Identity Verification Market Report

Published Date: 31 January 2026 | Report Code: identity-verification

Identity Verification Market Size, Share, Industry Trends and Forecast to 2033

This report presents a comprehensive analysis of the Identity Verification market, including insights into market trends, growth forecasts from 2023 to 2033, and key regional performances. It delves into market size, segmentation, technology advancements, and leading industry players.

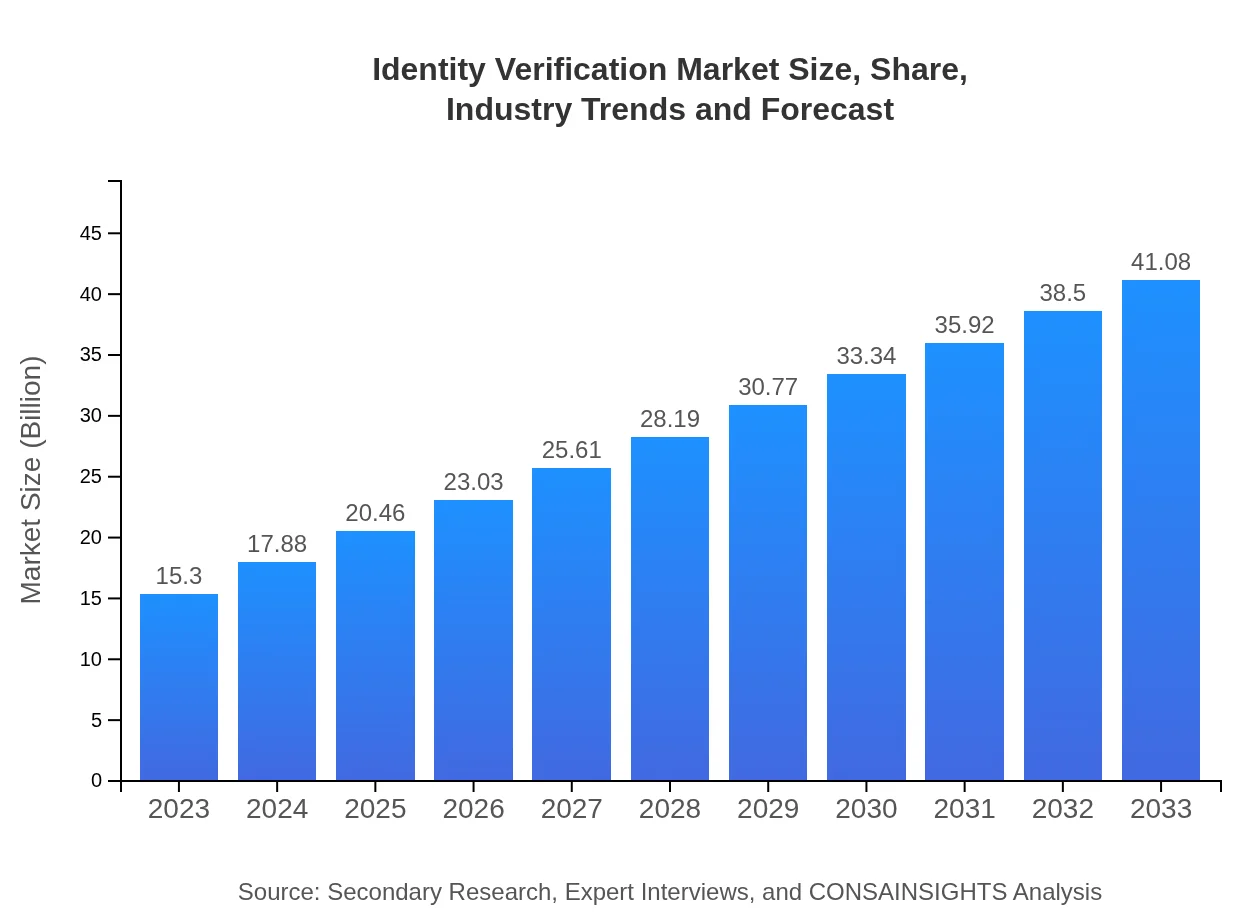

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.30 Billion |

| CAGR (2023-2033) | 10% |

| 2033 Market Size | $41.08 Billion |

| Top Companies | IDnow, Jumio, Experian, Trulioo |

| Last Modified Date | 31 January 2026 |

Identity Verification Market Overview

Customize Identity Verification Market Report market research report

- ✔ Get in-depth analysis of Identity Verification market size, growth, and forecasts.

