Igbt And Thyristor Market Report

Published Date: 31 January 2026 | Report Code: igbt-and-thyristor

Igbt And Thyristor Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the IGBT and Thyristor market from 2023 to 2033, including market trends, segmentation, regional insights, and detailed forecasts. Key data and insights are presented to guide industry stakeholders in decision-making.

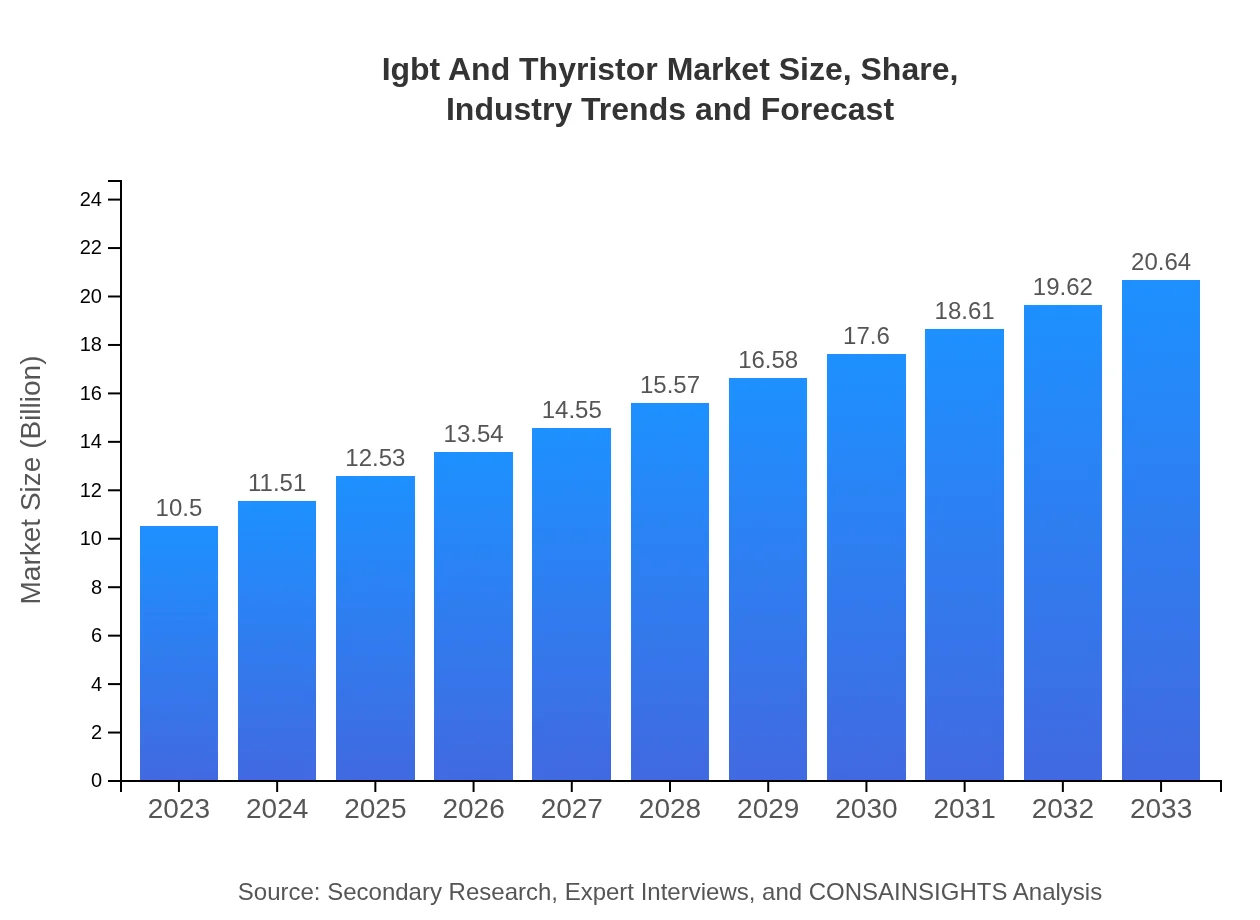

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $20.64 Billion |

| Top Companies | Infineon Technologies, Mitsubishi Electric Corporation, StMicroelectronics, Texas Instruments, ON Semiconductor |

| Last Modified Date | 31 January 2026 |

Igbt And Thyristor Market Overview

Customize Igbt And Thyristor Market Report market research report

- ✔ Get in-depth analysis of Igbt And Thyristor market size, growth, and forecasts.

