Implantable Cardiac Monitors Market Report

Published Date: 31 January 2026 | Report Code: implantable-cardiac-monitors

Implantable Cardiac Monitors Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Implantable Cardiac Monitors market, including current trends, market sizing, and growth forecasts for the years 2023 to 2033. Key segments, regional insights, and leading players are explored to offer a comprehensive overview of this evolving industry.

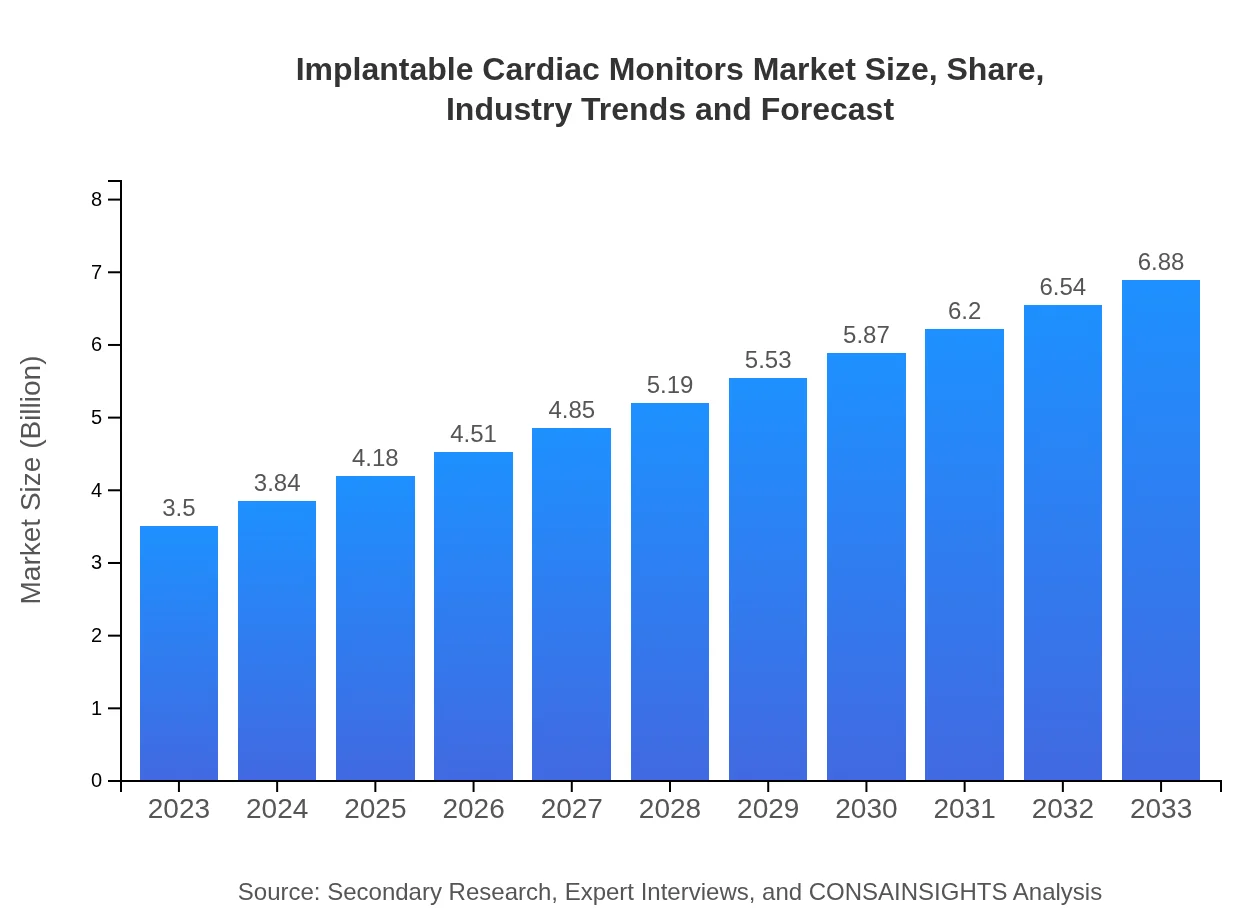

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $6.88 Billion |

| Top Companies | Medtronic , Abbott Laboratories, Boston Scientific, Biotronik, Zimmer Biomet |

| Last Modified Date | 31 January 2026 |

Implantable Cardiac Monitors Market Overview

Customize Implantable Cardiac Monitors Market Report market research report

- ✔ Get in-depth analysis of Implantable Cardiac Monitors market size, growth, and forecasts.

