Income Protection Insurance Market Report

Published Date: 31 January 2026 | Report Code: income-protection-insurance

Income Protection Insurance Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Income Protection Insurance market, focusing on key trends, forecasts, and insights from 2023 to 2033. It covers market size, growth rates, competitive landscape, and regional dynamics to guide stakeholders in making informed decisions.

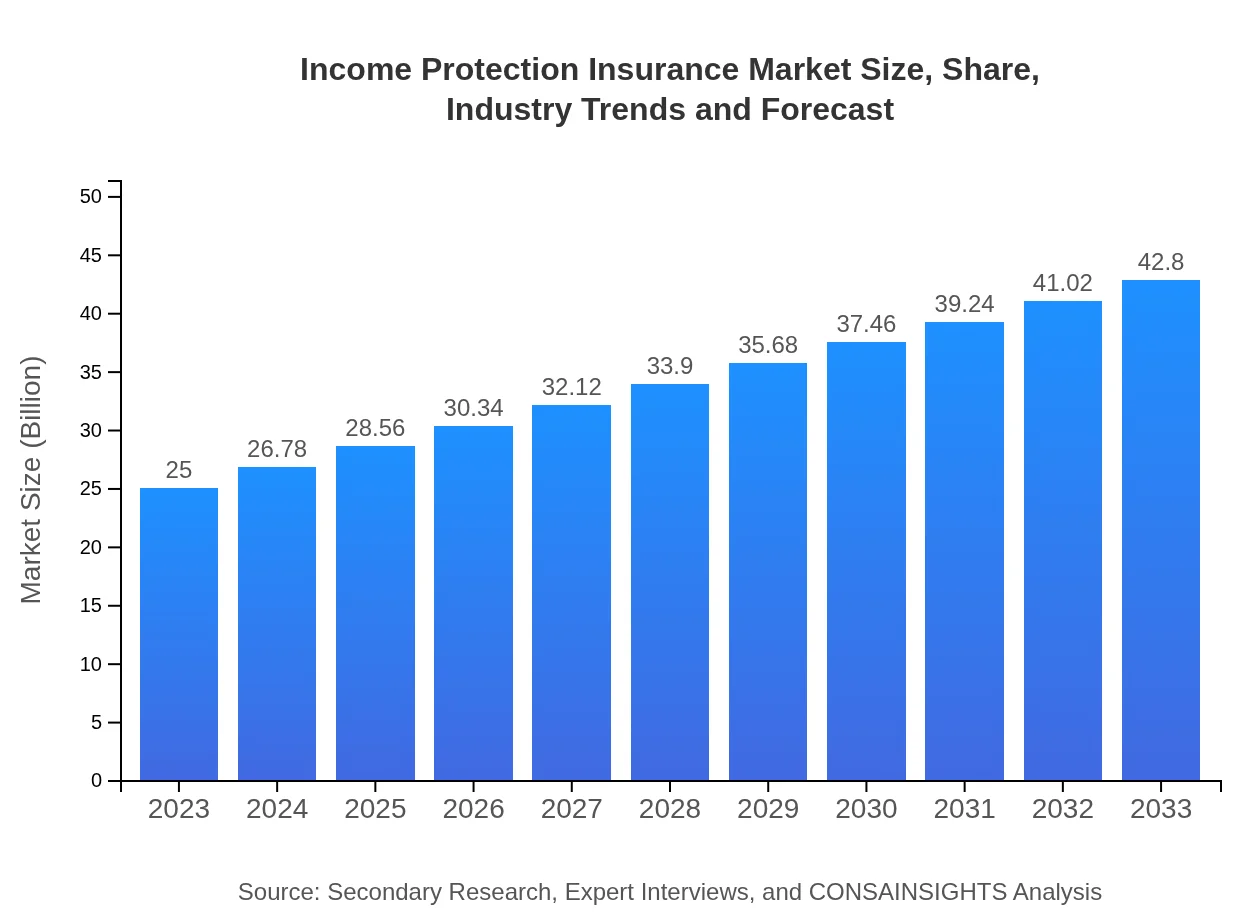

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $25.00 Billion |

| CAGR (2023-2033) | 5.4% |

| 2033 Market Size | $42.80 Billion |

| Top Companies | Aviva, Legal & General, Prudential, MetLife |

| Last Modified Date | 31 January 2026 |

Income Protection Insurance Market Overview

Customize Income Protection Insurance Market Report market research report

- ✔ Get in-depth analysis of Income Protection Insurance market size, growth, and forecasts.

