Identification Friend Or Foe Systems Market Report

Published Date: 03 February 2026 | Report Code: identification-friend-or-foe-systems

Identification Friend Or Foe Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Identification Friend Or Foe (IFF) Systems market from 2023 to 2033, detailing market trends, forecasts, opportunities, and competitive landscape insights.

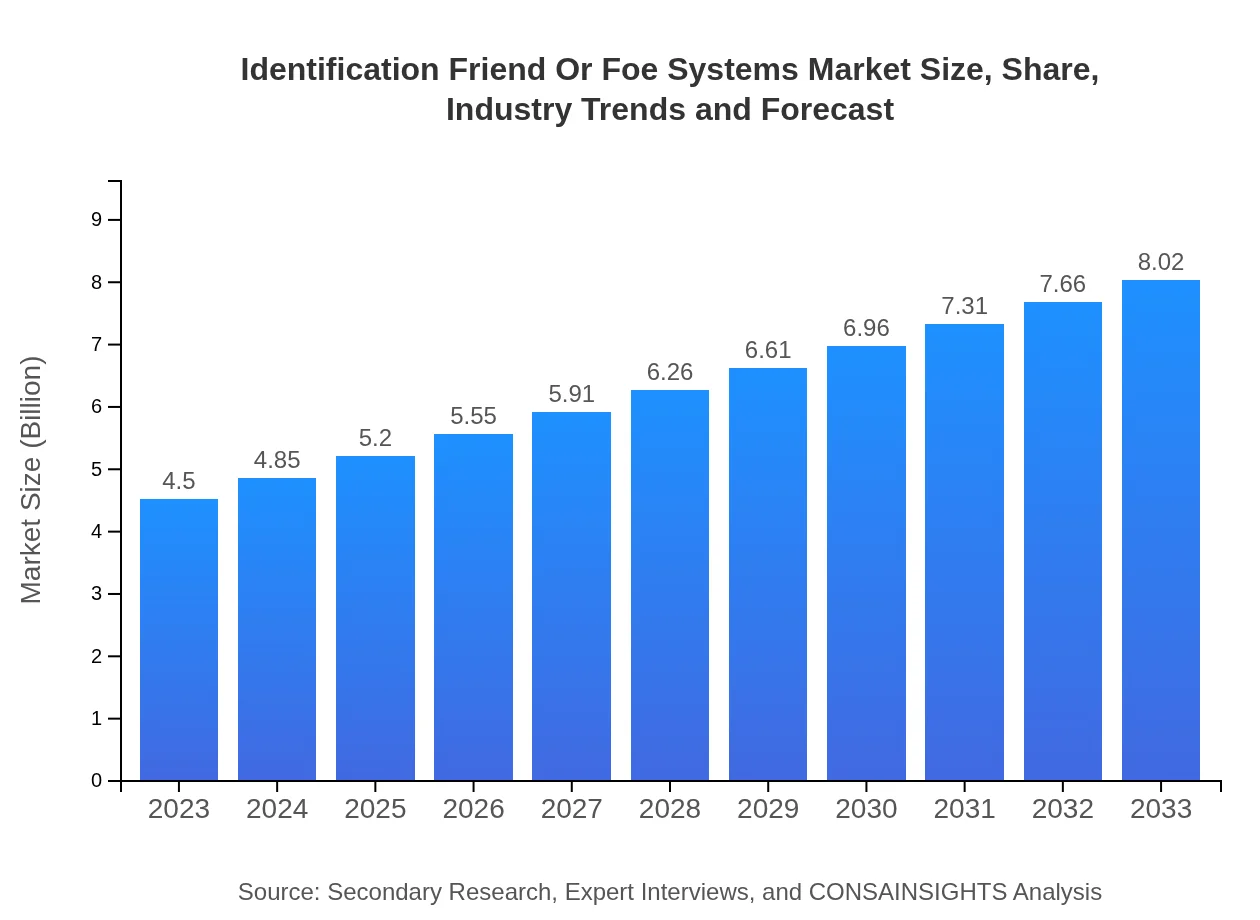

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $4.50 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $8.02 Billion |

| Top Companies | Thales Group, Northrop Grumman Corporation, Saab AB, Raytheon Technologies |

| Last Modified Date | 03 February 2026 |

Identification Friend Or Foe Systems Market Overview

Customize Identification Friend Or Foe Systems Market Report market research report

- ✔ Get in-depth analysis of Identification Friend Or Foe Systems market size, growth, and forecasts.

