Imatinib Drug Market Report

Published Date: 31 January 2026 | Report Code: imatinib-drug

Imatinib Drug Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Imatinib Drug market, detailing its size, trends, opportunities, and challenges from 2023 to 2033. Insights include market segmentation, regional analysis, key players, and future forecasts, focusing on generating strategic insights for stakeholders.

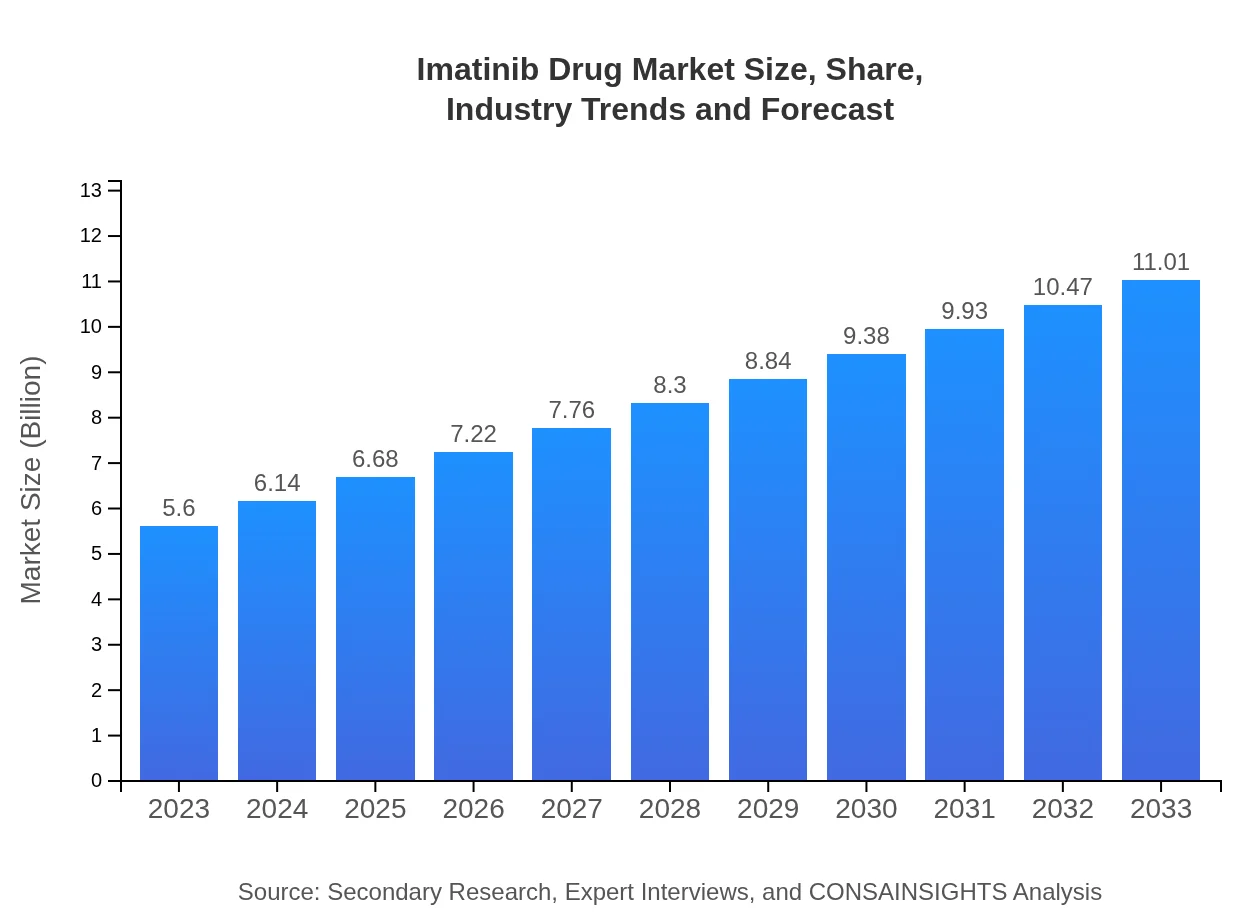

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $11.01 Billion |

| Top Companies | Novartis AG, Bristol-Myers Squibb, Pfizer, Inc., Teva Pharmaceuticals, Roche Holding AG |

| Last Modified Date | 31 January 2026 |

Imatinib Drug Market Overview

Customize Imatinib Drug Market Report market research report

- ✔ Get in-depth analysis of Imatinib Drug market size, growth, and forecasts.