- ✔ Understand Igbt And Thyristor's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Igbt And Thyristor

What is the Market Size & CAGR of Igbt And Thyristor market in 2023?

Igbt And Thyristor Industry Analysis

Igbt And Thyristor Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Igbt And Thyristor Market Analysis Report by Region

Europe Igbt And Thyristor Market Report:

Europe’s IGBT and Thyristor market was valued at USD 3.41 billion in 2023, with an expected growth to USD 6.69 billion by 2033. The region is leading in the adoption of renewable energy and electrification technologies, with strict regulations pushing for cleaner energy solutions driving the market growth.Asia Pacific Igbt And Thyristor Market Report:

In 2023, the Asia Pacific market was valued at USD 1.80 billion and is projected to grow to USD 3.54 billion by 2033. The region benefits from robust manufacturing and industrial sectors, particularly in countries like China and India, where the demand for renewable energy technologies is rapidly increasing. Advances in automotive applications, particularly electric vehicles, further contribute to market growth.North America Igbt And Thyristor Market Report:

In North America, the market size was USD 3.82 billion in 2023 and is expected to grow to USD 7.51 billion by 2033. The region is characterized by advanced technological infrastructure, with significant investments in smart grid solutions and electric vehicle production contributing to the market's robust growth.South America Igbt And Thyristor Market Report:

The South American market for IGBTs and Thyristors was valued at USD 0.25 billion in 2023, with projections of reaching USD 0.50 billion by 2033. While the market is smaller than other regions, growing investments in renewable energy and electrification projects present opportunities for expansion.Middle East & Africa Igbt And Thyristor Market Report:

The Middle East and Africa market was valued at USD 1.22 billion in 2023, with future projections indicating growth to USD 2.40 billion by 2033. Investments in energy infrastructure and increasing demands for industrial automation solutions are influencing growth in these regions.Tell us your focus area and get a customized research report.