- ✔ Understand Income Protection Insurance's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Income Protection Insurance

What is the Market Size & CAGR of Income Protection Insurance market in 2023?

Income Protection Insurance Industry Analysis

Income Protection Insurance Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Income Protection Insurance Market Analysis Report by Region

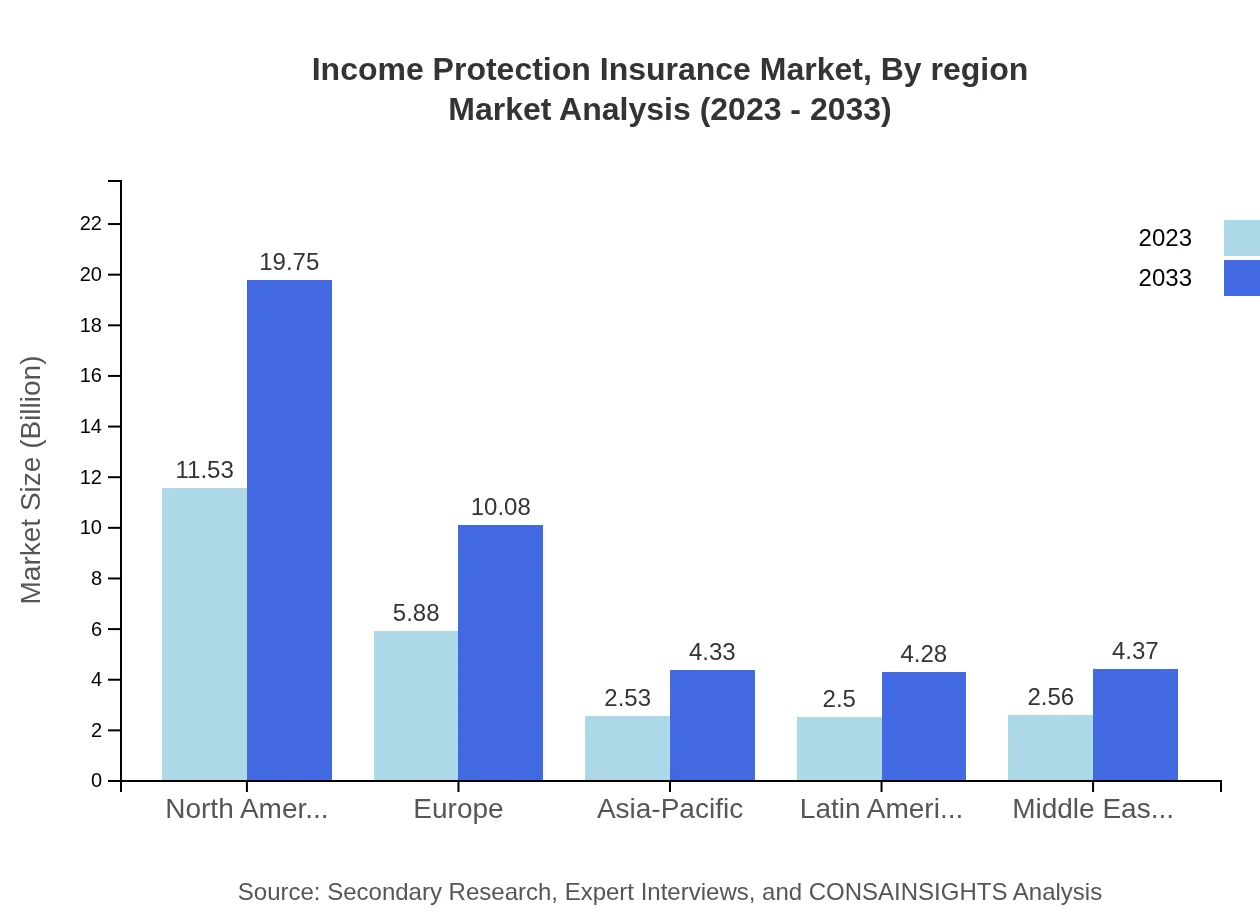

Europe Income Protection Insurance Market Report:

Europe's market for Income Protection Insurance stands at $7.26 billion in 2023, with expectations to grow to $12.44 billion by 2033. The robust regulatory framework and increasing focus on employee benefits are driving market expansion, particularly in the UK and Germany.Asia Pacific Income Protection Insurance Market Report:

In the Asia Pacific region, the Income Protection Insurance market was valued at approximately $5.02 billion in 2023, projected to grow to around $8.60 billion by 2033, driven by rising middle-class incomes and increased awareness about income protection. Key markets include Australia and Japan, where regulatory frameworks are supporting growth.North America Income Protection Insurance Market Report:

The North American Income Protection Insurance market, valued at about $8.05 billion in 2023, is expected to reach $13.78 billion by 2033. An increasing number of millennials and Gen Z entering the workforce and heightened awareness of financial security are contributing factors.South America Income Protection Insurance Market Report:

The South American market is estimated to grow from $2.24 billion in 2023 to $3.83 billion by 2033. Growing urbanization and a shift towards formal employment are influencing demand for income protection solutions, although economic volatility presents challenges.Middle East & Africa Income Protection Insurance Market Report:

In the Middle East and Africa, the Income Protection Insurance market is expected to increase from $2.42 billion in 2023 to $4.15 billion by 2033, fueled by a growing insurance culture and increasing market literacy, although there are significant disparities in market adoption across the region.Tell us your focus area and get a customized research report.