- ✔ Understand Identification Friend Or Foe Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Identification Friend Or Foe Systems

What is the Market Size & CAGR of Identification Friend Or Foe Systems market in 2023?

Identification Friend Or Foe Systems Industry Analysis

Identification Friend Or Foe Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Identification Friend Or Foe Systems Market Analysis Report by Region

Europe Identification Friend Or Foe Systems Market Report:

In Europe, the market size is $1.23 billion in 2023, expected to grow to $2.19 billion by 2033. The ongoing geopolitical tensions and NATO’s commitments to modernize their defense capabilities play a substantial role in driving the demand for IFF systems in this region.Asia Pacific Identification Friend Or Foe Systems Market Report:

In 2023, the IFF Systems market in the Asia Pacific region is valued at $0.94 billion and is expected to grow to $1.68 billion by 2033. This region is witnessing increased military spending from nations like India, China, and Japan, prompting a surge in the adoption of advanced defense technologies to enhance national security.North America Identification Friend Or Foe Systems Market Report:

North America, leading the global market with a value of $1.61 billion in 2023, is anticipated to grow to $2.87 billion by 2033. The U.S. defense budget significantly influences this market, with continuous investments in IFF technologies to ensure operational superiority and comprehensive security.South America Identification Friend Or Foe Systems Market Report:

The South America IFF Systems market was valued at $0.25 billion in 2023 and is projected to reach $0.45 billion by 2033. The growth in this region is largely driven by rising concerns over border security and the enhancement of local law enforcement agencies with advanced technologies.Middle East & Africa Identification Friend Or Foe Systems Market Report:

The IFF Systems market in the Middle East and Africa is valued at $0.46 billion in 2023, projected to reach $0.83 billion by 2033. Heightened security threats and conflicts have heightened focus on modern defense systems, supporting market growth in this region.Tell us your focus area and get a customized research report.

