Implantable Drug Delivery Devices Market Report

Published Date: 31 January 2026 | Report Code: implantable-drug-delivery-devices

Implantable Drug Delivery Devices Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Implantable Drug Delivery Devices market, including insights on market size, growth trends, and forecasts from 2023 to 2033. It encompasses various segments, regional analyses, and key players to furnish stakeholders with valuable data to inform strategic decisions.

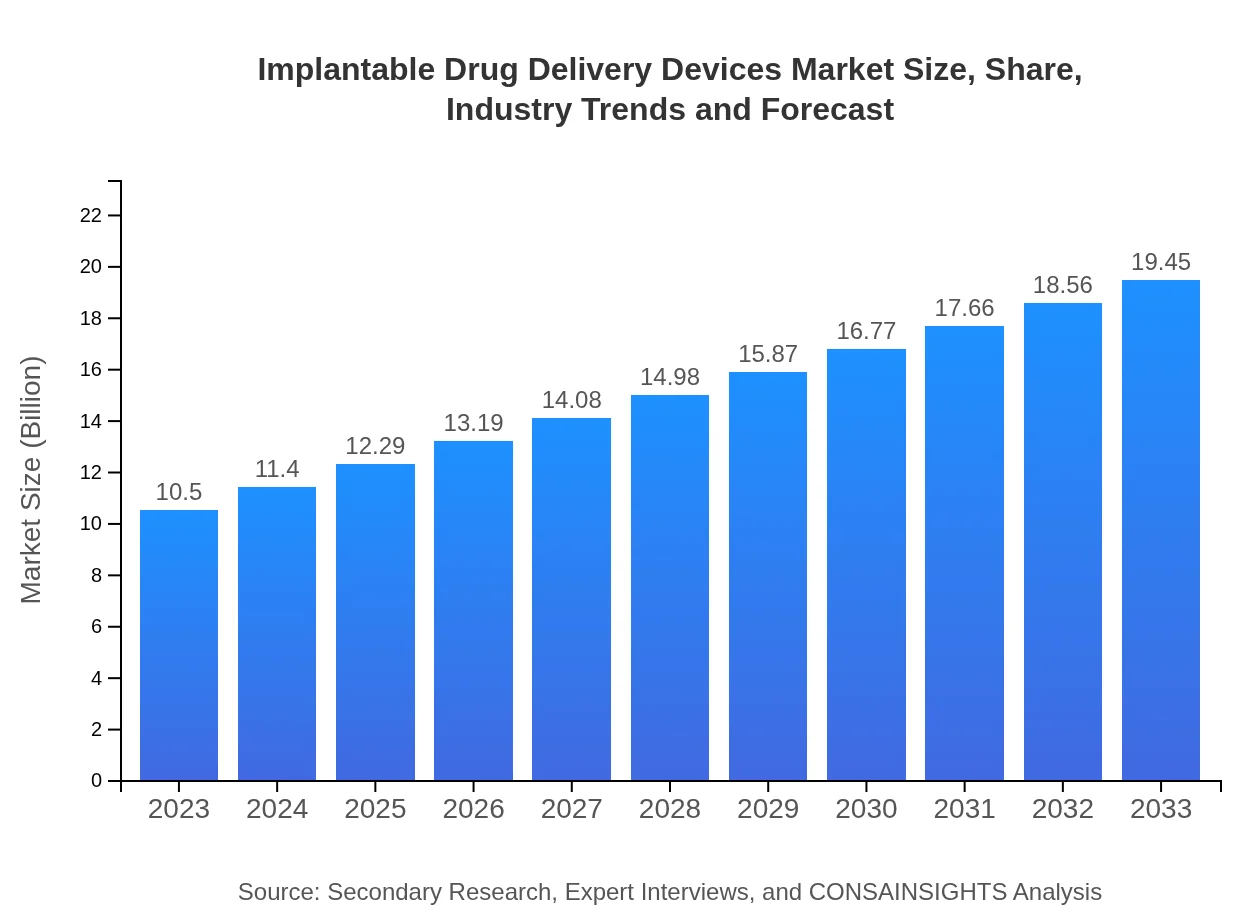

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $19.45 Billion |

| Top Companies | Boston Scientific Corporation, Medtronic , Roche, Johnson & Johnson, Abbott Laboratories |

| Last Modified Date | 31 January 2026 |

Implantable Drug Delivery Devices Market Overview

Customize Implantable Drug Delivery Devices Market Report market research report

- ✔ Get in-depth analysis of Implantable Drug Delivery Devices market size, growth, and forecasts.