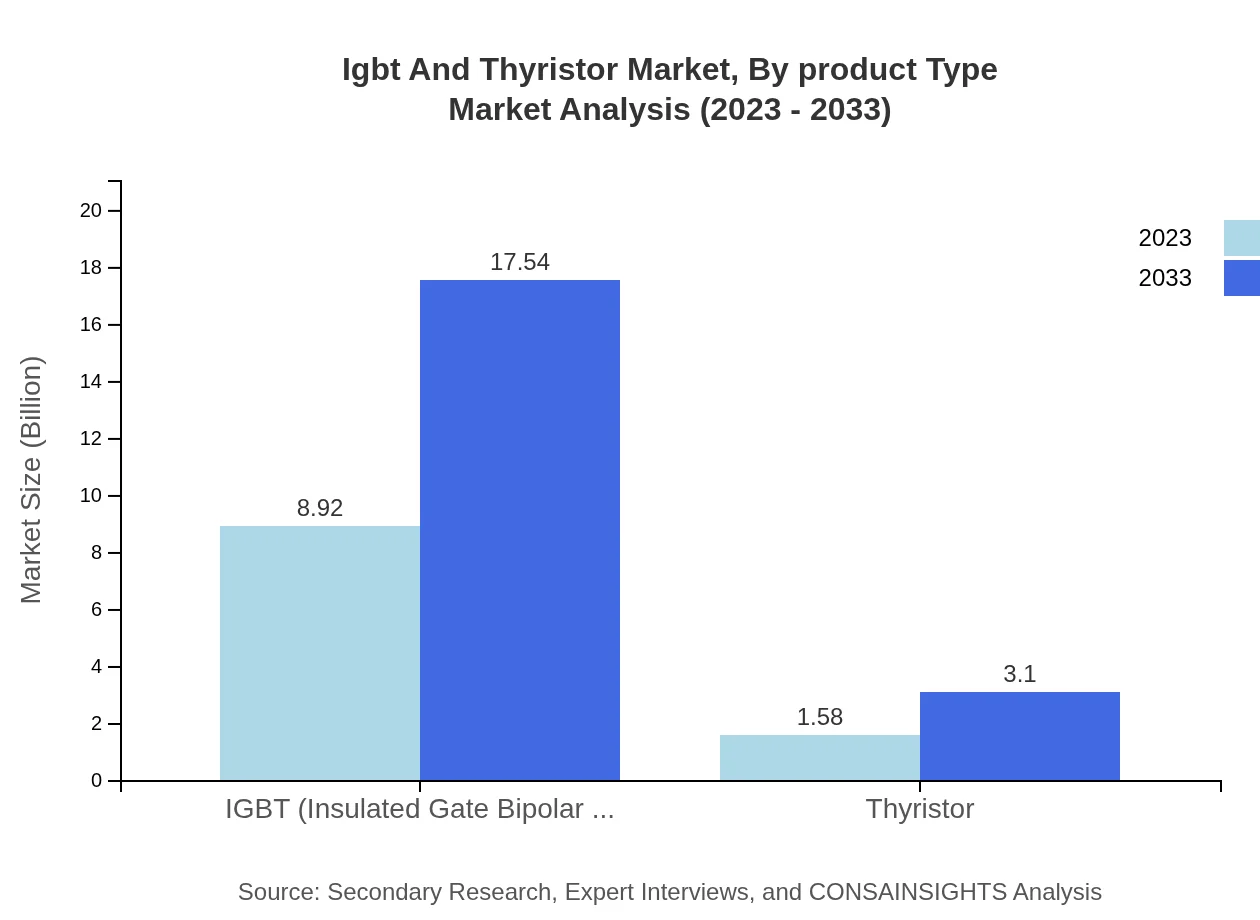

Igbt And Thyristor Market Analysis By Product Type

In the product type segment, IGBTs constitute the largest share, valued at USD 8.92 billion in 2023, expected to grow to USD 17.54 billion by 2033. Thyristors hold a smaller segment but are critical in specific applications, projected to grow from USD 1.58 billion to USD 3.10 billion during the same period.

