In Building Wireless Market Report

Published Date: 31 January 2026 | Report Code: in-building-wireless

In Building Wireless Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the In Building Wireless market from 2023 to 2033, offering insights into market size, segmentation, key players, and future trends. It aims to equip stakeholders with valuable data and forecasts to navigate this evolving industry.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

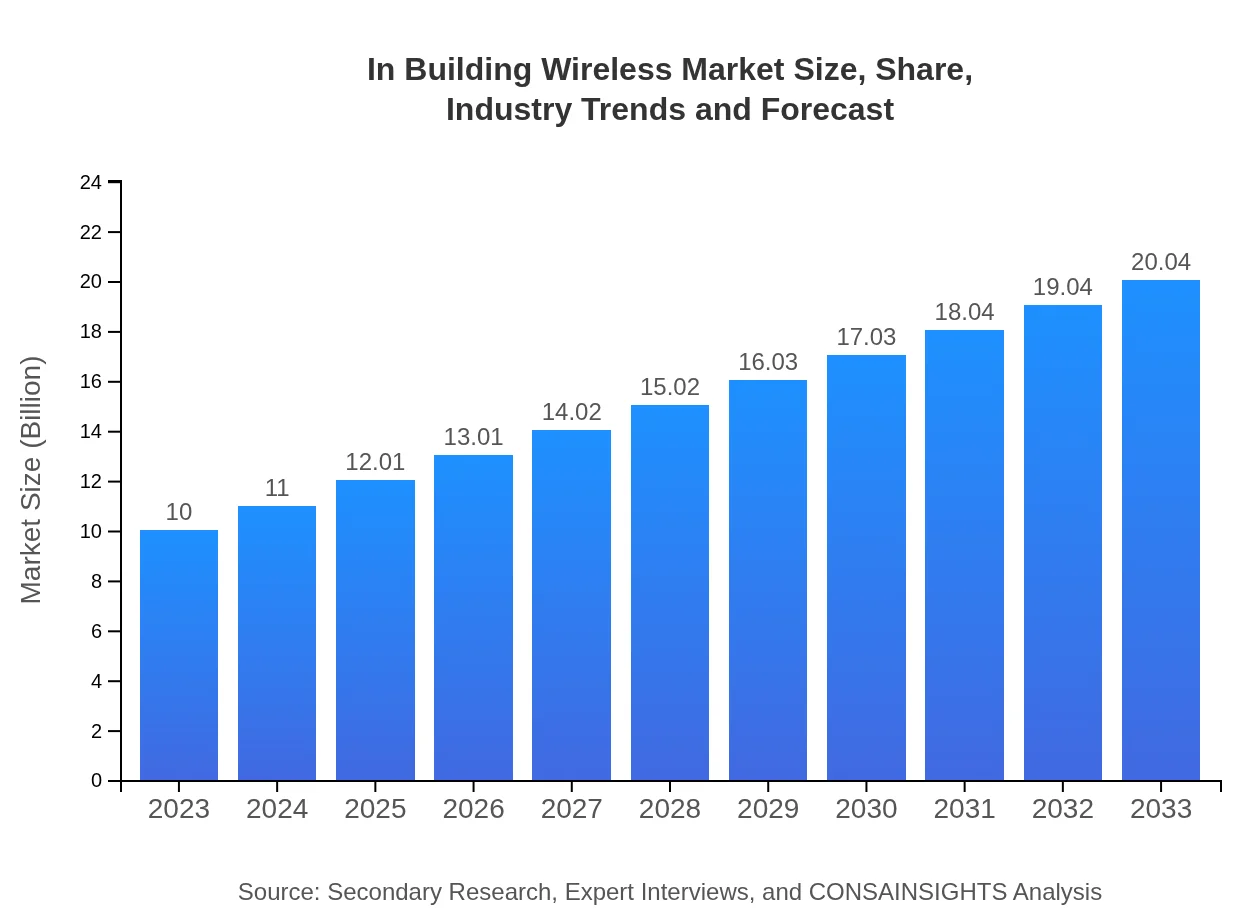

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 7% |

| 2033 Market Size | $20.04 Billion |

| Top Companies | Cisco Systems, Inc., CommScope Inc., Qualcomm Technologies, Inc., Huawei Technologies Co., Ltd., Zebra Technologies Corporation |

| Last Modified Date | 31 January 2026 |

In Building Wireless Market Overview

Customize In Building Wireless Market Report market research report

- ✔ Get in-depth analysis of In Building Wireless market size, growth, and forecasts.

