In Vitro Diagnostics Market Report

Published Date: 31 January 2026 | Report Code: in-vitro-diagnostics

In Vitro Diagnostics Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the In Vitro Diagnostics market, including insights on market trends, segmentation, and forecasts from 2023 to 2033.

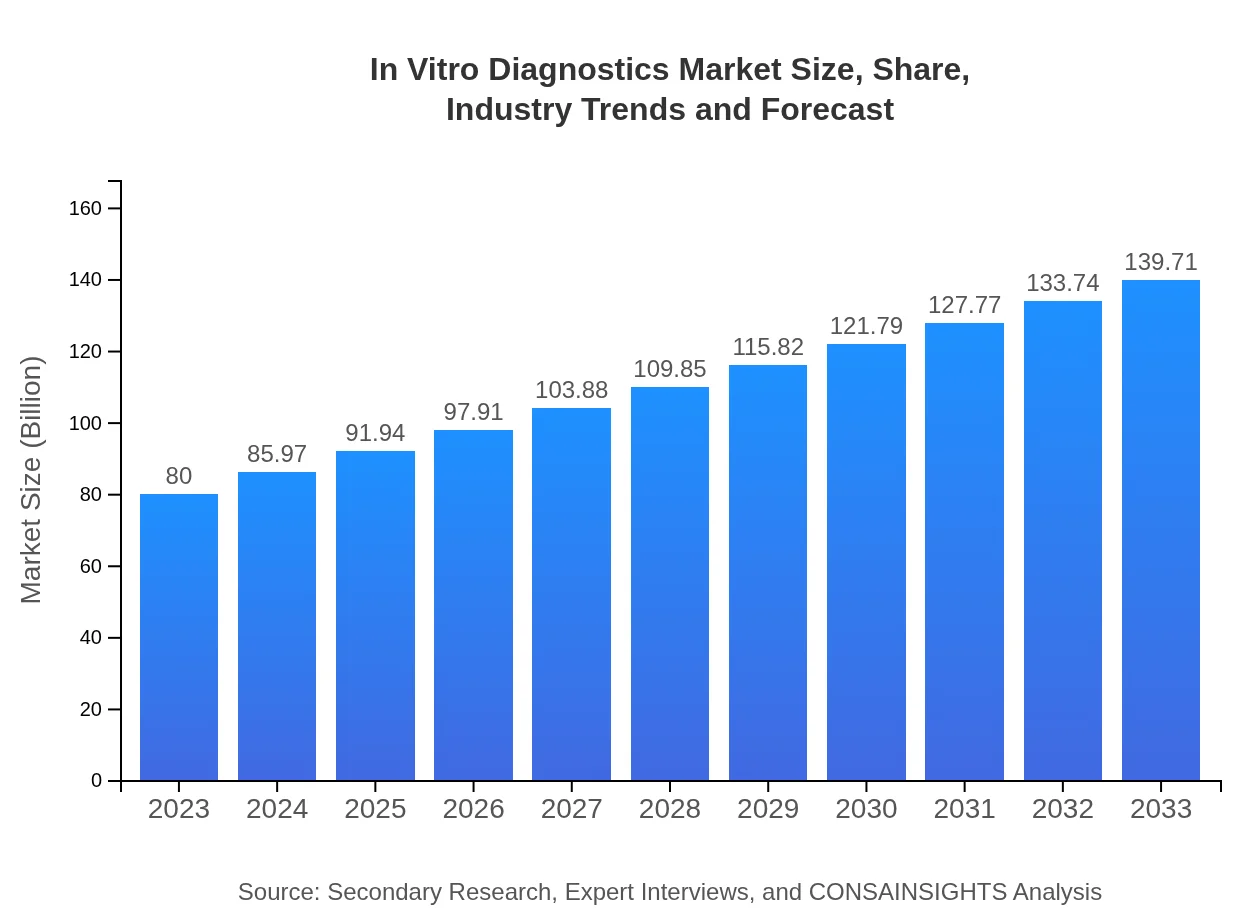

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $80.00 Billion |

| CAGR (2023-2033) | 5.6% |

| 2033 Market Size | $139.71 Billion |

| Top Companies | Roche Diagnostics, Abbott Laboratories, Agilent Technologies, Siemens Healthineers, Thermo Fisher Scientific |

| Last Modified Date | 31 January 2026 |

In Vitro Diagnostics Market Overview

Customize In Vitro Diagnostics Market Report market research report

- ✔ Get in-depth analysis of In Vitro Diagnostics market size, growth, and forecasts.