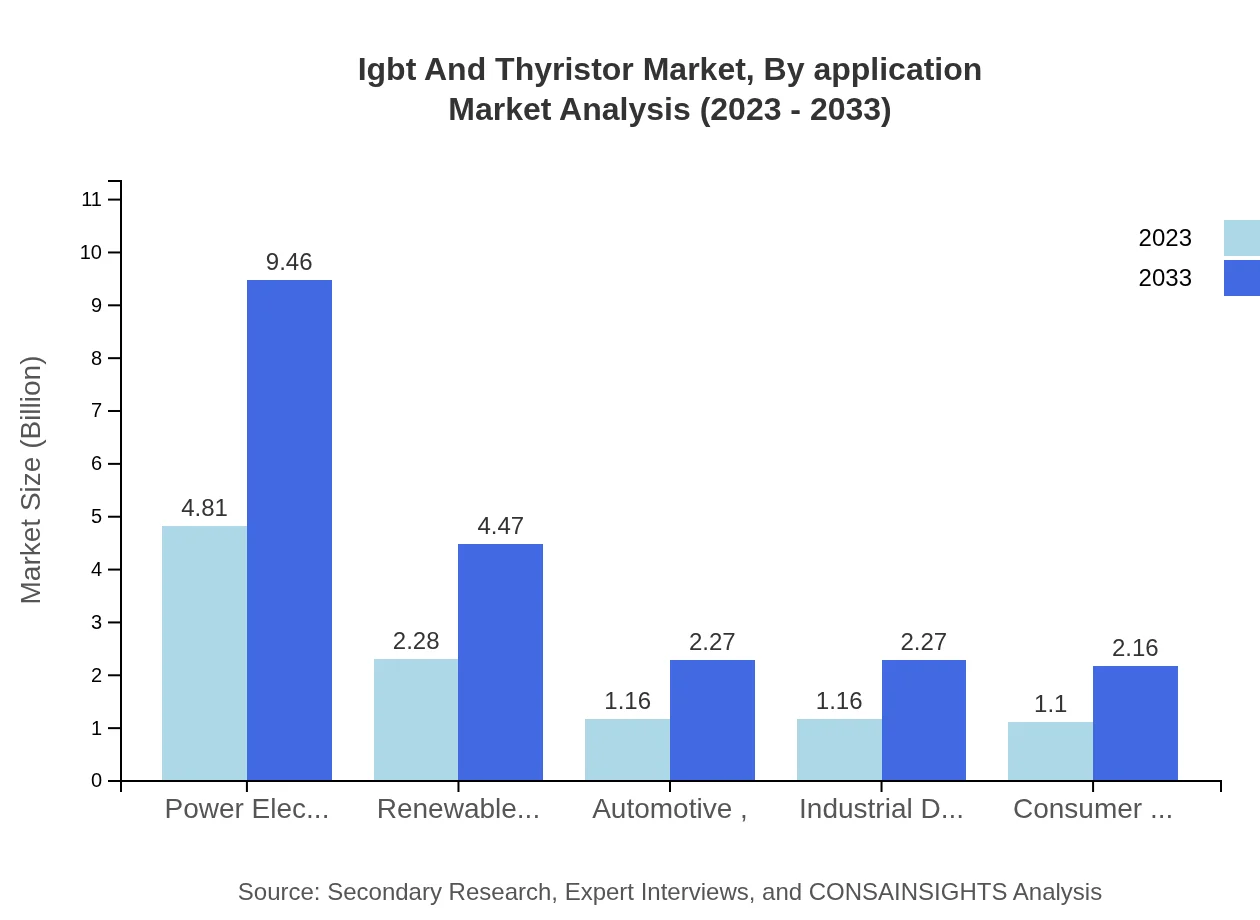

Igbt And Thyristor Market Analysis By Application

The market is largely driven by energy and power applications, accounting for USD 4.81 billion in 2023, while also showing robust growth in transportation (USD 2.28 billion) and telecommunications (USD 1.16 billion). Each segment is projected to grow significantly as industries continue to adopt semiconductor technologies.