- ✔ Understand In Building Wireless's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in In Building Wireless

What is the Market Size & CAGR of In Building Wireless market in 2023?

In Building Wireless Industry Analysis

In Building Wireless Market Segmentation and Scope

Tell us your focus area and get a customized research report.

In Building Wireless Market Analysis Report by Region

Europe In Building Wireless Market Report:

Europe's In Building Wireless market is anticipated to grow from $3.07 billion in 2023 to $6.16 billion by 2033. The increasing focus on digital transformation across industries, coupled with rising mobile data traffic, is driving growth in the region. Additionally, government initiatives to enhance telecommunications infrastructure and support smart city projects are pivotal for market expansion. However, challenges such as stringent regulatory requirements and technological standardization must be addressed to optimize growth paths.Asia Pacific In Building Wireless Market Report:

The Asia Pacific region is experiencing rapid growth in the In Building Wireless market, with a market size projected to reach $3.64 billion by 2033, up from $1.81 billion in 2023. This growth is primarily fueled by increasing urbanization and the rising adoption of smartphones. Countries like China and India are investing heavily in smart city initiatives, coupled with expanding internet infrastructure. The region's emphasis on 5G technology is expected to further bolster demand for advanced wireless solutions. Additionally, the post-pandemic focus on digitalization across various sectors sets a strong foundation for market growth.North America In Building Wireless Market Report:

In North America, the In Building Wireless market is set to grow substantially, from $3.84 billion in 2023 to $7.70 billion by 2033. The region's robust infrastructure, along with a rapid shift towards 5G integration, positions it as a leader in adopting advanced wireless technologies. Increased consumer demand for high-speed internet and mobile connectivity in commercial and residential sectors showcases the market's potential. Key players are actively engaged in expanding their offerings, integrating new technologies, and forming strategic partnerships to enhance market presence.South America In Building Wireless Market Report:

South America presents a smaller but growing market for In Building Wireless solutions, with a projected increase from $0.35 billion in 2023 to $0.69 billion by 2033. Economic conditions are gradually improving, leading to increased investments in telecommunications infrastructure. The demand for improved connectivity in corporate offices and public spaces will likely drive market growth. However, regulatory challenges and variations in technology adoption rates across countries may pose hurdles for swift expansion.Middle East & Africa In Building Wireless Market Report:

The Middle East and Africa region is expected to see notable growth in the In Building Wireless market, with projections rising from $0.92 billion in 2023 to $1.85 billion by 2033. Factors contributing to this growth include increasing investments in telecommunications and the necessity for improved indoor coverage in rapidly urbanizing areas. Furthermore, the localization of data centers and the implementation of advanced wireless technologies are anticipated to support future market development.Tell us your focus area and get a customized research report.