- ✔ Understand Imatinib Drug's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Imatinib Drug

What is the Market Size & CAGR of Imatinib Drug market in 2023?

Imatinib Drug Industry Analysis

Imatinib Drug Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Imatinib Drug Market Analysis Report by Region

Europe Imatinib Drug Market Report:

The European market for Imatinib is anticipated to grow from $1.79 billion in 2023 to $3.52 billion by 2033. Strong regulatory frameworks and a focus on innovative therapies contribute to this growth, alongside increasing incidence rates of CML.Asia Pacific Imatinib Drug Market Report:

The Imatinib market in the Asia Pacific region is forecast to grow from $1.04 billion in 2023 to $2.04 billion by 2033. Increasing awareness regarding targeted therapies and rising cancer incidence rates drive market growth. Countries like Japan and China are major contributors due to their extensive healthcare systems and investment in oncology research.North America Imatinib Drug Market Report:

The North American Imatinib market is projected to grow from $1.94 billion in 2023 to $3.81 billion by 2033. The presence of key market players, high healthcare expenditure, and rapid adoption of advanced therapies position North America as a leading region in the industry.South America Imatinib Drug Market Report:

In South America, the market size for Imatinib is expected to expand from $0.06 billion in 2023 to $0.13 billion in 2033. The growth is influenced by improving healthcare infrastructure and regional initiatives aimed at increasing access to cancer treatments.Middle East & Africa Imatinib Drug Market Report:

The Middle East and Africa region is expected to witness growth from $0.76 billion in 2023 to $1.50 billion by 2033, driven by rising investments in healthcare infrastructure and growing awareness of cancer treatment options.Tell us your focus area and get a customized research report.