- ✔ Understand Implantable Cardiac Monitors's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Implantable Cardiac Monitors

What is the Market Size & CAGR of Implantable Cardiac Monitors market in 2023?

Implantable Cardiac Monitors Industry Analysis

Implantable Cardiac Monitors Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Implantable Cardiac Monitors Market Analysis Report by Region

Europe Implantable Cardiac Monitors Market Report:

The European market for Implantable Cardiac Monitors was valued at $1.17 billion in 2023, with projections to reach $2.29 billion by 2033. Europe demonstrates a strong regulatory environment supporting innovative healthcare solutions, alongside a significant focus on patient-centric monitoring technologies.Asia Pacific Implantable Cardiac Monitors Market Report:

The Asia-Pacific region is anticipated to witness significant growth, with a market size of $0.59 billion in 2023 expanding to $1.15 billion by 2033. Factors such as an aging population, increasing healthcare expenditure, and rising awareness about cardiac health drive this growth. China and Japan are key markets, with government initiatives promoting advanced healthcare technologies.North America Implantable Cardiac Monitors Market Report:

North America holds the largest share of the ICM market, with a current size of $1.27 billion, expected to rise to $2.49 billion by 2033. This growth is fueled by high healthcare spending, advanced healthcare facilities, and a robust presence of key market players driving innovation.South America Implantable Cardiac Monitors Market Report:

In South America, the Implantable Cardiac Monitor market is relatively smaller but growing steadily. The market size was $0.11 billion in 2023 and is projected to reach $0.21 billion by 2033. Growth factors include improving healthcare infrastructure and increasing prevalence of cardiovascular diseases.Middle East & Africa Implantable Cardiac Monitors Market Report:

The Middle East and Africa region exhibited a market size of $0.37 billion in 2023 and is expected to double to $0.73 billion by 2033. Growing investments in healthcare infrastructure and increased demand for advanced monitoring solutions contribute to this anticipated growth.Tell us your focus area and get a customized research report.