- ✔ Understand Implantable Drug Delivery Devices's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Implantable Drug Delivery Devices

What is the Market Size & CAGR of Implantable Drug Delivery Devices market in 2023?

Implantable Drug Delivery Devices Industry Analysis

Implantable Drug Delivery Devices Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Implantable Drug Delivery Devices Market Analysis Report by Region

Europe Implantable Drug Delivery Devices Market Report:

The European market’s size is estimated to grow from $3.17 billion in 2023 to $5.87 billion by 2033. Comprehensive healthcare reforms and the presence of leading medical device manufacturers strengthen the growth trajectory, despite regulatory complexities.Asia Pacific Implantable Drug Delivery Devices Market Report:

In the Asia Pacific region, the Implantable Drug Delivery Devices market is anticipated to grow from $2.00 billion in 2023 to $3.70 billion by 2033. The growing population, increased healthcare expenditure, and the rising prevalence of chronic diseases drive this growth. Additionally, local manufacturers are beginning to gain market traction by offering cost-effective solutions.North America Implantable Drug Delivery Devices Market Report:

North America, the largest market for Implantable Drug Delivery Devices, is projected to expand from $3.63 billion in 2023 to $6.73 billion by 2033. Factors include high healthcare spending, established healthcare infrastructure, and a rising geriatric population with corresponding healthcare needs.South America Implantable Drug Delivery Devices Market Report:

The South American market for Implantable Drug Delivery Devices is expected to witness growth from $0.52 billion in 2023 to $0.96 billion by 2033. Increasing healthcare initiatives and rising income levels contribute to the market’s growth, despite economic challenges faced in some countries.Middle East & Africa Implantable Drug Delivery Devices Market Report:

The Middle East and Africa market is projected to witness growth from $1.18 billion in 2023 to $2.19 billion by 2033. Improving healthcare facilities and an increase in health awareness are key factors driving this growth in the region.Tell us your focus area and get a customized research report.