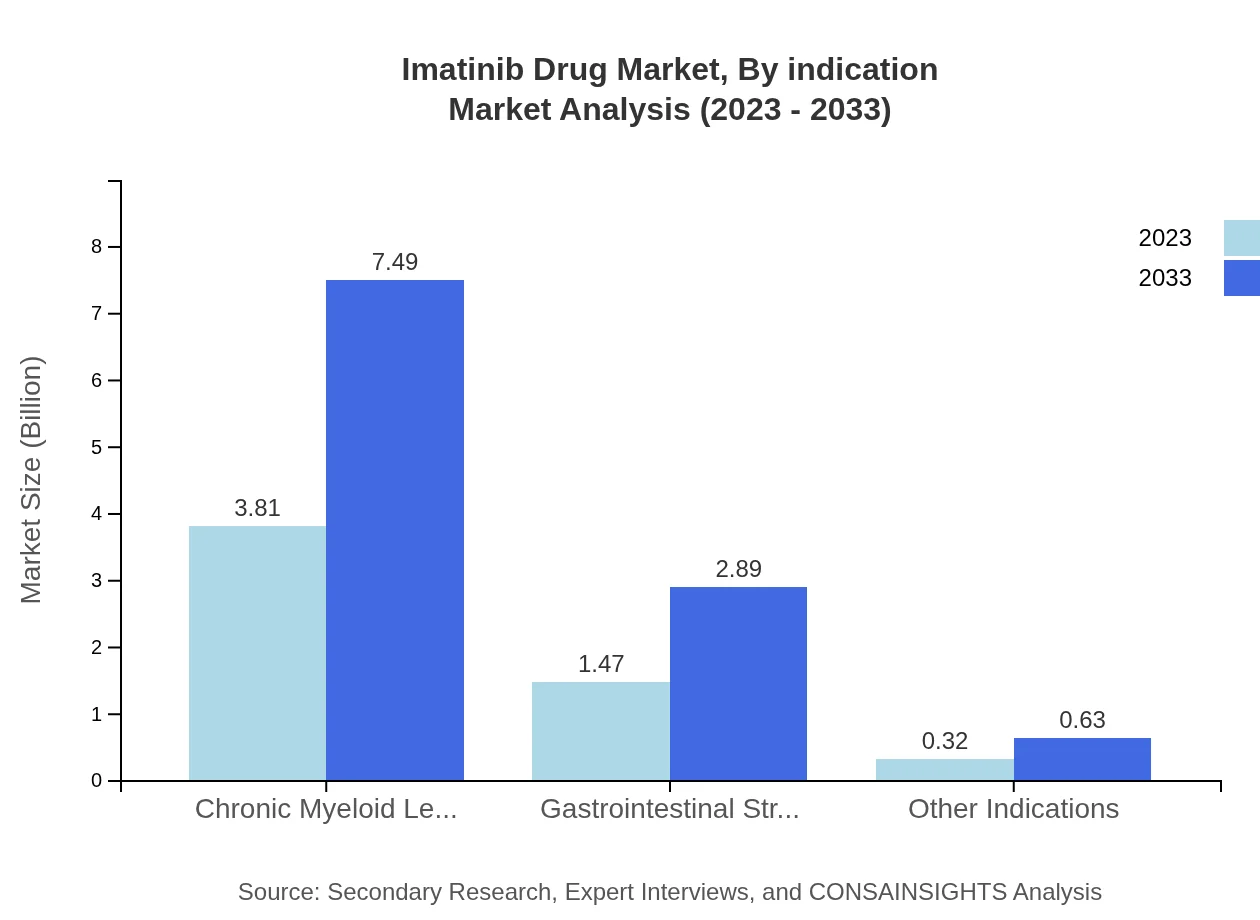

Imatinib Drug Market Analysis By Indication

By indication, the Imatinib market is primarily driven by Chronic Myeloid Leukemia (CML), which constituted approximately 68.02% of the market share in 2023. The growth rate for the CML segment is expected to continue leading through 2033, reflecting a healthy CAGR. Gastrointestinal Stromal Tumors (GIST) and other indications, including dermatological and hematological disorders, follow suit, capturing 26.28% and 5.7% of the share, respectively.

