Immunomodulators Market Report

Published Date: 31 January 2026 | Report Code: immunomodulators

Immunomodulators Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Immunomodulators market, including market size, growth rate, regional insights, industry trends, and forecasts for the period 2023 to 2033.

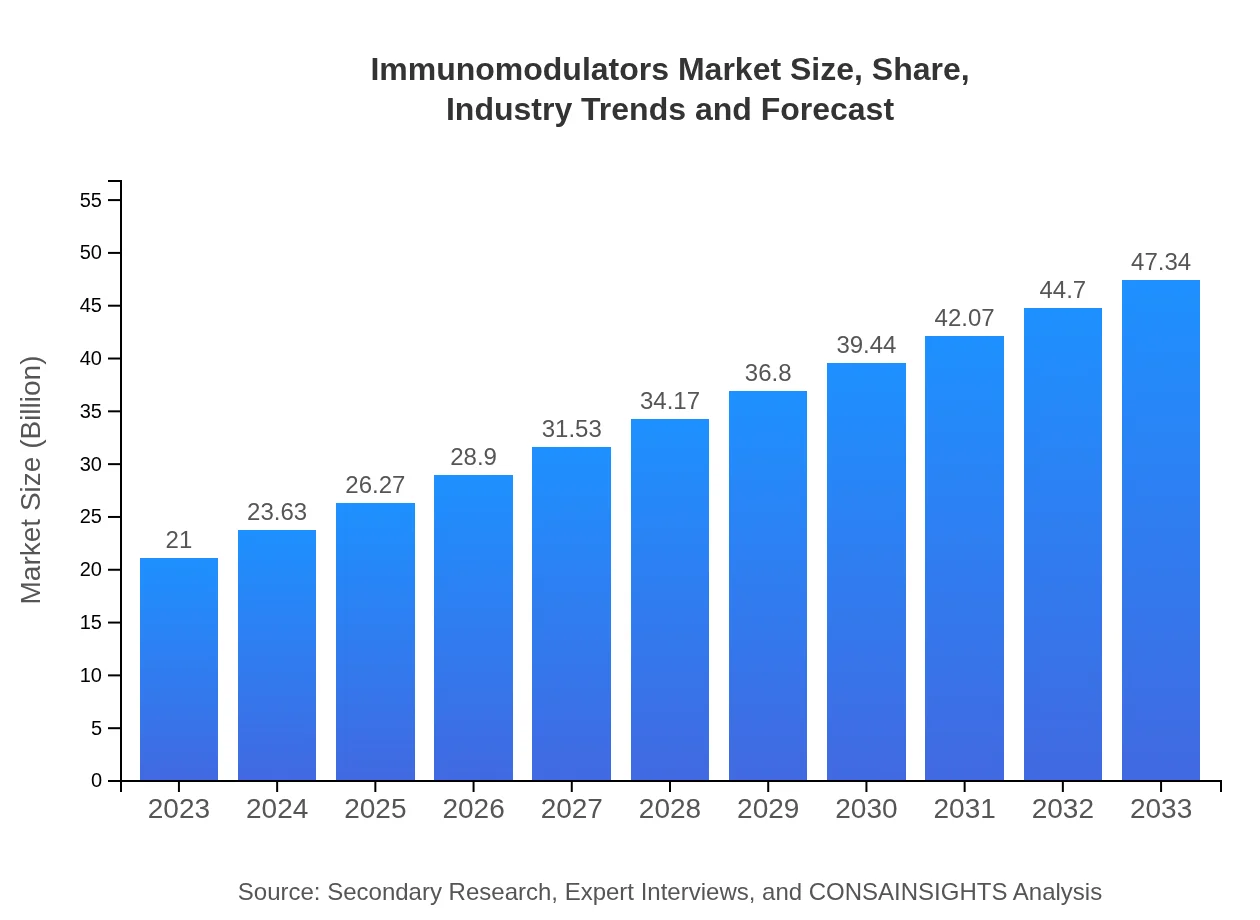

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $21.00 Billion |

| CAGR (2023-2033) | 8.2% |

| 2033 Market Size | $47.34 Billion |

| Top Companies | AbbVie Inc., Roche Holdings AG, Novartis AG, Pfizer Inc. |

| Last Modified Date | 31 January 2026 |

Immunomodulators Market Overview

Customize Immunomodulators Market Report market research report

- ✔ Get in-depth analysis of Immunomodulators market size, growth, and forecasts.