- ✔ Understand In Vitro Diagnostics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in In Vitro Diagnostics

What is the Market Size & CAGR of In Vitro Diagnostics market in 2023?

In Vitro Diagnostics Industry Analysis

In Vitro Diagnostics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

In Vitro Diagnostics Market Analysis Report by Region

Europe In Vitro Diagnostics Market Report:

Europe's IVD market is expected to grow significantly from USD 23.03 billion in 2023 to USD 40.22 billion by 2033. Factors contributing to this growth include an increase in population awareness regarding preventative healthcare and high disease prevalence leading to greater IVD adoption.Asia Pacific In Vitro Diagnostics Market Report:

In Asia Pacific, the IVD market is expected to grow from USD 16.58 billion in 2023 to USD 28.95 billion by 2033, driven by rising healthcare investments and increasing prevalence of chronic diseases among aging populations. The region’s burgeoning medical technology sector and government initiatives aimed at improving healthcare infrastructure are also pivotal for market growth.North America In Vitro Diagnostics Market Report:

North America leads the IVD market, with a valuation of USD 26.62 billion in 2023 projected to reach USD 46.48 billion by 2033. This growth is strongly influenced by advanced healthcare systems, extensive R&D activities, and high expenditure on health technologies in the region.South America In Vitro Diagnostics Market Report:

The South American IVD market is set to witness growth from USD 7.97 billion in 2023 to USD 13.91 billion by 2033. Demand for improved healthcare services in this region is fueling investments in diagnostic technologies, although economic fluctuations may pose challenges to growth.Middle East & Africa In Vitro Diagnostics Market Report:

The IVD market in the Middle East and Africa is projected to expand from USD 5.81 billion in 2023 to USD 10.14 billion by 2033. Improving healthcare infrastructure, coupled with rising government initiatives to enhance diagnostic capabilities, is likely to support this growth.Tell us your focus area and get a customized research report.