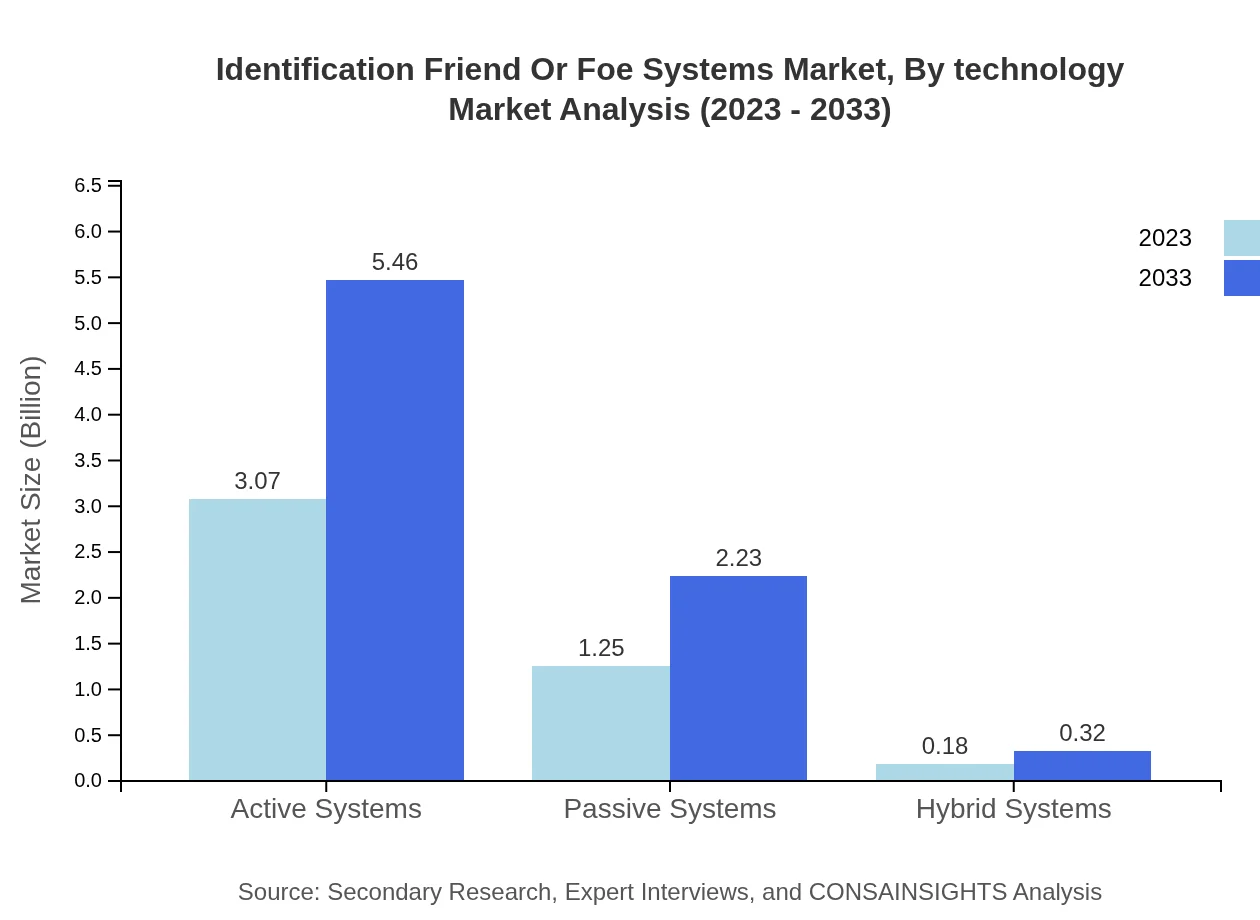

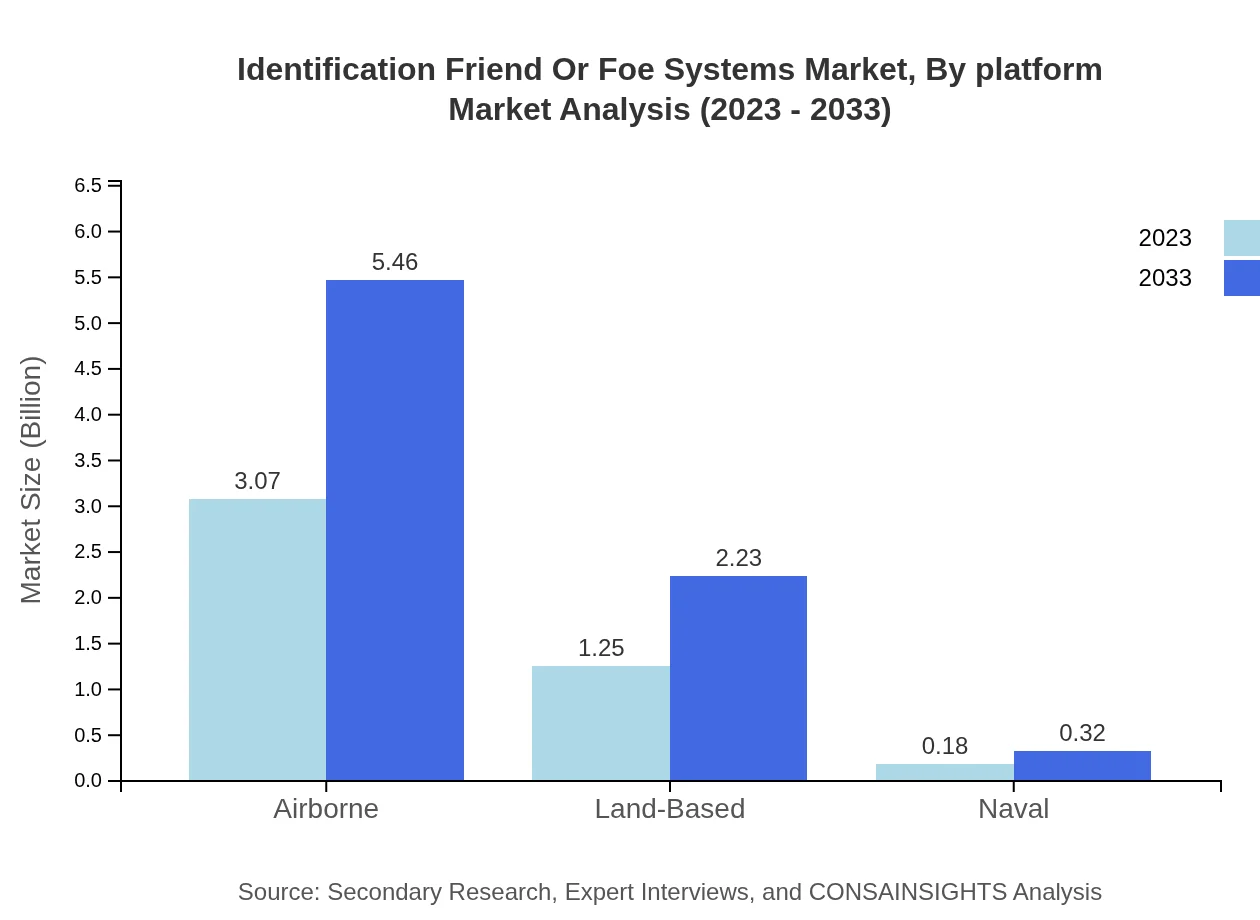

Identification Friend Or Foe Systems Market Analysis By Technology

The market is segmented by technology into Airborne, Land-Based, Naval, Active Systems, Passive Systems, and Hybrid Systems. Airborne systems dominate the segment, with a market size of $3.07 billion in 2023, expected to escalate to $5.46 billion by 2033, accounting for 68.13% market share. Land-based IFF systems follow, growing from $1.25 billion to $2.23 billion, which maintains a 27.87% share over the same period, while naval systems remain a smaller niche, increasing from $0.18 billion to $0.32 billion.