- ✔ Understand Immunomodulators's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Immunomodulators

What is the Market Size & CAGR of Immunomodulators market in 2023?

Immunomodulators Industry Analysis

Immunomodulators Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Immunomodulators Market Analysis Report by Region

Europe Immunomodulators Market Report:

The European Immunomodulators market was valued at USD 6.70 billion in 2023 and is set to reach USD 15.11 billion by 2033. Strong regulatory frameworks, alongside a growing emphasis on advanced biologics and personalized medicine, significantly influence market growth.Asia Pacific Immunomodulators Market Report:

In 2023, the Asia Pacific Immunomodulators market is valued at approximately USD 3.90 billion, anticipated to grow to USD 8.80 billion by 2033. The region is characterized by a large patient population suffering from autoimmune and infectious diseases, as well as increasing investments in healthcare infrastructure and research.North America Immunomodulators Market Report:

North America leads the global Immunomodulators market with a value of approximately USD 7.64 billion in 2023, projected to reach USD 17.23 billion by 2033. High healthcare expenditure, advanced healthcare systems, and the presence of major pharmaceutical companies contribute to this growth.South America Immunomodulators Market Report:

The South American market for Immunomodulators was worth around USD 1.81 billion in 2023 and is expected to reach USD 4.09 billion by 2033. The growth is driven by increasing healthcare access and a rising prevalence of chronic diseases, along with governmental focus on improving healthcare services.Middle East & Africa Immunomodulators Market Report:

The Middle East and Africa Immunomodulators market is relatively smaller, valued at USD 0.94 billion in 2023, with expectations to grow to USD 2.11 billion by 2033. Limited access to healthcare and variable economic conditions are challenges, but increasing investment in healthcare is likely to stimulate market growth.Tell us your focus area and get a customized research report.

