Imaging Chemicals And Materials Market Report

Published Date: 02 February 2026 | Report Code: imaging-chemicals-and-materials

Imaging Chemicals And Materials Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Imaging Chemicals and Materials market from 2023 to 2033, covering market trends, size, segmentation, and regional insights. It aims to offer valuable data and forecasts to stakeholders and industry leaders.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

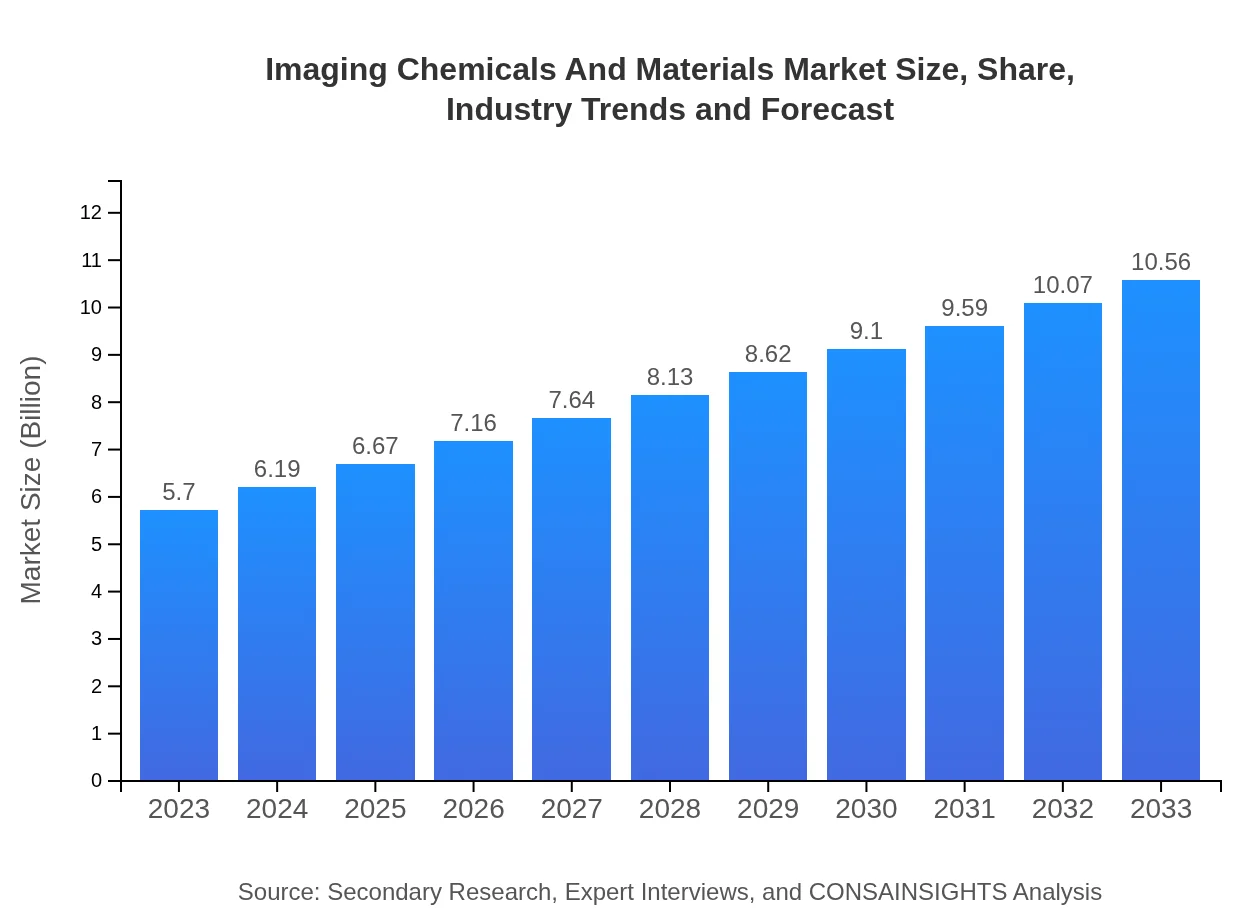

| 2023 Market Size | $5.70 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $10.56 Billion |

| Top Companies | BASF SE, Fujifilm Holdings Corporation, Kodak Alaris, Agfa-Gevaert Group |

| Last Modified Date | 02 February 2026 |

Imaging Chemicals And Materials Market Overview

Customize Imaging Chemicals And Materials Market Report market research report

- ✔ Get in-depth analysis of Imaging Chemicals And Materials market size, growth, and forecasts.