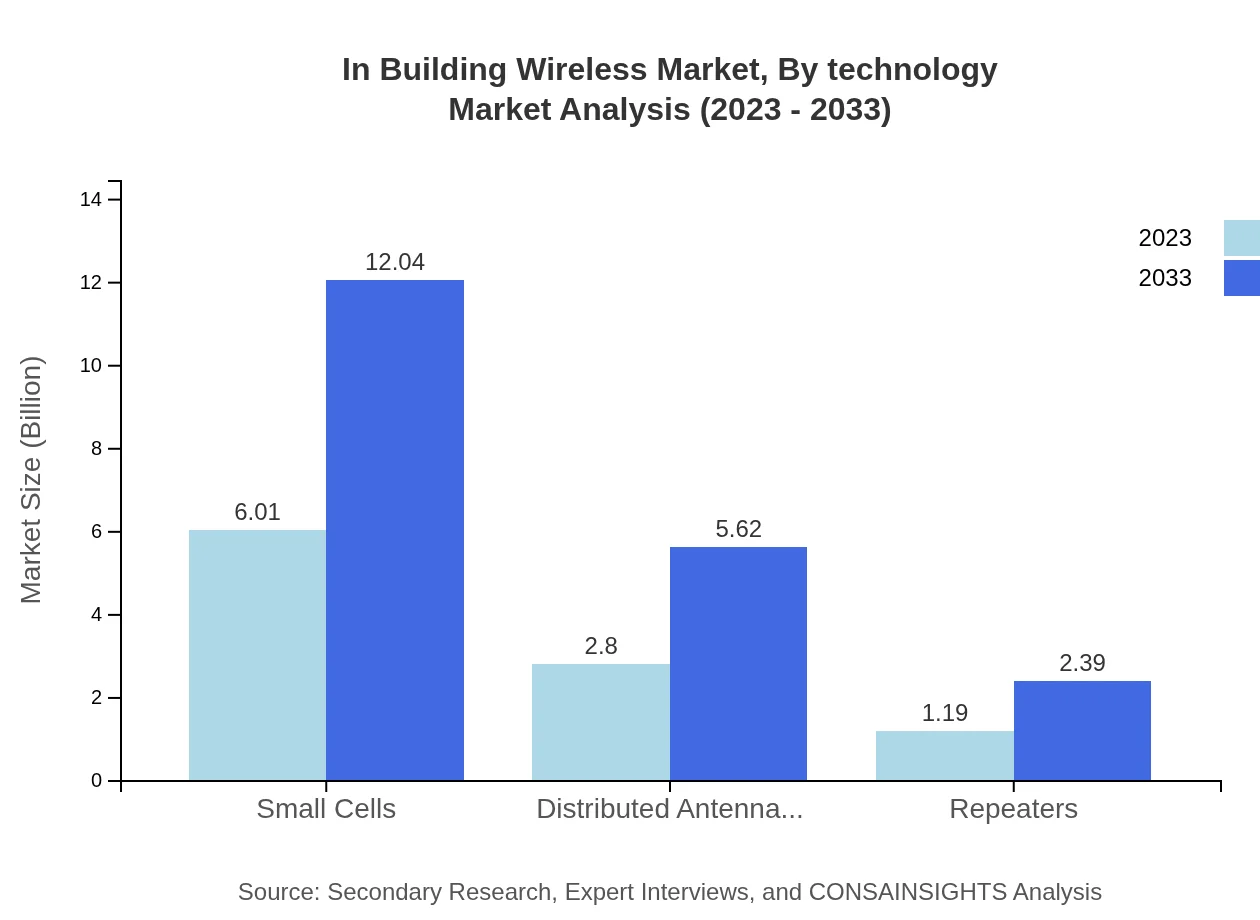

In Building Wireless Market Analysis By Technology

The In-Building Wireless Market is segmented by technology, primarily comprising Small Cells, Distributed Antenna Systems (DAS), Repeaters, Wi-Fi, and Cellular systems. Small Cells continue to dominate, holding a market share of 60.06% in 2023, reflecting their efficiency in enhancing signal quality within confined spaces. DAS follows closely, capturing 28.03% of the market share. The technological advancements in Wi-Fi solutions, growing pubic demand for reliable communication, and continuous enhancements in cellular technology are also pivotal in shaping this segment.