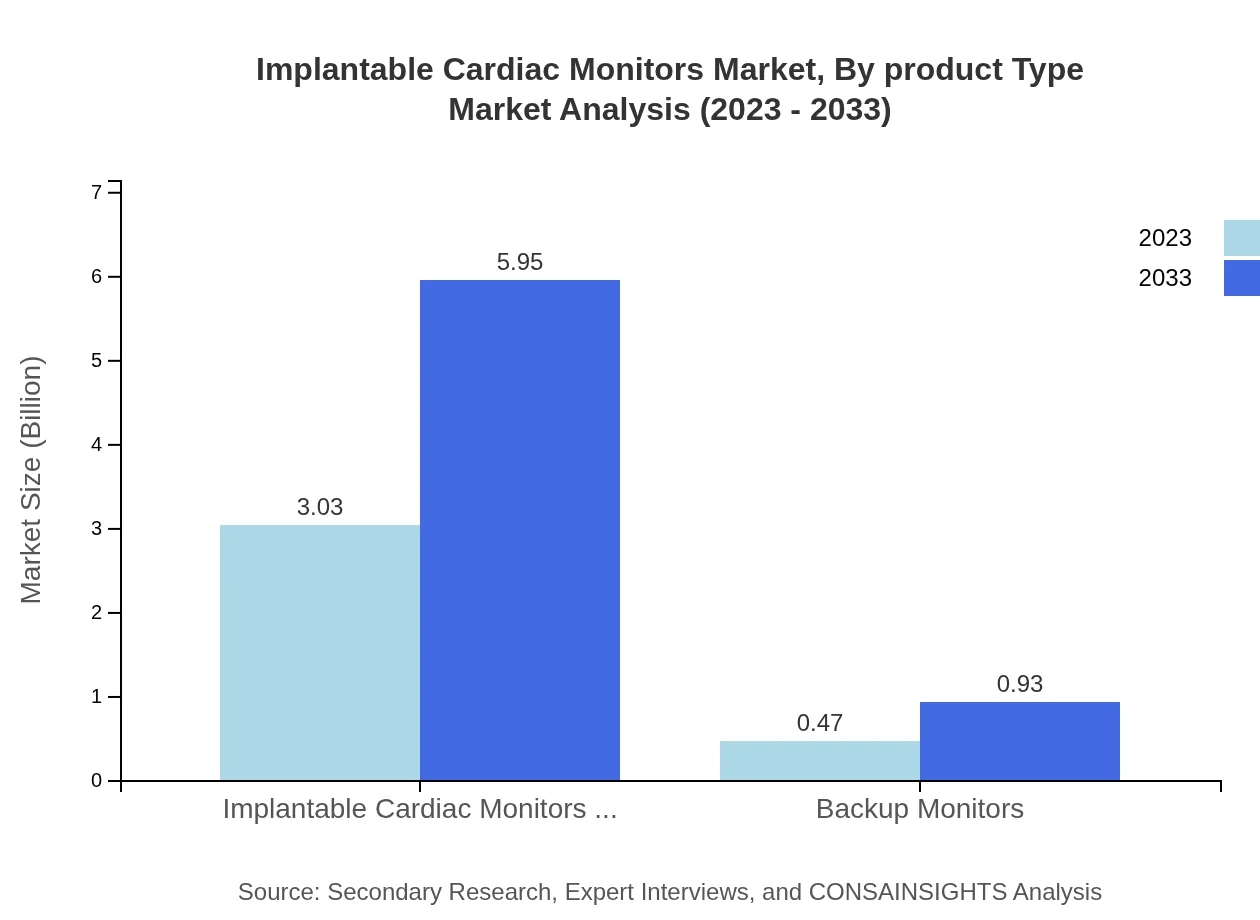

Implantable Cardiac Monitors Market Analysis By Product Type

The market analysis reveals a significant inclination towards Implantable Cardiac Monitors (ICM), which constitute a substantial share at 86.46% in 2023, expected to remain constant up to 2033. Backup Monitors represent a smaller segment, showing steady growth potential, with market size rising from $0.47 billion to $0.93 billion over the same period.

