In Store Analytics Market Report

Published Date: 31 January 2026 | Report Code: in-store-analytics

In Store Analytics Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the In Store Analytics market, covering insights on market size, growth trends, segment performance, and regional dynamics from 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

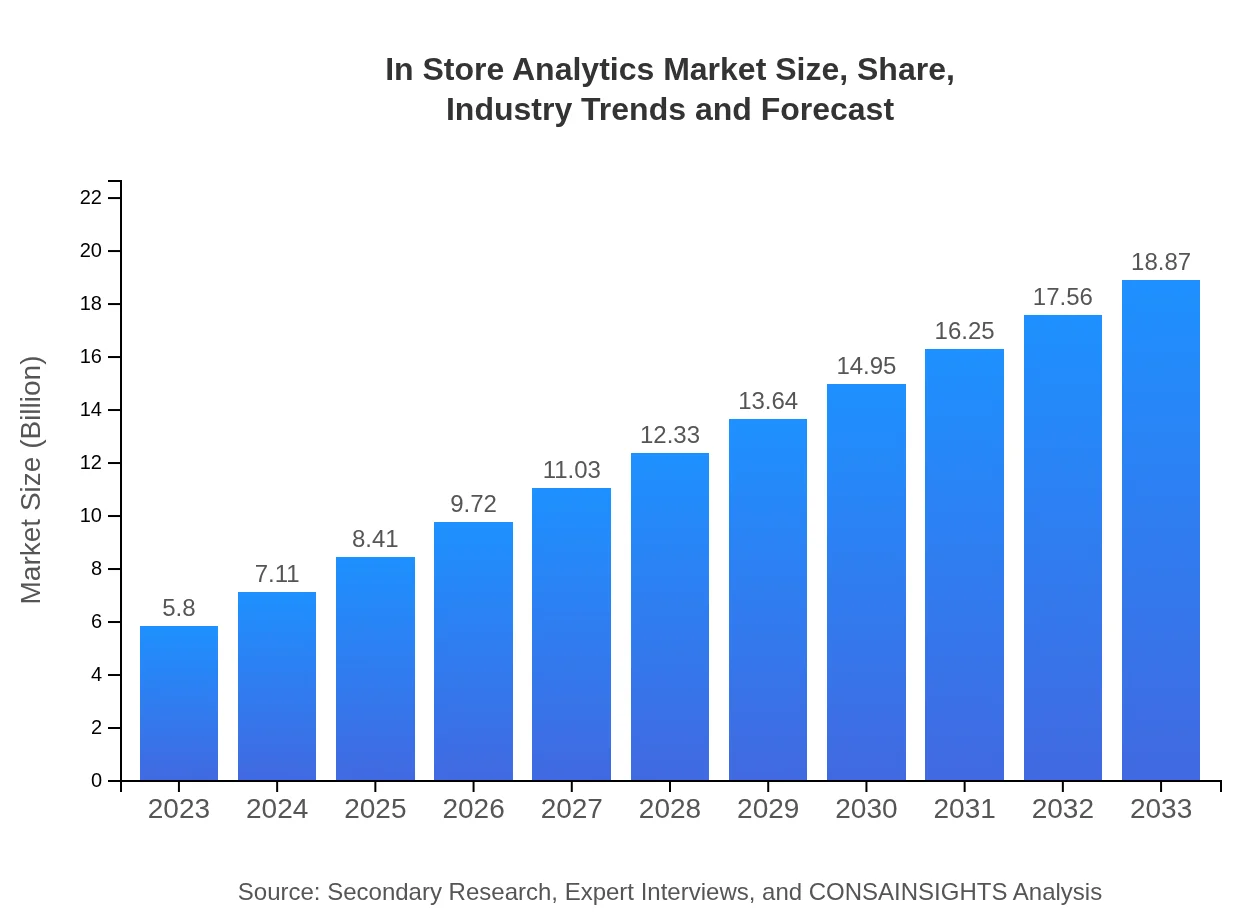

| 2023 Market Size | $5.80 Billion |

| CAGR (2023-2033) | 12% |

| 2033 Market Size | $18.87 Billion |

| Top Companies | RetailNext, IBM, Oracle, Nedap, Cisco |

| Last Modified Date | 31 January 2026 |

In Store Analytics Market Overview

Customize In Store Analytics Market Report market research report

- ✔ Get in-depth analysis of In Store Analytics market size, growth, and forecasts.