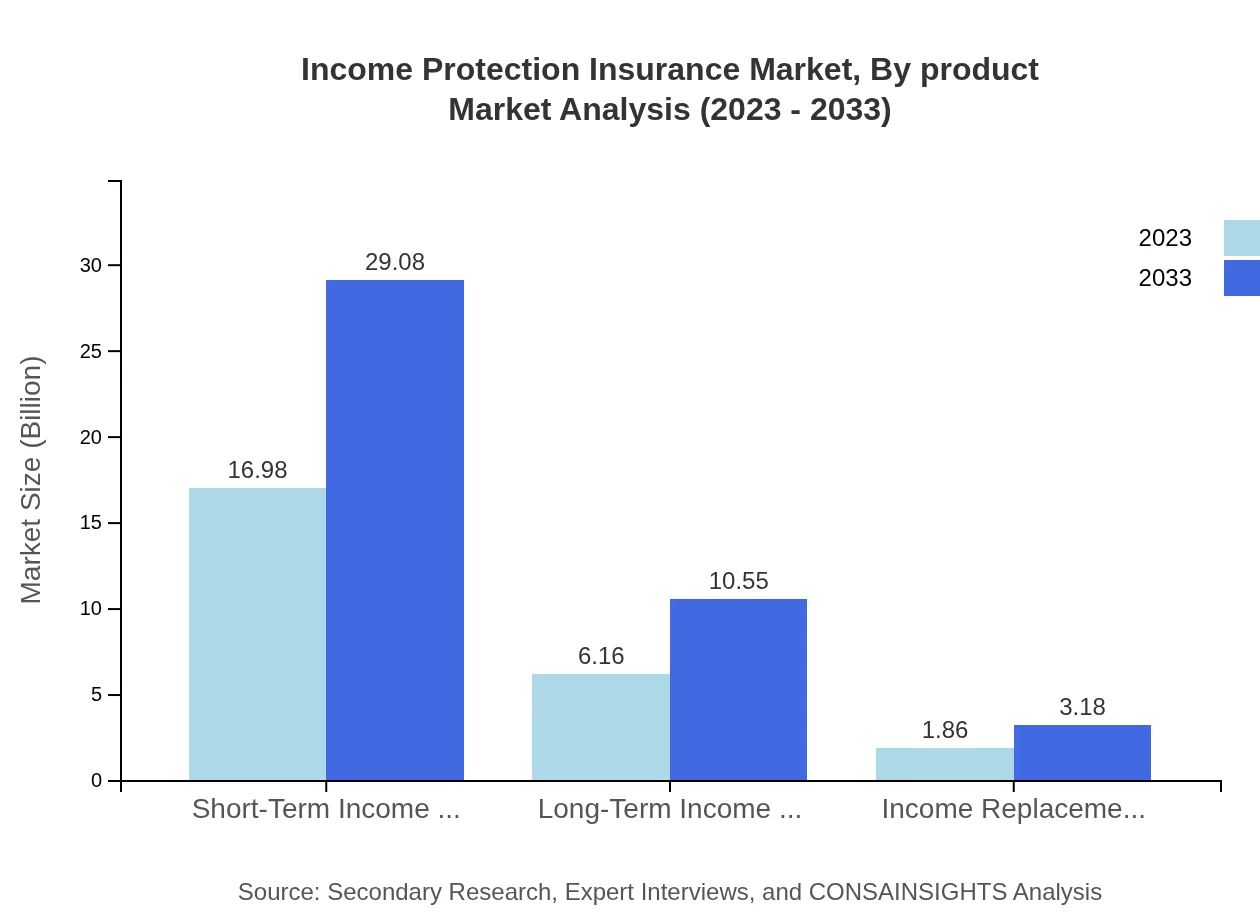

Income Protection Insurance Market Analysis By Product

The Income Protection Insurance market is segmented into Short-Term and Long-Term Income Protection Insurance. In 2023, Short-Term Income Protection accounts for $16.98 billion, while Long-Term Insurance represents $6.16 billion. By 2033, these figures are anticipated to rise to $29.08 billion and $10.55 billion respectively, underscoring a trend towards flexible and tailored income protection solutions.