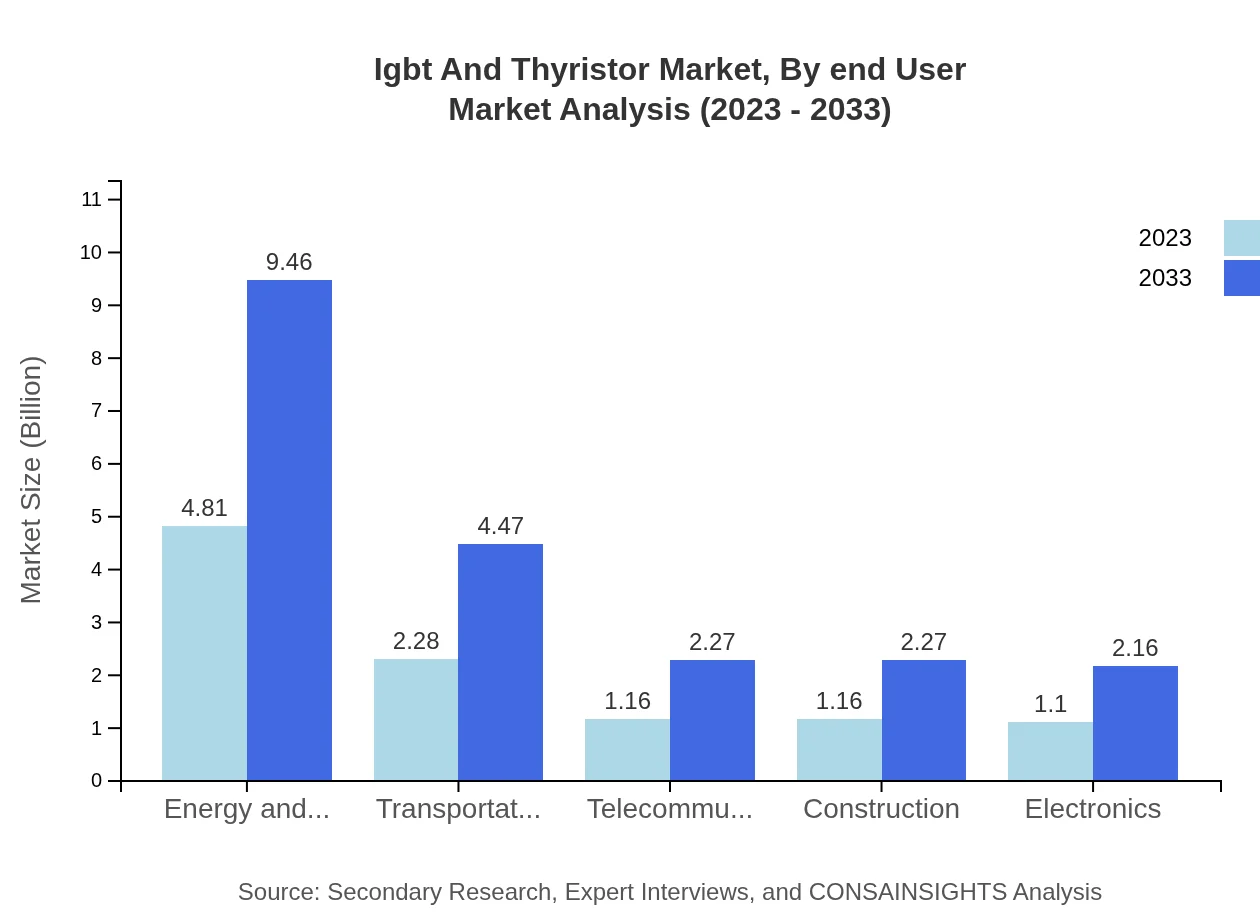

Igbt And Thyristor Market Analysis By End User

Key end-users of IGBTs and Thyristors include automotive, renewable energy, industrial, and electronics sectors. The automotive sector, particularly in electric vehicles, and the industrial sector with automation solutions, are among the fastest-growing areas influencing the market dynamics.