- ✔ Understand Identity Verification's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Identity Verification

What is the Market Size & CAGR of Identity Verification market in 2023?

Identity Verification Industry Analysis

Identity Verification Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Identity Verification Market Analysis Report by Region

Europe Identity Verification Market Report:

Europe's Identity Verification market is predicted to expand significantly from $4.58 billion in 2023 to $12.30 billion by 2033. The growth is primarily driven by the EU's comprehensive regulations such as GDPR, mandating organizations to enhance their identity verification capabilities. Increasing online transactions and related security threats lead to a greater focus on identity verification solutions.Asia Pacific Identity Verification Market Report:

The Asia Pacific region holds a significant share in the Identity Verification market, anticipated to grow from $2.82 billion in 2023 to $7.57 billion by 2033. Key factors driving this growth include the expanding digital economy, increasing internet access, and heightened security concerns among consumers and enterprises. Rapid urbanization and the growth of e-commerce in countries like China and India further underscore the demand for identity verification solutions.North America Identity Verification Market Report:

North America is expected to dominate the Identity Verification market, with market size increasing from $5.77 billion in 2023 to $15.49 billion in 2033. This region benefits from a robust technological infrastructure, early adoption of digital identity solutions, and stringent regulations around data security. Major players leveraging advanced technologies and investing in innovative solutions impact growth positively.South America Identity Verification Market Report:

In South America, the Identity Verification market is projected to rise from $0.92 billion in 2023 to $2.47 billion by 2033. This growth is supported by governments implementing strict identification processes for financial transactions and increasing cybercrime awareness among businesses. Emerging technology adoption and rising investment in secure payment solutions also contribute to market expansion.Middle East & Africa Identity Verification Market Report:

The Middle East and Africa region will see a steady growth in the Identity Verification market from $1.21 billion in 2023 to $3.24 billion by 2033. This growth is attributed to increased adoption of digital solutions by financial institutions and government agencies, alongside improving technological capabilities. The growing need for compliance with international standards further fuels this expansion.Tell us your focus area and get a customized research report.

