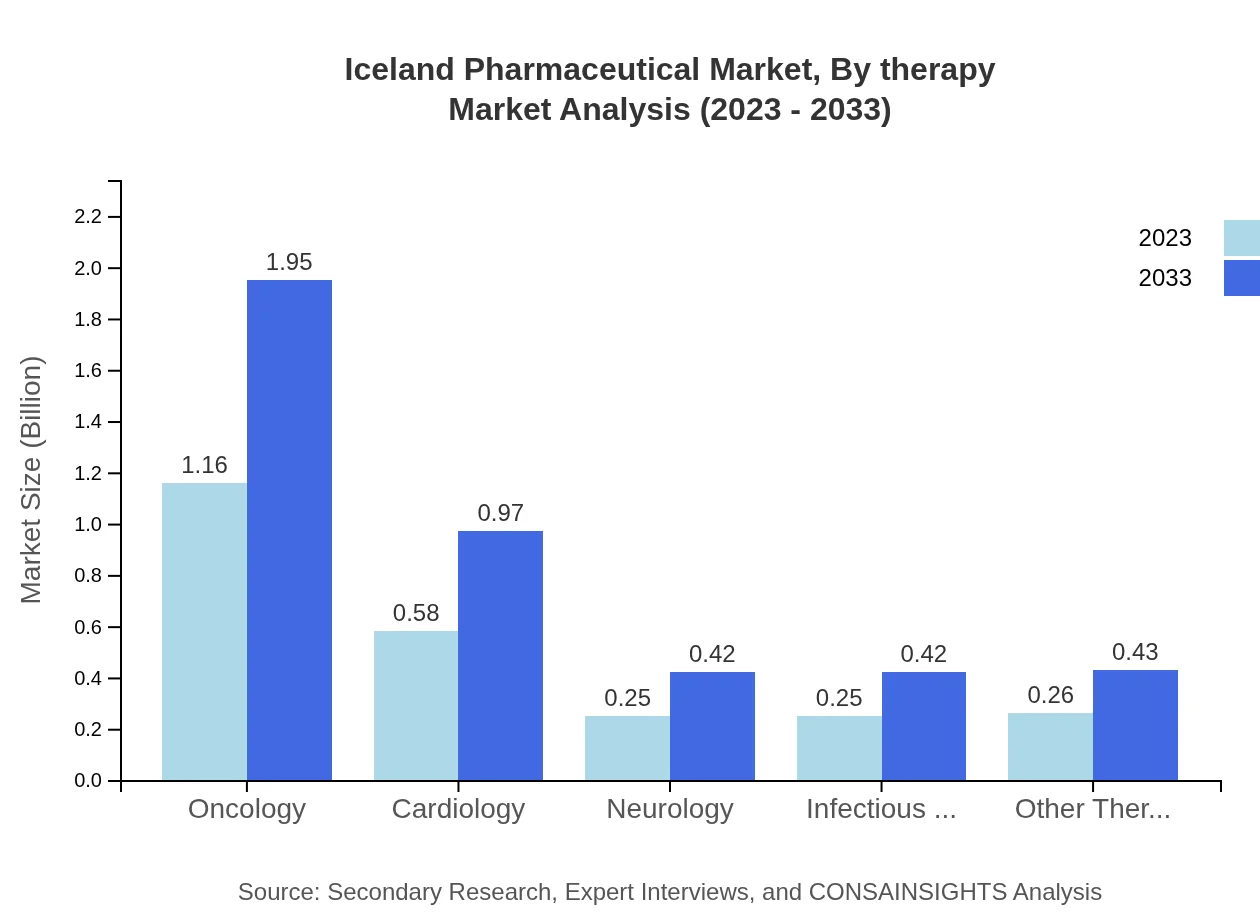

The oncology segment leads the therapeutic areas, with a market size projected to rise from $1.16 billion in 2023 to $1.95 billion by 2033. Cardiology, neurology, and infectious diseases are other significant segments, collectively enhancing the total market potential through specialized therapies and advancements.