- ✔ Understand Imaging Chemicals And Materials's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Imaging Chemicals And Materials

What is the Market Size & CAGR of Imaging Chemicals And Materials market in 2033?

Imaging Chemicals And Materials Industry Analysis

Imaging Chemicals And Materials Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Imaging Chemicals And Materials Market Analysis Report by Region

Europe Imaging Chemicals And Materials Market Report:

In Europe, the market is projected to grow from $2.01 billion in 2023 to $3.72 billion by 2033. Established industries and a robust regulatory framework for sustainable chemicals promote growth, alongside increasing interest in eco-friendly imaging solutions.Asia Pacific Imaging Chemicals And Materials Market Report:

The Asia Pacific region is anticipated to show significant growth, with the market size projected to expand from $0.99 billion in 2023 to $1.84 billion by 2033. This growth is propelled by increasing industrial applications and consumer electronics usage in countries like China and India, alongside substantial investments in digital healthcare.North America Imaging Chemicals And Materials Market Report:

North America dominates the Imaging Chemicals and Materials market with an anticipated rise from $1.86 billion in 2023 to $3.45 billion in 2033. The growth is fueled by advanced healthcare infrastructure, high disposable incomes, and a strong inclination towards innovation and advanced imaging solutions.South America Imaging Chemicals And Materials Market Report:

In South America, the Imaging Chemicals and Materials market is expected to grow from $0.04 billion in 2023 to $0.07 billion by 2033. The region is experiencing a gradual adoption of imaging technologies in healthcare and consumer markets, though growth will remain moderate due to economic constraints.Middle East & Africa Imaging Chemicals And Materials Market Report:

The Middle East and Africa market is expected to increase from $0.80 billion in 2023 to $1.48 billion by 2033, as regional economic developments and healthcare enhancements foster demand for advanced imaging technologies.Tell us your focus area and get a customized research report.