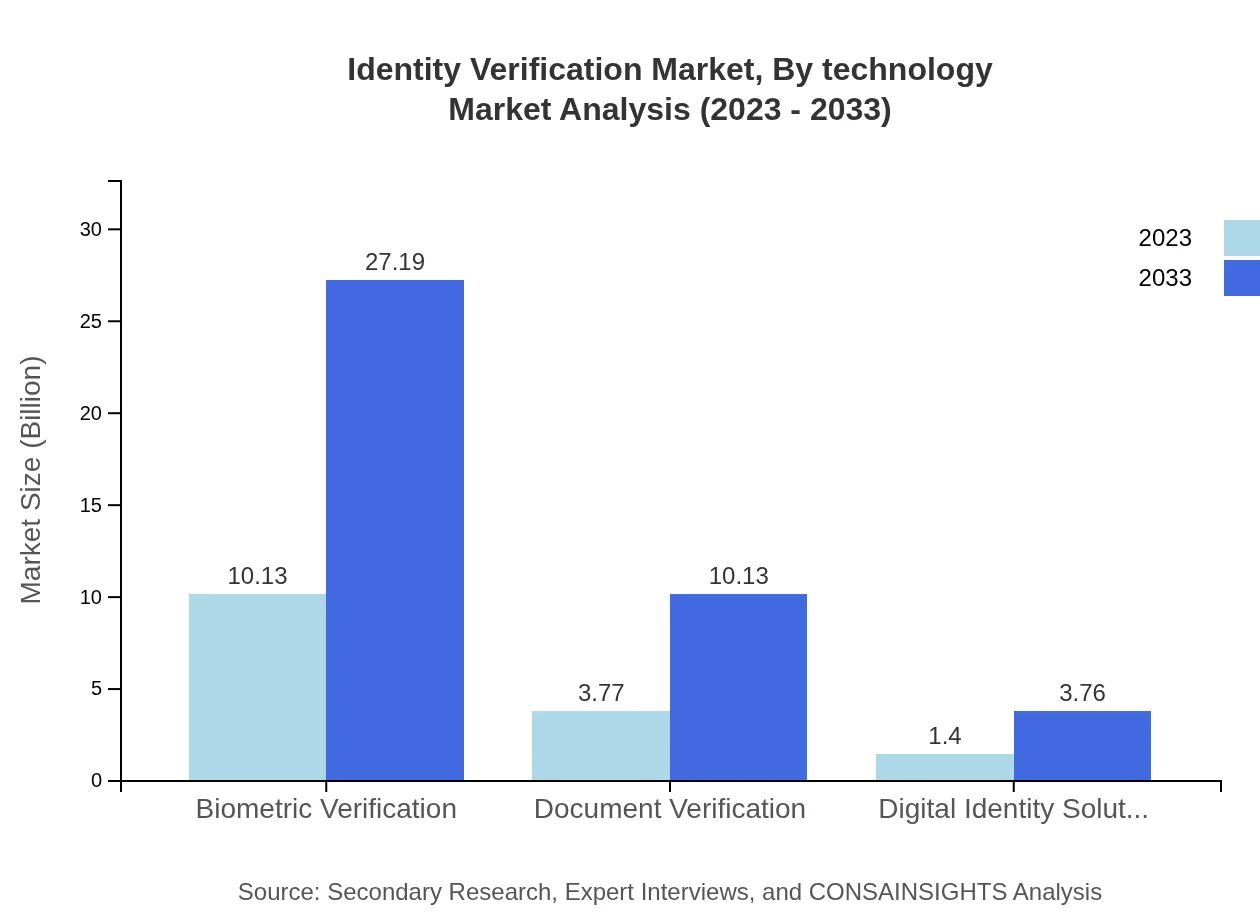

Identity Verification Market Analysis By Technology

The technology segment of the Identity Verification market includes biometric verification, document verification, digital identity solutions, and identity as a service (IDaaS). In 2023, biometric verification leads the market with a size of $10.13 billion, expected to grow to $27.19 billion by 2033, holding a 66.2% market share. Document verification follows with a market size of $3.77 billion, projected to reach $10.13 billion by 2033, representing a 24.65% share.