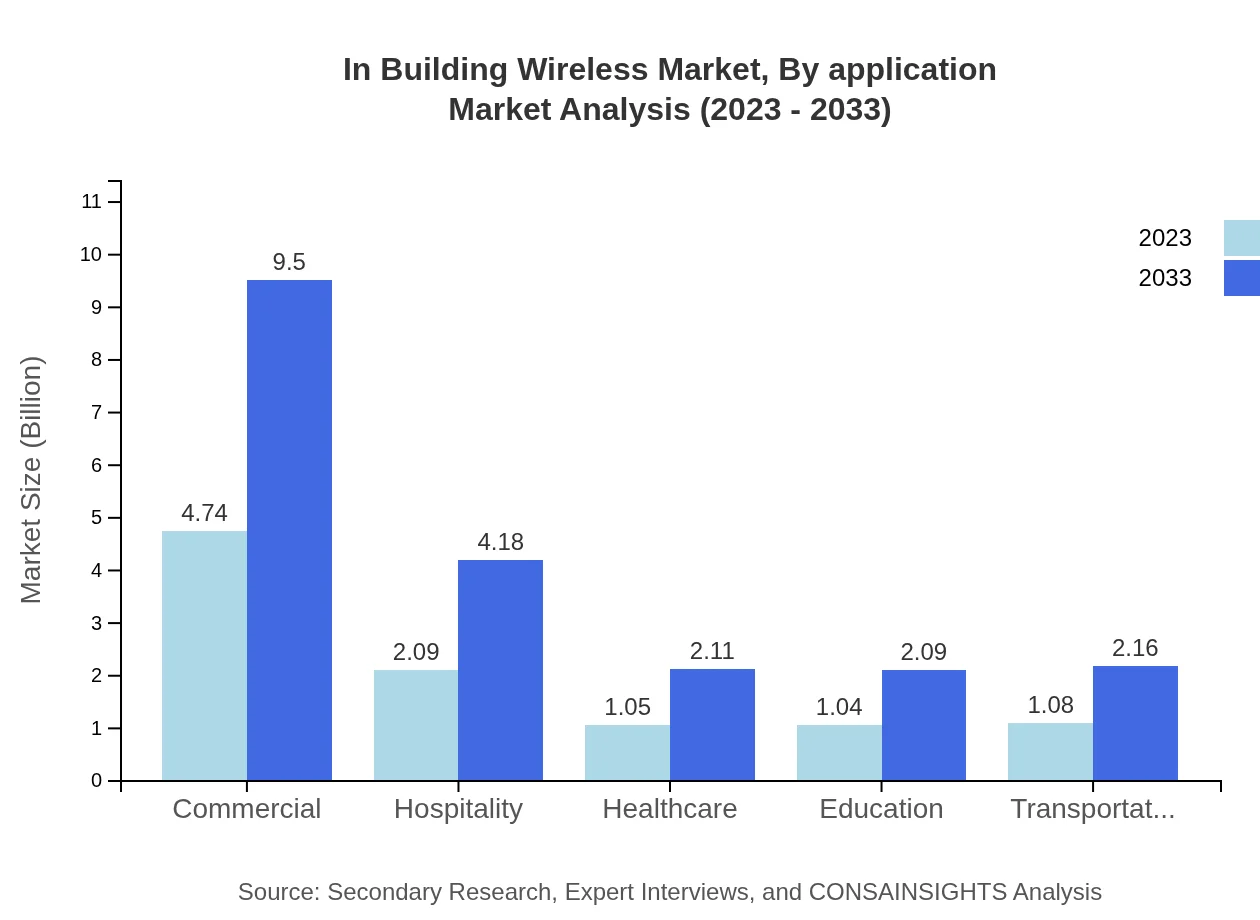

In Building Wireless Market Analysis By Application

Applications in the In-Building Wireless market function across various domains, including retail, healthcare, education, corporate, and industrial sectors. Retail accounts for the largest share at 47.38%, driven by the need for seamless connectivity in commercial spaces. The healthcare sector also holds a significant share of 20.87%, emphasizing the critical demand for reliable wireless communication for patient care. Other sectors such as education and hospitality are increasingly adopting sophisticated wireless technologies to improve customer and operational experiences.