Iceland Pharmaceutical Market Analysis By Distribution Channel

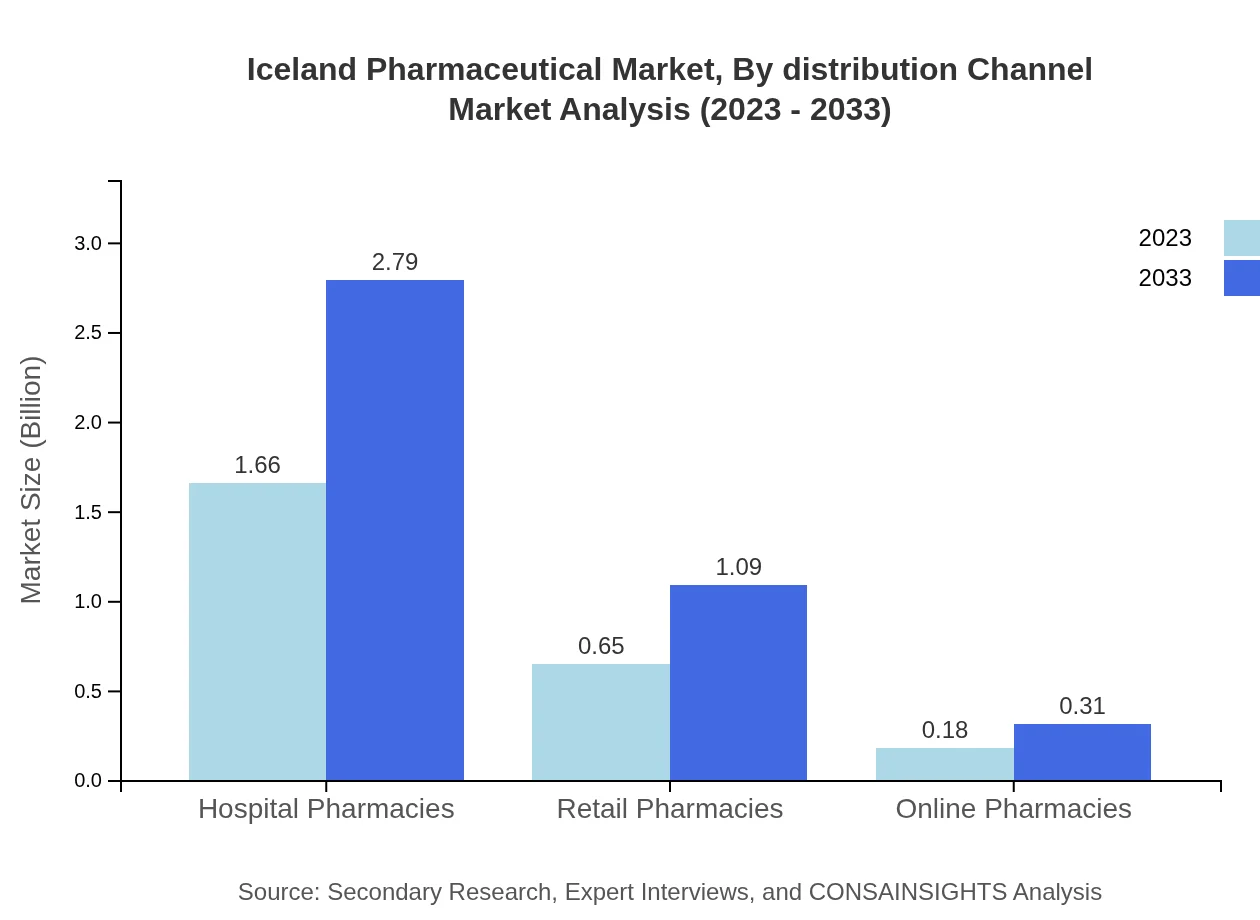

Hospital pharmacies dominate the distribution channel with a market share of 66.58% in 2023, which is projected to maintain its significance through to 2033. Retail pharmacies and online pharmacies will also see growth as consumer preferences shift towards more convenient access to medications.