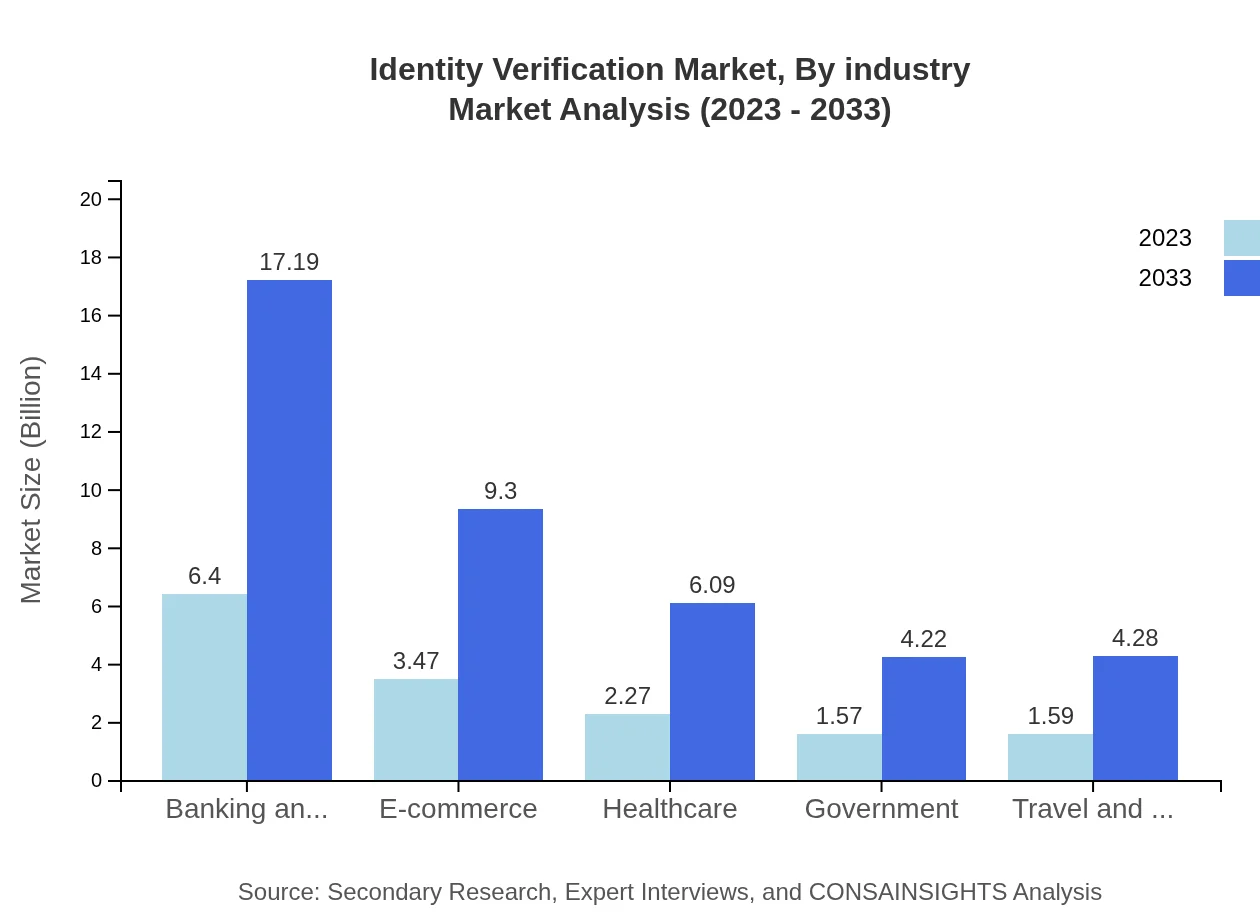

Identity Verification Market Analysis By Industry

The market is segmented by industry applications, with banking and financial services leading at a size of $6.40 billion in 2023, anticipated to reach $17.19 billion by 2033, maintaining 41.84% of the market share. E-commerce and healthcare also show significant growth, with sizes of $3.47 billion and $2.27 billion in 2023, respectively, both expected to rise over the forecast period.