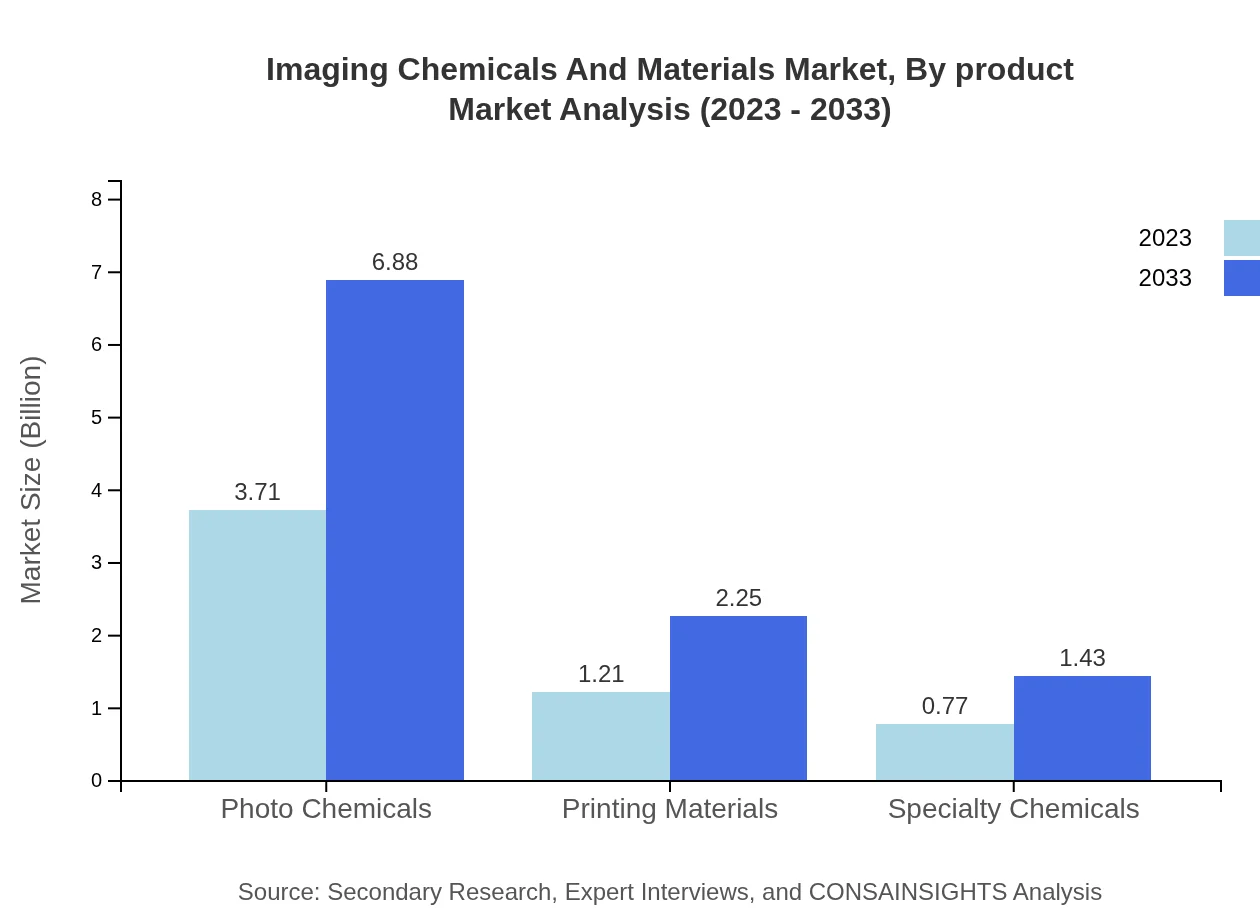

Imaging Chemicals And Materials Market Analysis By Product

The products segment is diverse, with photo chemicals leading the market at $3.71 billion in 2023 and expected to reach $6.88 billion in 2033. This segment signifies approximately 65.17% of the market share in both years. Printing materials and specialty chemicals follow, contributing significantly to the overall market dynamics.