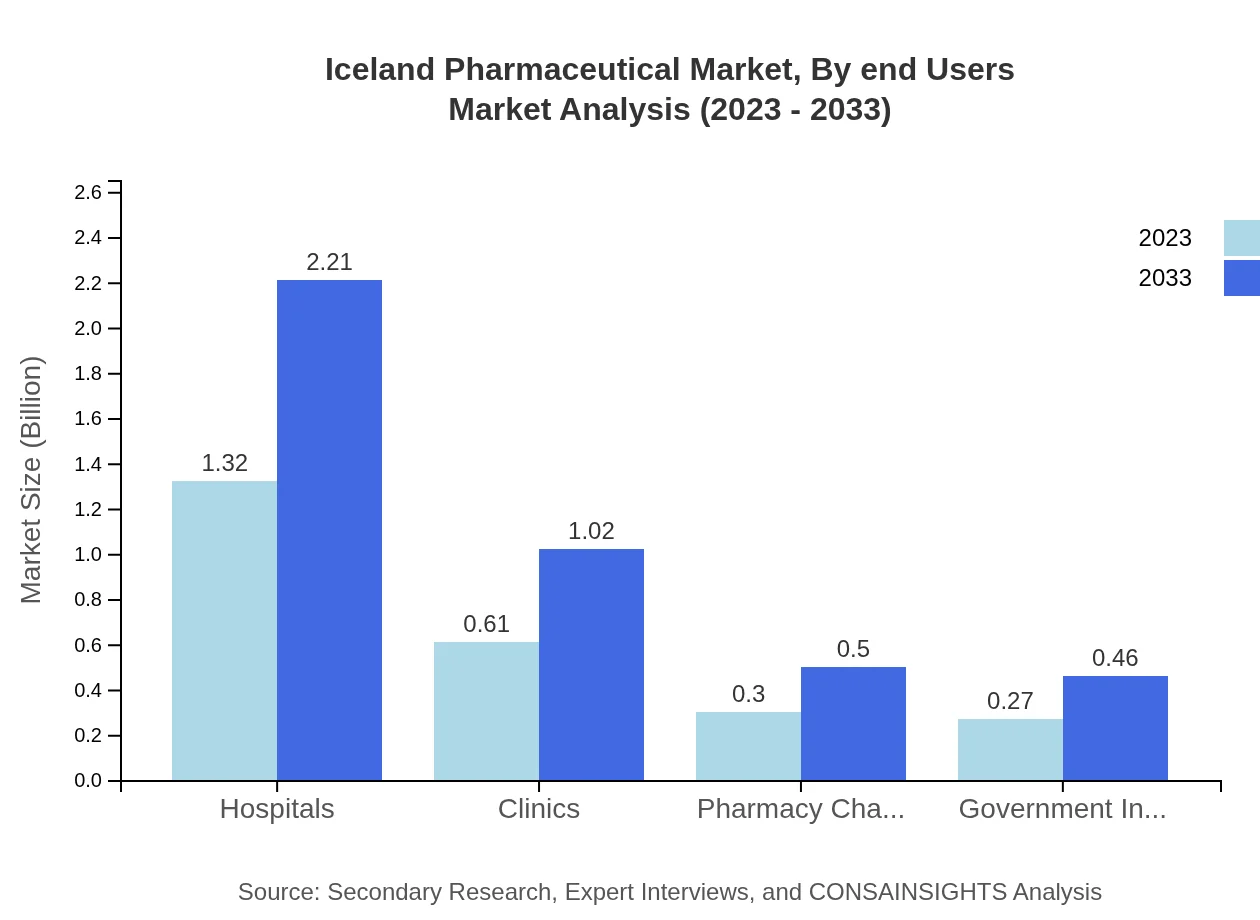

Iceland Pharmaceutical Market Analysis By End Users

In 2023, hospitals are the largest end-users of pharmaceutical products, accounting for approximately 52.64% market share. Clinics and pharmacies follow, indicating a diversified distribution of demand across various healthcare settings, which is crucial for ensuring that medications are accessible to the population.

Iceland Pharmaceutical Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Iceland Pharmaceutical Industry

Actavis:

A leading global pharmaceutical company headquartered in Iceland, Actavis specializes in generic and branded pharmaceuticals, making significant contributions to the Icelandic economy and healthcare sector.Alvotech:

Alvotech is a biopharmaceutical company committed to developing and manufacturing monoclonal antibodies and biosimilars, playing a vital role in elevating Iceland’s prominence in biotech.We're grateful to work with incredible clients.

FAQs

What is the market size of Iceland pharmaceutical?

The Iceland pharmaceutical market is valued at approximately $2.5 billion in 2023, with a CAGR of 5.2%. This growth reflects increasing healthcare demands and advances in drug development, indicating a promising future for the industry.

What are the key market players or companies in this Iceland pharmaceutical industry?

Key players in the Iceland pharmaceutical industry include major multinational corporations, local companies, and biotechnology firms. These companies work collaboratively to enhance pharmaceutical availability, focusing on innovative therapies and sustainable practices to meet market needs.

What are the primary factors driving the growth in the Iceland pharmaceutical industry?

Growth in the Iceland pharmaceutical industry is primarily driven by increasing healthcare expenditures, innovation in drug development, demographic changes, and a rise in chronic diseases. The government’s support for healthcare initiatives further accelerates market expansion.

Which region is the fastest Growing in the Iceland pharmaceutical market?

The North America region is the fastest-growing in the Iceland pharmaceutical market, projected to grow from $0.92 billion in 2023 to $1.55 billion by 2033. This growth is fueled by an increasing emphasis on healthcare accessibility and technology.

Does ConsaInsights provide customized market report data for the Iceland pharmaceutical industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the Iceland pharmaceutical industry. Clients can access detailed insights and analysis to support their strategic decision-making.

What deliverables can I expect from this Iceland pharmaceutical market research project?

Expected deliverables from the Iceland pharmaceutical market research project include comprehensive reports, market forecasts, segmented analysis, competitive landscape insights, and data visualization tools for strategic planning.

What are the market trends of Iceland pharmaceutical?

Current market trends in the Iceland pharmaceutical industry include a shift towards biologics, an increase in over-the-counter medications, and a focus on oncology and cardiology treatments, reflecting broader healthcare priorities and shifting consumer preferences.