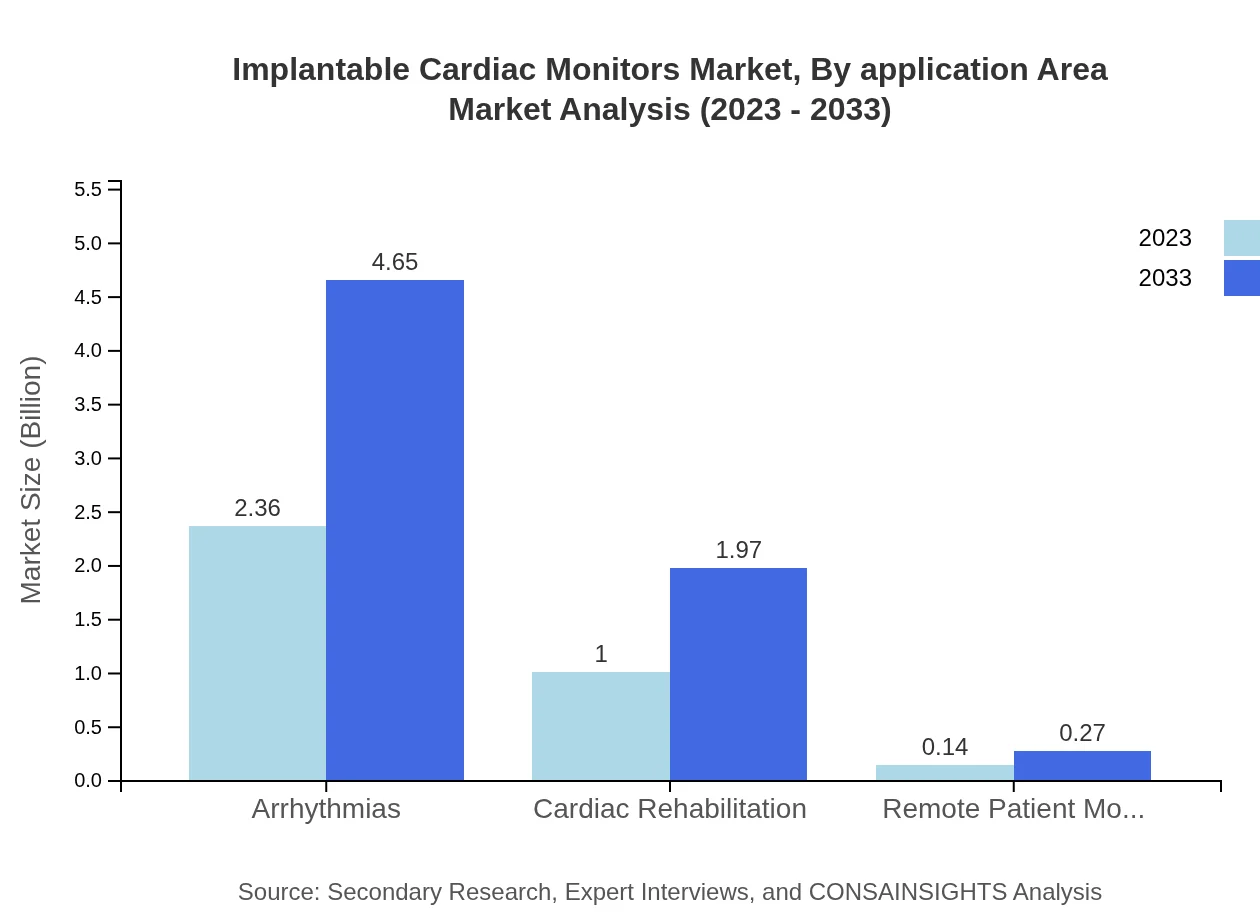

Implantable Cardiac Monitors Market Analysis By Application Area

The market for arrhythmias is dominant, accounting for 67.53% share in 2023, with expectations to remain stable through 2033, reflecting the critical need for monitoring in this area. Cardiac Rehabilitation follows at 28.6% share, indicating its importance in patient recovery and ongoing care.