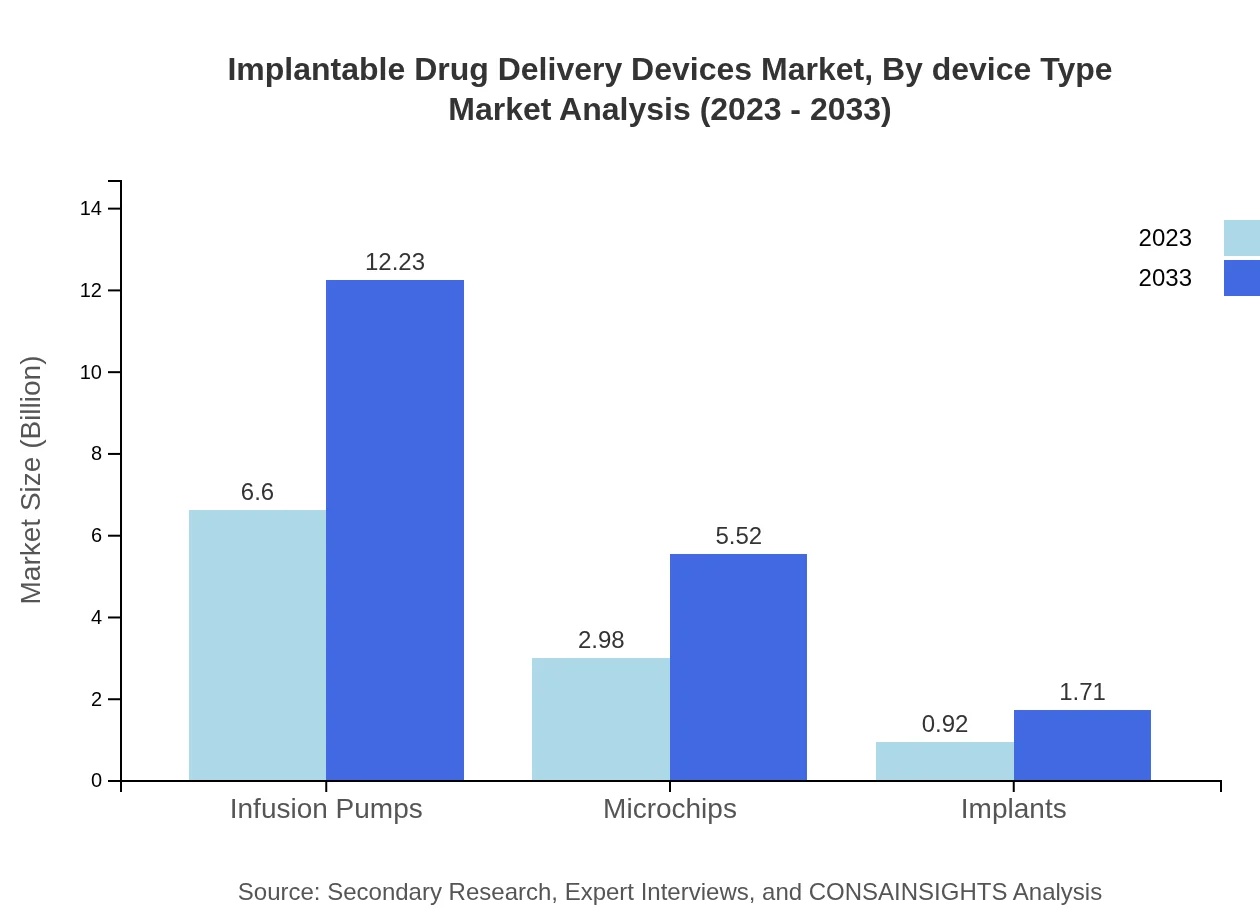

Implantable Drug Delivery Devices Market Analysis By Device Type

In 2023, the infusion pumps segment holds a significant market size of $6.60 billion, expected to reach $12.23 billion by 2033, accounting for 62.85% share of the market. Other segments, including microchips and smart delivery systems, also show growing trends, reflecting the diversity of delivery mechanisms tailored to specific therapeutic applications.