- ✔ Understand In Store Analytics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in In Store Analytics

What is the Market Size & CAGR of In Store Analytics market in 2023?

In Store Analytics Industry Analysis

In Store Analytics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

In Store Analytics Market Analysis Report by Region

Europe In Store Analytics Market Report:

The European market is anticipated to expand from $1.62 billion in 2023 to $5.27 billion by 2033. Retailers are increasingly leveraging analytics to improve operational capabilities, driven by the demand for personalization in shopping experiences.Asia Pacific In Store Analytics Market Report:

In the Asia Pacific region, the In Store Analytics market is predicted to grow from $1.14 billion in 2023 to approximately $3.71 billion by 2033. This growth is driven by the rapidly expanding retail sector and the increasing penetration of advanced technologies across emerging markets in countries like China and India.North America In Store Analytics Market Report:

In North America, the market is projected to experience robust growth from $1.88 billion in 2023 to $6.12 billion by 2033. The region benefits from a mature retail market, high technology adoption rates, and a strong focus on customer experience enhancement.South America In Store Analytics Market Report:

The South American market for In Store Analytics is expected to rise from $0.41 billion in 2023 to $1.35 billion by 2033. Factors such as the growing e-commerce sector and heightened competition among retailers are prompting investments in analytics solutions to better understand consumer behaviors.Middle East & Africa In Store Analytics Market Report:

In the Middle East and Africa, the In Store Analytics market is expected to grow from $0.74 billion in 2023 to $2.42 billion by 2033. Rising investments in retail infrastructure and the growing adoption of digital technologies are key drivers in this region.Tell us your focus area and get a customized research report.