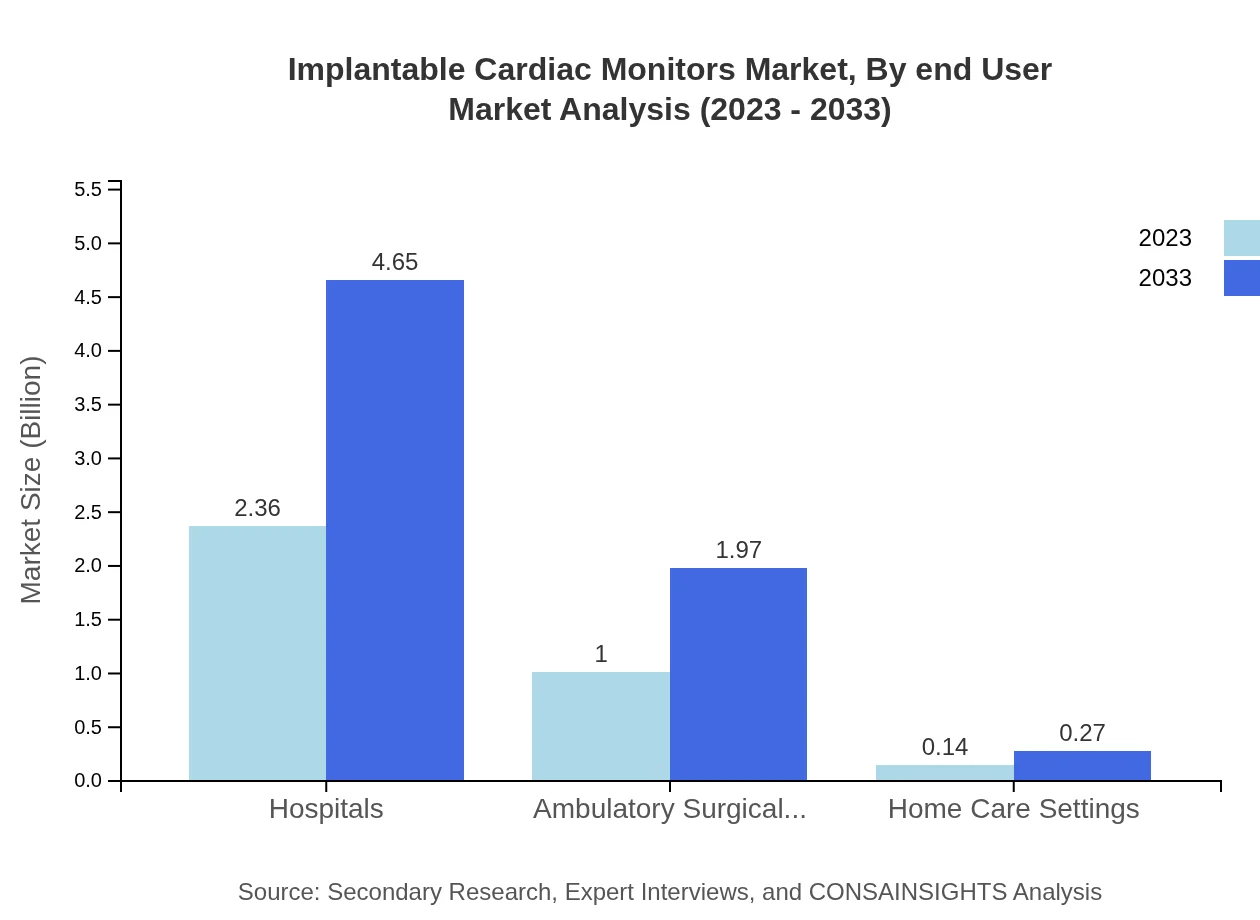

Implantable Cardiac Monitors Market Analysis By End User

Hospitals play a crucial role, making up 67.53% of the market share in 2023, expected to maintain this share until 2033. Ambulatory Surgical Centers contribute 28.6% of the market share, highlighting the increasing tendency towards outpatient care in managing cardiac conditions.