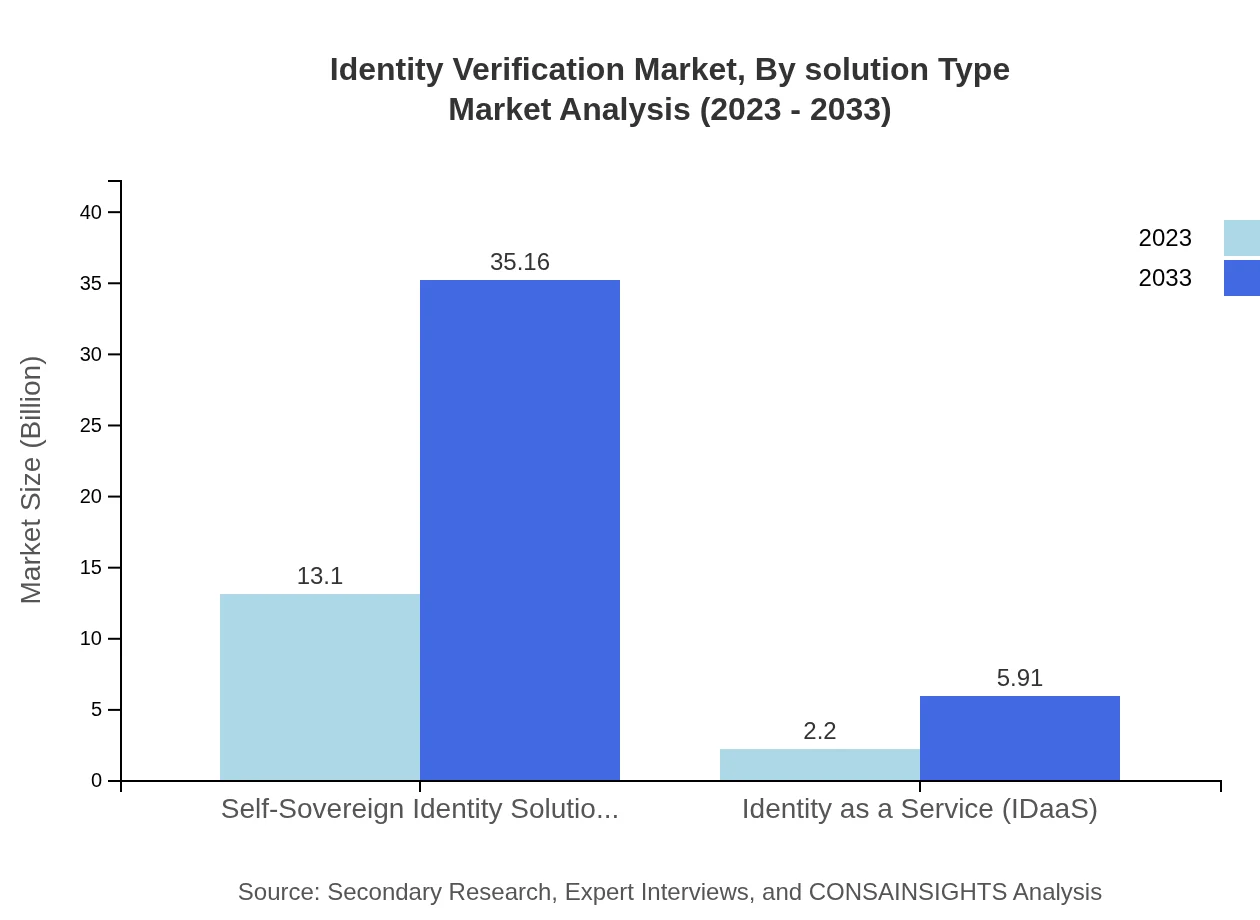

Identity Verification Market Analysis By Solution Type

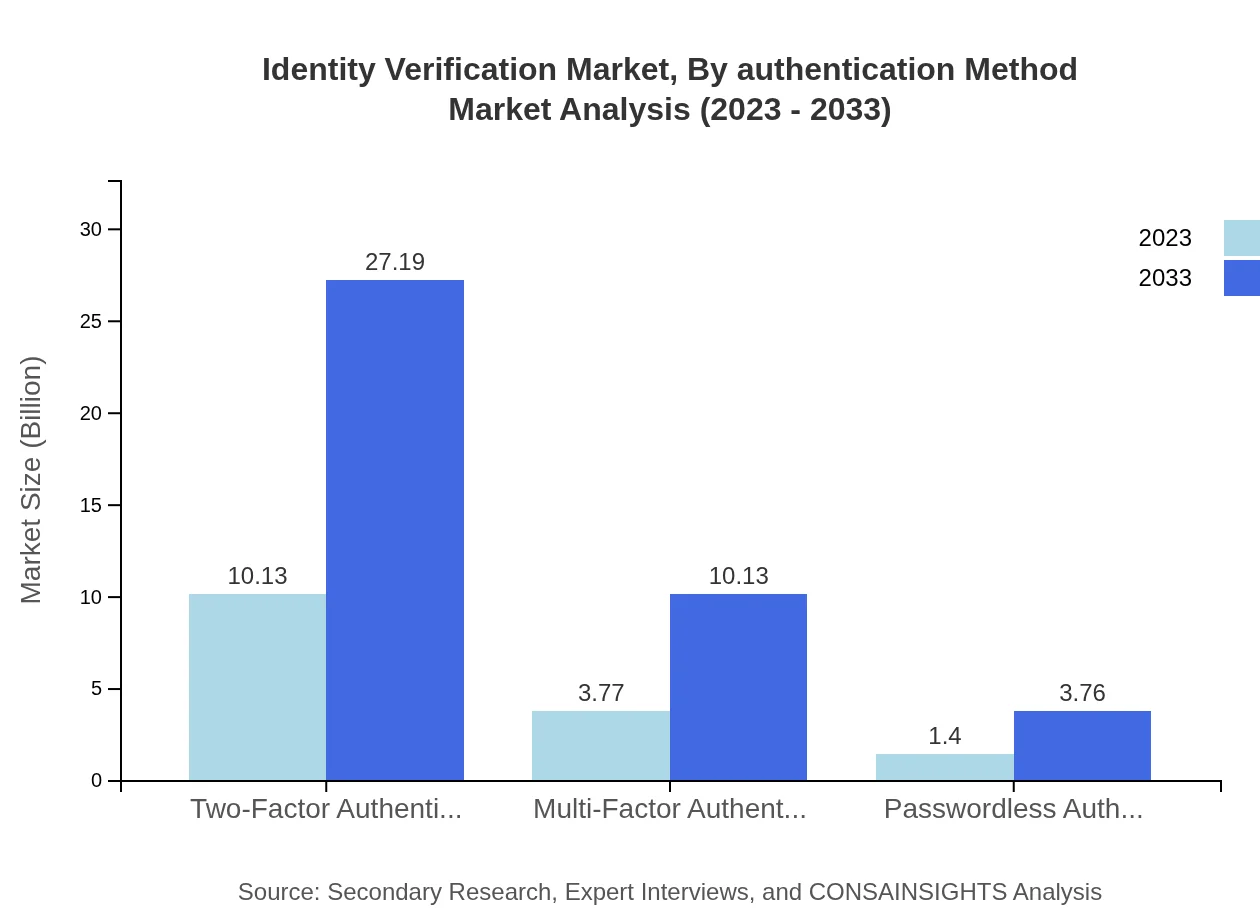

Key solution types in the Identity Verification market include two-factor authentication, multi-factor authentication, and passwordless authentication. Two-factor authentication is valued at $10.13 billion in 2023, expected to reach $27.19 billion by 2033, representing a 66.2% share. In comparison, multi-factor authentication stands at $3.77 billion with a similar forecasted growth trajectory.

Identity Verification Market Analysis By Authentication Method

This segment focuses on authentication methodologies employed in identity verification, including biometric and document verification. Biometric verification accounts for a major share, leading the industry at $10.13 billion in 2023, signaling robust growth in response to increased security needs across sectors. Document verification also plays a crucial role in regulatory compliance, enhancing overall market credibility.