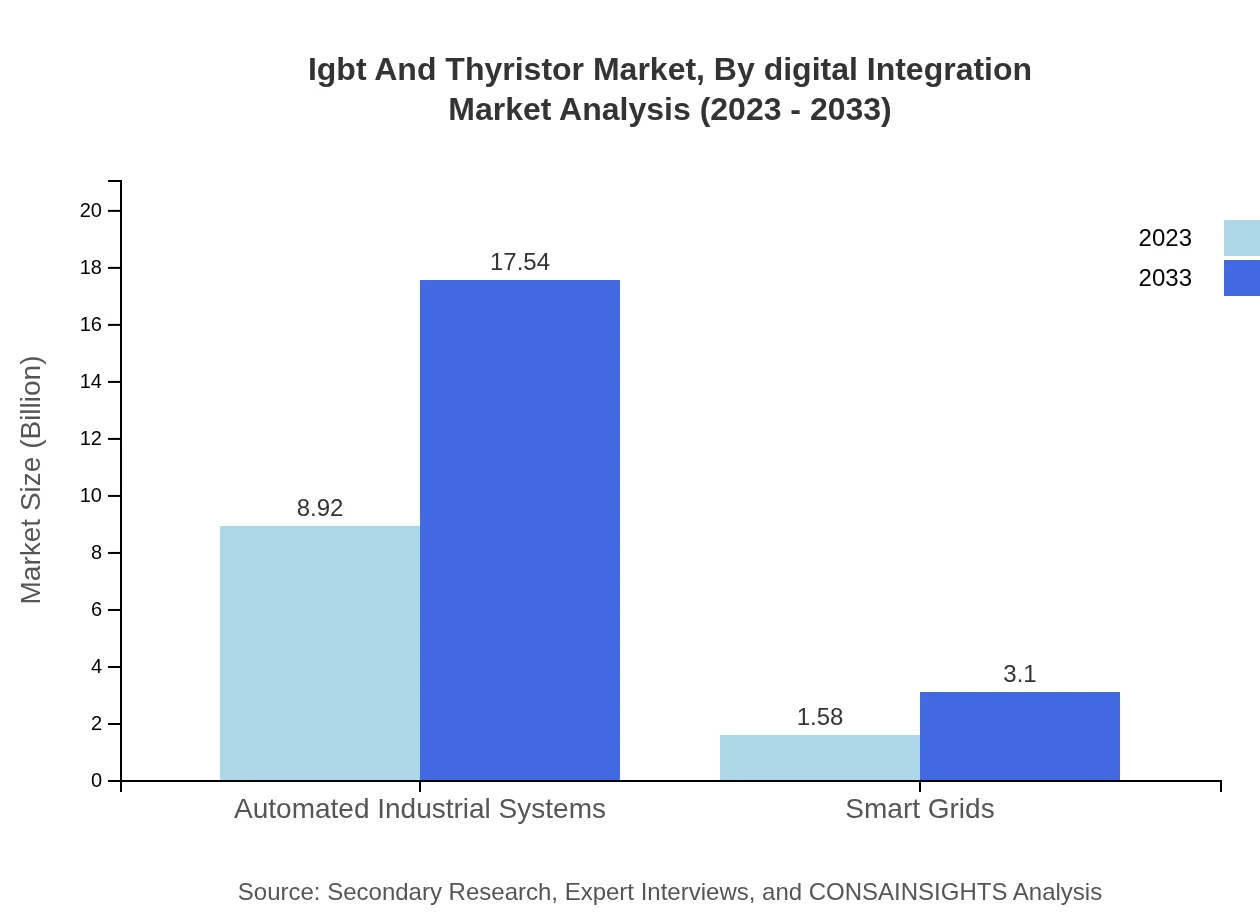

Igbt And Thyristor Market Analysis By Digital Integration

Digital integration in the IGBT and Thyristor market involves the incorporation of smart technologies for improved efficiency and performance. As industries increasingly adopt digital solutions, the demand for more integrated and intelligent power electronics continues to grow.