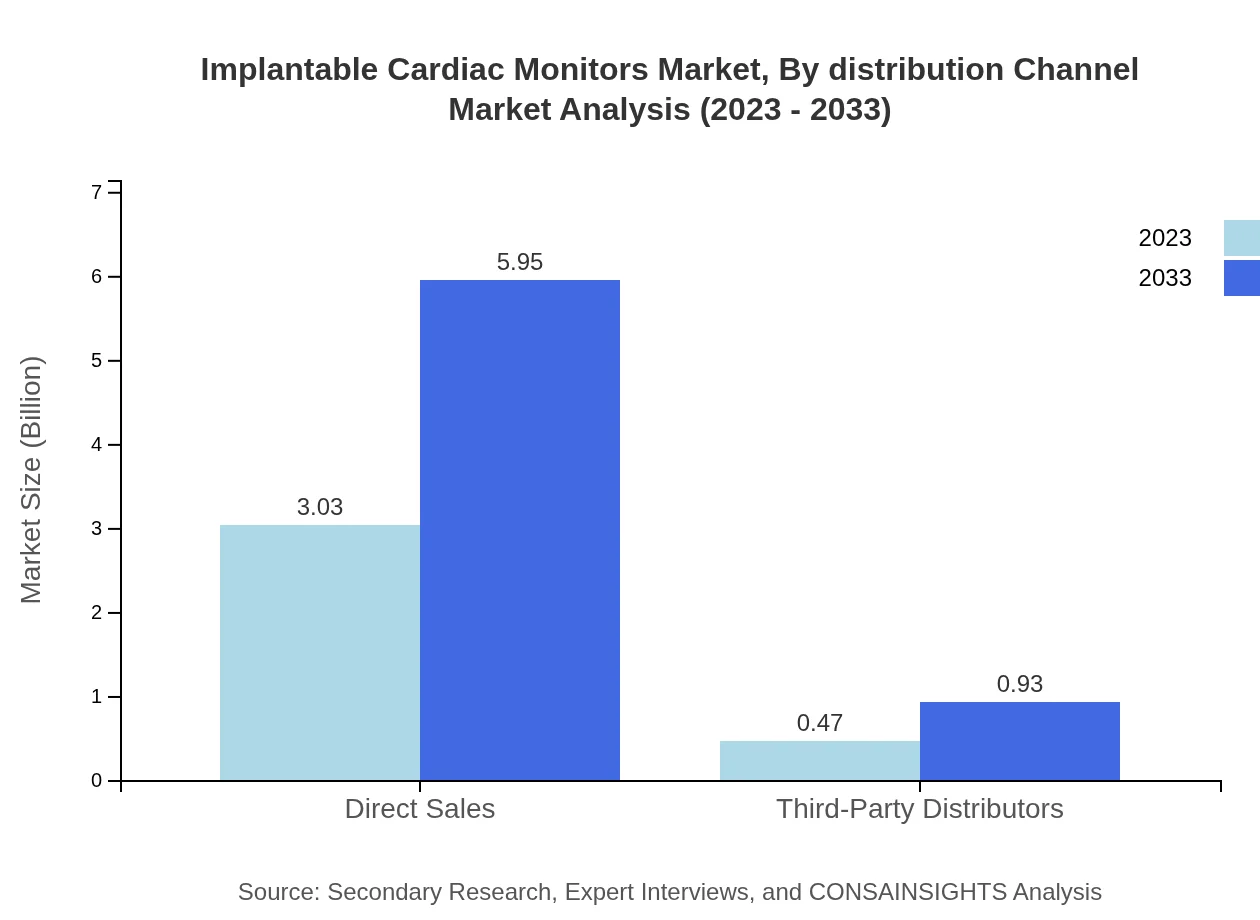

Implantable Cardiac Monitors Market Analysis By Distribution Channel

Direct Sales dominate the distribution channel, holding an 86.46% market share in 2023, with projections for continuity through 2033. Third-party distributors are also growing but represent a smaller share, accounting for 13.54%.