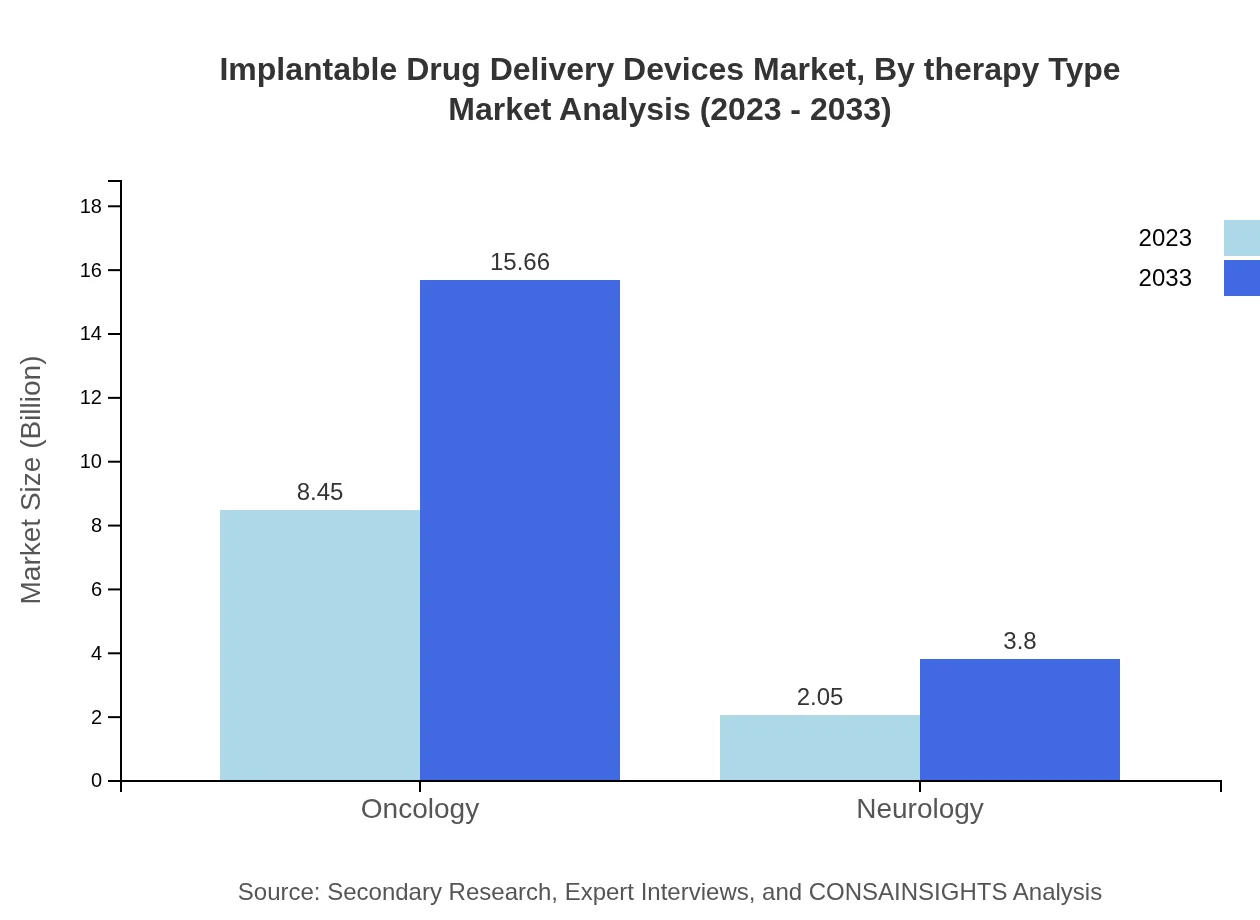

Implantable Drug Delivery Devices Market Analysis By Therapy Type

Oncology remains the leading therapy type, projected at $8.45 billion in 2023 and expected to grow to $15.66 billion by 2033, dominating with about 80.48% market share. Neurology devices follow, yet at a lower ₹2.05 billion market projection for 2023, rising to $3.80 billion by 2033, highlighting the urgent demand for effective drug delivery in neurological treatments.