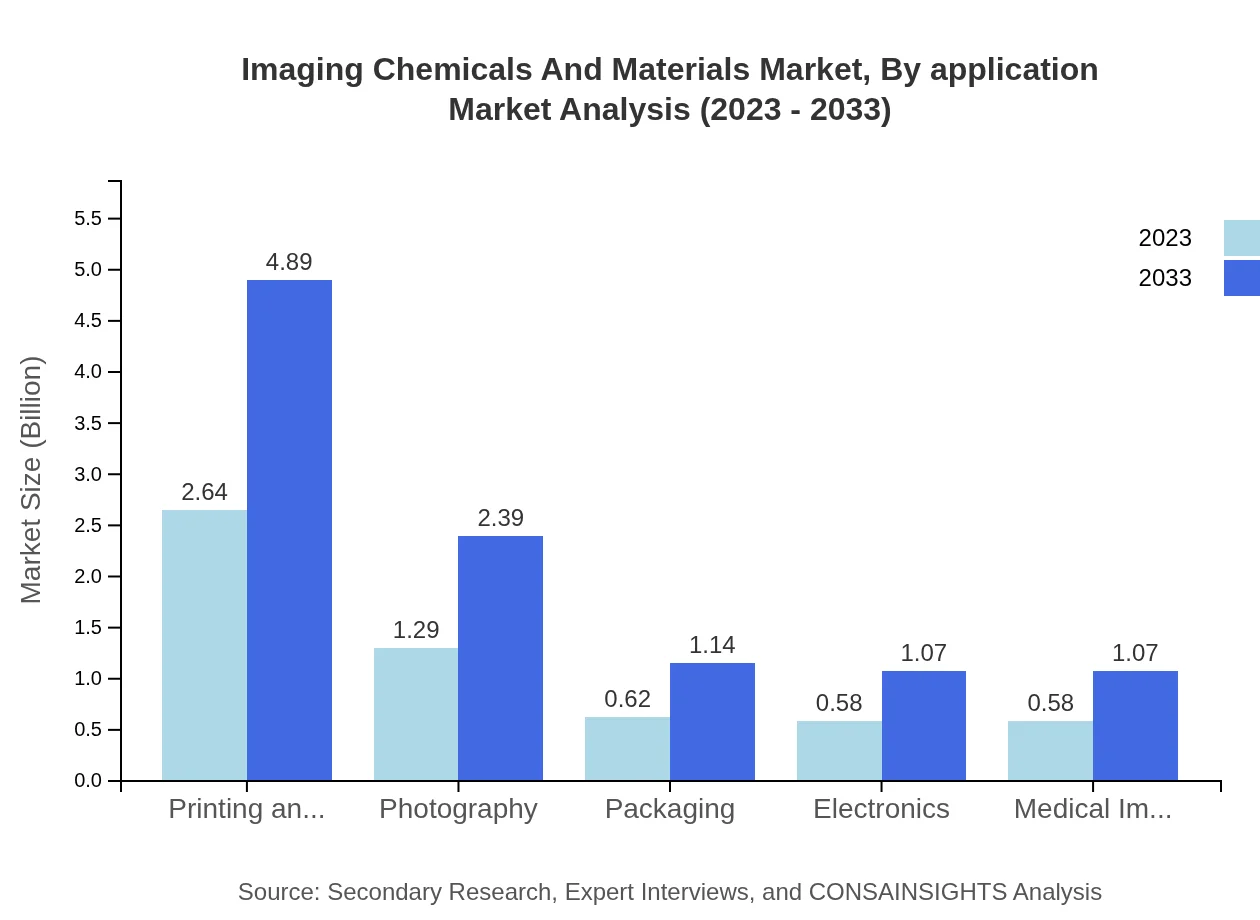

Imaging Chemicals And Materials Market Analysis By Application

The applications segment remains a pivotal component, with the consumer electronics and medical imaging sectors showing strong growth. For instance, medical imaging is projected to grow from $0.58 billion in 2023 to approximately $1.07 billion in 2033, indicating a rising dependence on advanced imaging solutions in healthcare systems.