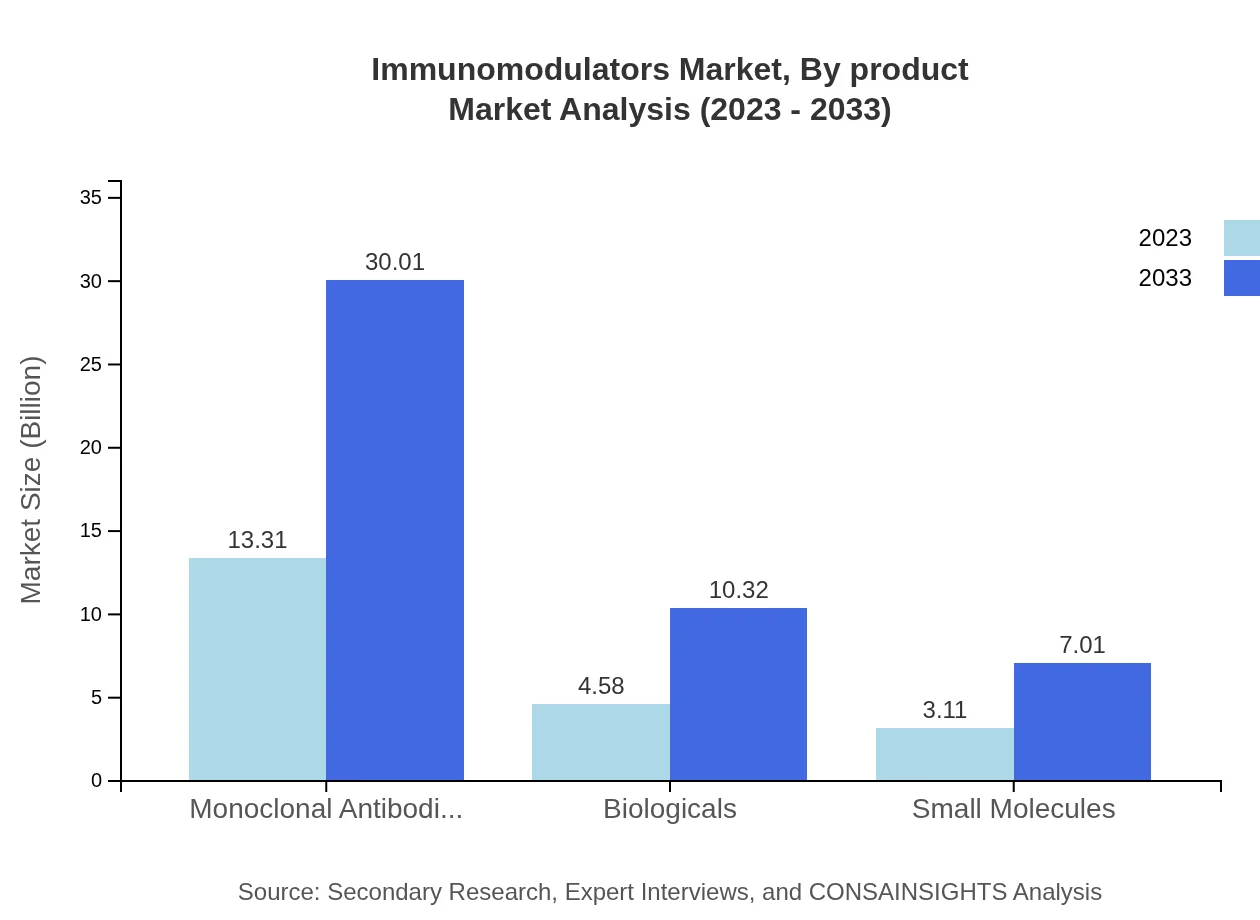

Immunomodulators Market Analysis By Product

The product segment of immunomodulators includes monoclonal antibodies, biologics, and small molecules. In 2023, monoclonal antibodies dominate this sector with a market size of USD 13.31 billion, projected to reach USD 30.01 billion by 2033, maintaining a market share of 63.39%. Biological therapies follow closely with a 21.81% market share, sized at USD 4.58 billion in 2023, expected to reach USD 10.32 billion by 2033. Small molecules capture a smaller share with USD 3.11 billion, growing to USD 7.01 billion over the same period.