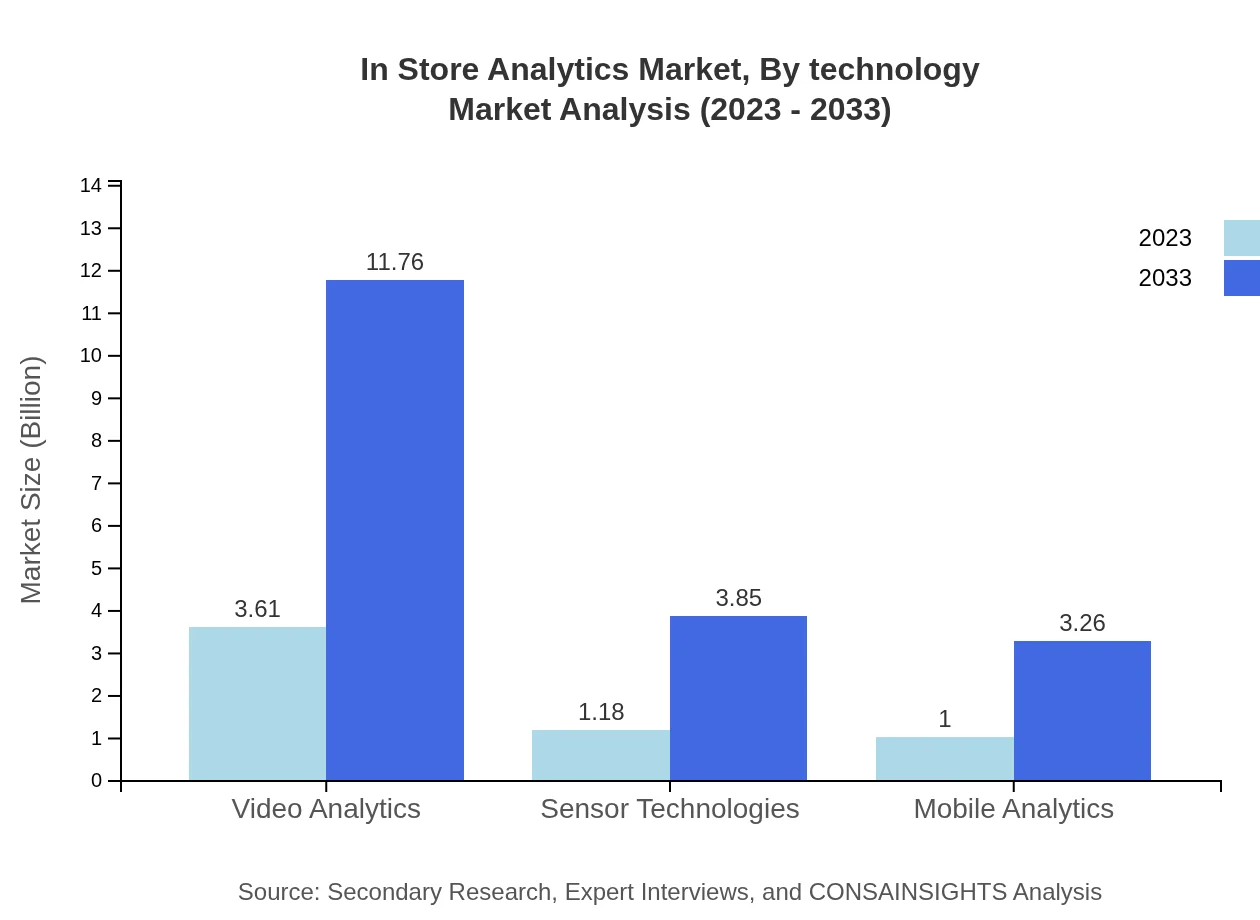

In Store Analytics Market Analysis By Technology

In-store analytics is significantly influenced by various technologies including video analytics, location analytics, and sensor technologies. In 2023, the market size for video analytics is valued at $3.61 billion, expected to increase to $11.76 billion by 2033. Location analytics and sensor technologies also play notable roles, enabling detailed operational insights and customer journey mapping.