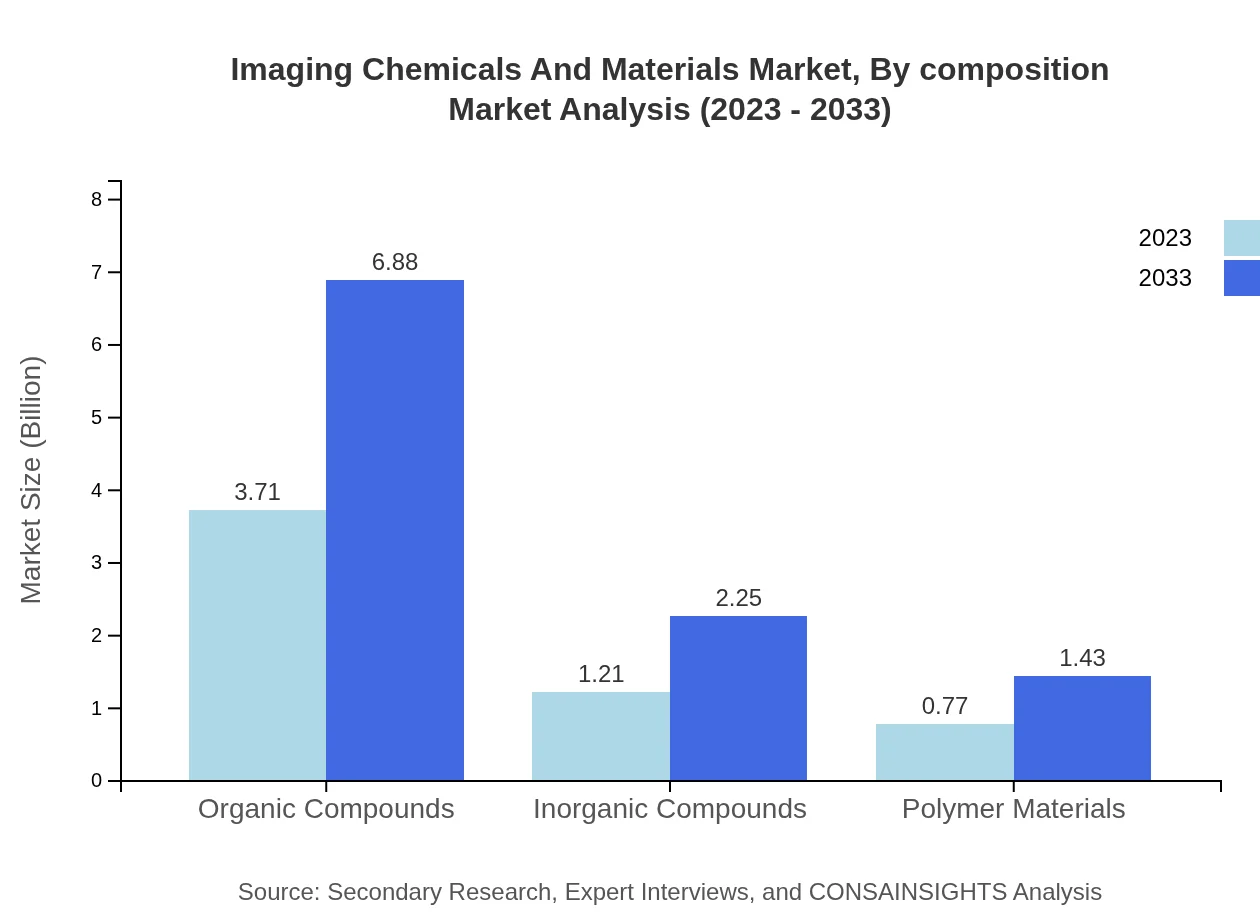

Imaging Chemicals And Materials Market Analysis By Composition

This market is typically divided into organic and inorganic compounds. Organic compounds dominate with a size of $3.71 billion in 2023, reflecting versatility and usage in various applications, while inorganic compounds are poised for growth from $1.21 billion to $2.25 billion by 2033.