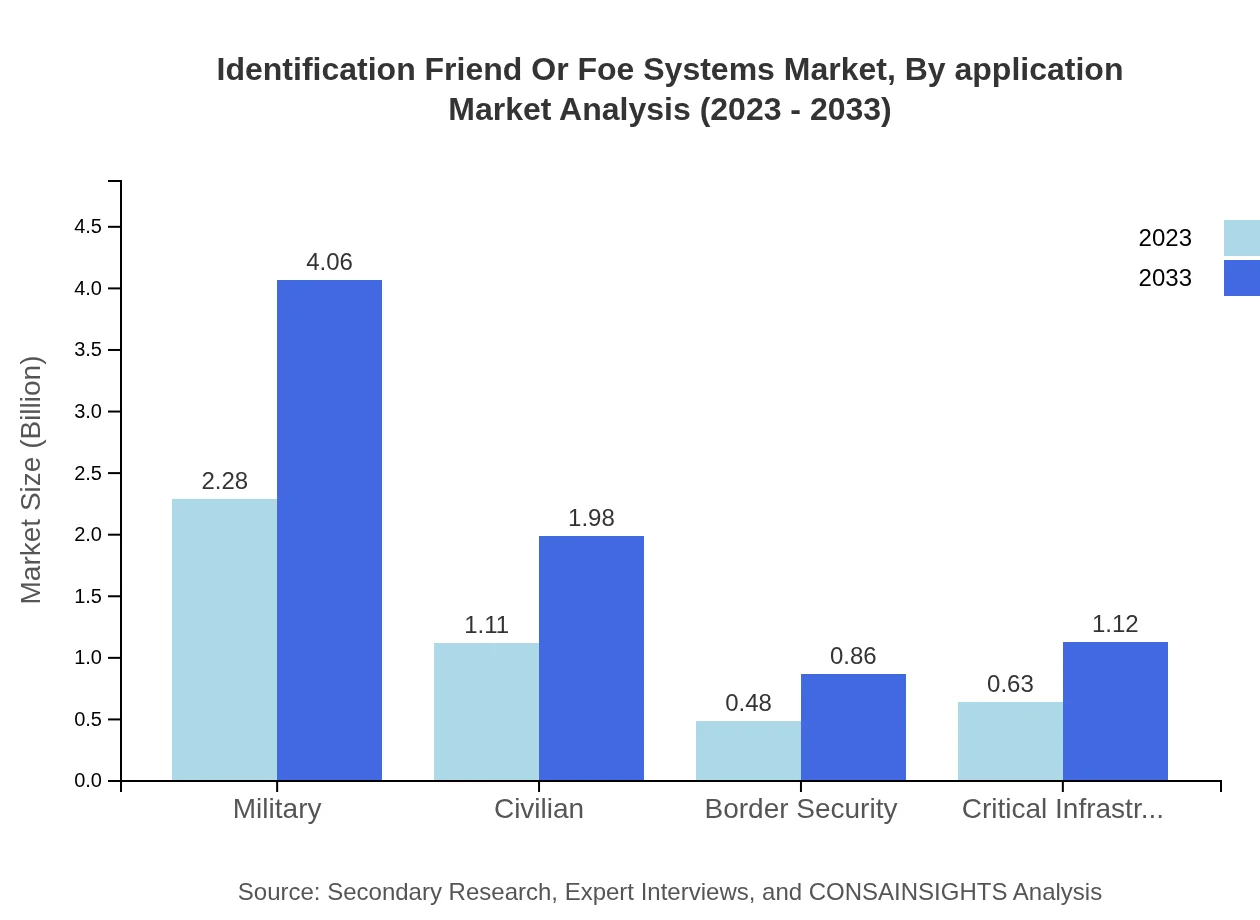

Identification Friend Or Foe Systems Market Analysis By Application

The application of IFF systems varies across sectors, including Military, Civilian, Border Security, and Critical Infrastructure. Military applications represent the largest segment, valued at $2.28 billion in 2023 and projected at $4.06 billion by 2033, holding approximately 50.67% market share. Civilian and border security applications also comprise significant portions of the market, valued at $1.11 billion and $0.48 billion respectively in 2023.