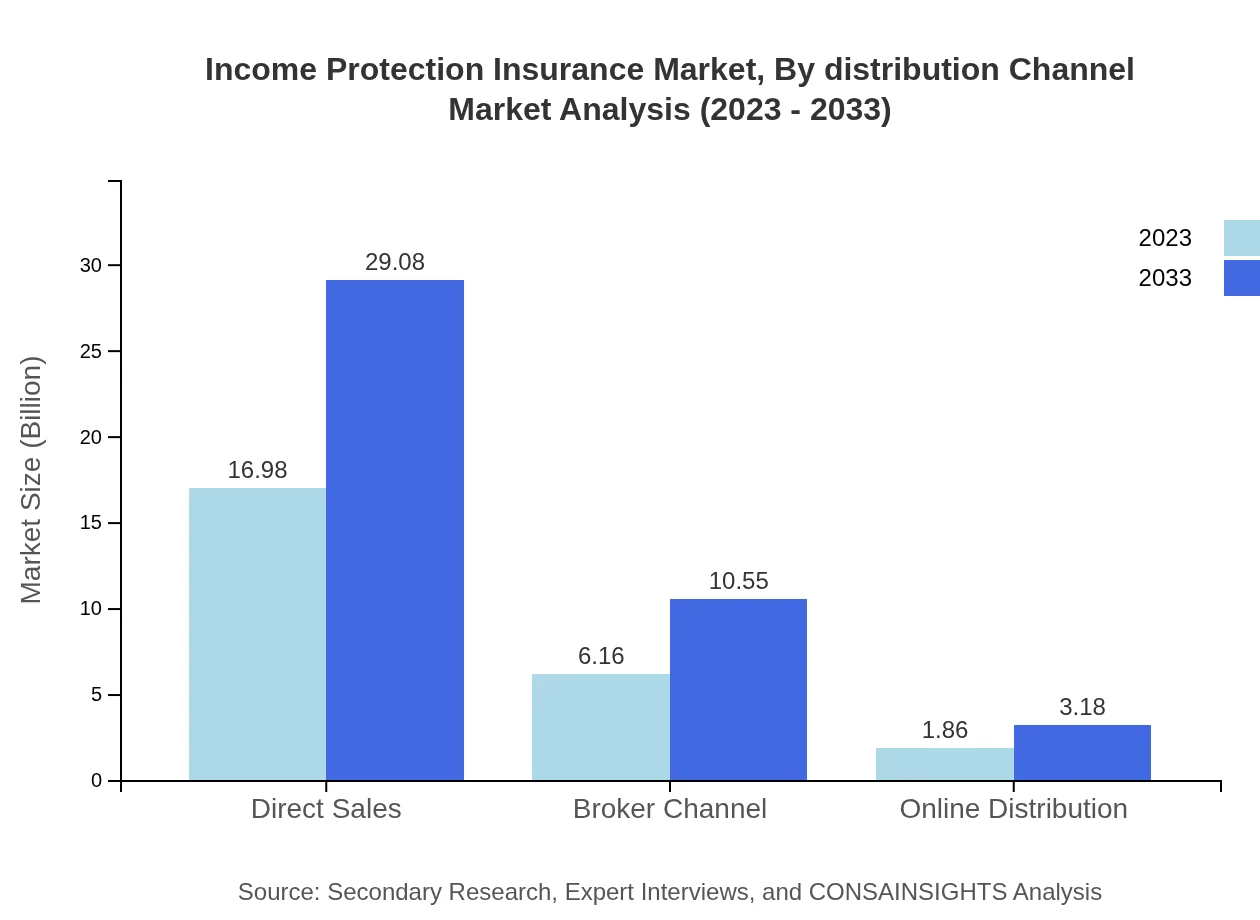

Income Protection Insurance Market Analysis By Distribution Channel

Distribution channels for Income Protection Insurance include Direct Sales, Broker Channels, and Online Distribution. In 2023, Direct Sales dominate at $16.98 billion, followed by brokers at $6.16 billion and online channels at $1.86 billion. Growth in direct and online channels is expected as digital platforms become increasingly preferred by consumers.