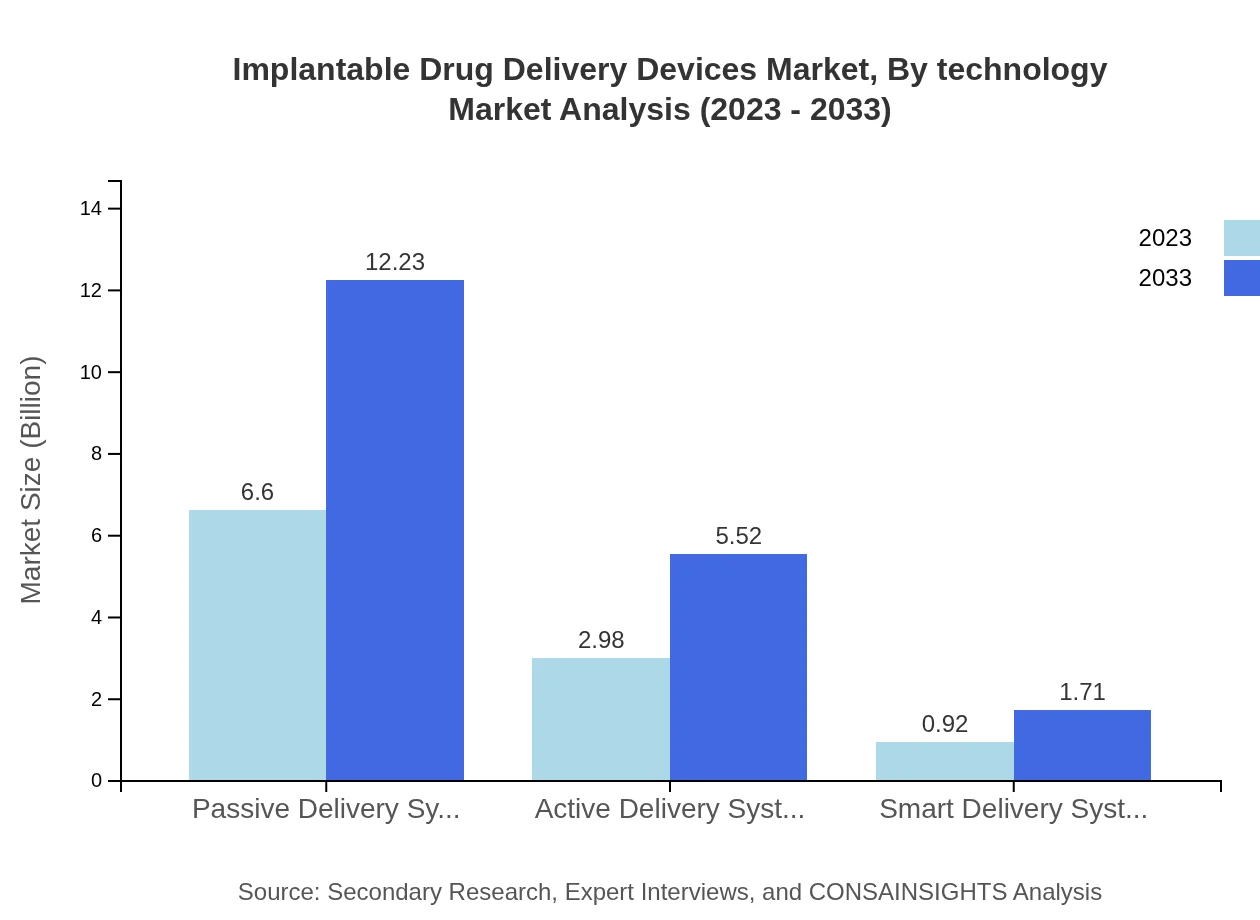

Implantable Drug Delivery Devices Market Analysis By Technology

The market segmentation by technology showcases passive delivery systems holding a market size of $6.60 billion in 2023, ascending to $12.23 billion by 2033, reflecting their prominence in sustained drug delivery applications. Active and smart systems are also on the rise, driven by the need for enhanced monitoring and drug dispensing capabilities, reinforcing their presence in treatment protocols.