Identification Friend Or Foe Systems Market Analysis By Platform

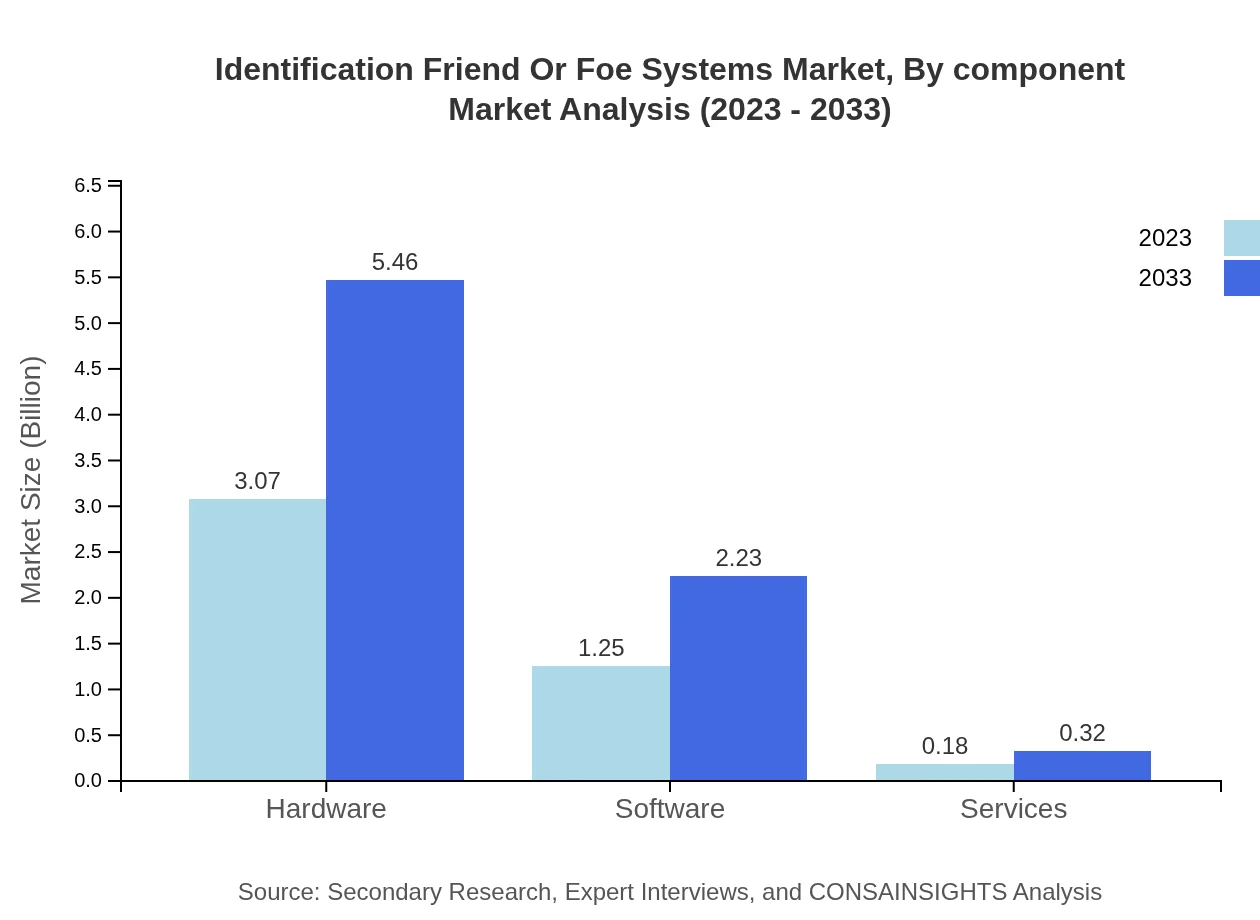

The platforms through which IFF systems operate include hardware, software, and services. Hardware remains the front-runner, valued at $3.07 billion with an expected reach of $5.46 billion by 2033, consistently accounting for 68.13% of the market share. Software and services contribute to the industry with firm growth as well, reflecting the increasing importance of cyber-security measures in modern defense.

Identification Friend Or Foe Systems Market Analysis By Component

The components involved in IFF systems include active systems and passive systems, with active systems anticipated to dominate the market. In 2023, active systems stood at $3.07 billion and will likely rise to $5.46 billion by 2033. Passive systems, while representing a smaller segment with $1.25 billion in 2023, will increase to $2.23 billion by 2033, indicating ongoing demand in both categories.

Identification Friend Or Foe Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Identification Friend Or Foe Systems Industry

Thales Group:

Thales is a leader in defense and aerospace technologies, including advanced IFF systems integrated into military platforms worldwide.Northrop Grumman Corporation:

Northrop Grumman provides innovative systems and solutions, excelling in IFF technology to enhance defense capabilities.Saab AB:

Saab develops advanced IFF systems for various military applications, focusing on integrating newer technologies for improved security.Raytheon Technologies:

A major player in defense technology, Raytheon provides comprehensive IFF solutions, critical for effective military operations.We're grateful to work with incredible clients.

FAQs

What is the market size of identification Friend Or Foe Systems?

The market size of Identification Friend or Foe Systems is projected to reach approximately $4.5 billion by 2033, growing at a CAGR of 5.8% from its current valuation.

What are the key market players or companies in this identification Friend Or Foe Systems industry?

Key players in the Identification Friend or Foe Systems industry include major defense contractors and technology firms specializing in military and security solutions. These companies are focused on innovating advanced identification systems.

What are the primary factors driving the growth in the identification Friend Or Foe Systems industry?

Factors driving growth include increasing defense budgets globally, advancements in technology, and rising security concerns leading to a demand for sophisticated identification systems.

Which region is the fastest Growing in the identification Friend Or Foe Systems?

The fastest-growing region for Identification Friend or Foe Systems is projected to be Europe, expanding from $1.23 billion in 2023 to $2.19 billion by 2033.

Does ConsaInsights provide customized market report data for the identification Friend Or Foe Systems industry?

Yes, ConsaInsights offers customized market reports tailored to client needs in the Identification Friend or Foe Systems industry, providing detailed insights and analytics.

What deliverables can I expect from this identification Friend Or Foe Systems market research project?

Deliverables include comprehensive market analysis, segment breakdowns, competitive landscape, regional insights, and actionable recommendations specifically for the Identification Friend or Foe Systems sector.

What are the market trends of identification Friend Or Foe Systems?

Current trends include a shift towards hybrid systems, increased military investments, and growing applications in civilian security and border control sectors.