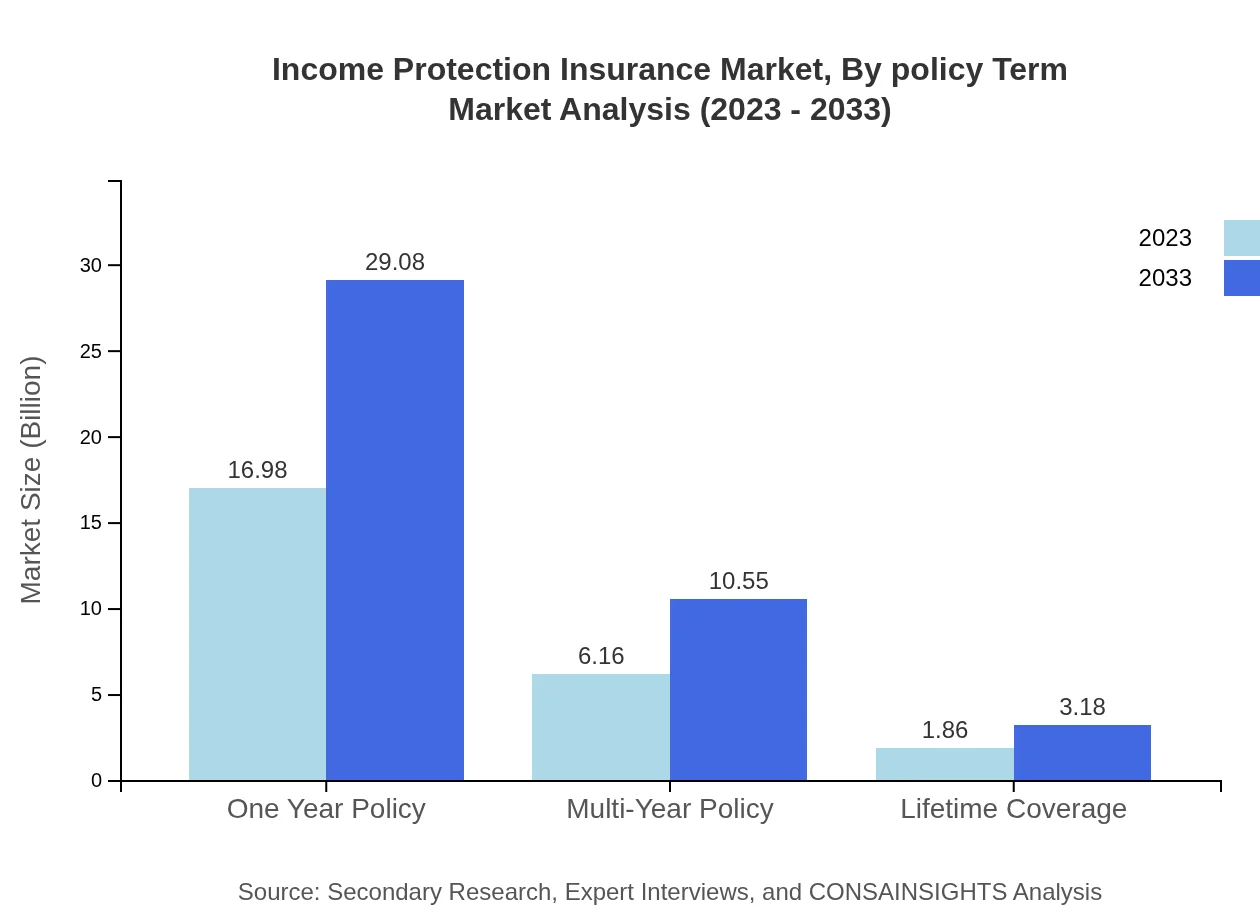

Income Protection Insurance Market Analysis By Policy Term

The insurance policy term segment reveals significant insights, with One Year Policies at $16.98 billion in 2023 and Multi-Year Policies at $6.16 billion. By 2033, these are expected to grow to $29.08 billion and $10.55 billion respectively. Lifetime Coverage, although smaller, shows potential growth from $1.86 billion to $3.18 billion.