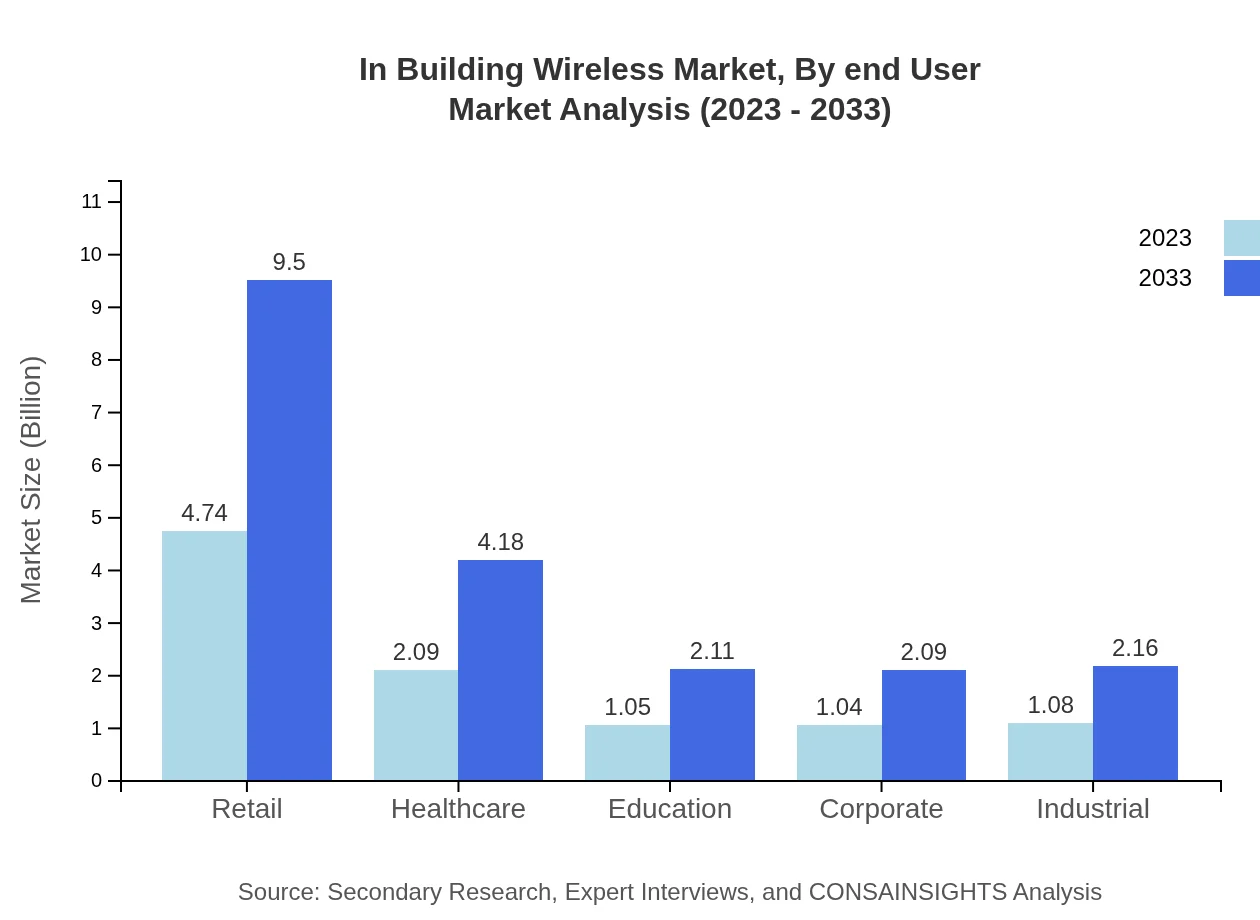

In Building Wireless Market Analysis By End User

End-user analysis reveals key stakeholders including corporate offices, healthcare facilities, retail spaces, and educational institutions. Corporate users have reached 10.45% of market share as companies strive for enhanced internal communications complemented by wireless infrastructure. Meanwhile, sectors like education and transportation will expectedly see growth as institutions look for reliable connectivity to support digital learning and operational efficiency.