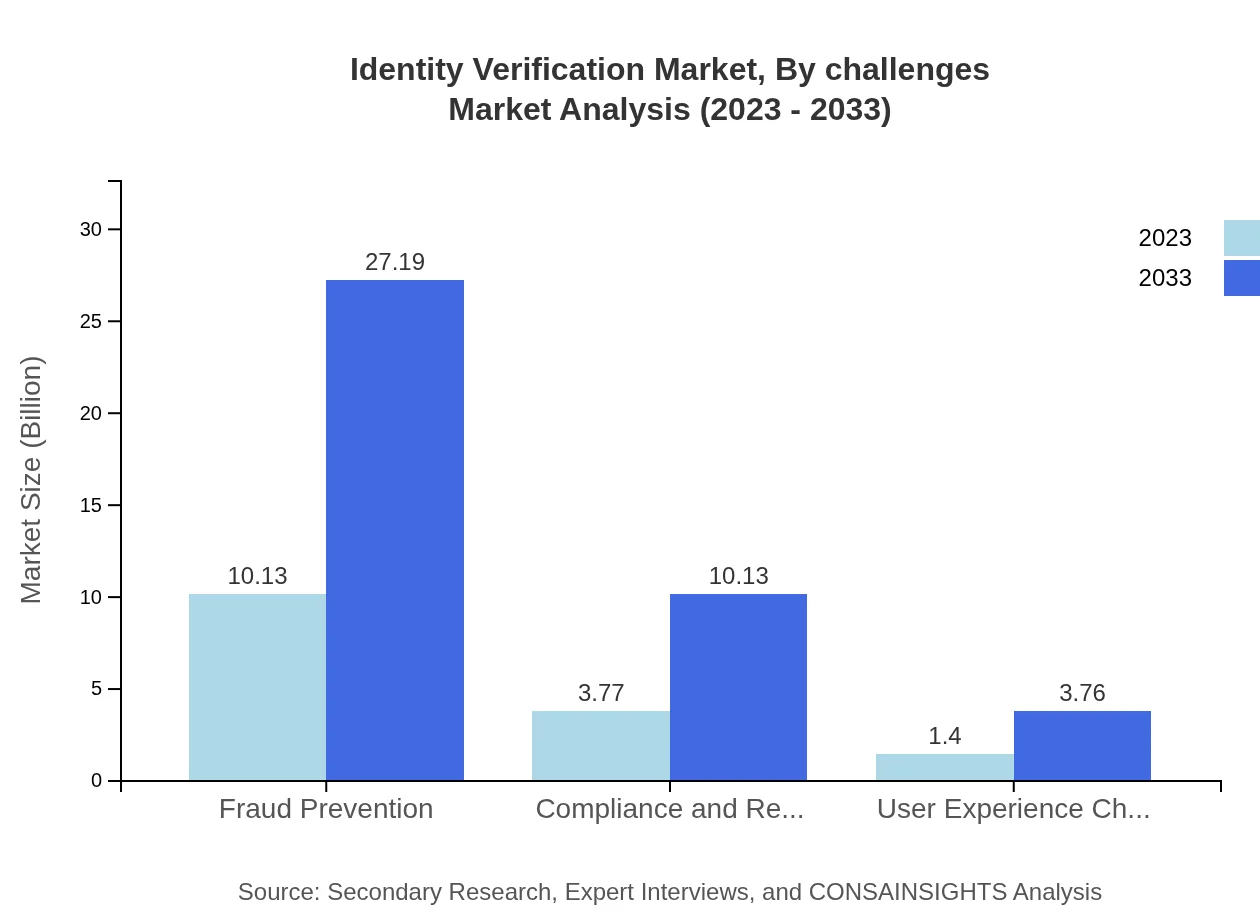

Identity Verification Market Analysis By Challenges

Challenges faced in the Identity Verification market include user experience hurdles, concerns over data privacy, and evolving regulatory frameworks. While companies innovate in technology, striking a balance between stringent security measures and maintaining user-friendly experiences remains a key market challenge.

Identity Verification Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Identity Verification Industry

IDnow:

IDnow specializes in identity verification solutions, providing services primarily focused on video identification and eIDAS compliant solutions for digital services. Their focus on innovation and regulatory compliance has positioned them as a market leader.Jumio:

Jumio provides AI-powered identity verification services with sophisticated fraud detection capabilities. Their solutions are widely used in financial services, e-commerce, and online travel, emphasizing user experience and security.Experian:

Experian offers a comprehensive range of identity verification and fraud prevention services designed to help organizations identify and manage risk. Their extensive data resources and analytic capabilities support robust identity validation.Trulioo:

Trulioo delivers global identity verification solutions with access to hundreds of data sources for real-time verification across various regions. Their multi-county and multi-platform identity verification services cater to businesses of all sizes.We're grateful to work with incredible clients.

FAQs

What is the market size of identity Verification?

The identity verification market is valued at approximately $15.3 billion in 2023, with a notable CAGR of 10% projected through 2033 as increased security demands drive growth.

What are the key market players or companies in the identity Verification industry?

Leading companies in the identity verification market include major players across technology and financial sectors that specialize in biometric solutions, digital identity management, and compliance tools, driving innovation and competitive growth.

What are the primary factors driving the growth in the identity verification industry?

Key growth drivers include the rise of digital transactions, increasing concerns about security breaches and identity theft, regulatory compliance needs, and advancements in biometric technologies, enhancing user satisfaction.

Which region is the fastest Growing in the identity verification market?

North America is emerging as the fastest-growing region, with its market expected to expand from $5.77 billion in 2023 to $15.49 billion by 2033, driven by strong technological adoption and security needs.

Does ConsaInsights provide customized market report data for the identity verification industry?

Yes, ConsaInsights offers customized market report data tailored to the identity verification industry, providing in-depth insights and analysis that cater to specific business needs and market dynamics.

What deliverables can I expect from this identity verification market research project?

Deliverables from this market research project typically include comprehensive market analysis reports, segmentation data, competitive landscape assessments, and forecasts to support strategic decision-making.

What are the market trends of identity verification?

Current trends include the increasing adoption of biometric verification technologies, the rise of identity as a service (IDaaS), and a growing emphasis on privacy-centric solutions, reflecting evolving consumer demands and regulatory pressures.