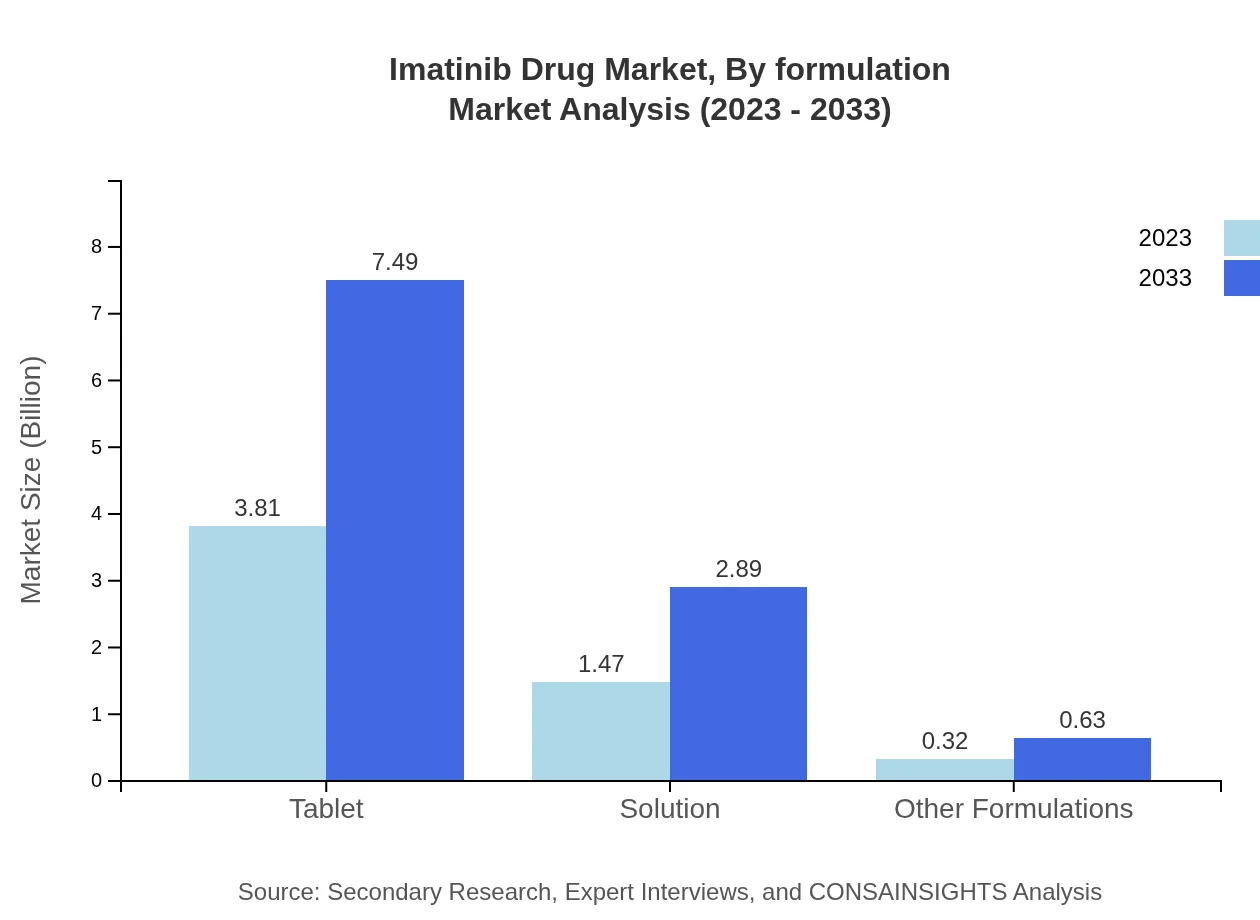

Imatinib Drug Market Analysis By Formulation

In terms of formulation, tablets dominate the market, holding a share of 68.02% in 2023, with a projected growth aligning with increased adoption in outpatient settings. Solutions and other formulations are also relevant, accounting for 26.28% and 5.7% share, respectively, fueled by advancements in drug delivery methods.