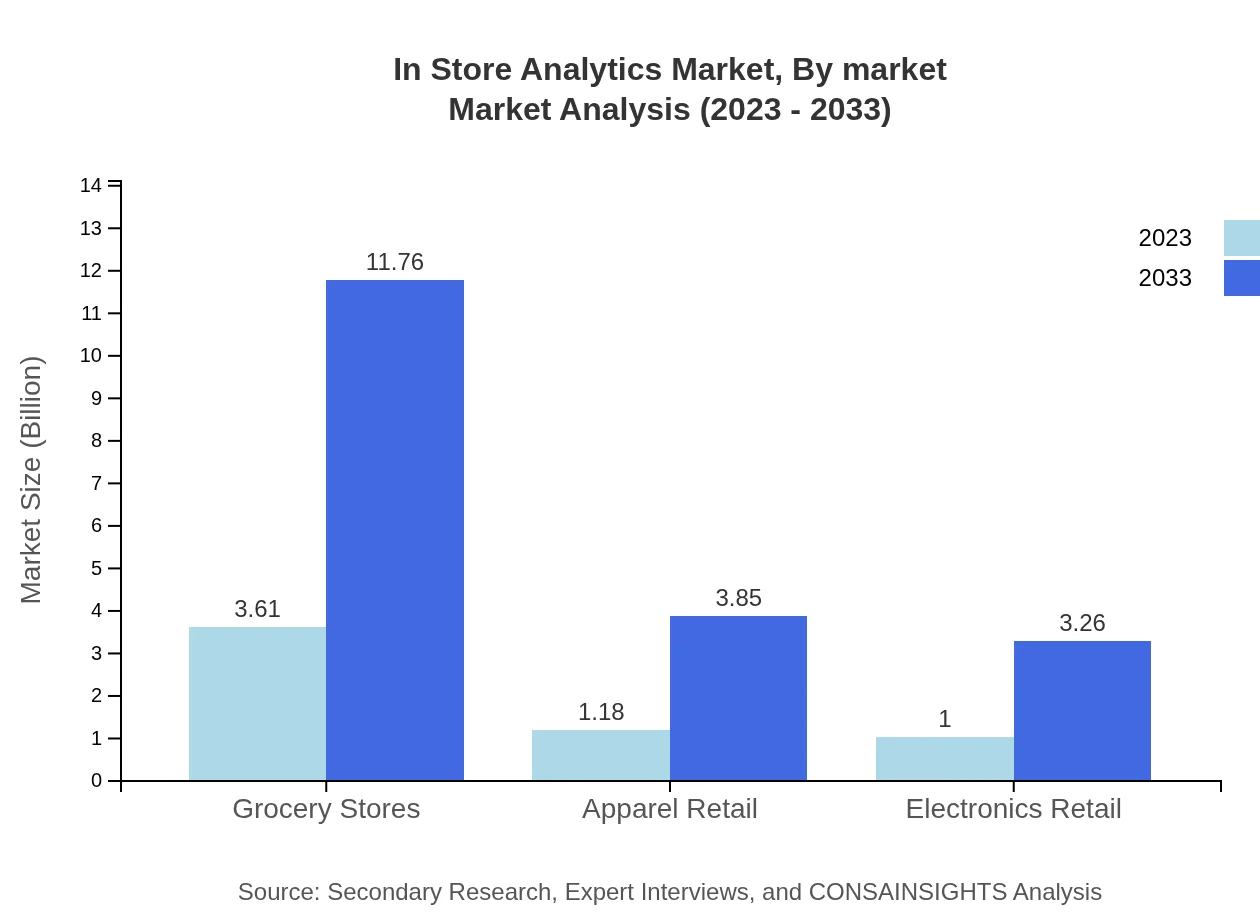

In Store Analytics Market Analysis By Market

Grocery stores dominate the In Store Analytics market with a size of $3.61 billion in 2023, forecasted to reach $11.76 billion by 2033. Apparel retail follows with an anticipated size increase from $1.18 billion to $3.85 billion in the same period. The performance of each market type is critical for understanding consumer purchasing patterns.