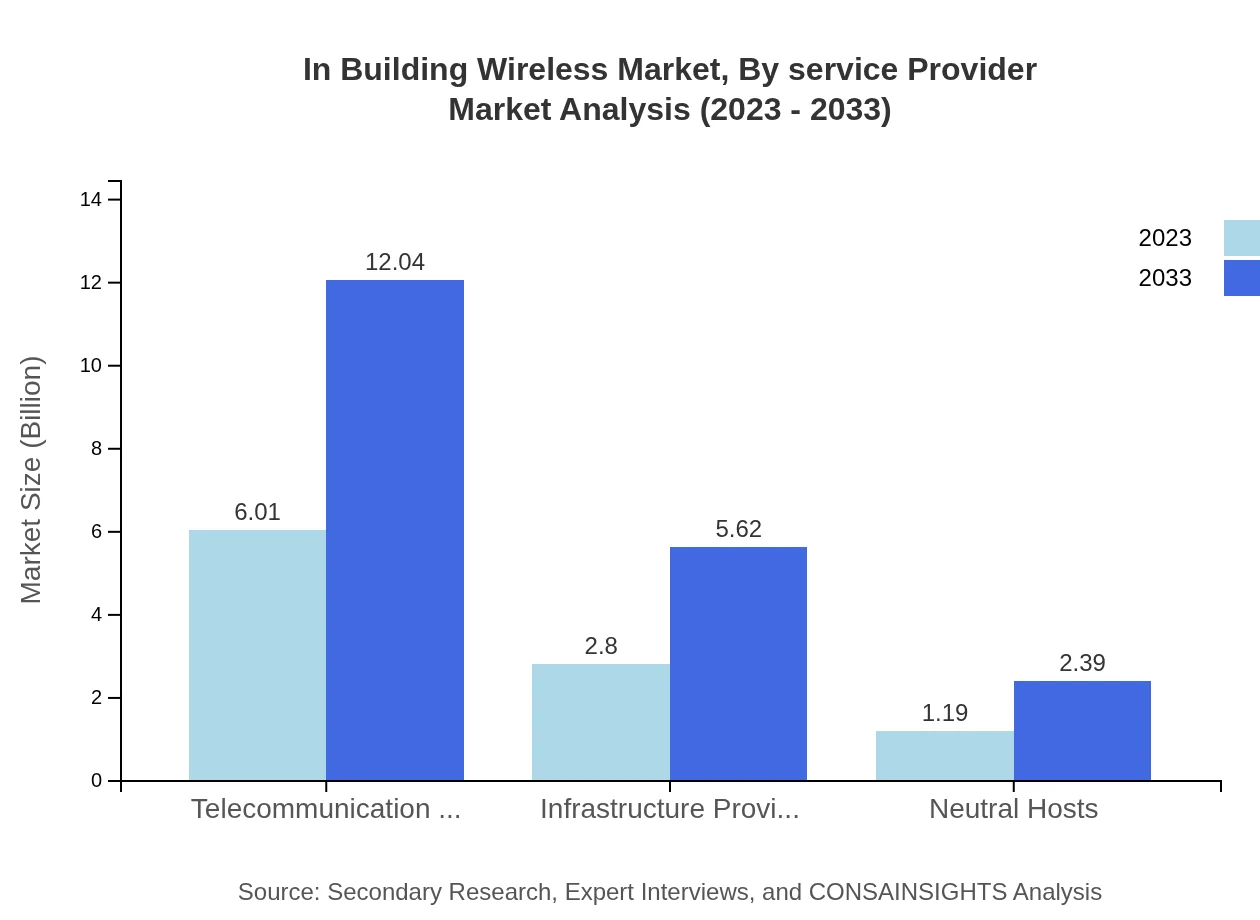

In Building Wireless Market Analysis By Service Provider

This segment explores the impact of various service providers, including telecom operators and infrastructure providers. Telecommunications operators dominate the market, holding a 60.06% share owing to the critical role they play in deploying wireless network solutions. Infrastructure providers and neutral hosts are also emerging rapidly as essential contributors to the market by facilitating the implementation of integrated wireless systems.