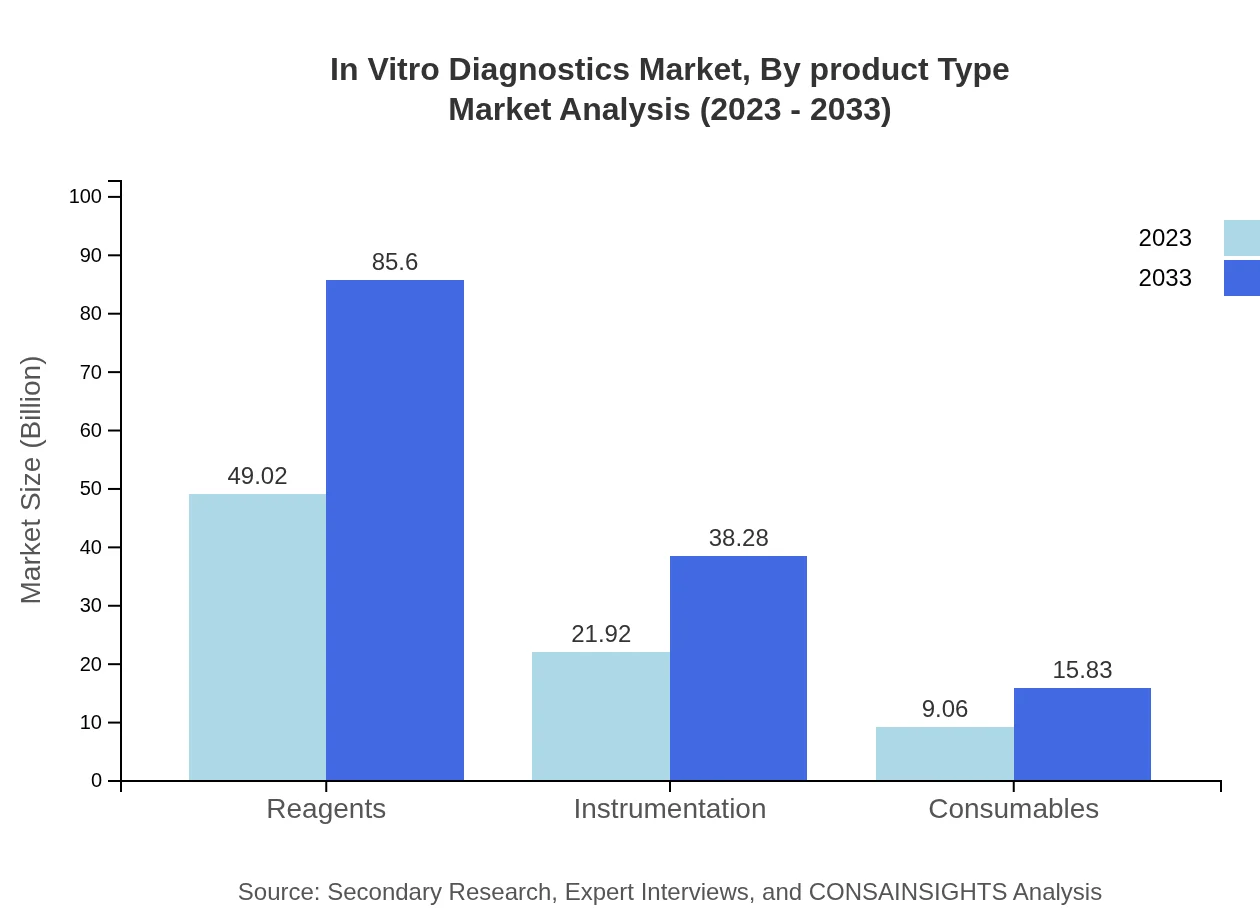

In Vitro Diagnostics Market Analysis By Product Type

In the IVD market, reagents dominate with a market size of USD 49.02 billion in 2023, expected to grow to USD 85.60 billion by 2033, indicating a significant share of 61.27%. Instrumentation follows closely with USD 21.92 billion now, projected to reach USD 38.28 billion, holding 27.4% market share. Consumables also play a vital role, with steady growth from USD 9.06 to USD 15.83 billion.