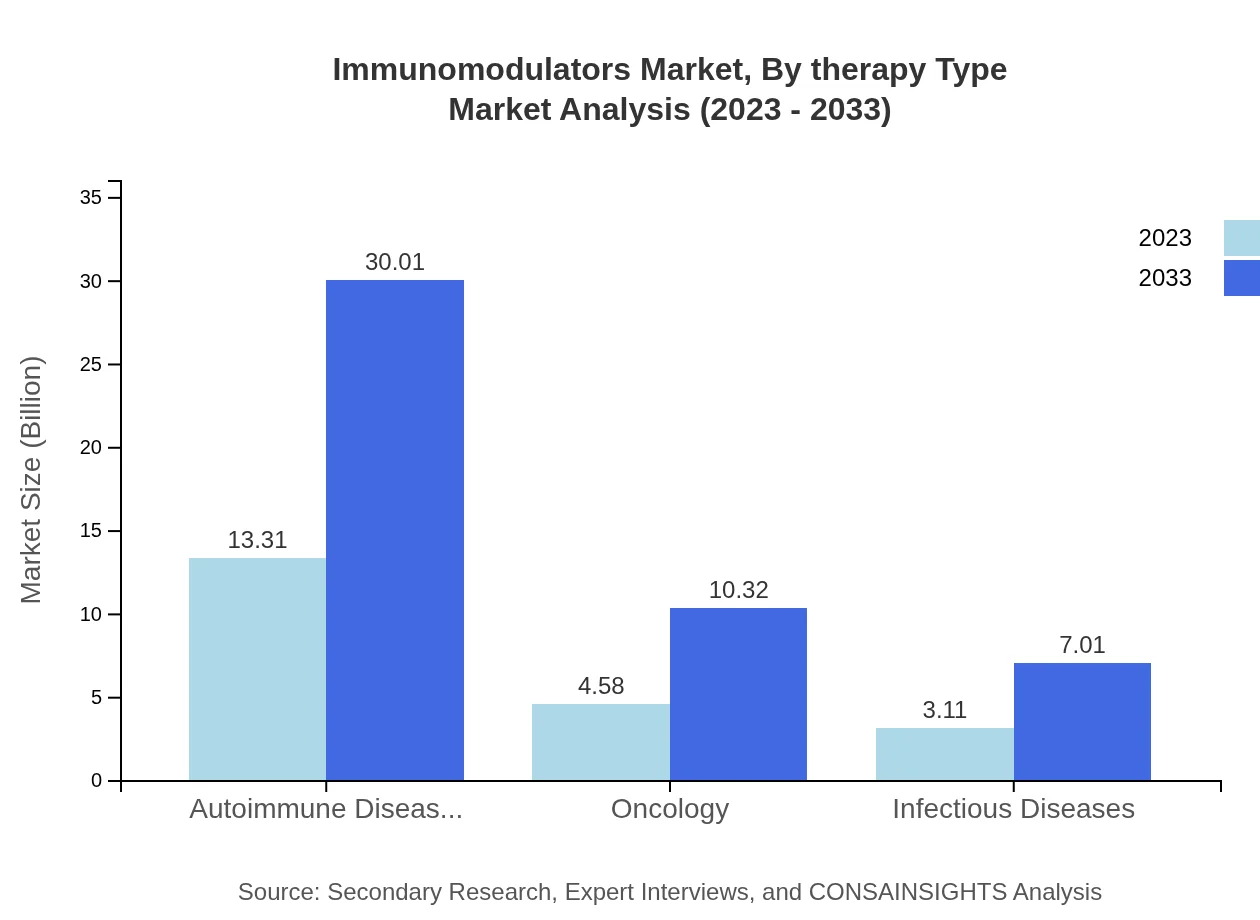

Immunomodulators Market Analysis By Therapy Type

The market for immunomodulators is significantly influenced by therapy type, primarily comprising autoimmune diseases, oncology, and infectious diseases. Autoimmune diseases represent the largest segment with a market size of USD 13.31 billion in 2023, projected to reach USD 30.01 billion by 2033, commanding a 63.39% market share. Oncology therapies, targeted at cancer, currently valued at USD 4.58 billion, anticipate growth to USD 10.32 billion by 2033 with a 21.81% market share, while infectious diseases capture USD 3.11 billion with projections to reach USD 7.01 billion.