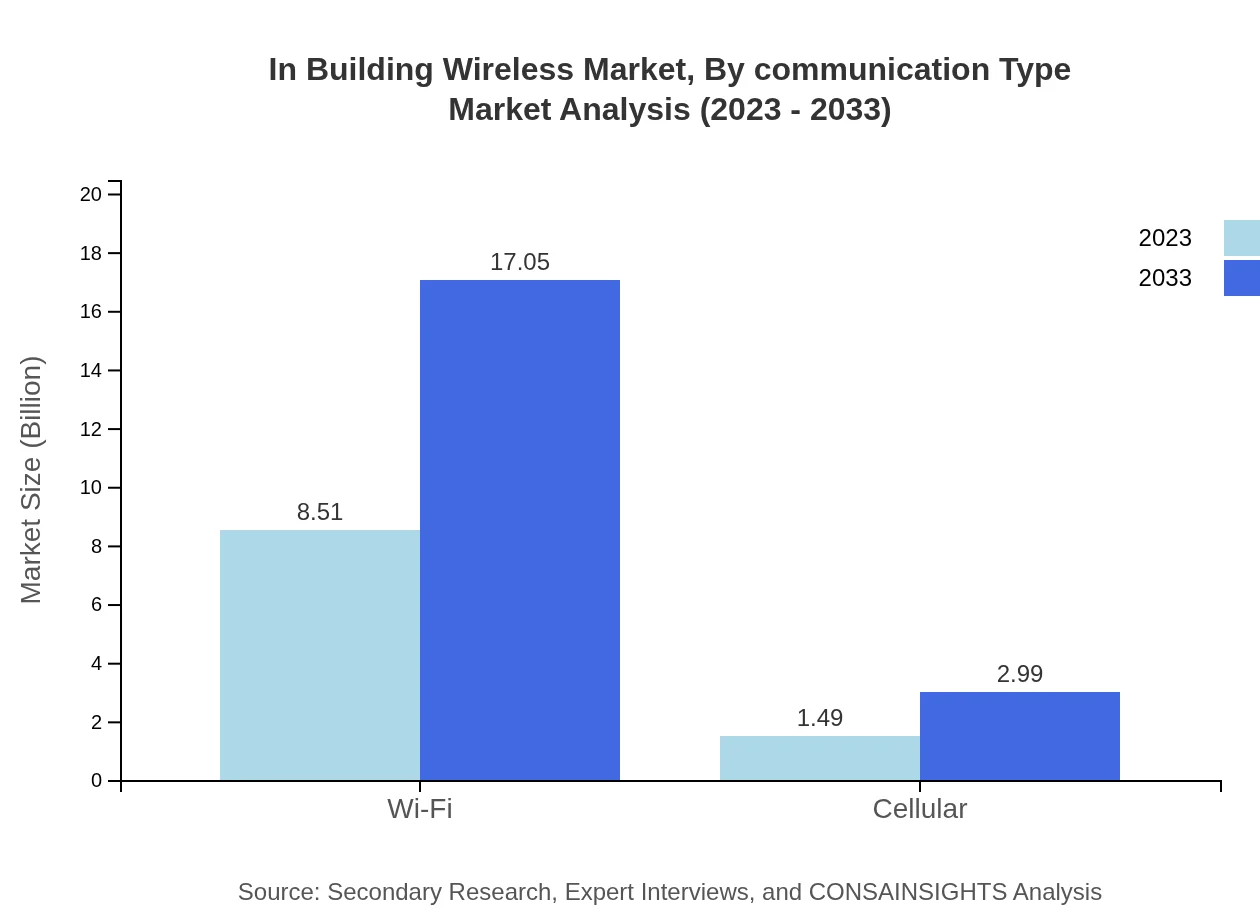

In Building Wireless Market Analysis By Communication Type

The In-Building Wireless market demonstrates distinct trends in communication types with Wi-Fi capturing 85.06% of the market share in 2023, primarily driven by user preference for high-speed internet access. Meanwhile, cellular technology, despite capturing a smaller share at 14.94%, is becoming increasingly relevant with the expansion of 5G networks and the rising need for reliable mobile data within viable installations.

In Building Wireless Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in In Building Wireless Industry

Cisco Systems, Inc.:

Cisco is a leading provider of networking equipment and has a strong presence in the In Building Wireless sector through solutions that support reliable connectivity and seamless integration of wireless technologies within customer environments.CommScope Inc.:

CommScope specializes in connectivity solutions and offers various products, including distributed antenna systems and small cell technologies, making it a vital player in enhancing indoor wireless coverage.Qualcomm Technologies, Inc.:

Qualcomm is recognized for its significant advancements in wireless technology, including the development of 5G chips that empower many In Building Wireless solutions, enhancing capacity and efficiency.Huawei Technologies Co., Ltd.:

Huawei excels in telecommunications infrastructure, with an extensive portfolio of wireless solutions that cater to various sectors, positioning the company as a considerable force in the In Building Wireless market.Zebra Technologies Corporation:

Zebra Technologies provides integrated solutions that enhance real-time visibility into operations across multiple sectors. Their wireless solutions play a crucial role in streamlining communication in enterprise settings.We're grateful to work with incredible clients.

FAQs

What is the market size of In-Building Wireless?

The global in-building wireless market is valued at approximately $10 billion in 2023, with a projected CAGR of 7%. By 2033, it is expected to reach around $20 billion, reflecting significant growth in this sector.

What are the key market players or companies in the In-Building Wireless industry?

Key players in the in-building wireless market include established telecommunications firms, hardware manufacturers, and service providers that specialize in wireless infrastructure. Their innovations and developments drive competition and contribute to market growth.

What are the primary factors driving the growth in the In-Building Wireless industry?

Growth in the in-building wireless sector is driven by increasing mobile data consumption, the demand for enhanced connectivity, and advancements in wireless technologies like 5G, which compel businesses to upgrade their infrastructure.

Which region is the fastest Growing in the In-Building Wireless market?

North America leads in growth with the market expected to rise from $3.84 billion in 2023 to $7.70 billion by 2033. Europe follows suit with a significant increase from $3.07 billion to $6.16 billion in the same period.

Does ConsaInsights provide customized market report data for the In-Building Wireless industry?

Yes, Consainsights.com offers customized market report data tailored to specific needs in the in-building wireless market, ensuring clients receive insights that align with their strategic objectives and market demands.

What deliverables can I expect from this In-Building Wireless market research project?

Deliverables from the in-building wireless market research project include comprehensive reports, market analysis, forecasts, competitive landscape assessments, and actionable insights to inform business strategies and decision-making.

What are the market trends of In-Building Wireless?

Current trends in the in-building wireless market include the shift towards small cells and DAS solutions, increased integration of IoT, and the adoption of 5G technology, facilitating better network performance and wider coverage.