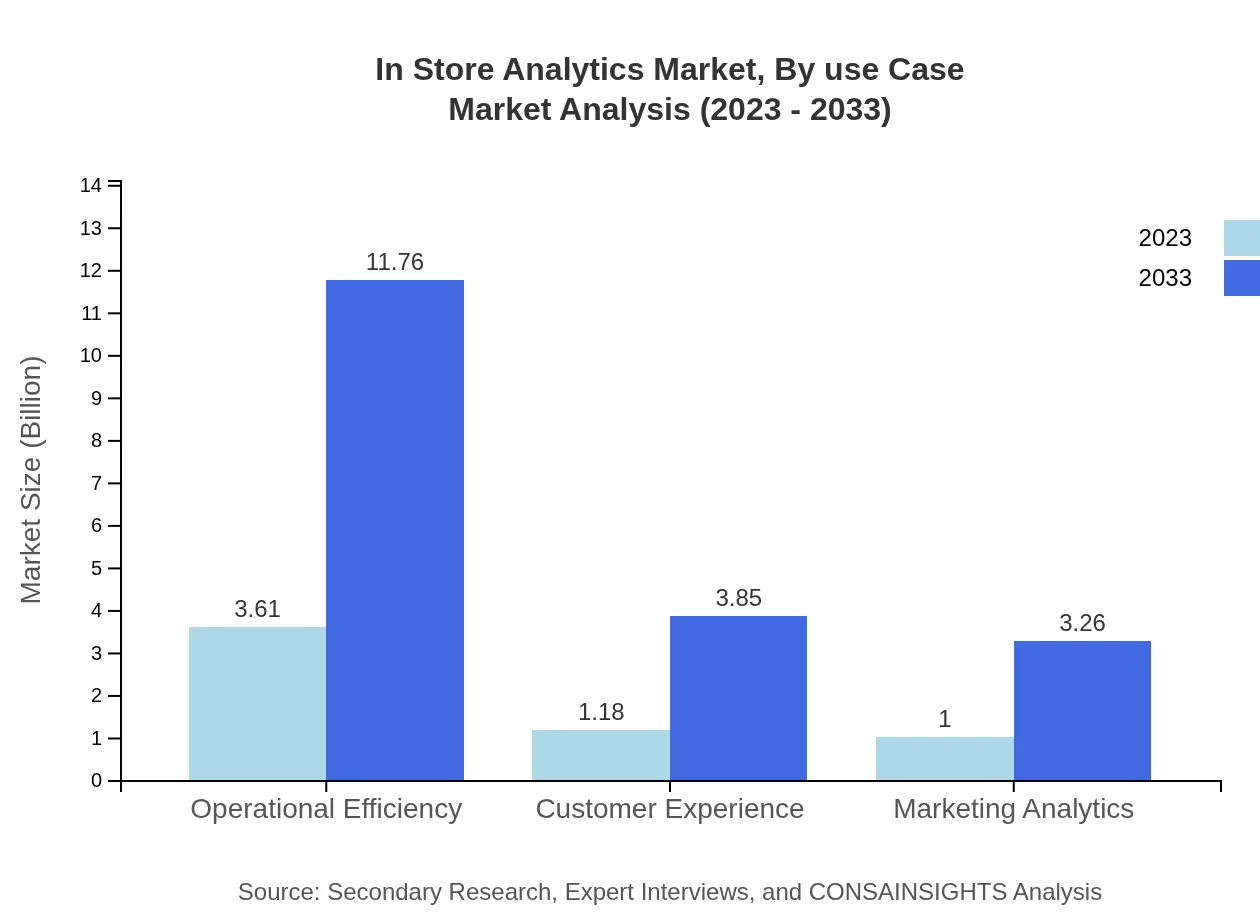

In Store Analytics Market Analysis By Use Case

Key use cases for In Store Analytics include operational efficiency and enhancing customer experience, with market shares reflecting their importance. Operational efficiency takes a leading share of 62.3% in 2023, remaining the same through 2033, while customer experience contributes 20.43% of market share for the same period, emphasizing the ongoing importance of personalized shopping experiences.