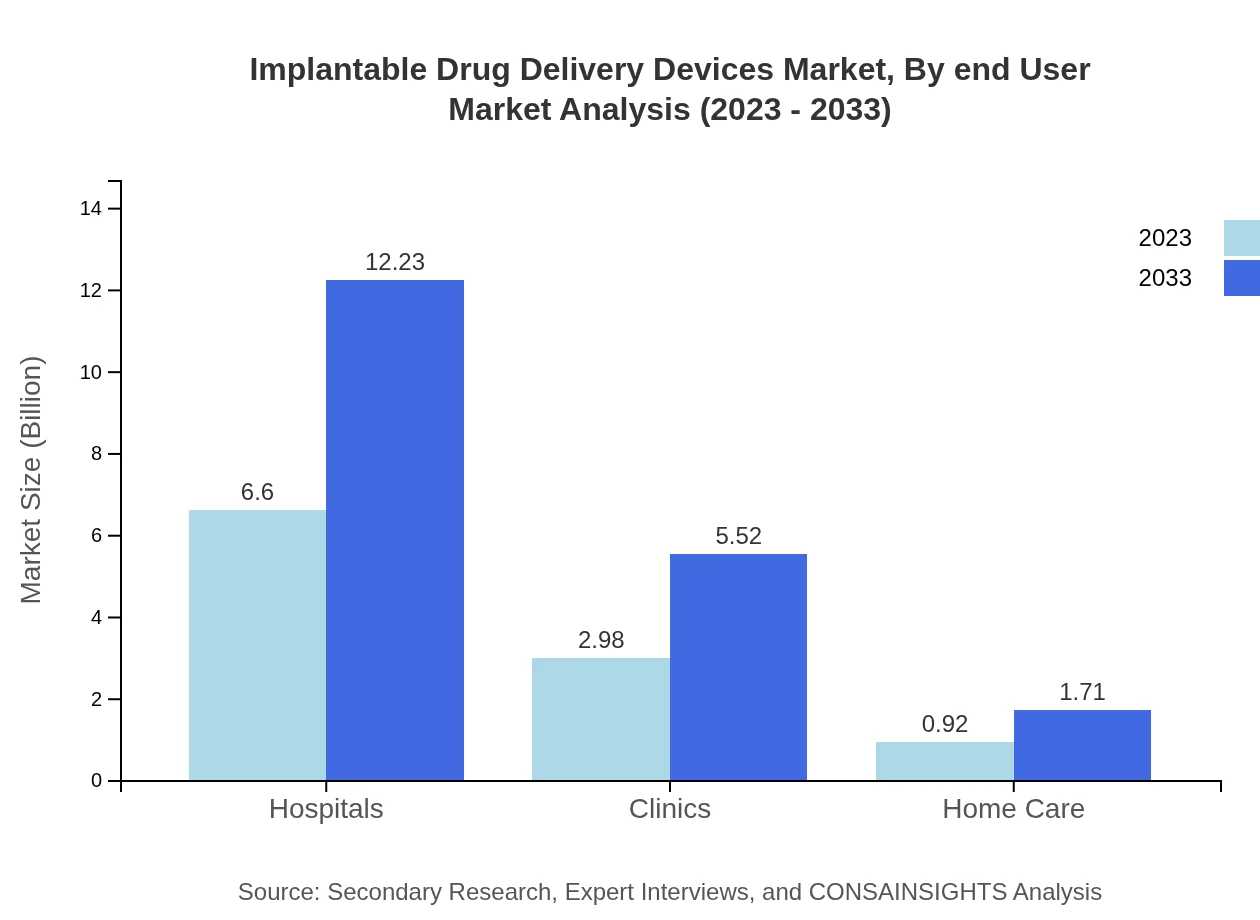

Implantable Drug Delivery Devices Market Analysis By End User

Hospitals represent the largest end-user segment with a market size of $6.60 billion in 2023 and an estimated growth to $12.23 billion by 2033, with a consistent share of 62.85%. Clinics and home care settings are increasingly adopting implantable devices, which indicates a trend toward outpatient care solutions.