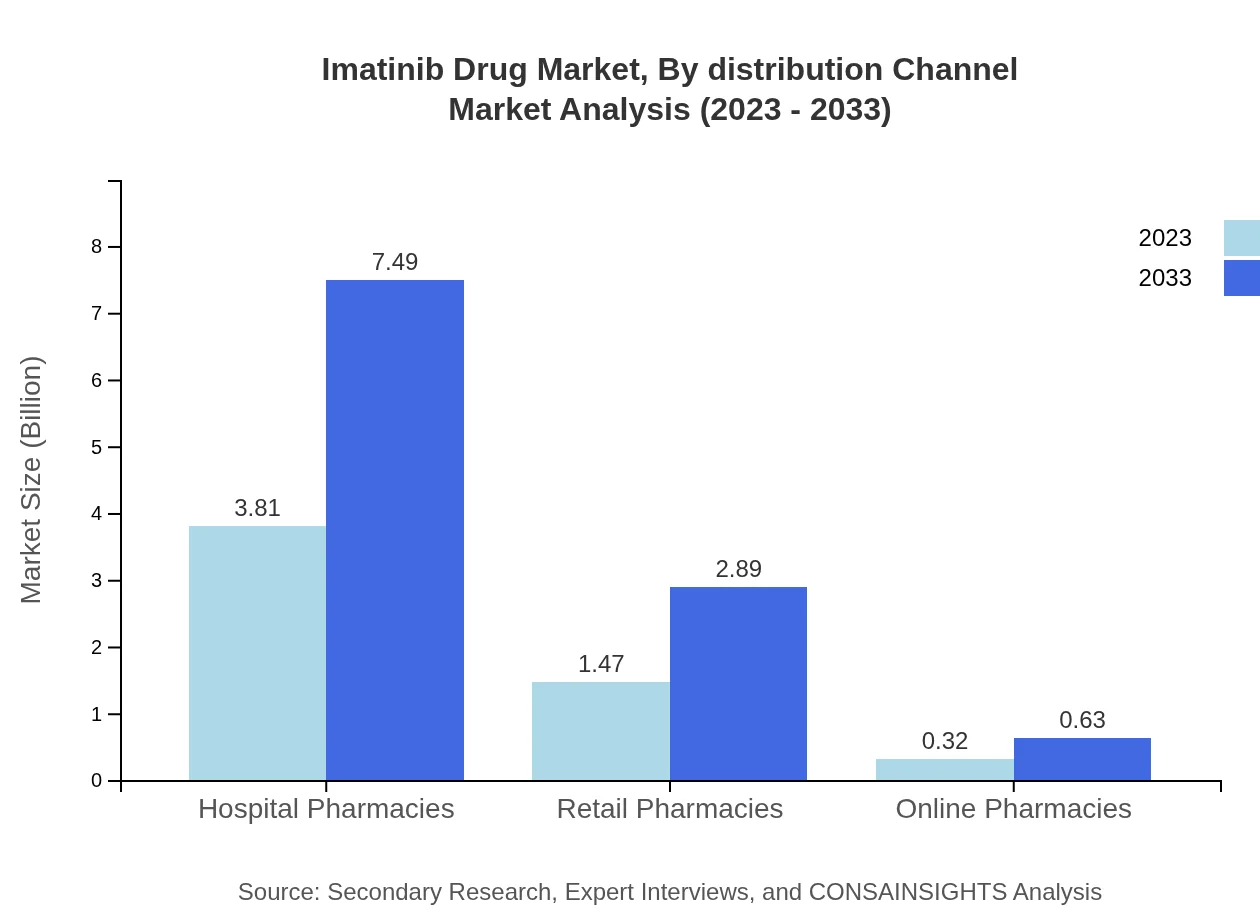

Imatinib Drug Market Analysis By Distribution Channel

Market segments by distribution channel show that hospitals account for about 68.02% of the market share for Imatinib, reflecting the drug's primary use in inpatient settings where monitoring is essential. Retail and online pharmacies capture significant shares, around 26.28% and 5.7%, respectively, indicating a shift towards outpatient care.