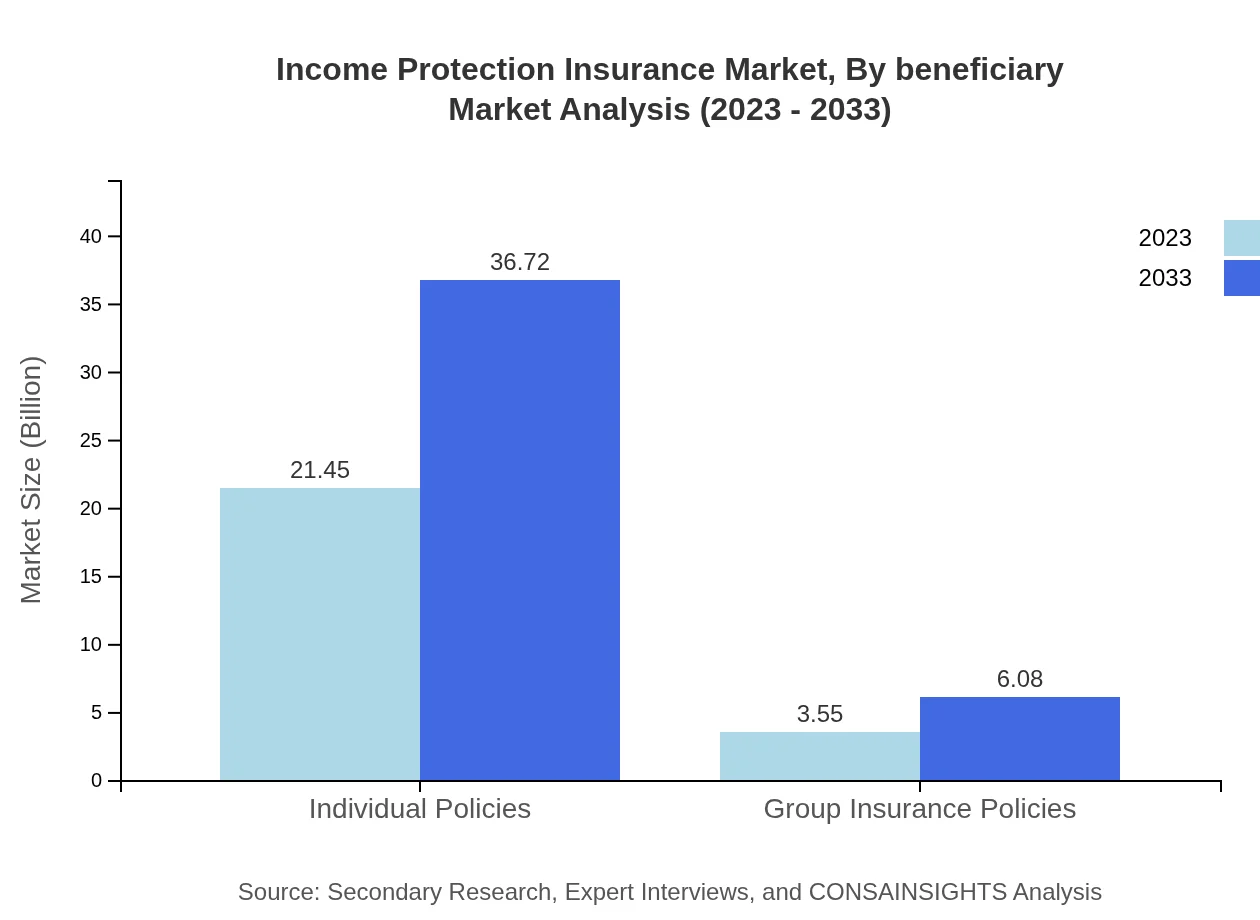

Income Protection Insurance Market Analysis By Beneficiary

The market segmentation by beneficiary type includes Individual Policies and Group Insurance Policies. Individual Policies accounted for $21.45 billion in 2023, indicating a strong preference amongst consumers, while Group Insurance Policies at $3.55 billion reflect employer-provided benefits. By 2033, the individual policies are projected to expand to $36.72 billion.

Income Protection Insurance Market Analysis By Region

The analysis across different regions illustrates the diverse landscape of the Income Protection Insurance market, with North America leading in both market size and growth rates. Europe follows closely, with Asia Pacific emerging as a vital growth region due to expanding economies and increasing insurance penetration.

Income Protection Insurance Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Income Protection Insurance Industry

Aviva:

Aviva is a leading provider of insurance and financial services worldwide, offering tailor-made income protection policies to meet the unique needs of consumers.Legal & General:

Legal & General is one of the largest financial services groups in the UK, known for its robust income protection offerings and innovative insurance solutions.Prudential:

Prudential provides comprehensive income protection insurance solutions, focusing on ensuring financial security for policyholders in various life circumstances.MetLife:

MetLife is a global leader in insurance and employee benefits, recognized for its extensive portfolio of income protection and life insurance products.We're grateful to work with incredible clients.

FAQs

What is the market size of income Protection Insurance?

The income protection insurance market is estimated to reach $25 billion by 2033, growing at a CAGR of 5.4% from its current valuation. This growth reflects increasing awareness of income security and evolving consumer needs.

What are the key market players or companies in this income Protection Insurance industry?

Key players in the income protection insurance industry include major insurers like Prudential, Legal & General, and New York Life. These companies are significant due to their extensive portfolios and vast distribution networks.

What are the primary factors driving the growth in the income Protection Insurance industry?

Primary growth factors include increasing unemployment rates, rising health concerns, and a growing focus on financial security. Additionally, demographic changes and the rise of gig economy jobs further amplify the demand for income protection solutions.

Which region is the fastest Growing in the income Protection Insurance?

The fastest-growing region is Europe, with market growth from $7.26 billion in 2023 to $12.44 billion in 2033. Other notable regions include North America, projected to grow from $8.05 billion to $13.78 billion.

Does ConsaInsights provide customized market report data for the income Protection Insurance industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the income protection insurance industry, allowing clients to obtain insights particularly useful for strategic decision-making.

What deliverables can I expect from this income Protection Insurance market research project?

Deliverables typically include comprehensive market analysis reports, segment data breakdowns, growth projections, competitive landscape insights, and actionable recommendations tailored to your business objectives.

What are the market trends of income Protection Insurance?

Market trends in income protection insurance include increased adoption of digital platforms for sales, greater customization of policies, and a rise in demand for short-term coverage options, reflecting shifting consumer preferences.