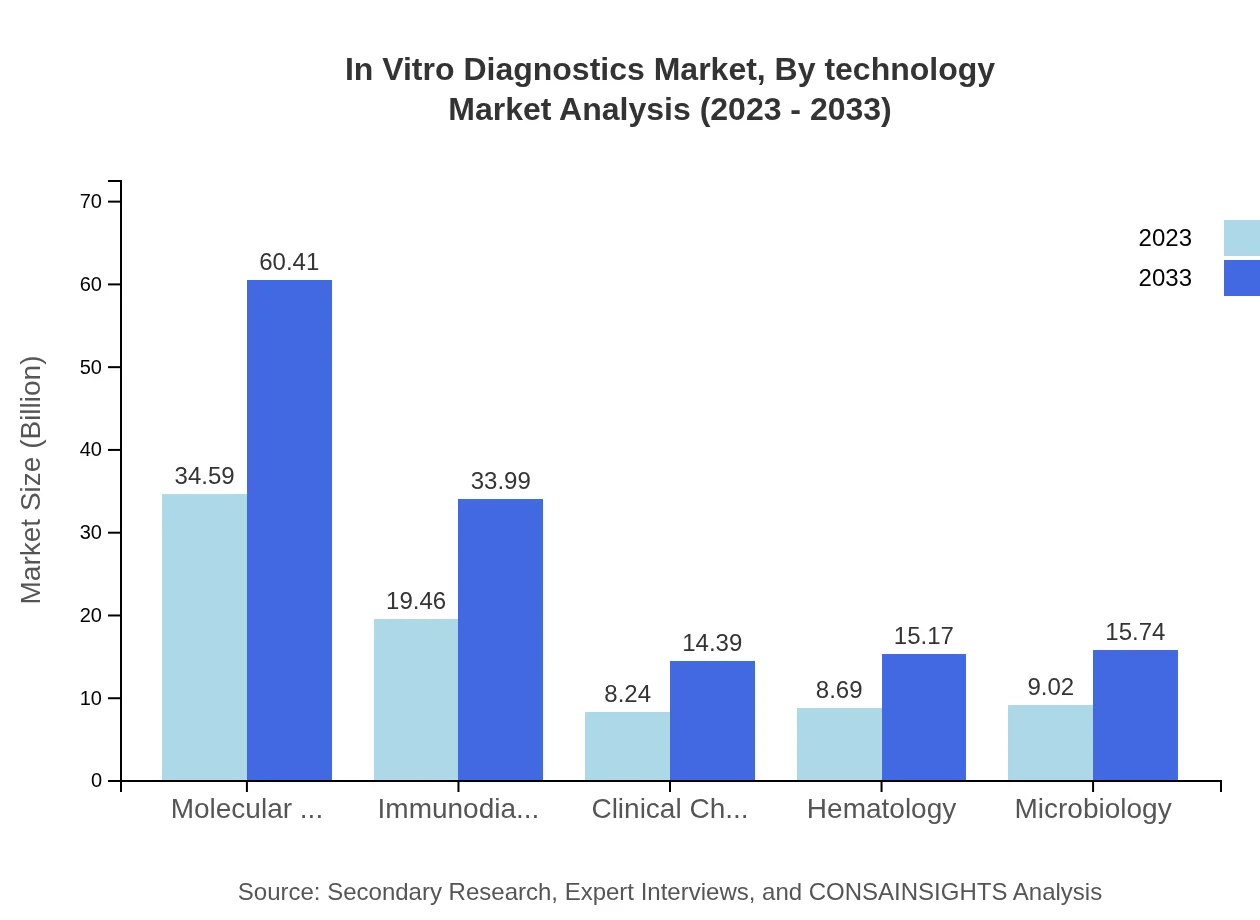

In Vitro Diagnostics Market Analysis By Technology

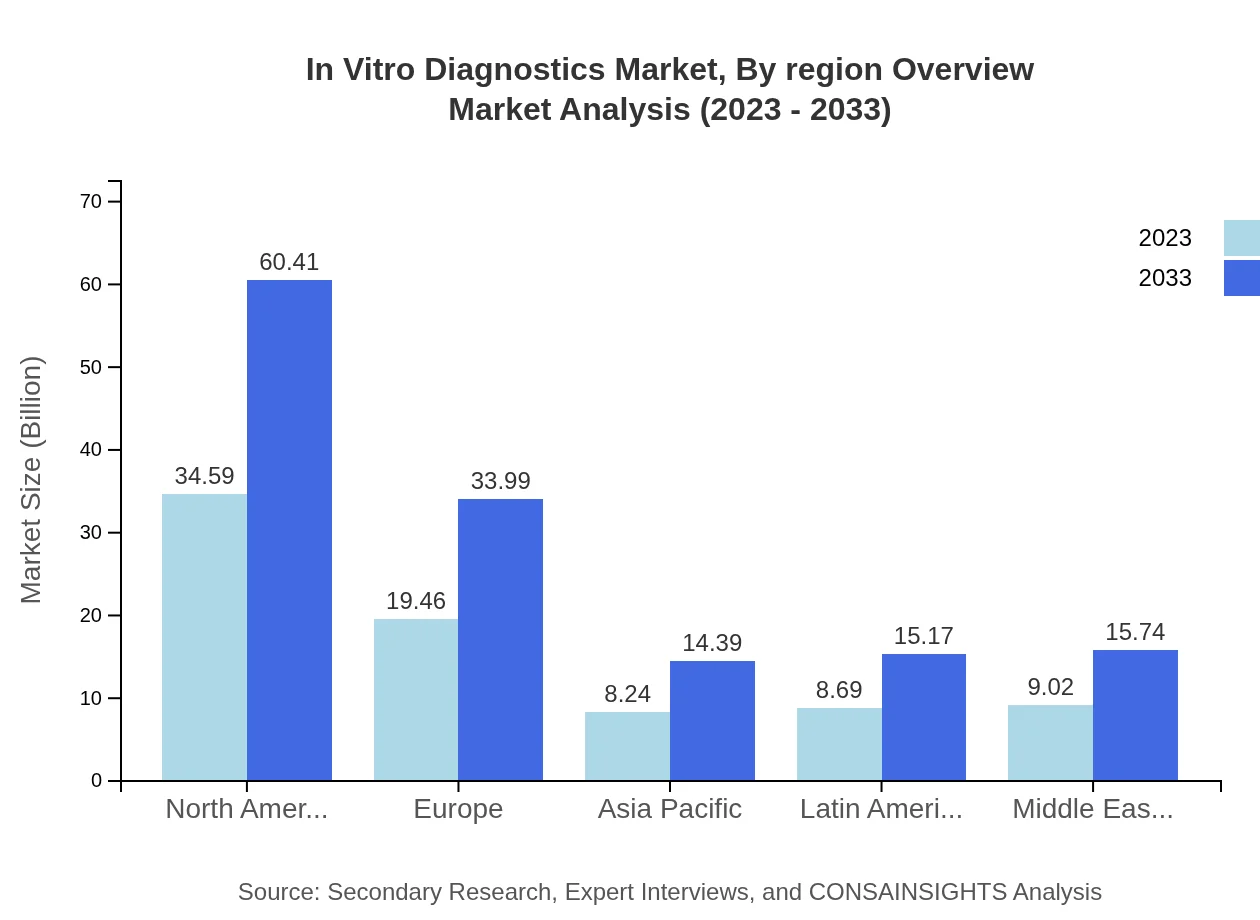

Molecular diagnostics command a substantial share of the IVD market, valued at USD 34.59 billion in 2023 and climbing to USD 60.41 billion with a 43.24% market share. Immunodiagnostics account for USD 19.46 billion currently, expected to rise to USD 33.99 billion. Meanwhile, clinical chemistry, hematology, and microbiology technologies are also significant contributors to market growth due to their widespread applications.