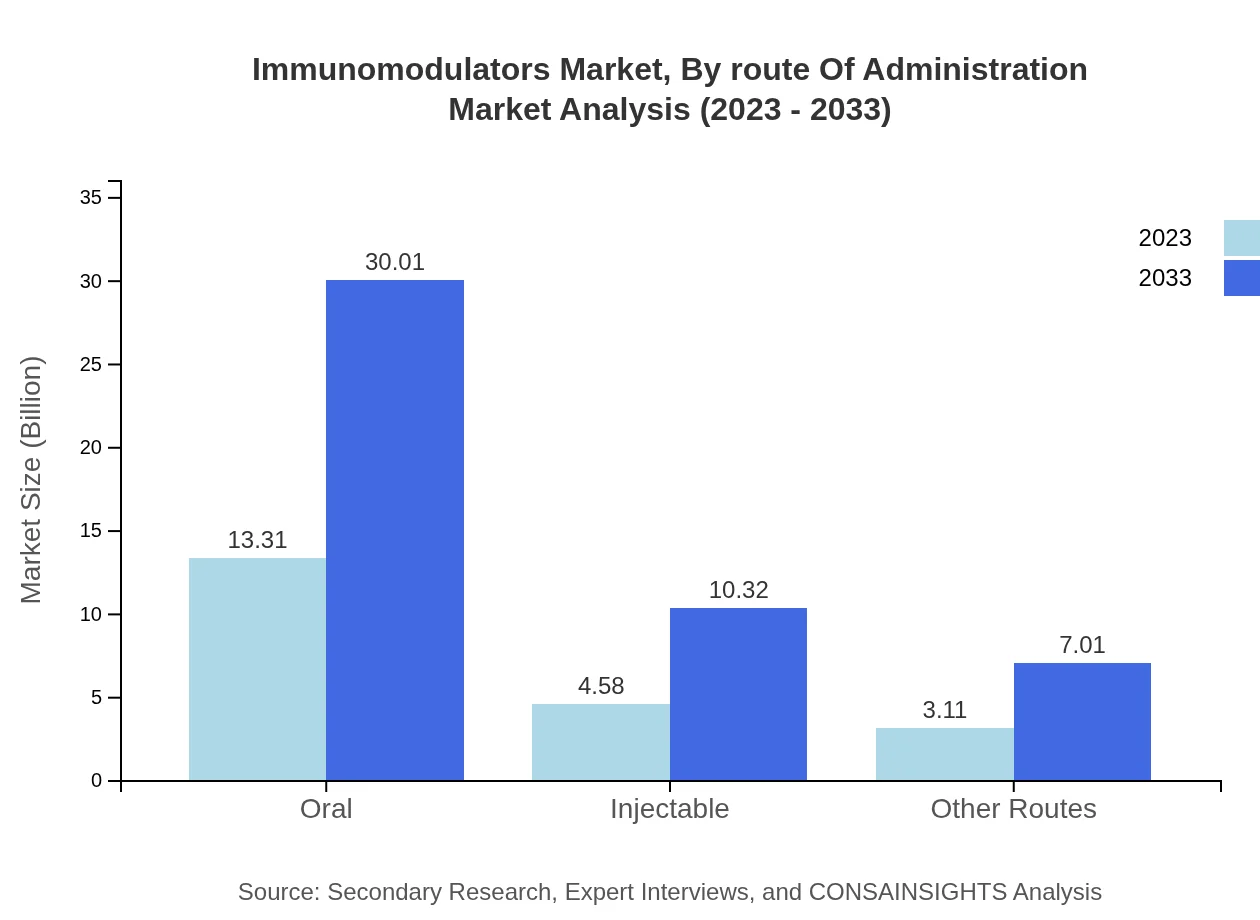

Immunomodulators Market Analysis By Route Of Administration

Routes of administration in the Immunomodulators market include oral, injectable, and other methods. Oral formulations dominate due to patient preference, valued at USD 13.31 billion in 2023 and anticipated to reach USD 30.01 billion by 2033. Injectables, accounting for a market size of USD 4.58 billion, are projected to grow to USD 10.32 billion, while other routes yield USD 3.11 billion and predict growth to USD 7.01 billion.