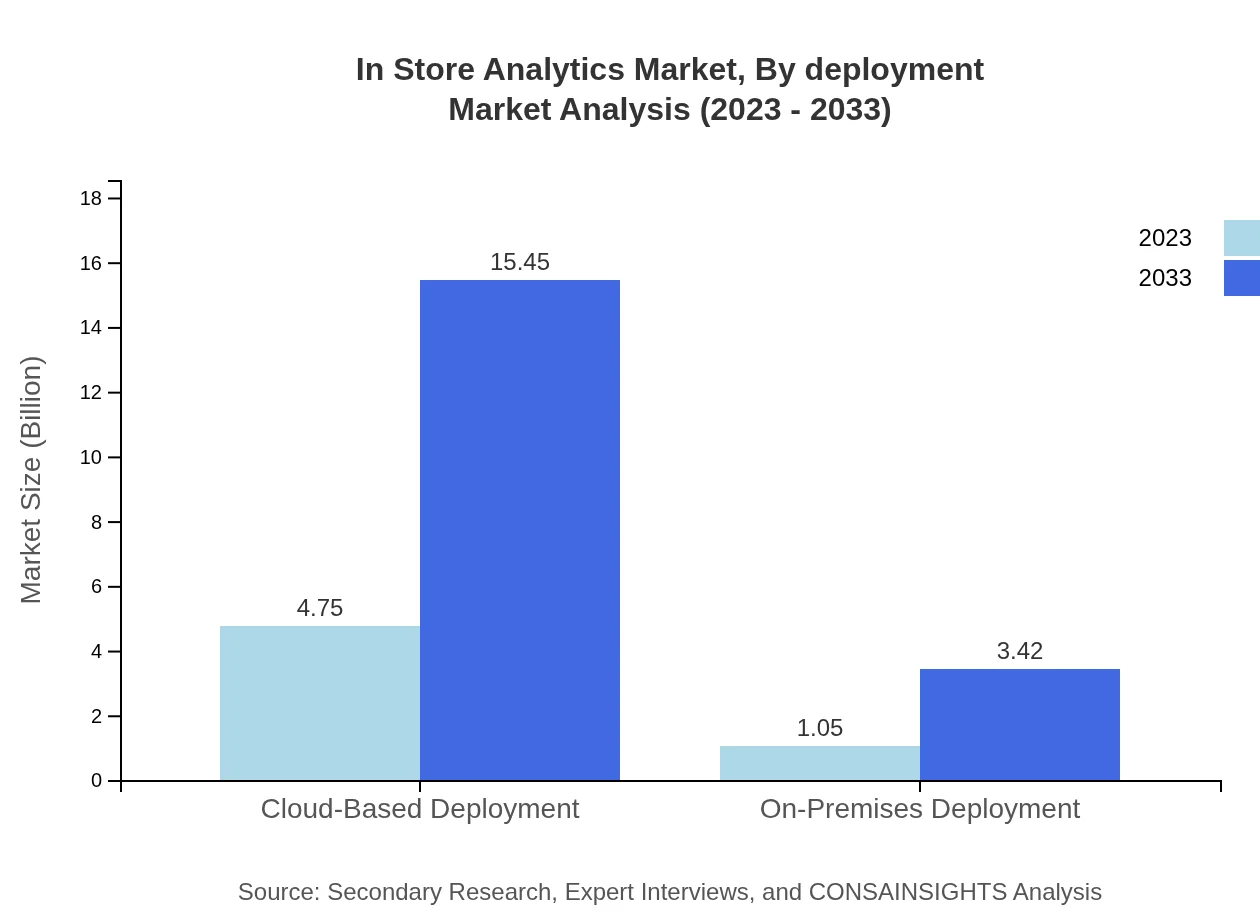

In Store Analytics Market Analysis By Deployment

The deployment segment of In Store Analytics includes cloud-based and on-premises solutions. By 2023, cloud-based deployment is expected to dominate with a size of $4.75 billion, scaling to $15.45 billion by 2033. This growth is a reflection of retailers' shift towards scalable, agile analytics solutions that leverage cloud technologies.