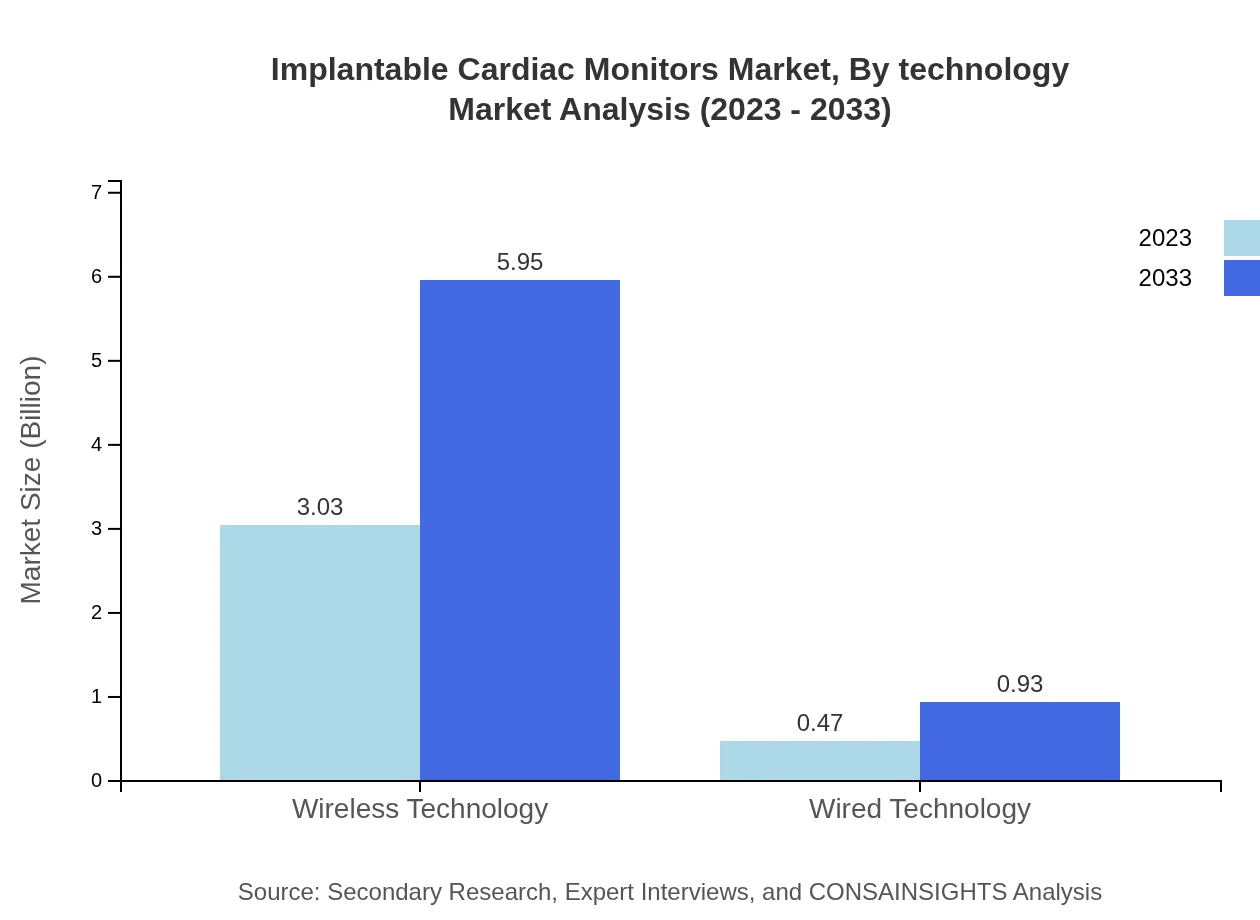

Implantable Cardiac Monitors Market Analysis By Technology

The shift towards Wireless Technology is evident, estimating at a 86.46% market share in 2023 and expected to maintain this level, driven by advantages of data transmission and patient convenience. Wired Technology, though significant, remains a smaller niche in a rapidly advancing market.

Implantable Cardiac Monitors Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Implantable Cardiac Monitors Industry

Medtronic :

A leading medical technology company, Medtronic specializes in innovative therapies, including implantable cardiac monitors that enhance patient outcomes.Abbott Laboratories:

Abbott is a global healthcare provider known for its cutting-edge medical devices, including heart monitors that are critically acclaimed for performance and reliability.Boston Scientific:

Boston Scientific has a robust portfolio of cardiac monitoring devices, focusing on improving healthcare quality through pioneering technology.Biotronik:

Biotronik stands at the forefront of developing advanced cardiac devices, contributing significantly to the global implantable cardiac monitor market.Zimmer Biomet:

Zimmer Biomet is known for its revolutionary medical devices that address cardiovascular health issues, including significant investments in ICM technology.We're grateful to work with incredible clients.

FAQs

What is the market size of implantable cardiac monitors?

The implantable cardiac monitors market is valued at approximately $3.5 billion in 2023 and is expected to grow at a CAGR of 6.8% by 2033, reflecting the rising demand for advanced cardiac monitoring solutions.

What are the key market players or companies in this implantable cardiac monitors industry?

Key players in the implantable cardiac monitors market include renowned companies such as Abbott Laboratories, Medtronic, Boston Scientific, and Phillips, all of which significantly contribute to innovation and market expansion.

What are the primary factors driving the growth in the implantable cardiac monitors industry?

The growth in this industry is driven by increasing prevalence of cardiovascular diseases, advancements in technology, and rising healthcare expenditures, enabling better patient monitoring and management.

Which region is the fastest Growing in the implantable cardiac monitors?

The Asia-Pacific region is projected to be the fastest-growing market for implantable cardiac monitors, with a market size growing from $0.59 billion in 2023 to $1.15 billion by 2033, indicating a robust demand.

Does ConsaInsights provide customized market report data for the implantable cardiac monitors industry?

Yes, Consainsights provides customized market report data tailored to specific needs and objectives in the implantable cardiac monitors industry, ensuring relevance and actionable insights for clients.

What deliverables can I expect from this implantable cardiac monitors market research project?

Clients can expect comprehensive reports that include market analysis, segment data, regional insights, competitive landscape, and future forecasts to guide strategic decision-making.

What are the market trends of implantable cardiac monitors?

Current trends in the implantable cardiac monitors market include increased adoption of wireless technologies, focus on home care settings, and emphasis on remote patient monitoring solutions for continuous patient care.