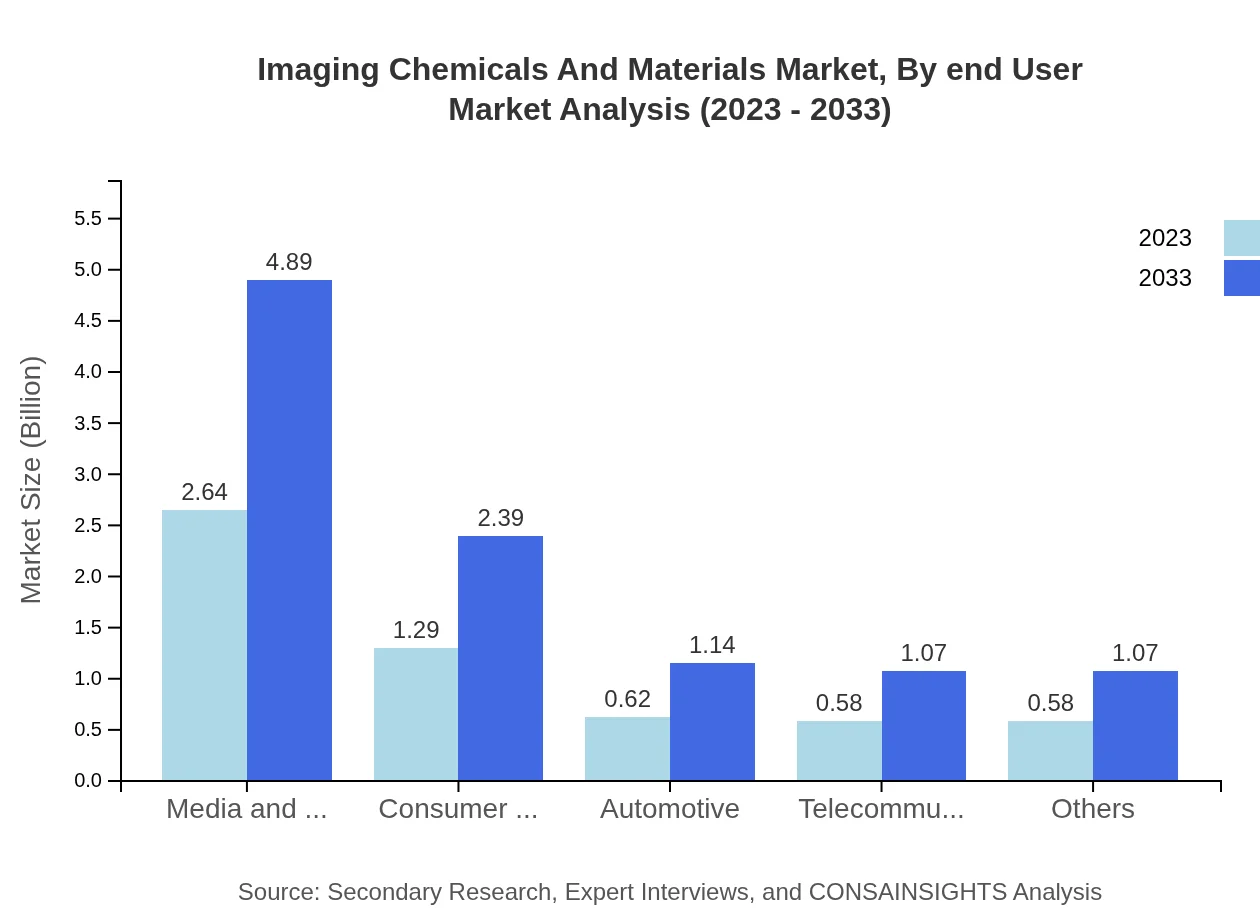

Imaging Chemicals And Materials Market Analysis By End User

End-user industries are broad, with key contributors including photography, medical imaging, and telecommunications. The photography sector reflects a stable market with $1.29 billion in 2023, while telecommunications shows substantial potential, growing from $0.58 billion to $1.07 billion by 2033.

Imaging Chemicals And Materials Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Imaging Chemicals And Materials Industry

BASF SE:

A leading global chemical company with a broad portfolio of imaging materials that cater to diverse industries including printing and medical imaging.Fujifilm Holdings Corporation:

Renowned for its innovative imaging solutions, Fujifilm excels in photographic chemicals and is a leader in the healthcare imaging sector.Kodak Alaris:

Known for its extensive history in photography and imaging chemicals, Kodak Alaris continues to innovate and provide solutions for both commercial and personal use.Agfa-Gevaert Group:

A significant player in the imaging materials market, specializing in printing and medical imaging solutions, with a commitment to sustainability.We're grateful to work with incredible clients.

FAQs

What is the market size of imaging Chemicals And Materials?

The imaging chemicals and materials market is valued at approximately $5.7 billion in 2023, with a projected compound annual growth rate (CAGR) of 6.2%, indicating robust growth potential through 2033.

What are the key market players or companies in this imaging Chemicals And Materials industry?

Key players in the imaging chemicals and materials industry include industry leaders in manufacturing chemicals for photography, printing, and electronics, however, specific company names require further data research as this report does not specify individual players.

What are the primary factors driving the growth in the imaging Chemicals And Materials industry?

Growth in the imaging chemicals and materials industry is driven by increased demand for high-quality imaging solutions in printing, consumer electronics, and medical applications, along with advancements in technology and a rising trend towards digital imaging.

Which region is the fastest Growing in the imaging Chemicals And Materials?

The fastest-growing region in the imaging chemicals and materials market is Europe, with projections showing growth from $2.01 billion in 2023 to $3.72 billion by 2033, representing significant regional expansion.

Does ConsInsights provide customized market report data for the imaging Chemicals And Materials industry?

Yes, ConsInsights offers customized market report data tailored to specific client needs within the imaging chemicals and materials industry, providing detailed insights and analysis.

What deliverables can I expect from this imaging Chemicals And Materials market research project?

Deliverables from the imaging chemicals and materials market research project include a comprehensive report with market size, forecasts, regional analysis, and insights on key trends, as well as segmentation analysis.

What are the market trends of imaging Chemicals And Materials?

Current trends in the imaging chemicals and materials market include a shift towards eco-friendly materials, advancements in digital imaging technology, and increasing demand in sectors like printing and medical imaging.