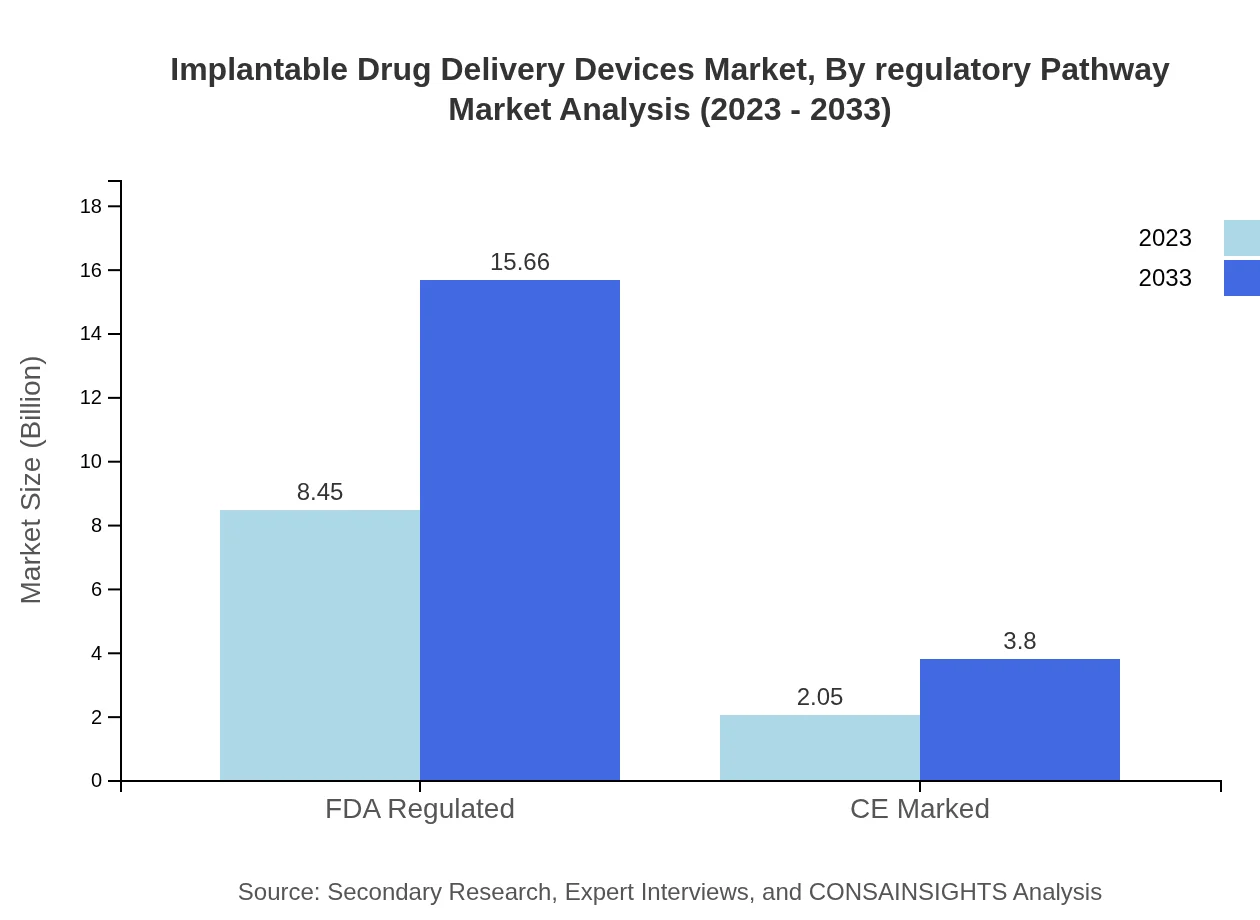

Implantable Drug Delivery Devices Market Analysis By Regulatory Pathway

FDA approved devices dominate the regulatory pathway segment with a market size of $8.45 billion in 2023, growing to $15.66 billion by 2033. Their significant share reflects stringent approval processes fostering advancements, while devices with CE marking gain traction within the European market, registering a market size growth from $2.05 billion in 2023 to $3.80 billion by 2033.

Implantable Drug Delivery Devices Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Implantable Drug Delivery Devices Industry

Boston Scientific Corporation:

A leading developer and manufacturer of medical devices, Boston Scientific specializes in innovative implantable drug delivery systems in various therapeutic areas, significantly contributing to market advancements through R&D.Medtronic :

Medtronic is a renowned global healthcare solutions company that develops and supplies a wide array of implantable drug delivery devices, focusing on enhancing patient outcomes through technological innovation.Roche:

Roche is a key player in pharmaceuticals and diagnostics, providing implantable drug delivery devices that improve treatment administration and patient adherence, mainly in oncology and chronic disease management.Johnson & Johnson:

A diversified global healthcare giant offering a variety of implantable devices, Johnson & Johnson is notable for its extensive research and development efforts in drug delivery technologies.Abbott Laboratories:

Abbott focuses on high-quality healthcare products including implantable drug delivery devices, playing a significant role in innovating drug therapies and operational methodologies within the sector.We're grateful to work with incredible clients.

FAQs

What is the market size of implantable Drug Delivery Devices?

The implantable drug delivery devices market is projected to reach a value of approximately $10.5 billion by 2033, growing at a compound annual growth rate (CAGR) of 6.2% from 2023 onward.

What are the key market players or companies in this implantable Drug Delivery Devices industry?

The implantable drug delivery devices market features key players such as Medtronic, Boston Scientific, Abbott Laboratories, and Johnson & Johnson. These companies are recognized for their innovative technologies and extensive product portfolios in drug delivery systems.

What are the primary factors driving the growth in the implantable Drug Delivery Devices industry?

Factors driving market growth include the rising prevalence of chronic diseases, advancements in drug delivery technologies, increased demand for minimally invasive procedures, and growing investments in healthcare infrastructure, particularly in developing regions.

Which region is the fastest Growing in the implantable Drug Delivery Devices?

The Asia Pacific region is projected to be the fastest-growing market for implantable drug delivery devices, expected to grow from $2.00 billion in 2023 to $3.70 billion by 2033, spurred by expanding healthcare access and increased investment.

Does ConsaInsights provide customized market report data for the implantable Drug Delivery Devices industry?

Yes, ConsaInsights offers customized market report data for the implantable drug delivery devices industry, tailoring insights to specific requirements, including regional analyses, segment-based trends, and competitive landscape evaluations.

What deliverables can I expect from this implantable Drug Delivery Devices market research project?

Deliverables from the research project include a comprehensive market report, detailed segment analysis, competitive landscape insights, market trends, and forecasts, as well as strategic recommendations tailored to enhance business decision-making.

What are the market trends of implantable Drug Delivery Devices?

Current market trends include the increasing adoption of smart delivery systems, the integration of monitoring technologies, a focus on personalized medicine, and ongoing regulatory advancements aimed at enhancing product safety and efficacy.