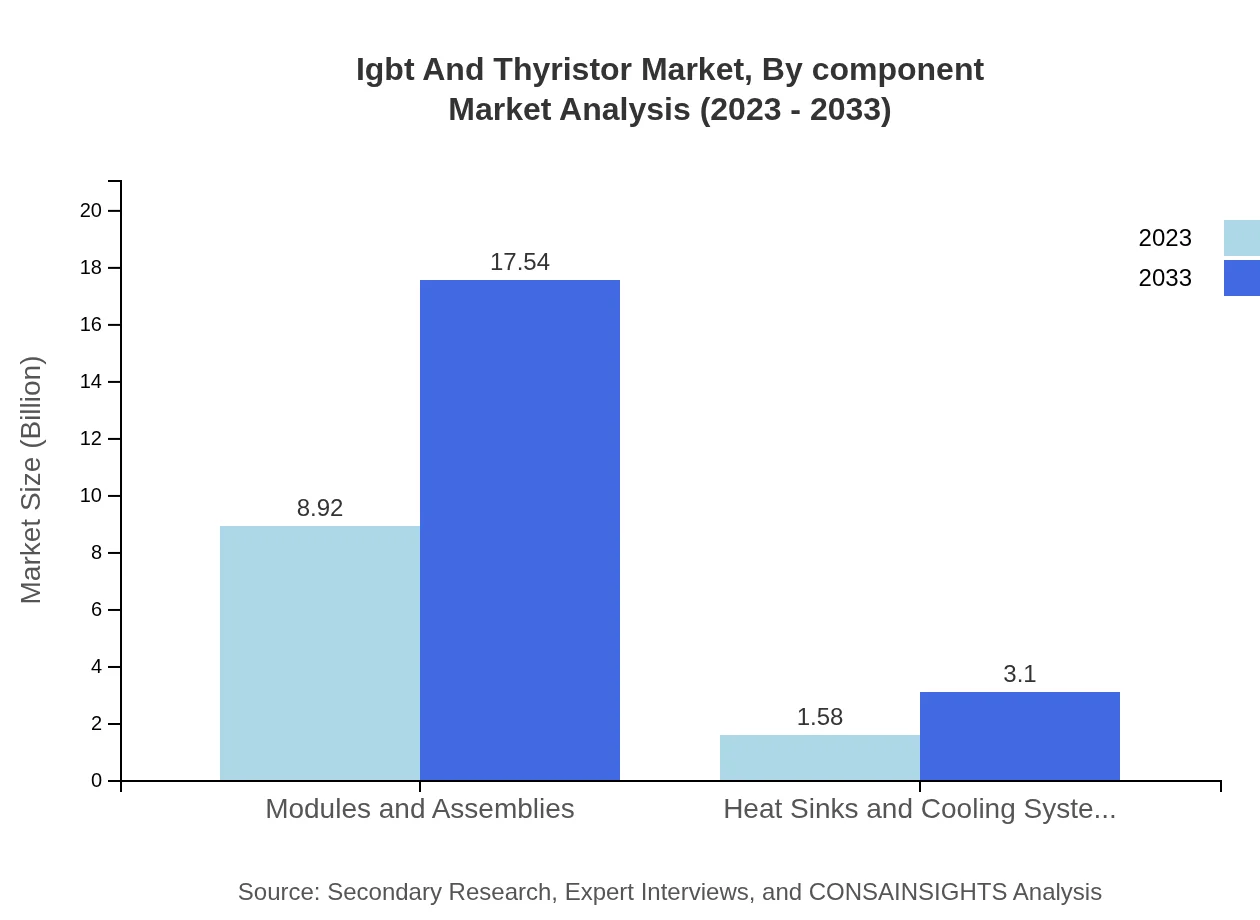

Igbt And Thyristor Market Analysis By Component

Components including modules and assemblies are crucial to the performance and application of IGBTs and Thyristors. The growth in demand for these components is driven by advancements in technology and the push for energy-efficient solutions across multiple industries.

Igbt And Thyristor Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Igbt And Thyristor Industry

Infineon Technologies:

A leading semiconductor manufacturer specializing in power semiconductors including IGBTs and Thyristors, known for its innovation and high-performance products.Mitsubishi Electric Corporation:

A key player in the power electronics industry, Mitsubishi Electric provides a wide range of IGBT and Thyristor solutions enhancing energy efficiency in various applications.StMicroelectronics:

Known for its advanced semiconductor solutions, StMicroelectronics focuses on the renewable energy sector with its line of IGBTs and Thyristors designed for high efficiency.Texas Instruments:

A prominent player in the global semiconductor market, Texas Instruments specializes in developing high-performance IGBT and Thyristor technologies for diverse applications.ON Semiconductor:

Offers a comprehensive range of power management solutions including IGBTs and Thyristors, focusing on applications across automotive, industrial, and consumer electronics.We're grateful to work with incredible clients.

FAQs

What is the market size of IGBT and Thyristor?

The IGBT and Thyristor market is currently valued at approximately $10.5 billion, with a projected compound annual growth rate (CAGR) of 6.8%. This signifies robust growth prospects within the industry, driven by rising demand in various applications.

What are the key market players or companies in the IGBT and Thyristor industry?

Key players in the IGBT and Thyristor industry include major semiconductor manufacturers, power electronics companies, and technology innovators. Industry leaders focus on product development and expanding their market share globally, thus influencing market dynamics significantly.

What are the primary factors driving the growth in the IGBT and Thyristor industry?

Growth in the IGBT and Thyristor industry is primarily driven by increasing adoption of renewable energy solutions, advancements in electric vehicles, and rising demand for efficient power electronics across various sectors such as automotive and industrial automation.

Which region is the fastest Growing in the IGBT and Thyristor market?

The fastest-growing region in the IGBT and Thyristor market is North America, with market size projected to grow from $3.82 billion in 2023 to $7.51 billion by 2033. This significant growth is attributed to technological advancements and increased investments in power electronics.

Does ConsaInsights provide customized market report data for the IGBT and Thyristor industry?

Yes, ConsaInsights offers customized market report data tailored to client specifications in the IGBT and Thyristor industry. Clients can request specific data insights, trends, and analytics to better understand market dynamics and make informed decisions.

What deliverables can I expect from this IGBT and Thyristor market research project?

Deliverables from the IGBT and Thyristor market research project typically include comprehensive market analysis, segmented insights, competitive landscape overview, growth forecasts, and strategic recommendations tailored to stakeholder needs.

What are the market trends of IGBT and Thyristor?

Market trends for IGBT and Thyristor indicate a shift towards higher efficiency and integration in power electronics, a rise in renewable energy applications, and growth in electric vehicle technology. These trends are anticipated to shape future market developments significantly.