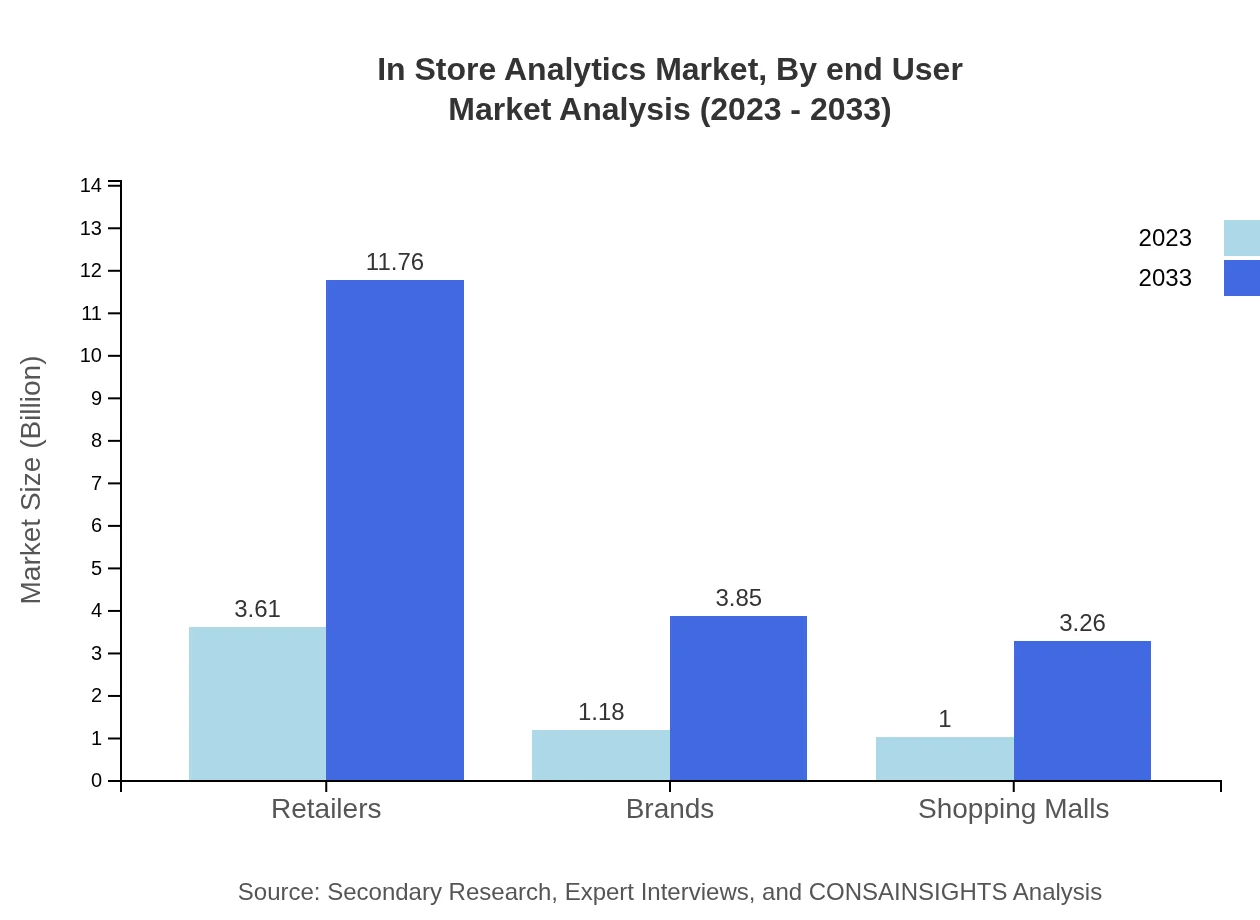

In Store Analytics Market Analysis By End User

Major end-users of In Store Analytics encompass retail sectors like grocery, electronics, and apparel. Grocery stores lead the segment with a share of 62.3%, while apparel retailers account for 20.43%. Understanding these distinctions helps tailor analytics solutions to specific retail categories.

In Store Analytics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in In Store Analytics Industry

RetailNext:

RetailNext specializes in retail analytics solutions, offering in-store technology that analyzes customer movements and optimizes retail operations.IBM:

IBM provides advanced analytics and AI solutions tailored for retail, enabling businesses to improve decision-making processes using data insights.Oracle:

Oracle’s retail solutions include In Store Analytics that utilize big data to understand customer behavior and enhance operational efficiency.Nedap:

Nedap is known for its innovative technology solutions in retail, providing analytics tools that help retailers optimize store performance.Cisco:

Cisco offers a range of retail analytics solutions leveraging network data to gain insights into shopper behavior and improve customer experiences.We're grateful to work with incredible clients.

FAQs

What is the market size of In-Store Analytics?

The In-Store Analytics market was valued at $5.8 billion in 2023 and is projected to grow at a CAGR of 12%, reaching significant milestones by 2033.

What are the key market players or companies in the In-Store Analytics industry?

Key players in the In-Store Analytics industry include companies specializing in data analytics, retail technology solutions, and consumer behavior analysis, contributing actively to market advancements and innovations.

What are the primary factors driving the growth in the In-Store Analytics industry?

Growth is driven by increased demand for consumer insights, technological advancements in analytics tools, and a stronger emphasis on enhancing customer experience through data-driven decision-making in retail.

Which region is the fastest Growing in the In-Store Analytics?

North America shows the fastest growth, with market size increasing from $1.88 billion in 2023 to $6.12 billion by 2033, driven by technological adoption and increased retail competition.

Does ConsaInsights provide customized market report data for the In-Store Analytics industry?

Yes, ConsaInsights offers customized market reports tailored to specific client needs, ensuring relevant and detailed insights for stakeholders in the In-Store Analytics industry.

What deliverables can I expect from this In-Store Analytics market research project?

Expect comprehensive reports, including market size analysis, segment breakdown, industry trends, competitive landscape insights, and growth forecasts tailored to your needs.

What are the market trends of In-Store Analytics?

Trends include the rising integration of cloud-based solutions, advanced video analytics, and increased focus on mobile analytics, reflecting a shift in how retailers leverage data for strategic decisions.