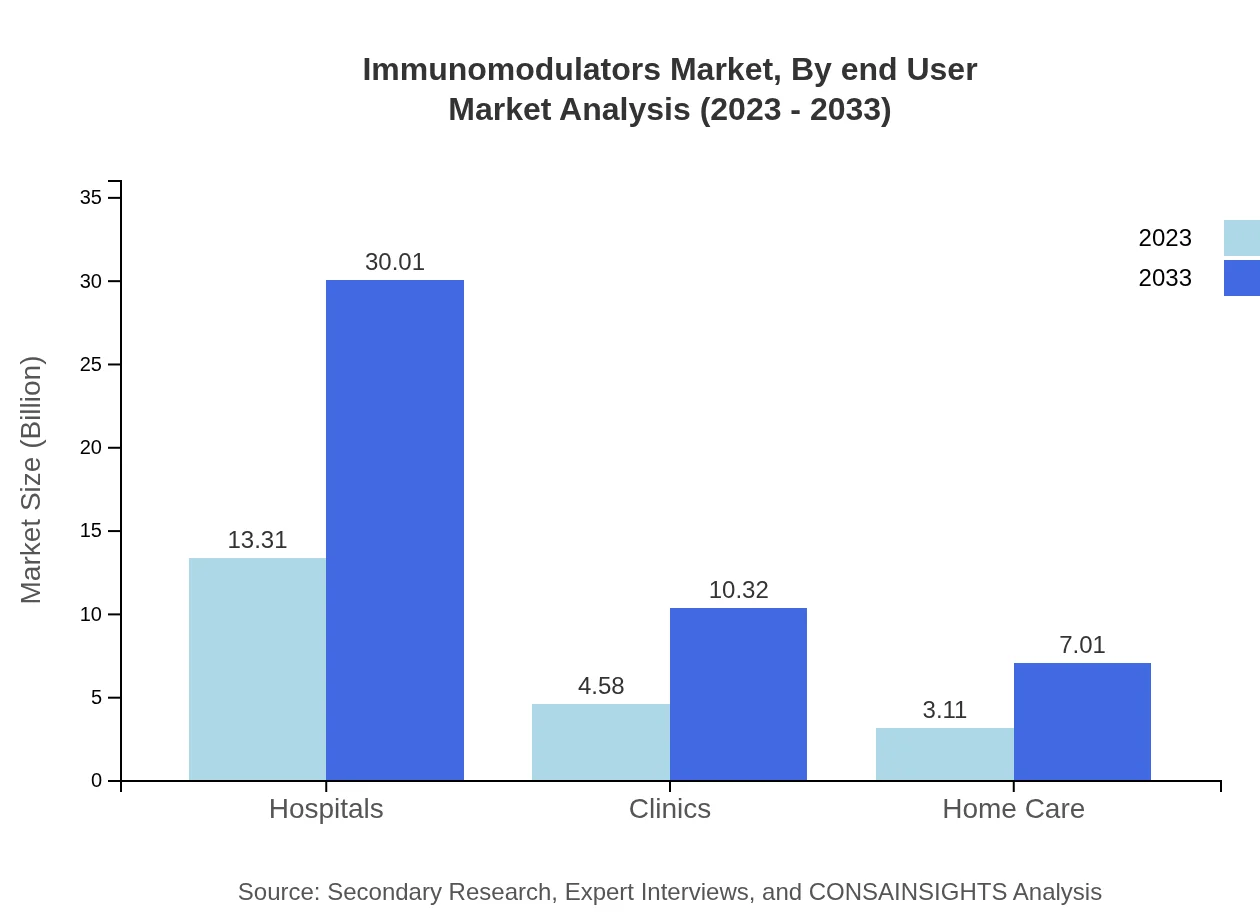

Immunomodulators Market Analysis By End User

End-users in the Immunomodulators market primarily include hospitals, clinics, and home care settings. Hospitals represent the largest segment with a market size of USD 13.31 billion in 2023, estimated to grow to USD 30.01 billion by 2033. Clinics follow with USD 4.58 billion in 2023, projecting to reach USD 10.32 billion, while home care services currently valued at USD 3.11 billion are expected to expand to USD 7.01 billion.

Immunomodulators Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Immunomodulators Industry

AbbVie Inc.:

AbbVie is a leading biopharmaceutical company known for its innovative immunology therapies, including Humira, which has significantly impacted the treatment landscape for autoimmune diseases.Roche Holdings AG:

Roche is a global leader in healthcare with a strong portfolio in immunomodulators, particularly monoclonal antibodies used in oncology and autoimmune disorders.Novartis AG:

Novartis is a prominent player in the immunomodulators market, providing advanced therapies that target various immune-mediated conditions.Pfizer Inc.:

Pfizer is recognized for its development of immunomodulatory drugs, contributing to the treatment of several diseases through innovative therapies.We're grateful to work with incredible clients.

FAQs

What is the market size of immunomodulators?

The global immunomodulators market is projected to reach approximately $21 billion by 2033, expanding at a compound annual growth rate (CAGR) of 8.2% from its current size in 2023.

What are the key market players or companies in the immunomodulators industry?

Key players in the immunomodulators market include global pharmaceutical giants specializing in biologics and monoclonal antibodies, as well as innovative biotech firms focusing on novel therapies targeting autoimmune and infectious diseases.

What are the primary factors driving the growth in the immunomodulators industry?

Growth in the immunomodulators market is primarily driven by rising incidences of autoimmune diseases, advancements in biotechnology, increased healthcare expenditure, and the growing demand for personalized medicine options among patients.

Which region is the fastest Growing in the immunomodulators market?

The North American region is currently the fastest-growing in the immunomodulators market, projected to grow from $7.64 billion in 2023 to $17.23 billion by 2033, driven by high healthcare expenditure and advanced research facilities.

Does ConsaInsights provide customized market report data for the immunomodulators industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the immunomodulators industry, allowing stakeholders to access detailed insights that align with their strategic objectives.

What deliverables can I expect from this immunomodulators market research project?

Deliverables from the immunomodulators market research project typically include comprehensive market analysis reports, segmented data presentations, competitor assessments, and trend forecasts that guide informed business decisions.

What are the market trends of immunomodulators?

Current trends in the immunomodulators market include a shift towards monoclonal antibodies, an increase in biologics, and a growth in home-care settings, reflecting changing patient needs and preferences in treatment options.