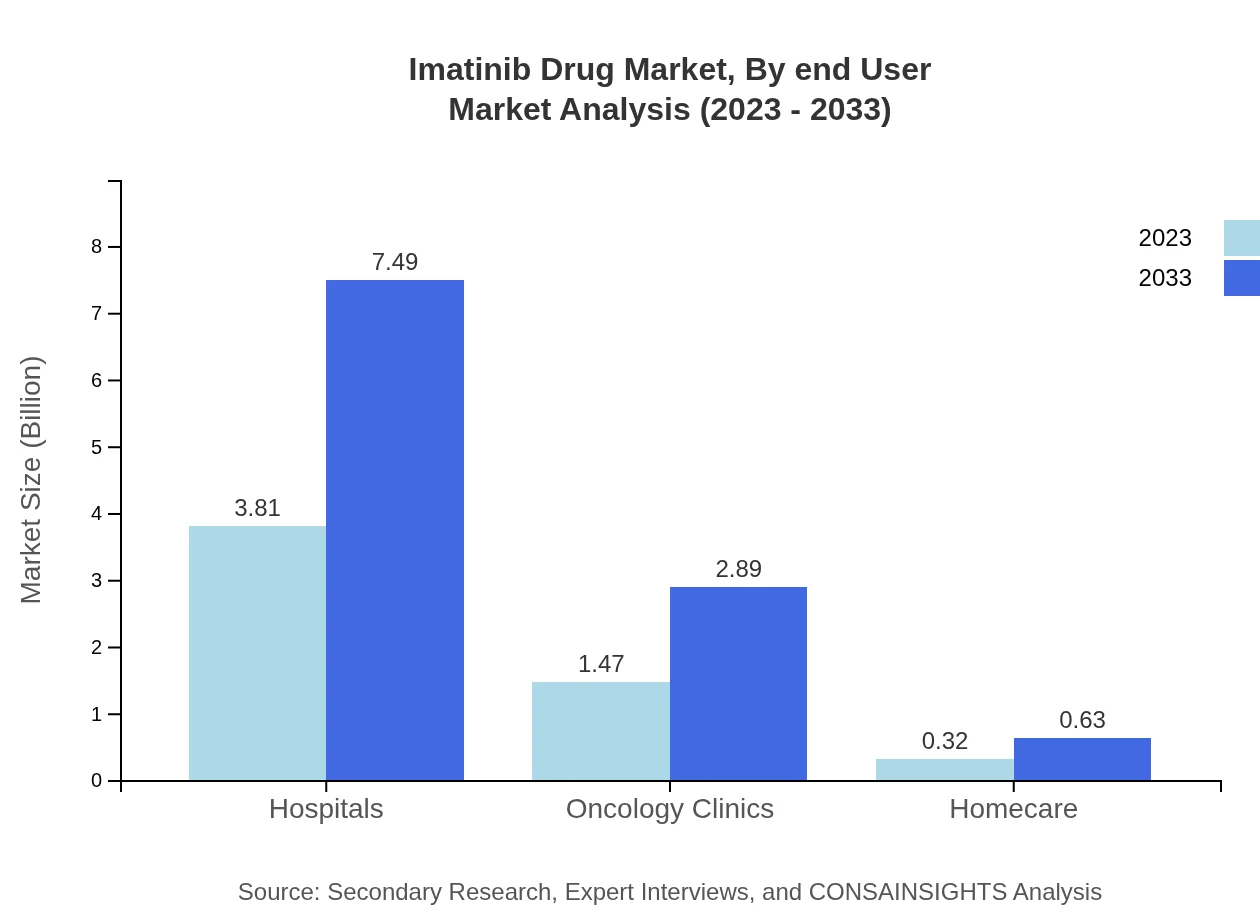

Imatinib Drug Market Analysis By End User

The end-user segment identifies hospitals as the primary user of Imatinib, representing 68.02% market share in 2023. Oncology clinics and home healthcare services are also growing, leveraging targeted regimens that cater to patients requiring ongoing management of their conditions.