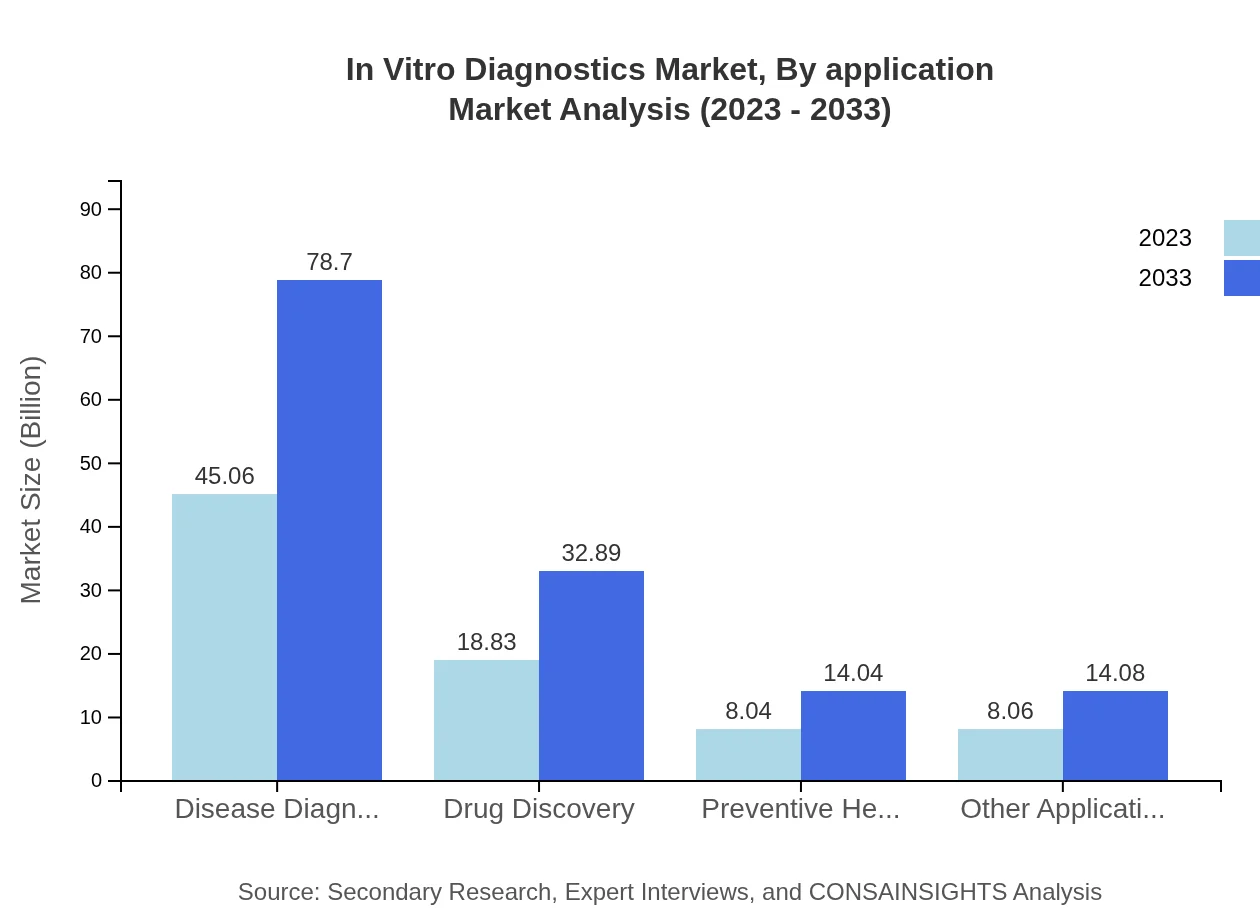

In Vitro Diagnostics Market Analysis By Application

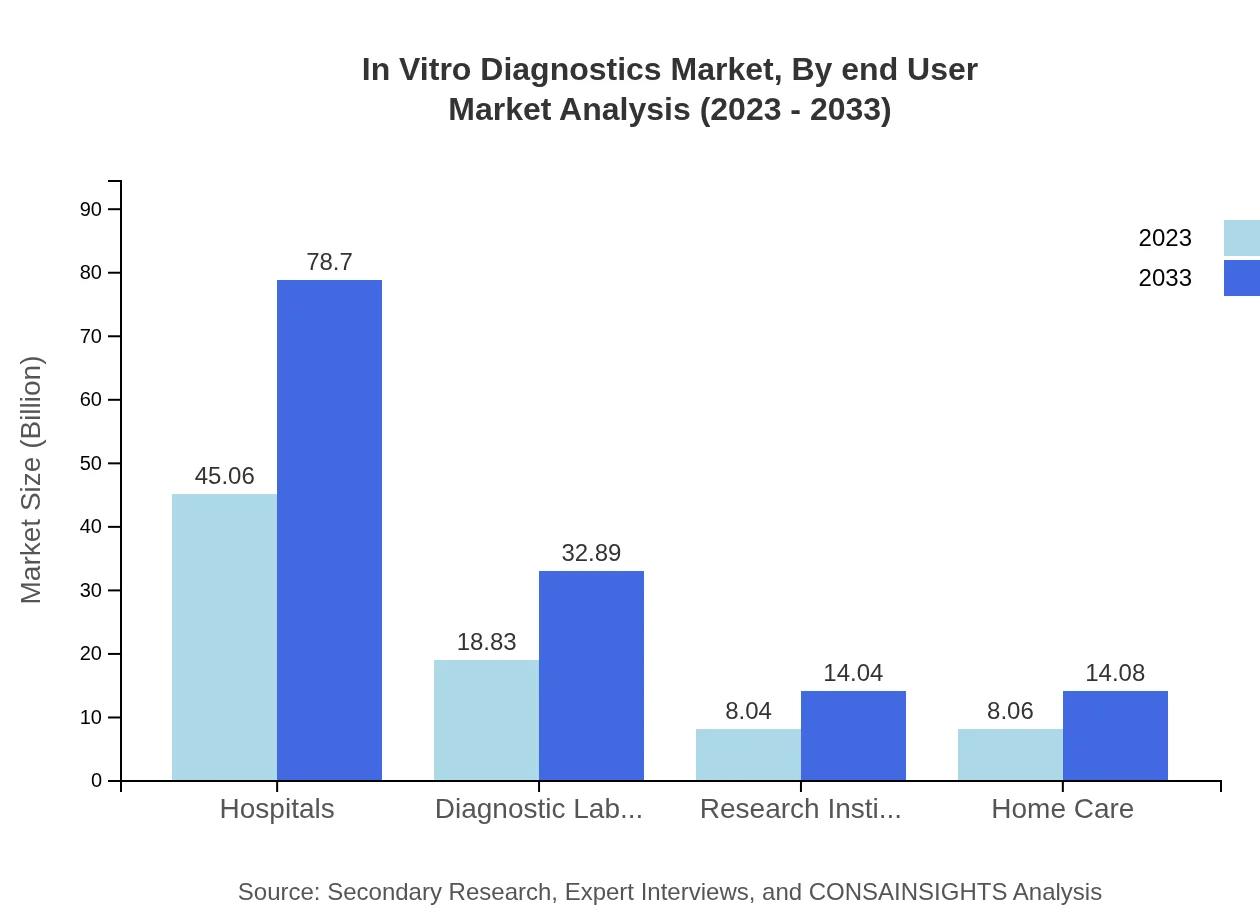

The application of IVD in disease diagnosis accounts for USD 45.06 billion in 2023, growing to USD 78.70 billion, representing 56.33% of the market share. Drug discovery and preventive healthcare segments are also essential, with substantial growth projected from USD 18.83 billion to USD 32.89 billion and from USD 8.04 billion to USD 14.04 billion respectively.

In Vitro Diagnostics Market Analysis By End User

Among end-users, hospitals lead the market, accounting for USD 45.06 billion in 2023, with significant expansion expected by 2033. Diagnostic laboratories and research institutions follow closely, with rising demand for advanced testing and research capabilities improving their market standing.

In Vitro Diagnostics Market Analysis By Region Overview

The regional landscape for IVD reveals varying growth trajectories, with North America and Europe leading due to their advanced healthcare systems, followed by Asia Pacific, where emerging economies are rapidly adopting diagnostic technologies. Latin America and the Middle East and Africa display promise in terms of growth potential driven by enhanced healthcare initiatives.

In Vitro Diagnostics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in In Vitro Diagnostics Industry

Roche Diagnostics:

A leader in the IVD market, Roche Diagnostics is renowned for its innovative diagnostic solutions and extensive product portfolio that includes a wide range of reagents and automation technologies.Abbott Laboratories:

Abbott is a key player in the IVD space, focusing on developing advanced technologies for disease detection and management, with a strong presence in both molecular diagnostics and immunodiagnostics.Agilent Technologies:

Agilent provides comprehensive tools and solutions for laboratories and researchers in the field of diagnostics, recognized for its contributions to precision medicine and diagnostic development.Siemens Healthineers:

Siemens Healthineers is committed to advancing healthcare through innovative diagnostic solutions that enhance efficiency and precision in testing procedures.Thermo Fisher Scientific:

Thermo Fisher Scientific excels in providing cutting-edge diagnostic solutions, with a focus on improving workflows through automation and high-quality testing products.We're grateful to work with incredible clients.

FAQs

What is the market size of In-Vitro Diagnostics?

The In-Vitro Diagnostics market is projected to reach approximately $80 billion by 2033, growing at a CAGR of 5.6% from its current size. This growth reflects an increasing demand for accurate and efficient diagnostic solutions.

What are the key market players or companies in the In-Vitro Diagnostics industry?

Key players include Roche Diagnostics, Abbott Laboratories, Siemens Healthineers, and Thermo Fisher Scientific. These companies lead the industry through continuous innovation and strategic partnerships, ensuring they stay competitive in the growing market.

What are the primary factors driving the growth in the In-Vitro Diagnostics industry?

Growth is driven by a rise in chronic diseases, advancements in technology, and an increased emphasis on early disease detection. Moreover, the growing aging population and a surge in demand for personalized medicine also significantly contribute to market expansion.

Which region is the fastest Growing in the In-Vitro Diagnostics?

Asia Pacific is the fastest-growing region, projected to reach approximately $28.95 billion by 2033, up from $16.58 billion in 2023. This region's growth is fueled by increased healthcare access and investments in medical infrastructure.

Does ConsaInsights provide customized market report data for the In-Vitro Diagnostics industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the In-Vitro Diagnostics industry, allowing clients to gain deeper insights relevant to their particular interests and market positioning.

What deliverables can I expect from this In-Vitro Diagnostics market research project?

Expected deliverables include comprehensive reports, data analysis, trend identification, market segmentation insights, and strategic recommendations to assist decision-making and investment strategies in the In-Vitro Diagnostics industry.

What are the market trends of In-Vitro Diagnostics?

Emerging trends include the rise of molecular diagnostics, point-of-care testing, and digital health solutions. Additionally, there is a growing focus on home care diagnostics and the integration of artificial intelligence in diagnostic processes.