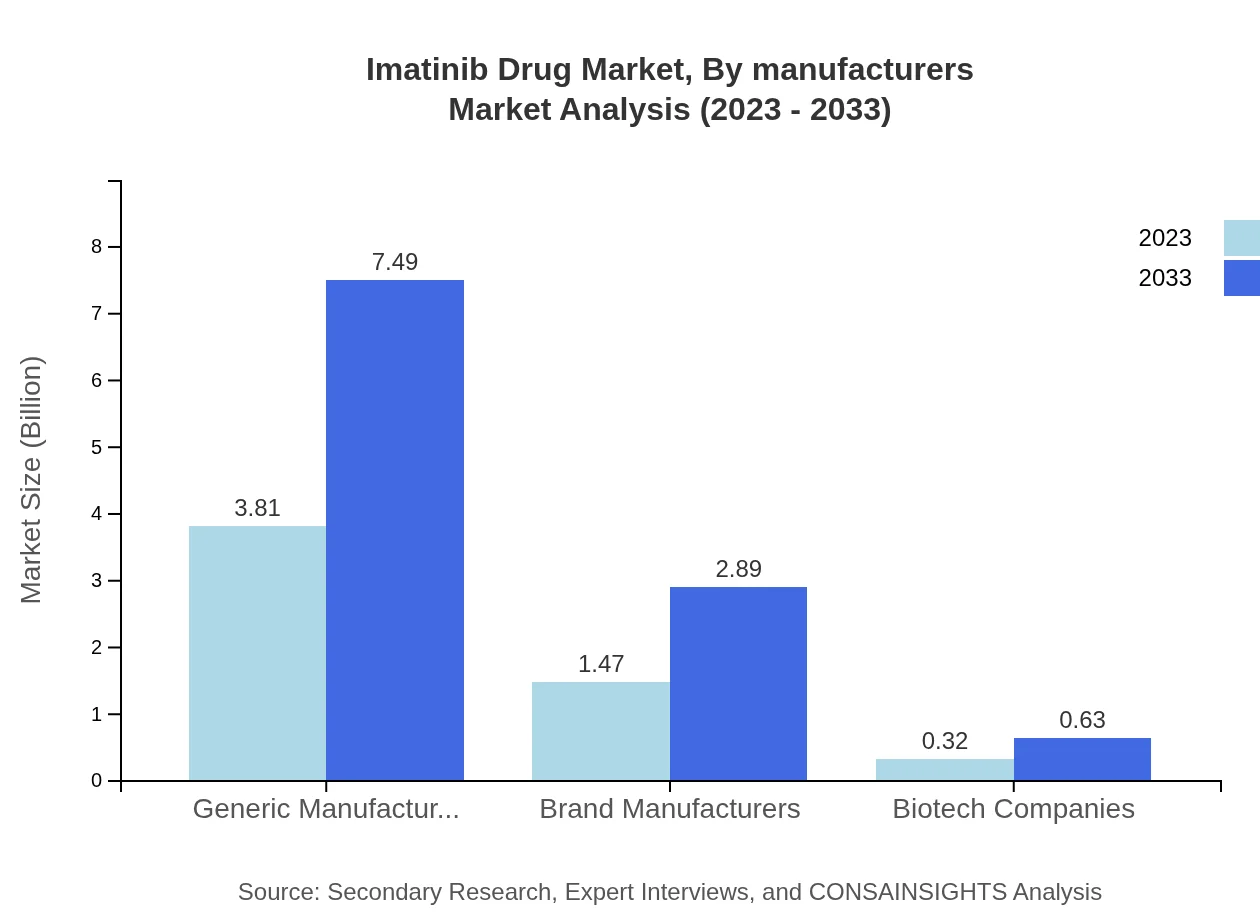

Imatinib Drug Market Analysis By Manufacturers

Market analysis by manufacturers shows a notable share for generic manufacturers (68.02%), who contribute significantly to the affordability of Imatinib Pharmaceuticals. Brand manufacturers and biotech companies follow, demonstrating the industry's transition towards a more competitive landscape, with increasing market entries driving innovation.

Imatinib Drug Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Imatinib Drug Industry

Novartis AG:

Pioneering the development of Imatinib, Novartis remains a market leader in cancer therapies and has significantly contributed to advancements in targeted treatment for CML and GIST.Bristol-Myers Squibb:

Engaged in developing innovative oncology medications, the firm actively works to expand the application of Imatinib through collaborative research efforts.Pfizer, Inc.:

Pfizer plays a key role in expanding access to Imatinib and enhancing generic versions, making it an essential player in the global market.Teva Pharmaceuticals:

A major player in generics, Teva has significantly impacted the Imatinib market, offering cost-effective alternatives that cater to diverse patient needs.Roche Holding AG:

Aligned with targeted cancer therapy innovations, Roche supports extensive research initiatives focused on bringing new treatment options to patients.We're grateful to work with incredible clients.

FAQs

What is the market size of imatinib Drug?

The global imatinib drug market was valued at approximately $5.6 billion in 2023, with a projected CAGR of 6.8% through 2033. This growth reflects the increasing prevalence of diseases like Chronic Myeloid Leukemia (CML) and GIST.

What are the key market players or companies in this imatinib Drug industry?

Key players in the imatinib drug market include major pharmaceutical companies and generic manufacturers. They play crucial roles in the development, production, and distribution of imatinib, impacting its availability and pricing dynamics.

What are the primary factors driving the growth in the imatinib Drug industry?

Primary factors include rising incidences of cancers treatable by imatinib, advancements in drug formulations, and increasing awareness about targeted therapies. Moreover, ongoing research and development efforts enhance treatment options, fueling market expansion.

Which region is the fastest Growing in the imatinib Drug?

The Asia-Pacific region is anticipated to emerge as the fastest-growing market for imatinib, projected to grow from $1.04 billion in 2023 to $2.04 billion by 2033, owing to increasing healthcare infrastructure and rising disease diagnoses.

Does ConsaInsights provide customized market report data for the imatinib Drug industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the imatinib-drug industry. This includes in-depth analysis of segments, regional markets, and trends to support strategic decision-making.

What deliverables can I expect from this imatinib Drug market research project?

Deliverables typically include comprehensive reports on market size, growth forecasts, competitive landscape analyses, and insights into regional trends and segments, ensuring clients have actionable data for informed decisions.

What are the market trends of imatinib Drug?

Current trends in the imatinib drug market include a shift toward precision medicine, increasing use of generic formulations, and a focus on improving patient access through online and hospital pharmacies, shaping future market dynamics.